White Rock Minerals: 1 World Class Gold Target + 2 Advanced Assets For ~US$23 M

White Rock Minerals (WRN.AX) is a new junior which I have taken a position in and will try to explain why in this article.

White Rock Minerals in Short

- Ticker: WRN.AX / WRMDA.AX

- Website: LINK

- Presentation: LINK

- Quinton’s Presentation: LINK

- Matt Gill Interview: LINK

- Video Presentation: LINK

- Basic Market Cap @ $0.65/share: ~A$47.2 M (~US$34 M)

- Basic Enterprise Value @ $0.65/share: ~A$31.5 M (~US$23 M)

- (Update: @ A$0.77/share the EV is still only US$29 M for all three projects)

- Cash: ~A$15.7 M

- Projects:

- “Last Chance” – district scale gold project, Alaska, USA

- Potentially an Epizonal/IRGS target (like Fosterville/Donlin Creek etc)

- Huge 15 km2 gold in soil anomaly and potentially growing

- Over 6km mineralized trend

- Bonanza grade soil samples (Up to 7,130 ppb)

- Rock chip samples up to 77 gpt

- “Red Mountain” – district scale base metal VMS project, Alaska, USA

- 55,900 Hectares

- Mineral Resource estimate of 9Mt grading 13% zinc equivalent

- Includes 46.1 Moz Silver

- Includes 260 Koz Gold

- “Mt Carrington” – District scale gold/silver project, NSW, Australia

- Mineral Resource estimate of more than 340,000 ounces of gold and 23 million ounces of silver.

- Mt. Carrington PFS showed a NPV of A$98 M at A$2,300 gold using an 8% discount rate

- IRR: 105%

- CAPEX: A$35 M

- Option on project financing in place

- Note: Australian price of gold is currently around A$2,700/ounce

- The Mineral Resources are situated in seven surface deposits, all located on granted Mining Leases and with developed infrastructure.

- “Following a positive Pre-Feasibility Study in late 2017, the Company can now progress Mt Carrington through a Definitive Feasibility Study and permitting process prior to a Decision to Mine”

- “Last Chance” – district scale gold project, Alaska, USA

- Total precious metal (only) resources:

- 69.1 Moz of silver

- 600 Koz of gold

- Management/Insider Ownership: ~20%

- Major shareholder: Sandfire Resources

Upcoming Catalysts:

- More soil sampling results from the “Last Chance” gold target

- More rock chimp sampling results from “Last Chance” gold target

- Drilling at the “Last Chance” gold target

Flash Update July 31: “Drilling Commences at the Last Chance Gold Target, Alaska”

HIGHLIGHTS

• Diamond drilling has commenced at the large Last Chance gold anomaly in central Alaska.

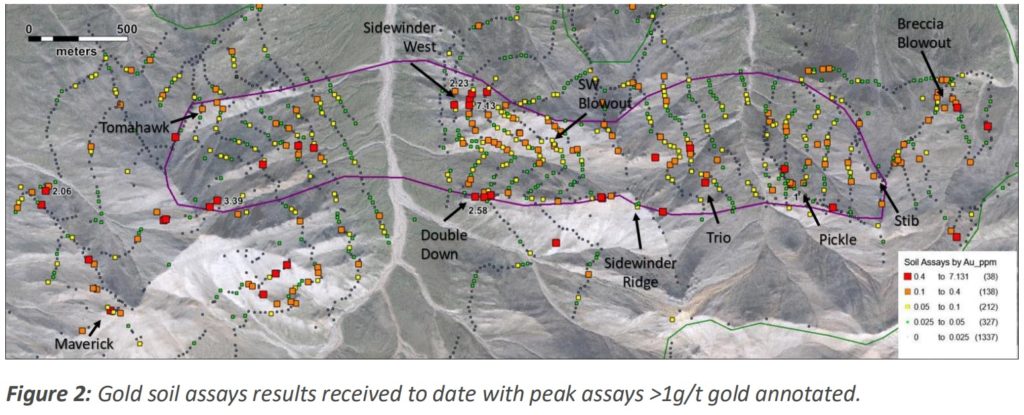

• The drilling will test a number of high priority targets which have been defined by detailed surface mapping and geochemical analysis and where assay results include 77.5g/t gold and 4,580g/t (147oz/t) silver in rock chip samples and up to 7.1g/t gold in soil samples.

• Drilling will initially target the broadest and most developed zones of gold and pathfinder geochemical anomalism along 2km of strike from the Sidewinder West to the Pickle prospects, located within an enormous gold system defined by surface sampling that extends for over 6km strike east-west and up to 1.2km wide.

My Case For White Rock Minerals in Short:

White Rock Minerals is a pretty simple case. The company owns three projects. The “Red Mountain” asset is an early stage, district scale, base metal play with an inferred resource of 9 Mt grading 13% Zinc Equivalent (Including 46.1 Moz of silver and 260 Koz of gold). The company also owns a currently small but very advanced project called “Mt Carrington” in New South Wales, Australia. This project is on its way towards being fully permitted and already has a PFS done which shows outstanding economics in today’s gold environment. The most exciting aspect of this company however is that it has quite recently discovered an immense gold in soil anomaly near their Red Mountain project which is located within the Tintina gold province of Alaska, USA. The company was not even really looking for gold but was looking for more primarily base metal rich VMS targets that could complement their pre-existing Red Mountain resource.

One can currently buy all three assets for US$23 M which qualifies it as a rare “no brainer” in my book simply because I think any of the three assets is worth more than that alone. In other words I see it as getting three assets for the price of one which by extension implies that I take little to no risk and get any and all benefit from two out of the three assets. Furthermore, I’m not talking about three grassroot exploration assets but talking about a) One low CAPEX, PFS stage project that shows incredible economics at today’s gold price and is perhaps 12-18 months away from a decision to build in a tier 1 jurisdiction, b) One advanced exploration asset in a tier 1 jursidiction with a 9 mt high grade resource already, and c) Probably one of the most impressive grass root gold exploration projects around.

Why the Bargain?

White Rock had a Share Purchase Plan which allowed existing shareholders to join the recent financing at 0.3C/share which equates to $0.30/share after the rollback that just went into effect. Many people, including me, were expecting that the company to accept and raise around A$1.5 M this way. At the end of the day the company decided to significantly hike it to A$10 M. This meant that a lot of shareholders who were not expecting to get a full allocation suddenly got it anyway. The combination of getting more shares than expected coupled with these shares already being well in the money was probably the reason for the extreme volumes seen in the stock since then. I suspect over 20% of the outstanding shares have changed hands during the last two weeks. Again, extreme! Since I did not participate in the PP I have been happy to be able to buy a lot of shares from these motivated sellers. I suspect most of the shares that were sold from existing shareholders have gone into strong hands like me and that the currently extreme bargain might not last that much longer. Lastly, this story is very much flying under the radar since I have only seen one person commenting on it on Mining Twitter so far.

How This Article is Structured

- Section 1: I discuss the geology and opportunity I see in the “Last Chance” gold target

- Section 2: I discuss the opportunity and the value I see in White Rock’s two advanced assets

- Section 3: I lay out my extended case for White Rock Minerals and discuss a theoretical blue sky scenario

- (Skip to this section if geology etc bores you)

1. The “Last Chance” Gold Project

Setting the scene:

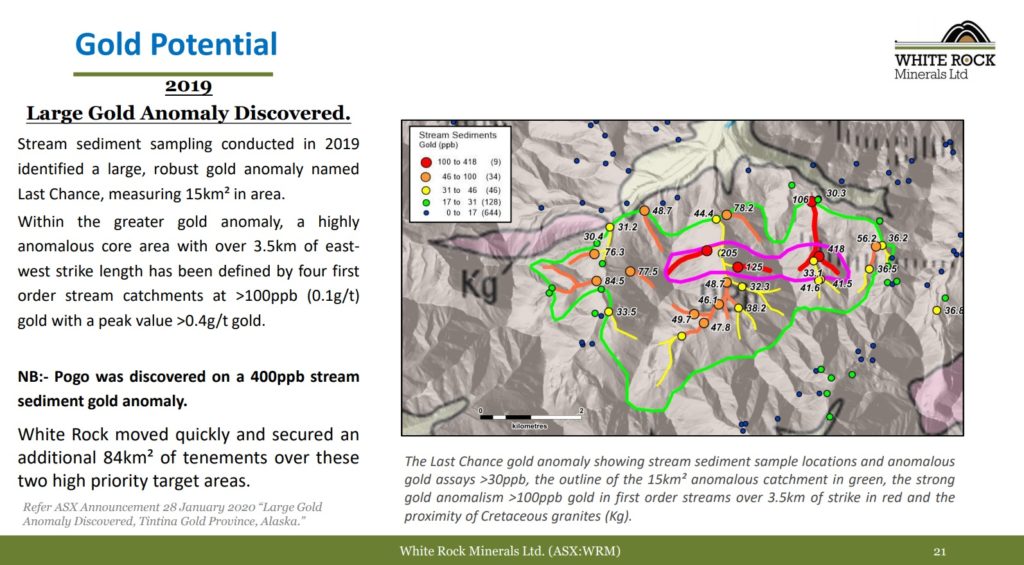

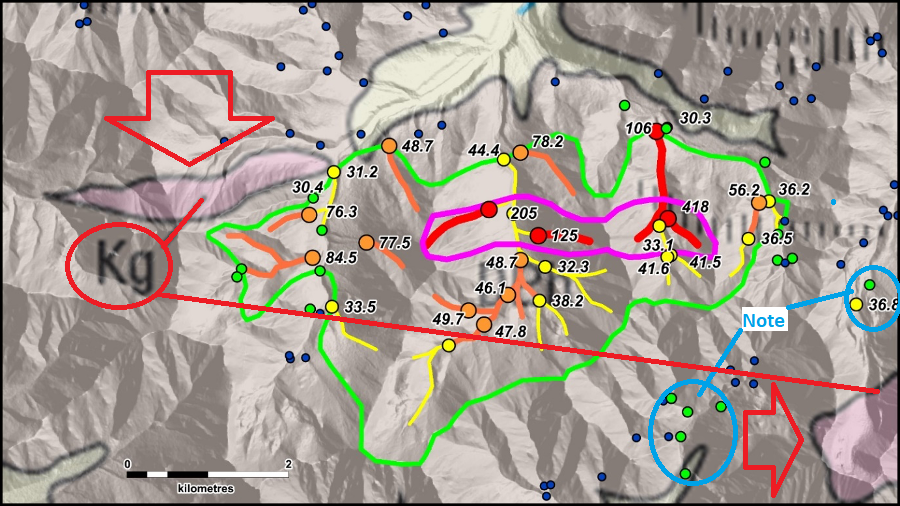

White Rock’s newest project, which is the number one focus right now, is called “Last Chance” and this project contains a gold in soil anomaly that currently measures a whopping 15 square kilometres:

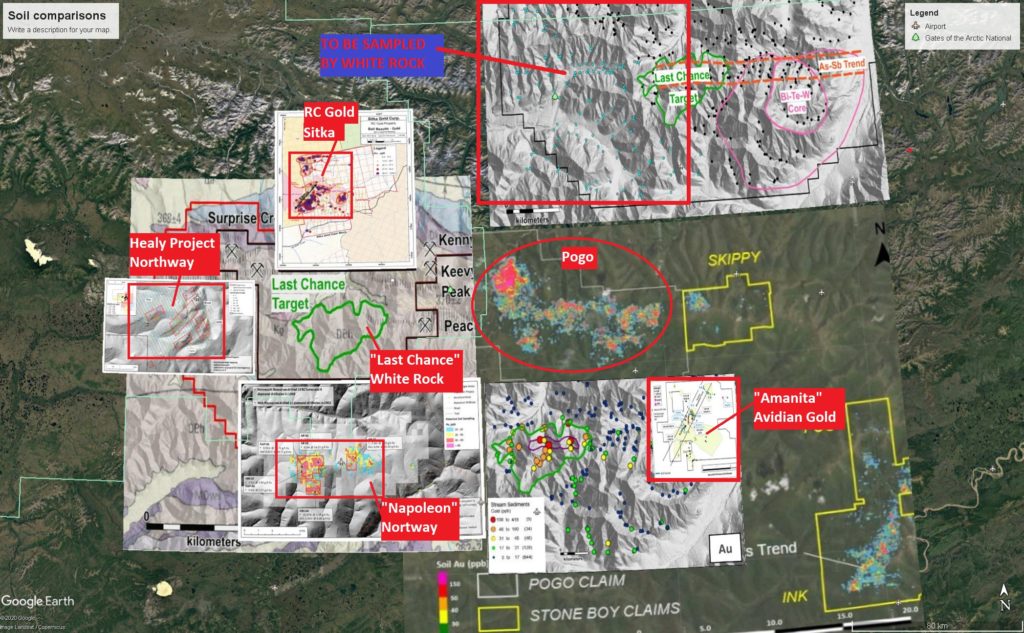

It’s not often you see a soil anomaly this big but especially this rich. There is obviously something that has been and is shedding a lot of gold over a very large area here.Also note the comparison to the Pogo deposit (Northern Star) which is a 10 Moz behemoth some hundred kilometers to the north of the Last Chance target. The Pogo deposit was also discovered via a gold in soil anomaly as is stated in the slide above and I found an interesting snippet on this from this article:

“Following staking in 1991, surface exploration around the Pogo and Liese Creeks led to the definition of a 2 km2 area of >100 ppb Au in soils. Diamond drilling of this anomaly in 1994 intersected gold mineralization in quartz veins in what became the Liese Zone. Drilling continued in 1995 and 1996, returning additional mineralized intercepts, mostly at depths greater than 100-150 m below the surface, which were interpreted to be steeply dipping parallel veins. In 1996, it was suggested that the intercepts might be part of several relatively flat zones, a model that was confirmed by drilling in 1997. Further drilling in 1998 led to the preliminary resource estimate mentioned previously, and on-going drilling is aimed at further definition of this resource. An adit is being driven to permit in-fill drilling and testing of mineralization at depth in the L3 zone.”

Note that the Last Chance gold in soil anomaly CURRENTLY has a >3.5 km of strike at >100 ppb. This is what Quinton Hennigh stated when he recently came on board the company as a Technical Advisor:

“The Last Chance gold anomaly displays the highest clay fraction stream gold analyses I have ever seen, and the footprint of gold anomalism is huge, especially when viewed alongside the elevated As (arsenic) and Sb (antimony). My suspicion is that the reason for the very high gold clay fraction stream values is that the style of mineralization that might be present is potentially epizonal in nature. Epizonal gold mineralization forms at a high level within an orogenic gold system and can potentially be highgrade, occurring in the form of finely divided gold particles, the type that would generate such high values as those seen at Last Chance. It is a very exciting story and I am pleased to help White Rock advance this remarkable new gold project.”

What I think is important to understand is that Quinton Hennigh has discussed this target with a gentleman from Irving Resources (Quintin Hennigh is Director and Technical Advisor for Irving Resources which many people probably already know). The gentleman I am talking about is Irving Resources’s Technical Advisor and Chief Mining Engineer Mr. Hidetoshi Takaoka:

“Mr. Hidetoshi Takaoka is a geologist with more than 40 years exploration and mining experience. Mr. Takaoka spent the majority of his time with Sumitomo Metal Mining Co. Ltd. (SMM) where he was instrumental in the discovery of the world class Pogo Mine in Alaska.”

This means that Quinton Hennigh has had direct access and discussions about this target with one of the very persons that were responsible for the discovery of the 10 Moz Pogo deposit and who should be very familiar with gold in Alaska. On that note, when Quinton recalls Takaoka’s reaction to the soil anomaly at Last Chance he says:

“I showed him this data and he said wow this is bigger than Pogo… The numbers are higher etc… So he was quite excited about this too…”

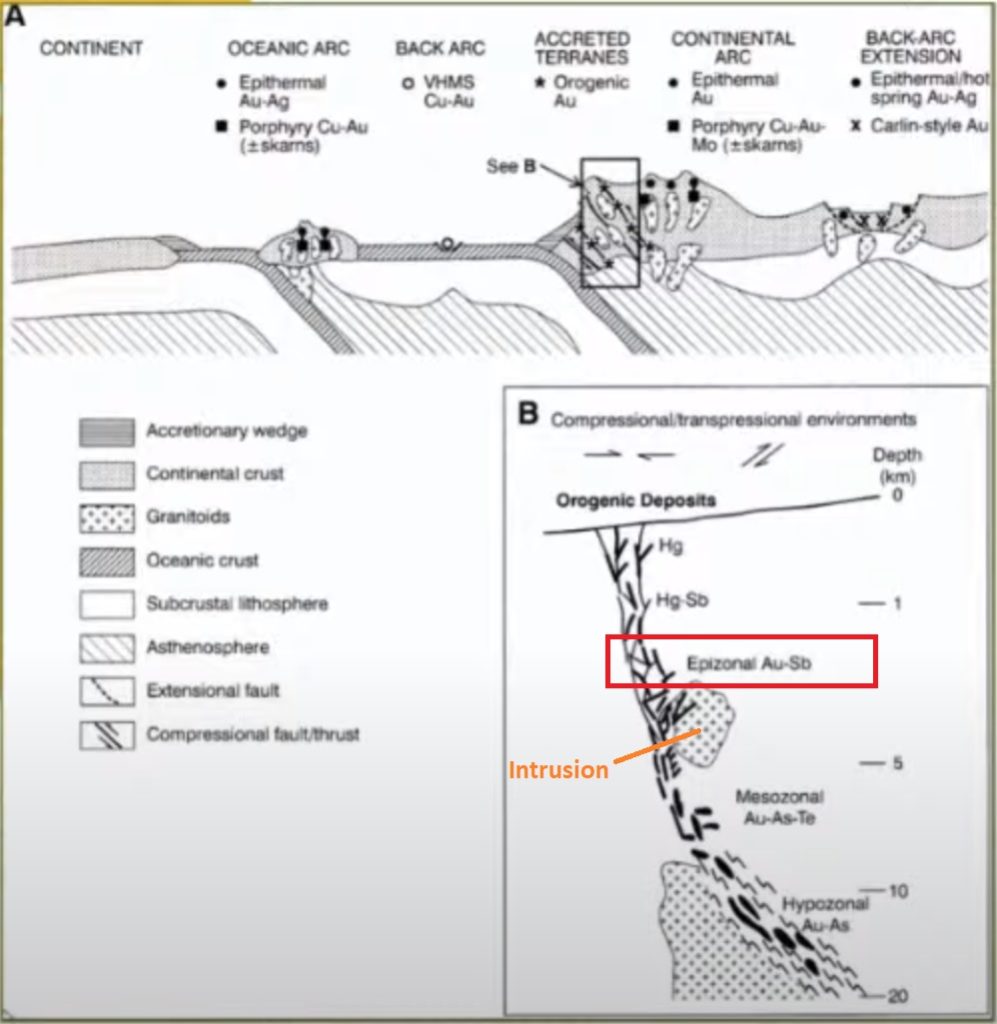

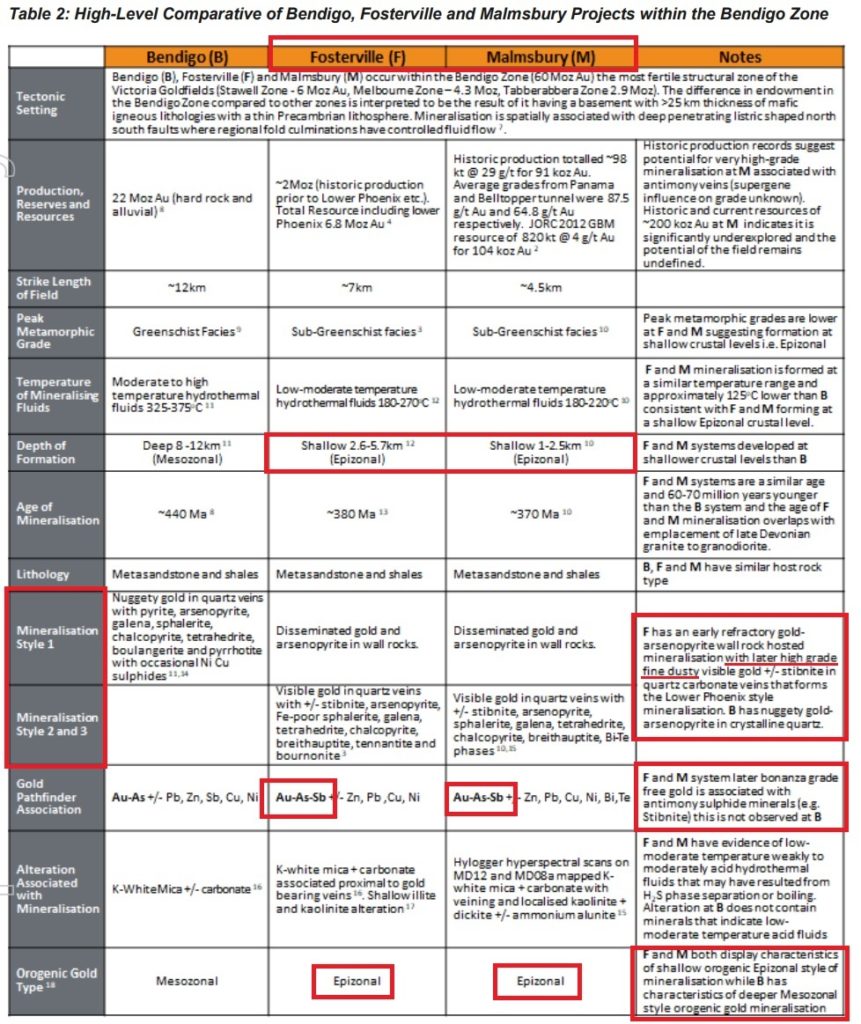

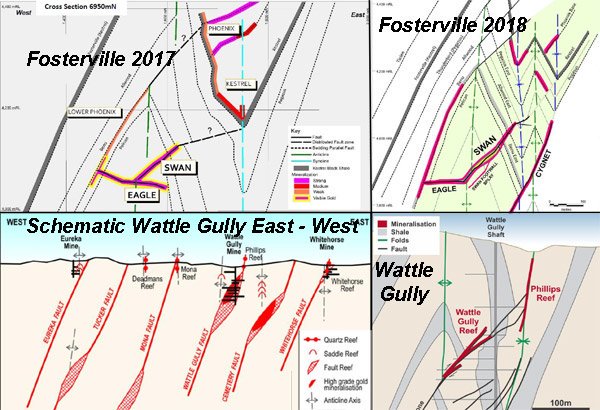

I noticed that Quinton believes the mineralization might be “Epizonal gold mineralization“. Anyone who has done research on Kirkland Lake’s Fosterville deposit will know that it is also considered to be an an Epizonal gold deposit. Epizonal gold deposits formed at shallow crustal levels and tend to have finer gold than deposits formed at greater depth. Therefore I interpret Quinton’s earlier comments about “very high gold clay fraction stream values” leading him to believe it is potentially an Epizonal gold deposit is because a larger amount of fine gold ought to end up in fine material (clay) if the original form of mineralization was indeed very fine to begin with.

