Junior Investing: The Importance of Quality and Derisking

- You can follow me on twitter: https://twitter.com/Comm_Invest

- You can follow me on Ceo.ca: https://ceo.ca/@hhorseman

- You can follow me on Youtube

We know the success chance of any wild cat drill campaign is extremely low (Much lower than many of us dare to acknowledge in my opinion). We also know that most of us wants to get rich tomorrow and that micro cap drill plays seems like the best way to potentially achieve that goal. However, the odds of that happening is again extremely low and the long term cost of destroyed capital is huge because one can’t compound capital that is gone. The best way of actually reaching say financial independence some day is probably to take less risk by looking for opportunities of that have a probable chance of returning 30%-50% over the next 12-month period of say 100% over the next 24-month period etc. This is why my appetite for most pure exploration plays lately have gone down significantly and I need a really good reason to take any kind of meaningful position in said plays. On that note I would like to discuss why quality matters a lot in light of all of the above.

Let’s say you are invested in a $10 M micro cap explorer with unproven management and prospects. The odds of finding a tier 1 deposit is beyond extremely low and the odds of finding even a run of the mill 1Moz deposit are very low. Compare that scenario to an explorer with some drilling success that shows there is a decent chance for a tier one deposit and a good chance of a good deposit and the junior is trading for lets say $50-$150 M. Most people would still prefer to “gamble” on the $10 M MCAP company because the blue sky scenario is indeed larger.

However, when one accounts for the risk of a loss of capital, the higher MCAP company with the de-risked prospect, is often a superior Expected Value proposition. Even if the drill results disappoint, there might be a decent chance for the company to have stumbled upon a tier 3-2 project that has a shot of turning into a mine even though the tier 1 potential and a 10+ bagger looks out of reach.

Furthermore, there is a critical threshold that any project would need to reach in order to have a decent shot of becoming a mine (aka actually turn into a valuable business down the line). The difference between a junior that finds 0Moz and a junior that finds a decent 1Moz is infinite. One is worthless, the other might be worth something. BUT, the difference between a junior that finds 2Moz of decent quality and 3Moz of decent quality is much less, relatively speaking, since both are probably worth SOMETHING. This is why I prefer junior explorers that have had some success that would act as a floor while also having 10-bagger potential since it drastically reduces the downside but at the same time have a lot of upside left.

Lastly, quality has another benefit since value per ounce often scales with mine life, estimated margins and production profile. Three decent 1Moz deposits will most likely not fetch the same price as a good quality 3Moz deposit. Furthermore, there is probably a much higher chance that someone will buy or put a good 3Moz deposit into production than three decent 1Moz deposits. The only thing that the

These “hidden” factors that work in the favor of quality should not be underestimated for investors even though most people does not appreciate it. When you break it down, they are rather simple and straightforward concepts, but that’s the beauty of it. I want to keep things as simple as possible due to the amount of noise and un-important details that could easily flood any decision making process. I want to find “no brainer” cases where the downside seems rather limited and the upside range is so wide that I can “miss” a lot and still do OK.

Two drive these points home I think it’s best to use a few real life examples from my own portfolio and how I think it relates to quality and de-risking; Irving Resources, TriStar Gold and Lion One Metals. I am of course talking my book here, but there is obviously no other way to show that I eat what I cook.

