Perspective: Trial by Fire

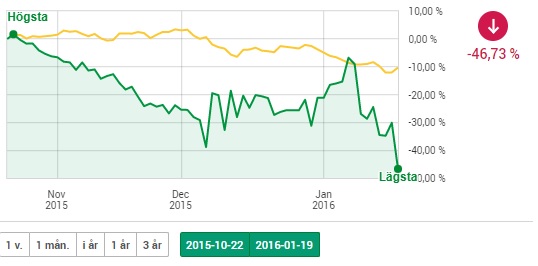

Since I have been on a site visit I haven’t followed the market that closely but I did read that yesterday was a slaughter. I checked some individual names and some were down like -18% even though gold was only down -0.9% and silver down -2.6%. In other words totally irrational overreactions compared to the change in underlying business values. This sort of panic selling of securities (mining companies) that are already incredibly undervalued is what I remember from the 2015-2016 bottom:

Do you think anyone was bullish on miners on January 19? You think anyone dared to buy? Do you think the chart looked anything than awful? Do you think anyone felt smart owning miners?

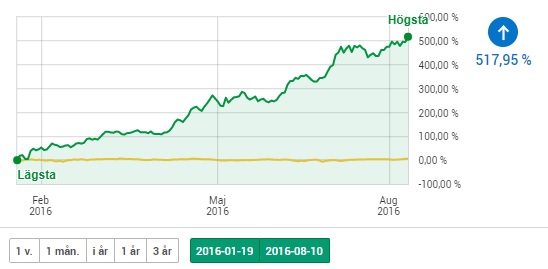

I remember another “colleague” of mine who showed me his portfolio back then and the majority of his miners showed -60% and he was about to give in (sell out). Fast forward to 8 months later and every miner he had was up a lot. This is how my portfolio did from January 19 to August 10 in the very same year:

I still remember to this day how I was buying stocks like Silver Standard (Now SSR Mining) when it went down -10% in a day, around the time of the bottom, when gold/silver were only moderately down. That was capitulation selling. People selling something that was already incredibly cheap simply because they couldn’t take it any more and I guess feared that it could always go down more. I bet many felt like the mining sector was pretty much “ending” and the idea of “Price is what you pay and Value is what you get” had gone out the window. The costliest mistake I could have done would be if I sold everything around the bottom in disgust. Even if I bought nowhere near the bottom, as evidenced by the 47% decline, it still worked out incredibly well… Think about that.

What do we know?

- Gold is still very high and the producers have near record cash flow

- Gold/silver juniors are so cheap that the metals in the ground are almost given away for free in some cases

- The world mines a lot more gold/silver than is found each and every year

- The world’s miners will all need to replace their current mines

- An above average quality gold/silver deposit will still be an above average gold/silver deposit regardless if gold is at $3,000 or $1,000.

- The mining sector is not going away

- Demand for gold is high and many central banks are buying a lot

- The debt bubble is getting bigger each day

- Real rates are negative

- The supply/demand for gold/silver looks increasingly attractive from a macro stand point

The most (only) important question

- Are juniors miners undervalued?

- YES

… It’s just that RETAIL INVESTORS etc are nowhere to be found right now and are highly emotional. There is little capital entering the space to pick up the shares that disgruntled investors are selling currently.

Gold would need to drop hundreds of dollars more for many juniors to actually be overvalued at this point in time in my opinion.

Conclusions

This feels like we are near a capitulation bottom in the juniors just like in 2015/2016. Some companies become so absurdly cheap that they can then go up hundreds of percent when the sentiment pendulum swings. Personally I think it should almost be a crime to be selling securities that are so obviously undervalued.

In my book I am only making a mistake if I am overpaying for something. Overpaying for something is increasingly plausible during times when sentiment is good and valuations are lofty obviously. Right now I think it is becoming near impossible to be making a mistake in the form of overpaying for almost anything…

So if it becomes almost impossible to be making a technical mistake in the form of overpaying for anything it still leaves us with the possibility of making emotional mistakes in the form of selling and/or not buying undervalued securities…

Everyone has heard the phrase “buy low, sell high”. Well, right now the sector is friggin low. This is trial by fire and I bet 95% of people who know the phrase, and were sure they were be able to do it, are actually not able to do it.

In 2015 I was sure I did the rational (right) thing by buying miners because they looked cheap to me. That did not stop many of them from going down 30% more. The important thing is that I did not panic sell anything and instead tried to buy more and more as Price went down further. Why? Because the Risk/Reward was getting EXPONENTIALLY better.

