Eloro Resources (ELO.V): Missing The Forest For The Trees

Flash February 25: Quinton Hennigh talks about the News Release over at Kereport.com:

“ELORO RESOURCES – MORE INFORMATION ON THE DRILL RESULTS FROM YESTERDAY AT THE ISKA ISKA PROJECT”

Follow me on twitter: https://twitter.com/Comm_Invest

Start of Article

Eloro Resources just released more assays from the testing of the different breccia pipes at Iska Iska, Bolivia. Unfortunately the assays from the deep holes were delayed but we got assays from holes that tested the shallower parts of the Santa Barbara Breccia Pipe:

Highlights of the SBBP drill results are as follows:

Underground Drill Holes

- 67.39 g Ag eq/t over 213.10m including 205.17 g Ag eq/t over 13.04m in Hole DHK-16 drilled at -10 degrees 50m southwest and parallel to Hole DHK-14 (see press release January 26, 2021)

- 279.82 g Ag eq/t over 8.57m, 74.21 g Ageq/t over 52.93m and 121.61 g Ag eq/t over 37.85m in Hole DHK-17 drilled at -50 degrees 50m southwest and parallel to Hole DHK-15 (see press release January 26, 2021)

Radial Surface Drill Hole

- 114.43 g Ag eq/t over 33.25m in Hole DSB-01 drilled at -45 degrees south

My Thoughts:

Although the grades aren’t necessarily flashy I think the market seems to have missed that the tonnage is building very quickly and the sheer scale of the Iska Iska system(s) makes it much more likely to become one giant bulk mining operation (not a small scale high grade operation). On that note…

Moriarty gave this comment in the forum:

“I’m not sure where you got the idea this is low grade. Low grade depends on what country it is located and near surface or underground. This is $105 rock near surface. It would be economic almost anywhere in the world but certainly in Bolivia. In Bolivia it would be economic even underground. If you can’t see that is represents a giant deposit, you need to go do some more research.”

