Enduro Metals (ENDR.V): Hidden Value And Four Distinct Systems Identified Within 63,800 ha Land Package

In this article I will discuss my case for Enduro Metals (ENDR.V) and explain why I have bought shares and was happy to have the company come on as a banner sponsor of The Hedgeless Horseman…

My Case For Enduro Metals in Short:

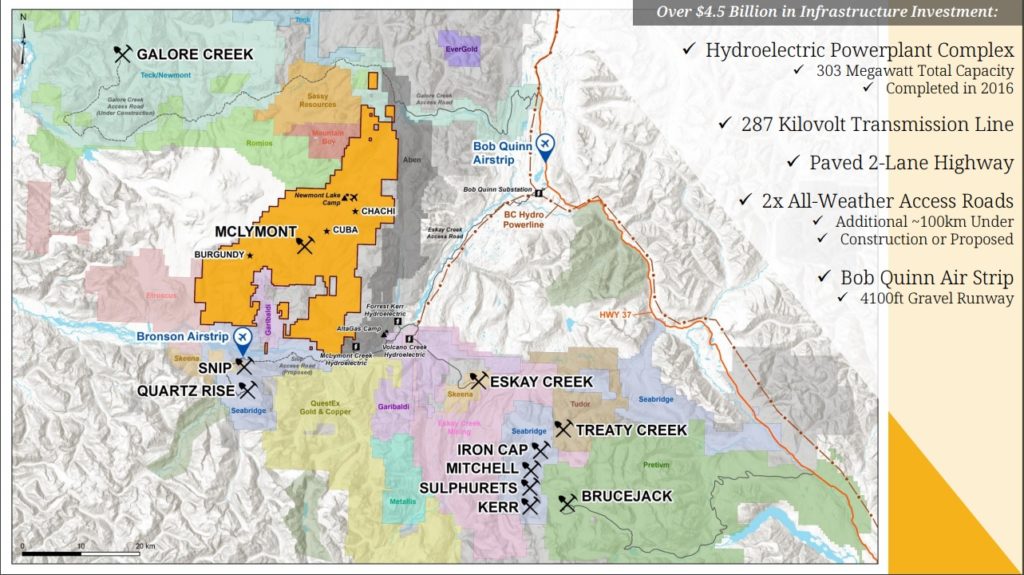

Enduro controls a whopping 63,800 ha land package in the heart of the Golden Triangle and is directly on trend from some of the best deposits in the world (Galore Creek & Eskay Creek etc). With the company having identified four distinct systems within this underexplored district scale land package I would argue that this junior is more than ready to take full advantage of a major bull market in precious metals and commodities overall. This kind of long runway for growth is something I prefer to see in a junior going into the more exciting stages of a bull market because it should mean that said junior does not need to go out and buy assets in a potential future where project valuations have gone up exponentially across the board. In other words I want to own companies that will hopefully do the SELLING and not the BUYING when the sector has become very hot and valuations have gone from selling at discounts to selling at premiums compared. If a company has been growing before that happens it means that I hopefully will get the alpha revaluation, that then gets the beta multiplier on top, for those abnormal returns. This will take time but time is the friend of a good management team…

Cole Evans and his team strikes me as very energetic, smart, out of the box thinkers. On that note the team has already been successful in showing what previous operators missed at the McLymont Fault target. In other words their new interpretation on things has seems to be working which signals a high degree of competence. Further evidence of said competence is the fact that none other than Rob McEwen (smart money) is one of the companies largest shareholders. To top it all off the CEO, Cole Evans, has directly invested over $2 M in the company which means he very much eats his own cooking and really believes that the team has the ability to unlock value within this district scale land package. Furthermore I recently discussed Enduro Metals with another industry veteran and he noted that David Watkins who is a director of the company is a serious ore finder and a big value add (One can look up his impressive resume on the company website)… In other words the people box is more than checked [X].

