Eloro Resources (ELO.V): I Hereby Upgrade “Iska Iska” to Behemoth Class

Setting The Scene

- Yesterday’s NR: LINK

- Quinton talking about Eloro Resources and the latest NR on Kereport: LINK

- Quinton talking about Eloro Resources and the latest NR on Jay Taylor’s show: LINK

- My first report on Eloro Resources: LINK

- My last update: LINK

Without further ado I’ll just jump right into what my current thoughts are and why I have been adding like crazy since the NR hit the wires yesterday (now a top 3 holding)…

Highlights from the NR are as follows:

- 129.60 g Ag eq/t over 257.5m (29.53g Ag/t, 0.078g Au/t, 1.45%Zn, 0.59%Pb, 0.080%Cu, 0.056%Sn, 0.0022%In, 0.0064%Bi and 0.0083%Cd1) from 0.0m to 257.5m in hole DHK-15, the deepest of the three holes reported within the SBBP;

- 79.00 g Ag eq/t over 121.33m (21.77g Ag/t, 0.034g Au/t, 0.35%Zn, 0.23%Pb, 0.18%Cu, 0.056%Sn, 0.0011%In, 0.004%Bi and 0.0055%Cd) from 0.0m to 121.33m in Hole DHK-14 within the SBBP;

- 74.16 g Ag eq/t over 40.88m (33.43g Ag/t, 0.032g Au/t, 0.04%Zn, 0.33%Pb, 0.13%Cu, 0.045%Sn, 0.0010%In and 0.0012%Bi) from 30.40m to 71.28m in Hole DHK-13 which is within the approximately 100m wide mineralized envelope that surrounds the breccia pipe (Figure 1).

… Note increase in average grade in the deepest drill hole. Like Quinton stated in a recent interview he expects the Iska Iska system(s) to get even better at depth.

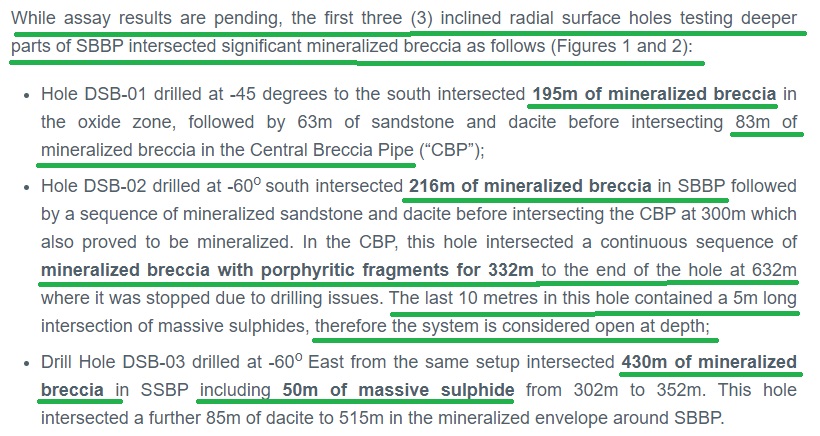

More from the NR:

Dr. Quinton Hennigh, P.Geo, Senior Technical Advisor for Eloro said: “Hole DHK-15, the deepest hole in SBBP with assays back, gives us our first picture of the true potential of the Iska Iska system. A whole suit of metals including Ag, Zn, Pb, Cu, Sn, In, Bi and Cd are present, exactly the sort of assemblage one would like to see in a prolific ‘Potosi-type’ deposit. In fact, the way this picture is unfolding, it appears we have an entirely preserved mineralizing system of this type with lots of room to host a major deposit. An early indication of large size comes from hole DSB-02 which tells us that both the large SBBP and even larger CBP appear to be strongly mineralized. In short, we have been able to confirm in a few short months of drilling that Iska Iska has the right metal-assemblage, strong Ag-polymetallic grades and very large size.”

