Eloro Resources: A Large Untested System(s) Among Giants

- Follow me on twitter: https://twitter.com/Comm_Invest

- Follow me on CEO.ca: https://ceo.ca/@hhorseman

- Follow me on Youtube: My Channel

Eloro Resources (ELO.V) recently became a banner sponsor of my site and as is customary I am doing an introduction article on the company!

Eloro Resources in Short:

- Ticker: ELO.V

- Website: LINK

- Video Presentation: LINK

- Market Cap: C$44.6 M

- Cash: C$1.7 M

- Projects:

- Iska Iska, Bolivia

- La Victoria, Peru

- 3 early-stage projects in Quebec, Canada

- Management/Insider Ownership: 28%

- Upcoming Catalysts: 3,000 m maiden drill program at Iska Iska expected within weeks

Before I continue I urge people to watch Quinton Hennigh’s presentation on Eloro Resources from the “Crescat Gets Activist on Gold” video series:

I would also recommend reading Bob Moriarty’s recent piece on Eloro: LINK

My Case For Eloro Resources:

What I see in Eloro is the opportunity to get exposure to one of the most interesting silver/polymetallic plays around in the form of Iska Iska at a time when anything silver is extremely hot. Iska Iska is located in TRUE elephant country and is not that far from the largest silver deposit ever found (Potosi) and the famous San Cristobal mine which was the first home run for Tom Kaplan of the Electrum Group. What is interesting about the Iska Iska project is that it hosts a “smorsgosbord of metals” to quote Quinton Hennigh who also believes there is true potential for a 1 Boz silver deposit with a lot of additional metals to boot. The fascinating reason for this seems to be because there evidently is a precious metal-rich epithermal system that has formed within a base metal-rich disseminated porphyry style system which Quinton described as being a rather “unique” feature.

Furthermore Eloro Resources is underpinned by their previous flagship project in the form of La Victoria which is located in Peru. Here they are waiting to get access to and drill their best target called San Markito. The La Victoria project is surrounded by Fresnillo, Barrick Gold, Newmont Goldcorp, Anglo American and First Quantum Mining so one can safely say it’s a very good neighborhood.

I don’t put much value on the early-stage projects in Quebec but lets just say that an Enterprise Value of C$43, for a shot at a true elephant (Iska Iska) with a Peruvian project surrounded by majors (La Victoria), at a time when exploration and silver plays are red hot does strike me like very good but speculative risk/reward. Some people are probably aware of the meteoric rise of New Pacific Metals Corp which has reached a Market Cap of C$753 M on the back of the success at their large silver project to the north of Iska Iska (Yes, it’s in Bolivia as well). This tells me that if Eloro is able to show there is potentially something big to really big at Iska Iska, the market will probably reward the company greatly for it.

Iska Iska is planned to be drilled within weeks so I can see it being bid up by investors/speculators as soon as the word starts to spread about a) The potential and b) That it will probably see modern drilling for the first time ever very soon. What I really like about getting in early into an exploration company that is swinging for the fences is that it can revalue quite a bit before results are out (allows some profit taking). But if it stays cheap the risk/reward can stay so good that it can make sense to keep the entire position going into drill results because it might be valued according to a chance of success of 5% when it might actually be closer to 30% in regards of hitting something good to truly great.

Is this something I think one should bet the farm on? No, because even if very little success is priced in at the moment, finding a true elephant is always a long shot. With that said, since the mineralization looks so robust at Iska Iska (multiple events and all that), I think the chance of success of finding something of value is probably a lot higher than can be said for your average junior. Besides, even a relatively small position can do wonders for ones portfolio if they hit a home run and the La Victoria project could be considered to underpin quite a bit of the Market Cap already.

