THH – Barsele Minerals (BME.V): 45% of The Largest Undeveloped Gold Deposit in Sweden

This article will be describing my personal case for Barsele Minerals and why I have bought shares in the open market. It contains forward looking statements, personal (biased) opinions, speculation and all that good stuff. Since I am a shareholder and have also been able to get Barsele on as a banner sponsor you should consider me biased. Never invest a single dollar in any stock if you don’t see the reason for it. I share neither your profits or losses and there are no guarantees of anything in this sector.

Setting The Scene

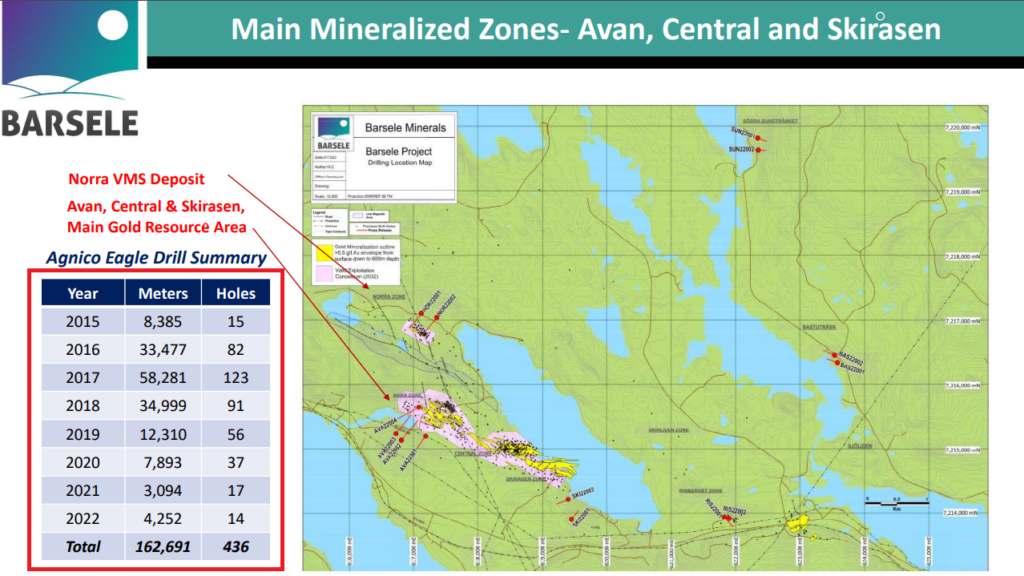

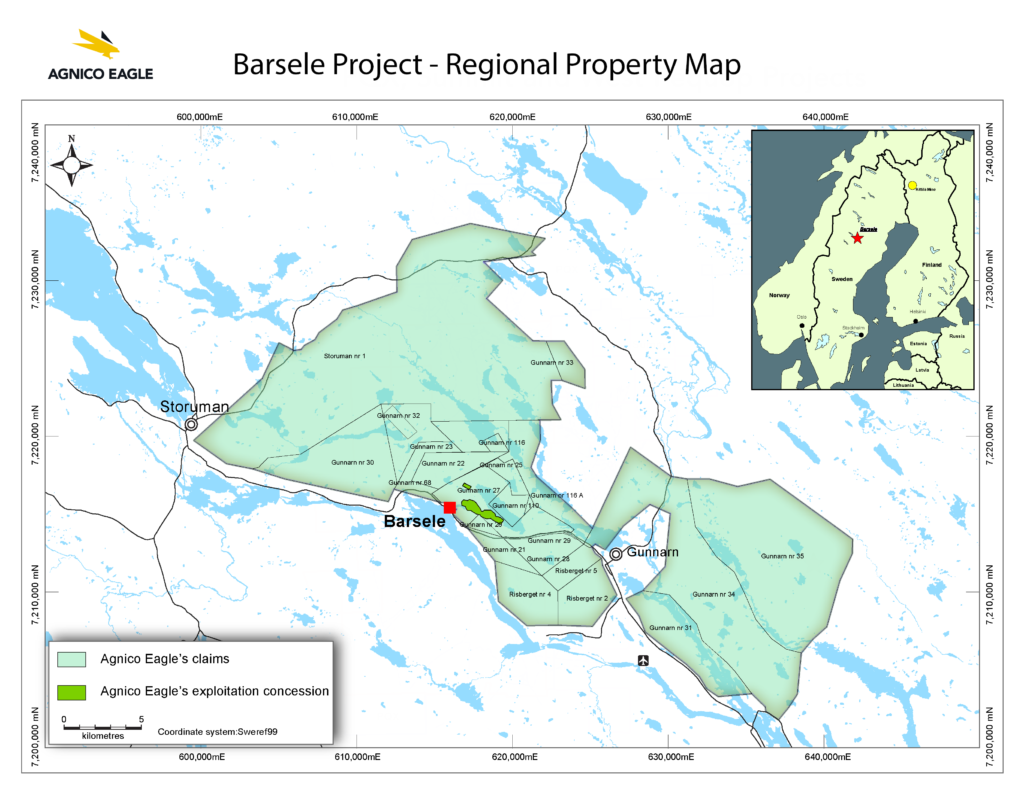

That the big money is typically made by starting off buying assets on the cheap is no surprise. That the junior mining sector is cheap thanks to extremely depressed sentiment is no surprise either. Anyway, the constant hunt for bargains lead me to Barsele Minerals a couple of months ago, which might be one of the biggest “value sleepers” around. Go check Barsele’s room on CEO.CA and you will see the definition of a sleeper. I remember when Barsele was a hot story back in 2016/2017, and the share price ran from around $0.10/share to around $1.6/share, on the back of robust drill drill results produced by Barsele Mineral’s partner Agnico Eagle (who owns 55% of the flagship Barsele gold project). After a few years of intense drilling the drill campaigns got smaller and smaller, while sentiment got worse and worse, due to lack of excitement in both the space and for the company. In the last few years there have only been very limited drilling done and today the stock is the definition of sleepy…

(Drilling budget “suddenly” went down a lot despite system being wide open and new discoveries having been made)

How does a stock chart typically look after going from exciting to extremely boring? Well like this:

The thing is that Barsele is currently Free Carried by Agnico Eagle and if Agnico Eagle decides not to do much then not much happens.

As I see it Barsele is in a bit of a conundrum. With Agnico Eagle’s focus having mostly shifted to Canada the Barsele gold project has been put on the shelf. It looks too good to let go but perhaps not good enough for Agnico to change its mind about focusing on Canada nowadays. With Barsele being free carried by Agnico, it is Agnico that sets the pace, which is very slow nowadays. So Barsele can’t really do much given that Agnico is obligated to foot the bill on any work but Agnico is not doing much work.

Barsele Minerals tried to rectify this a couple of years ago as the company tried to purchase Agnico’s 55% share of the project and planned a very aggressive drill campaign to rejuvenate the story. Why? Because it would seem that Barsele’s management/insiders, who own an impressive 25% of the company, believes that the Barsele gold project is a high quality gold asset that can grow a lot. Unfortunately that plan failed as the junior sector started to crater and have been getting worse ever since (As we are well aware of). Thus, the conditions necessary to fund the acquisition has not materialized… Yet.