It’s best to be emotionally prepared for anything since the market is often irrational. I do not rule out a further 30% drop in my total portfolio even though it makes no rational sense from a valuation perspective. All I know is if that happens the following rally will massive and I expect to see almost every junior I have to go up several hundred percent…

In other words I know I will win and it just becomes a matter of how long it takes and how much pain one will have to endure before said win. If I wouldn’t be able to take it and would sell miners at this level or lower I would basically be signaling to the universe that I do not have what it takes to be a value investor… This is the trial by fire.

One very important thing to note is that buying something that is cheap and see it go down does not mean one made a mistake. Buying something that SHOULD go down and STAY DOW is when one is making a mistake.

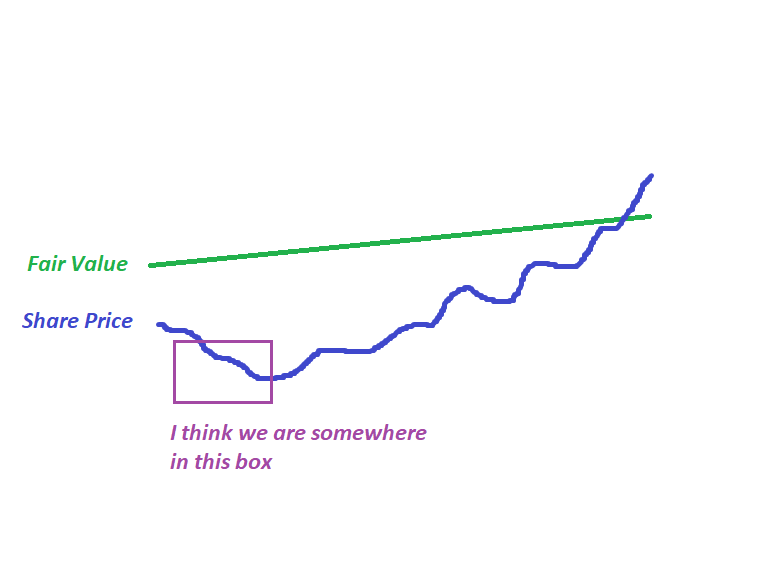

Below is a crude graph of a theoretical junior that has a positive trend in terms of fundamentals (intrinsic value). Any time one is buying said junior below its “fair value” one is buying something that has a positive Expected Return. In other words whenever one buys it below the green line one is NOT making a mistake. However, that does not mean that it can’t go down further before it heads higher towards fair value. One would however be a making a mistake by selling said junior when it is below the green line all else equal:

I would just end with saying that I have no intention of selling anything and I got a severe case of greed when I saw some juniors go down close to 20% in PRICE when nothing really has changed fundamentally. I am actually up to like 30-40 names that I think have incredible Risk/Reward and the only frustrating thing about the current environment for me is that I do not have a lot of dry powder. I do believe that any dollar I invest today will see a 100% return at least on average over the coming 12 months and that’s a proposition I would be stupid not to act on.

I enjoy tests like we are seeing now because that’s the only way of knowing for sure how strong I am mentally. It should be a matter of personal pride not to allow the marginal, irrational investor to influence oneself enough to not even retain common sense simply by the act of pushing down the price when he/she panics. If I sold a cheap share, with positive Expected Return, in panic simply because Average Joe got spooked and dumped his position then that is not OK… Because I would even be less than average.

You either take advantage and use the market (the marginal investor) or you are a victim of it.

For dramatic affect:

Best regards,

The Hedgeless Horseman

Even those of us who have been through many cycles appreciate a bit of encouragement during tough times. Thanks Erik.

Be right and sit tight. Investing is a games of conviction(faith), nerves, patience and will.

I’m sorry, but we’ve been hearing the same spiel for years now…….what is going to change the continual pattern of the criminals capping Gold and the PM stocks when the overall equity market is going higher, and annihilate the PM sector when stocks go down( like today)?

The longer this manipulation

goes on, the more stupid I feel for ever getting involved in this Godforsaken industry.

When your crying you should be buying and when your yelling you should be selling. I live by these words

Wait, I just wrote that down next to “sit tight”. Right now my eyes are watering since I spent all of my dry powder a few weeks ago. I didn’t see this one coming. We truly live in some interesting times…