Defense Metals (DEFN.V): An Advanced Rare Earth Element (REE) Asset in Canada for C$22 M

Defense Metals (DEFN.V) is my only holding which is involved in the Rare Earth Elements (REE) space. Since I know very little about said elements my short case for Defense Metals is as simple as it can get and was primarily based on “reading between the lines” and the low valuation:

Case in Short

- Advanced, de-risked asset in a tier 1 jurisdiction

- 4,89,000 tonnes averaging 3.002 LREO (Light Rare Earth Elements)

- 3rd party validation

- Working towards PEA and Pilot Plant

- Macro tailwinds

- EV revolution and other high tech sectors with very promising demand curves

- Geopolitical tensions are making NA prioritize REE sources closer to home for strategic reasons

- Cheap in absolute terms (MCAP of C$21.0)

- Warrants are currently being exercised which creates “artificial” selling pressure aka potential opportunity

Defense Metals in Short

- Ticker: DEFN.V

- Market Cap: C$21.9 M

- Cash: C$1.1 M with warrants being exercised currently

- Enterprise Value: C$20.8

Setting The Scene

Since I do not know much about Rare Earth Elements the case for Defense Metals is very much based on “reading between the lines” coupled with a low valuation…

Defense Metals looks like a possible “no brainer” from a risk/reward perspective due to several factors. Firstly, the company has an advanced Rare Earth Elements (“REE”) project in a tier 1 jurisdictions. Secondly, there is simply not many of these projects around in a time when demand looks to be soaring and supply is “uncertain” to put it mildly. Demand for REEs comes from the electric power industry and green energy technologies as per the company. Where it gets even more interesting is the fact that REEs have significant military and national security applications. On that note there was recently an article titled “China may ban rare earth technology exports on security concerns“ and it stated that:

While China has no plans to restrict shipments of rare earths to the U.S., it is keeping the plan in its back pocket should a trade war break out again, the person said.

Furthermore, last year there was an article titled: “Trump executive order targets rare earths minerals and China” which stated:

U.S. President Donald Trump on Wednesday signed an executive order declaring a national emergency in the mining industry, aimed at boosting domestic production of rare earth minerals critical for military technologies while reducing the country’s dependence on China.

And how about this article from The Economist dated April 3, 2021, titled “Governments have identified commodities essential to economic and military security” which stated:

Cut deep into the desert rock of southern California are the jagged tiers of an open-pit mine. Mountain Pass is North America’s only mine of rare-earth metals, used in everything from fighter jets to the drive-trains of electric cars. In 2015 Mountain Pass shut, unable to compete with rare-earth producers in China.

… As the world gets more chaotic, and geopolitical tensions rise, one would expect that nations get more and more focused on securing a supply source closer at home. In other words the it seems that not only is demand for Rare Earth Metals increasing OVERALL but nations that does not have much in terms of sources of supply themselves (any country except China basically) will want to secure “local” supply.

Thus one could argue that a) There are macro tailwinds for Rare Earth Elements and b) The demand for Rare Earth Elements projects within North America for example will see further demand pressure due to strategic (geopolitical) reasons. This is pretty much a double whammy, in a very good way, for a company like Defense Metals.

Further Reading

- “US-China: Washington Revives Plans For its Rare Earths Industry

- “The Race Against China’s ‘Rare Earths Wepon'”

- “Prices of Chinese Rare Earths Are Soaring”

- “Top 4 Trends Likely to Stimulate Rare Earth Metals Market Outlook Over 220-2026”

