THH – Tax Loss Silly Season: “Sell Button” Thrown Away

Dec 07, 2021

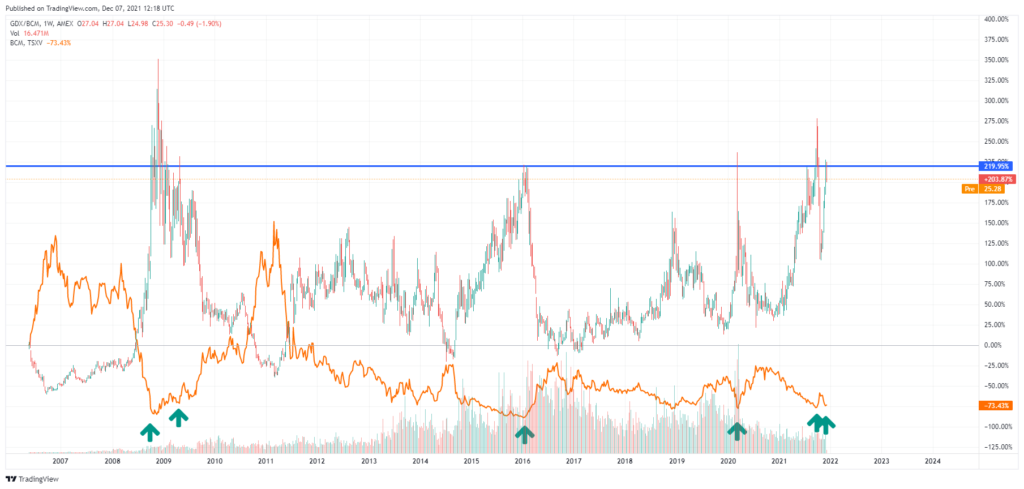

Lets first take a look at the trusty “Sentiment Proxy” aka “Junior Trading Sardine” which goes under the name Bear Creek Mining:

I agree with Mr Bear Creek and my expectations are around 200% on average within a two year time frame for the money I am deploying in the juniors right now (I expect some to do better and some to do worse obviously). In other words I have thrown away the sell button long ago and am in 100% buying mode. With that said I am always in buy mode since I am a stock picker and I have always been able to find at least one stock I think is undervalued even sector sentiment is high and valuations are closer to overvalued on average. But right now there are Fire Sale prices all over the place. Miners are cheap overall, with producers trading near record low valuations based on cash flow multiples, but juniors are probably the cheapest they have been relative to gold/silver that I can remember…

For some “weird” reason humans tend to be humans and I barely see any gold, silver or mining bulls at all. It’s like people hate buy/sell based on emotions and overall just hate making money…

Main reason for selling or not buying right now that I hear…?

“I think they could go lower”

… No shit Sherlock. Show me a stock that can’t go lower. I’ll wait.

In the meantime I am personally comfortable knowing that if I buy something with an Expected Return of 200% within two years I will be very very rich if I can replicate that on a two year rolling time frame. News flash: It doesn’t even matter if they go down -50% first because a stock going down first does not mean you made a mistake. If a stock will hit $6/share in two years and I buy it at $2/share it could go to $0.01/share first and I will still get a 200% return (Assuming no leverage of course!). If you sell something with an Expected Return of 200% you are de facto saying that you think you can do better than 200%. Yet 95% does not beat the market in the long run… Food for thought.

It is WAY more expensive to NOT BUY LOW than occasionally BUYING HIGHS om the long run. I would only be a seller right now if someone held a gun to my head pretty much.

When sector valuations are high stock picking becomes very important.

When sector valuations are low across the board then one can diversify like never before and still have great future returns.

Below we have a chart showing the ratio of GDX (Major miners) and Bear Creek Mining (Junior proxy):

(The share price of Bear Creek Mining (BCM) shown in orange)

… In my opinion this confirms the first slide in telling us that the current valuation environment in the juniors is pretty much as good as it gets for a buyer. Every time the GDX/BCM ration has hit these kind of nose bleed levels it has been near major bottoms. In fact, you only get opportunities like this a few times per decade.

When I started investing in miners during late 2015 I actually just tended to buy what was down the most over the last year or so. I mean I knew nothing about mining and I just wanted to buy the cheapest stuff I could find. I literally just bought as much as I could and would typically buy whatever was down the most on any given day on pure impulse. At one point I was down 55% from where I started even though I thought I started out buying cheap. When the bottom finally came my entire portfolio went up >500% within 8 months or so. Needless to say I have been here before and I don’t care if what I buy today goes down >30% more because I know that when the tide changes they will be up a considerable amount on average.

The cheaper you buy the less skill you need…

Tax Loss Silly Season Candidates

So lets look at some juniors that are down a lot, mostly due to sentiment + tax loss selling, while the intrinsic values have gone up or at least stayed pretty neutral. Note that when I have drawn “Value trends” its purely my subjective and biased estimations. Regardless, if I am even 50% right many look very cheap to me.

Note: I have added in most or all names listed below recently. They are also banner sponsors of mine. Therefore assume I am biased and do not treat this as investing advice.

