THH – Pacific Ridge Exploration (PEX.V): High-Grade Copper/Gold Porphyry Discovery in BC and a Big Pipeline

Feb 06, 2022

Pacific Ridge Exploration Inc (PEX.V) is one of few copper plays that I own. The primary reasons why I like the case is that it appears they are on to a high-grade porphyry discover in British Columbia (“Kliyul”), have a very large pipeline of additional projects and is Priced at C$24 M (US$18.8 M) @$0.44/share. If one subtracts the value of the peripheral projects and cash I would argue that the resulting valuation for the entire “Kliyul” project barely makes it look like they are even on to a high-grade porphyry discovery. I thought Pacific Ridge was incredibly cheap in July 2021 when I wrote this piece and I think it is incredibly cheap now. These are my current, personal & biased (I own shares and the company is a banner sponsor) reasons why I really like the Risk/Reward in Pacific Ridge…

Company website: LINK

Setting The Scene

On Aug 15 2019 Newcrest announced it is buying a majority stake of 70% in the Red Chris mine, which happens to be a high-grade copper/gold porphyry in British Columbia, for US$804 M. The implied value for 100% of Red Chris would be US$1,148 M which is no small sum of money. Sure, this was an operating mine so that price tag came with a lot of valuable infrastructure, and not just the deposit itself. However, when this deal was announced Copper was trading for $2.6/lb. Today the price of Copper is a whopping 68.7% higher:

What would the price tag be for 100% of Red Chris today? I don’t know except a lot higher than $US1,148 M if I had to guess.

The main point is that a high-grade copper/gold porphyry deposit in British Columbia could be worth a lot. Last year Newmont acquired GT Gold, which was also located in British Columbua, after it discovered a decent grade gold/copper porphyry. Newcrest recently acquired Pretium Resources, which is a gold miner operating in British Columbia, for $2.8 B… The majors apparently love BC as a jurisdiction today so success here is probably worth more than most places on earth (all else equal).

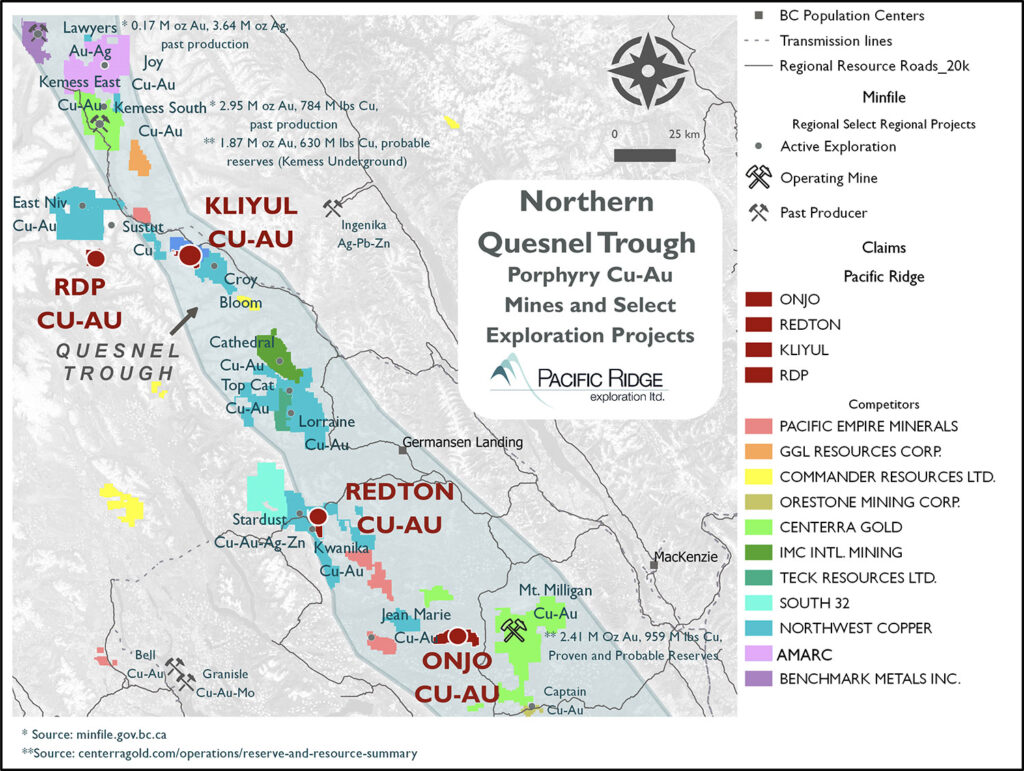

Anyway, as stated earlier, Pacific Ridge has a Market Cap of US$18.8 M. That valuation should reflect all the other projects in BC:

Note:

The “RDP” project has seen some drilling with encouraging results:

• Roy: Hole EQ-001 encountered 0.11% Cu and 0.64 gpt Au over 122.95 m.