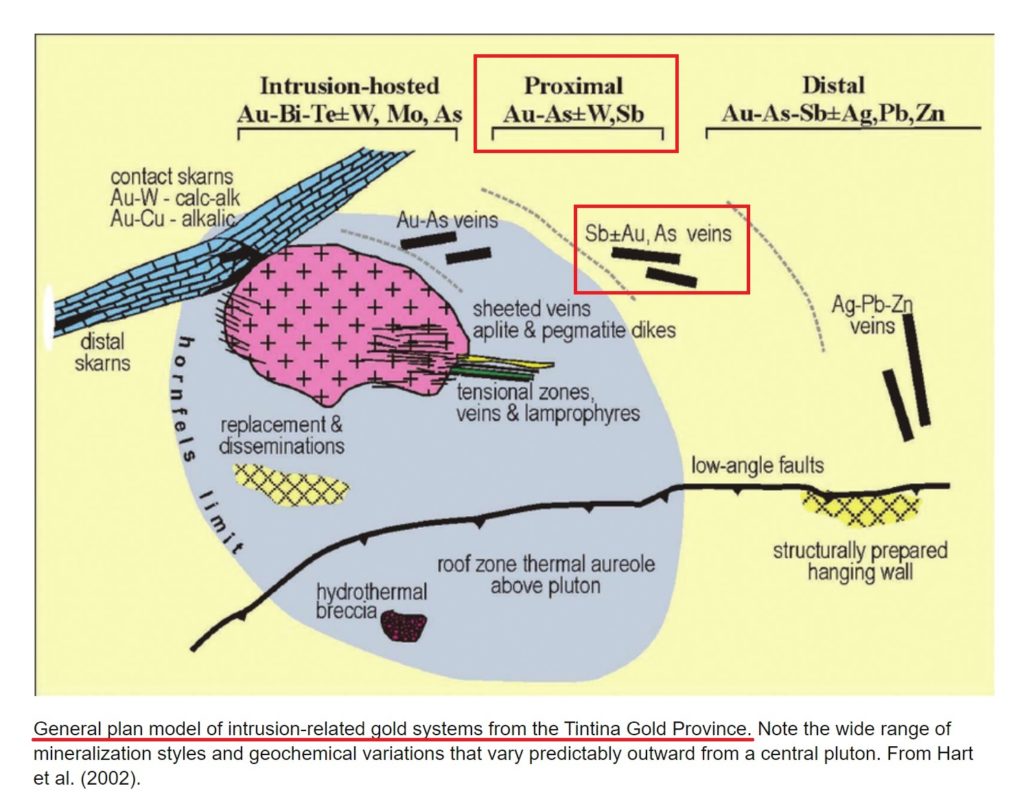

Some people might know that Fosterville is also considered to be an Intrusion-Related Gold System (“IRGS”). On that note, consider these comments by Quinton:

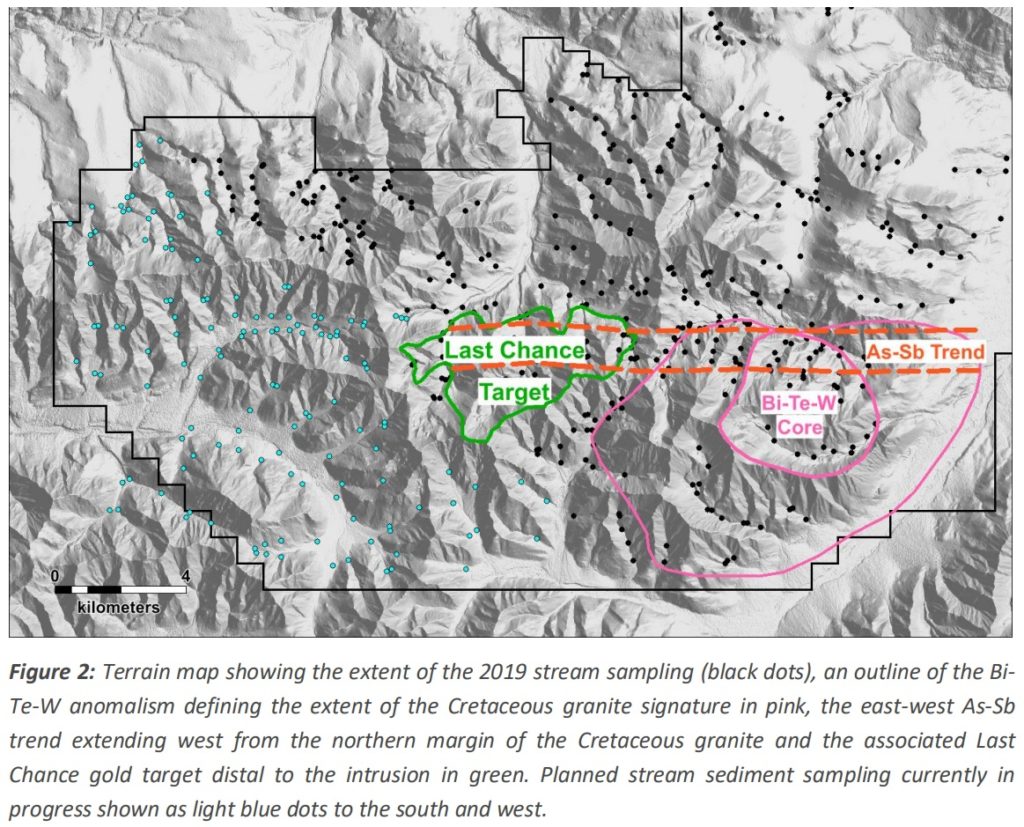

“The Last Chance gold anomaly displays the highest clay fraction stream gold analyses I have ever seen, and the footprint of gold anomalism is huge, especially when viewed alongside the elevated As (arsenic) and Sb (antimony).”

… Together with this slide I found in a geological paper on IRGS systems within the Tintina gold province (which has also now been included in a recent news releases):

An interesting aspect is that in the latest news release it states that they found some rare but very high grade silver samples as well. Two quartz vein samples showed 3,150 gpt and 1,625 gpt of silver for example and two silica breccia samples showed 4,580 gpt and 1,210 gpt of silver. This is interesting because in the slide above it is suggested that these intrusion related gold systems (“IRGS”) found within the Tintina Gold Province typically deposits silver in “distal” veins (a bit further away from the intrusion than where gold is typically deposited). I will get back to the most recent findings later.

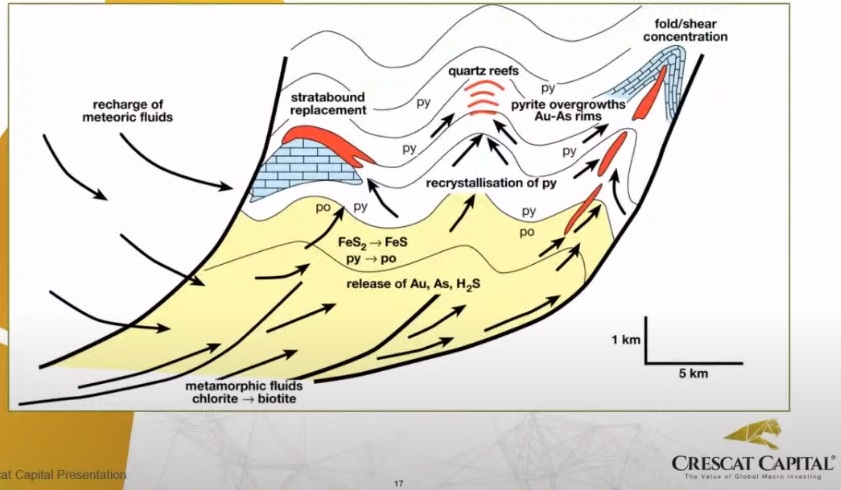

The following slide is from Quinton’s presentation where he talks about “Epizonal” Orogenic gold deposits:

So I guess the high gold in soil values, together with the high Sb values, suggests the original source is an Orogenic “Epizonal” gold system. And the elevated As/Sb values alongside gold, together with the proximity to granitic intrusions, suggests that it’s a “classic” Tintina Gold Province Intrusion Related Gold System (“IRGS”). Again, this is similar to for example Fosterville (and the nearby Malmsbury system) where there seems to have been more than one gold event (both orogenic epizonal style gold mineralization as well as an overprint from IRGS style mineralization):

Interestingly the very high grade Pogo deposit (18 gpt, in the Tintina Gold Province) seems to have formed at a much deeper crustal level while the much larger, but lower grade Donlin Creek deposit (45 Moz, in the Tintina Gold Province) is thought to have formed at the Epizonal level:

“Available data indicate that other mid-Cretaceous gold deposits hosted by metamorphic rocks in the Fairbanks and Goodpaster districts have the same gas-rich, low to moderate salinity fluid type. Pogo and adjacent prospects in the Goodpaster district show indications of being the most deeply formed and hottest among the TGP gold ore systems. In contrast to the gold deposits in the eastern part of the TGP, the Late Cretaceous Donlin Creek and Shotgun deposits in southwestern Alaska formed within the upper 1 to 2 km of the crust“

What this means I am not sure. Maybe the source of the large gold anomaly are narrow but high grade lodes akin to Fosterville or perhaps thicker structures with lower grade material such as Donlin Creek.

The following notes are from the Last Chance project page on White Rock’s website:

- Regional geology suggests the gold anomaly could be a response from a Cretaceous granite related gold system of the Intrusion-Related Gold System (IRGS) style of mineralisation.

- Gold anomalism at Last Chance is accompanied by associated As-Sb (arsenic and antimony) pathfinder element anomalism, as seen at other IRGS deposits.