My Even Shorter Case for Enduro Metals:

- Smart people with skin in the game as well as smart backers (Rob McEwen who increased his ownership at C$0.25/share)

- Huge land package in a tier #1 jurisdiction and a great address (Golden Triangle, BC)

- One de-risked flagship target which seems to have a lot of previously unknown potential

- Historic Resource

- Wide open

- Three additional major targets known

- It’s got a low Enterprise Value (~US$23 M) for all of the above at C$0.18/share

Catalysts:

- Assays from 17 drill holes

- Assays from 511 core samples from unsampled historic core

- 850 soil samples

- 252 rock samples

- 15m of channel sampling

- Geophysics and mapping

Balance of Probabilities…

Would suggest to me that there should be a big deposit or more hiding within Enduro Metal’s Newmont Lake Project:

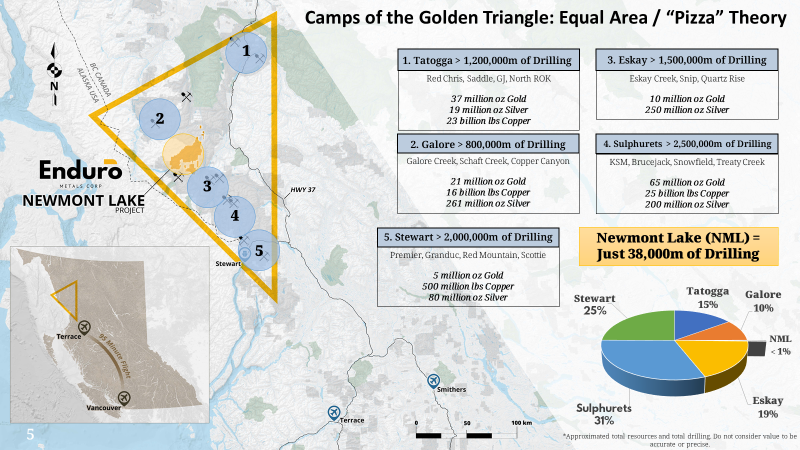

As you can see in the slide above the Newmont Lake project is sandwiched between some very prolific camps in the Golden Triangle. The five major camps that are outlined host some very famous mines and contains/contained over 130M ounces of gold, 780M ounces of silver, 65 billion pounds of copper. Personally I think that there will prove to be even more more deposits and metals in the mentioned areas since for example Eskay Mining and other juniors are proving there probably a lot left to be found. Why does this matter to Enduro Metals? Well, if you take the average (current) metal endowment in the string of camps directly on strike from Newmont Lake it would suggest that there should probably be a material amount of different metals to be found on Enduro Metal’s ground. Why hasn’t at least one large deposit been outlined at Newmont Lake already? Well if you look at the slide there has only been 38,000m of drilling in TOTAL done on the Newmont Lake project while the other camps have seen 800,000m to 2,500,000m of drilling. Newmont Lake is simply very under explored and therein lies the opportunity…

This simple concept of “balance of probabilities” or “Pizza” theory as the company calls it is a big reason why I like Enduro Metals and am a shareholder. As many people might know by now I do think junior mining investing is a numbers game and I like to have the odds skewed in my favor. I have no doubt that the previous slide is a big reason why the CEO, Cole Evans, personally has invested over $2 M in the company and why Rob McEwen is one of the company’s largest investors. Who would not want to own such a large land package where the balance of probabilities would suggest that there is a monster or two hiding going into a hopefully multi year bull market?

