Novo Resources: Front Running a Major Shift in Narrative/Perception

I thought it was time to discuss a bit what I think is in store for shareholders of Novo Resources as Beaton’s Creek is finally getting into production…

Firstly, I would like to point out four main reasons why Novo has been so cheap lately, in my opinion:

- The market is waiting to see how production at Beaton’s Creek will go

- The market is not discounting any of the progression in ore sorting technology (and results)

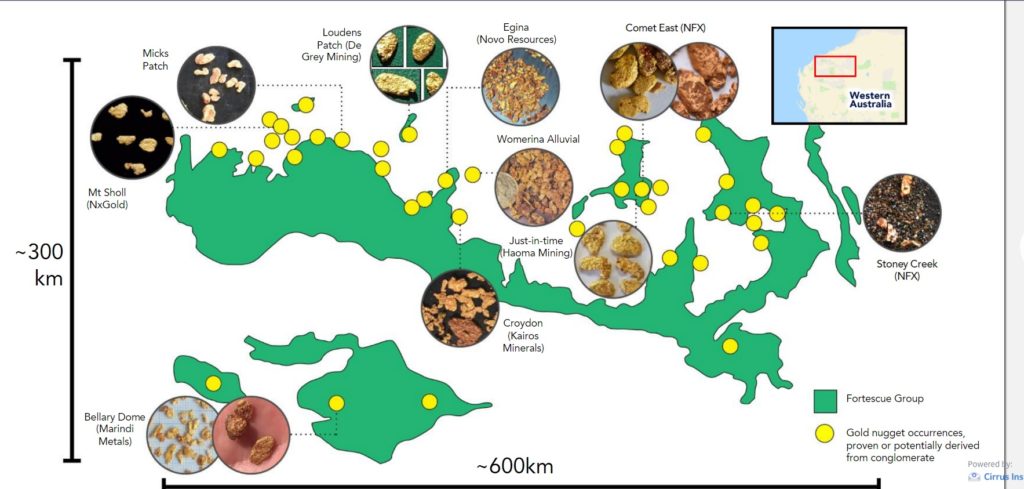

- The market gives little to no credit to any of the other projects in the 14,000 km2

- The market gives little to no credit to any equity positions nor join ventures

Why is Proof of Concept at Beaton’s Creek such a big deal?

Well, first of all it would be the first ever conglomerate deposit to be successfully put in commercial production in all of Pilbara. Second of all, success here will mean an increased chance of success at every other conglomerate target (and Novo has many). Thirdly, it will open up the spigot of growth since Novo would be self funded for the first time. Beaton’s Creek was always thought of as the very first step. The spark to ignite the real case for Pilbara and Novo if you will. I don’t know a single company with more projects, targets and/or prospects than Novo and thus I don’t know a single company that has so many avenues for additional value creation. Thus, I expect that the incoming cash flow from Beaton’s Creek will be worth more than face value. What I mean by this is that if Beaton’s Creek brings in C$50 M per year I expect it to be worth a lot more than that for long term investors in in hind sight. Hopefully Beaton’s Creek alone will be enough to fund all required expenditures to get Karratha, Egina and Talga Talga into production. I also believe it will be able to fund exploration activities across the board (Other Eginas, Virgin Creek, Contact Creek, lode targets across Mosquito Creek, Blue Spec and Malmsbury etc).

Overall Narrative/Sentiment/Perception

- “It’s all just a science experiment!”

- Beaton’s Creek will fail because X, Y and Z, and it being unconventional

- Ore sorting is a joke and/or a distraction

- Pilbara conglomerates/lag gravels are too nuggety and too low grade to be economically mined

I would say that most people who are bearing on Novo believe that one or more of the above points are true and will be true forever. It’s basically a huge circle jerk dominated by one liners and comforted by the subdued stock performance of Novo during the last two years. When I discuss Novo privately with some bears most of them readily admit that they don’t know much about the story however. In other words I think the consensus is dominated by “absolutes”, that get regurgitated over and over again, while being “confirmed” by a low share price. Furthermore, I think a lot of investors (speculators) in this sector are foolishly looking for the “sure thing” and when they see what they perceive to be a “red flag” they stop their analysis right then and there. Case in point: I think many Novo longs are aware of certain people who when asked about Novo seem to be stuck in 2017 and are not even aware that the company seems to have turned nuggety gold (red flag) into an advantage (via ore sorting) and is actually about to go into production. I think this goes for the overall market as well. What I mean by that is the usual one liners are perceived to be as true now as before, despite the obvious advances on multiple fronts, simply because the share price has yet to reflect (discount) said advances. It’s understandable since I know stocks that I maybe used to own or follow, but decided to sell or not invest in, which have been performing badly since and I just assume things have stated the same and that I was “right” to sell and not come back. I would note that this usually ends up being true because the average juniors has one flagship project/target and if that is a miss then the story is over until further notice.

