Amex Exploration (AMX.V): A High-Grade, Low Capex Gold Project in Quebec Looking to Push Towards Production

Amex Exploration has been on my radar ever since the company started to put out some of the best drill results in the gold junior sector. A few years back it was understandably a market darling and I held off buying it because at the time I didn’t feel like there was much of a discount to is fundamentals (rightly or wrongly). Then in 2024 the company came out with its first Resource Estimate, which came in lower than what the market was expecting, and the company was sold off hard. The sentiment soured greatly and it appeared like some shareholders had decided to give up on the stock and just sell their positions. This is what prompted me to re-visit the case and it resulted with me taking a starter position at a bit higher price than where the stock is currently trading and bringing the company on as a banner sponsor. Fast forward to today and I think the Risk/Reward might be the best looking yet as the company has gotten a bit cheaper despite a record high gold price and several potentially high impact catalysts coming this year. Given the apparent quality of the deposit, the impressive PEA, the insider buying, the gold price and the coming resource update etc in light of the depressed sentiment/valuation I think Amex has a good shot at surprising to the upside sooner or later. A bonus is that there is almost no warrants or options out which is rare for a junior and has a tendency to “cap” prices. Thus I have increased my position around these levels as well as for the HODL-folios I help manage. This makes me naturally biased and as always there are no guarantees that this bet/investment will pay off regardless and if so, when. I simply think the Risk/Reward looks very favorable. Some of the valuation and gold numbers might vary a bit throughout the article because the share price of Amex as well as the gold price has moved around some during the time I spent writing the article.

Presentations

- Amex Exploration Inc: Virtual Investor Conferences

- “Quebec Gold Developer Evaluates PFS Option for 1.6Moz Perron Project”

- “High-Grade Gold & District-Scale Expansion: Amex Exploration CEO on $2.2B Potential Cash Flow”