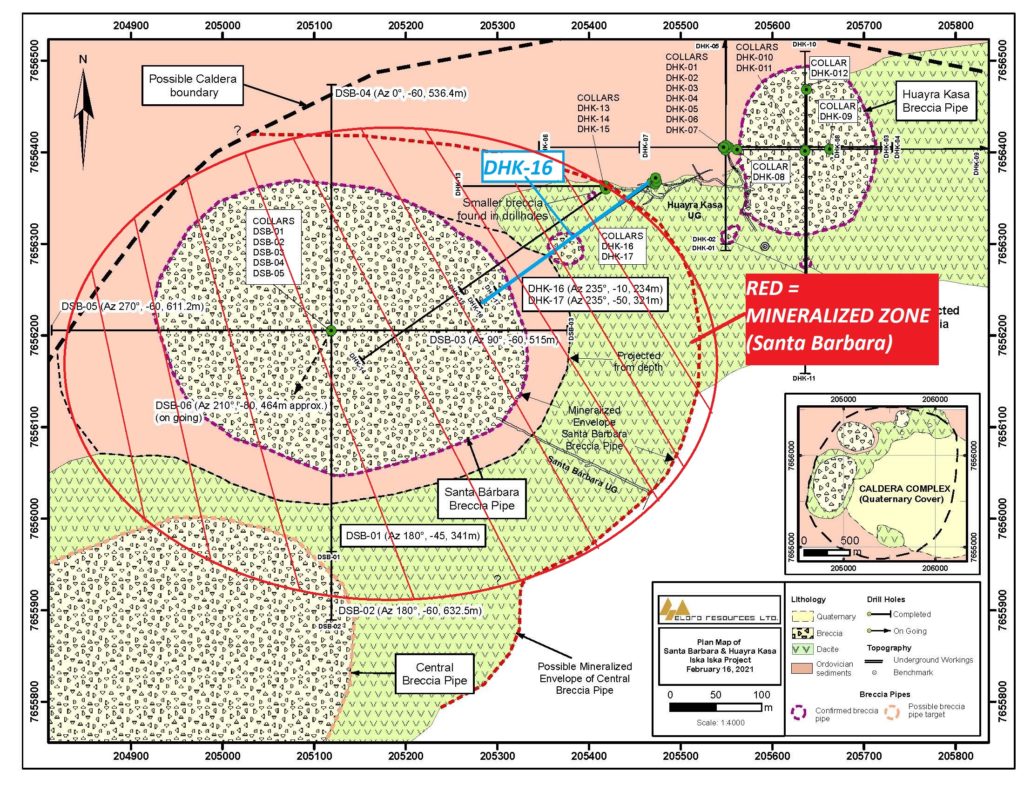

Just consider the fact that, as per the slide below, hole DHK-16 seems to have just made it 1/3rd across the Santa Barbara Breccia Pipe AND mineralized envelope that surrounds it. That hole assayed 67.39 AgEQ over 213 m and that might not even be halfway through…? Think about it!

BLUE LINE = DHK-16

RED CIRCLE = Breccia Pipe + Mineralized Envelope

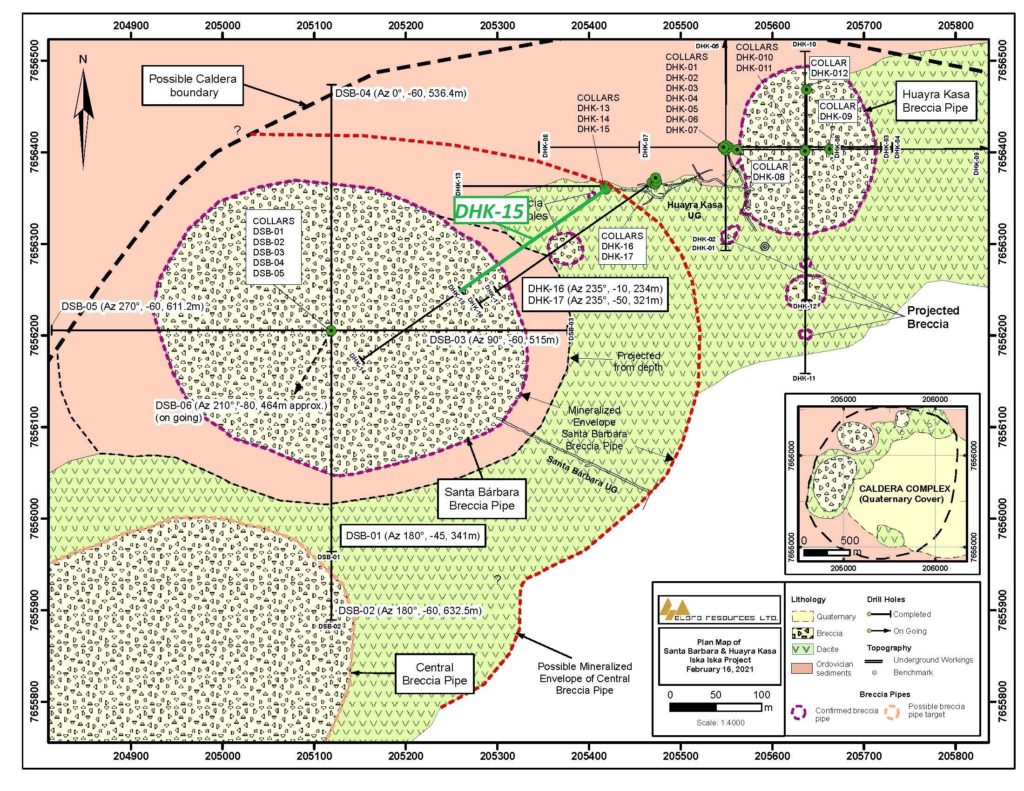

The same goes for DHK-14 which reached about halfway into the red circle and hit 79 gpt AgEQ over 131 m. Keep in mind that these hits are pretty high up in the system and DHK-15 which was drilled deeper than DHK-14 hit 129.6 gpt AgEQ over 257.7 m and according to the plan map DHK-15 didn’t even pass the halfway point of the diameter of the pipe + mineralized envelope.