Mantaro Precious Metals (MNTR.V)

Timberline Resources (TBR.V)

District Metals (DMX.V)

Rokmaster Resources (RKR.V)

Cabral Gold (CBR.V)

Novo Resources (NVO.TO)

Defense Metals (DEFN.V)

Kuya Silver (KUYA.CN)

Tombill Mines (TBLL.V)

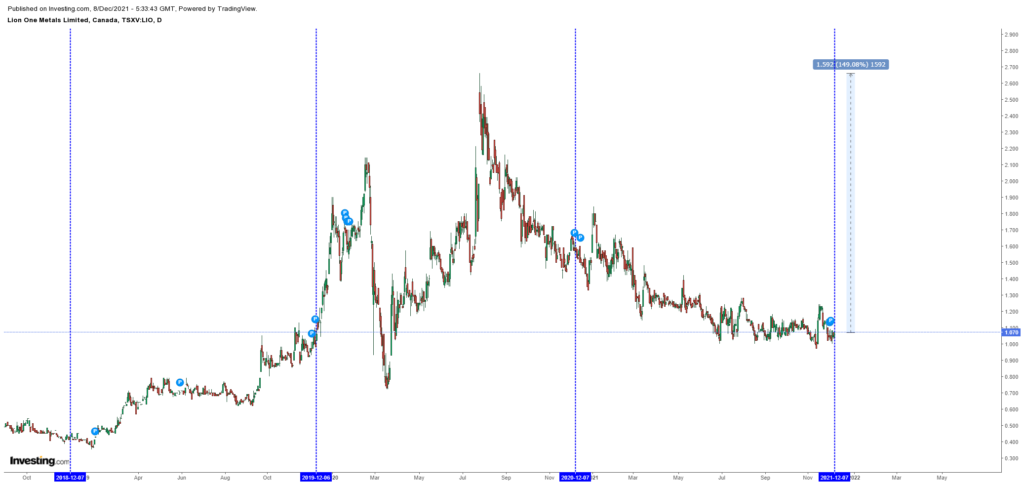

Lion One Metals (LIO.V)

Eloro Resouces (ELO.V)

Headwater Gold (HWG.CN)

StrikePoint Gold (SKP.V)

Galantas Gold (GAL.V)

There are a ton of other examples out there. I have like 50 companies I would consider to be screaming buys right now. I have never seen a better environment since I started out. One can pretty much just buy whatever is down the most from 52w highs, assuming no materially negative event has happened, and just buy buy buy.

Biggest Take Away

One should by now realize that 95% of juniors did no suddenly drop in value in tandem. It is just negative sentiment and tax loss selling that brings down everything in PRICE for a while. In fact, most of these companies are WORTH more today than at the 52w highs. It’s our jobs to front run GOOD SENTIMENT by buying LOW SENTIMENT…

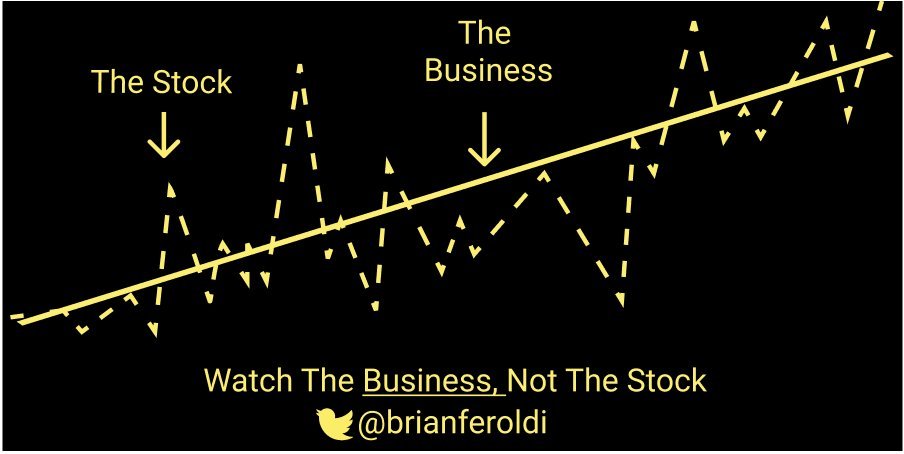

Positive fundamental developments might not get reflected during tax loss silly season but they will one day. That’s all the conviction you should need.

”…Charlie and I let our marketable equities tell us by their operating results – not by their daily, or even yearly, price quotations – whether our investments are successful. The market may ignore business success for a while, but eventually will confirm it.” – Warren Buffett

The market is not hard to beat. It’s just that we beat ourselves.

In short:

I AM BUYING EVERYTHING I CAN

When sentiment + sector valuations are high you use a scalpel…

When sentiment and sector valuations are extremely low you use…

A HAMMER

If I lacked the fortitude to just HOLD I would simply diversify as crazy until I reached a point of comfort.

There is NO NEED to have a very concentrated portfolio with great exposure to company risk when everything is one sale.

It has taken a while but I finally understand why Bob Moriarty has Sentiment as the most important factor when it comes to beating the market. Thus I would recommend reading his book “Nobody knows anything”.

Note: This is not investing or trading advice. Do your own due diligence. Miners are risky and I am biased etc.

Best regards,

The Hedgeless Horseman

In principle, I agree with everything that you’ve written in your analysis. But there’s one thing that I think you’re omitting in the valuation of precious metals equation.

Mining equities are not AlLOWED to trade freely. It used to be that you could go to shortsqueeze.com, and ascertain the short interest and what that was versus the outstanding number of shares. It’s truly my belief that these stocks are sold “short” in reckless abandon. Who’s going to say anything about it…….the SEC? Certainly not. The real number of shares that are “short” for a lot of these stocks, is multiple times the numbers that are published, because it’s a way of manipulating these stocks, and keeping the narrative alive, that money managers and the public would be foolish to invest in these companies.

Could it be that the bigger miners are drooling at the chance to buy out some of these well managed, smaller miners with proven assets in the ground? Date I say, that they even may be going along with an alleged shorting mania that helps to prevent the explorers/ small producers from gaining any traction?

Look what happened this morning with the announced buyout of Great Bear Resources by Kinross. How much of a premium is that to its closing price? First SSR Mining takes out Taiga and now Great Bear……

Hmmm…