Enter Defense Metals

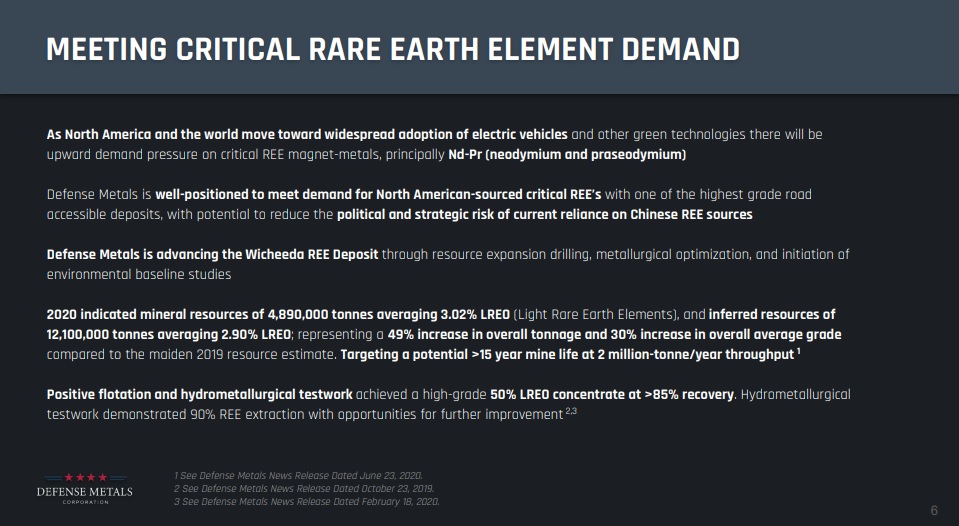

Defense Metals is uniquely positioned to take full advantage of the current state of world affairs through its well advanced Wicheeda REE deposit as per the company:

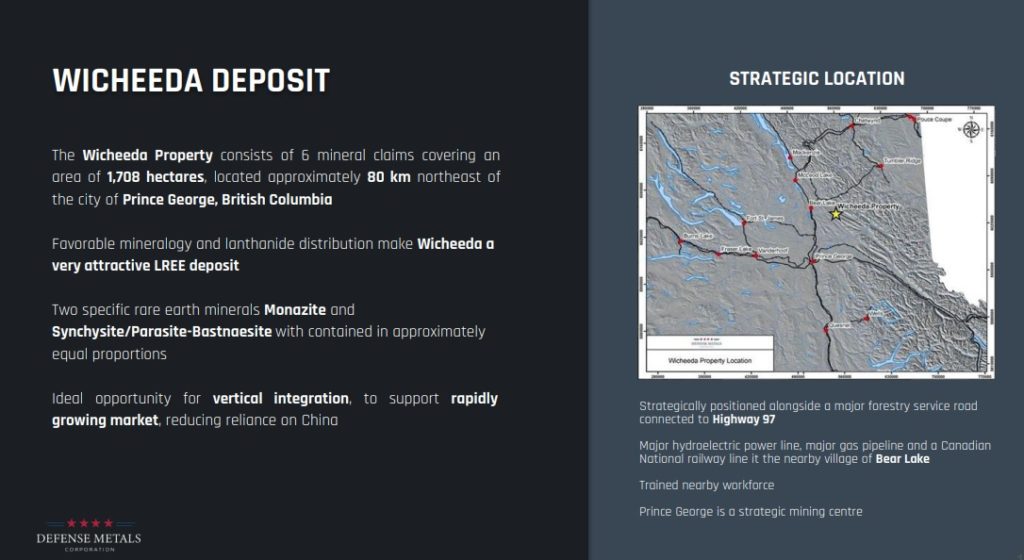

The project is located in the mining friendly, tier #1 jurisdiction that is British Columbia, Canada. It’s close to Highway 97, a major hydroelectric power line, major gas pipeline and even a Canadian National railway:

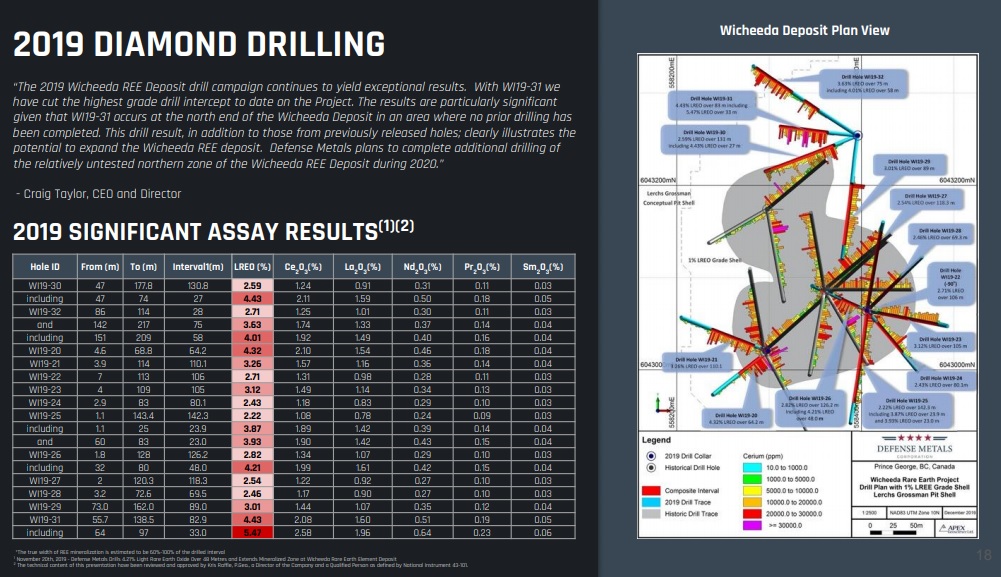

If that wasn’t enough, the deposit itself appears to be wide open with some areas that clearly looks to have pretty probable growth potential:

“The 2019 Wicheeda REE Deposit drill campaign continues to yield exceptional results. With WI19-31 we have cut the highest grade drill intercept to date on the Project. The results are particularly significant given that WI19-31 occurs at the north end of the Wicheeda Deposit in an area where no prior drilling has been completed. This drill result, in addition to those from previously released holes; clearly illustrates the potential to expand the Wicheeda REE deposit”

So, Who Cares About All This?

If the macro trend assumptions discussed earlier are correct, coupled with the apparent quality of the project, then one might expect to see some external parties taking an interest in Defense Metals, right(?). Well look no farther than some of the many headlines that the company has pumped out lately;

“DEFENSE METALS PREPARES HIGH-GRADE RARE EARTH ELEMENT CONCENTRATE SAMPLES FOR SHIPMENT TO MULTIPLE POTENTIAL OFFTAKE PARTNERS” –

The news release states;

(Bold added by me)

Defense Metals Corp. (“Defense Metals”) (TSX-V:DEFN / OTCQB:DFMTF / FSE:35D) is pleased to announce that it has recently been notified by Welsbach Holdings Pte Ltd. (“Welsbach“) that is has received requests from two interested third-part Rare Earth Element (REE) processors for samples of high-grade REE mineral concentrate for the purposes of evaluation prior to entering discussions with respect to the negotiation of an initial memorandum of understanding (MOU) and subsequent potential mineral concentrate offtake agreements.

Furthermore we got these comments from Defense Metals and Welsbach itself:

Craig Taylor, CEO of Defense Metals, stated: “We are extremely pleased that Welsbach has successfully identified two REE processors interested in receiving representative samples of our high-grade Wicheeda REE Deposit mineral concentrate. These requests represent a major step forward in our efforts to assess the market potential of long-term REE mineral concentrateofftake sale agreements.”

Mr.BrendanJephcottof Weslbachsays: “Potential partners in Asia are seeking a secure, long-term supply of rare earth concentrate to cover projected shortages in NdFeB magnet supply as demand for electric motors used in new energy vehicles continues to grow.”

Just FYI: Greg Nolan of EquityGuru wrote a good article on the recent corporate developments titled “The Plot Thickens – Defense Metals Draw Interest From Two International REE Processors“.