A Bit of History

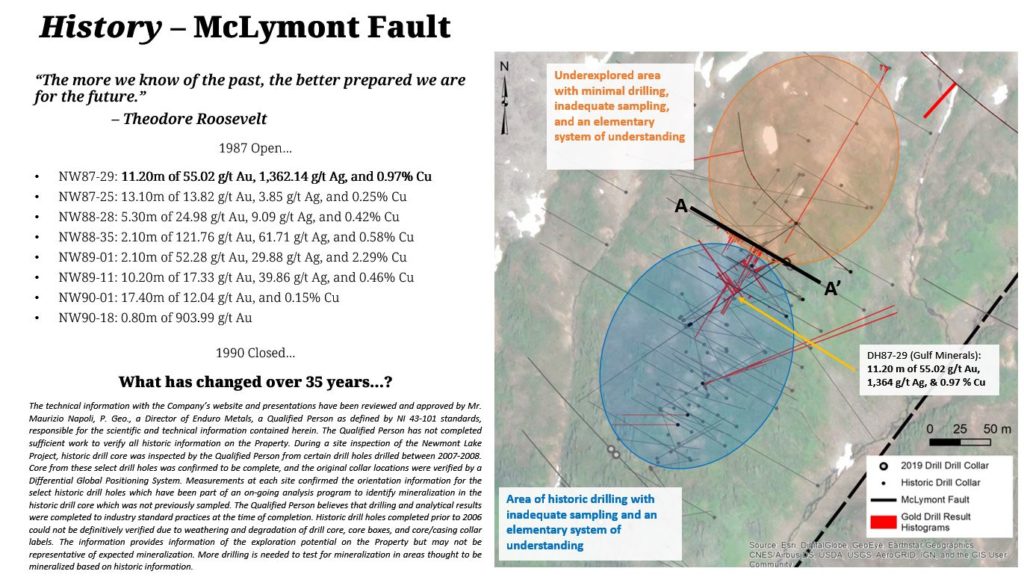

From what I can gather by talking to management the major mining company Newmont first identified the Newmont Lake project area as prospective for high-grade gold in the mid 1960’s when they landed on top of the Tom Zone. Gulf Minerals discovered and drilled the NW Zone in between the late 80’s to early 90’s and had spectacular results. Unfortunately for them, their results were overshadowed by the Eskay Creek’s discovery hole. Leading into the early 80’s, the junior mining space was in a bear market and thus the Newmont Lake project was back on the shelf.

… If those holes would have been drilled today by Enduro itself I am pretty sure that the stock price would be quite a bit higher than it is. But alas, this is historic drilling and “what is old is boring”. In the early 2000s a junior explorer called Romios Gold began to compile the previous results, and recognized the potential, which led the company to assemble an immense land package. Unfortunately it seems Romios was never able to gain enough interest from investors to conduct a comprehensive and expansive exploration program…

Enter Enduro Metals

Fast forward and Enduro entered into an option agreement to acquire 436km2 from Romios Gold Resources who has carefully amalgamated the area since 2005 from numerous smaller operators. Remaining terms on the option agreement are a $1,000,000 CAD cash payment, and issuance of 8 million Common Shares to Romios Gold Resources. Romios will retain a 2% Net Smelter Returns Royalty (an “NSR”) on the Newmont Lake Project, or on any after-acquired claims within a 5 km radius of the original boundary of the project, which may be reduced at any time to a 1% NSR on the payment of $2 million per 0.5% NSR. The remaining 202km2 is owned 100% by Enduro and was acquired via staking or cash purchase.

The Meat And Potatoes

1. Blue Sky Potential

So Enduro Metals owns a whopping 63,800 ha of land in the heart of the Golden Triangle, British Columbia. As many will know by now I like to see juniors with a long runway in terms of internal growth potential. This is simply because I want to feel that a company I own does probably not need to be a buyer in a hot market. I mean I want to own the thing that is being sold in a hot market and not the thing that needs to (probably) overpay for something in a hot market that will be devalued greatly when the market has topped. Anyway, Enduro controls such a large area of land in a tier #1 jurisdiction that I think the company could be busy for years to come “just” within their flagship project. The fact that it is located in British Columbia also means that whatever is found will probably not be taken away. These factors have quite high weighting for me going into the more exciting phases of a major bull market:

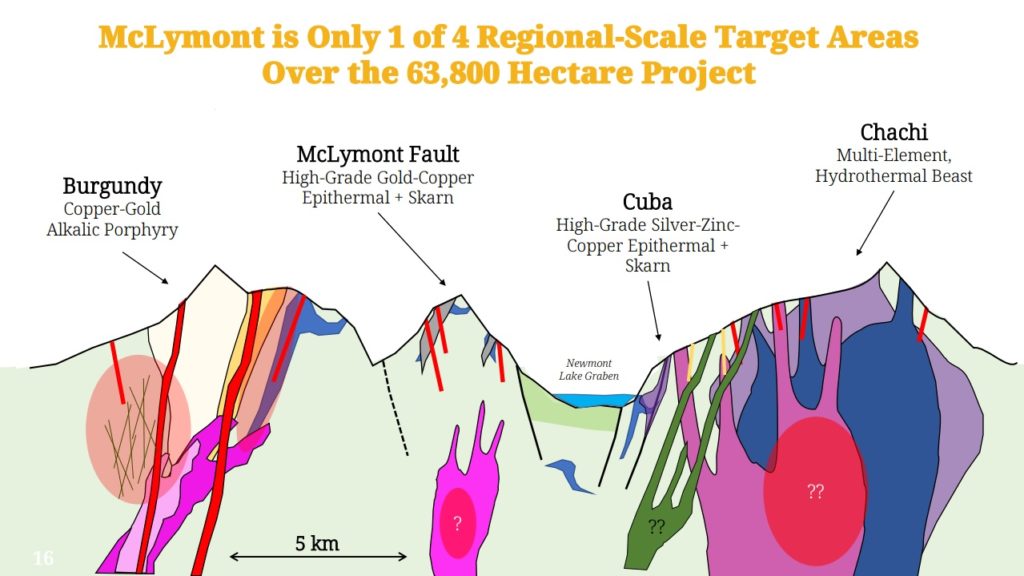

… Note the four market targets named McLymont, Burgundy, Cuba and Chachi. These are all relatively early stage but it is certainly good to know that there is already a total of four distinct targets for the company to work on. This of course means there is a well defined pipeline for potential growth and that there is at least four currently known “bullets in the chamber”. At the current valuation, where not much is priced in, it means that any of these targets could be a company maker.

All of the four main targets appear to have big potential as they are described as “Regional-Scale Target Areas” and what is interesting is that at least some of them seem to be hybrids with potentially more than one type of mineralization. This sounds very promising because it would suggest that perhaps an abnormal amount of mineralizing fluids might have come up within the same areas:

If you’re looking for a big prize it certainly does not hurt if a lot of good “stuff” coincides.

One thing to keep in mind is the people aspect and I don’t think Cole Evans would invest $2 M of his own money nor would a guy like David Watkins be involved if they didn’t believe there is a big opportunity here. Neither would Rob McEwen be invested and some of his latest investment successes that I can think of are Great Bear Resources and New Found Gold. Will Enduro Metals find something of similar value? No idea but the important thing for me is that this kind of people would not be involved if they thought it was not within the realms of possibility and they know a lot more than me when it comes to geology and the targets themselves. In short they are good cooks and eat their own cooking. I can’t ask for much more than that in a cheap junior mining company.

If one takes the approximate US$23 M in Enterprise Value and divides it by just the main four targets then it comes out to US$5.75 M/target which is not much at all. Given that I think what is already known (and found) at McLymont Fault is probably worth more than the current total Enterprise Value it should become pretty obvious why I think Enduro Metals has a great risk/reward profile in my view.

2. First Target: McLymont Fault

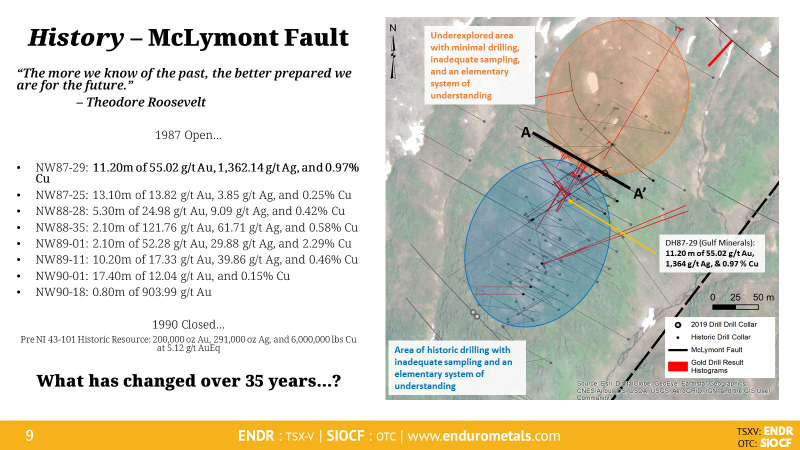

As mentioned earlier the McLymont Fault target is the most advanced target out of the four and there have been historic hits from limited drilling that would normally get a lot of people’s attention:

… One key thing to note in the slide above the comment(s) about “inadequate sampling”. Why? Because it seems that previous operators might have left a lot on the table DESPITE putting out numbers like that. The following snippets are from Enduro Metal’s news release dated November 9:

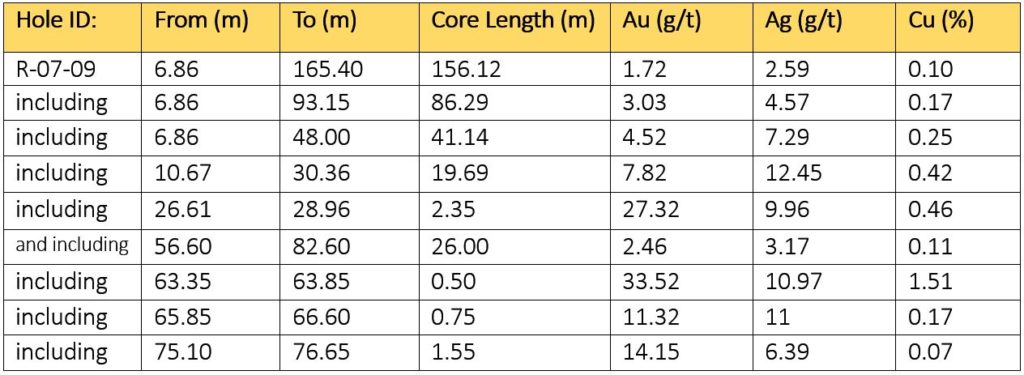

“R-07-09’s original reported intersection was 19.69m of 7.82 g/t Au, including 2.35m of 27.32 g/t Au (see Romios Gold news release of December 18th, 2007). Enduro Metals took an additional 52 samples over a total of 83.08 metres from previously unsampled core. Of those 52 samples, 18 returned new anomalous gold values (see Figure 1).”

Figure 1 from the NR:

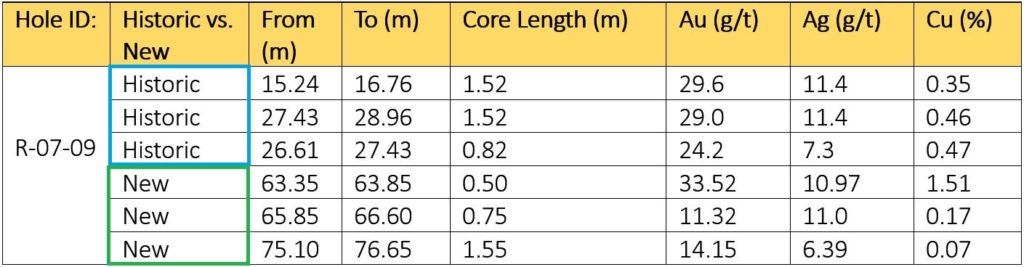

Furthermore Enduro presented a table where they only include intervals that graded more than 10 g/t Au and this one really drives home the point:

“Table 2: Summary of assays returning >10 g/t Au from R-07-09. True width is estimated to be >90% of the reported core length based on lithological modelling. R-07-09 was drilled vertically to a depth of 190.50m”:

… Those kind of results are much more than just rounding errors and I just have to assume that there will be a lot of additional intervals from the historic drilling activities that were not sampled. In other words I think the metal endowment at McLymont Fault is going to go up without Enduro even having to drill. On that note the following is stated on slide 17 in the latest presentation: “Collected and submitted 511 core samples from unsampled historic core”.