• Day: Hole D-74-1 encountered 0.67% Cu and 0.93 gpt Au over 58.8 m.

• Porcupine: Float samples assayed as high as 17.2% Cu and 0.19% Cu with 7.98 gpt Au.

The “Redton” project is located 2 km away from where NorthWest COpper recently intercepted 235.45 of 2.92% CuEQ.

The “Onjo” project is 15 km west of Centerra Gold’s Mount Milligan Mine which contains 837 million pounds of copper and 2.1 million ounces of gold.

… What would a guesstimated value be for the combined, inherent potential in these projects? Lets say US$7 M which I think is quite conservative…

If we subtract that from the Market Cap we have US$11.8 M left…

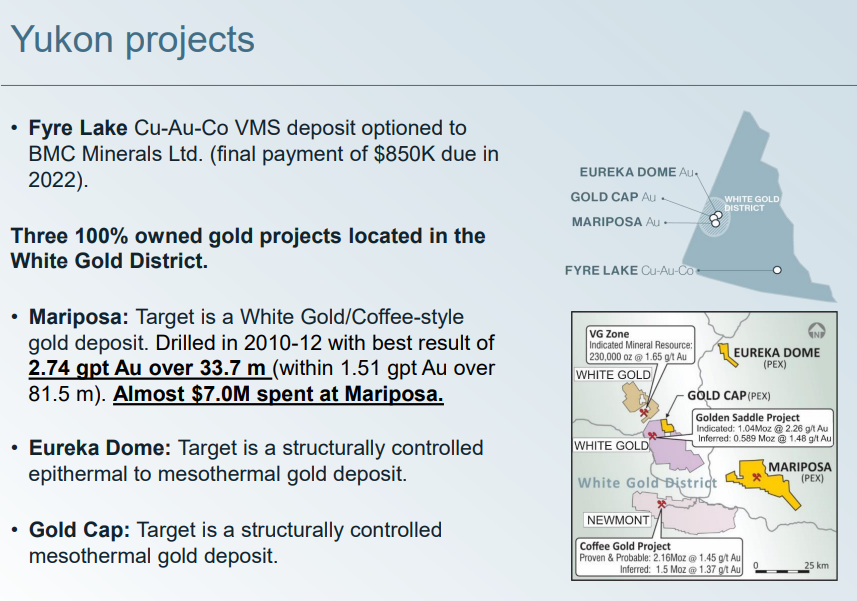

This should also account for and reflect the implied value of the Yukon Portfolio:

What value should one put on the four projects mentioned above? I think US$5 M would be very conservative since I don’t think the combined MCAP of all four projects would only be US$5 M if they were spun out into four different vehicles. Regardless, lets stick with US$5 M…

According to my rather conservative estimated I get a value of US$13 M for all the peripheral assets in BC and Yukon. If we subtract that from the Market Cap of Pacific Ridge then we end up with US$18.8-US$13.0 = US$5.8 M, which is the value left that should reflect the value of the flagship “Kliyul” project, that has recently produced intercepts like:

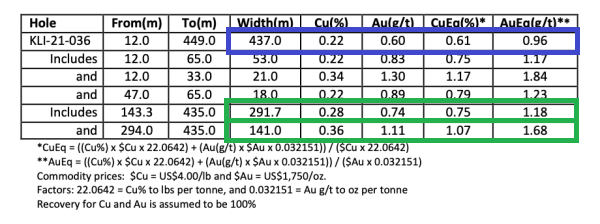

- 437.0 m of 0.61% copper equivalent (CuEq) or 0.96 g/t gold equivalent (AuEq) – LINK