TL;DR: My Short Case For Barsele Minerals

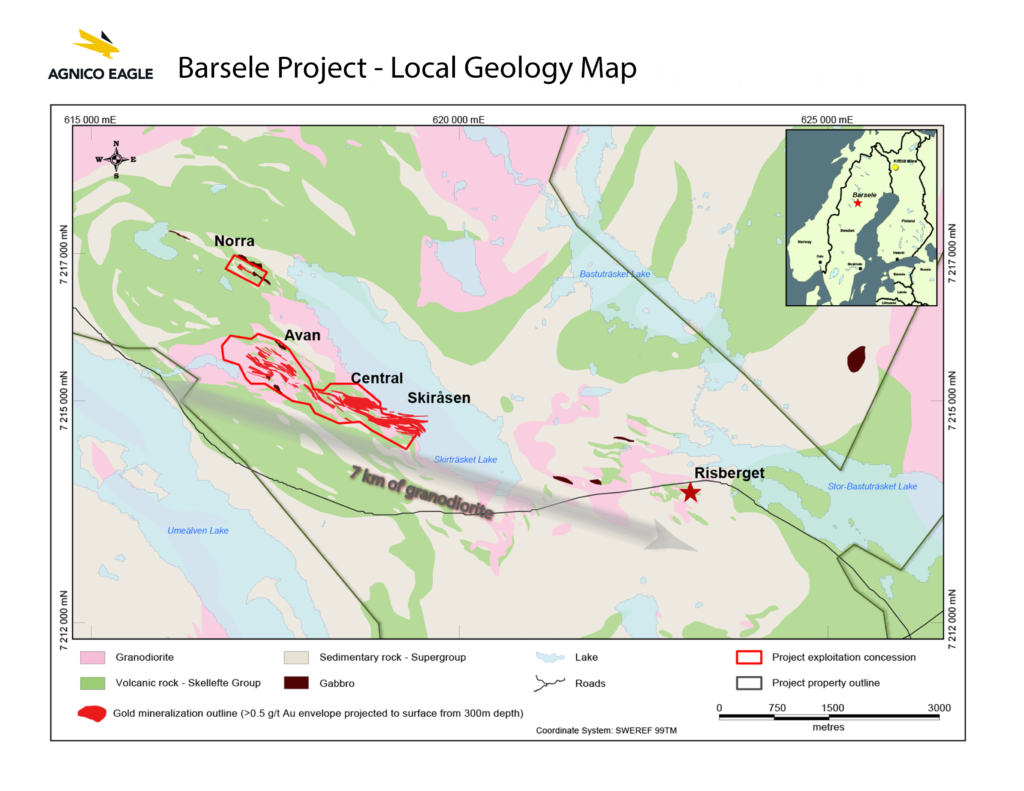

Barsele is by far the largest undeveloped gold project that I am aware of in Sweden, and one of the largest in at least northern Europe, with a current (conservative) resource of ~2.5 Moz. Management believe that it could relatively easily get to 3-5 Moz just based on what is currently known about the system, and >10 Moz is not out of the question, given that the resource only covers 3 km of an 8 km long structural trend. And the average depth of the resource is some 450 m while gold has been confirmed as deep as 925 m already. So in my personal “book” this is a probable 3-5 Moz gold system with 5 to >10 Moz long term blue sky potential.

- A very conservative 2.5 Moz resource (makes it the largest undeveloped gold project in Sweden)

- Tier 1 jurisdiction

- Tier 1 location (infrastructure; Highway, rail, power & smelter nearby, power costs, etc)

- 5->10 Moz of gold potential

- + VMS potential

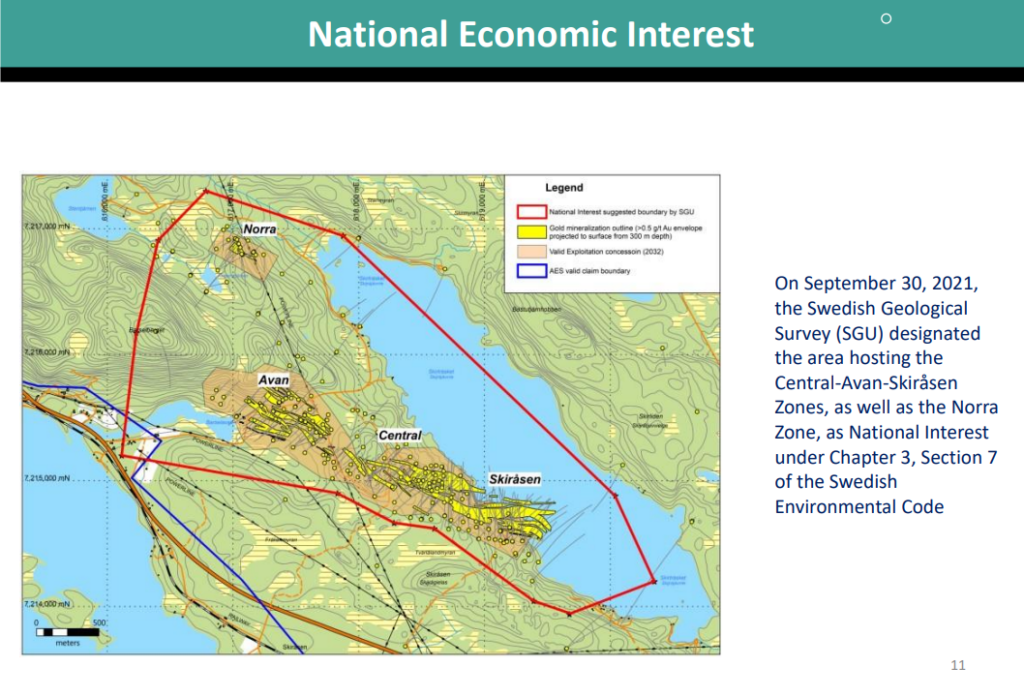

- Project is designated by Sweden to be of “National economic interest”

… Barsele owns 45% of the above and Mr Market currently has a price tag of C$25 M. In my opinion Mr Market is making a mistake here.

My Longer Case For Barsele Minerals

Below are some tidbits I put together when I was collecting information on Barsele which I may reference later

- Agnico deal would have put them as the largest shareholder of Barsele (“They demanded that“) – Source

- Resource goes down to 450 m on average but they know mineralization extends to at least 1 km – Source

- Resource is “ultra conservative” and much closer to “Reserves” – Source

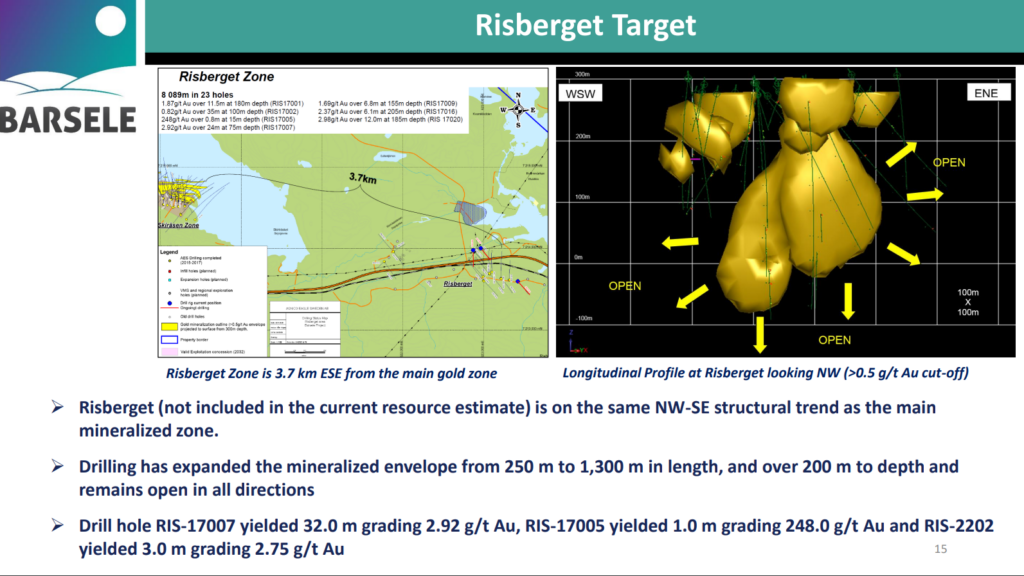

- Current resource fits within 3 km of an 8 km trend. Gold is confirmed at “Risberget” which is 5 km away. – Source