Anyway, Iska Iska is a high-octane speculative opportunity and if we assume that the La Victoria project is worth ONLY C$15 M then one could say that the Enterprise Value currently prices in say C$28 M of Expected Value for Iska Iska…

Put another way one could say that:

- The current Market Cap is pricing in a 11.2% chance of Eloro finding something worth $250 M at Iska Iska

- The current Market Cap is pricing in a 5.6% chance of Eloro finding something worth $500 M at Iska Iska

- The current Market Cap is pricing in a 2.8% chance of Eloro finding something worth $1 B at Iska Iska

- The current Market Cap is pricing in a 1.4% chance of Eloro finding something worth $2 at Iska Iska

- And so on…

… Which makes me ask myself if Quinton Hennigh would even be interested if he thought there was a 2.8% chance of finding an elephant deposit worth at least $1 B? If the “true” chance of success is closer to 20% (although no one can know the exact odds!), then Eloro is still extremely cheap from a pure mathematical perspective. If the true chance of success of finding a deposit worth at least $1 B is 10% then one could argue that the stock should be pricing in around $100 M already for Iska Iska instead of $18 M (if the market was totally rational).

Again, only god knows what the “true odds” are but I gotta believe there is at least a greater chance than 5.6% for Eloro to find something worth at least $500 M at Iska Iska and if the “true” chance is closer to 20% then it’s still very cheap since it would mean that the expected value is $100 M. Remember, mathematically good risk/reward does not mean a guaranteed or even high chance of success, it just means that the chance of success and reward if successful more than offsets the risk and cost of failure.

Personally I can see the value of Eloro more than doubling before we know what the maiden drill campaign shows without me necessarily thinking the risk/reward has turned bad. Primarily because the potential prize is so big which positively skews the risk/reward calculation. If Eloro hits a few decent to good holes in their maiden drill campaign then the chance of success will spike up dramatically in a hurry of course and the share price with it.

So What do We Know About Iska Iska

Location

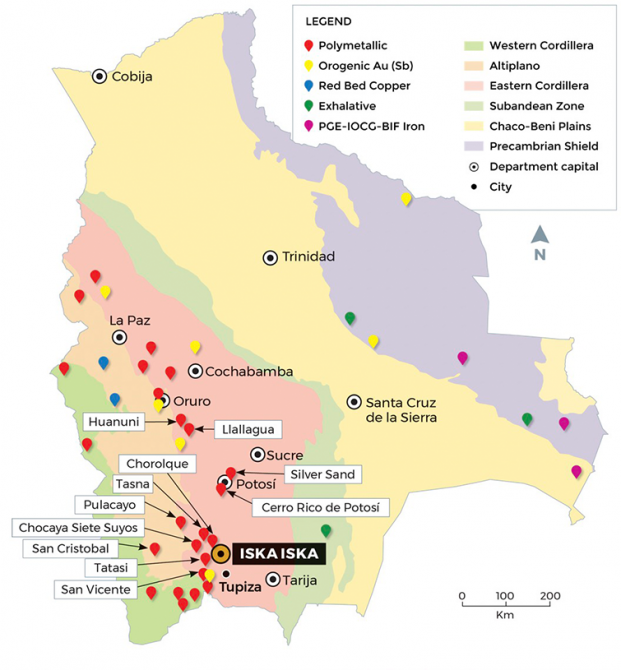

Iska Iska is located within the “Eastern Cordilera” in Bolivia. It’s south of Potosi (world’s largest silver mine which is also located in the Eastern Cordilera) and the Silver Sand project (New Pacific Minerals) and east of San Cristobal (Sumitomo):