Anyway, when/if these narratives starts shifting is when I think Novo will surprise everyone, including the bulls, on the upside…

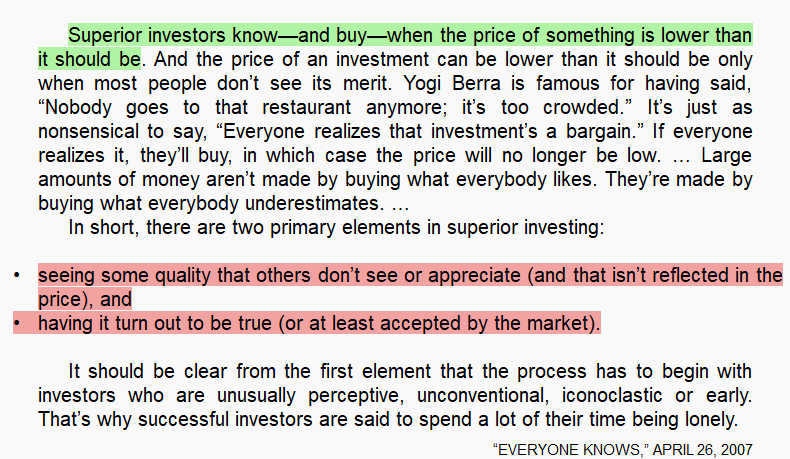

The section above is from the book “The Most Important Thing” by Howard Marks. I think it is relevant to Novo because even with the recent bump I would argue that we are far away from the bull case for Novo being “accepted”. However, Beaton’s Creek is probably about to come “true”. What I mean by this is that with BC going into production, successfully, the market will be forced to accept reality (a cash flow statement). However, the REAL case for Novo that includes 14,000 km2 of ground, ore sorting and multiple equity positions is yet to be “accepted”. Now I don’t know if/when Karratha, Contact Creek, Virgin Creek and/or Egina will be be accepted but Beaton’s Creek becoming reality should probably help the market to at least start “accepting” Beaton’s Creek look-alikes. Potentially it will even start to “accept” the really nuggety deposit types of Mt Roe and Egina lag gravels as well to some degree…

This is why I think Novo could a lot higher, and quicker, than most people are conditioned to think right now. The simple reason is that something theoretical becoming true will affect the the degree of “acceptance” for all the other projects. The two highest impact narrative changes would in my opinion come from:

- Showing that nuggety gold can be economically mined in Pilbara

- Showing that ore sorting can be economically viable at scale

Up until either happens the naysayers being right is still a possibility and as a matter of fact the market has been pricing Novo like it is almost a certainty. It’s going to be hard to laugh at the conglomerates if Beaton’s Creek becomes one of the highest margin mines around.

“Fool me once… Shame on you. Fool me twice… Shame on me.”

Another way to look at the narrative change I see coming is to consider the quote above. In 2017 Novo had a meteoric rise on the back of a trench littered with gold nuggets. As the stock rose people started to believe, and as more people started to believe the stock rose further, in a positive spiral. When it became obvious that the gold mineralization at Karratha was extremely nuggety and could not be drilled the stock got slammed. This marked a sentiment/narrative change which produced a negative spiral instead…

That led to a big increase in trolling and ridicule of Novo and the bashers made it sounds like they had it all figured out from day one (regardless of what their stated reasons were initially). In other words the narrative became, in hindsight of course, that anyone who invested in Novo had made an obvious mistake. In my experience investors who have been “burned” in a stock are very hesitant to ever come back since there are negative emotions attached to it. If that is also fueled by naysayers proclaiming that it was obviously a pipe dream from day one it makes it even worse. Losing money on paper is one thing but losing money AND being a fool? That is often just too much to bear…

Thus, I think there are a lot of people who not only thought they did a mistake while buying Novo at higher levels but that they were real fools for doing it. And again, few will suffer the risk of “being made a fool”, for a second time. I of course completely disagree with this narrative. First of all no one could have known that the fine gold at Karratha was limited to a halo around the nuggets. If the fine fold was disseminated throughout the conglomerate then Novo might be trading at $50/share today and we would not have this conversation. Second of all, which is the most important thing, is that Novo has worked their assess off to make the nuggety deposits of Pilbara work since then, with incredible success.

