Three High Octane Exploration Stories: Prosper Gold, Labrador Gold & NuLegacy Gold

Setting The Scene

When I look at early stage exploration stories I want to see targets with tier #1 or tier #2 potential. I mean given the risks are so high regardless of what quality the target is I want to see a BIG PRIZE. Furthermore there is no shortage of exploration targets or mediocre deposits out there. EVERY junior around has at least one.

Regardless of the quality of the target the costs for sampling, drilling, assaying, salaries, helicopters and you name it stay roughly the same. If I was presented with a bunch of lottery tickets with the same cost (price), but different pay offs, any rational person would of course buy the lottery ticket with the highest potential pay off (assuming odds stay the same). This is basic stuff based on Expected Value.

Now the thing is that most junior explorers will not COST the same of course. Often the higher quality explorers with higher quality targets will cost more (higher Enterprise Value). The Risk/Reward functions will therefore vary a lot and be impossible to get exactly right. Why? Because the only thing we know for sure is Price (Enterprise Value) and only god knows the actual chance of success.

The risk/reward function gets even more complicated when one accounts for the fact that ounces in the ground are not of equal value. The lower the quality of ounces the higher the critical threshold will be in terms of reaching a size that would make sense to develop. 300 Koz of low quality gold will not entice many miners but 3 Moz of the same stuff might (economies of scale). In the case of high quality ounces the critical threshold will be much lower. 1 Moz of high quality gold might be a no brainer to put into production (Just to be clear: what I mean by high quality is the inferred economic value per ounce).

If one hopes to see a “natural exit” in the form of an explorer being bought out by a major one would of course like to see high quality ounces and/or lower quality ounces but with a lot of size. With that said there are of course many other factors that will play a big part in terms of how an acquirer would value said ounces than sheer economic potential. Jurisdiction is one said factor for a good reason. I mean it makes sense that if one buys an asset one would not really want to see it get taken away by some greedy government (nationalization). Then there is also permitting and community risk. If permitting is very slow or almost impossible then the economic value per ounce will significantly drop due to discounting (a promise of a dollar in 10 years is worth less than a dollar tomorrow). Furthermore community risk can vary based on population density, a community’s experience with mining- and processing techniques. For example: Open pit mining leaves a larger footprint than underground mining and the use of cyanide can have people worry about environmental risks.

With all the above said I think it should make sense why three of my favorite early stage explorers are Prosper Gold, NuLegacy Gold and Labrador Gold…

Prosper Gold (PGX.V)

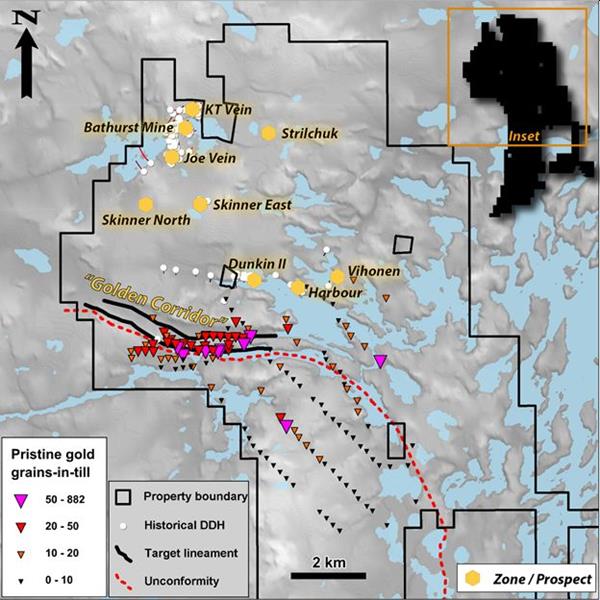

Prosper Gold is located in Ontario which very much is mining country (less community/permitting risk). Not only that but it is a tier 1 jurisdiction (less geopolitical risk). Furthermore the area around the flagship target called “Golden Corridor” is sparsely populated (less community/permitting risk). Taking this into account one could expect that a discovery in such a location would fetch a higher “per ounce value” than most explorers…

THEN we have the fact that the gold in till anomaly that has been outlined so far is both a) Huge and b) Of high quality:

… That’s a multi kilometer long trend with some truly obscene grades to boot. This is what I would certainly call a tier #1 target.