TL;DR Investment Case

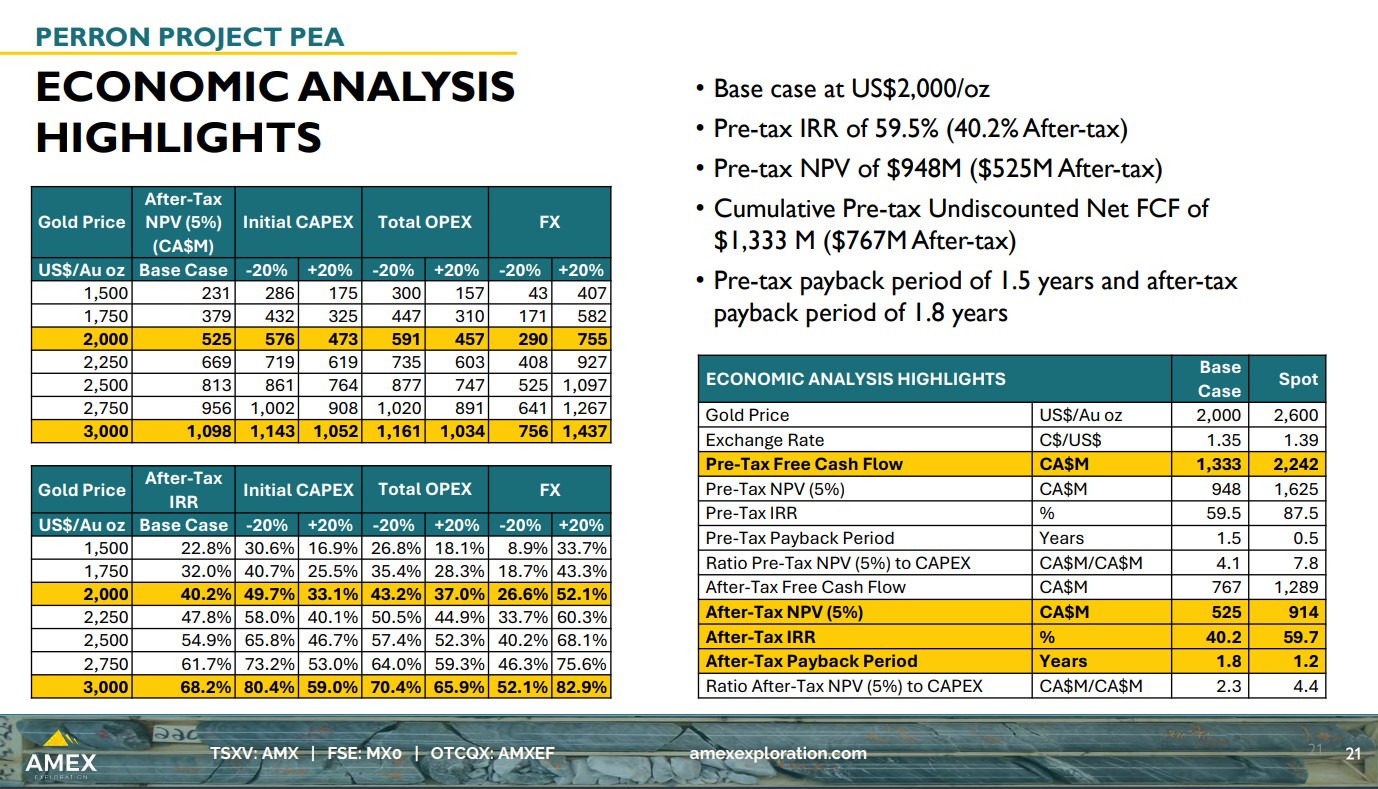

The Perron project is expected to be a Low CAPEX project ($229 M according to the latest PEA) with exceptionally short Payback Period at today’s gold price thanks to one zone in particular being very high grade (10+ gpt). I also expect the project to look even better after the next resource update. The CEO has recently stated in an interview that he wants to position Amex as a “Near term producer“. Thus I expect Amex to push towards production, while continuing to explore the Perron project, as well as the recently acquired ground. Right now ounces in the ground might be valued at around $100/oz, while many producing mines are enjoying AISC margins of >$2,000/oz, on the ounces coming out of the ground. This is a gap I would want any junior to close as quickly as possible and with the very high-grade gold inside the Perron project I think that could make money at most conceivable gold price and not just >$3,000/oz.

“When I look at it from a pre-tax Free Cashflow using $2,600 gold you’re looking at $2.2 B over the ten year mine life… When you average that out it’s $224 M per year in Free Cash Flow… You’re talking about a mine that, according to our PEA, that you can put up into production with a CAPEX of $229 M… So we’re gonna look at all… Everything we can do do try and bring this into production as quickly as possible…”

The PEA suggests that at today’s gold price the initial investment to build the Perron project could be paid back in one year’s worth of production. So I guess the Blue Sky case would be being able to buy the Perron project at sunk costs today, get it into production and paying back the initial investment in one year, and then have Perron producing for not 10 but 20-30 years thanks to how deep these lode gold systems in Quebec can go. I’m not saying I will be holding the stock for 10+ years but I am trying to highlight the attraction with a project like this. Furthermore I would not be surprised if Amex got acquired before the first potential gold pour.

Expected Catalysts in 2025

- New Updated Resource Estimate

- New Updated PEA

- Continuous Drill Results

- Position the company as a “Near Term Producer”

- De-risking for future production

Margin of Safety

- Jurisdiction: Quebec, Canada

- Great infrastructure

- A 1.6 Moz resource (So far)

- Grade (Margins)

- Payback Period

- Low CAPEX

Third Party Validation/Backing

- Eldorado Gold: 9.9% (Participated in the last two financings)

- Eric Sprott: 12%

- Quite a bit of Insider Buying recently in the open market:

My Investment Case

Amex has a Low CAPEX project with very favorable economics according to the last PEA, and is expected to come out with a new Resource this year, as well as a new Economic Study. Given that there is a very high-grade zone in the resource, which could also become better in the next resource update, the Perron project looks to be a project that is very much developable. The location/infrastructure and jurisdiction is great to boot.

The CEO has stated that he want to position the company as a “Near term producer” and thus open up the threat of actual monetization which would put it in the second wave of the Lassonde curve. I like this story a lot because my favorite type of plays right now are companies that have the junior sector sentiment discounts but have a legitimate shot at becoming a producer. That is the biggest “arbitrage” opportunity that I can think of in the junior sector right now. I mean according to the latest PEA Perron is expected to have a LOM AISC cost per ounce of US$807. Even if one rounds it up to $1,000 to be a bit more conservative that would theoretically translate to over $2,000/oz of AISC margin if the project got into production near today’s gold price. At today’s MCAP one is paying around $75 per ounce of total resource, or $164 per ounce, if one only counts the very high-grade (10+ gpt) ounces in the “High Grade Zone”. And of course such grades should make bank in pretty much any gold environment.

In years 1-5 the project is expected to produce on average 124,000 ounces per year with AISC of US$739 per ounce. At $3,000/oz gold that would translate to an annual AISC margin of 124,000 * ($3,000 – $739) = US$280 M or C$388 M. That would pay off the initial $229 M investment off very quickly obviously and one would be “free rolling” from then on. If 124,000 ounces is enough to to cover the investment then imagine how much Free Cash Flow one could be getting for “free” in case this project turns out producing 1-3 Moz, or more, over time.