Let’s start with Irving…

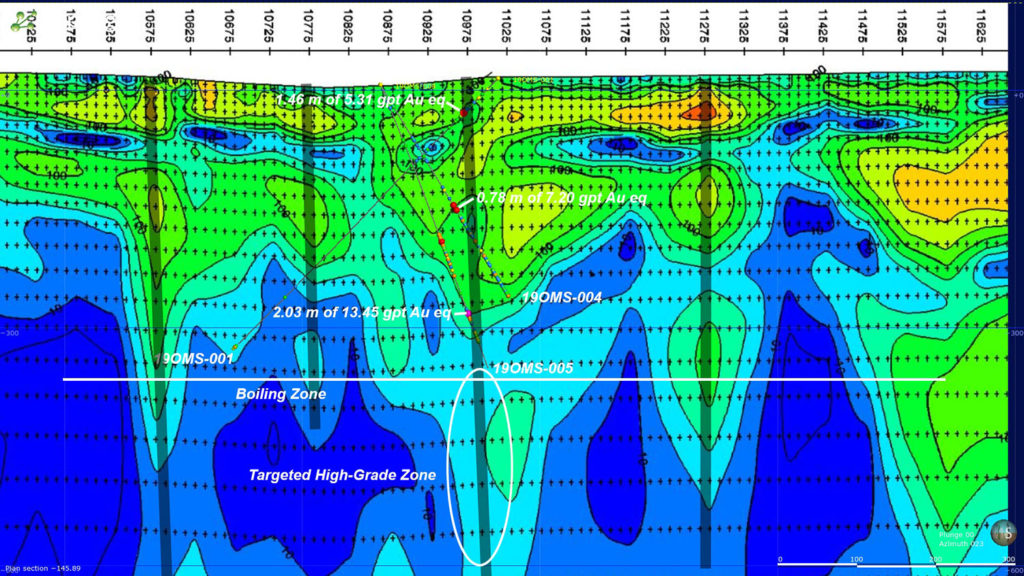

Irving recently put out a news release that included CSAMT survey results from the three main (known) prospects within their greater Omu Project. These CSAMT results showed multiple trends at each prospect that are targets of their own. We also know that each of the prospects have seen legacy mining of gold and silver so we know these systems are indeed gold and silver bearing. The Omu Sinter project is the first project that has been drilled and Irving has already encountered high-grade veins grading up to 135 gpt AuEQ while drilling blind (Without the help of CSAMT):

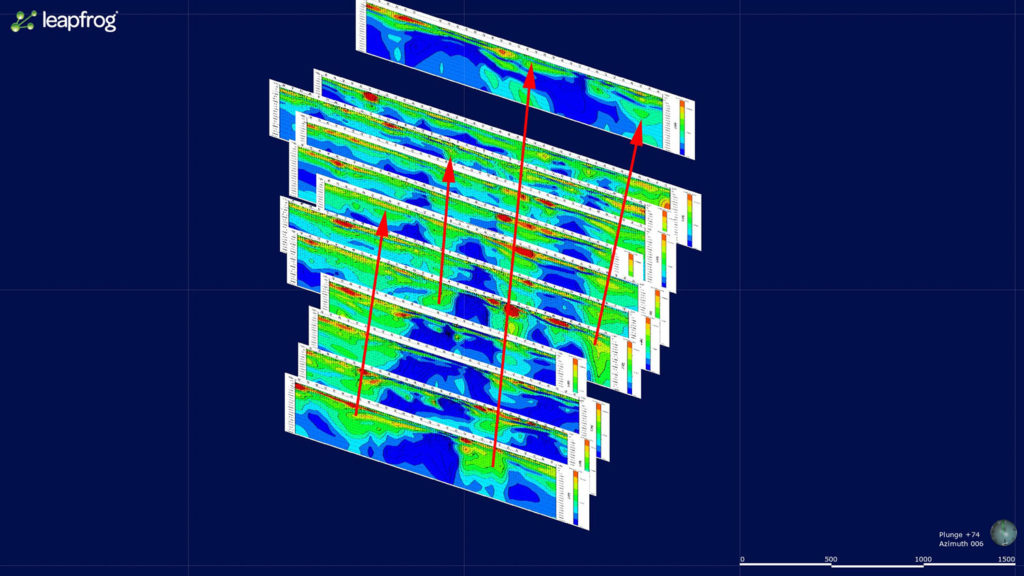

As one can see in the slides above, there are at least four distinct parallel trends that got highlighted by the CSAMT survey readings. With only one trend at one of the three prospects having been drill tested (and confirmed Au/Ag bearing), there is a lot of potential left on the table. Especially since they have not even drilled into the theoretical boiling zone yet(!). There is also a chance for cross structures that does not show up in these surveys due to the strength of the readings of the main parallel trends. Now, Irving has a market cap of C$142 M with around C$10 M in cash. Many people probably considers Irving to be expensive or at least see it as a bad risk/reward opportunity because they don’t understand the significance of Irving’s results and pretty much only look at the market cap. Personally, I think Irving is one of the best opportunities out there despite the relatively high market cap. Why? Because Irving is only pricing in a relatively small high-grade deposit. Given the extraordinary success of the first ever “blind” drill campaign, the odds of finding a decent deposit that could be a mine should be good. With that said, there is potential for the Omu Project to host multiple high-grade mines and that’s the potential upside that is still on the table…

So the question is what are the chances of Irving not finding even one 1Moz-2Moz deposit of high-grade gold within 3 main prospects and 12+ trends spread between said projects? What is the chance for (geological) failure at the end of the day?

