THH – White Rock Minerals (WRM.AX): Added a “Mine”, Grown Red Mountain, Yet Back to The Same Valuation

Feb 16, 2022

White Rock Minerals is an interesting story. For me it started out as a top #5 position when I was buying in at around $0.50-$0.70/share. The case back then was simple: White Rock has a lot of assets, a good looking gold-in-soil anomaly at “Last Chance” and is dirt cheap based on the sum of its parts. Unfortunately the first drill campaign in 2020 at Last Chance, which had become the flagship target in the eyes of the market, got cut short before winter hit. In 2021 the focus was mostly on the Red Mountain base metals VMS targets and the ongoing merger with Austar Gold which owned the Morning Star Mine and Woods Point Gold project. All in all I think I think it left some investors confused in terms of what the company’s real focus and vision was. The ones who bought in for the Last Chance Gold target might have gotten bored, and as many already know base metals plays have not really had the excitement factor going on, so Red Mountain is/was probably underappreciated. Then a new asset as well as a newly minted White Rock shareholders entered the picture via the Austar merger and all of a sudden White Rock became kind of a developer play as well. Sprinkle in a financing or two and you have a lot of tail winds from a perception stand point, new shares on issue, as well as new shareholders from AuStar Gold who might want to sell their shares in this new consolidation play…

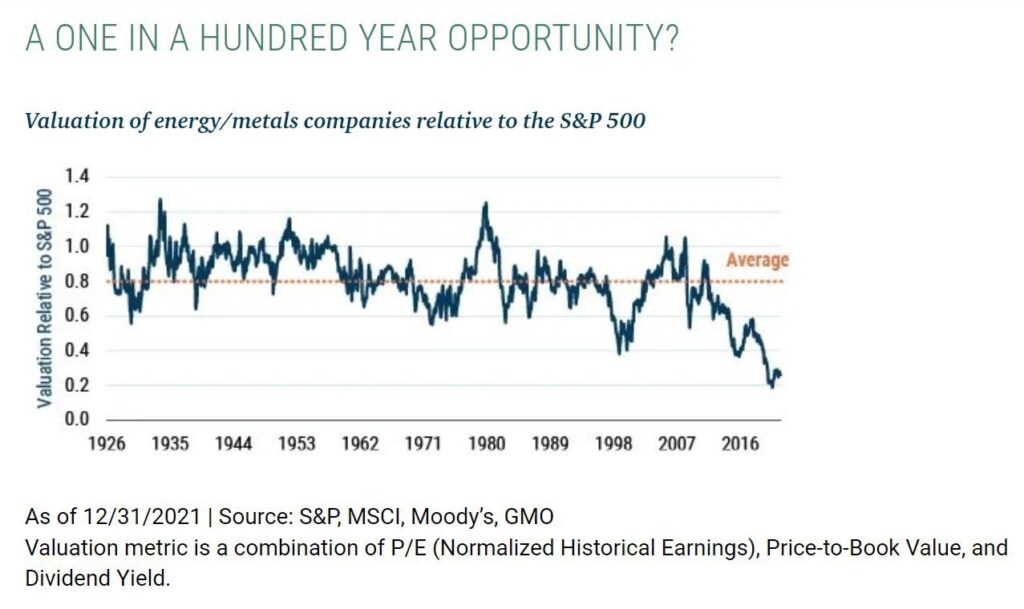

Due to the factors just mentioned I guess it should come as no surprise that the net result was more sellers than buyers. Especially in a sector where investors were already growing impatient and disenchanted with precious metals juniors overall after suffering through an 18-month long sector decline. Therefore I see the decline as thankfully being mostly sentiment/psychology driven and not a fair assessment of fundamentals. Anyway the past is the past and investing is about probability based expectations for the future so in this article I will try to explain my current view of White Rock Minerals.