So to sum up I see the PRIZE having tier #1 potential via the combination of size and grade potential. Said PRIZE also benefits from all the factors outlined earlier ( lower community risk, lower permitting risk, lower geopolitical risk) which should mean that for example 2 Moz here might be worth multiples of 2 Moz in a worse location.

For all of the reasons above I would think that Prosper Gold will attract many eyes when we see the announcement of drill start and that excitement will ramp up as we get closer to potential assay results. I mean lets face it. Majority of people want to get rich tomorrow and there are simply not many junior explorers out there with a target like this that also happens to be in one of the best areas in the world…

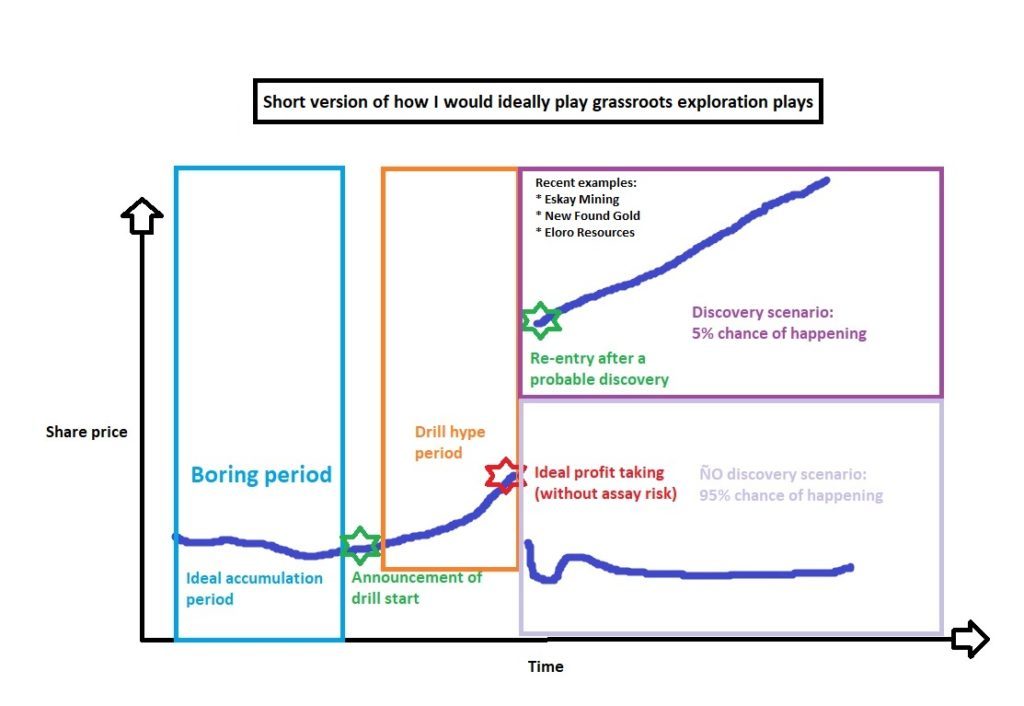

Therefore I simply expect that shares of Prosper Gold will be stronger than the average junior in the coming months. My current strategy is to ride my fairly decent position until we get closer to assays and evaluate my position size. If the share price is up a lot going into assays then I can take some profits and not have a full allocation exposed to assay risk. If the share price is stagnant or even goes down then it might be worth holding my full position going into assays since the risk/reward will be good or even better than today. Flexible is the name of the game!

Ps. It doesn’t hurt that the stock is in an uptrend it looks to just recently have broken out of a bullish wedge pattern:

(Note: NOT trading advice!)

Labrador Gold (LAB.V)

Pretty much all the same qualities in terms of location/jurisdiction that I outlined for Prosper Gold are present in Labrador Gold. In fact, Newfoundland might possibly be the best jurisdiction in North America right now, at least according to some industry people I have talked to.

