Novo: Eye on The Prize(s)

The recent discussions seems to have given the impression that the case for Novo Resources is centered around Beaton’s Creek. As I see it nothing could be farther from the truth. What bashers and overall clueless people are often good at is focusing on one thing and harping on about it. In this case that Beaton’s Creek for whatever reason would fail and that it’s all there is to Novo…

First things first:

I have no reason to believe that Beaton’s Creek will not be successful given the characteristics of the deposit (grade, metallurgy & near surface etc). Furthermore, on the topic of “over indebtedness” which someone recently raised I dare say said person forgets about the fact that Novo already believes that the company is fully financed to bring Beaton’s Creek into production and the fact that we have equity positions that are probably worth around C$100 M to boot. Oh and by the way, the partial sale of Blue Spec (A$20 M) has been restructured, not cancelled.

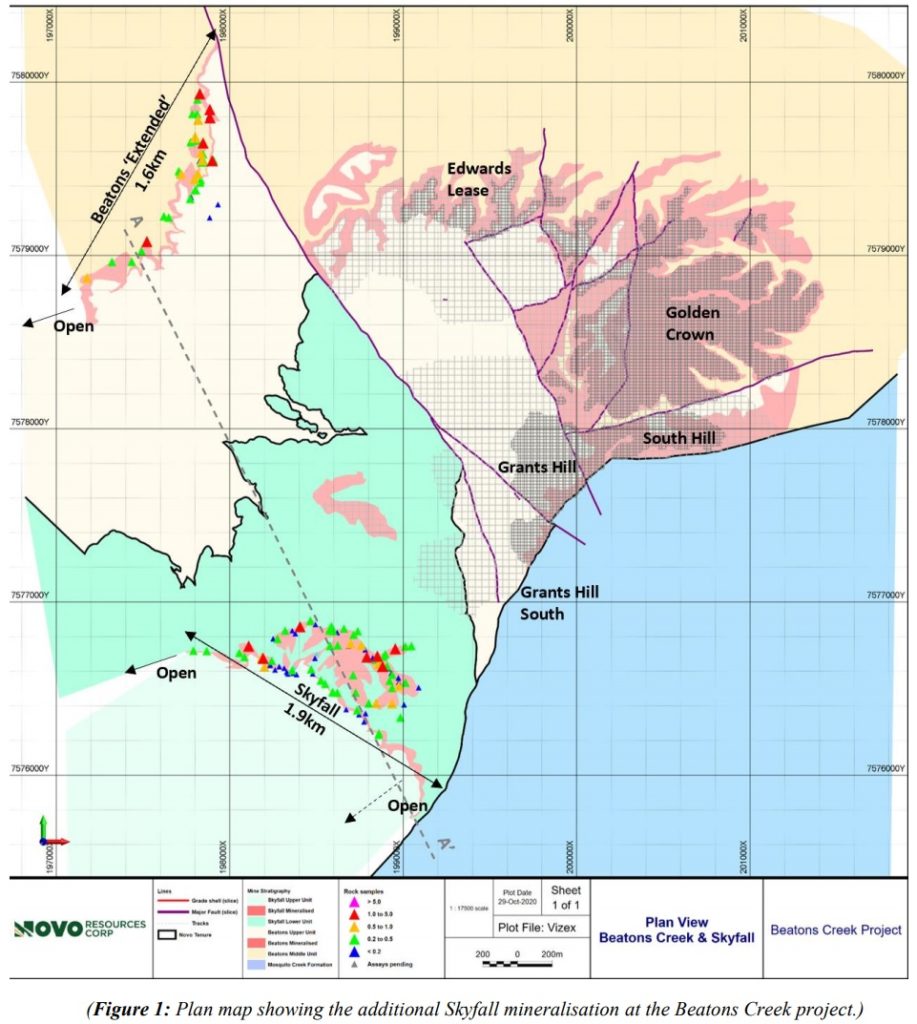

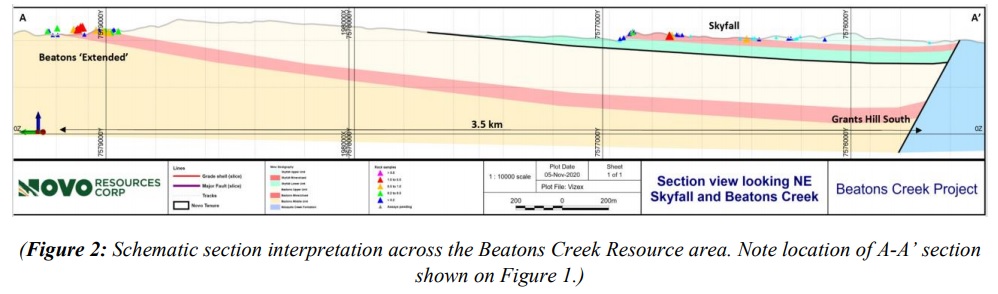

For all I know Beaton’s Creek should be in production in Q1 of next year, which is not far off, and it could be a quite high margin operation. If that turns out to be true then Novo should be cheap based on Beaton’s Creek alone given that there is immense exploration potential both in the form of Hardey Formation (Recently discovered “Beaton’s Creek Extended” and “Skyfall”:

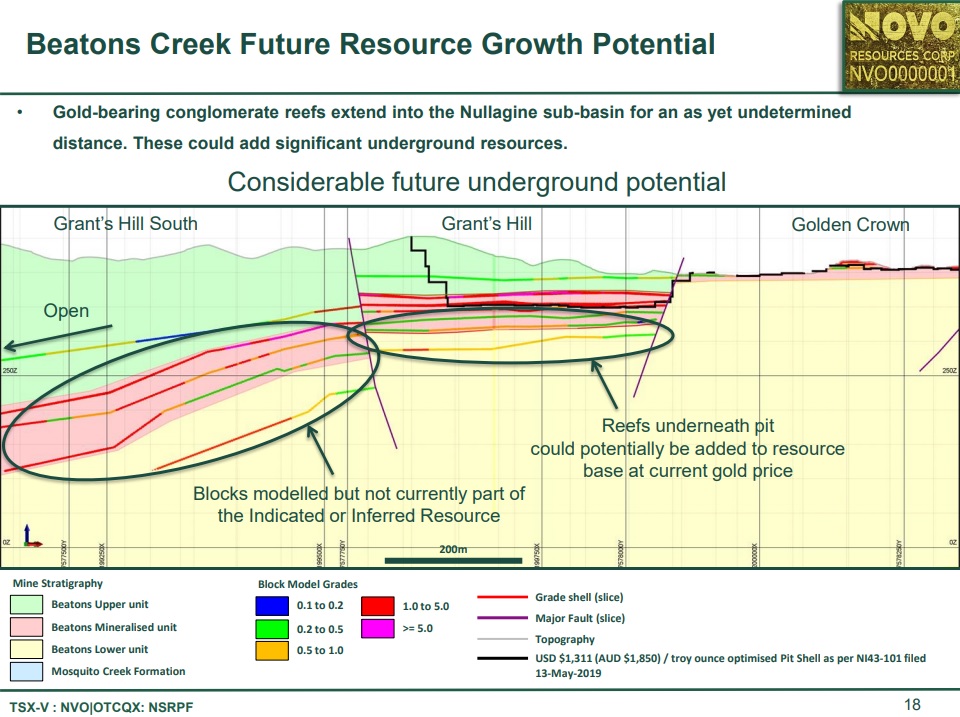

And in a future where the near surface stuff would be mined out there is also:

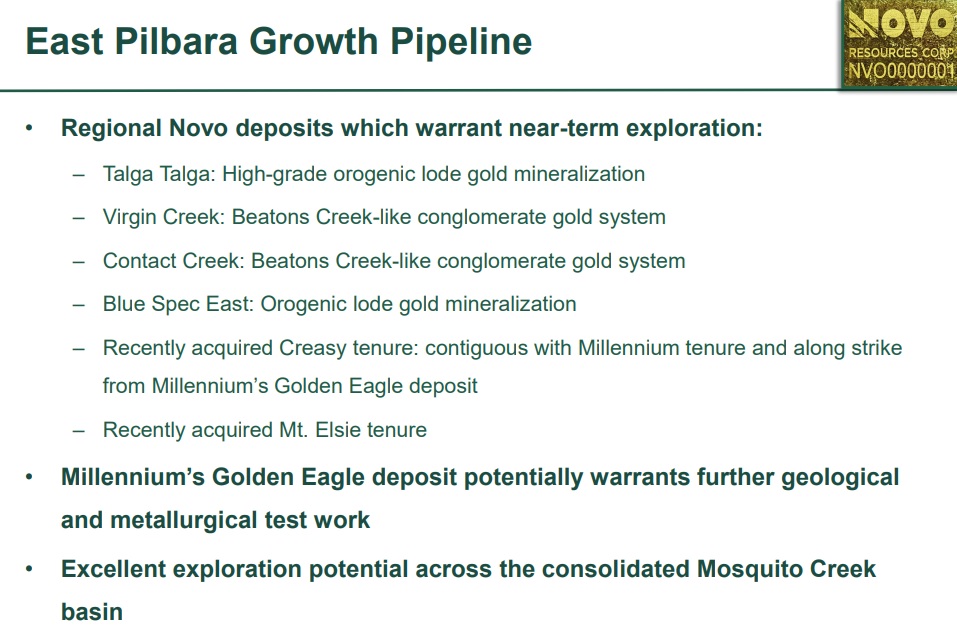

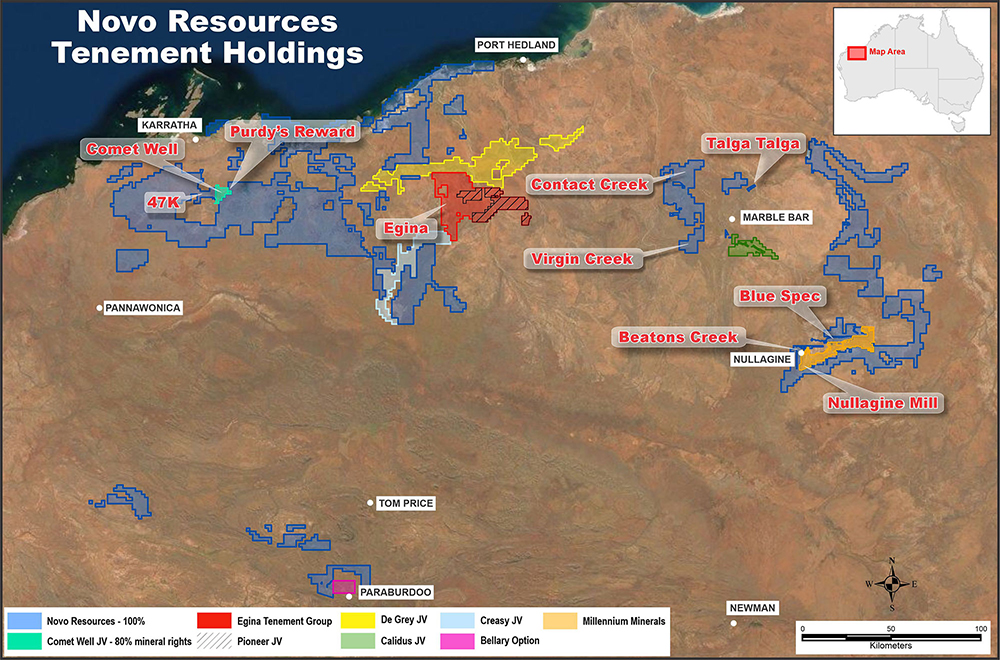

And speaking of just East Pilbara there is also all of this:

… And that’s just Novo’s projects/targets/prospects in Eastern Pilbara.