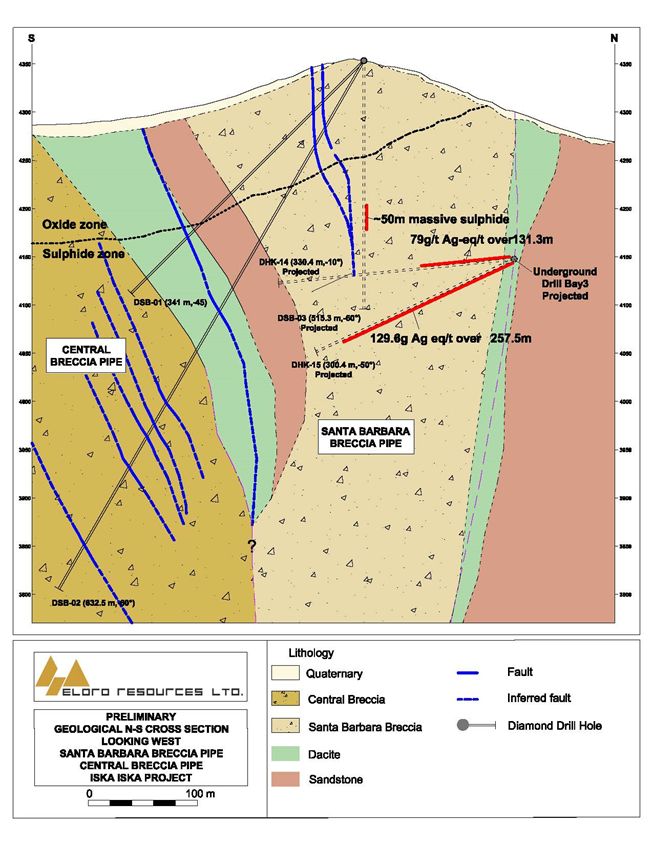

Dr. Bill Pearson, P.Geo., Chief Technical Advisor for Eloro commented: “The scale of the new breccia pipes discovered and the wide range of metals at Iska Iska is phenomenal. Drilling has confirmed a 400m wide diameter of the Santa Barbara Breccia Pipe with a further 100m mineralized envelope around the pipe for a total effective mineralized diameter of 600m as shown in Figure 2. The adjacent Central Breccia Pipe to the south is even bigger with a surface dimension of 400m by 700m; hole DHK-02 intersected mineralized breccia in the CBP to a depth of 475m below surface where it is completely open. It appears likely that the Santa Barbara and Central Breccia Pipes may merge at depth. The widespread tin mineralization suggests that we are getting closer to the magmatic source. Deeper holes are planned in both the SBBP and CBP to further confirm the full extent of the pipes and to test for mineralization at depth.”

Dr. Osvaldo Arce, P.Geo., General Manager of Minera Tupiza and an expert on the geology of Bolivia commented: “The mineralization at Iska Iska defines a massive epithermal-porphyry-system hosted mainly in large magmatic-hydrothermal breccia pipes, along with Tertiary dacitic domes and Ordovician quartz sandstone sequences, being a new geological environment for polymetallic deposition in the southern Bolivian Andes. Regionally, in terms of metal contents Iska Iska is comparable with neighboring world-class polymetallic systems including Cerro Rico de Potosi, San Vicente, Chorolque and Tatasi, all of which have similar geological environments, with the notable exception of the large and remarkable mineralized breccia pipes at Iska Iska.”

A Potential Category Killer Emerges

Lets recap some key points:

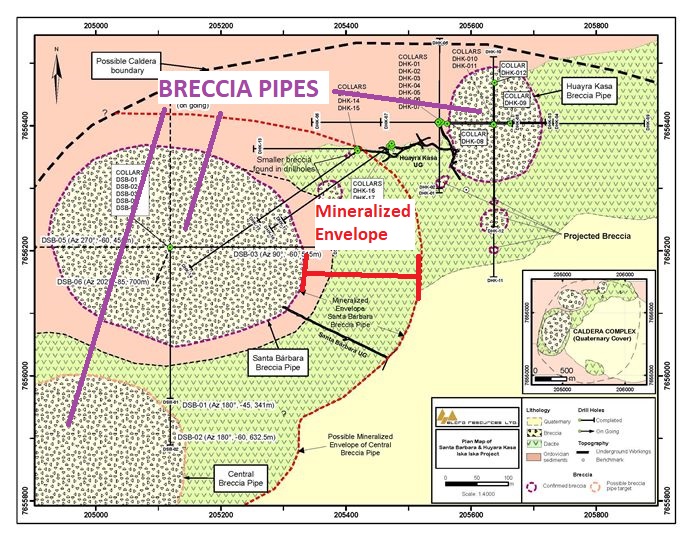

400m wide diameter of the Santa Barbara Breccia Pipe with a further 100m mineralized envelope around the pipe for a total effective mineralized diameter of 600m as shown in Figure 2. The adjacent Central Breccia Pipe to the south is even bigger with a surface dimension of 400m by 700m

mineralized breccia in the CBP to a depth of 475m below surface where it is completely open. It appears likely that the Santa Barbara and Central Breccia Pipes may merge at depth

74.16 g Ag eq/t over 40.88m (33.43g Ag/t, 0.032g Au/t, 0.04%Zn, 0.33%Pb, 0.13%Cu, 0.045%Sn, 0.0010%In and 0.0012%Bi) from 30.40m to 71.28m in Hole DHK-13 which is within the approximately 100m wide mineralized envelope that surrounds the breccia pipe

The widespread tin mineralization suggests that we are getting closer to the magmatic source. Deeper holes are planned in both the SBBP and CBP to further confirm the full extent of the pipes and to test for mineralization at depth.

Figure 1 from the latest NR with some additional drawings by me:

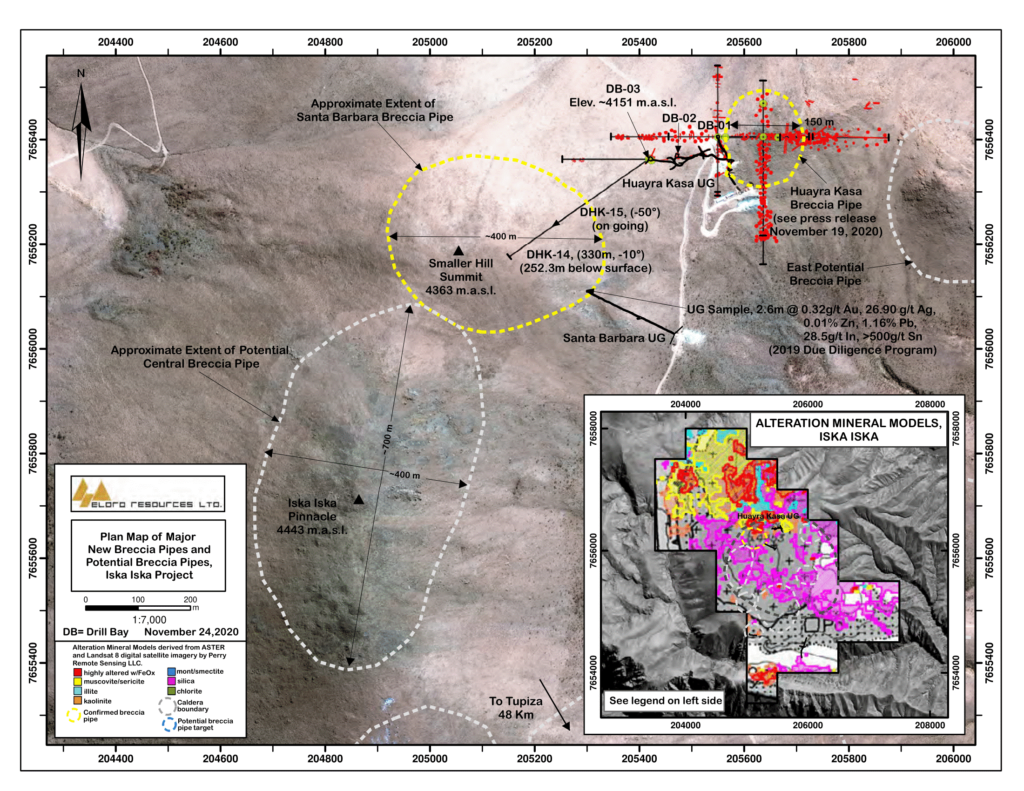

Zoomed out:

… Again, note the inferred size of the Central Breccia Pipe relative to the Santa Barbara Breccia Pipe.