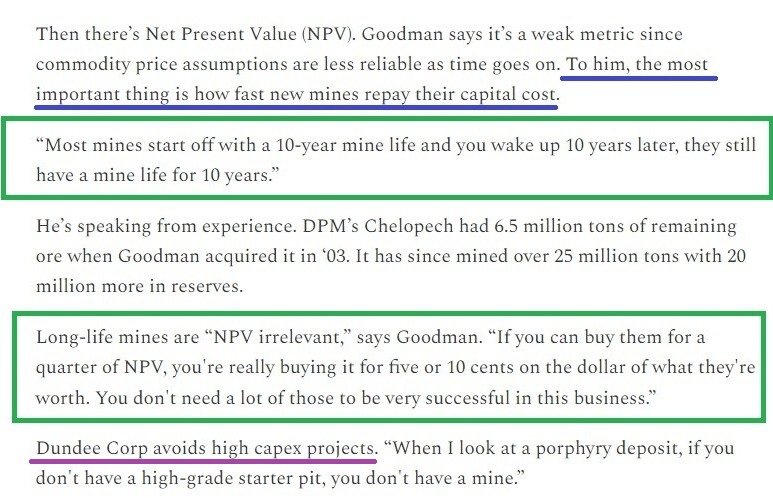

On that note I sometimes remind myself of these thoughts from Jonathan Goodman of Dundee Capital:

… I dare say Amex and the Perron project certainly looks to check the “most important thing” and I do expect that this could be in production for much more than 10-years which is typical for these types of deposits (Especially since all known zones are still open). At $2,600 gold the PEA states an After-Tax NPV of $914 for Perron which with today’s MCAP of $123 M means that one is buying the Perron project for 13 cents on the dollar. If one reasons like Goodman it might turn out to be a lot cheaper than even that (in hindsight).

Some quotes by CEO Victor Cantore in a very recent webinar (Recommended watch):

“… Definitely there is going to be changes going forward… We are going to continue adding Mining people to our board and capital markets experts to our board…”

“… But right now we are also very focused on looking at the economics of our project and you know looking at the path to production to take advantage of this elevated gold price…”