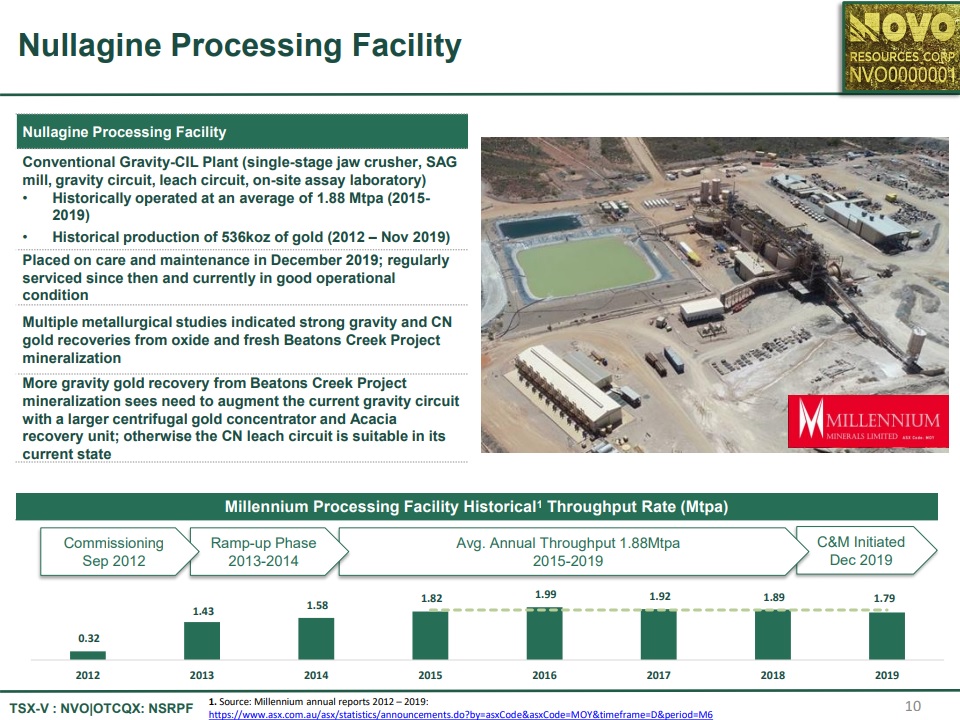

Pretty good when you have a mill to boot:

What my grand case for Novo is about is all of the potential in the slide below coupled with the next generation ore sorters that have shown preliminary sorting capabilities that are unheard of:

The obscene recoveries and mass pull shown from the coarse gold is one thing but as people might have already forgotten it was announced not long ago that EVEN the “run of the mill” ore sorter at Steinert’s facility in Perth seems to actually be able to recover the fine gold as well:

… And that’s not even the juiced up, state of the art, custom made ore sorter that Novo will be using shortly. Food for thought.

Then we of course have the the potential beast also known as Egina. Make no mistake, no basher, pundit, Kirkland Lake or online pirate has any experience with modern lag gravel mining and especially not lag gravel mining with the use of next generation ore sorters. On that note I will hereby re-post this from my “Egina For Dummies Part 2” piece:

Who actually “Gets” Egina and Novo?

I would argue that 99% of market participants have no idea about what is happening down in Pilbara and have no idea just how many “bullets” Novo has in the chamber or how big the targets are. Most don’t know about it and the few who does know about it does not understand it since it takes weeks of due diligence to even have a shot of grasping the magnitude of the Greater Terrace, Mt Roe conglomerates and Hardey Formation conglomerates which could cover a large portion of the Pilbara Craton.

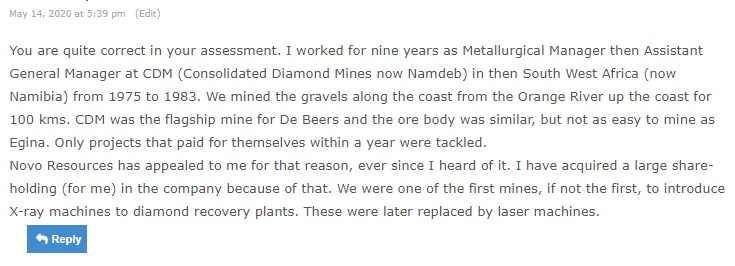

… $40 B Sumitomo gets it and the another gentleman who might be the authority above all others gets it. I am of course talking about our new friend who had this to say on the “Egina For Dummies” Part 1 article:

Since this gentleman might be one of the few people on earth who actually has first hand experience with a mining venture such as Egina, I jumped on the opportunity to pick his brain further. Luckily for us all, he was willing to summarize his personal case for Egina and Novo as follows:

Erik,

You asked me to tell you what I thought was the potential prize for Egina and Novo Resources.

The potential prize as I see it is a mine with a hundred-year life, huge capital gains for shareholders on the ground floor, many employment opportunities for people in Western Australia, technical challenges and job satisfaction for those that way inclined, opportunities for indigenous peoples to benefit and opportunities for equipment suppliers to innovate. I also see a regular flow of significant dividends in the years to come.

What is my background? I am an eighty-year old Chemical Engineering pensioner with an Economics degree and thirty-four years’ experience in the mining industry, with hands-on knowledge of gold, iron ore, coal and especially diamond mining. I have been an investor in gold mining shares since my first pay check in 1958.

There is so much that appeals to me about Novo which is more than the financial rewards.