… Highly encouraging for sure. But wait. It gets better. Not even a month later we got the following news release…

“DEFENSE METALS PREPARES ADDITIONAL HIGH-GRADE RARE EARTH ELEMENT CONCENTRATE SAMPLES FOR EVALUATION BY LEADING GLOBAL RARE EARTHS PRODUCERS” –

The news release states;

(Bold added by me)

Defense Metals Corp. (“Defense Metals”) (TSX-V:DEFN / OTCQB:DFMTF / FSE:35D) is pleased to announce that it has recently been notified by its Asian based advisor Golden Dragon Capital Limited (“GDC“) that is has received requests from two leading global Rare Earth Element (REE) smelting and separator enterprises to provide samples of Wicheeda REE mineral concentrate for the purposes of evaluation prior to entering discussions with respect to the negotiation of an initial memorandum of understanding (MOU) and subsequent potential mineral concentrate offtake agreements. These requests represent the third and fourth REE concentrate evaluation requests received by the Company to date, and discussions are currently ongoing with several other parties.

Furthermore we got these comments from Craig Taylor, CEO of Defense Metals:

We have now received four requests for evaluation samples of our high-grade Wicheeda REE mineral concentrate from Asian-based REE refiners. Defense Metals believes this underscores growing international market demand for readily accessible, high-quality, North American REE products. Discussions with potential offtake partners have the potential to yield benefits through opportunities for direct project funding, technical services agreements, and access to the full downstream rare earths value chain.

To Sum up

- Demand for Rare Earth Elements is going up worldwide

- Demand for Rare Earth Elements PROJECTS is increasing in North America

- Defense Metals has is uniquely positioned given the lack of advanced Rare Earth Elements assets in North America

- Thus demand for Defense Metal’s REE deposit is increasing as evidenced by the RECENT interest from MULTIPLE entities

… Does a Market Cap of C$24 M sound right in light of the above? To me it sounds like a case with an irrationally favorable Risk/Reward equation.

What is Defense Metals Worth?

I sure don’t know but I have read Bob Moriarty’s piece from 2019 which states:

(Bold added by me)

If you ignore the facts surrounding the drill hole there is another way of determining if it is cheap or if it is expensive is to look at the June 2019 43-101 that showed 11.37 million tonnes at an average grade of 1.96%. One percent LREOs is worth about $121 USD. That’s an in the ground value. The only purpose is to show value and to compare drill holes to something we do understand, like the price of gold.

If you accept $121 being the value of 1% LREOs and you do the math, you will realize their old 43-101 showed a gross metal value in the ground of just short of $2.7 billion USD. The entire market cap of DEFN today, after brilliant drill results, is less than 1/10th of 1% of that. I’d call that pretty cheap.

Defense Metals is a permanent call on the value of REOs. I don’t see any way it could get much cheaper. We are in Tax Loss Silly Season and if investors ever wake up to what DEFN has already, the sky is the limit.

… Now I have no idea what the NPV would be but I know the in ground value ought to be higher today given that a) The total resource is up to ~17,000,00 tonnes (up from 11.37 Mt), b) The average grade is now 3.02 LREO (Light Rare Earth Oxide) in the indicated category and 2.90% in the inferred.

If we use the the same value assumptions as Bob then the in ground value today would be somewhere around $6.2 B assuming my math is correct. $6.2 B in gross value is equivalent to a gold deposit which contains around 3.5 Moz of gold with a grade of circa 6.5 gpt Au (calculated based on a gold price of $1,750/oz). Again, this is just a very crude mathematical exercise and I have no idea what the ACTUAL economic value of Wicheeda might be. However, the important thing is that an advanced stage deposit like this is probably worth as hell of a lot more than C$24 M.