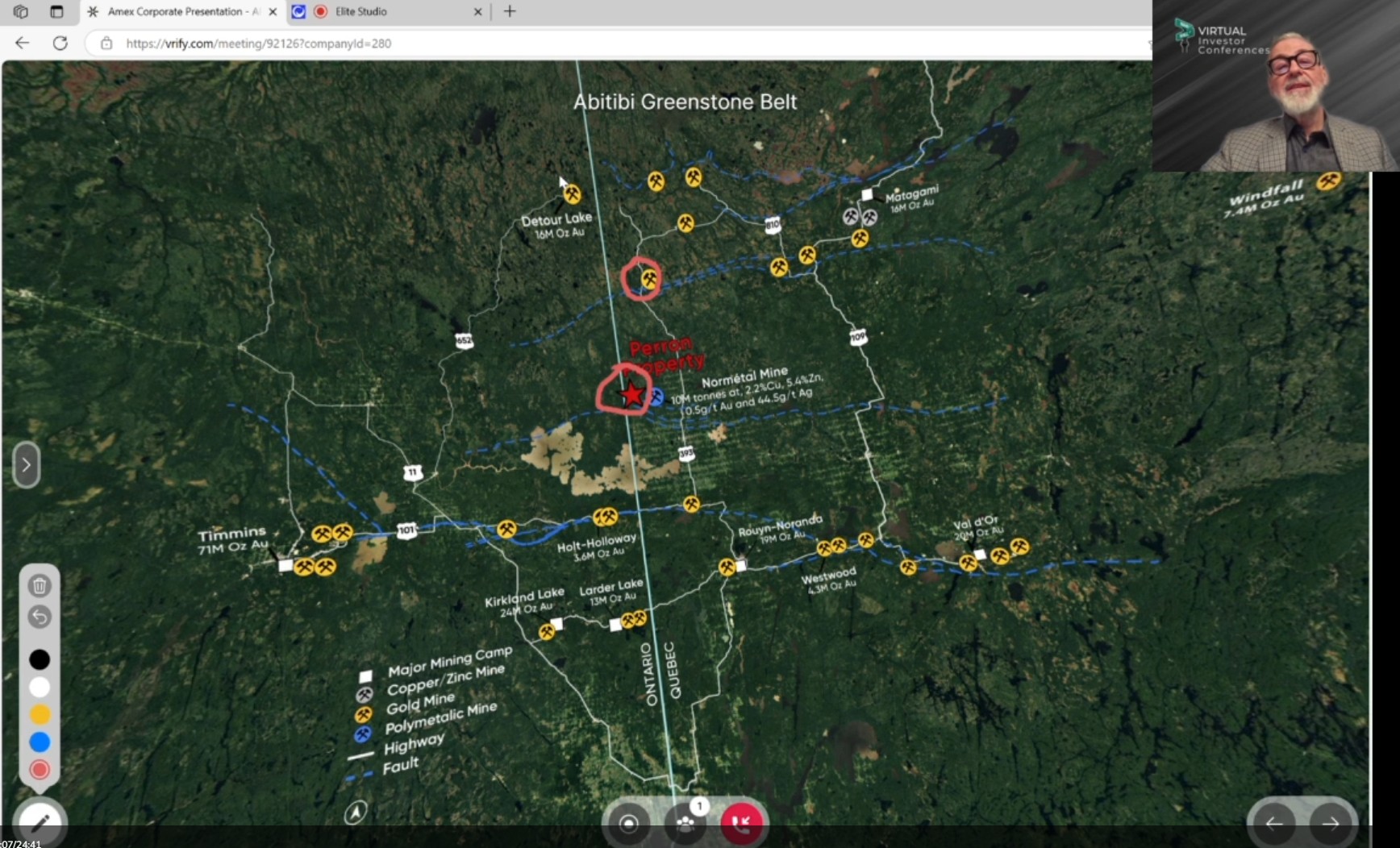

Below is a picture that shows the regional situation for Amex. There are plenty of mines (and mills) in the area, belonging to larger companies, which I can see would have interest in Perron’s high-grade gold. On the flip side I guess it also points out that there could be a scenario where Amex could choose to toll mill some ore. I mean the high-grade zone running >10 gpt should have no problem being trucked quite a way and still throw off a lot of cash (Especially at these gold prices):