If/when Beaton’s Creek successfully gets into production the “Fool me once shame on you. Fool me twice shame on me” affect will start to work for our benefit instead. Remember all the naysayers that have been harping on about it being impossible to mine any of these nuggety deposits for the last two years? Well, they might soon be looking like fools. If they were “fools” in regards to that why wouldn’t they be wrong about a lot more things? As the Novo team keeps solving problems the way it has I expect the people who have been calling Novo investors fools to be looking like fools and falling like dominoes. If/when that happens investors will start to give Novo the benefit of the doubt instead of the naysayers while not wanting to get “fooled again” by said naysayers.

For example, how much credibility might Ken (who has been one of the most vocal bashers) lose when Beaton’s Creek pours its first gold bar in light of the following?…

… For all intents and purposes he bet his life on something that he will end up being wrong about no more than 2 years later. He will be joined by his other “expert pals” soon enough.

Recent Developments

#1 Appointment of Michael Spreadborough to Board of Directors

“Michael Spreadborough is currently CEO of Metals X Limited (ASX: MLX) and previously Managing Director & CEO of Nusantara Resources and a Non-Executive Director of CleanTeQ Holdings. Mr. Spreadborough has a mining engineering background, with over 30 years’ experience in mining lead, zinc, uranium, copper, gold and iron ore.”

#2 Novo And Sumitomo Complete Earn-In Over Kangan Project at Egina

#3 Novo has graduated to Toronto Stock Exchange

- CEO Rob Humphryson has bought 60,000 shares for $141,000

- Chairman Quinton Hennigh has bought 9,000 shares for $20,271

- CFO Ronan Sabo-Walsh has bought 3,500 shares for $8,231

Thoughts

You don’t have to be a genius to see what the events above are suggesting…

1. Michael Spreadborough would obviously not come on board at this time if he AT LEAST thought Beaton’s Creek would NOT be a SUCCESS.

2. Completing the earn in suggests Egina is good and Sumitomo is still involved.

3. Graduating to TSX suggests that a) Novo has a future and b) It will get even brighter

4. Insider buying going into production start at Beaton’s Creek is an immense vote of confidence in my opinion…

Why? Because a) Novo has debt for the first time and b) The rubber is about to hit the road. Furthermore, Quinton has a huge position in Novo already and Quinton/Rob/Ronan have millions of options which means that they should do very well if/when the share price of Novo appreciates. Now, buying shares in the open market means that they are willing to add DOWNSIDE risk for added UPSIDE exposure. Not only that but at the most critical junction for Novo so far given that so much currently rests with Beaton’s Creek becoming a success. This tells me that they are very convinced that Beaton’s Creek will be a success and that the share price of Novo will likely not get much lower than this, ever. I can’t understate what a sign of confidence I take away from the timing. I doubt there are many cases where insiders are adding to their exposure at such a critical time. I mean if Beaton’s Creek would be a bust then the whole company could be in jeopardy and that means their employment would be at risk. Thus, adding additional exposure which is very tied to the success of Beaton’s Creek speaks volumes in my opinion. Just out of curiosity I checked the SEDI-filings for Pure Gold Mining, which is one of the most recent juniors to go into production, and sure enough there was insider SELLING going into first pour…

This is actually understandable from both a risk management stand point as well as “Lassonde Curve” timing. A big difference between Pure Gold and Novo Resources is that Pure Gold will have a hard time growing a lot after their one flagship project is in operation while Beaton’s Creek is “just” the soon to be producing asset that will be used to UNLOCK the most obscene pipeline of growth projects in the sector. In other words selling into production start makes sense for Pure Gold (where substantial growth will be hard) but nor for Novo Resources (Where BC’s cash flow will go to numerous growth projects).

Anyway, I find myself contemplating how the events above might translate into probabilities…

First of all I assume that Beaton’s Creek successfully going into production is a critical step at a critical time. In other words I see this first step as very defining for the story overall and I assume insiders see it the same way…

What would Michael Spreadborough’s personal view of the chance of success for Beaton’s Creek be to join at this time? Personally I would guess he sees at least an 70% chance of success. What chance of success would I say a listing on the TSX signals? Well, I would say at least 70% there as well. What chance of success would the insider buying signal? I actually think it’s at least 80% for reasons stated earlier…

Thus I conclude that the market is currently oblivious to all the signs and that market perception is way off the mark when it comes to Beaton’s Creek (and Pilbara overall). If there is a 70% chance that Beaton’s Creek will meet or exceed expectations then I think Novo Resources is grossly underpriced (no surprise there). As a result I have begun shedding some peripheral holdings of mine and started the great rotation into Novo. I have stated multiple times that I think Novo Resources is the best long term bet in the whole mining sector by far. I actually see it as one of the very few cases that is actually an INVESTMENT that will actually produce RETURNS that are not dependent on share appreciation. Note that I don’t think Novo is the best long term investment case in the sector DESPITE the low share price but BECAUSE of it.