GREEN = DHK-15

DHK-13 (reported earlier), which seems to have only really intersected the mineralized envelope, still assayed 74.16 AgEQ over 40.88 m.

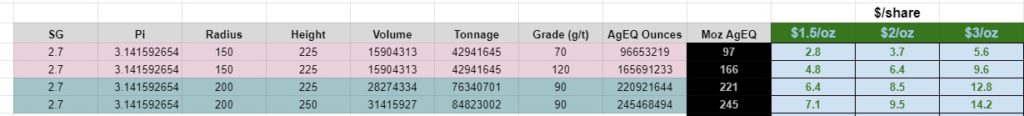

Tonnage Quickly Increasing

I have done some crude calculations and “even” if I use a radius of 150m, height of 450m, 70 gpt AgEQ for the upper 225m and 120 gpt AgEQ for the lower 225 m I get over 250 Moz of AgEQ:

At $1.5/AgEQ ounce that’s $7.6/share from only this part of one pipe. Am I too optimistic? I don’t think so. Especially since there are two more pipes for added economies of scale and the Santa Barbara pipe has not been fully tested in width and is wide open at depth.

To quote Quinton from the NR:

“In the meantime, we are quickly seeing Iska Iska grow dramatically through mineralized intercepts encountered in recent drilling.”

Two More Pipes…

We already know the smaller Huayra Kasa Breccia Pipe is mineralized as well:

“On November 18, 2020 Eloro announced the discovery of a significant breccia pipe with extensive silver polymetallic mineralization just east of the Huayra Kasa underground workings and a high-grade gold-bismuth zone in the underground workings. Diamond drilling intersected a number of extensive mineralized intersections within the major breccia pipe including 54.48 g Ag/t, 1.45% Zinc (Zn) and 1.60% Lead (Pb) over 16.39m (140.91 g Ag eq/t) within a broader interval of 122.74m grading 14.29 g Ag/t, 0.81% Zn and 0.41% Pb (53.67 g Ag/t eq) in Hole DHK-04 (see press release November 18, 2020).”

Comments on Huayra Kasa from the NR:

Dr. Osvaldo Arce:

“At Iska Iska, the Huayra Kasa breccia pipe could be peripheral higher-level epithermal mineralization with predominantly Zn, Pb, Ag and Au.”

“The Au-Bi mineralization outlined in the underground workings of Huayra Kasa and in the beginning of hole DHK-05 is also characteristic of mineral deposits in the district such as Tasna, located 50 km northwest of Iska Iska”

The Central Breccia Pipe and a Porphyry at Depth…

Dr. Osvaldo Arce:

“Hole DSB-02 intersected at its bottom significant grades of Sn and Au, which is characteristic of other deposits in the district such as Chorolque, located 25 km northwest of Iska Iska. At Iska Iska, the Huayra Kasa breccia pipe could be peripheral higher-level epithermal mineralization with predominantly Zn, Pb, Ag and Au. The SBBP west of Huayra Kasa is likely an intermediate zone with telescoped polymetallic mineralization of Ag, Sn, Zn and Pb. The CBP with Sn-Au association could constitute the core zone similar to the Chorolque tin deposit.”

“In the case of Iska Iska, the mineralized system has a high degree of preservation of the entire porphyry-epithermal system.”

Dr. Bill Pearson

“We are seeing increasing evidence of an Sn porphyry at a much shallower depth than previously thought. The SBBP is a major Ag-Zn-Pb target whereas CBP is looking more like an Sn-Ag-Au target. In the Huayra Kasa underground workings we identified a third major target, high-grade Au-Bi. Clearly we have a large scale complex multiphase porphyry-epithermal system driven by a major porphyry at depth.”

Dr. Quinton Hennigh:

“The preliminary results for hole DSB-02 strongly suggest we are rapidly approaching an underlying Sn-Ag-Au porphyry system as we test the deeper part of the CBP area.”