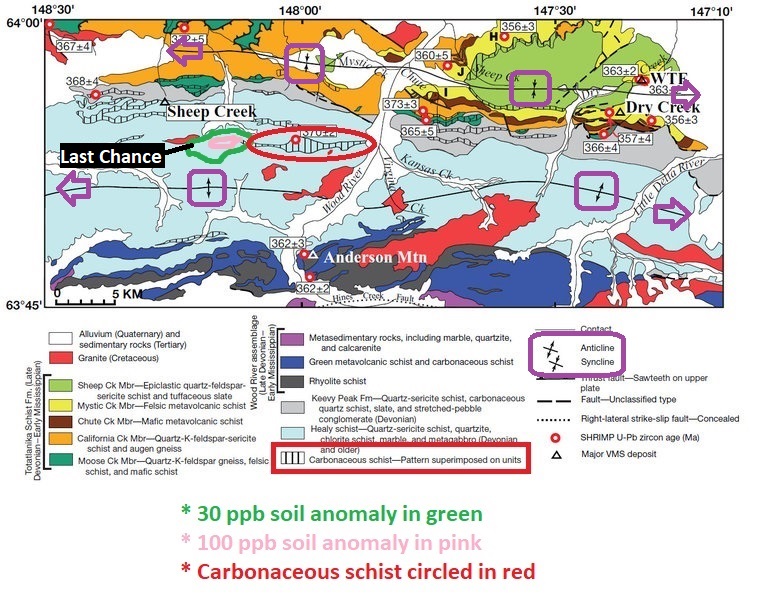

In the slide below you can see these “Cretaceous Granite (Kg)” units shown in pink:

Needless to say there is evidence that the very large and very rich gold in soil anomaly might indeed be sourced from an Epizonal/IRGS gold system akin to Fosterville or Donlin Creek. Note the Cretaceuous Granite unit mapped in the lower right corner and the anomalous gold in soil values. In the slide below you can see different gold in soil anomalies which includes the final soil anomaly for Pogo as well as some soil anomalies from early stage Alaskan juniors:

(I have tried to get relative scale as accurate as possible but it will obviously not be 100% accurate)

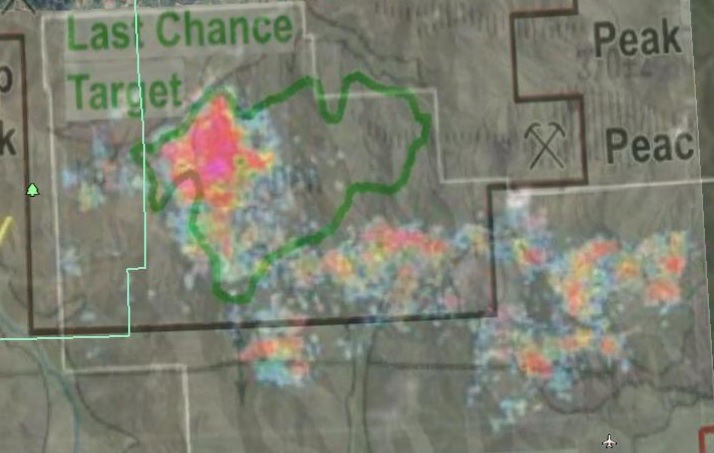

You can clearly see that the 30 ppb soil anomaly at “Last Chance”, highlighted in green, stands head and shoulders above the rest. In other words the currently known soil sample results already points to the “Last Chance” gold system having a much bigger footprint than the rest. Furthermore the 30 ppb Last Chance anomaly, which is still open in many directions, is already larger than the largest “blob” at Pogo (10+ Moz). To show just how much bigger you can just look at the slide below. Keep in mind that any Pogo marker with a “colder” color than yellow is below 30 ppb which is the limit of the Last Chance anomaly:

Most if not all of the yellow to pink hot spots from pogo would fit within the “Last Chance” 30 ppb anomaly if truncated. Also note that the Pogo soil sampling program is very much fully mature already and that we are still waiting for results from a very large area to the west, south and north of the current “Last Chance” soil anomaly so I am expecting it to grow further. Lastly I would point out that the “Last Chance” soil anomaly looks a lot more robust and coherent when compared to the more scattered hot spots at Pogo. Now back to some more geology…

The latest exploration update contained a lot of information. First of all, they have taken a lot more detailed soil samples, including many samples that grade higher than 400 ppb (0.4 ppm):

The first pass soil sampling results from early this year “only” had one bonanza sample that graded higher than 400 ppb. The second best was 205 ppb. Meanwhile in the slide above you can clearly see that they have now found numerous 400+ ppb samples (red squares) and the highest grade soil sample at Last Chance is currently a whopping 7,130 ppb of gold (7.13 ppm). What is perhaps even more remarkable is that they are finding bonanza grade soil samples for many kilometres in an east-west direction. To find a lucky, local enrichment is one thing, but to find extremely high values across such a distant and even outside the previous high grade core (in purple) is another. I take it as a clear sign of fine, high grade gold mineralization being eroded across multiple kilometres. Another important thing to note is that they are finding very high grade soil samples all the way up to local topographic highs in a lot of places. I take that fact as another sign in regards to the potential robustness of the gold system.

White Rock also recently announced that they have significantly increased the Last Chance claim block to about three times the original size :

The company is also on the way of taking a lot more soil samples over a very large area which will hopefully increase the size of this already huge soil anomaly farther:

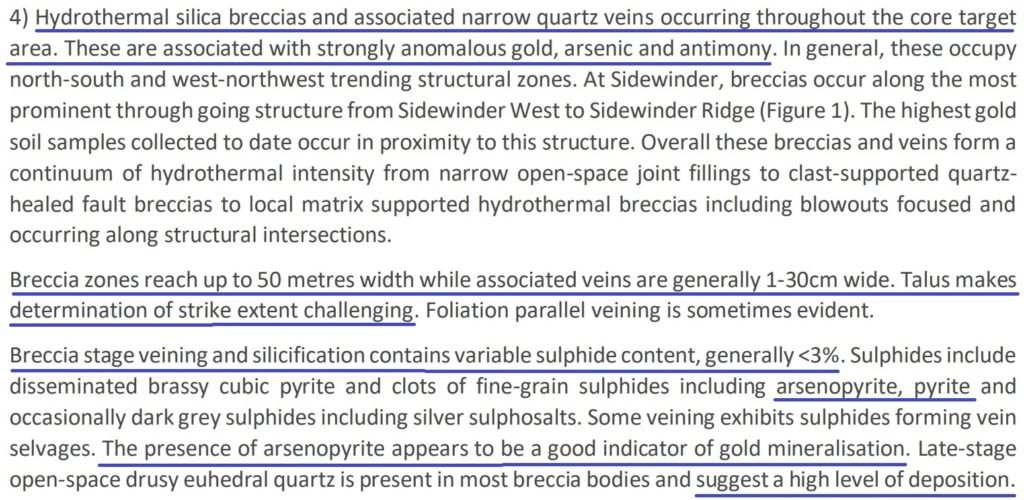

It’s still early days at Last Chance and there is apparently heavy scree cover across the property and it is estimated that only 5% of the bedrock is outcropping. In other words 95% of the bedrock is covered with fragments of rocks which obviously makes geological mapping more difficult. Anyway, the White Rock team has been able to identify some different units of rock, including a lot of breccia:

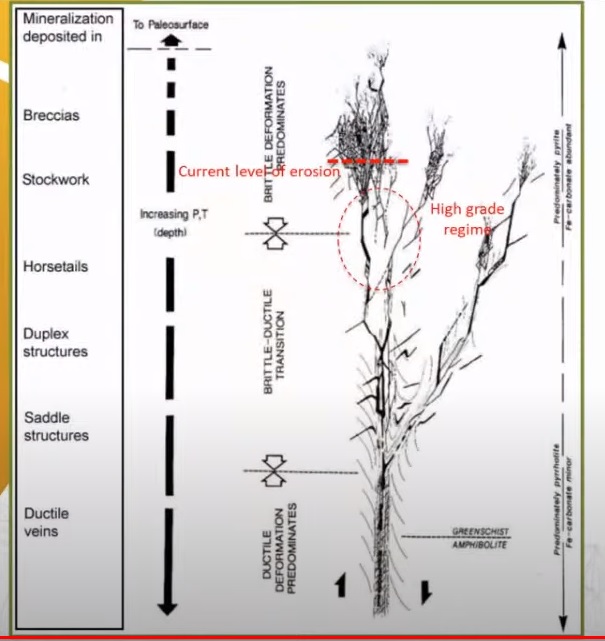

Again, it is Quinton’s belief that this might be an Epizonal Orogenic gold system which is outcropping across many kilometres at Last Chance. In his presentation he included a slide of where he believes the current level of erosion is and goes on to explain why he think there might be high grade lode gold at depth:

As you can see in the slide above these Orogenic systems have a “brittle” section that is located at the top of the systems. When these hydrothermal fluids race towards the surface the pressure from the surrounding rocks decreases. This means that it is easier for the fluids to crack, break and deform the rocks which the fluids are trying to pass through. This is why these systems can create breccia and stockwork mineralization at shallow levels. Breccia is basically rock that has been pounded, smashed and broken into smaller pieces and stockwork is basically a swarm of veins. The slide also shows that as one follows this system deeper, where the surrounding rock pressure is higher, it is expected that the fluids will have formed more intact “lodes”… Akin to Fosterville and/or Queensway lodes since the fluid pressure is not enough to break the surrounding rocks at those levels.

With the above in mind it should be easier for readers to understand the following statements in the latest exploration update:

“Geological reconnaissance and surface geochemical results to date suggest the Last Chance gold target

lies within the upper brittle domain of a large orogenic and/or Intrusion Related Gold System (“IRGS”).

Hydrothermal silica breccia bodies with their associated gold-arsenic-antimony anomalism may represent

upper leakage of hydrothermal fluids immediately above a zone of more favourable gold deposition.

A maiden program of diamond drilling is planned to commence prior to 1st August, 2020. Drilling has two

priorities. First, drilling will test a number of immediate targets to assess the potential for shallow

economic gold mineralisation associated with the robust hydrothermal silica breccia bodies and

associated quartz veining. Initial drilling will likely provide valuable geologic information with which to

further interpret the geometry, orientation and relationship of these important breccias and veins as well

as better understand their full extent underneath talus cover. Second, the drill program will include a

series of deeper holes designed to follow leakage vectors downward to test for potentially high-grade

gold mineralisation at depth. “

As is stated above, the shallow targets are primarily the hydrothermal breccia and associated quartz veining. Below is a segment from the news release that further describes this type of mineralization:

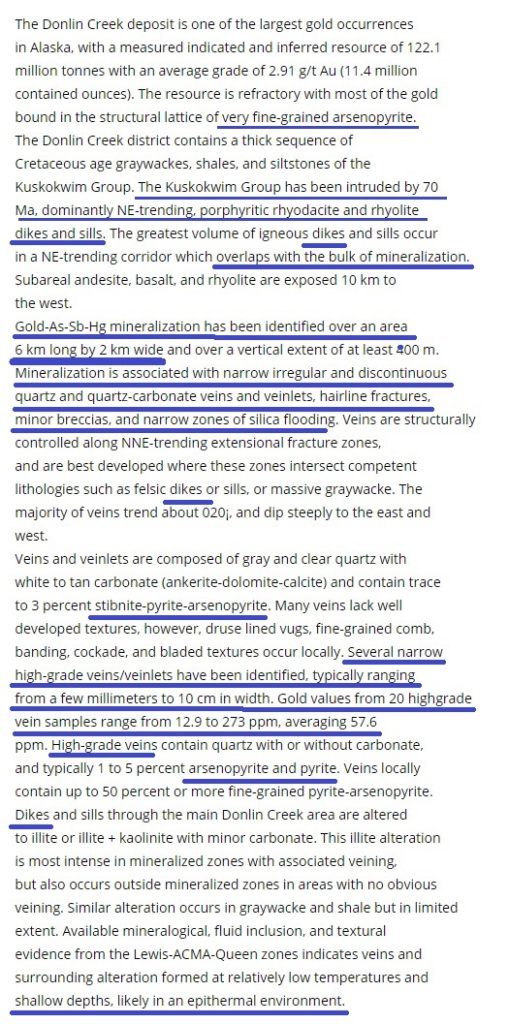

Note especially the underlined portions. Another interesting thing is that this recent NR mentions “Throughout the area the schist package has been intruded by at least 3 different dyke events“. I bring all this up because some of this stuff sounds quite similar to the Donlin Creek deposit (45 Moz):

And then add this from Novagold’s page about the Donlin Creek deposit:

“The Donlin Gold deposits comprise a northeast elongated cluster, roughly 5,000 ft (1.5 km) wide x 10,000 ft (3 km) long, that can extend vertically over 3,100 ft (945 m). The deposits are hosted primarily in igneous rocks and are associated with an extensive late Cretaceous hydrothermal system. Gold occurs in broad disseminated sulphide zones in rhyodacite and in vein networks.