To put the previous two slides in context:

… That’s 26.01 m * 2.46 gpt =63.98 gram-meters that were left on the table by previous operators in a single hole(!). Most juniors are not even fortunate enough to drill an intercept like that in an entire drill campaign let alone getting it as a “bonus”.

What is really interesting about the McLymont Fault target is that this area seems to host a total of three distinct mineralization styles. The following snippet is from the news release dates July 27:

(Bold text added by me)

“Romios technical teams found and historically reported multiple gold mineralization styles. Enduro has built upon this excellent work by advancing the understanding and has created the first lithological and geophysical models in the area suggesting 3 gold mineralization styles are present similar to what has been observed in R-08-07 and NW19-012 drilled 150m to the NE (see September 18th, 2019, Crystal Lake Mining). Newly reported mineralization below the skarn (75.71m) in R-08-07 is interpreted as broad, porphyry-like gold with high-grade “feeder structures”. Little is known about this mineralization style at this time as historic drilling focused on the shallow, high-grade skarn. The three styles of gold mineralization interpreted by Enduro in NW19-012 are shown in the following breakdown:

Skarn: 44.03m of 4.03 g/t Au, 4.06 g/t Ag, and 0.29% Cu starting at 82.00m

Epithermal: including 1.00m of 76.56 g/t Au, 11.54 g/t Ag, and 0.47% Cu starting at 111.35m

Porphyry: 77.15m of 0.30 g/t Au, 0.25 g/t Ag, and 0.03% Cu starting at 157.00m to EOH.”

… And to make it even more interesting there have been some pretty obscene grades in some of the historic holes:

The following snippet from the same news release refers to these ultra high-grade gold intervals:

“The Company has identified a total of 8 ultra high-grade gold intervals (>100 g/t Au) interpreted to represent coarse visible gold drilled within a 150m radius of R-08-07 reported in Table 2. The skarn horizon consistently intersects high-grade gold mineralization, but ultra high grades are erratic and difficult to reproduce in diamond drill core.”

Trivia: This made me think of Eric Sprott when he talked about his early investment into Rob McEwen’s Goldcorp and the Red Lake mine. I merely mention this because it’s nuggety gold and Rob McEwen happens to be one of the largest investors in Enduro Metals. I’m not saying this is another Red Lake mine.

Recent Drilling

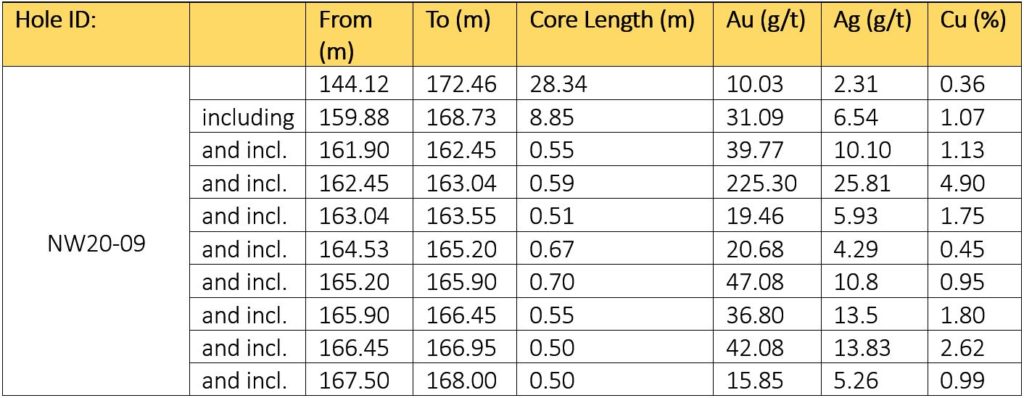

Only results from one out of a total of 17 drill holes from the 2020 exploration program has been reported so far. This first hole to be reported was a “rushed assay” due to the amount of visible gold seen in the core and it was a barn burner hole grading 31.09 g/t Au and 1.07% Cu over 8.85. The break down of the interval was as follows:

Cole Evans, President/CEO of Enduro commented, “This discovery within the NE Extension is highly significant because of striking similarities to mineralization at the Snip deposit located ~20km SW directly along the regional trend. Further, mineralization in NW20-09 is distinctly different from the skarn mineralization we see at the NW Zone and elsewhere in the NE Extension. This relates back to our current models of 3 gold mineralization styles and how important these concepts are in understanding the McLymont area. Now that field crews have demobilized, we are focused on amalgamating our work from 2020 to create what we believe will be a revolutionary new way to look at the entire Newmont Lake area that may have greater implications for the Golden Triangle as a whole.”