Not only would every trend at Omu Sinter need to be uneconomic, but Omui and Hokuryu as well. This is what the CSAMT readings looks like around Omui (which we already know is gold and silver bearing since the system has seen historic mining):

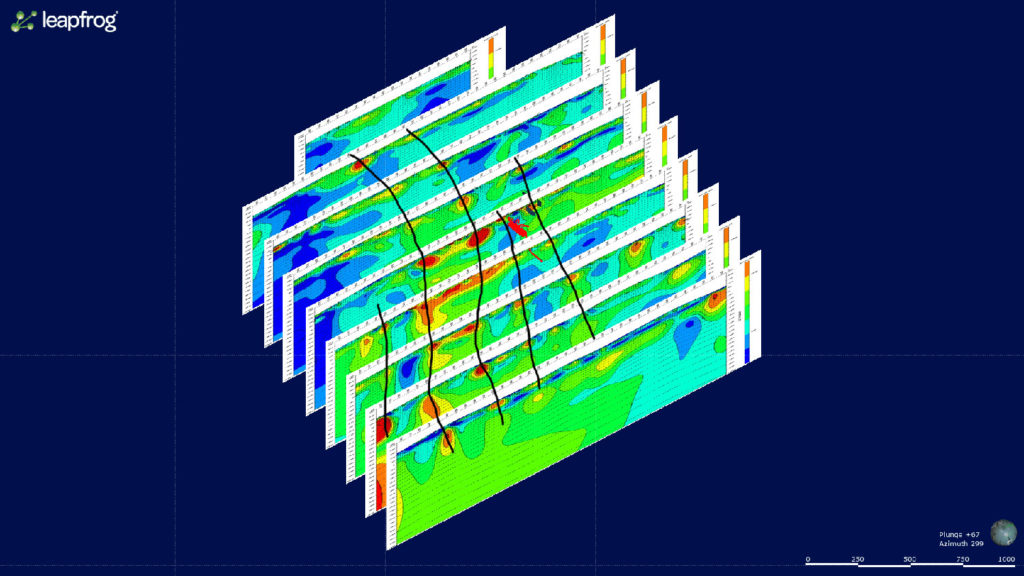

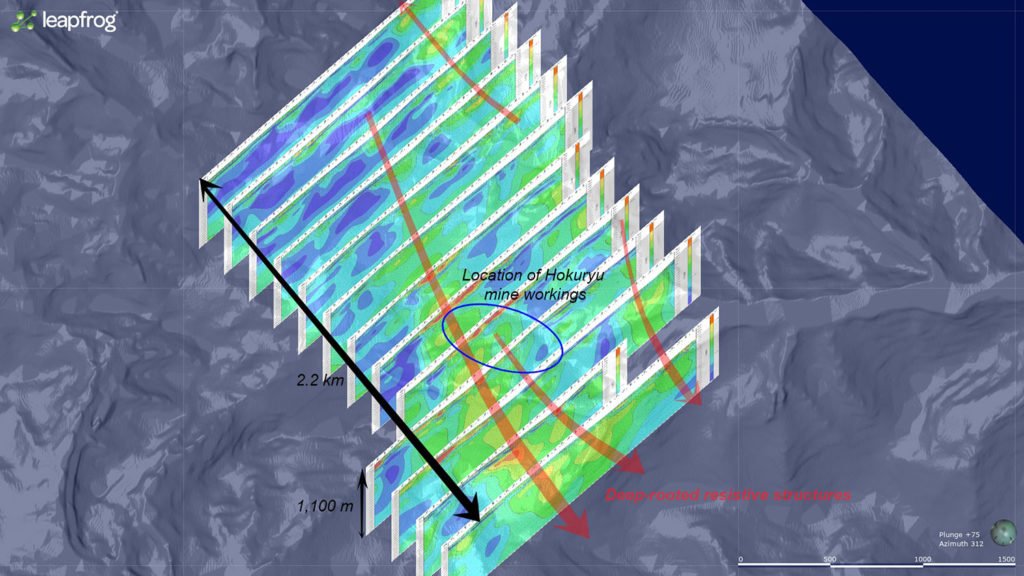

… Then we have this monster of a main trend at Hokuryu which is also described as “deep-rooted”:

Worth noting is that the CSAMT survey suggests that there are multiple trends here as well and the north-eastern trends are in the direction of the Maruyama prospect(!). Furthermore, the very large main trend as well as two of the parallel trends seem to be heading towards the Omui Mine site which is located 8km to the south-east(!). Hokuryu has also seen historic gold and silver production so we already know this system(s) is indeed precious metal bearing as well. Hokuryu looks like a real monster and is scheduled to be drilled next year.

All of the three main prospects have seen historic mining that took place ABOVE the boiling zone. In these Low Sulfidation Epithermal systems the highest grade material is found in the “boiling zone”, which is assumed to start a couple of hundred meters down. Given the nice shallow hits already at Omu Sinter and the legacy mine at Hokuryu having produced gold (and silver) at an average grade of 8gpt, it does look very likely that there might be some very good grades deeper down. Furthermore Irving has found implosion breccia at Omui, which is made up of flushed up fragments, that graded 480gpt Au and 9,660 gpt Ag. This is a glimpse of what kind of grades might be found in the main prize, the boiling zone.

For Irving to totally fail from a geological point of view, every one of these trends must prove to be uneconomic. Basically I see it as Irving offering investors 10+ de-risked lottery tickets and we need to lose on all for Irving to be a failure. Instead, what if each prospect ends up being as big as the CSAMT readings would suggest? In that case then this district scale, interconnected system might host tens of millions of high-grade ounces. On that note, one has to think about what kind inherent potential is in place to get Newmont Goldcorp involved and potentially another major as in Sumitomo. I mean one major alone needs a very large project to move the needle, so what kind of potential would be needed for two majors to potentially share the spoils in the future? Food for thought.

If Irving “only” finds one high-grade 1Moz-2Moz deposit then maybe there is not significant upside left, but at the same time little downside, from here on out. Now, compare that to a $10 MCAP junior that has a 1% shot of finding a tier one deposit and a 10% chance of finding a decent deposit that may or may not even be good enough to make a mine out of. Which one is “safer” and which one actually has the best “risk/reward”? Think about this concept and make up your own mind. I know I have and that’s why I just shake my head when some people who obviously missed the first run in Irving comes in and explain why Irving is expensive relative to whatever “hot” micro cap company they are putting their hopes on.

The exact same rationale is why I really like Lion One Metals as well:

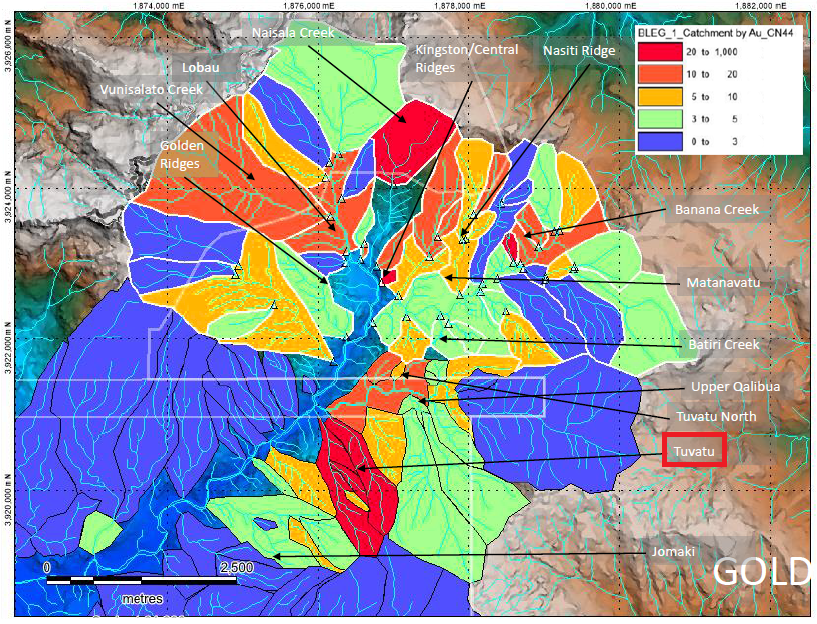

Lion One has almost 1Moz of high-grade gold delineated with a PEA study that shows an after tax NPV of US$150 at $1,500 gold price for starters. The thing is that the alkaline system around Tuvatu looks much bigger. In fact, the Tuvatu Deposit covers a fraction of the potential foot print judging by the Radiometric (Potassium) readings and BLEG sample results…