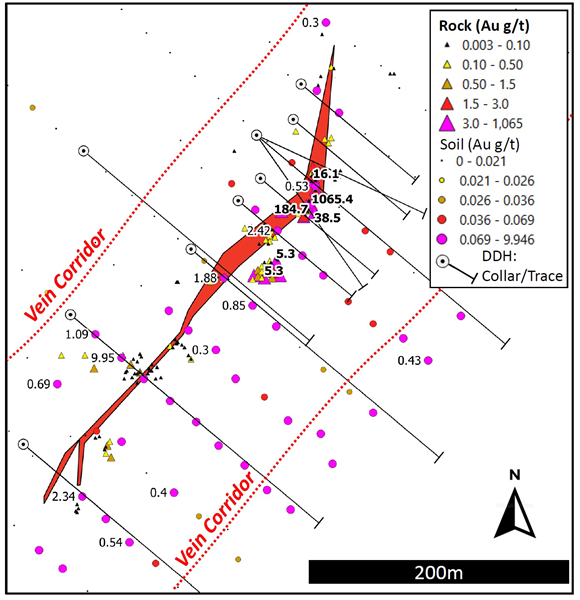

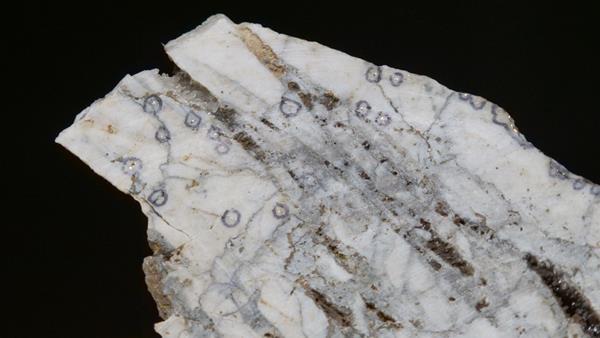

Labrador is however a bit different when it comes to target type etc. First of all Labrador has already confirmed visible gold in outcropping veins at surface and the mineralization has indeed been identified as Epizonal in nature (same as Fosterville and Labrador’s neighbor which is New Found Gold). One could therefore consider this to be a relatively de-risked exploration play which makes it easier to understand why Labrador decided to go ahead with an impressive 10,000m of drilling right off the bat:

It’s also worth noting that there is considerable strike to the “golden smoke” in the identified vein corridor.

I participated in the PP of last year and have also added about the same amount in the open market. I will not touch the PP shares so I will have at least 50% of my position going into assay results. Some amount of the shares bought in the open market might get sold if share price ramps going into said assay results. We know that Epizonal Gold Systems can provide some of the most insane intercepts around but we also know that the bonanza zones in these systems can be tricky to hit. Labrador will be drilling very close to where the surface vein sample showed a lot of visible gold and graded 1,065 gpt Au:

To sum up I would say that I do believe Labrador has an above average chance for success and given that the target is Epizonal in nature I would also argue that the quality of the target (prize) is well above average as well. I would therefore be a bit surprised if no good hits at all came out of the 10,000m drill campaign. With that said there are never any guarantees and the market can be very volatile depending on expectations versus results. I am not in the “get rich quick” business so I am certainly not betting the farm on any single news release but I have an above average exposure (around 3% which many would consider high). If all holes miss then I expect the stock to be down at least 50% in 6 months. If they are able to make a discovery then I would expect it to be materially higher within 6 months since New Found Gold’s Market Cap will act as positive “emotional context”.

FWIW it looks like the share price has been forming a bull flag that we might have broken out of last week. Re-test or false break out? I have no idea but right now I think there is positive momentum. And if this is indeed a bull flag breakout then there could be some solid upside left in the short term:

(Note: NOT trading advice)

Flash Update April 12: “Labrador Gold Updates Its 10,000 Metre Drill Program at Kingsway Project”

Snippet:

Our drilling program is off to an encouraging start with the first hole intersecting two zones with significant quartz veining and sulphide mineralization,” said Roger Moss, President and CEO of Labrador Gold. “The presence of the vuggy quartz, stylolites, arsenopyrite and possible boulangerite are all indications that we are in the targeted epizonal gold system.