- Current resource does not include “Risberget”, “Bastuträsk” or “Norra” and was done at $1,300 gold

- CEO Gary Cope personally believes it will end up being 10-20 Moz – Source

- Drill orientation and the recently discovered bonanza gold veins – Source

For further evidence of it’s quality, and potential economic value, the areas was designated to be of National Economic Interest for Sweden in 2021:

“On September 30, 2021, the Swedish Geological Survey (SGU) designated the area hosting the Central-Avan-Skiråsen Zones, as well as the Norra Zone, as National Interest under Chapter 3, Section 7 of the Swedish Environmental Code“

And given that Sweden is Europe’s largest metal producer, which includes production from the state owned giant LKAB, you better believe that the country knows mining and what makes a good mine. Sweden also have some of the best mining equipment in the world thanks to Atlas Copco, Sandvik, Volvo, Scania and Epiroc etc. This is why we have some of the most efficient low cost mines in the world:

- The world’s most efficient open-pit copper mine – Source

- The Kiruna mine is the largest and most modern underground iron ore mine in the world – Source

- The world’s most productive underground zinc mine – Source

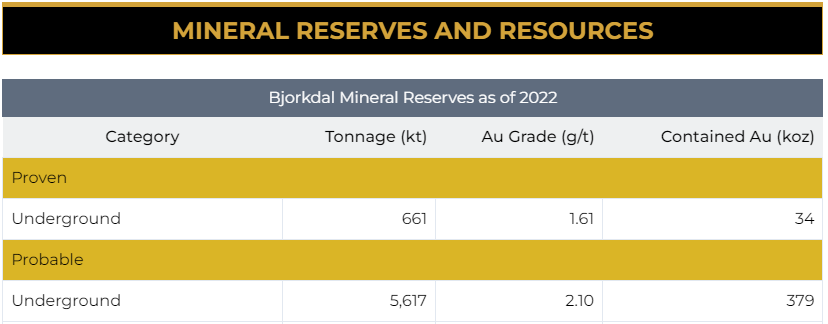

- Mandalay’s Björkdal mine is mining sub 2 gpt underground – Source

In contrast the company is currently valued at a mere C$25 M by Mr Market which certainly doesn’t jive with owning 45% of something that would be of “National economic interest”. The last Resource estimate was done in 2019 and showed close to 2.5 Moz. However, this does not include a single ounce from Risberget, Bastuträsk, Norra, nor any of the drilling in the main zones done since 2019, and has been described to be so conservative that it is closer to actual “Reserves”, AND it was based on a $1,300 gold price(!). From what i understand there has also been a very conservative buffer zone used for the lake which has also reduced the ounces for better or for worse. In other words the ~2.5 Moz number is both outdated and probably very conservative to boot…

Barsele actually reached a MCAP of ~C$178 M in 2017 with a much smaller resource:

“We joke… That that was at half the ounces, and half the grade, and gold at $1,200...” – Source

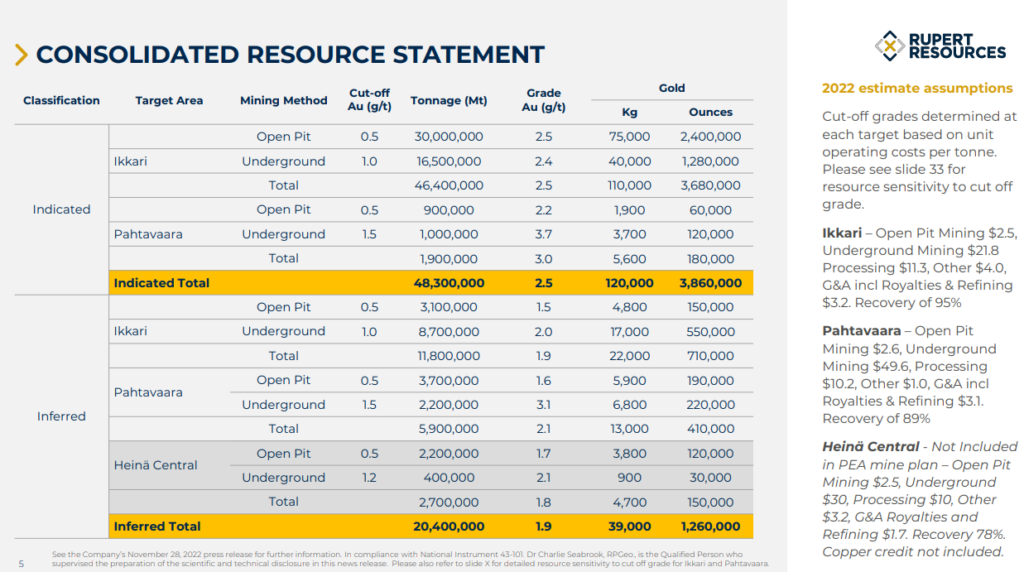

But even if we use this conservative number then Barsele share is 0.45 * 2.5 = 1.125 million ounces of gold that have already been delineated. Then the MCAP/Oz calculation gives us a mere C$22/Oz. This looks really silly when compared to Rupert Resource which has a global Indicated and Inferred resources of 5.12 Moz, spread across three deposits, in Finland. Even with the recent share price decline the Market Cap of Ruper Resources is still C$626 M (Down from ~C$1 B earlier this year) which gives them a CAP/oz number of C$122/Oz. Sure, for example Ikkari is more advanced and has a PEA study done already but the price difference strikes me as ridiculous given that the resource estimate from Barsele is a) Very conservative, b) Outdated, and c) confined in one single project. Slap on the probable growth potential, large blue sky potential, “National Interest” designation, superb infrastructure, low cost power, and it looks even more silly.

Barsele’s stock price is C$0.18 today at the time of writing. As recently as June 0f 2021 the share price was as “high” as $0.82 which meant the company was valued at around C$112 M or $112/1.125 = $100/oz. THIS would actually be fitting in light of Rupert Resource’s current valuation. So what changed? Well not much given that there has not been a resource updated since 2019 and Agnico only drilled 7,346 meters in all of 2021 and 2022. In other words common sense would suggest that it is pretty much theoretically impossible for the deposit itself to have gotten much worse since then. As a matter of fact the “National Interest” (Aka, this for sure is worth something!) designation was granted later on, in November of 2021, and the stock spiked for a brief moment at least(!)…

Oh and as I was still writing this piece we got a news release from the company on Oct 04:

“Barsele Provides a Preliminary Summary of 2023 Drilling Activities”