The enormity of the scope of the project is mind boggling. I worked at CDM (now Namdeb) on the Skeleton Coast in Namibia for eight years and therefore know about extensive deposits. CDM is the only project in the world that comes close to what Novo is trying to do with their 12 000 km2 of staked claims. Alluvial diamonds were first discovered at Kolmanskop in 1908, and Namdeb is now concentrating on mining diamonds at sea, having virtually exhausted the deposits on land. The rich diamond fields near Oranjemund were only discovered in 1928, or twenty years after the initial discovery at Kolmanskop 270 kms away. I see several distinct mines with different technologies being developed by Novo Resources over the years to work their orebodies. They may only find the richest deposit in a few years’ time.

I always regarded myself as an enterprising risk-taker, not content to follow the way things are done conventionally. The way management is looking at new technology, such as X-ray sorters, at the head of the process, really appeals to me. Their use of Ground Penetrating Radar to delineate richer deposits, seems also to be a new development. There will be hiccups en route, but there will be major technical breakthroughs and it will be a departure from old-fashioned gold recovery technology. All of this appeals to me.

The involvement of Sumitomo was a major coup. Not only do they bring capital to the project, but they bring the Japanese work ethic, which is second to none. I worked with a Japanese engineer from Kawasaki Crushers; he was forced to take three days leave a year if you counted the Sunday in the middle of his holiday. Sumitomo’s contribution in terms of hands-on knowledge, different perspective and board presence will be enormous.

Egina’s location in the First World is a tremendous advantage. Dealing with government, whose first language is English, will make a big difference. Government will quickly realise that it is in their interest to grant permits to enable mining to start and so offer employment opportunities and tax benefits. Also there will be little likelihood of the mine being nationalised.

It is easy to read between the lines and see the enthusiasm of the Novo team under Rob Humphryson. They are attempting so many tasks simultaneously which must demand a big contribution from them. Being part of such a challenging project will also bring its own job satisfaction rewards. On top of that, Australian miners are known for their ingenuity.

Lastly, what I as a shareholder appreciate is the regular feedback of progress at the mine. I do not know of any other mining company which gives information so regularly and willingly as Novo does. Here credit must go to Dr Hennigh, the driving force behind the project. The man’s intellect, leadership, integrity, loyalty, expertise and experience is an enormous asset to the company, and allows me, as a shareholder, to sleep well at night, knowing the best brains in the business are working for me. He has asked me to be patient; I will surely be that.

Putting on my investor’s hat, I see a share which had a euphoric rise in 2017, which is normal when an exciting find is announced. Then it is normal for the share price to fall back as initial exuberance wanes and the hard work starts on the project. Novo fell back to a major line of support under CAD2.00, has now consolidated and I see the next euphoric wave starting soon. As with so many other mining projects, except this one is bigger and better, the share price then rises orders of magnitude above the first wave [HH: First wave hit C$9/share]. This will happen especially soon as the gold price rises and Egina starts production on a small scale.

Those are my humble thoughts.

Kind regards

I was also fortunate enough to get a few additional insights out of him:

About the early days:

“Incidentally, both German bankers and De Beers board felt that these deposits were a one-day wonder and didn’t want to become involved. Much like the opposition Novo faces from some quarters today.”

Fast Forward:

“When I arrived in 1975, CDM was the most expensive quoted share on the Johannesburg Stock Exchange“

“It was claimed at the time that we had the second biggest fleet of Caterpillar vehicles in the world, second only to the US Army”

“In conclusion, there was no mining operation comparable to the CDM operation. I have visited many mines all over the world, including copper, gold and diamonds, and can vouch that Novo Resources deposit seems to come closest to that of CDM. It is vast, and seems to be shallow with variable grade, most of it unsampled. I can add, that at the time, CDM had been the biggest profit generator for De Beers for many years.”

And here are some other snippet from the same gentleman:

#1. ” Hi Erik,

This is another outstanding article on Novo Resources. You have done exceptional work in bringing attention to the potential of what we have, to all concerned. Like you, I cannot understand how anyone who professes to be interested in gold mining, does not clamour for a piece of the action. A colleague once said to me, “You don’t know what you don’t know.” That adage certainly applies to Novo Resources. None of us, including QH and RH, know for sure what riches wait to be discovered.