For lets say >98% of miners the way an investor (speculator) will get returns is by buying low and selling high. What I mean by this is that >98% of junior companies will never become a long term, free cash flowing business. Even the few that actually are able to discover, finance and build a mine will have a very hard time to grow in a timely manner. If it takes 10 years to build a mine with a 10-year mine life then maybe it takes 10 years more to get a similar mine up and running. Furthermore, even if that is successful the first mine might be nearing its end when the second mine gets up and running, which means that after 10 long years there is no real growth to speak of.

What really sets Novo apart from other developers is that it has the project pipeline that surpasses a major and Beaton’s Creek is just the spark to set it all on fire. Now I doubt that Novo shares will ever reflect the fully discounted potential of all assets but it should give comfort that fair value might always be higher than what the current price is on any given day. The best part is that with internal cash flow and the main prize being high margin gold production with help of ore sorters it doesn’t really matter. If Novo stays periodically stays “way too cheap” it does not result in additional dilution, unlike a junior exploration company that would need to raise money at low prices, nor does it affect the future cash flow potential. Beaton’s Creek has been doubted, ridiculed, and the share price was sub $2 not long ago, but that didn’t stop Beaton’s Creek from going into production.

A Perfect Storm

The calm comes before the storm and the sentiment has been near peak conservatism in the wake of the Kirkland Lake selling and Beaton’s Creek nearing the sink or swim moment. In other words market participants have been holding their breaths as evidenced by the, up until now, subdued share price. When Beaton’s Creek is successfully launched we will have passed the eye of the storm and with it the greatest risk will have been overcome. Then add the fact that Novo will be classified as a producer and nowadays trading on TSX instead of TSXV. Lastly, when we reach $5/share it will allow additional funds to be allowed to own Novo…

In other words I see a lot of ingredients for a perfect storm:

- Novo overcoming the biggest risk is the eyes of the market with BC successfully coming online (pending)

- The market will stop looking at Novo as a developer that is in the highest risk stage (rubber meeting the road)

- Novo gets classified as a producer (pending)

- A producer listed on TSX (complete)

- Egina gets attention again (pending)

- Novo can gradually re-focus on the Pilbara as an ultra-district-scale proposition as has always been the real prize/case (pending)

- The narrative will shift from Novo being a developer to Novo being a beyond blue sky exploration story again