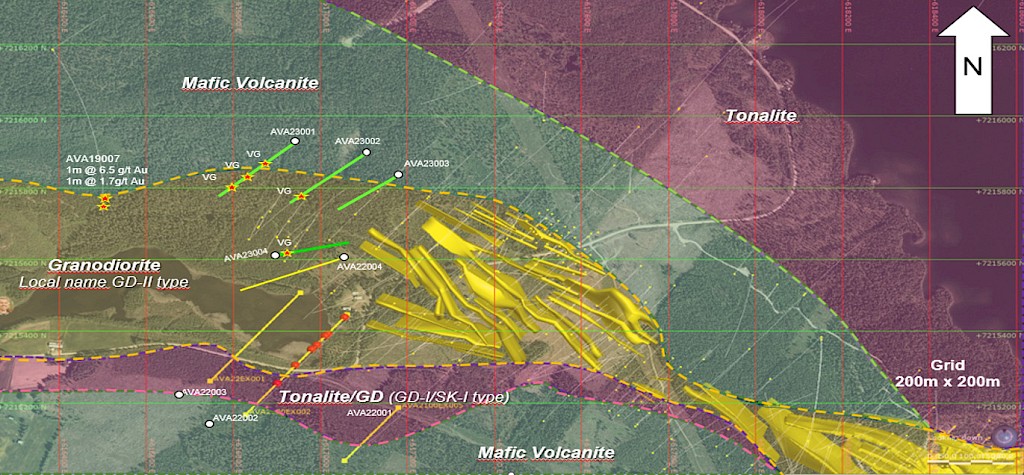

Agnico only drilled 3,245 meters and appears to have mostly been testing new areas except for a few holes along strike at the Avan zone as well as the Norra VMS zone. Well the assays from the Risberget area were no barn burners but showed that there is gold mineralization farther out than what has been drilled. BUT the news release also stated:

“Hole AVA23001 was drilled in a southwesterly direction and hit the favourable granodiorite unit GD-II at 58.0 metres down hole. Visible gold was observed at 142.6 metres, 185.2 metres and 213.2 metres. Favourable quartz veining and arsenopyrite mineralization were observed throughout the entire GD II portion of the hole. This drilling extends the gold mineralized Avan Zone 300 metres to the northwest from the end of the Avan resource wireframes. Analytical results are pending.”

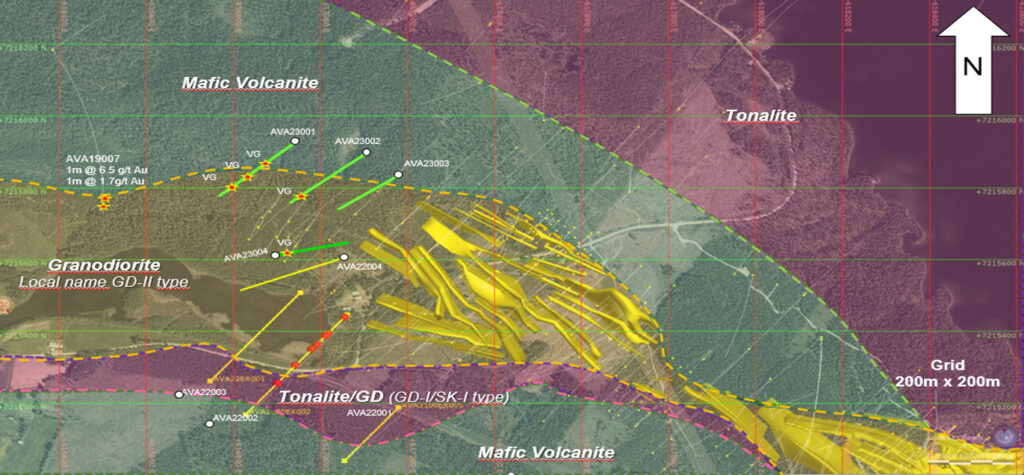

(VG encounters marked with stars)

… So you have what looks to be a 300 m strike extension to one of the largest undeveloped gold systems in northern Europe. How did the market react? Barsele traded ZERO shares on the day of the announcement. This is how friggin crazy this sector is right now. At face value there was not a single person in the entire world who was able and willing to even pick up shares despite Barsele probably being dirt cheap even before the announcement. So is this sector bad or not? Well that obviously depends on how you look at it. I do not know any other sector where one can steal as much value as in the gold juniors right now.

So if nothing got fundamentally worse for the project, but rather better, since the stock was at $0.82 (or $1.6 for that matter) then what gives? Well it was in 2021 when Barsele tried to put a finance package together in order to acquire Agnico’s 55% interest in the project. So what I think happened was that we got a glimpse of what the actual stand alone value of the Barsele Gold project could be. That is until the deal fell through as the junior sector started to deteriorate, and “risk on” capital started to dry up, for real. After the deal was terminated the story went back to being extremely boring, which everyone knows is like Kryptonite for investors (impatient speculators), in this space. Oh and while this acquisition deal was still pending/live CEO Gary Cope did a public presentation at Deutsche Goldmesse in Frankfurt and stated that; “Barsele’s drawn an incredible amount of interest from Newmont who is waiting, standing by to go see it”(Link)…

The Agnico Eagle Deal

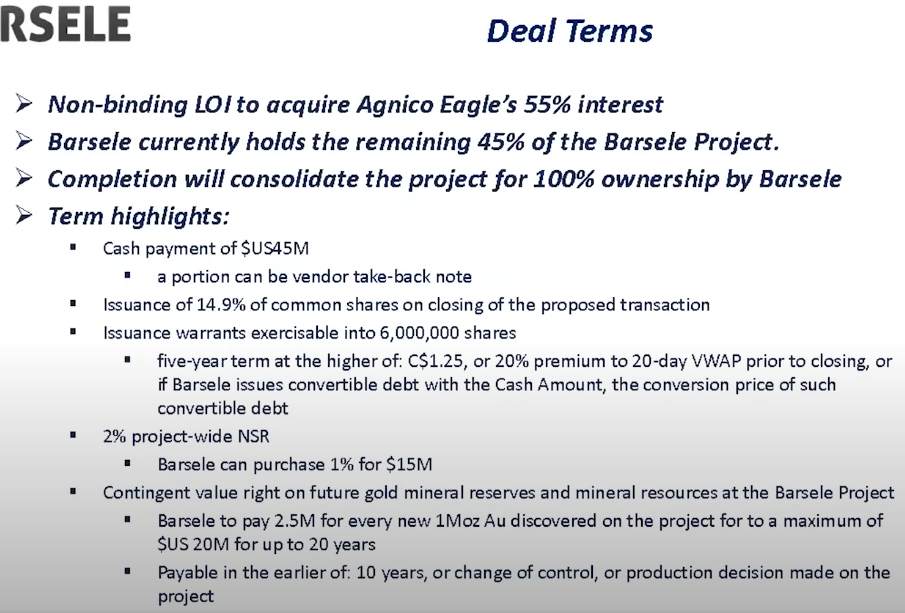

To drive home the current undervaluation in my eyes we can simply look at the deal terms. Well it was a complicated deal with many things involved but in short it included a cash sum of US$45 M, Agnico getting a 14.9% stake in the company, warrants exercisable at $1.25/share and royalties etc:

Just the USD cash portion would be around C$60 M. Then add the extra 14.9% worth of shares, implied value of the 6M warrants, 2% NSR where one 1% could be repurchased for $15 M, and the up to US$20 M in payables depending on any future resource increase(s). The cap of US$20 M translates into a cap of 8 Moz in additional ounces resources/reserves for what it is worth. “Change of control” is also included in the clause. So you have a) Agnico Eagle demanding shares in order to be the largest shareholder instead of getting paid with more cash, b) 6M warrants set at $1.25/share and, c) “change of control”, and d) resource growth payables up to >10 Moz etc…

It should be pretty obvious that Agnico thought that this project could have a lot of room to run post deal close (At a time when the shares were trading around $0.60/share). Note this was as recently as 2021 and since then the only major change for the project has, again, been that the project was granted the “national interest” designation (aka gotten even more derisked). It is almost like the big wigs was going to walk away on principle (New Canada focus) and that at least the Agnico personnel who were familiar with the project got to help structure the deal in order for Agnico to also profit from the future revaluation of the project. Well this jives with Gary Cope’s comments that the local Agnico team was “distraught” that Agnico would let this one go.