I appreciate the way that management is tackling this assignment, taking one step at a time, to try to quantify the enormity of the project. As I stated before, there is no doubt that, in time, the share price will appreciate by orders of magnitude above current levels.Best wishes ###”

#2. ” I have waited all my life to be a part of something like this from the ground “

#3. ” Dear Erik,

You are putting me under pressure, but I am enjoying the reason for that pressure.

Again, these results are only indicative, which is what all results from MAK sampling are. These indications are, however, very positive indeed. When Novo do bulk sampling which they plan to do soon, we will get a much better idea of the true grade across this particular swale and area. Trial mining will then confirm the bulk sampling. One step at a time is all we can take. I suppose a good metaphor is that of a baby crawling, then walking and then running. Novo is still at the crawling stage and every stage is vitally important to master before moving to the next stage.

I am sanguine about these results as they conform exactly to my thinking, and I presume, to that of Novo management. There are no surprises here. Egina is an incredible deposit and we will find several more highly profitable swales as we explore the area thoroughly. It is a no-brainer. All things being equal, the share price should continue moving ahead. But obviously the gold price in the short term will dictate what happens. Longer term as we develop the prospect more and the dollar price of gold rises, the share price will definitely not remain static. Everything about this news release has bolstered my bullishness. This is not investment advice and all should do their own due diligence.

Best wishes”

#4. “On to answering your letter: My thoughts remain the same. Like most investors, I am patiently waiting for production start-up. I am expecting them to have a few teething problems, which will test their ingenuity and tenacity. It must be getting very hot in the Pilbara, which will also be a severe test for personnel there. But I remain confident that they will overcome any obstacles with panache. That is their style. I can’t wait to hear about their initial results, as I know they have had to be conservative, so hopefully any surprises will be to the upside. If I am excited, one can imagine how excited the Pilbara team must be. I am also looking forward to the commissioning of the ore-sorter.

From a technical analysis view point, I remain very bullish. I don’t think CAD5 per share is too far away. Then once production gets underway with this rising gold price, it will be “Up, up and away” as Superman used to say. One aspect I cannot fathom is the large number of shorts outstanding. I cannot see anyone in his right mind shorting Novo; and when it starts moving up we may be onto a hallelujah short squeeze.

I think Quinton has played an amazing hand. To have this deposit with all its potential and Sumitomo’s support and seemingly ring-fenced against any take-over, is masterly. Then there is all the innovation he has introduced to keep costs down. As an investor this is a once-in-a-lifetime opportunity. Or as my son says, a no-brainer. I continue to see this as a CDM (HH: CDM was De Beers flagship operation which mined diamonds hosted in Egina type gravels) investment on steroids.”

#5. “Don’t worry about pressure on me.

I must correct something first: I am not smarter than you. I may be more experienced in mining, but I am not smarter.

I can understand your impatience. I have waited all my life to get in on the ground floor of something like Novo. They certainly don’t come round often; if you’re lucky, then once in a lifetime.

Then there is the double whammy of a rising gold price simultaneously to Novo exposing itself. I suppose that is what makes the two of us so enthusiastic for this project to progress as quickly and smoothly as possible. It also explains why we cannot understand why others don’t see it as we do. Both of us have extreme faith in Quinton and his team. So we sit tight and harness our patience, waiting for the next revelation. And the revelations are going to come thick and fast as we are at that stage of the project.”

This is what the second De Beers guy, who used to work for the first De Beers guy, sent me (he is also a Novo shareholder):

“*I considered only a 1 x 5 km mining area

*A gold grade representing an “average” swale grade (0.87 g/m3)

*A medium-sized continuous miner

*A 90% plant utilisation (i.e. 7884 working hours per year)

*A 95% efficiency for gold recovery

*To determine the number of XRT ore sorting machines required, I used throughput information per particle size class based on data derived from the DebTech Large XRT machines (sourced from old friends).The flowsheet is attached for your interest. Essentially, using this equipment, a single continuous miner would chew up an area of 1 x 5km in a year and produce in the order of 6.2t of gold. Total value of about 359 mill USD (assuming 1800 USD per oz). If we assume a working cost of 5 USD per m3 mined (as you have mentioned), then total working cost is about 37.5 mill USD per year….that’s quite a profitable situation to be in.”