BLEG samples:

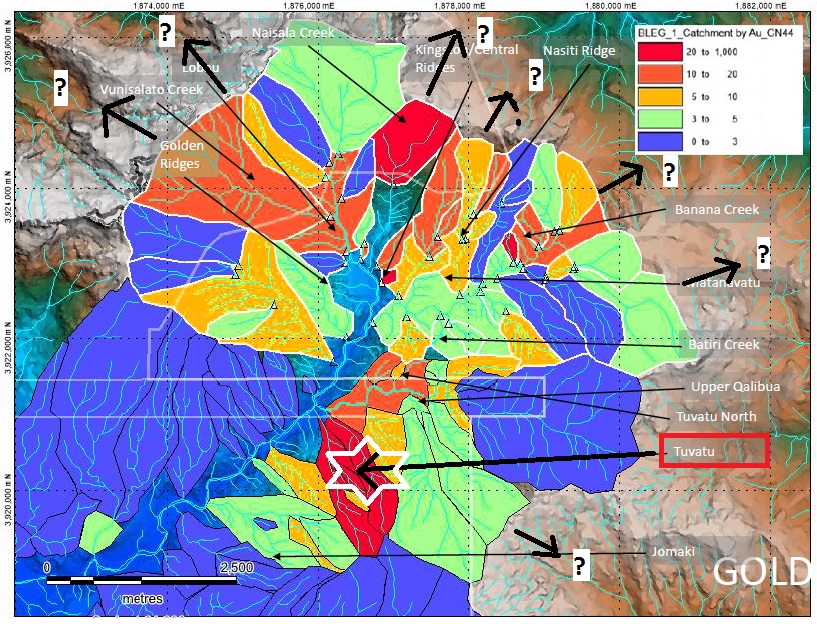

Furthermore, these BLEG sample results suggest that the system might be even larger than what they had dared to hope for given the fact that anomalous readings stretches all the way to the sampling boundry in multiple areas(!):

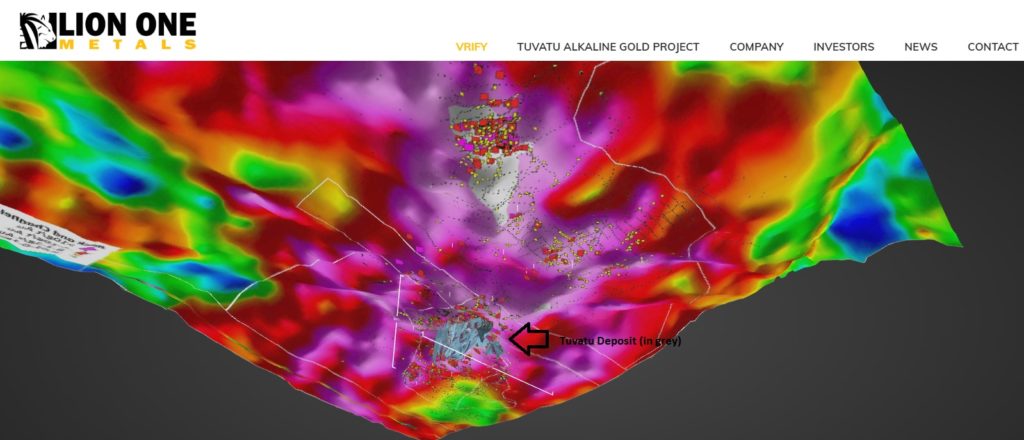

… The odds of this system being limited to the postage stamp that is the current Tuvatu Resource looks increasingly low, which is the main selling point for Lion One in my opinion. Another hint that the system might be many times larger than what has been tested thus far is to look at the Potassium readings in relation to the current Tuvatu Deposit:

… It might be a bit hard to see in the slide above but the current Tuvatu Resource literally covers a fraction of the high potassium readings and the deposit has only really been drilled down to 300m. These alkaline systems can extend to 1,300m depths which makes the upside potential pretty obvious. I probably can’t stress this point enough. It’s not only that the lateral extent of the system looks to be many times larger than the current Tuvatu Resource and what has been drill tested but also the fact that it probably extends much deeper as well and might even get richer at depth.