- $5/share will allow more funds to buy

- … Price changes sentiment and better sentiment leads to more buying…

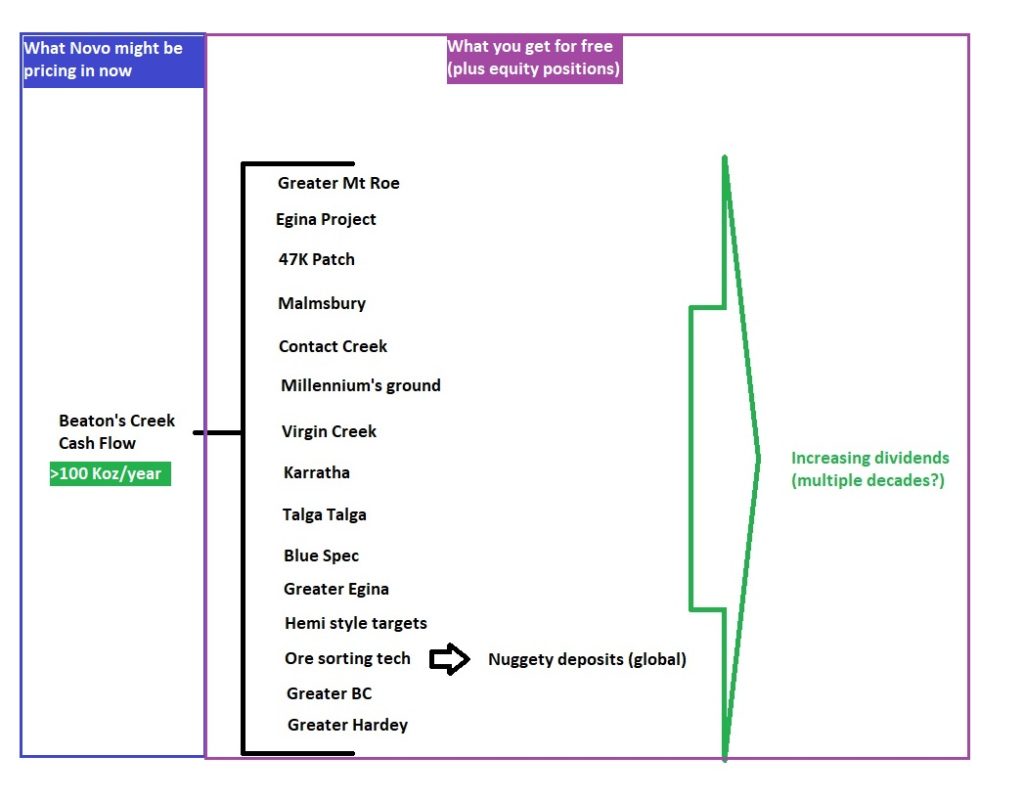

The slide below is where I think we are at, value wise, at the moment. One thing to keep in mind is that due to the assay labs being stuffed we have not seen the results out of Egina yet. On top of that the Novo team has been laser focused on Beaton’s Creek lately for obvious reasons. What will eventually happen is that we will get a lot of results from Egina sooner or later and that will probably result in re-ignited excitement for what might be the crown jewel. Then, as Beaton’s Creek reaches steady state production and cash flow we will see the macro exploration pick up again. We already know about distinct large scale targets such as Virgin Creek and Contact Creek but it has been stated in recent presentations/interviews that they have found a lot more conglomerate targets than that. Thus I really see the whole story right now to be a pressure cooker with the market focus limited to Beaton’s Creek that will eventually explode and result in focus “getting back” to the big picture (future) again.

Final Words: Know that you will never see a story like this in your life and enjoy ever moment of this adventure.

Last but not least: Moriarty’s book on Novo is finally out! (Link to Amazon):

Note: This is not investment advice. I am not a geologist nor am I a mining engineer. This article is speculative and I can not guarantee 100% accuracy. Junior miners can be very volatile and risky. I have bought shares of Novo Resources in the open market and have participated in one private placement. I can buy or sell shares at any point in time. I was not paid by any entity to write this article but the company is a passive banner sponsor of The Hedgeless Horseman. Therefore you should assume I am biased so always do your own due diligence and make up your own mind as always.

Best regards,

Erik Wetterling aka “The Hedgeless Horseman”

Follow me on twitter: https://twitter.com/Comm_Invest

Follow me on CEO.ca: https://ceo.ca/@hhorseman

Follow me on Youtube: My channel

Great article! Thank you

Is it “t” time?

4. The market gives little to no credit to any equity positions nor join ventures

That is because if Beaton’s Creek does not “work out” and operates at a loss, the other projects won’t matter. If Beaton’s Creek is not successful, nobody is going to fund Novo’s exploration budget at other locations while the Beaton’s Creek mine drains the cash earmarked and needed for exploration.

IMHO, Beaton’s Creek is an all or nothing deal for the future of Novo, so please don’t be distracted by talk of other projects (e.g. ore sorting at Karratha) until Beaton’s Creek is a materially profitable mine operation. The key point is for Quinton to provide SHAREHOLDERS with a well thought-out financial projection that reveals a timeline for reaching break-even for the mining operation alone. That document and Novo’s actual performance related to it, will be the key driver of the stock price during 2021, not their talk about the next big project.

Also, the Beaton’s Creek mine failed under previous ownership. Yes, it has been said, discreetly as possible, that previous management of the mine was anything but an “A’ team player. Nevertheless, that failure plants a reasonable doubt in the mind of investors and contributes in part to Novo’s stock being discounted accordingly.

When Beaton’s Creek becomes profitable, I as an investor want to see a very aggressive exploration timeline on the next most promising project (not projects plural). The one thing I like most about NewFound Gold is that after their excellent drill results, they raised enough cash to do a 200,000 meter 1-year drill program. With other exploration companies, investors are tired of the slow pace of drilling that takes place over so many years and in too many locations (i.e. lack of focus), that these companies ultimately fail in large numbers.

Excellent article by Erik. I also agree with Sach’s “all or nothing.” If BC is not profitable (after start-up and tweaking) then it will be hard to justify investing or speculating in Novo. I do think the odds favor BC success and that the narrative will change due to the production and the incredible pipeline, as Erik has outlined. Could be a great stock to help fund one’s future retirement.

Valuable write ups. Cheers.

In QH we trust

I’ve got a bunch of shares. I hope QH and Novo deliver!

Erik, thanks for excellent summary of the value proposition with Novo Resources. It was well articulated. Now the waiting is over and the ball is in Novo’s court.