Mineralization

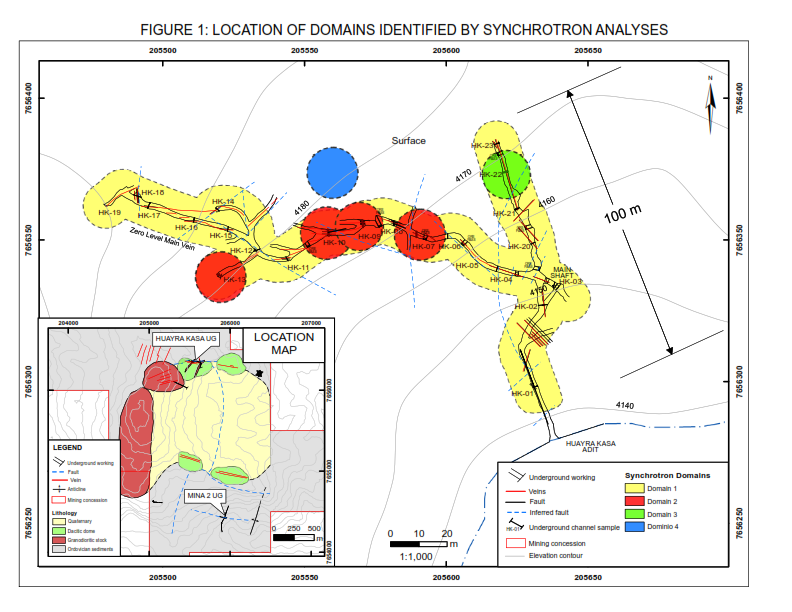

First of all it has NEVER been drilled so this is not one of those projects that looked very promising, was debunked, and then it’s recycled in a hot market. Thus, all the potential for an elephant deposit still exists. Second of all, the statement made earlier about there being two overlapping systems is an oversimplification. Eloro’s channel sampling of the colonial workings within the northern rim of the Iska Iska caldera suggests that there is in fact four different “domains” of mineralisation:

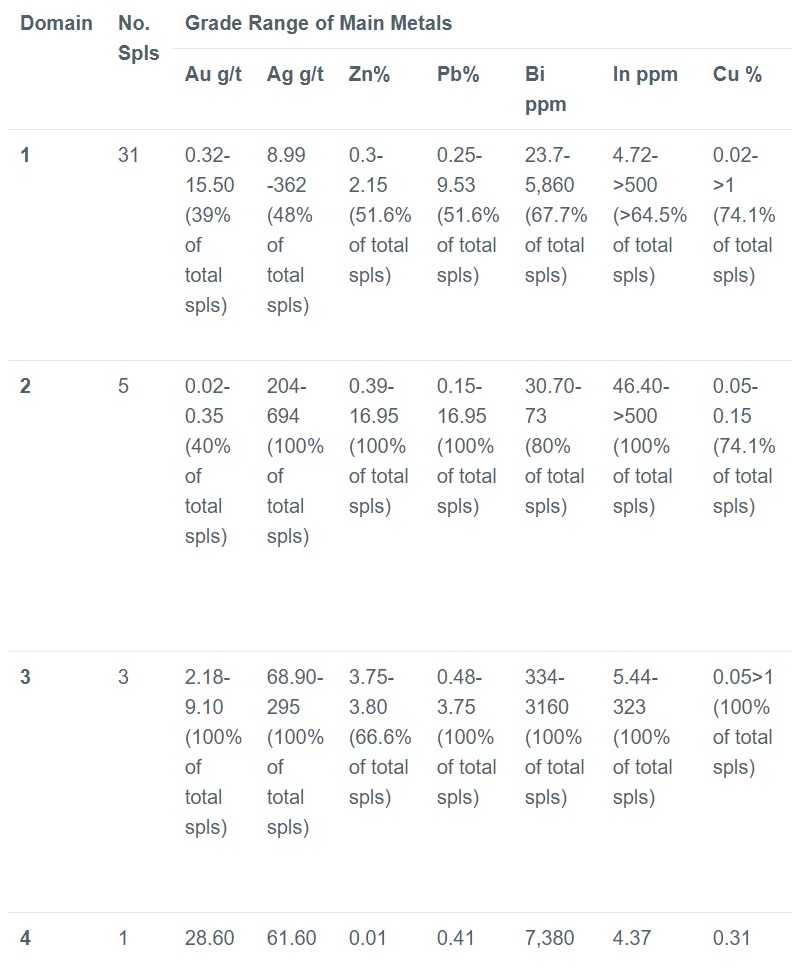

These channel samples within and around the “Huayra Kasa UG” workings show a dominant “Domain 1” coupled with Domains 2 to 4. The mineralisation for each domain in this part of the project is as follows:

… As you can see, the most prevailing (Domain 1) mineralisation consists of low to high grades of multiple metals:

- Gold values up to 15.50 gpt

- Silver up to 362 gpt

- Zinc up to 2.15%

- Lead up to 9.53%

- Bismuth up to 5,860 ppm

- Indium up to over 500 ppm

The “Domain 2” mineralisation which pops up in a few places have somewhat different numbers:

- Low gold values

- Silver valued up to 694 gpt

- Zinc up to 16.95%

- Lead up to 16.95%

- Low Bismuth values

- Indium up to over 500 ppm

Domains 3 and 4 also had their quirks and this segment below is from the latest news release out of Eloro:

Dr. Osvaldo Arce, P.Geo., Eloro’s Project Manager in Bolivia, commented: “The results from this study support the concept of outlining potential bulk mineable silver-polymetallic mineralization at Iska Iska as concluded by Micon. Domain 1 is very widespread with mineralization and alteration occurring in all rock types including granodiorite, dacite and sandstone. Some samples returned grades comparable to those samples in the more restricted domains. Domain 2 contains high silver, zinc, lead and indium values while Domain 3 has high gold and bismuth values. Domain 4 returned the highest gold value with high silver and bismuth. It is likely that the mineralization in Domains 2 to 4 is a precious metal-rich epithermal style that occurs along structures cutting the widespread Domain 1 mineralization that is of disseminated porphyry style. It should be emphasized that this is a preliminary study the conclusions of which will be refined with additional surface/underground geological mapping and diamond drilling.”

This is what Bob Moriarty had to say about the channel sampling results:

“The company has taken underground channel samples that are simply absurd, measuring Silver 35.5 – 694 g/t, Gold 0.31 – 28.6 g/t Au, Zinc 1.05 – 16.95% Zn and Lead 0.41 – 16.95% Pb. If you took the worst of each of those samples for each element it would be $67 a ton rock. In Bolivia that is economic.”

First of all I gotta admit that when I first saw the indium values for example I didn’t think anything of it. I had no reference to go by and I would have totally discounted it if I hadn’t watched Quinton’s presentation.

Anyway, the comments by Dr. Osvaldo paints a rather impressive picture. I mean the Domain 1 mineralisation is allegedly “very widespread” and occurs in ALL rock types. I guess one could consider this to be the “background system” if you will. Then Osvaldo goes on to say that “Domains 2 to 4 is a precious metal-rich epithermal style that occurs along structures cutting the widespread Domain 1 mineralization that is of disseminated porphyry style”…

Which begs the question: How much does the odds increase for there being a valuable deposit within Iska Iska if there is one widespread/disseminated style of mineralization that is cross-cut/overprinted by three different styles of precious metals-rich epithermal mineralization?

… This is what Quinton called “unique”. I mean the odds of finding a volume of rock worth mining should surely increase a lot if there are two different kinds of overlapping systems no? One might not be able to make a mine out of a system that is “so so” in terms of value per tonne but lets say there are two “so so” systems overlapping… Two “so so” systems might still make ONE good deposit because the the two systems together might theoretically double the value per tonne on average.