My Thoughts:

Eloro has just begun scratching the surface at two of the at least three breccia pipes and the inferred tonnage/endowment is already stacking up to a very sizeable deposit in my opinion. Furthermore the mineralization seems to get STRONGER and DEPTH and also seems that there is a major Sn-Ag-Au porphyry system below which we have not even gotten into yet…

To quote Osvaldo again:

“In the case of Iska Iska, the mineralized system has a high degree of preservation of the entire porphyry-epithermal system.”

Do I know how big Iska Iska could get? No, but I think it has a good shot of being a system(s) for the history books given how quickly the inferred tonnage is stacking up.

To Quote Hennigh again:

“In the meantime, we are quickly seeing Iska Iska grow dramatically through mineralized intercepts encountered in recent drilling.”

Further signs

More signs of this being a serious discovery already can be found in the company’s plans as per the NR:

“Preliminary metallurgical tests have also been initiated with Micon.”

“Our second drill will commence shortly with first pass drilling of the 700m longitudinal extent of the CBP from both the north and south setup areas. The drill currently at SBBP will complete the deep hole then we will follow up areas of higher-grade mineralization in the vicinity of Hole DHK-15 and follow up on the major extension of the SBBP to the west. Drilling will be designed in consultation with Micon International to optimize future resource estimation.”

… Metallurgical testing and planning to optimize the drilling for resource estimation ALREADY. You don’t do that for shits and giggles.

Closing Thoughts

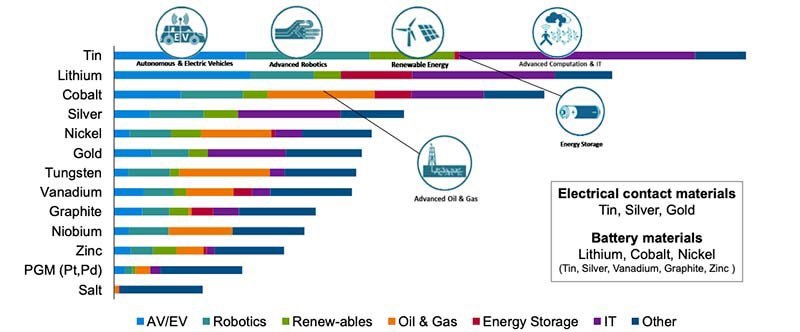

Don’t let the non flashy grades from the shallow drill holes fool you. The potential tonnage and size of Iska Iska has the potential to be almost unique and we are just in the very early days. Ideally Iska Iska will prove to have the potential to be one of the biggest deposits around in the form of three different systems sharing one caldera. With the price of tin rocketing on limited supply one can only imagine what a major Tin-Silver-Gold porphyry could be worth alone…

If things play out as I hope I think Iska Iska will be worth multiple Billions at the end of the day. And the best part is that a lot of this mineralization can be de-risked quite quickly given the overall disseminated nature.

I wouldn’t say the market is at Novo level stupidity but it’s pretty damn insulting to see a 30% sell off on a few shallow holes when Eloro might be onto one of the biggest discoveries in decades. The best part is that if this is a true behemoth then there is plenty of upside left since the Market Cap is “only” $210 M and a “new Potosi” should be worth a helluva lot more than that. In light of this I am very comfortable with my large position and even added during the sell off…

“We have only just begun”

My Case:

- Valuation already underpinned by the first ~400 m of the Santa Barbara Breccia Pipe in my opinin

- Might be a LOT larger than that with multiple pipes and THREE different mineralizations

- Might have a major Tin-Silver-Gold porphyry in addition to the above

- Oh and tin has been ripping lately…

Tin futures:

Note: This is not investment or trading advice. I am not a geologist nor am I a mining engineer. This article is speculative and I can not guarantee 100% accuracy. Junior miners can be very volatile and risky. I have bought shares of Eloro Resources in the open market. I can buy or sell shares at any point in time. I was not paid by any entity to write this article but the company is a passive banner sponsor of The Hedgeless Horseman. Therefore you should assume I am biased so always do your own due diligence and make up your own mind as always.

Best regards,

Erik Wetterling aka “The Hedgeless Horseman”

Follow me on twitter: https://twitter.com/Comm_Invest

Follow me on CEO.ca: https://ceo.ca/@hhorseman

Follow me on Youtube: My channel