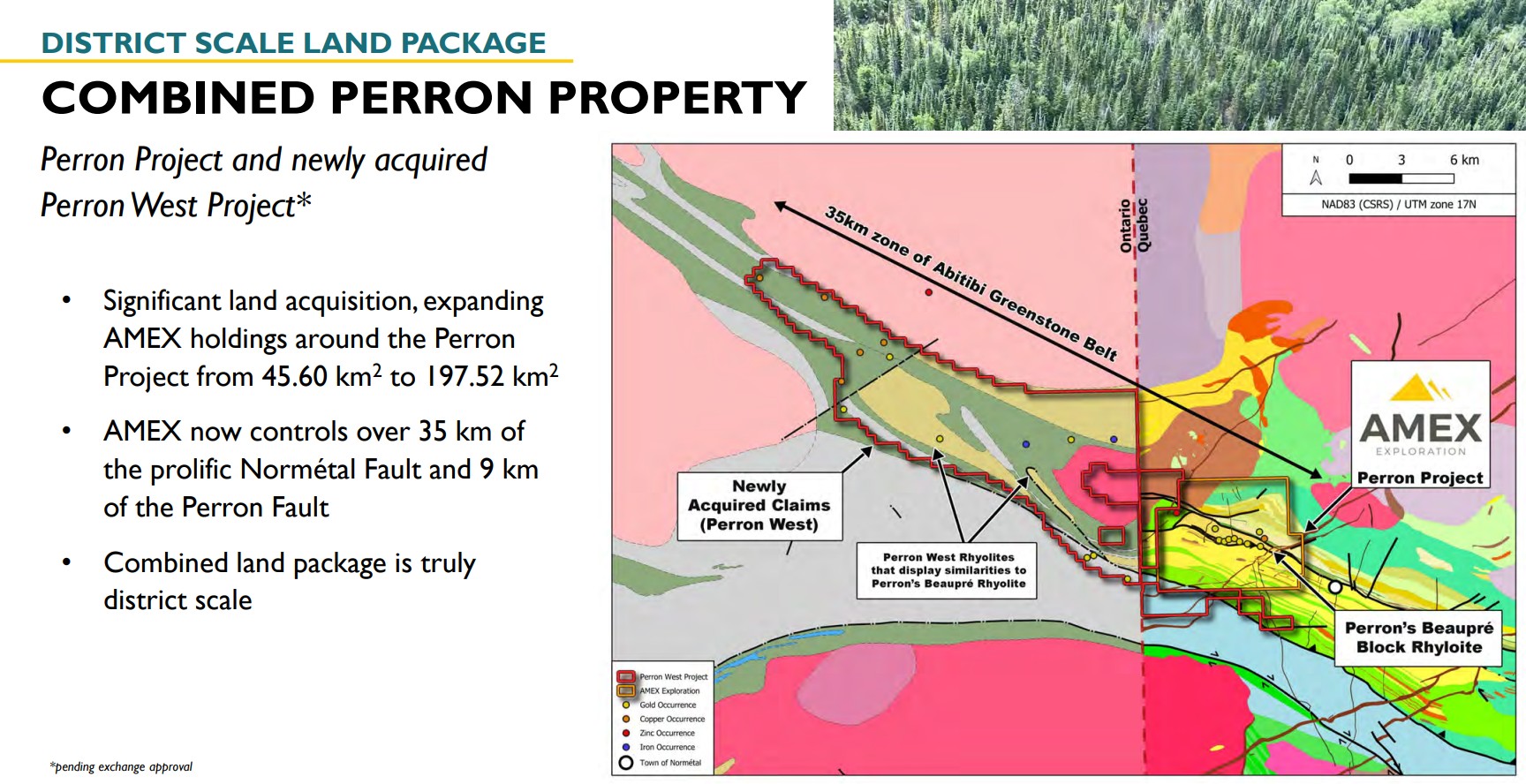

Furthermore I think over $100 M dollars has been spent on the project which was used to drill some 500,000 meters. So basically one can buy $100 M of work and 500 km of drilling today at sunk costs. Granted it might be off-putting hearing that it took that amount of money/drilling to come up with a 1.6 Moz in total resource (which should improve this year). But keep in mind that the company has a lot more data today, and have multiple known zones, so I think the cost per ounce will decrease. Furthermore the important thing is that those sunk costs resulted in a delineated deposit that very much looks mining worthy and which looks to have an economic value multiples higher than said sunk costs. Lastly, this resource that has been drilled off is expected to be a high-margin project so once in production it should be no problem to keep funding the drill bit and continuously grow the resource base. I mean at today’s gold price they could potentially afford to drill 500,000 m, per year, if they wanted to. And with the recent land acquisition there is plenty of grassroot ground to explore on top of the known zones:

Now the average junior does not have a good project (or even a proven deposit) that would be expected to become a good mine. If they do have a deposit it needs to be deposit that can be permitted or else it is for all intents and purposes worthless (or should be heavily discounted if it could be in production 10+ years from now). If it can be permitted then one would hope it has good infrastructure and a CAPEX profile that a junior could overcome because otherwise it could keep being a “paper project” for a long time. What I am trying to say is that most juniors are pretty much worthless almost regardless of what the gold price is…

But the few juniors who have projects that could become good mines, could be permitted and could be financed/built in the not too distant future have never been worth more than today given the current record margins on gold production.

If I were Eldorado Gold, or any mid-tier really, I would start sweating if potential production from Perron was getting closer. I mean if gold prices hold up I couldn’t possibly assume I would be able to buy Perron at today’s prices, in case the PEA is somewhat correct, and the gold mine was going to start throwing off hundreds of million in cash flow per year. Basically I would want to close this “arbitrage” between the in situ valuation per ounce, and the value of ounces coming out of the ground at, today’s gold price:

… Margins of gold coming out of the ground have literally never been higher than they are now in dollar terms. In fact, as of the time of writing the gold price is $3,400/oz. So the AISC margin on gold coming out of the Perron project, if it were in production Today, could be closer to $2,600 per ounce. Meanwhile said ounces, still in the ground, are sold for less than $100 per ounce in the market…

The Gap between what an ounce of the ground costs to buy and how valuable the same ounce is coming out of the ground is the largest ever. This is the main reason why I think advanced explorers/developers who have legit shot of being able to take those ounces out of the ground is the sweet spot today.

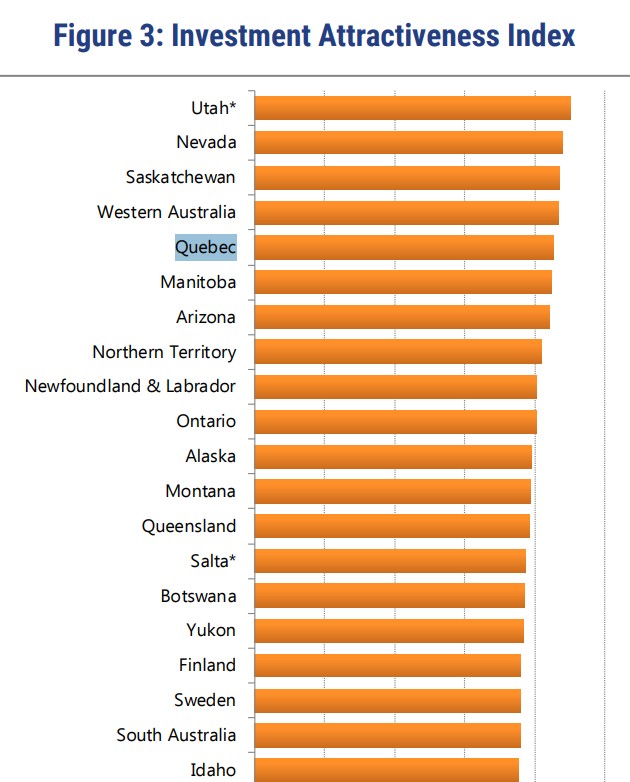

Quebec being ranked as the 5th best overall Jurisdiction in the world int he last Fraser Institute rankings does not make things worse.

… In a time when there is a lot of turbulence between East and West, people getting killed at gold mines in some parts of the world, and some countries are turning to nationalization of mining projects, I think jurisdictions where one can permit a mine as well as get to keep a mine are looking better and better.