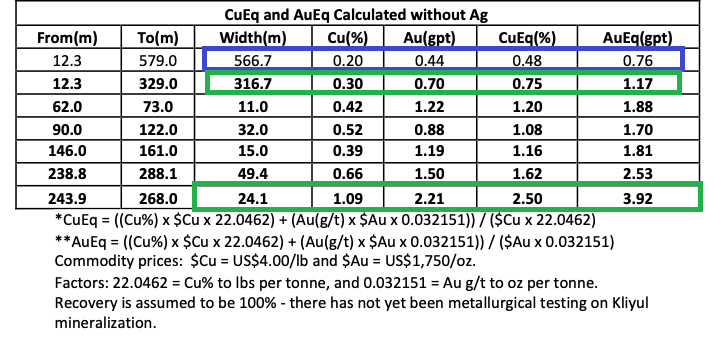

- 566.7 m of 0.48% copper equivalent (CuEq) or 0.76 gpt (grams per tonne) gold equivalent (AuEq), comprising 0.20% Cu and 0.44 gpt Au. – LINK

“We continue to be extremely pleased with the results from our first ever drill program at Kliyul,” said Blaine Monaghan, President and CEO of Pacific Ridge. “Hole KLI-21-037 successfully extended mineralization to the west and the grade compares very favourably to our first hole, which was the best hole ever drilled at Kliyul. We now wait for results from drill hole KLI-21-038, a vertical hole targeted to test the interpreted centre of the porphyry system at KMZ, which was the third and last hole to be drilled during our 2021 drilling campaign.”

Here is Dr. Quinton Hennigh of Crescat Capital talking about the recent results out of “Kliyul” (Aired on Feb 04):

To Summarize

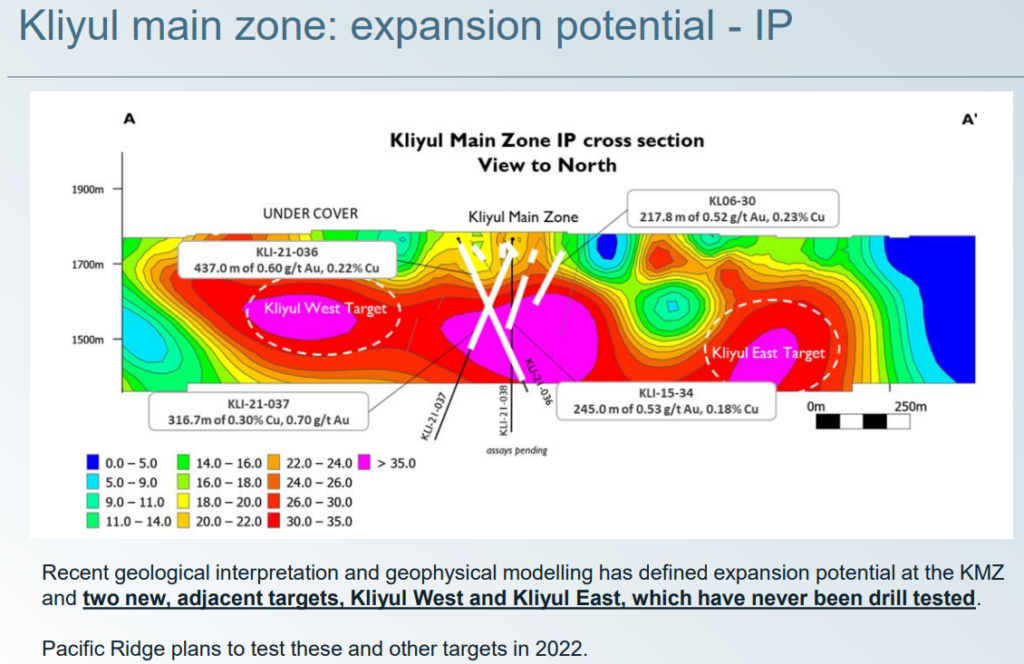

“Risk” to me is overpaying for something whether it be banked value or potential. If my guesstimates for the intrinsic value of all the other projects in the pipeline would be correct then one is currently paying some US$5.8 for all all the potential within the “Kliyul” project. That includes the high priority targets like “Kliyul West” and “Kliyul East”:

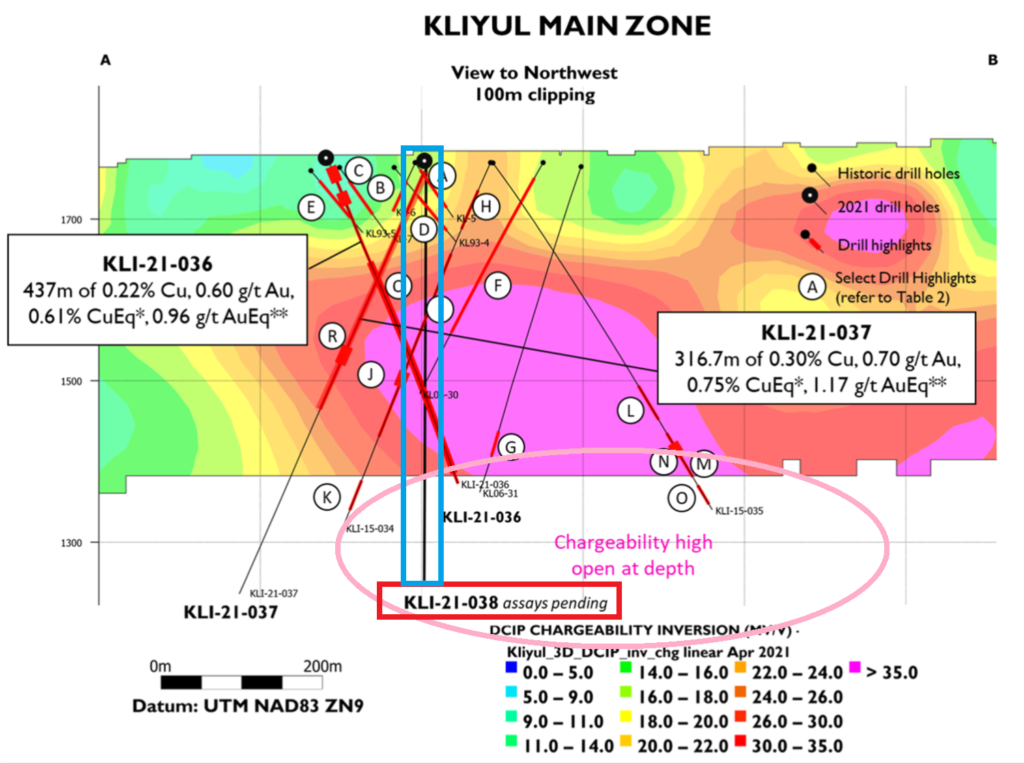

Note that “Kliyul Main Zone”, which is the only one of these three targets that has been drilled so far, is open at depth:

(Some drawings added by me)

Hole KLI-21-036 which was recently released graded 1.68 gpt AuEQ over 141 meter and that was the lowermost interval. What will they find when they push some deeper holes in this years program? KL-21-038 (Outlined by BLUE in the slide), which is the final hole to be released from the 2021 campaign, looks to be the deepest hole within/around the chargeability high.

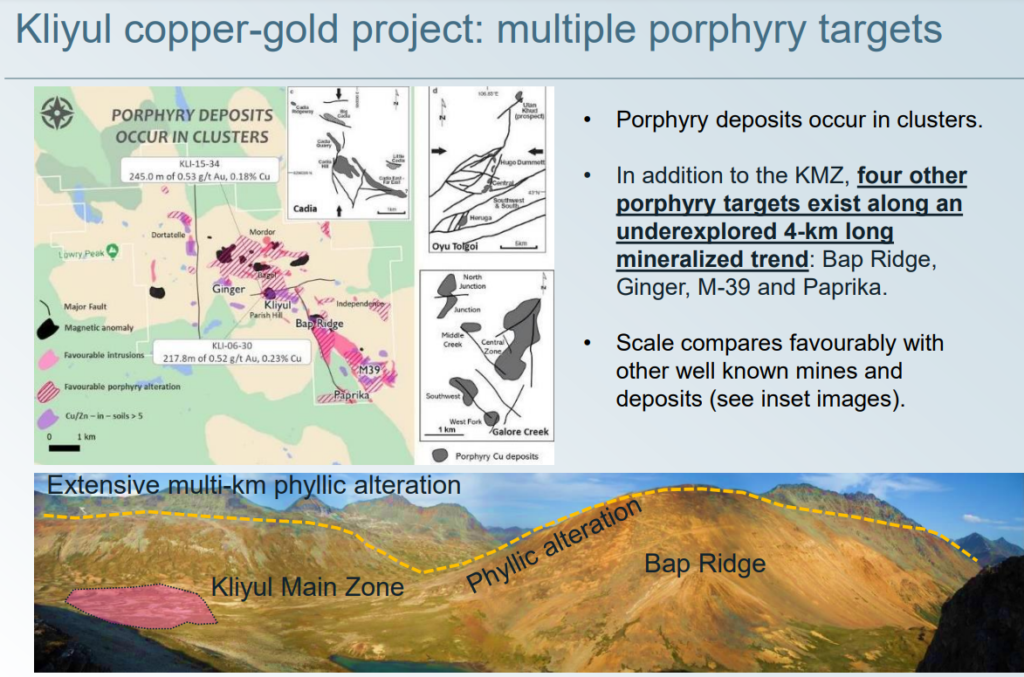

The US$5.8 M should also cover all the value potential in the other porphyry targets within the greater “Kliyul” Project:

… I would argue that given the resent results, and the blue sky potential, “Kliyul” alone is probably worth more than US$18.8 M. When one factors in ALL the other projects one gets for US$18.8 M then Pacific Ridge looks grossly undervalued to me.

Lets say a “new Red Chris” is at least worth US$1.5 B today (probably higher given where copper is trading at) and my assumption of US$5.8 being left to reflect the value of the whole “Kliyul” project when one account for the pipeline. In that case Mr Market is currently pricing in a 5.8/1,500 = 0.3% chance of Pacific Ridge finding something similar (excluding dilution). My guesstimates could be off by a lot and I think the resulting “chance of success priced in” would be way too low… I mean when Quinton says Kliyul is “looking more and more like Red Chris” I don’t think he means there is just a 0.3% chance. Another way to think about it is that one could say the market is pricing in say a 0.6% chance of “Kliyul” becoming even 50% of what Red Chris is. Even if we jacked that number up by 200% to reflect dilution it would still end up at a 1.8% chance of finding half of a new Red Chris. However I slice it the valuation ends up being too low in my book. This is obviously why I think the opportunity and Risk/Reward is great in Pacific Ridge.

In Conclusion:

I am currently comfortable riding my entire original position because there is no way in my mind that the “Kliyul” project as a whole + the massive pipeline of projects is not worth more than US$18.8 M. The value attributed to “Kliyul” makes it look like one could hit holes like the company has done any day of the week. This is far from reality and nobody would be “stupid enough” to even look for another Red Chris type deposit if the current valuation would be fair. I don’t see myself taking any profits before Pacific Ridge gets a MCAP of at least $50 M, when say $35 M of value is put on “Kliyul,” and if the next hole is good as well then that threshold might be jacked up.

If “Kliyul” would totally “bomb” going forward then there is some margin of safety from that large pipeline of projects. If “Kliyul” keeps on delivering then there might be a >10 bagger in store for me. All I know is that I am barely paying anything for “Kliyul” itself right now. On the flip side one could say I am underpaying for the “Kliyul” project itself while getting a whole pipeline of projects for free that could be spun out or sold one day. I simply think Mr Market is giving away too much value for C$24, M which is the current Price (MCAP) for everything, today. If SENTIMENT in the junior mining sector was good right now I don’t think we would find Price-to-Value gaps like this… And the thing about sentiment is that it always changes. We are currently in a total buyers market where one is not even paying fair price for banked success. One day Mr Market will be overvaluing banked success and potential success (like in Q1 2016). I am simply front running the change in sentiment and new buyers by heavily loading up on juniors over the last several months.

Lastly I will say that regardless of how great the mathematical Risk/Reward is I am not betting the farm on any single explorer. I have enough of a position that a >50% loss will not destroy me but enough so that it could have a meaningful impact if they do end up proving up something akin to a Red Chris system. My current plan is to sit tight with my position until it either a) Actually gets way overvalued and/or b) The case for whatever reason becomes materially worse and the fundamental trend stops being positive.

I do hope and expect a meaningful raise in the future which will allow the company to go big this coming field season since just a few, big additional holes could hike up the implied value tremendously.

I don’t have much to say about the chart other than it looks like the share price is in an uptrend and slowly workings its way closer to what I would say is closer to fair value:

In 12-24 months I expect to either be sitting on a multi bagger from here or see a 50% loss for whatever reason. I like cases where they can grow from years and if one buys in low one is “only” risking a 50% downside whilst the pay off could be hundreds of percent over time… Especially when early results are suggesting it might be something really good.

Note: I own shares of Pacific Ridge Exploration Inc. and the company is a banner sponsor. Therefore assume I am biased, do your own due diligence and form your own opinion. Juniors are risky and volatile. Never invest money you cannot afford to lose. I share neither your profits or losses. This is not investing or trading advice. I cannot guarantee the accuracy of the information in this article.

Best regards,

The Hedgeless Horseman

I also started to like PEX… my investment went from a loss of 75% to a gain of 75% :-))