… On that note, here is a snippet from the recent news release:

“a 4 m interval of hydrothermal breccia beginning at 422.5 m. This breccia is unlike any mineralization previously observed at Tuvatu but closely resembles that seen in some lodes at the Vatukoula Gold Mine approximately 40 km to the northeast. The 4 m breccia zone occurs in monzonite and is cemented by vuggy quartz-adularia-pyrite veining (Figure 2). Specks of visible gold up to 2 mm across are observed in vugs at approximately 423 m (Figure 3). Lion One believes this intercept is highly significant and suggests the mineralizing system is evolving with depth at Tuvatu, a possible indication of further high-grade mineralization below.”

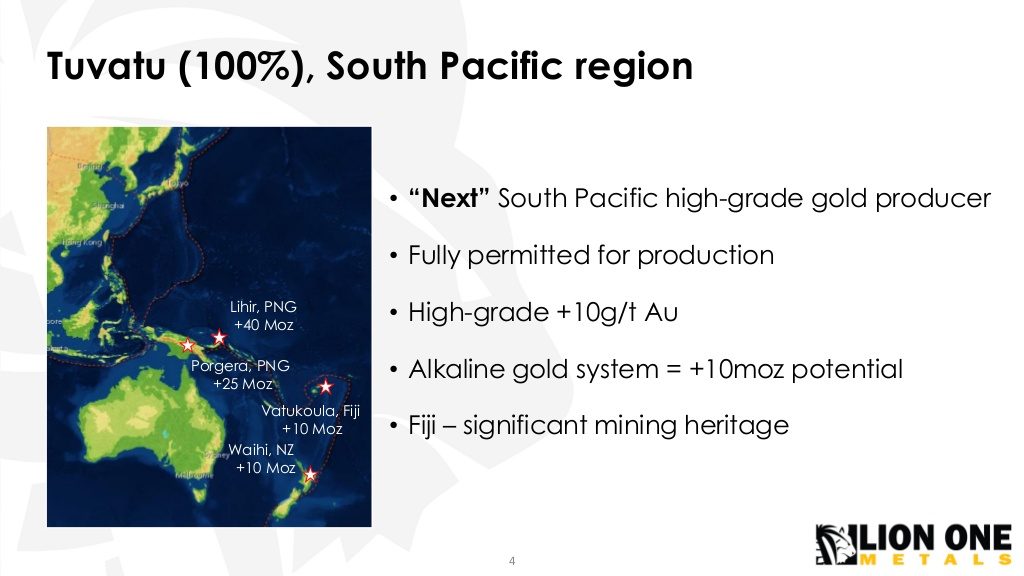

I recommend people to take a look at the VRIFY profile themselves to fully grasp the potential. In my eyes this looks like an alkaline system that has potential for tens of millions of ounces, just like Lihir and Porgera (which are also located along the ring of fire):

The real and simple reason why I like Lion One Metals is the fact that the company is pretty much underpinned by the current small scale project while there is obvious opportunity for the team to prove that this might be one of those very rare tier 1 alkaline gold systems.

So again, would one rather own a $10 MCAP junior with an extremely low chance of finding a tier 1 deposit (say 1%) and a very low chance of finding a decent deposit (say 5%-10%), that may or may not turn into a mine, or would one want to hold a $100 MCAP junior which already has 1Moz high-grade, a robust PEA with very high IRR, and a fully permitted mining lease that acts as a floor coupled with realistic exploration upside of tens of millions of ounces?

Food for thought. I know what I think… But I would argue that most people would not agree with me judging by their actions and comments.