Current PEA

Lets dig in a bit into the economics of the current PEA study:

Obviously the PEA is impressive. The Initial CAPEX is only $229 M and the After-Tax Payback Period at $2,600 gold is only 1.2 years. Imagine making an investment of $229 M and getting $1,289 M in After-Tax Free Cash Flow at $2,600 gold and maybe closer to $1.8 B at around the spot gold price. At today’s gold price I guess the After-Tax Payback Period would be closer to 0.6 years which is pretty crazy. I mean one would get ones investment back in less than a year and then be “free rolling” for the rest of the mine life and since the mine would be located in Quebec I do not see anyone “stealing” the deposit and cutting the free roll short.

Now given that the company plans to put out a new Resource Estimate as well as a new PEA this year already I assume the new resource will be bigger than the last (Why else do one right) and perhaps even higher quality (higher grade). In that case I think it is safe to assume that the next economic study will likely be even better in many aspects. Thus the implied value might jump further in the not too distant future.

So if one thinks a ~C$130 M MCAP looks cheap for a project that might cost around $229 M to build, have that initial investment paid back in less than a year of production, with all the rest of the Free Cash Flow being pure net upside.

The beauty with the Perron project is that it has a very high-grade zone which is expected to be very high-margin and why the expected Payback period for the project is extremely short:

Note that this high-grade part of the resource might get even better in the coming Resource Estimate update.

Lundin Gold just showed us what kind of Free Cash Flow can come from mining 10 gpt material in their Q2 results:

… Those quarterly numbers out of Fruta Del Norte is what I imagine a year’s worth of production from Perron’s high-grade zone could look like at $3,081/oz gold. Oh and think all the numbers are in USD so the Free Cash Flow would in that case translate to $238 MCAD/year. Lunding Gold added C$1.9 B in Market Cap on the back of this quarterly report by the way.

Furthermore this high-grade zone is still open at depth with 10 gpt assays having been hit 1.6 km down and therefore I think one can pretty safely assume that whatever the next Resource Estimate will show it will likely still underestimate the “true” gold endowment in the high-grade zone as well as the other zones for that matter:

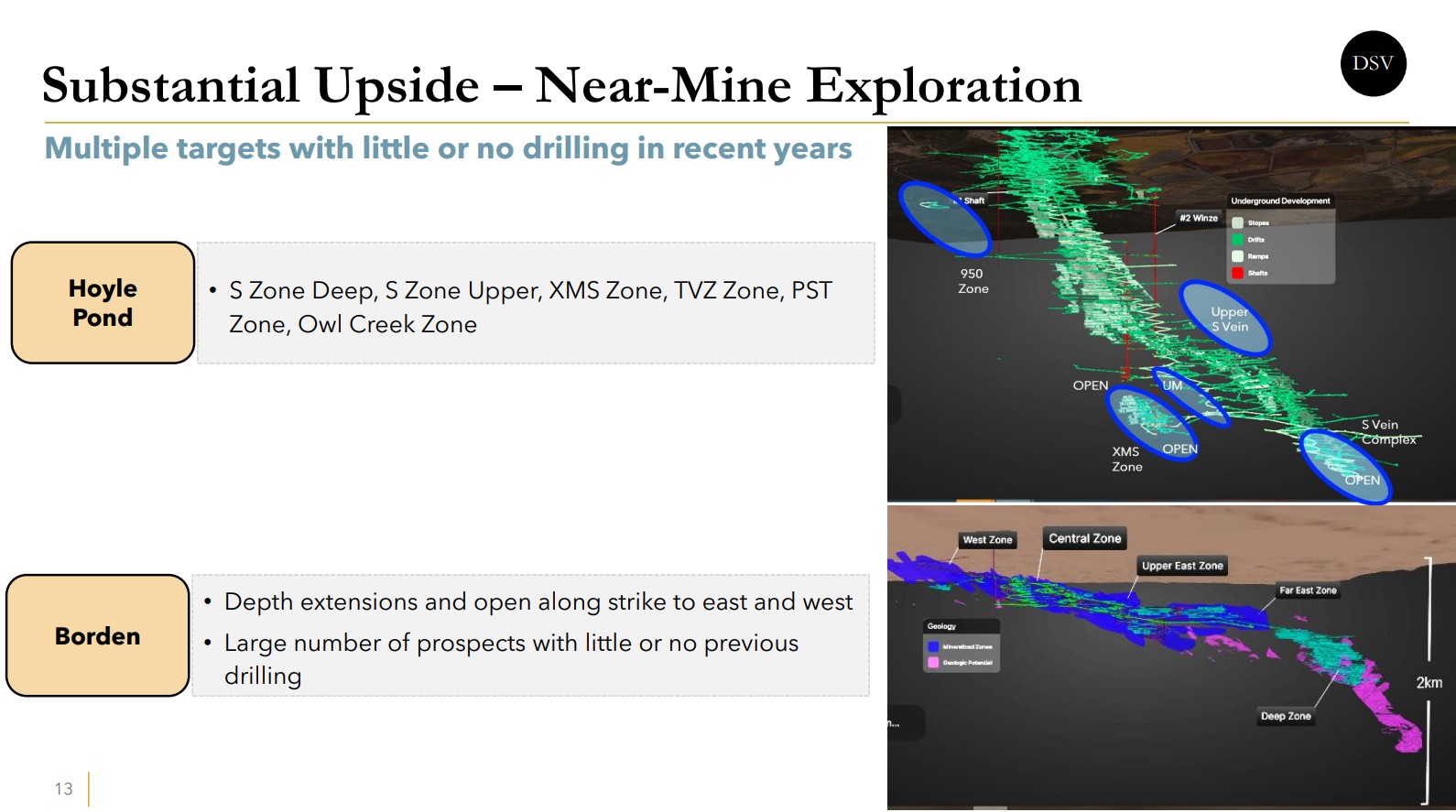

As stated earlier these Archean lode gold systems can go down to considerable depths, have underexplored zones nearby, and thus have considerably longer mine lives than what was on the books at say the date of first production. Discovery Silver has recently acquired the Porcupine Gold Complex from Newmont because Tony Makuch and his team believes these assets have more to give despite some of them having already produced for many years:

“If we end up with Free Cash Flow of $229 per year that is plenty of money to continue to exploration to make it much bigger… Do I believe it is much bigger? Yes I do. So right now what you do is to put this thing into production as quickly as you can… With the least dilution possible… And you go into production and you continue to make this thing bigger… And that’s why it is really undervalued here… I mean we still have 1.6 Moz… That is a lot of gold at these levels…”

One should note that there are plenty of known zones to extend so whatever the next Resource Update shows, which I assume will be bigger than the 1.6 Moz, there is pretty much a certainty it could grow past that snapshot number in time. This includes zones like the Gratien Zone which has mostly been drilled at quite shallow levels with some high-grade hits at depth:

On the note, below are some thoughts from Pierre Lassonde on buying a bird in the hand on the cheap and getting birds in the bush for free:

… I think Amex fits this bill where the risks are to the upside from the current valuation.

Eldorado Gold, who is a 9.9% shareholder of Amex Exploration, is not a stranger to Canadian lode gold projects. On May 15, 2017, it was announced that Eldorado Gold was acquiring Integra Gold for C$590 M. Integra Gold’s flagship asset was the Lamaque project near Val-D’Or, Quebec:

The Lamaque resource comes out at 1.5 Moz in the Indicated category, and 0.89 Moz in the Inferred category, for a total resource of 2.39 Moz at very good grades. The PEA saw a production profile of 123,000 ounces per year with all-in sustaining costs of US$634 per ounce over 10 years. At the time of acquisition the gold price was $1,255/oz compared to around $3,200/oz today.

If we just do a quick and dirty PEA comparison between the two:

10-year average production profile

- Lamaque: 123,000 oz/year

- Perron: 101,000 oz/year

10-year average AISC profile

- Lamaque: US$634/oz

- Perron: US$807/oz

Cumulative AISC margin over 10 years using a gold price of $1,255 (price at acquisition) for Lamaque and $3,260 (price today) for Perron

- Lamaque: (($1,255 – $634) * 123,000) * 10 = US$764 M

- Perron: (($3,260 – $807) * 101,000) * 10 = US$2,478 M

Market Caps

- Integra Gold: C$590 M (Acquisition price)

- Amex Exploration: ~C$130 M (Today)

Reflections

- At last known gold prices Perron would be expected to throw off 3.2 times the AISC margin of Lamaque in the first 10 years.

- At the last known trading price Amex Exploration was trading for 22% of the Integra Gold’s (Lamaque’s) valuation.

Should one be surprised if the Perron Project grows and gets closer to the same endowment as Lamaque had when it was acquired? I don’t think so. Besides, it already looks good enough to build an economic mine on and Amex is much lower valued than Integra Gold was despite the fact that the economics of Perron today looks much better than what Lamaque looked back then to boot.

Eldorado Gold remarks from a news release:

“From previous experience of building and operating gold mines in Canada, I am excited about Eldorado’s entry into the Eastern Abitibi region of Canada. With our current balance sheet strength post the sale of our Chinese assets, this acquisition represents a use of the proceeds complementing our existing portfolio of high quality, low cost assets.”

The Lamaque Deposit

Eldorado gold knows Canada and the Abitibi lode gold systems and they know how deep they can go and how they are mined. Thus, I take their interest as a very good vote of confidence for the Perron Project. Personally I am surprised they have not taken advantage of the depressed sentiment in the stock… Yet at least. Maybe Sprott is too given that he is not even waiting around for a potential placement to buy.