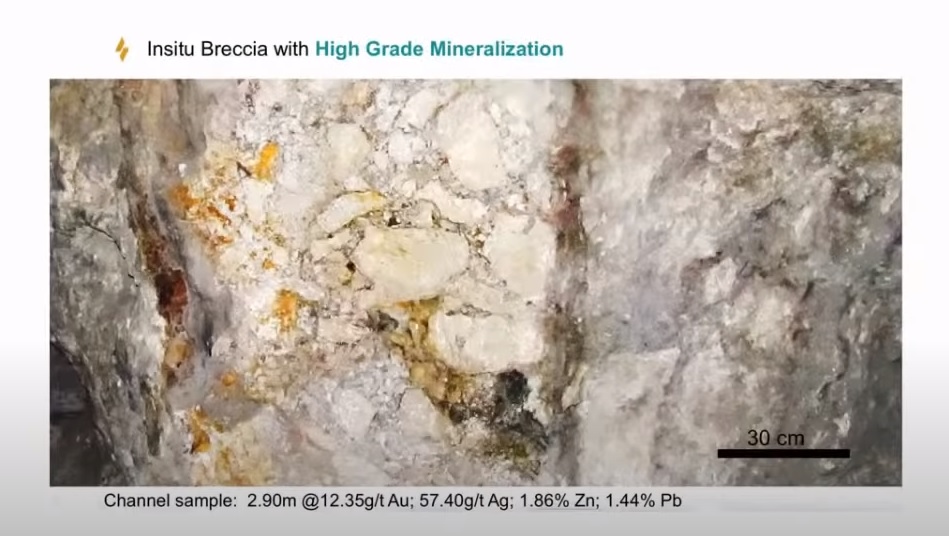

Take this slide from the presentation for example:

… That’s around 37.3 gram*meters of gold equivalent from the precious metal values alone, coupled with “background” values of 1.86% zinc and 1.44% lead. Lets say Iska Iska does indeed turn into a bulk mine then the precious metal value of this vein could be said to contribute 37.3 m of 1 gpt of value or 74.6 m of 0.5 gpt of value on a bulk mineable (mining dilution) basis and then you add on the value from all the other metals. That is certainly nothing to sneeze at!

Again, the likelihood of finding a large volume of rock which is economical to mine surely increases a lot if there are TWO systems overlapping versus ONE standalone system because the average value per tonne of rock mined should go up a lot.

Then there is the indium kicker which seems to be present in 3 of the 4 Domains, and more importantly in the widespread/disseminated Domain 1. This added value is something I would have missed but which made Quinton say, quote: “I almost fell out of my chair”.

The Kicker of The Kicker(s)

The most important thing to remember is that neither of the systems need to be great on a standalone basis. If one system is say 10% in quality away from being good enough to mine, then the additional juice from the other system might only need to be decent in order for a given volume of rock to suddenly become economical to mine. This fact both decreases the downside risk of Eloro not finding anything of value while also increasing the ultimate potential of the project!

In other words the sum is greater than its parts:

- Lets say there is a 10% chance of the porphyry style mineralisation being good enough to mine on a standalone basis

- Lets say there is a 10% chance of the different epithermal styles being good enough to mine on standalone basis.

… Taken together maybe the chance of a given volume of rock to be good enough to mine increases to 50%+ in areas where both types of mineralization is present… And if they overlap over a large area then the theoretical chance of success coupled with the overall prize potential should go up dramatically. An easy way to think about it is that a 0.5 gpt open pit deposit might not be economic to mine but lets say there was an overprint of 100 gpt silver as well. All of a sudden the Au equivalent grade is 1.5 gpt and the the deposit might go from being uneconomic (worthless) to incredibly economic “all of a sudden”.

Furthermore the indium kicker alone, which seems to present in three out of four domains (including the widespread/disseminated one), has values up to and over 500 ppm. Quinton stated that indium is worth around $350/kg which means that volumes of rock with say 500 ppm indium might have an in situ rock value of over $150/tonne from the indium alone. That is equivalent to around 2.61 gpt of gold or 259 gpt of silver. The point is that there are so many different metals found within Iska Iska that all will contribute to the overall average rock value. Every cm of rock does not need to carry ore value, but if any and all of these different value drivers (all the different metals) spike now and then, then there might be a very large volume of rock that is economic to bulk mine.