The last example to be used in this article is TriStar Gold:

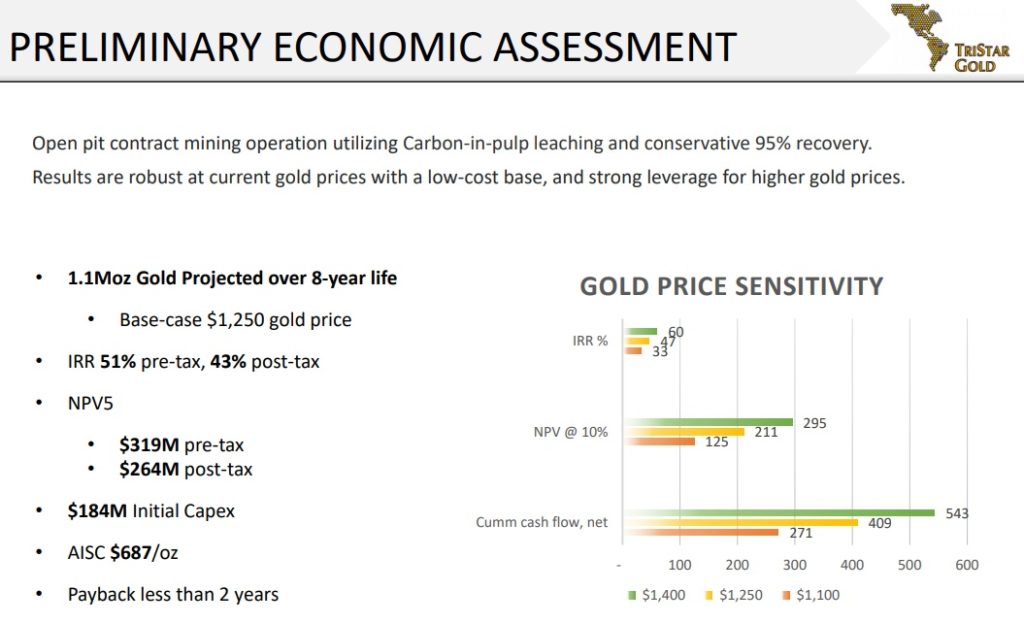

TriStar is currently doing Feasibility drilling at its large Castello de Sonhos paleoplacer project in Brazil. What you get in TriStar is a very de-risked project with a lot of blue sky potential (like the previous companies). Castello de Sonhos already has a PEA study which showed an after tax NPV of US$264 and an IRR of 43% M at $1,250 gold:

A gold price of $1,500 translates to an after tax NPV of around US$445 M for the project. The current Basic Market Cap of TriStar is ~US$30 M. This means that there should be a hefty margin of safety baked into the share price already since the already banked success is suggesting that the company is undervalued right off the bat.