So there are 16 holes yet to be reported on top of all the assays that will be coming from resampling of the historic core. In other words Enduro we can expect a lot of news over the coming months.

McLymont Fault: Growth Potential

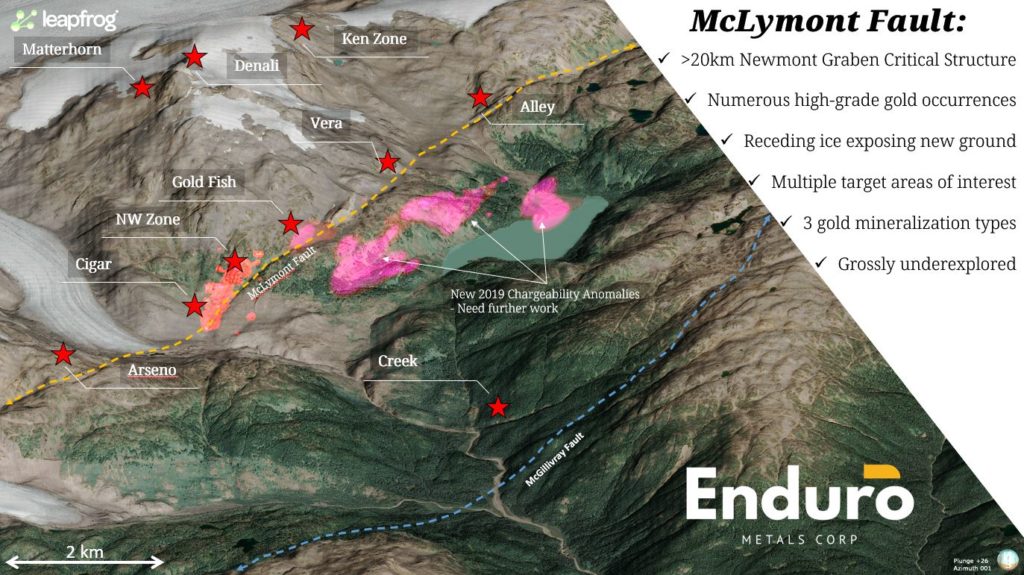

Not only do I think that the historic resource area will grow in endowment but there is also a truckload of growth potential in the larger region:

… Targets, targets and more targets within the first major target.