After going over the case a few times, coupled with watching Quinton’s presentation a bunch of time, I am now very sold on the risk/reward case present in Eloro in light of what I just stated above. It took a while to digest it and to get why Quinton called it “unique” and a “world class opportunity” but thankfully I think I “get it” now.

Do I think that say C$28 M for this opportunity at Iska Iska is a fair valuation given all that I have outlined in this article?

NOPE, because as I stated early on in the article one could argue that:

- The current Market Cap is pricing in a 11.2% chance of Eloro finding something worth $250 M at Iska Iska

- The current Market Cap is pricing in a 5.6% chance of Eloro finding something worth $500 M at Iska Iska

- The current Market Cap is pricing in a 2.8% chance of Eloro finding something worth $1 B at Iska Iska

- The current Market Cap is pricing in a 1.4% chance of Eloro finding something worth $2 at Iska Iska

- And so on…

If the (unknown) chance of success could be considered to be quite a bit higher given all that I have outlined in this article then the Expected Value for Iska Iska changes quite a bit:

- If the chance of success of finding something worth $250 M at Iska Iska is 30% then the current Expected Value is $75 M for Iska Iska alone

- If the chance of success of finding something worth $500 M at Iska Iska is 20% then the current Expected Value is $100 M for Iska Iska alone

- If the chance of success of finding something worth $1 B at Iska Iska is 15% then the current Expected Value is $150 M for Iska Iska alone

- If the chance of success of finding something worth $2 B at Iska Iska is 10% then the current Expected Value is $200 M for Iska Iska alone

- If the chance of success of finding something worth $3 B at Iska Iska is 7.5% then the current Expected Value is $225 M for Iska Iska alone

For what it’s worth this is was Micon International had to say in their (2019) NI 43-101 Technical Report on Iska Iska:

That is a whopper of a target and makes one appreciate why this project was hand picked by Dr. Osvaldo Arce as his favorite project in Bolivia. And the man should know given that Mr. Arce was President of the Bolivian Geological Society from 2010 until 2017 and has written books on the different deposits found in his country of origin. Furthermore, does it sound like Micon Internation thinks the chance of finding an elephant is only 2.8% which is approximately reflected in the current Market Cap? Food for thought.

Closing Thoughts

We can only guess what the TRUE chance of success of Eloro finding say a $1+ B polymetallic deposit is. And we can only guess what Quinton believes the chance to be of finding a polymetallic deposit worth $1+ B. What I do think is that said chance is probably quite a bit higher than 1.8% as I would argue is reflected in the Market Cap of Eloro today and I would also argue that Quinton and the Eloro team would agree with me given what is known about Iska Iska so far. I also don’t think $1 B is the limit if this turns into another Bolivian giant. Potosi has been mined for hundreds of years, produced around 2 billion ounces of silver, and I have read there is over a billion ounces still in the ground. In the presentation Quinton states that San Cristobal who is nowadays owned by Sumitomo cranks outs 25 Moz of silver per year and is one of the lowest cost silver mines because of the base metal credits and if there is something Iska Iska looks to have it is an abundance of additional metals on top of the gold and silver.

If the share price doubled to $1.6/share tomorrow then one could argue that the stock would be pricing in a chance of success of around 5.7% for Iska Iska to be worth at least $1 B in the future. Would that be too high or still too low? I sure don’t know but I of course have a personal opinion. If one believes the chance of Iska Iska being an elephant worth at least $1 B is say 15% then a “fair” share price today would be around $3.6/share. Given how unknown this story is, so far, I wouldn’t be surprised to see the share price climb through a news release stating that the drills are on site and all the way up to an NR with assays (Especially since silver dominant plays are hot right now and elephant hunting is pretty much always hot, even in Bolivia, as evidenced by New Pacific Minerals MCAP of $765 M). If that happens, the priced in chance of success will creep higher which would allow for some profit taking/position resizing in case one believes the risk adjusted “fair value” has been hit etc. If for some reason the shares do not revalue higher going into assays then the risk/reward of holding the position into said assay results would be better. This is why I see getting in early into a story with potential for a very large prize can lead to win-win scenarios because either you get paid up front with no risk and/or you get paid through the risk/reward being irrationally good. All in all, ~C$18 M which is approximately what I think is priced into the stock today for Iska Iska sounds ridiculously low in light of everything I have read and what the experts are saying about the potential of this project.