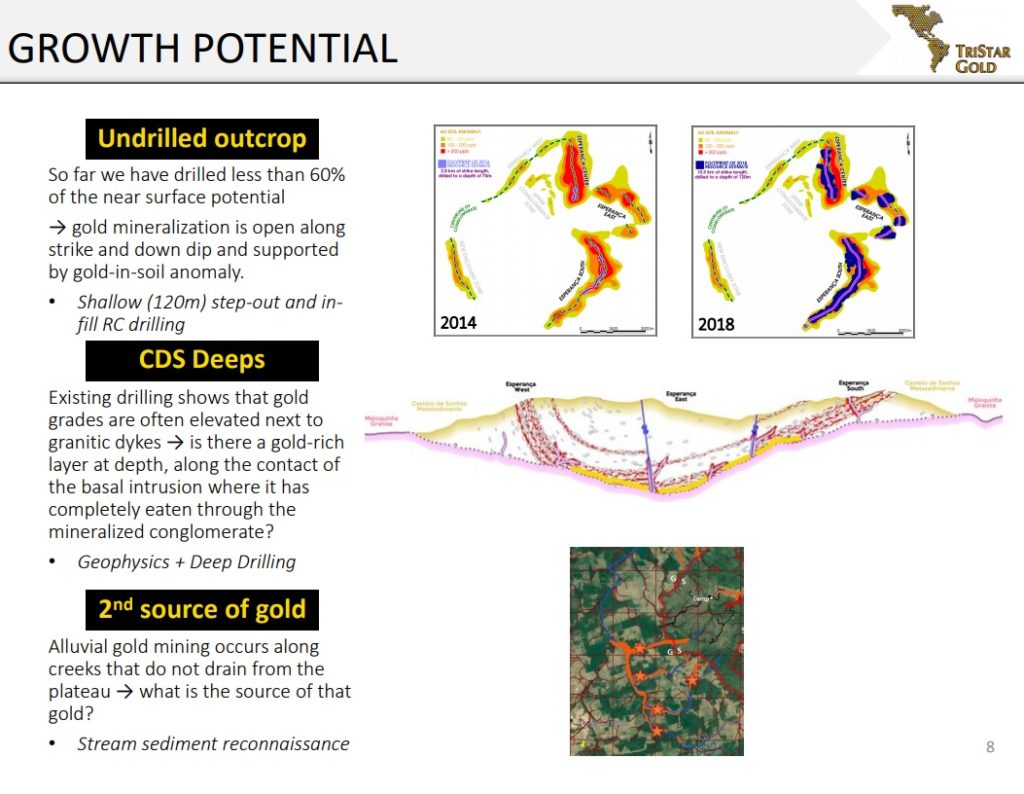

Furthermore, as with both Irving and Lion One Metals, the best might be yet to come for TriStar because there is a tonne of exploration potential:

… TriStar is so far only nipping at the very near surface edges of this rather large ancient basin. It’s closest known relative is probably the Tarkwa paleoplacer deposit and that’s a 30Moz gold deposit that is mined by Gold Fields in Ghana. Suffice it to say, Castelo de Sonhos probably hosts a lot more gold than the current resource of 2Moz. How much could be economically mined? That I don’t know, but since the company looks so undervalued compared to the already known success, one could argue that investors get all of the exploration upside for free. With Royal Gold having done a royalty deal on the project I think it is safe to say that they have high hopes for this project, and that they expect it to get much bigger before all is said and done. TriStar is probably the one out of the three with the most probable upside since it is the most de-risked. It is also the one that should have the highest beta currently.

To Sum Up

I hope I have made some points in regards to my investing strategy and how it relates to some of the companies I own. In short I look for companies with (seemingly) relatively limited downside and open ended upside because in that case I can be pretty wrong in regards to future developments but still come out OK and if things come together as I hope, well then there should be great returns coming my way over the coming years. I mean I think the blue sky for Irving, Lion One and TriStar is 10Moz++ but if I each company would fall 80% short in that respect then these projects should still be above a critical threshold and be worth SOMETING. The same could not be said for most exploration juniors where the chance of reaching that threshold is probably less than 10% in the first place.

- Buying quality with open ended upside means that your blue sky case can miss by quite a lot and still come out OK.

- Buying pure grassroot drill plays or mediocre prospects means that a lot of things must come together for the company to be worth anything in reality.

- I rather buy a more expensive junior with apparent tier 1 (10-bagger+) potential than a $10M junior with little to no chance of finding a tier 1 deposit and a very low chance of finding even a decent deposit that may or may not ever become a mine.

- I will most likely lose a lot of money in the $10 M junior

- I will likely not lose my but and have a decent shot of getting a multi bagger with the de-risked, high quality, but more expensive junior

Disclaimer: I own shares of Irving Resources, TriStar Gold and Lion One Metals and thus I might be biased. I have bought all shares in the open market. I may buy and sell shares at any point in time. I am not a geologist and nor am I a registered financial advisor. Always do your own due diligence and do not view this article as investment advice. Lion One Metals and TriStar Gold are passive sponsors of my site.

Best regards,

Erik Wetterling aka “The Hedgeless Horseman”

www.thehedgelesshorseman.com

You can follow me on twitter: https://twitter.com/Comm_Invest

You can follow me on Ceo.ca: https://ceo.ca/@hhorseman

You can follow me on Youtube

What people might not realize and or know, is that Irving does not need to build a freaking MILL or Processing plant!

Do you know what that does to your bottom line?

The brilliance of this rock is the use of it as smelter flux, someone else is gonna process this stuff for Irving, get all the goodies out of it and hand over the High Grade cash back! Big deposit or small this operation is gonna cost nothing! They should rename the company Irving Federal Money Cash machine! Cant wait for the trial bulk sample!

keep up the good work brother

-Sasha in san diego