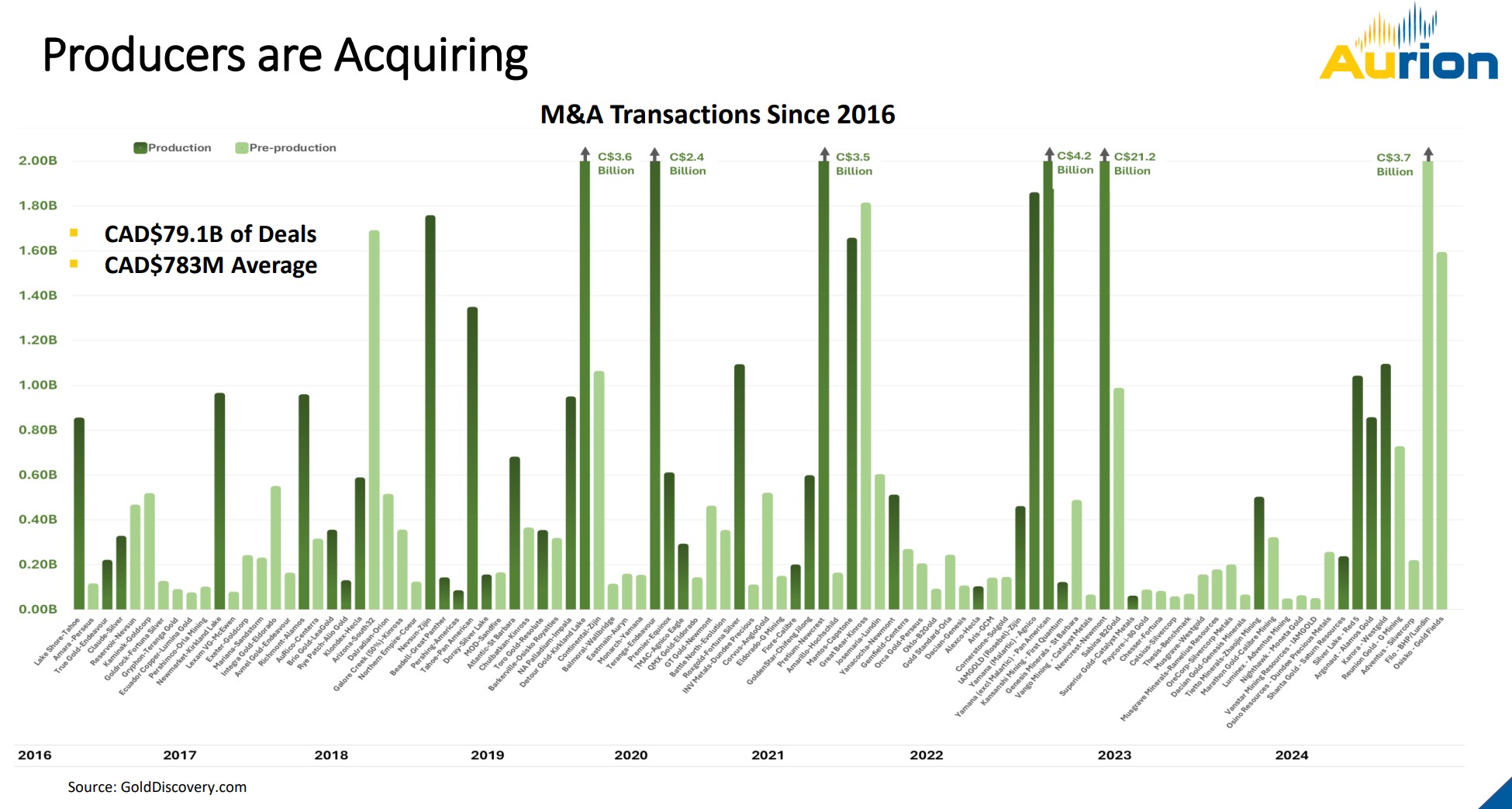

This last slide is from Aurion Resources/GoldDiscovery which shows M&A transactions since 2016. I would note that it appears that Pre-production acquisitions have been increasing lately (For good reason):

Closing Thoughts

I simply would be surprised if I did not end up making money buying a project like this, in a place like this, for a price of some ~$130 M in a time like this. The current valuation kind of suggests that projects like this grow on trees and/or that gold is at $1,800/oz or something. I do not agree with either so I am a shareholder. I also think that Amex’s decision to start pushing towards production is akin to lighting a fuse. I do not see anyone who would be interested in acquiring Amex sit around and risk seeing Perron being close to as good as it looks on paper turning into reality. Why? Because if that happens the purchasing price would probably be a lot higher than what the company is trading at right now (including any dilution).

… As always there are no guarantees with any investment. I am betting on the Risk/Reward that I see! If I lose or make money in Amex from here is TBD.

Note: Consider me biased as I own shares of the company and Amex is a “banner sponsor”. This is not financial advice. Juniors are risky so never invest money you cannot afford to lose. I share neither your profits or losses. Assume I could buy or sell shares at any time. Do your own due diligence and make up your own mind. Never buy a stock just because someone else owns a stock.