Additional Value Creation

Well, the company is not sitting idly to put it mildly. It is in fact progressing rapidly on multiple fronts to further de-risk and increase value to shareholders…

On March 30 it was announced that:

The news release includes the following:

Defense Metals is currently advancing the road accessible Wicheeda Critical Rare Earth Element (REE) Property, which is located close to infrastructure approximately 80 kilometres northeast of Prince George, British Columbia (BC). The Wicheeda project has indicated mineral resources of 4,890,000 tonnes averaging 3.02% LREO (Light Rare Earth Elements) and inferred mineral resources of 12,100,000 tonnes averaging 2.90% LREO[1].

The scenario analysis will facilitate decision making related to performing a Preliminary Economic Assessment (PEA) with respect to the Wicheeda REE Project. The scenario analysis will evaluate the potential of multiple mine development scenarios through the completion of economic trade-off studies, which subject to results, will form the basis for the PEA.

In other words we are approaching a time when the inferred value of the “Wicheeda REE Project” will be put in black and white. Personally I don’t think the company would bother with PEA if the current Market Cap was anywhere close to reflecting the theoretical value. And again, I doubt there would be much interest from external parties if the current Market Cap made sense.

Yesterday (April 20) it was announced that:

“Defense Metals Receives Hydrometallurgical Pilot Plant Proposal From SGS Canada Inc.”

The news release included the following:

The Company’s highly successful 26-tonne flotation pilot plant campaign, also completed at the SGS Lakefield, ON metallurgical test facility, yielded approximately 1,200 kilograms of high grade REE mineral concentrate. Initiation of the hydrometallurgical pilot plant test program is the next step in establishing overall flowsheet operability at scale.

The test program will utilize representative flotation concentrate generated during the flotation pilot plant campaign and is expected to be completed in stages comprising initial gangue leach; caustic crack; primary acid leach; caustic re-crack; impurity removal; and REE precipitation. Parallel investigations into operability of acid and caustic regeneration; operability of gangue leach and caustic crack and primary acid leach circuits using recycled reagents; in addition to tailings neutralization studies will also be completed.

And Craig Taylor, CEO of Defense Metals, stated:

“Since initiating its option to acquire 100% of the Wicheeda REE Project in late 2018 and subsequently collecting a 26-tonne bulk sample, Defense Metals has rapidly advanced Wicheeda from an attractive prospect to compelling resource-stage project. Flotation and hydrometallurgical flowsheet development was completed in parallel with our highly successful 2019 diamond drill campaign that led to an upgraded and expanded mineral resource estimate. We are now excited to take the next step in demonstrating scale-up operability of the Wicheeda REE beneficiation process, leading to the production of a saleable NdPr oxide product.”

In short: The company is progressing on multiple fronts.

Bottom Line

The only logical conclusion I can draw from all ongoing internal corporate activity, interest from major external parties, macro demand trends and geopolitical trends is that C$21.9 M in Market Cap is probably a joke valuation which should get rectified sooner or later.

From what I can gather the recent price pressure, and therefore undervaluation, has been greatly influenced by warrants being exercised. This “artificial” selling pressure will abate sooner or later and given everything that has been outlined in this article I would expect to see the uptrend continue shortly. Just to get back to the mere two month old highs the stock would need to rise almost 100%.

Then there is upside “threat” stemming from;

- Potential off take agreements with external parties

- Interest from more majors/mid tier REE processors

- PEA study

- Potential pilot plant construction

- Potential resource expansion via drilling

… All in all the company has a lot of irons directly and indirectly in the fire and I therefore believe that not only is Defense Metals very cheap but the trend in terms of intrinsic value through de-risking etc is in a clear uptrend…

Note: This is not investment or trading advice. I cannot guarantee 100% accuracy as to what has been stated in this article. I own shares of Defense Metals and the company is a banner sponsor of The Hedgeless Horseman. Therefore assume I am bias, do your own due diligence and make up your own mind(!). Junior mining stocks are very risky and can be very volatile.

Best regards,

The Hedgeless Horseman