The two primary deposits at Donlin, ACMA and Lewis, have different geological settings. The ACMA deposit is comprised of dikes and sills intruded into folded shale and siltstone rocks. The Lewis deposit consists of dikes intruded into massive greywacke. Mineralized material in the ACMA deposit tends to be higher grade and more continuous compared to Lewis and other dike dominant areas of the deposit. The most extensive and highest-grade mineralized zones in ACMA are located where “feeder” dikes intersect the sill sequence. Mineralized zones follow steeply dipping dikes and sills beyond the depth limits of current drilling, or over a vertical range of at least 3,100 ft (945 m). “

Similarities Between Donlin Creek and “Last Chance”:

- Extensive presence of dykes

- About similar sized gold in soil anomaly

- 6 x 2 km2 for Donlin Creek

- 6 x 1.2 km2 for “Last Chance” (Note that this might get bigger when the rest of the soil samples results are in)

- Breccia and high grade but narrow vein mineralization

- The highest rock chip sample so far from Last chance is 77 gpt which came from a narrow vein

- Both are believed to have been formed in shallow crustal levels (“Epizonal”)

- Both are believed to be “IRGS”

- Similar geochemical signature

Some Similarities Between The Bendigo Zone (Fosterville) and “Last Chance”:

The regional geological map of this area outlines an extensive Anticline and Syncline which both have an east-west strike and continues for tens of kilometres (Highlighted in purple):

So basically the “Last Chance” anomaly is straddled by a mapped Syncline “fold” to the north and an Anticline “fold” to the south. Both which both run parallel to the elongated high grade core of the soil anomaly as well as a carbonaceous schist unit for tens of kilometers (highlighted in red). This means that these rocks have been squeezed together (north-south) and given rise to a “wavy” orientation of rock packages in the region. Furthermore we can see that all the mapped Carbonaceous Schist units between the mapped Anticline/Syncline are going in an east-west direction just like the one that goes straight into the soil anomaly. This might indicate that the north-south squeezing led to many perpendicular folds in this “belt”. I bring this up because we see the same thing in the Bendigo zone in Victoria, Australia which includes the now legendary Bendigo and Fosterville mines as well as the Wattle Gully mine etc:

Cross Section of typical orogenic gold deposits in the Bendigo zone, Victoria, Australia:

Cross sections of Fosterville and Wattle Gully (Both in the Bendigo zone):

Will these Anticlines/Synclines prove to be important controls at Last Chance as well? I don’t know but I sure like the fact that the area shares even more similarities to Fosterville and the Bendigo zone. During Quinton’s presentation he shows three different deposit examples and says that any type is still on the table:

I would assume the style of mineralization farthest to the right, the “gold/shear concentration”, is Fosterville style mineralization. When Quinton talks about said style he goes on to say:

“… And I certainly see this aspect on this property… But these are the different morphologies… What we have?… Don’t know yet but we are going to find out…”

To Sum Up The Geology at “Last Chance”

- The soil anomaly is masssive and shows some spectacular high gold values which I assume points to the original source being an Epizonal gold system (like Fosterville/Donlin Creek)

- The corresponding Au-As-Sb values and the proximity of Cretaceous granite suggests the source might be an intrusion related gold system (Like Fosterville/Donlin Creek/Pogo)

- Both the Alaskan Donlin Creek deposit and Pogo deposit also had soil geochemistry with corresponding Au-As-Sb (Also like Fosterville)

- The source of the significant Last Chance soil anomaly might potentially be an Epizonal/IRGS hybrid with more than one mineralization event (Like Fosterville/Donlin Creek)

- We don’t know if it might turn out to be a narrower, but very high grade mineralization akin to Pogo/Fosterville or wider, with lower grade, but perhaps larger tonnage akin to Donlin Creek

- We don’t know if it might be akin to Donlin Creek at shallow levels and then turn into something more akin to Pogo/Fosterville at depth (High grade lode gold)

- I am excited.

Even More Smoke…

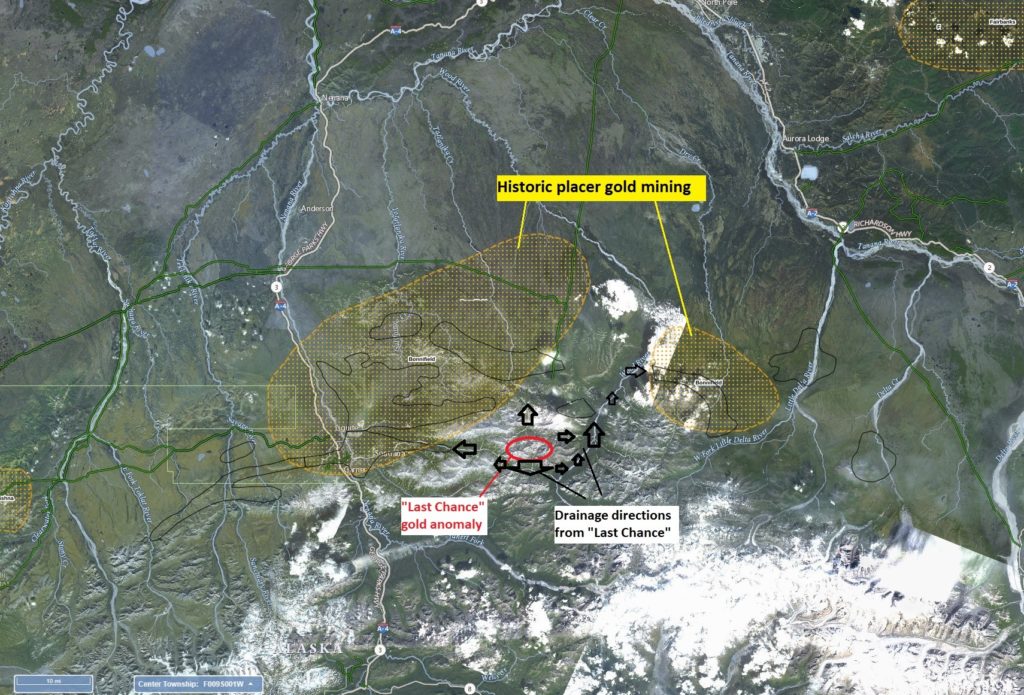

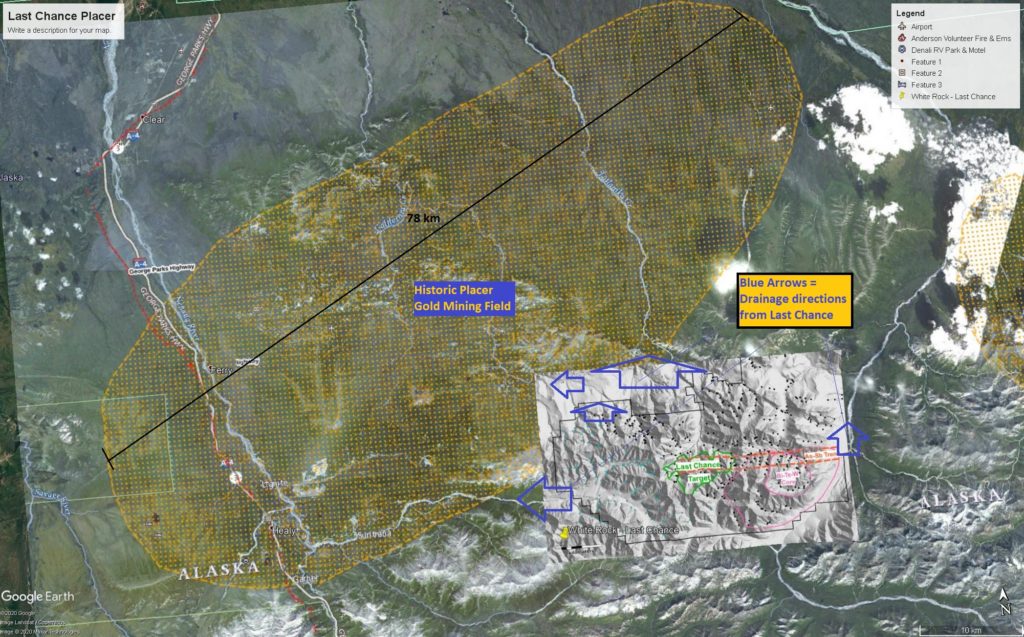

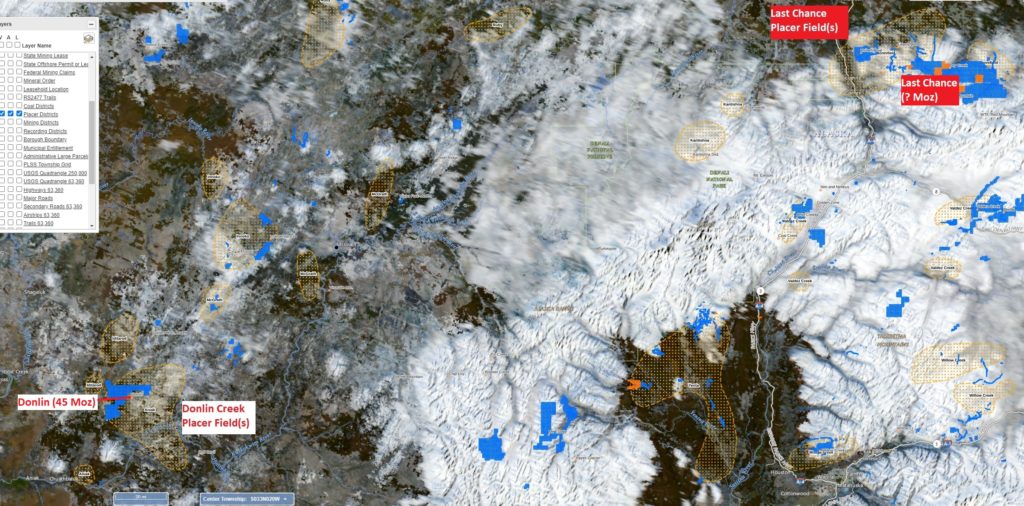

This is a map with known placer gold fields as well as added “drainage direction” drawings by me:

Here is a zoomed in view over the Last Chance gold anomaly with drainage directions added:

Here is a very zoomed out view where you can see the extent of some other placer gold fields:

(including the one(s) near Donlin Creek in the bottom left)

This is a very zoomed out view where you can see the extent of some placer gold fields that are nearby Last Chance:

(Including the one near the 13.5 Moz Fort Knox mine)

… To say there there is an overwhelming amount of smoke by now would be an understatement. The gold in the placer gold fields, down stream from Last Chance, was sourced from something. The very big and very rich 15 km2 gold in soil anomaly at Last Chance is sourcing its gold from something and many of the major drainage from said soil anomaly heads straight into the placer gold field. Now it’s up to White Rock to find the source of all that gold. It is however important to remember that exploration is a process and that I don’t expect a bulls eye on the first ever drill hole but I personally do expect them to hit the “bulls eye” during the maiden drill campaign. With that said, there is is probably something very big hiding at Last Chance.