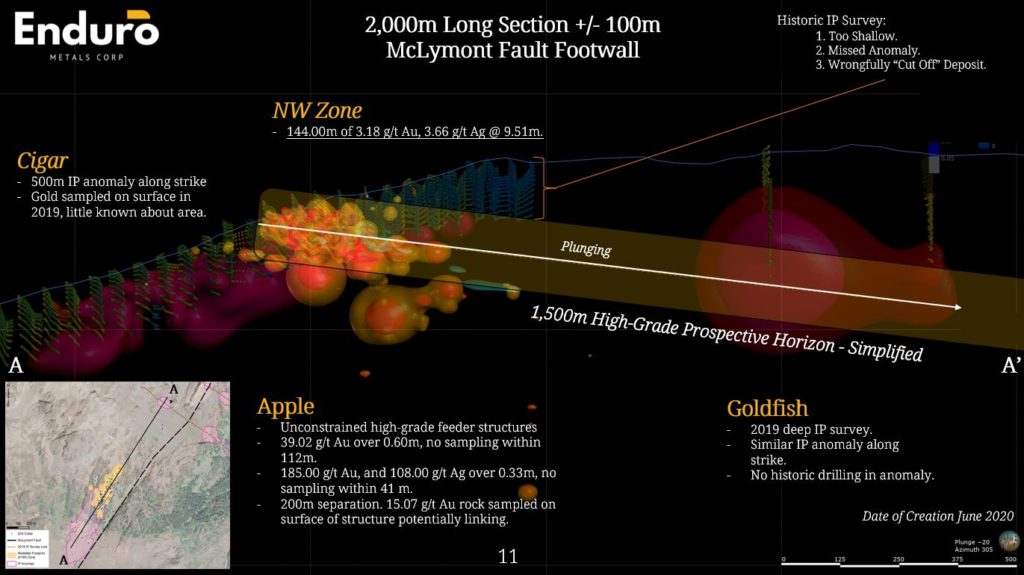

One of the most exciting things to come out of Enduro’s re-interpretation of the area is that the team believes that the legacy IP surveys, which could not “see” down more than 80-100 m below the surface, led the previous operators to falsely believe that they had identified the end of the deposit. In contrast, Enduro Metal’s geologists believe that the system(s) is simply plunging into the mountain, which would put it out of reach of the legacy IP survey:

On that note, here is a clip where Cole Evans talks about Enduro’s new interpretation and why the team believes there might be a very large prize at depth:

Furthermore there are quite a lot of areas that saw historic high-grade hits but where there is either no drilling or sampling nearby as per the company presentation:

Unconstrained high-grade feeder structures drilled in 1989. No follow up work for over 30 years.

• 39.02 g/t Au over 0.60m, no sampling within 112m.

• 185.00 g/t Au, and 108.00 g/t Ag over 0.33m, no sampling within 41 m.

• 200m separation. 15.07 g/t Au rock sampled on surface of structure potentially linking.

To Sum Up

I think McLymont Fault is going to grow both from within (sampling of unsampled historic core) and from without (new expansion drilling). With potentially three different mineralization types it would mean that a lot of mineralizing events have taken place. I find this very exciting since it should mean that there is greater potential for something big to be hiding and hopefully discovered. I assume this is why CEO Cole Evans has personally put in a lot of money into the company and why Rob McEwen significantly jacked up his ownership in the company a few months ago at a price of C$0.25/share.

Beyond McLymont Fault

Enduro Metals could probably stay busy for many years ahead just drilling out the McLymont Fault area. This is of course a good thing. However, as stated earlier there are three additional regional targets within the company’s super district scale land package. More information on these targets will probably come out in the future but the current focus is to see if McLymont Fault hides a multi-system monster.

Bottom Line

The Golden Triangle explorers are in varying degrees of the “boring period” and I have personally been buying shares in a bunch of said companies. I think many of these will double just from nearing the “fun period” again in a few months and with the help of the gold/silver price they might double yet again without even doing much. In the case of Enduro Metals there will thankfully be a lot of news coming from the company over the coming months which will shorten the “boring period”.

The valuation coupled with the people involved, backers, land position, jurisdiction and the apparent quality of their first flagship project made me buy shares and get the company on as a sponsor in order to help get this “sleeper” story out there.

Some TA

From a Technical perspective I got many reasons as to why I think the stock is near at least a short to medium term bottom:

- Seasonality

- Re-test of major trend line

- Head And Shoulders bottoming pattern

- At major long term support zone

Note: This is not investment advice. I am not a geologist nor am I a mining engineer. This article is speculative and I can not guarantee 100% accuracy. Junior miners can be very volatile and risky. I have bought shares of Enduro Metals in the open market. I can buy or sell shares at any point in time. I was not paid by any entity to write this article but the company is a passive banner sponsor of The Hedgeless Horseman. Therefore you should assume I am biased so always do your own due diligence and make up your own mind as always.

Best regards,

Erik Wetterling aka “The Hedgeless Horseman”

Follow me on twitter: https://twitter.com/Comm_Invest

Follow me on CEO.ca: https://ceo.ca/@hhorseman

Follow me on Youtube: My channel

Agreed. Nice job Erik.