So even though it is impossible to say exactly how much the deal for Agnico’s 55% interest was worth in Risk Adjusted Net Present Value lets say C$80 M. C$80 M for 55%, with implied upside beyond this given Agnico’s demand and deal structure, it would in that case mean that the project would at least be valued at C$145 M at the time I reckon. Again I would see this as a very conservative floor. Well in that case one could argue that Barsele’s 45% stake should be worth a minimum of: C$80/0.55*0.45 = C$65.5 M…

That would already be 2.6 Times the current Market Cap or in other words $0.47 per Basic Share Outstanding (versus the current price of $0.18/share).

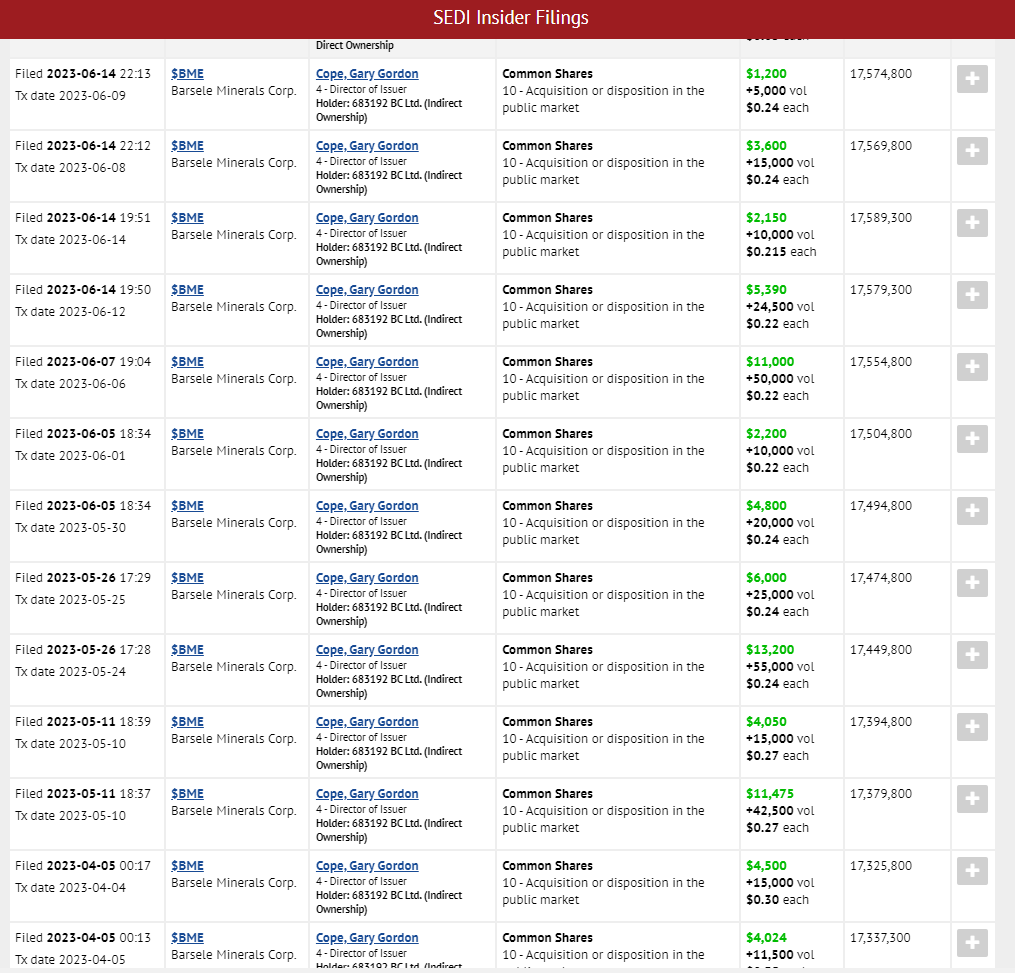

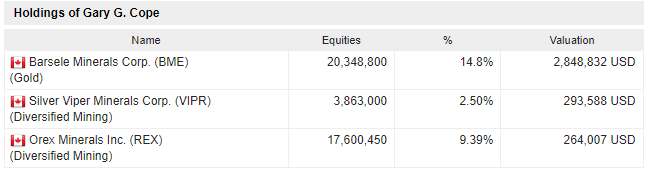

Since I am no geologist, nor a mining engineer, I especially appreciate being able to use implied signal value. In this case we Agnico Eagle which was is signaling a belief in further upside when the stock was at $0.60, and on the other side of the table we have a company where management owns 25%, and would be shooting themselves in the foot if they thought the deal price was too high since an increase in share price is what impacts insiders the most. Basically both parties appear to suggest that the deal price at face value was undervaluing Barsele and that both expected to make more profits later on. On that note there has been heavy insider buying, mainly by CEO Gary Cope, for years and a lot of it was done at share prices that were multiples higher than today.

Lets just say that it appears that the CEO has very high conviction when it comes to Barsele:

Why Would Agnico Eagle do a Deal?

So the first thing one naturally would ask is why would Agnico Eagle want to give up control of the Barsele project at all? Well I had put together a few snippets from Agnico itself as well as some anectodes that jives with Agnico Eagle simply leaving everything outside Canada/NA behind…

Anecdotes

- Agnico Eagle selling Gold projects in both Sweden and Finland to Gold Line Resources not too long ago

- Talked to geos from a Finland focused junior who said Agnico had some nice targets in the area but nothing was being done there

In the news

At Detour, Agnico completed a rework of the mine plan in July, lifting the reserve base 38% and improving the long-term outlook for the operation materially. Gaining complete control of the 640,000-oz.-per-year (100% basis) Canadian Malartic mine represents the crowning of Agnico’s unofficial ‘Canada-first’ strategy. – LINK

“What really makes a good miner, is do you know the ground better, do you know the suppliers better, do you know the contractors better, the permitting better and all of that you get from experience,” Al-Joundi said. “Where many of our peers are global miners and they’ll go anywhere in the world to build a mine, we’re regional.” – LINK

Expectations

Barsele might be, or might not be, boring until the gold sector picks up and people suddenly realize that high quality gold ounces in the ground have been trading at ridiculous prices. But if/when that happens I think Barsele could go up a lot. And if/when that happens I think that the company will be able to acquire 100% of the project. And if/when that happens I think we will see a very aggressive growth plan to get this then 100% owned project to 3-5 Moz and perhaps more. The plan was actually to start a >30,000 m drill campaign as soon as the Agnico Eagle deal would have closed. I do not see any reason why a story like that should not fetch >$100/oz in a decent market. According to management the likes of Newmont have expressed interest in the project which is obviously a very welcome sign. The blue sky scenario is of course that the company gets acquired in a few years, in a hotter market, at a very attractive valuation (For example say 5 Moz at $150/oz for a price tag of $750). If this would grow to world class scale (for example >8 Moz) then I think the dollar per ounce price would go up as well.

Lastly, I can see some value/sentiment adding synergies between Barsele and Gold Line Resources which just announced that Taj Singh is coming on as a CEO. If Gold Line, which controls some >80 km of strike in the Swedish “Gold Line”, to the north and south Barsele, shows that there is a lot more gold in this belt then I think a major would be even more interested in acquiring the big jewel in the middle.