NuLegacy Gold (NUG.V)

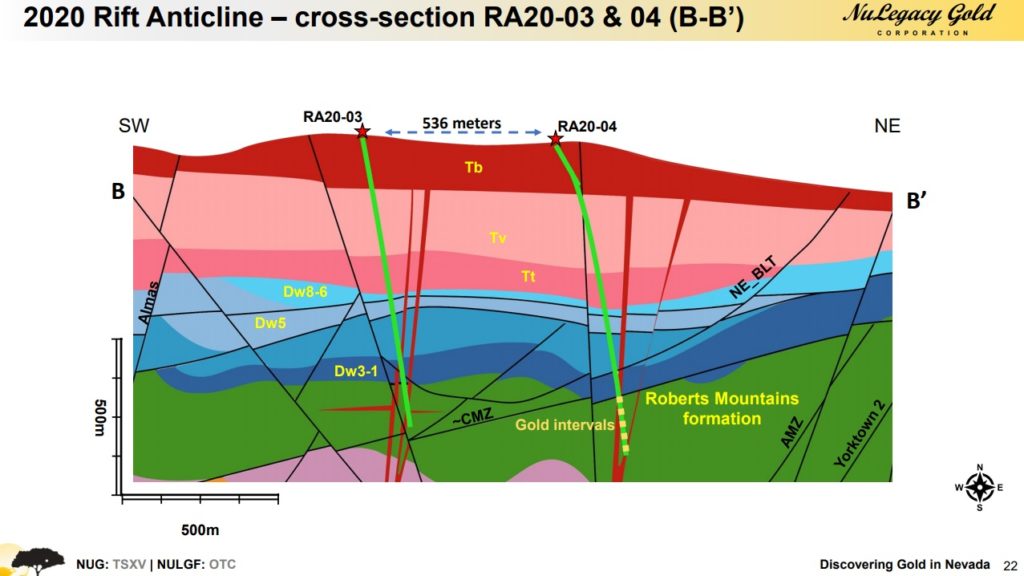

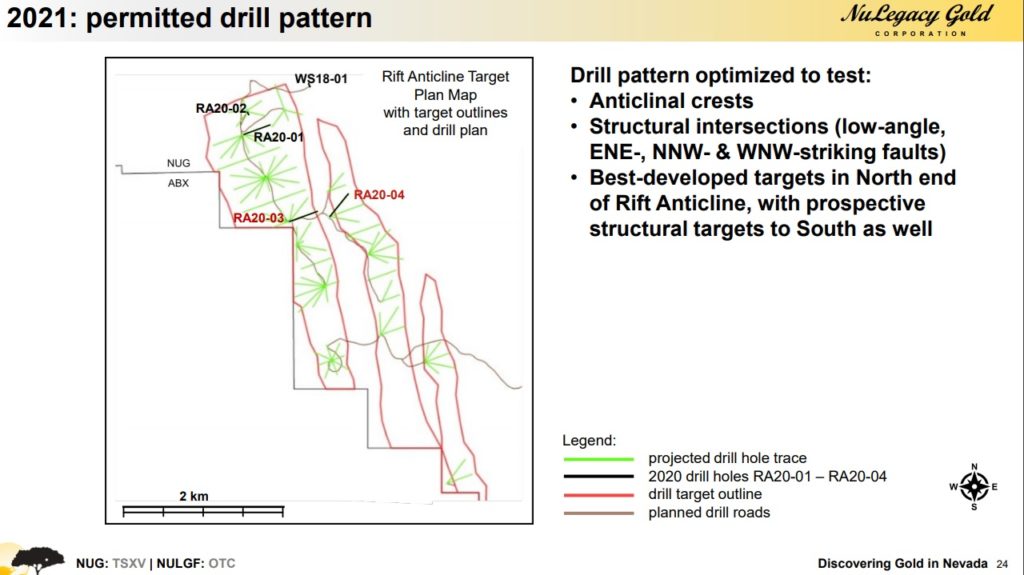

I have a fair bit of NuLegacy via two Private Placements. So far I have yet to sell a share even though I have warrants as well. This is pretty much as high risk/high reward as it gets. We know there is smoke at depth since the first “blind” holes hit some low grade intervals. This gold doesn’t just fall out of the sky so one can safely say that there has been gold bearing fluids come up in the “Rift Anticline” target area. The soon to be coming drill program is a very aggressive one since it will involve multiple drill rigs. And since the first holes proved that there are thick sections of Roberts Mountains formation at depth, beneath the targeted Wenban5 horizon, the company has decided to drill very deep holes this time around:

Why? Because the Roberts Mountains formation is a known host of Carlin style mineralization. In other words the target strata has expanded from Wenban5 (Dw5) to both Wenban5 and Roberts Mountains formation. One could assumes this means that both the prize and chance of success might have increased in light of this.