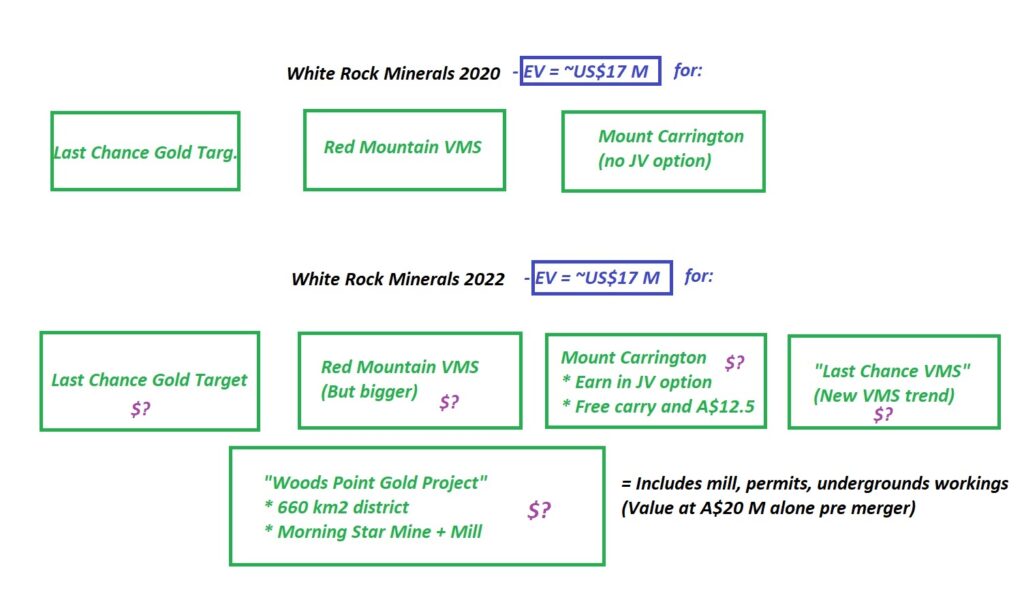

First of all White Rock is back to almost the same valuation it was when I first bought in with an Enterprise Value of around US$17.5 (pre current financing) at $0.20/share. Note that I am not 100% sure how the capital structure and cash position will look once the financing is closed but Enterprise Value would stay roughly the same anyway since shares increase but cash does as well. Since I am a shareholder and the company is a banner sponsor I urge you to do your own due diligence and form your own opinion since I am likely biased…

- Company website: LINK

- Ticker: WRM.SX

So what has changed since my original purchases when White Rock had a similar valuation as now?

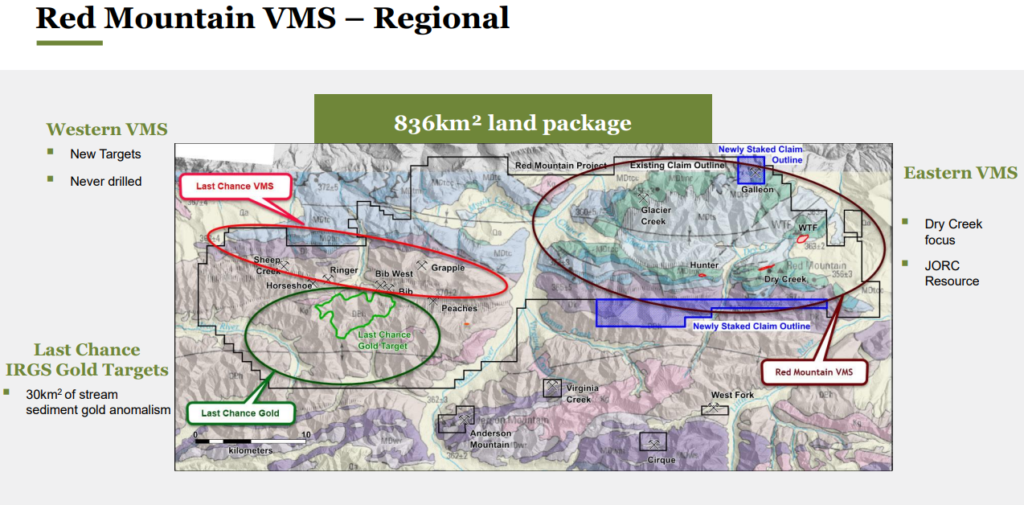

#1 Red Mountain VMS district, Alaska

Well the company has advanced the Red Mountain Project, which already started off with a JORC resource of 9.1 Mt at a silver equivalent grade of 609 gpt(!), via more drilling over the last couple of years. One can look up all the 2021 results from Red Mountain on the company’s website. In other words the “inferred” resources at the Red Mountain Project has surely grown since the first time I wrote up the case. I would also note that the company identified even more VMS targets during last year’s field season.