Comparables

Lets take a look at Rupert Resources (“Ikkari”) and another small scale gold miner operating in Sweden…

Rupert Resources

The flagship project is obviously the Ikkari deposit which has some 4.5 Moz of gold delineated already. Most of the ounces are in the open pit unlike Barsele. However, the undergound resource grade is actually higher at Barsele. Furthermore, as discussed earlier, I think the Barsele project will end up showing at least a resource the size of Ikkari (Hence the in my opinion significant upside potential in the Barsele stock).

Björkdal underground reserves and resources (Operating mine east of Barsele)

Mandalay’s Björkdal mine is located to the east of Barsele and has been in operation since 1983. The mill feed is currently made up of 75% from underground mining and 25% from low grade stockpiles. These are the underground reserve grades that are being mined:

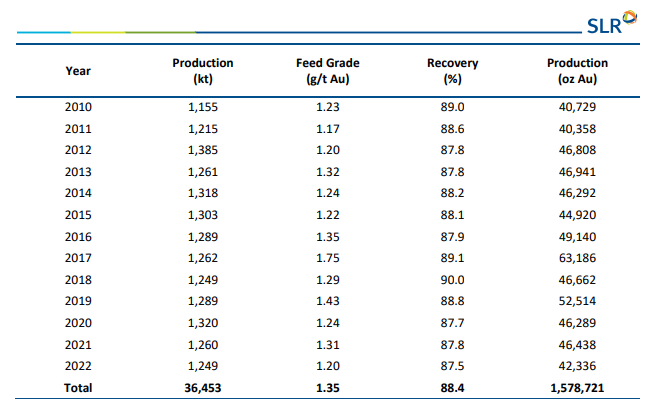

Björkdal’s past production, feed grades and recoveries:

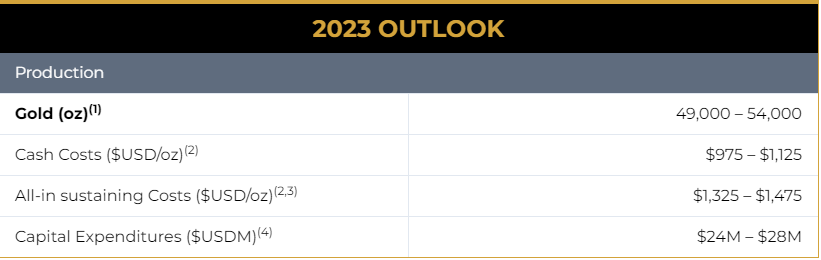

Those grades would make most people weep. Especially if it is a small operation with no economies of scale even. Despite this the 2023 Outlook according to the company makes it seem that they can even make some money:

… I cannot understate just how freakishly good Sweden can be, especially northern Sweden, from a mining cost perspective. And the Barsele project would probably be a) a much larger operation and b) a higher grade operation.

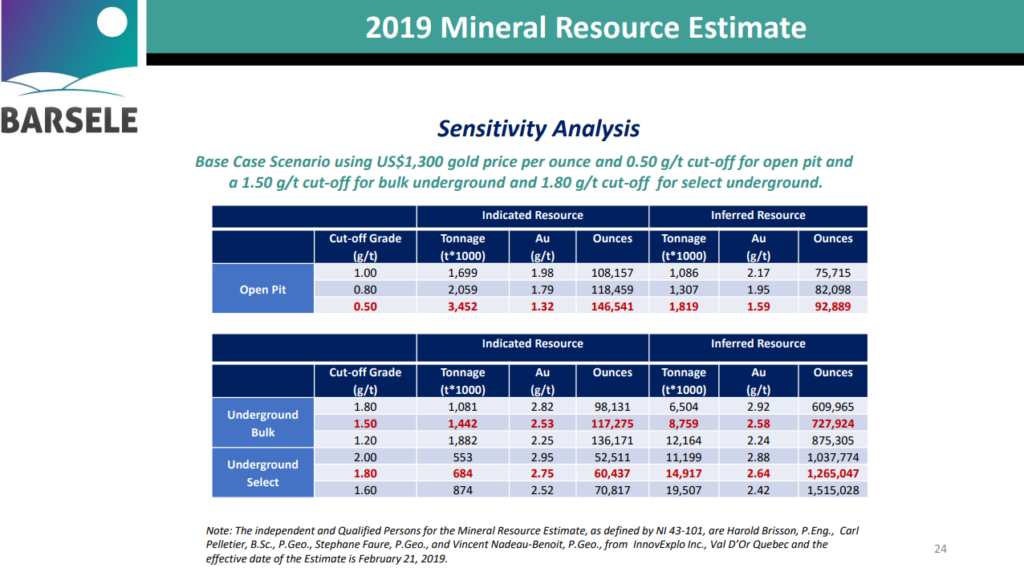

Cut-off, grade and resources for Barsele

Things to note

First of all this resource has been described as being “ultra conservative” and to be closer to actual reserves rather than resources by the company. Anyway, lets consider a few things…

Gravity Recovery

- Ikkari: is expected o recover 34% of the gold via gravity

- Barsele: “Composite Testing yielded a 92.6% recovery rate of which 50-60% could be recovered through a gravity circuit.”

Gravity is the cheapest recovery process that I am aware of. For reference the Kittilä gold mine, which is the largest gold mine in Finland and belongs to Agnico Eagle, is expected to have total cash costs of only $950/oz for 2023. That in itself is quite impressive for an underground mine with a reserve grade of 4.2 gpt. It gets really impressive when you account for the fact that Kittilä is refractory:

“At Kittila’s processing plant, ore is treated by grinding, flotation, pressure oxidation, and carbon-in-leach circuits. Kittila has Agnico Eagle’s only pressure oxidation circuit (autoclave), which is required because of the ore’s refractory nature.” – Link

Grade

The underground resource at Barsele currently has higher grades than both Ikkari and especially Björkdal.

Cut-off grade

- Ikkari: 1-1.5 gpt for underground

- Barsele: 1.5-1.8 gpt for underground

Gold price assumption

A gold price as low as $1,300/oz was used in calculating the Barsele resource. I have not seen the exact number but I am pretty sure Ikkari used quite a bit higher gold price in its resource estimate.

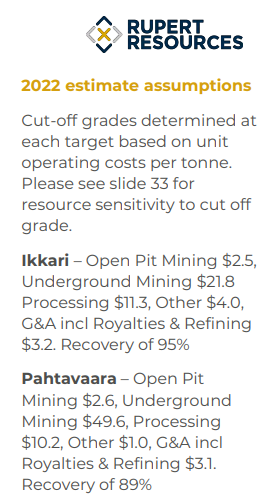

Ikkari’s estimated mining costs

Barsele’s Underground resource

- UG Grade: 2.6 gpt

- Dollar value at $1,800 gold: 2./31.1 * $1800 = US$150.5/t

Rupert’s Underground Mining costs estimates

- Ikkari UG

- US$40.3/t

- Pahtavaara UG

- US$63.9/t

I see no reason why the Barsele gold deposit would not make good money at today’s gold price. The people I have talked, that know the story but are not with the company, loves the project/geology.