Anyway, the company will test quite a bit of land across three different high priority trends:

Via drilling the company has also discovered that the Wenban5 horizon is a lot thicker here than at the giant Goldrush deposit some kilometers to the north. All in all the (very) theoretical Prize ought to be a behemoth. This fact coupled by a) the close proximity to some of the largest gold operations in the world run by the Barrick/Newmont JV b) It being located in one of the best mining jurisdictions in the world and c) The coming drill campaign being very aggressive, leads me to believe that there could certainly be some “hot money” coming into the stock in the not too distant future.

The chart for NuLegacy looks a bit similar to Labrador Gold in the sense that it looks to be forming a Bull Flag (bullish continuation pattern):

NuLegacy Flash Update, April 13: “Core Drilling Commences in Rift Anticline”

… It’s on!

Closing Thoughts

Labrador Gold currently has a higher excitement factor given that the company has actually begun drilling and said drilling is located around a bonanza sample found in an outcrop. Many are probably also aware of who the neighbor is a few kilometer to the south and what kind of results have come from their drilling. If one enjoys the excitement of potential discovery than I think Labrador is one of the better plays out there. However, assay results are always quite risky and I would certainly not bet the farm on any single maiden drill campaign. There is no shame in taking some profits if the share price (SP) gets way ahead of itself and re-entering after a discovery hole even though price might be significantly higher. Personally I am in the wait and see mood right now. If SP heads to 0.90 going into assay results then I will for sure shed some shares. If SP stays around these levels then I might hold on to most of my shares. Anyway, it’s not a large position that can break my portfolio.

Prosper Gold has a longer runway until “peak excitement” since drilling has not yet started. Therefore the assay risk will not materialize for a few months yet. The Golden Corridor target is not only exciting because of the grades found in the till samples but also the sheer size of the anomaly. Furthermore it is not far away from Red Lake or Great Bear Resources’s Dixie Project so there ought to be some very positive “emotional context” to increase the appetite for shares.

NuLegacy Gold should soon be joining Labrador and start drilling. I would not be surprised to see NuLegacy outperform the sector in the weeks/months following drill start. It’s pretty fitting that both stocks appear to have formed bull flags as well. Since my position in NUG is via PP, that I am not planning on selling, I will most likely hold every share going into assay results (fingers crossed). This is not something I would recommend however.

To wrap things up I would just say that all three stocks that have been discussed in this article have entered the “excitement period” or are very close to entering them. This is typically when hot money and people who wan to “get rich tomorrow” start piling in. From a risk/reward perspective I do think the optimal strategy is to take a decent amount of profits shortly before assay results if the stocks have ramped higher. Then one can re-enter after a potential discovery. Sure, one might have to pay up 50%-80% but the trade off is that one isn’t taking assay risk. If instead the stocks go down or trade sideways then one will have decisions to make since at some price the risk/reward might even warrant holding into assay risks (to some degree).

Best of luck to us all!

Lastly I will repeat this point again: I would not bet the farm going into assays in hopes of getting rich overnight!

Note: This is not investment advice and certainly not trading advice. Always make up your own mind do your own due diligence. I own shares in all companies mentioned and Labrador Gold as well as Prosper Gold are sponsors of my site. Therefore assume I am biased!

Erik thanks. Any thoughts on Lab showing photos of drill core as part of news release. Suggests to me a level of confidence.

I’m not selling my NuLegacy till they find another Betze-Post

What will NEM-GOLD pay for a 50 million oz gold deposit in NV?

Love it bonzo – hell I’d be happy if they find anything over 3mm oz as it would immediately become a takeover target.

I have owned and sold Nulegacy over the past five or more years. I have only lost money so far, and a lot of it. I too would love to see them hit the Mother Load, but deep in my gut I’m thinking another Charlie Brown!