I bet White Rock could JV this thing out to a large miner in a heart beat if they wanted to (as evidenced by Sandfire’s decision to invest more in White Rock). I am happy that White Rock has decided to keep 100% to themselves and see if they are sitting on a monster.

My Toughts:

This is one of the best grass root projects that I know of and I think “Last Chance” alone is worth quite a bit more than US$25 M.

2. Margin of Safety aka “The Meat and Potatoes”

A big part of the reason why I personally consider White Rock to be a rare “no brainer” in my book is because the company already has advanced and de-risked assets that arguably are worth quite a bit more than the current Enterprise Value. This in turn is why I believe that I am not taking any rational valuation risk at all with their new flagship project that is Last Chance.

2.1 “Red Mountain”

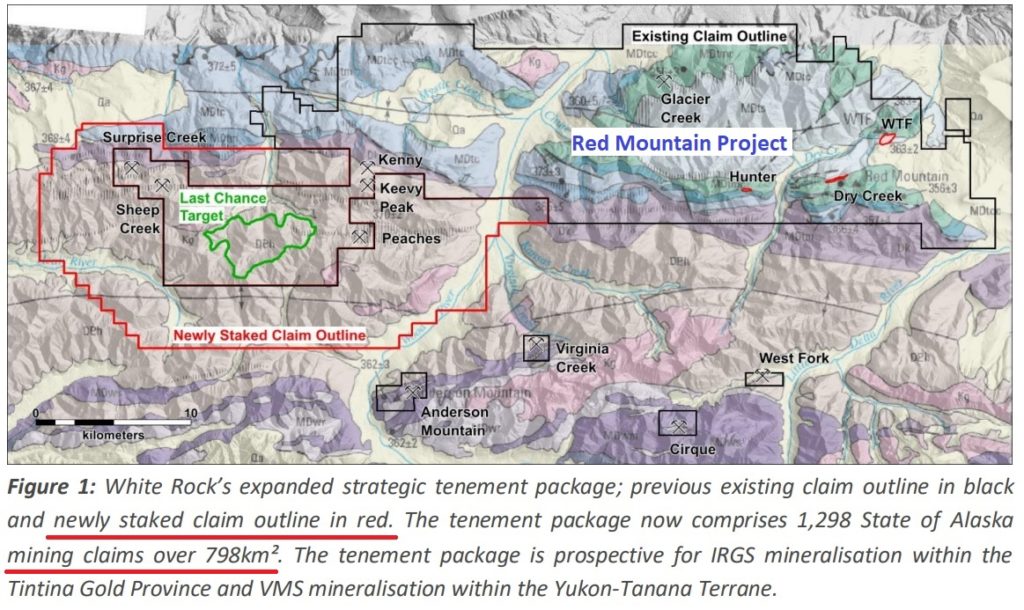

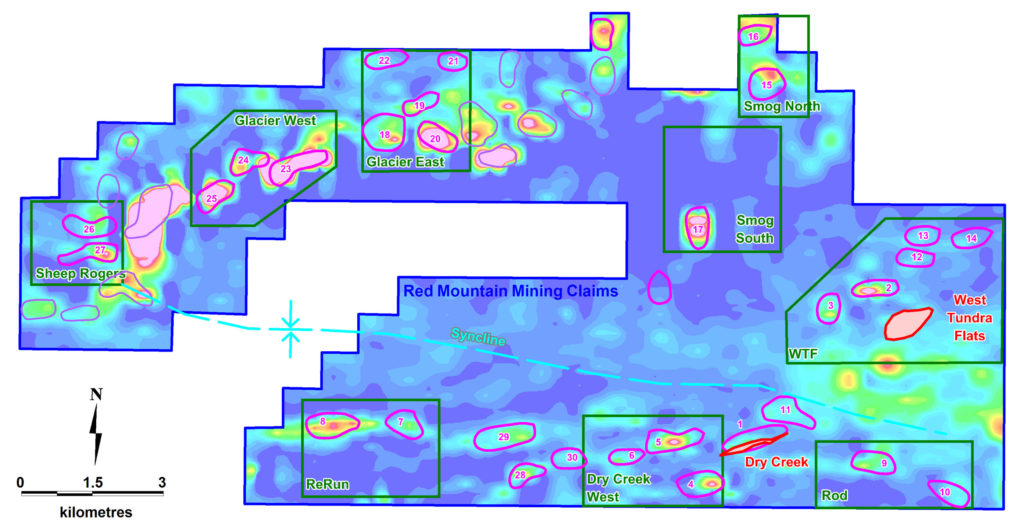

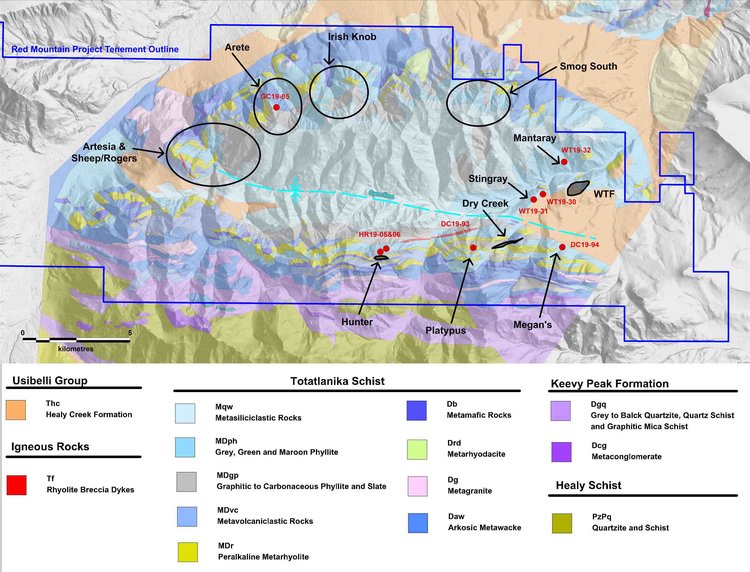

White Rock’s Red Mountain project consists of a district scale land package that is prospective for Volcanic Massive Sulphide (“VMS”) deposits. This project actually borders the newly staked “Last Chance” area so there are some obvious synergies. Anyway, these VMS deposits comes in the form of clusters so where one finds one, there should be more. Hence why the Red Mountain project clam block covers an area of 475 km2 (47,500 Ha).

This is how Red Mountain is described on the company’s project page:

- Red Mountain is a 100% owned, globally significant, zinc-rich volcanogenic massive sulphide (“VMS”) project located in central Alaska, USA. The area has had historic exploration from 1975-1999 and has significant upside using modern technology and techniques.

- White Rock controls a highly prospective land position of 475km2.

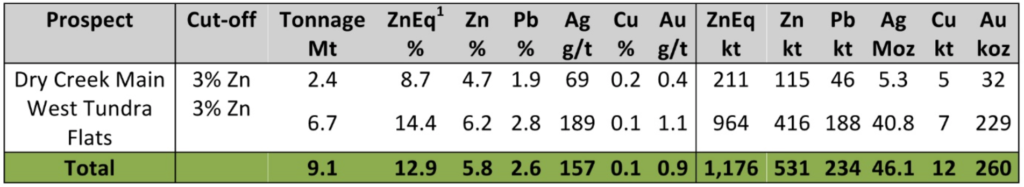

- Red Mountain has two identified deposits (Dry Creek and West Tundra Flats) providing White Rock with a Maiden Resource base of 16.7Mt at 8.9% ZnEq including a high-grade component of 9.1Mt @ 12.9% ZnEq, and newly discovered massive sulphide mineralisation at the Hunter prospect.

- This makes Red Mountain one of the highest grade and most significant deposits of any zinc company listed on the ASX.

- White Rock joined forces with Sandfire Resources (ASX:SFR) in March 2019 to fund the exploration and development for Red Mountain.

The project already has a quite impressive resource with a 3% zinc eqv cut-off already:

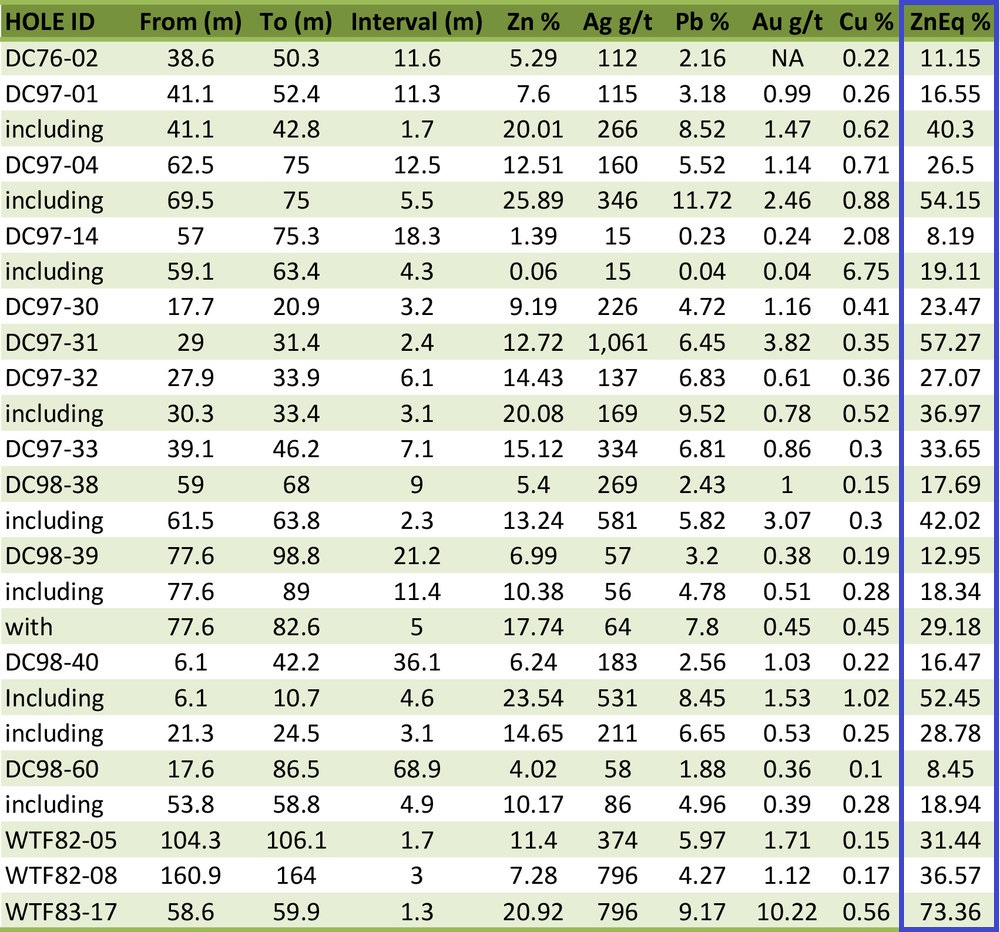

Note that the total resource with a lower cut-off is a bit bigger. Anyway, even though it is considered to be a base metal play, this higher grade resource still contains 46.1 Moz of silver and 260 Koz of gold, on top of zinc, lead and copper. Given that the project is relatively remote the company argues that they would need to double the resource for it to become a viable mining venture. Thankfully the company has no shortage of targets and they had barely just begun working this project when they discovered the huge Last Chance anomaly:

The total land package is actually larger and in the slide below you can see some of the different targets annotated:

And here are some examples of drill intercepts from the Dry Creek area:

Sandfire Resources actually entered into an earn in JV agreement which meant that the company would have to spend $20 M to earn a 51% stake in the project. However, on February 10th of this year Sandfire announced that they would forgo its rights to earn-in to the Red Mountain Project. This was shortly after the price of zinc had fallen through a major support line dating back to 2016:

… Things could pretty much not look much worse for zinc and even the COVID chaos could not bring the price that much lower. Anyway, I think this depressing price environment surely played a big part in the decision and that it was not because the company saw no potential at Red Mountain given the amount of targets left to be tested.