Blue Sky Potential

#1 Blue sky: Depth

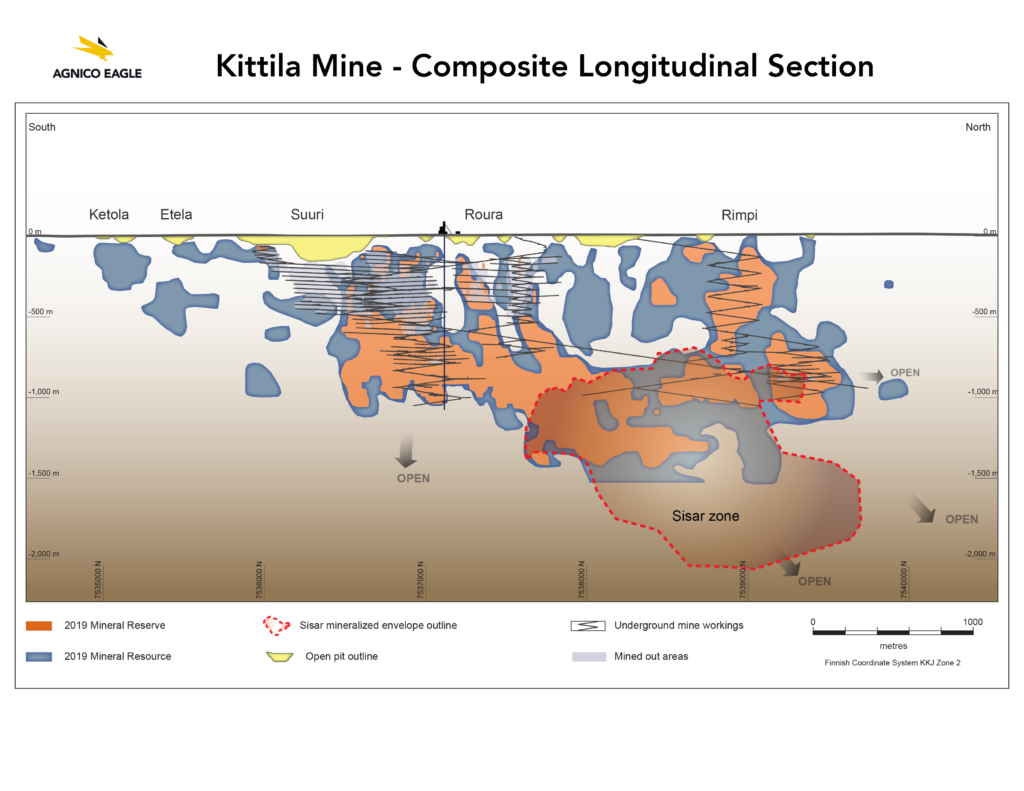

Since Barsele is considered to be a orogenic gold system there could very well be significant depth potential as seen at the Kittilä mine for example…

Kittilä Mine, Finland

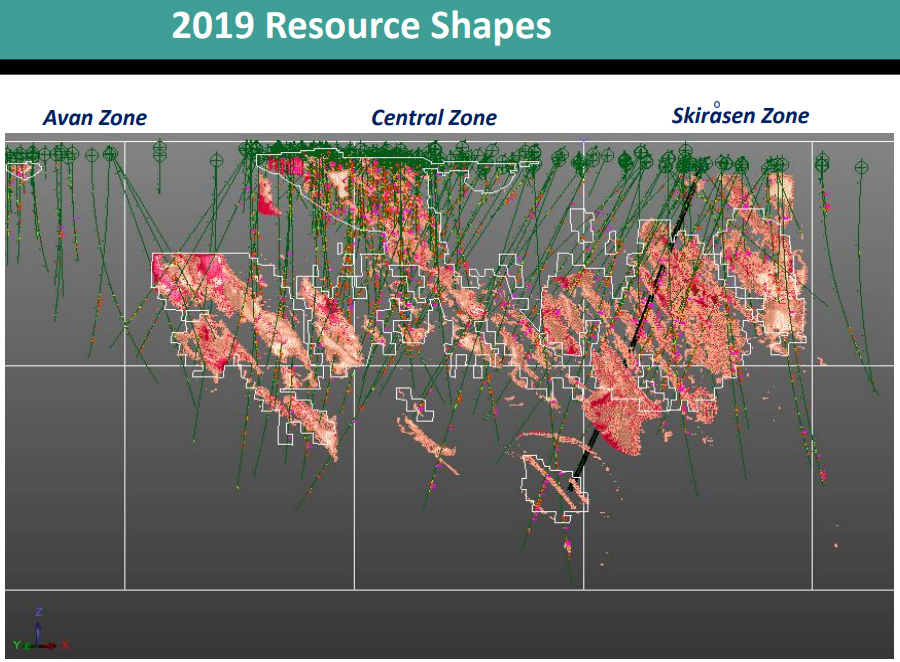

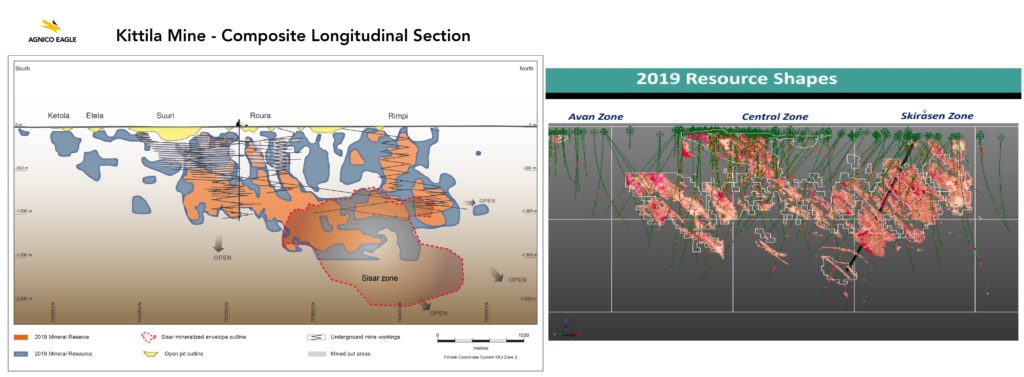

Barsele Gold Deposit (Current)

Side to side comparison

(Not correctly scaled!)

The point is that these orogenic gold systems can go way down at depth. The comparison above is not even scaled correctly given that the Barsele Resource goes down to around 450 m if I remember correctly while Kittilä is mining at >1 km depth. Thus I personally expect that most of the mineralized trends shown above will continue to depth. Now given that the 2019 resource has an average depth of 450 m, and hosts around 2.5 Moz, I think it is pretty obvious that this could grow significantly with more drilling at depth.