Closing Thoughts

Listen to who you want. If the run of the mill bashers or twitter heroes strike you as informed and all knowing when it comes to the value proposition and overall case for Novo then listen to them and act accordingly. Personally I haven’t shifted my stance at all and I put a lot more weight on what Novo and the De Beers guys (who have actual experience with especially Egina type deposits) have to say. Hence why I will keep adding at these levels because I think Novo is at step one of hopefully 100. Make up your own mind about what makes sense and what not makes sense. I do and trust my own due diligence which I think is the key to over perming the indices and my view is still that Novo is the most misunderstood case around (hence the valuation)…

Beaton’s Creek is just the appetizer and Novo might be a 100,000 oz producer as soon as next year.

Novo’s current Enterprise Value is around US$320 (including investments at face value) M which should reflect the above plus everything else;

- Egina

- Greater Egina

- Greater Beaton’s Creek

- Greater Hardey Formation

- All targets in the East

- Virgin Creek

- Talga Talga

- Contact Creek

- Mt. Elsie

- Blue SPec

- Karratha

- Greater Mt Roe

- All the “interesting stuff” they have found while exploring at Egina

- … When Quinton was asked about the potential for Hemi style (De grey) deposits

Note: This is not investment advice. I am not a geologist nor am I a mining engineer. This article is speculative and I can not guarantee 100% accuracy. Junior miners can be very volatile and risky. I have bought shares of Novo Resources in the open market and I was able to participate in the latest Private Placement. I can buy or sell shares at any point in time. I was not paid by any entity to write this article but the company is a passive banner sponsor of The Hedgeless Horseman. Therefore you should assume I am biased so always do your own due diligence and make up your own mind as always.

Best regards,

Erik Wetterling aka “The Hedgeless Horseman”

Follow me on twitter: https://twitter.com/Comm_Invest

Follow me on CEO.ca: https://ceo.ca/@hhorseman

Follow me on Youtube: My channel

NOVO is also the most easily defensible operation environmentally of all the miners I own.

Ore sorting and sweetening minimize water contamination, consumption, and petroleum use.

Most of the ore bodies lie near-surface reached through re-workable site disturbance. The arrival of sweetened ore fractions at the near-site mill will minimize the observation of colorful settlement ponds by the easily offended. NOVO has a carefully attended reputation for polite and respectful dialogue with the area’s earliest inhabitants, a reputation not shared by all WA mining outfits. For me, these are important keys to a compelling gold mining story, and the biggest reason I want to make a shit-load of money from NOVO. You don’t get to see things done right everyday. Good Luck.

Friend, you forgot to mention that 1/2 of the new shares issued in August will unlock for trading on 12/27/20. All other things being equal, one would expect this to drag down Novo’s share price some more, due to last minute tax loss selling. But all things are not equal since I don’t know the “strength of the hands” that hold those shares.

Maybe Kirkland wanted out quickly before those shares begin trading. Maybe an asteroid will hit the earth tonight. I don’t know, I don’t care except for my losses. I just have to navigate what the chaos of the world throws at me from all corners of life. When I am on the wrong side of stock trades I just buy more physical gold, especially burnished gold eagles. Sure, I’m overpaying per ounce but it makes me happy.

Sach-thanks for the reminder about the additional Novo shares that will begin trading December 27 and possible tax loss sales.Will be looking for opportunities to buy.

See Kirkland lakes Aug 13th News Release. Sold all Sisko mining shares and a little of Novo shares. Kirkland announced earlier in 2020 they plan to buy back 20 million shares in the next 12 to 20 months. This makes sense as KL shares are also in correction.

Thank you for the carefully thought through and comprehensive evaluation of Novo’s position with reference to Kirkland Lakes sales of a portion their holdings of Novo’s shares.It was quite well organized and informative.I am watching the market for buying opportunitie.Also thanks to Sach for reminding about the additional shares that will begin trading December 27.

Erik, what about KL’s interest in Eskay Mining’s acreage? If KL & QH are cross-wise, what might happen there?

Thanks for a great article, Horseman. I hope NuLegacy can announce an 80 million oz deposit soon so I can sell some and buy more Novo.

thh just a thought…. i read kirkland lake’s note and it occured to me that

when their warrants were not extended and were also not priced to execute

they got mad and jumped off the novo train. They overpaid and compounded things by

underselling…. STUPID!!!!!

In Rob McEwen’s “Ask the Expert” interview (Sprott Money), his first response to a question on future technology in mining was ore sorting…..