The following comments about Red Mountain are from Quinton Hennigh’s recent presentation:

“This is a big system. Have they given up on it? Heck no. They were just getting started and that is where they are at right now. This definitely has 20+ million tonne potential. So I think that is a very good start… It helps underpin the company with a lot of value. “

So what value should one put on Red Mountain?

US$20 M? US$40 M? US$60? US$100+? I don’t know but there is obviously some value in 9 Mt of very high grade ore and Sandfire would not have initiated the earn in JV if they did not see enough potential for a $1 B company to be interested in the first place.

What we do know:

- Red Mountain contains 2 high grade deposits already which includes 46.1 Moz of silver and 260 Koz of gold

- Matt Gill argues that that they would have an economic mine if they can double that size

- Matt Gill states that they have 30+ VMS targets outlined for potential growth

The in situ value of the silver resource within the resource alone is for example up 36% since February of this year. At US$24.5 per ounce the gross metal value of the 46.1 Moz silver portion is US$1,129,450,000 today. Gold is up around 22% since February of this year and is currently trading at an all time high of US$1,938 per ounce. At US$1,938 per ounce the gross metal value of the 260 Koz gold portion is US$403,880,00 today.

In other words, the Zinc Equivalent resource is probably a fair bit higher at Red Mountain given that is the formula and numbers that were used:

ZnEq =100 x [(Zn% x 2,206.7 x 0.9) + (Pb% x 1,922 x 0.75) + (Cu% x 6274 x 0.70) + (Ag g/t x (19.68/31.1035) x 0.70) + (Au g/t x (1,227/31.1035) x 0.80)] / (2,206.7 x 0.9).

My Thoughts:

I think Red Mountain alone is worth more than US$20 M which is more than the current Enterprise Value of White Rock. Especially at today’s gold and silver price. Just the fact that Sandfire was interested enough to spend $8 M, on the way to $20 M, on Red Mountain is enough for me to appreciate that White Rock has a real chance of finding enough ore to turn this into an actual mine. Sandfire opting out of the earn-in when zinc hit new multi year lows is not something I am reading too much into given that they barely got started and have 30 targets outlined.

2.2 “Mt Carrington”

The third project owned by White Rock is their very advanced stage Mt Carrington Project in New South Wales, Australia. It contains gold and silver resources and is described as this on the Mt Carrington project page:

White Rock’s cornerstone asset is the 100% owned Mt Carrington project where shallow Indicated and Inferred Mineral Resources totalling 341,000oz gold and 23.2Moz silver have been defined.

“Just two of the four gold resources gives it an initial 4.5 year mine life… There is still another two gold resources and there is the four silver resources that are not in that plan…”

“It has had past mining so you walk on to ore… The gold pits are pre-stripped… There is a 100,000 m of drilling behind it….”

“… There’s a tailings dam there… The plant side is cleared… It’s on a mining lease…”

“..There are not many projects that are that advanced..”

“…But it’s got that approval step… that just is holding it back… We crack that and we are away…”

Economics for Mt Carrington from the latest presentation:

Matt Gill talking about the economics during a recent interview:

“At $2,300 Aussies… So still under spot… Its got a pay back under a year… Its got a rate of return nudging 80%… That generates $20-$30 M in Free Cash… All that gold price improvement goes straight to the revenue…”

Keep in mind that the company uses a quite conservative discount rate of 8% and that the Australian gold price is currently around A$2,700 per ounce. A 2% increase in discount rate to 10% shows a NPV of A$21.2 for the project at A$1.700 gold. In other words it means that a 2% decrease in discount rate hikes up the NPV by 12.7%. If one would use a 5% discount rate, which is often used in studies, one could argue that the NPV at A$2,500 gold would be A$144.2 M for Mt Carrington…

By extension a simple projection could then imply a NPV of A$180.4 M (USD$129.6 M) for Mt Carrington at A$2,700 gold with a discount rate of 5% instead of 8%.

My Thoughts:

Mt Carrington alone would probably bring in more money in a fire sale than the current Enterprise Value for White Rock given that it has a PFS study done that shows incredible economics and that the asset is very advanced and de-risked.

3. The Pretty Simple Case as I See it

White Rock Minerals is one of my absolute favorite high risk/high reward plays at the moment. As you might know by now this US$34 M ($A47 M) MCAP company has a high-grade base metal resource in Alaska (“Red Mountain”) and a small but advanced stage gold/silver project in Australia (“Mt. Carrington”) which together should very conservatively speaking be worth minimum US$45 M (A$63 M) in my opinion (The Mt. Carrington PFS alone showed a NPV of A$98 M at A$2,300 gold using an 8% discount rate). This leaves around -US$9 M to be attributed to “Last Chance” and the company should has over A$15.7 M in cash to boot…

Long story short: You can buy all projects for an Enterprise Value of US$23 M (A$31 M) and since I could easily argue that anyone of the assets is worth at least that I see it as paying for one and get all the value and upside in the other two for free.

For the ones who love a shot at tier 1 deposits it means that I don’t think one is paying anything and by extension not taking on any exploration risk at “Last Chance”. In my opinion this is bonkers for an anomaly that is this big and rich coupled with the indications that the gold might be sourced from a huge epizonal/IRGS type gold system akin to Fosterville/Donlin Creek and is located in a tier 1 jurisdiction. Add on the fact that it seems they have already found outcropping mineralization. I’m just waiting for more market participants to figure out just how many factors are pointing to this having a seemingly good chance of being something remarkable, then compare it to what is priced in, and get a possible “oh shit moment” like I had after digesting all the known information. I think the overall market is still pretty much asleep at the wheel on this one since I haven’t seen almost anyone commenting on White Rock on MinTwit. This is a very good sign and coupled with all the sellers from the recent SPP would explain why it’s significantly undervalued in my opinion.

Risk as I see it is overpaying for something. I don’t see how on earth I could be overpaying (making a mistake) for all this smoke and potential at Last Chance when literally nothing is priced into the stock in my opinion.I personally think Last Chance alone should probably be worth at least A$60+ M on a risk adjusted basis today and that might be conservative. Again, simply given because this looks to be a) An Epizonal Orogenic System + Intrusion Related Gold System (akin to Fosterville/Donlin Creek), b) One of the largest and highest grade soil anomalies Quinton has ever seen, c) The actual prize might be even bigger, d) Jurisdiction and e) They seem to have found some outcropping veins already which will be drilled within a month.

Even though I think this is one of the best high risk/high reward plays out there it is important to remember that there is obviously a risk that they somehow find NOTHING. If that for some reason were to happen, one would still own a small but advanced gold/silver Mt. Carrington project in Australia with a NPV of over A$121 M on paper at today’s gold price, even with a discount rate of 8%, as well as a 9 Mt high grade zinc deposit which contains 46.1 Moz of silver etc. With the low CAPEX and high IRR of Mt. Carrington, coupled with an option on project financing, I think there is a solid chance that this project will actually be built and lead to tangible value. So on paper one could argue that there might be no “rational” downside at these levels regardless of what they find at Last Chance. However, one should expect a reaction since the market is not rational on a day to day basis. Anyway, on paper White Rock is possibly the single best asymmetrical bets I know of currently (Heads; I lose little to nothing, tails; I win and perhaps win a lot). Given the current valuation I deem it almost impossible that I would be making a mistake (overpaying) while buying any and all potential at Last Chance, Red Mountain and Mt Carrington for US$23 M. Avoiding mistakes (overpaying) and limiting my risk to the downside is what I put a lot of emphasis on.

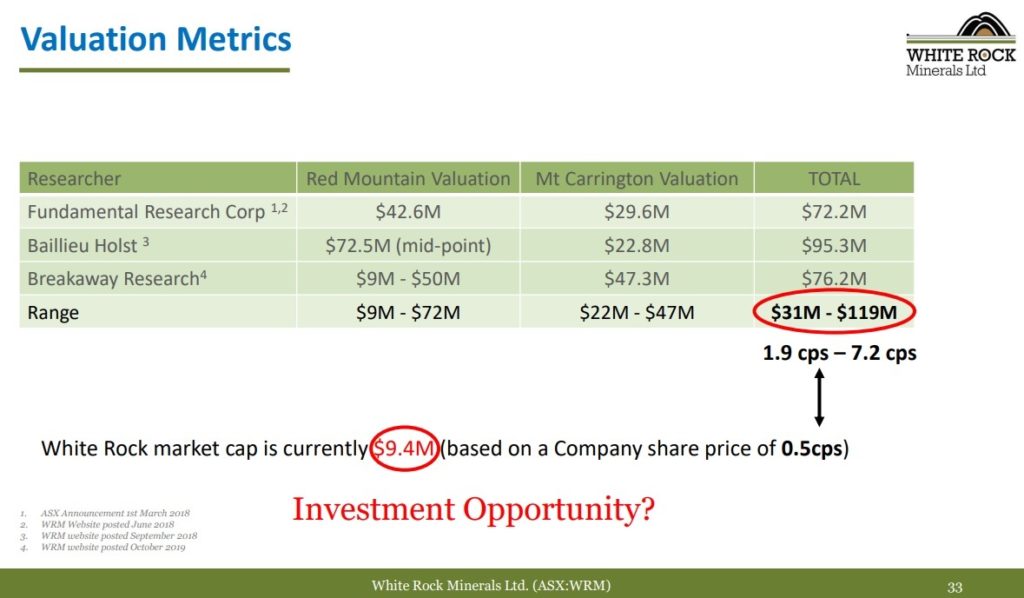

External Valuation:

Valuation Metrics for Red Mountain and Mt. Carrington ONLY according to analysts

(Based on 2018-2019 reports, when gold and silver was a lot lower)

… By extension these analysts suggests that one is paying around A$0 M to -$A119 M for the whole Last Chance target. Lets be extremely conservative and take the lowest ends on both projects. Then we get a rock bottom valuation of A$31 M for the Mt. Carrington and Red Mountain projects which again means that the most pessimistic valuation case gives $0 M accredited to “Last Chance”. In other words they suggest that one might not be taking any “rational” downside risk while getting any and all upside. Again; “Heads I lose nothing, tails I win”. This is friggin incredible for me as an investor/speculator. If we take the average of the valuations in the table above, which is A$75 M (US$53.9 M), then it means that an investor can currently buy “Last Chance” for free while also getting “Red Mountain” and “Mt Carrington” for less than half of (average) fair value. Keep in mind that this analyst valuation range is based on reports from 2018-2019 when gold and especially silver was trading at much lower levels than today.