#2 Blue Sky: East

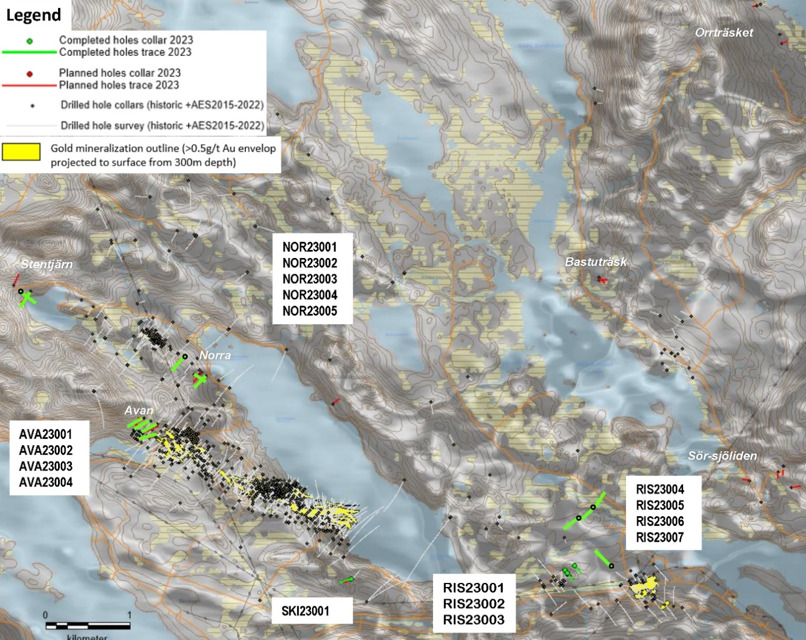

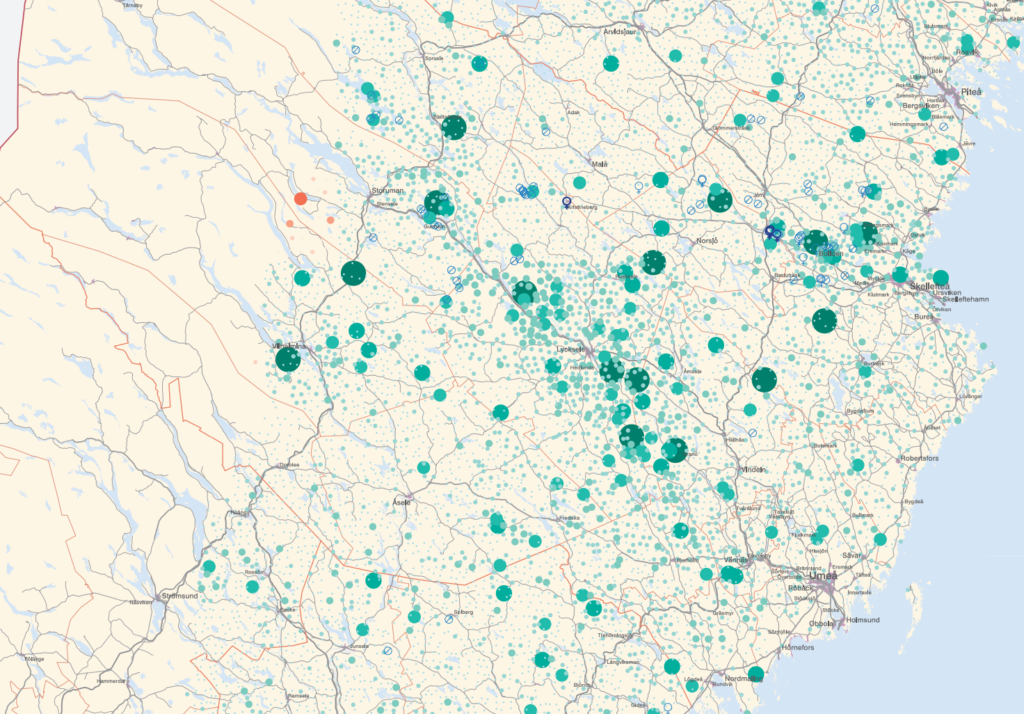

The “Risberget” target is located around 3.7 km to the east of the eastern edge of the current resource and here a 1,300 m by 250 m “Mineralized envelope” has already been confirmed with limited drilling:

What is the potential around Risberget and/or the 3.7 km stretch between Risberget and the known resources? Well that is impossible to say but we know none of it is captured in the resource and I would say there is zero potential reflected in the stock currently.

#3 Blue Sky: West

As per there recently published news release Agnico Eagle drilled four holes along strike of the Avan zone to the north-west. Even though we do not have assays yet we know visible gold was encountered and it looks like this limited drill campaign might increase the strike of the system by a whopping 300 m:

To sum up the exploration potential

I would say that the the low hanging fruit for growth would be:

- Drill known zones at depth

- Infill drilling of gaps in and between known zones

- Extend the resource along strike north of Avan

- Drill Risberget and include into resource

And the longer term blue sky areas of interest:

- Risberget area

- The 3.7 km gap between Risberget and the current resource

- Other areas along the 8 km corridor

- Other targets such as Bastuträsk and the VMS targets

- Follow up on 90 gpt boulders

Closing Thoughts

It’s time to wrap up this article even though I have not even gone through have the corporate deck. Anyway, I think the case is pretty clear and I hope I was able to communicate it…

I simply think Barsele is a world class gold system that has the potential to host between 5-10 Moz of gold or more. The project is located not only in a tier 1 jurisdiction but in a quite remarkably good location within said jurisdiction as well. The project being deemed of “National Interest” ought to de-risk it by quite a bit. In other words ounces here ought to be worth quite a bit.

As I see it I get the Beta (from the outdated 2019 resource) and the Alpha (growth) potential all the way up to 5-10 Moz or more. People who follow me know I prefer the hybrid cases where one gets ounces in the ground (leverage to the gold price) but also a shot of material value increase that is not tied to the gold price. Thus I have acquired a pretty decent position. It was not easy since this is one of the most tightly held stocks I have ever seen that can go up or down 20% on very little volume. My base case is simply that I think Barsele might be trading much higher in a year or two. Do I know that will happen and I make a lot of money on it? No.

Risks/hurdles/challenges

The only real challenges I can see is that we don’t know when Barsele can steer its own destiny better. Will someone take Agnico’s spot? Will the sector come alive soon and give Barsele the opportunity to finally buy out Agnico and consolidate it 100%? The value is obviously there and I am happy to risk being bored in order to “steal” 45% of the largest undeveloped gold project in Sweden for C$25 M personally.

Another challenge that has come up by folks I have talked to is the proximity to the lake. On that note Agnico was apparently very conservative and did not include ounces that were too close to the lake in the resource. Furthermore, from what I can gather this should be a significant gold project worthy of development even if one excludes some areas that are close to, or under, the lake. With that said SGU did, as we know, put a significant area under the “national interest” designation and that includes a large part of the lake. That Avan is growing to the north-west which is away from the lake is obviously significant. Oh and Risberget is not even close which means there is no obvious challenge to a large open pit there.

Note: This is not investment advice. I own shares of Barsele minerals and the company recently came on as a banner sponsor. This consider me biased. I cannot guarantee the accuracy of the information in this article. I share neither your profits or your losses so always do your own due diligence and make up your own mind. Assume I may buy or sell shares at any time!

Map dump and some additional thoughts

Stopped following up despite discoveries

I think there is a lot left to explore within the Barsele project. I mean Agnico put the project on the shelf despite making new discoveries…

“Following recent structural reinterpretations, drilling along the Avan Zone has presented the technical team with new insights regarding high-grade zones. Within a ~200 metre X ~200 metre X ~700 metre volume, there are new High-Grade (Bonanza-style) expansion drill intercepts adjacent to and beneath the existing Avan mineral resource area. Here, possible north-south oriented cross structures carry high gold grades along a trend that currently is outside existing wireframes. For example, at the Avan Zone, Expansion drill hole AVA18003-extension cut a new deeper high-grade gold zone, yielding 5.0 metres core length (true thickness not yet determined) grading 84.0 g/t gold uncut (4.38 g/t gold cut to 20 grams), including 0.65 metres core length (true thickness yet to be determined) grading 647.3 g/t gold uncut, at a midpoint depth of 385 metres below surface.” – source

Within the Avan and Central gold zones, new mineralized structural trends are emerging, and recent drilling has been encouraging. In addition, base of till drilling and sampling has defined a new area known as Bastuträsk, located 4.8 kilometres ENE of the Barsele gold deposit. – Source

… Only 7,500 meters have been drilled, project wide, since then in 2021 and 2022 (plus 3,245 meters now in 2023).

Barsele regional hole BAS20007B at newly discovered Bastuträsk intersects 0.70 metres grading 32.20 g/t gold, including 0.12% nickel, 0.08% copper, and 0.05% cobalt – Source

Regional hole BAS20007B cut one gold-base metal zone, with 0.70 metre core length (true thickness to be determined) grading 32.20 g/t gold, 0.12% nickel, 0.08% copper, and 0.05% cobalt at a midpoint depth of 85 metres below surface.

– Source