Even though I don’t usually buy too many early stage explorers I really like the opportunity in Eloro because:

- At leas two mineralization types which increases chance of success and blue sky potential

- Domain 1 mineralization is disseminated and widespread so that alone should make it harder to even see true dusters

- Mineralization has been found all around the caldera and by balance of probabilities it suggests that not only the accessible parts of the systems should be mineralized because people can get to those parts

- I think there is a relatively low chance of Eloro finding nothing of value at Iska Iska given everything that is known, which is something I really like in speculative plays

- I see only around C$18 M being priced in for ISKA ISKA and the prize could be a really big one

- … Which I think results in a way above average chance of success, with billion dollar potential, selling for C$28 M

Given that the maiden drill campaign at Iska Iska is expected to begin in a few weeks it might not be that long before we have more of an idea of how good this project which sees at least two overlapping mineralization events might be. I did not cover Eloro’s second and original flagship project called La Victoria (which is surrounded by multiple majors) in this article but might do so at a later date. If you want to find out more about said projects you can simply go to the company’s website and dig in.

I have added shares up to $1 and have a pretty decent position now. I think I will be holding on to most if not all of them to at least $1.6/share or so. After that my position would be pretty big and I would need to shed some to keep the sizing in check. I do however expect to keep a good exposure unless the stock runs to say $3+ before any further information on the quality of Iska Iska is out (through the maiden drill campaign). At the same time it’s worth remembering that a primary silver elephant could really run in this type of market environment. If Iska Iska is as good as it looks and as the people who know more than me thinks, then this could be a real home run.

Remember, success is the exception not the norm in this business. Risking money one can’t afford to lose sounds like a really bad idea no matter how good the opportunity and risk/reward looks.

Now that I have hopefully broken down the case in an understandable way, I think it will be easier to appreciate what Quinton Hennigh was saying in his presentation. I sure know it took be a while to appreciate it and I take that as a good sign because it probably means that the marginal market participant has yet to grasp the quality and size of Iska Iska:

My Amateur TA suggests to me that this is a major break out right here:

Note: This is not investment advice. Always do your own due diligence. I am not an investment advisor, geologist nor am I a mining engineer. This article is highly speculative and it’s just my opinions. I can’t guarantee accuracy. I own shares of Eloro Resources together with some family members and friends. I can buy or sell shares at any time. Also the company is a passive banner sponsor.

Best regards,

The Hedgeless Horseman

Follow me on twitter: https://twitter.com/Comm_Invest

Follow me on CEO.ca: https://ceo.ca/@hhorseman

Follow me on Youtube: My Channel

Thanks, Erik. I have made so much on Novo, Lion 1, Irving, SSPXF, and White Gold lately that I decided to take a gamble on ELO.V too. Should be an exciting summer and fall. Happy drilling!

Welcome Bonzo!

I do like ELO and think they have a greater chance of success than your typical exploration company coupled with the prize being larger than your typical exploration company’s target.

Not betting the farm but I got a decent chunk and will hold at these levels 🙂

All the best,

Erik

Hi Erik, did you notice WHGOF, which I bought last [email protected], [email protected] yesterday and shot all the way up to 2.00 before [email protected]. Did you [email protected]? What a wild day!!! After watching Quinton’s video on Eloro 3 times I got to wondering about Condor Resources, which Quinton also discussed after he discussed Eloro. Condor looks good too and Quinton just joined their board. Have you talked to Quinton about Condor CNRIF ? Happy Independence Day, Bonzo