Novo: Investing is Hard

This is just going to be a very short post about some simple things such as basic math and inference that I think is quite important when it comes to investing…

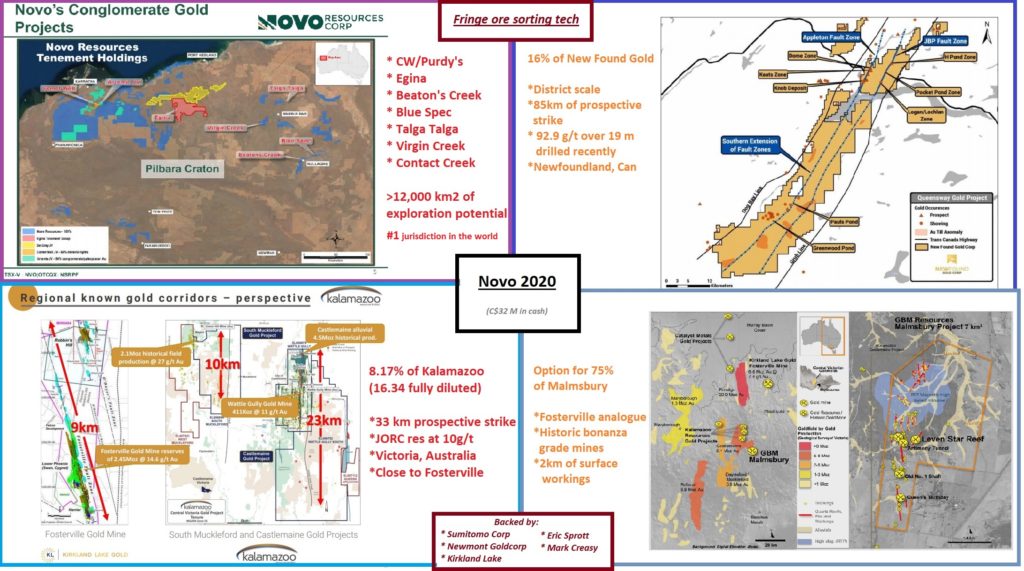

This is Novo’s land package in Pilbara:

Egina

The US$37 B enterprise (and insider) known as Sumitomo Corporation currently is currently earning into 40% of the area seen in RED, in a staged approach, for US$30 M. The third party risk-adjusted value for Novo’s slice (60%) in that red is thus US$45 M. Now given that a corporation as big as Sumitomo couldn’t care less for a prize estimated to be worth US$30 M+ we can safely assume that if the venture is successful then it should be worth a lot more than that. Given that that this is still early stage and highly unconventional the pricing of the option will of course have a huge discount to the prize because of the inherent challenges.

But anyway, lets take this highly risk-adjusted third party valuation at face value which is US$75 M for 100% of the area in RED. Lets then assume that the area in Yellow and the Blue area north of the Fortescue basin is roughly 2X times the area in Red. This would then imply a discounted risk-adjusted value of upwards of US$150. In total, the claims which are deemed prospective for Egina type lag gravels would have a discounted risk-adjusted value of around US$195 attributed to Novo Resources.

Beaton’s Creek (Hardey Formation)

Then we have Beaton’s Creek where the same US$37 B enterprise (and insider) known as Sumitomo Corporation has set aside something like 5B Yen, which is something like US$46 M, for investment purposes at Beaton’s Creek. Now given that Sumitomo Corporation does not take majority positions in mining companies but prefer to be passive stakeholders one can assume that this US$46 is not meant to buy the whole thing but to gain some % exposure in the wide open, high-grade, near surface Beaton’s Creek project. Thus we can assume that Sumitomo believes that Beaton’s Creek is worth no less than US$46 M and as high as who knows. It simply depends on what stake they are looking to acquire for that amount. If it’s 40% like Egina then the implied value of Beaton’s Creek is US$115 M. It is worth mentioning that Sumitomo Corporation signed an MOU with Novo in 2017 for the Beaton’s Creek project so it is safe to assume that no one except for perhaps Novo has a better grasp on the quality of the project.