Anyway it does suggest that ANY one of these assets should cover the current Enterprise Value alone…

The Value Proposition for White Rock Minerals

- “Red Mountain”

- contains 9.1 Mt of ~13% zinc equivalent

- Including: 46.1 million ounces of silver

- Including: 260 thousand ounces of gold

- Located right next to “Last Chance” in Alaska, USA

- “Mt Carrington”

- PFS showing a NPV of A$121.1 M with a 129% IRR at a gold price of A$2,500/oz

- … With a discount rate of 8%, which is higher than one usually sees

- Gold is currently trading around A$2,700…

- NPV today should be closer to A$145.4 M (US$103.4 M) and IRR closer to 154% for Mt Carrington

- A$20 M in existing infrastructure and is perhaps 12-18 months from being build ready

- Low CAPEX

- Option on project financing in place

- 340 thousand ounces of gold

- 23 million ounces of silver.

- PFS showing a NPV of A$121.1 M with a 129% IRR at a gold price of A$2,500/oz

- “Last Chance”

- Enormous and very high grade gold in soil anomaly that is already 15 km2 and wide open

- Signs that it is a Epizonal and/or IRGS system akin to Donlin Creek and Fosterville

- Tier 1 jurisdictional diversification

- Alaska, USA

- New South Wales, Australia

- Asset diversification

- Three projects in two different jurisdictions

- Metal diversification

- A high grade base metal resource with a lot of silver and gold in “Red Mountain”

- A very advanced stage, highly economic gold/silver project that should be close to a potential decision to build in “Mt Carrington”

- An enormous high grade gold in soil anomaly in “Last Chance”

- Alpha and Beta

- The price of gold, silver and zinc etc directly affects the implied value of Mt Carrington and Red Mountain

- Especially so if Mt Carrington will indeed get pushed to production

- Last Chance is the huge wild card that could provide a lot of alpha and eclipse them both with exploration success

- The price of gold, silver and zinc etc directly affects the implied value of Mt Carrington and Red Mountain

- Synergies

- Further success at either Red Mountain and/or Last Chance would probably lead to better infrastructure being put in place

- … Would hike up the value for both projects since they are right next to one another (more bang for the buck)

- … Would also decrease average exploration costs for both

- Further success at either Red Mountain and/or Last Chance would probably lead to better infrastructure being put in place

- Current precious metal (only) resources:

- 69.1 Moz of silver

- 600 Koz of gold

… One can buy all that for around US$23 M at the moment(!)

White Rock’s Enterprise Value at different share prices:

- $1.0/share = US$40 M in Enterprise Value

- $1.2/share = US$51 M in Enterprise Value (Average 2018-2019 analyst value for “Red Mountain” and “Mt Carrington” only)

- $1.4/share = US$62 M in Enterprise Value

- $1.7/share = US$77 M in Enterprise Value (US$25 M per project)

- $2.0/share = US$93 M in Enterprise Value (US$31 M per project)

- $3.0/share = US$145 M in Enterprise Value (US$48 M per project)

… At $1.7/share I would argue that one is still getting a bargain. At $2.0/share I would argue it’s still fairly cheap…

Theoretical Blue Sky Case as I See it:

- White Rock gets the very economic Mt Carrington asset into production

- Potentially brings in more pits and adds mine life as time goes by

- Mt Carrington then bankrolls the exploration at Last Chance and Red Mountain with minimal dilution

- White Rock proves up a very high grade, precious metal rich base metal mine at Red Mountain and a world class Epizonal/IRGS gold deposit at Last Chance worth billions

- … Which I was able to buy for US$23 M in 2020, so I didn’t even take on any exploration risk, since no potential was priced in to begin with

In essence I see White Rock as a junior company that could relatively soon be in production with relatively little CAPEX required and you get two high quality (one possibly world class), district exploration plays for free.

If “Last Chance” is as good as it looks White Rock could easily be a 10++ bagger from that project alone obviously. Only time will tell but I do think there is a relatively good chance of a significant discovery here for White Rock and I don’t think the Enterprise Value is reflecting/appreciating just how good this looks at all. I am not saying I think this is going to be another Fosterville but again, given the valuation, finding something worth even 20% of a Fosterville should lead to substantial returns for shareholders. Ideally I find cases like White Rock where almost nothing is priced in (margin of safety) and where the upside is therefore open ended (any and all success will benefit me). As I see it I’m not taking any exploration risk at Last Chance. If for some reason they don’t find anything of value at all at Last Chance then Red Mountain and Mt Carrington still covers the current valuation and then some.

I was unfortunately not quick enough to join the PP but I have taken a substantial position (for me at least) in White Rock for the reasons outlined above. When I find an asymmetrical bet with a lot of blue sky potential the risk/reward compels me to go big. Cases like this are simply to rare for me to pass on and not take advantage of. Anyway I am happy to have found this story and I am very excited for the possibility of being part of what might be the next big discovery from the ground floor. Looking further out I could see scenario where Mt. Carrington gets into production and then helps fund further exploration at Last Chance. Is there even a chance White Rock could turn into a small high margin miner with a potential world class project in the pipeline? Sure, and that could obviously be one of the better growth stories around in that case. But, if Last Chance ends up being as good as it looks I would assume there will be a few sharks circling given the proximity to Pogo (Newcrest) and Fort Knox (Kinross).

Another thing to note is that Sandfire Resources decided to not go further ahead with their earn-in at Red Mountain after having spent A$8.5 M. This was announced in February of this year which means that Sandfire retains no direct interest in the Red Mountain project. I bring this up because Sandfire apparently participated in the recent placement. Given that the only real change has been the discovery of the Last Chance target I interpret it as Sandfire wanting to keep their ownership level in White Rock because the company wants exposure to this exciting gold target (The JV earn-in with Sandfire did not cover the growing Last Chance claim block). Since Sandfire has all the data that White Rock has I assume that Sandfire probably wanted to have Last Chance included in the JV… But got a no from White Rock which forced Sandfire to simply up their share ownership in White Rock instead. Long story short: I see Sandfire’s participation in the placement as a sign that Sandfire thinks the Last Chance target is a potential game changer for White Rock. Especially since the price of zinc is about the same price as when they opted out from the Red Mountain earn-in and no additional work has been done on that project since.

An additional thing that is meaningful to me at least, is that Quinton stated that he has been buying in the open market recently, during the cascade of selling from shareholders receiving their cheap shares. The one and only case I have seen SEDI filings showing Quinton adding shares in the open market was in Irving Resources in May-April of 2016. During that time Irving was trading at around $0.12-$0.19 per share and was long before they were able to do any drilling. It was very early stage like Last Chance. I guess he was just THAT convinced in terms of the prospectivity within the greater Omu Project and has since then been proven right. Irving’s stock recently traded at over $4 per share and both Newmont and Sumitomo are now shareholders… So when I hear one of the best geologists in the world saying he is buying shares in the open market, in addition to the ones he got in the recent placement, at least I take note. In the case of Irving it took a few of years before any drilling could be done but those open market purchases should be up over 2.000% today which obviously made it more than worth the wait. The thankful thing about White Rock is that they might already have started drilling the very first hole at Last Chance and that Alaska is a much easier place to work (Except field season being shorter and the current lack of infrastructure going into the project).

This article was a long way of saying that I believe White Rock is probably the second best risk/reward case I have seen in the last 5 years.

Upcoming Catalysts

- More soil sampling results from the Last Chance gold target

- Rock chimp sampling results from Last Chance gold target

- Drilling at the Last Chance gold target (Just commenced)

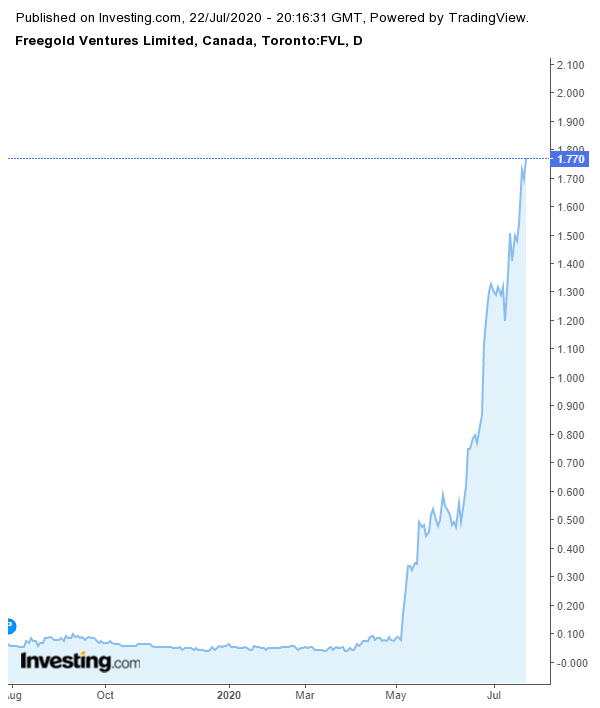

Judging by the response from a single drill hole in the Alaskan junior Freegold Ventures (Now with a MCAP of C$385 M)I would expect success at Last Chance to be highly rewarded by the market:

Note: This is not investment advice. I am not a geologist nor am I a mining engineer. This article is speculative and I can not guarantee accuracy. Junior miners can be very volatile and risky. I have bought quite a bit of shares of White Rock Minerals in the open market and one should therefore assume I am biased. I can buy or sell shares at any point in time. Never risk money you can’t afford to lose. Most importantly: Always do your own due diligence and make up your own mind!

Best regards,

The Hedgeless Horseman / Erik Wetterling

Follow me on twitter: https://twitter.com/Comm_Invest

Follow me on CEO.ca: https://ceo.ca/@hhorseman

Follow me on Youtube: HERE

Good on ya, hedgelesshorseman.

Excellent work Erik!!

Grateful to You Eric. Extremely unselfish and giving to share this montage of White Rock Minerals and it’s prospects. Whilst You admit bias, I am sure even accredited mining persons would find merit in much of Your view given that there is statement of fact. I personally found this to be far more objective than many company presentations and analysis by market journalists. I will reference this link often as things unfold. All the best Mate. Kind regards Stephen H . Buy / Held ))

Hello,

I have no idea how to trade on AX.

Hi Eric,

whay is the best risk/reward stock if White Rock is 2nd best please.

Great analysis btw of White Rock.

Best

Paul Martin