Preliminary Cross Section:

… If these two pipes do merge at depth I think it makes perfect sense that the grade will increase at depth given the natural “chokepoint”. On that note hole DSV-02 had the following description: “The last 10 metres in this hole contained a 5m long intersection of massive sulphides, therefore the system is considered open at depth;”

“Things are getting bigger and better at depth” – Quinton Hennigh

Some Number Crunching

What we know:

- Santa Barbara Breccia Pipe: 400 m in diameter

- Mineralized envelope: 100 m

- Central Breccia Pipe: 400 m by 700 m (much larger than Santa Barbara)

- Deepest hole: 475 m (true vertical) where it is completely open

Assumptions:

For simplicity lets assume that the Santa Barbara Breccia Pipe and the Central Breccia Pipe both have an average radius of 300 m including the lower grade mineralized envelope (in other words the Central Breccia Pipe dimensions are scaled down). Then lets assume the vertical potential is 475 even though a) It looks to be wide open at depth and b) Mineralization looks to be getting even better. Then lets assume that the average grade is 3 ounces of silver equivalent per tonne (~93 g/t AgEQ). Lastly, lets assume the Specific Gravity is 2.6 t/m3…

Using the assumptions above the volume of rock for each breccia pipe + mineralized envelope would be:

V=πr2h

V = 134,303,086 m3

The total tonnage for both would therefore be:

134,303,086 * 2 * 2.6 =698,376,047 tonnes

With an average grade of 3 ounces AgEQ per tonne the inferred potential would thus be:

698,376,047 * 3 = 2,095,128,141 AgEQ ounces…

Or 2.1 billion silver equivalent ounces (excluding recovery loss etc)

… Note that these are just my calculations and personal assumptions(!).

Closing Thoughts

Even if one cuts tonnage by half that’s still around a whopping 1 billion oz potential from “just” these two breccia pipes (even at 25% it would be huge). What’s even better is how relatively quickly a huge, inferred, deposit could be outlines here given the nature of the deposit type. The coming drill holes will probably have some of the best “bang for the buck” in the exploration space currently. It’s also worth noting that the company believes the total number of breccia pipes at Iska Iska might be SEVEN in total. Lastly the best in terms of grade might still be yet to come. Oh and I almost forgot to mention that Quinton said they believe there should be a porphyry target hiding underneath it all(!).

At C$3.25/share the MCAP is C$169 M. With something like C$7 M in cash the Enterprise Value is around US$127 M which I think is a drop in the bucket given that this might be a beyond Behemoth level system. Heck this has the potential to be one of the biggest discoveries in the last couple of decades if not more. I think Eloro Resources is going to go a lot higher basically. In light of that I have been adding like crazy for myself, family members and friends.

As always, do your own due diligence, your own calculations and draw your own conclusions.

Oh and the best is probably yet to come:

Note: This is not investment advice. I am not a geologist nor am I a mining engineer. This article is speculative and I can not guarantee 100% accuracy. Junior miners can be very volatile and risky. I have bought shares of Eloro Resources in the open market. I can buy or sell shares at any point in time. I was not paid by any entity to write this article but the company is a passive banner sponsor of The Hedgeless Horseman. Therefore you should assume I am biased so always do your own due diligence and make up your own mind.

Best regards,

Erik Wetterling aka “The Hedgeless Horseman”

Follow me on twitter: https://twitter.com/Comm_Invest

Follow me on CEO.ca: https://ceo.ca/@hhorseman

Follow me on Youtube: My channel

Yep, I just matched the position size of this with Eskay in my portfolios… know when to go big on something.

Hugely de-risked on the discovery side, totally undervalued from the likely outcome.