Comet Well (Bellary Formation, under Mt Roe)

In July 2018, Novo Resources exercised its rights to acquire half of the 1% NSR on the Comet Well property which means that Kirkland Lake and Eric Sprott signed off on this purchase. This purchase was triggered when International Prospect Ventures (IZZ) entered into LOI for acquisition of the NSR on Comet Well. Anyway, a 0.5% NSR on the very early stage Comet Well was deemed to be worth atleast C$1,750,000 by IZZ and Novo (which also means Kirkland Lake by extension). There were added payments included such as:

For Announced Resources and/or Mined Resources up to 5,000,000 ounces gold, the Company shall make a payment of CDN $0.50 per ounce; and

For Announced Resources and/or Mined Resources over 5,000,000 ounces gold, the Company shall make a payment of CDN $1.00 per ounce.

Thus we can conclude that International Prospecting Ventures, Novo and Kirkland Lake believed that a 0.5% NSR, on just the relatively small and very early stage Orange claim in the picture above, was worth C$1,750,000 and more at that time. If you look around you won’t find many transactions that value a 0.5% royalty on a single claim this “small” and this early stage at that price.

… All that is just for Egina, Beaton’s Creek and one claim containing Bellary Formation.

If we scale it up even beyond the ultra district play on laterally extending gold deposits then we get something like this (which still doesn’t even capture everything):

Or you could simply look up the Resource Estimate for the single most advanced project which is Beaton’s Creek and assign that as the only intrinsic, implied and/or expected value in Novo and have a good day… That seems to be the most popular route. If you think that neglecting to ascribe any value at all to any of the following factors is a wee bit of a simplistic way of valuing Novo then you are surprisingly a full blown contrarian investor:

- Comet Well

- And the implied value set by IZZ, Novo and Kirkland Lake

- Implied value of Beaton’s Creek by Sumitomo

- Purdy’s Reward

- Blue Spec

- Talga Talga

- Virgin Creek

- Contact Creek

- Novo/Sumitomo JV at Egina

- And the implied risk-adjusted value by the deal

- All the rest of similar lag gravel ground which is around 2X of the Novo/Sumo JV in total

- All Hardey and Bellary Formation prospects found within the 10,000km2 land package

- Equity holding in Calidus Resources

- Equity holding in Kalamazoo Resources

- Including the possibility to be granted additional prime ground in the Bendigo Zone

- Equity holding in New Found Gold

- Equity holding in Elementum 3D

- Which recently got an investment from the US$37 B enterprise known as Sumitomo Corporation

- ORE SORTING the likes of: “100% of gold recovered in 1.2% of the mass “

- This might be the single biggest value driver to boot!

So to sum up:

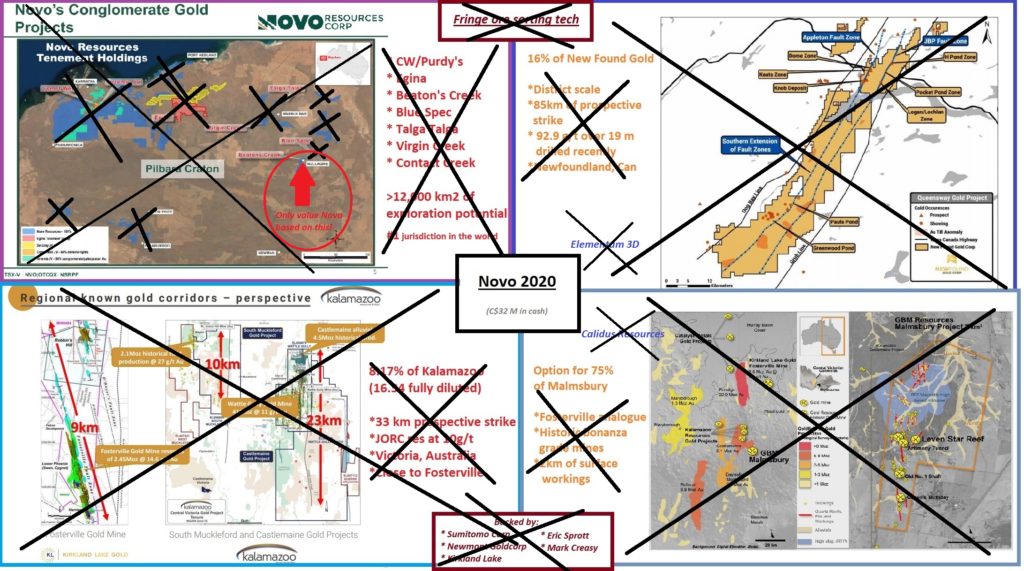

If one wants to visualize it, this kind of valuation method puts ZERO value on everything which is crossed over in the slide below:

Ps. Never interrupt an “enemy” when he is making a mistake as the saying goes…

What all of MinTwit is currently patting themselves on the back and agreeing is excellent security analysis is to neglect everything above and value Novo ONLY on a snapshot resources estimate found in one single project. If you ever doubted why it might be a good idea to learn about sound investing and potentially invest in the most inefficient sub sector of the market then this should take away all that doubt. This sector is like playing the game of investing on easy mode. It’s pretty much a walk over in some cases. I have tried my hardest not to be too sarcastic about all this despite how extremely amusing I find it. When I think about it, the report and all that ensued after it is perhaps the single best bull sign I have ever seen for a stock. If a majority of people are actually going about investing like this then it means that your “competition” is pretty much asleep.

In order for you to potentially win big you also require the opposing side to be as far off as possible. You don’t want to compete with the best, you want to compete with the worst. We want the marginal/buyer to agree with such views as above.

To be fair, I don’t think that people actually are stupid. Novo is the largest and most complex case that I know of and to really grasp the value proposition I think you need to put in at least a few hundreds of hours to even have a shot. Less than that and you are bound to sound stupid because you will be focusing on one tree and not thus not see the forest.

The most important thing is to THINK FOR YOURSELF.

Best regards,

The Hedgeless Horseman

Note: This is not investment advice. I own shares of Novo Resources and Kalamazoo Resources which makes me biased. Novo Resources is also a banner sponsor on my site.

Great thoughts again, Horseman. Thank you for all your hard work and the compilation of the various assets of NOVO. Most of us who have been here for a while continue to appreciate your hard work and understanding of the potential. Now if we can get some beginning production in 2020 the road forward will become clearer to all. Best regards.

I invested in Novo at 5 dollar. I bought some more at 2 dollar. Stil waiting. I hope you’re right but don’t fall in love with your shares.

When the head investment executive at Sprott USA tells me that NOVO is a science project, that sums up the level of skepticism in the investment world, because they simply cannot think differently. They are stuck in their paradigm of hard rock vein type gold and like you said, can’t see the forest through the trees. It’s also interesting that not even a sizable Eric Sprott ownership in NOVO would help these guys to see it differently. I think this is what you are calling “requiring the opposing side to be as far off as possible”. I’m anxiously waiting for the continued value proposition to build out and some sort of resource estimates or actually production with increasing ounces that show up in their profit bucket.

‘Show me the money’

That’s what my wife always tells me when I tell her these grandiose stories of potential riches! XD

I am long and strong- still buying even after today’s up move. I plan to keep buying up till 3ish us$.

Thank you for all of your research and for sharing it with us.

Wouldn’t mind hearing more of your preparedness type writing as the next step is for the PA governor to stick us in FEMA camps “to save us from covid19”.

Best wishes

Horseman, an excellent updated summary on the basic NOVO value proposition in 2020. You pulled everything together in an easily understood way. I 100% agree with you.

Do you have any thoughts on when field test mining using Steinert or Tomra mining technology might get announced? It seems like this would be the next shoe to fall and then QH pleasantly surprises me with the GBM Resources investment.

Thanks again for your great insights and analysis on NOVO.