All in all it’s a Value add

#2 Last Chance Gold Project, Alaska

The very large gold-in-soil anomaly that was delineated a couple of years back has yet to be explained. The company has only been able to put in 8 holes for 1,990 m and the hunt continues for whatever it is that has been shedding that much gold at Last Chance. Furthermore the company has identified another VMS trend which is located to the north of the Last Chance Gold anomaly and to the west of the Red Mountain VMS cluster called “Last Chance VMS”:

… The potential still exists at “Last Chance Gold” and the identification for another VMS cluster at “Last Chance VMS” hikes up the implied value via Potential boosted by Potential synergies.

All in all it’s a Value add.

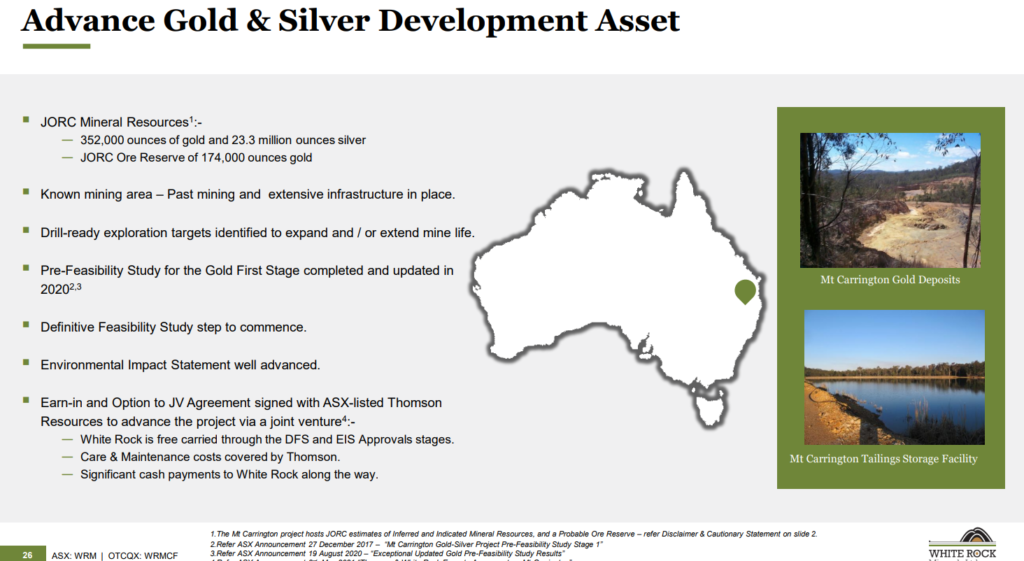

#3 Mount Carrington, NSW, Australia

This advanced Gold & Silver project which is located in NSW, Australia is now in an a “Three stage earn-in and option to Joint Venture Agreement formed with ASX-lusted Thomson Resources”:

Since White Rock Minerals is free carried up to a 51% ownership by Thomson, and then gets a A$12.5 M cash payment if Thomson wants to move to 70% ownership, I basically see this as a risk free option which could be worth as much as the current Enterprise Value of the total company if executed. White Rock would obviously give away value in the ground as well as upside but will not have to pay a cent in development costs up to 70% while also getting a A$12.5 M payday.

All in all a value add via the potential for risk-free unlocking of value.

By the way Mount Carrington currently has:

- 352,000 ounces of gold and 23.3 million ounces silver

- JORC Ore Reserve of 174,000 ounces gold

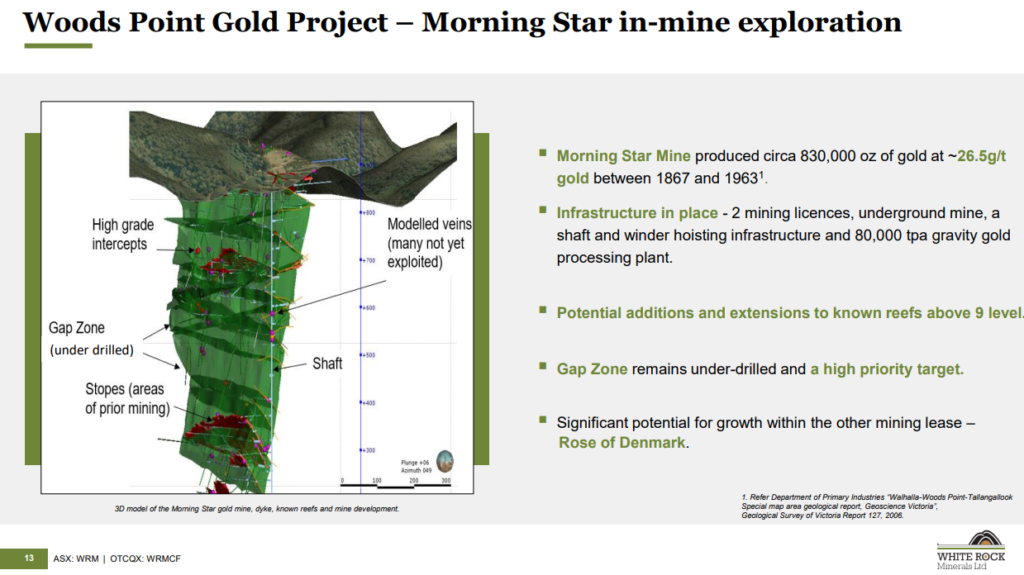

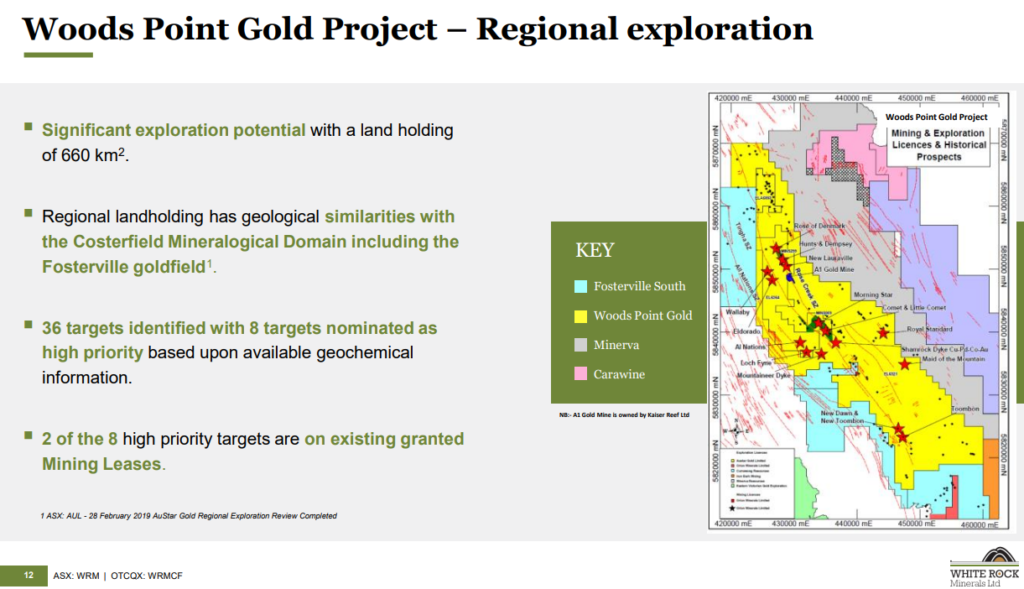

#4 “The Woods Point Gold Project” & The “Morning Star” mine, Victoria, Australia

This is where it gets really interesting for White Rock Minerals since the Woods Point Project was the flagship asset (and only asset) of Austar Gold and is now “just” the main project out of many for White Rock Minerals…

The Morning Star mine which forms the backbone of the Woods Point Gold Project was a historic producer and is/was akin to a “mini Fosterville” given it produced 830,000 ounces of gold at a mind blowing grade of 26.5 gpt (it also happens to be located in Victoria):

“White Rock acquired the Woods Point Gold Project by way of merger with ASX-listed AuStar Gold (ASX:AUL) in mid-2021, bringing a functioning gold mine, gravity plant and a significant gold exploration package into the White Rock portfolio.” – White Rock Minerals website

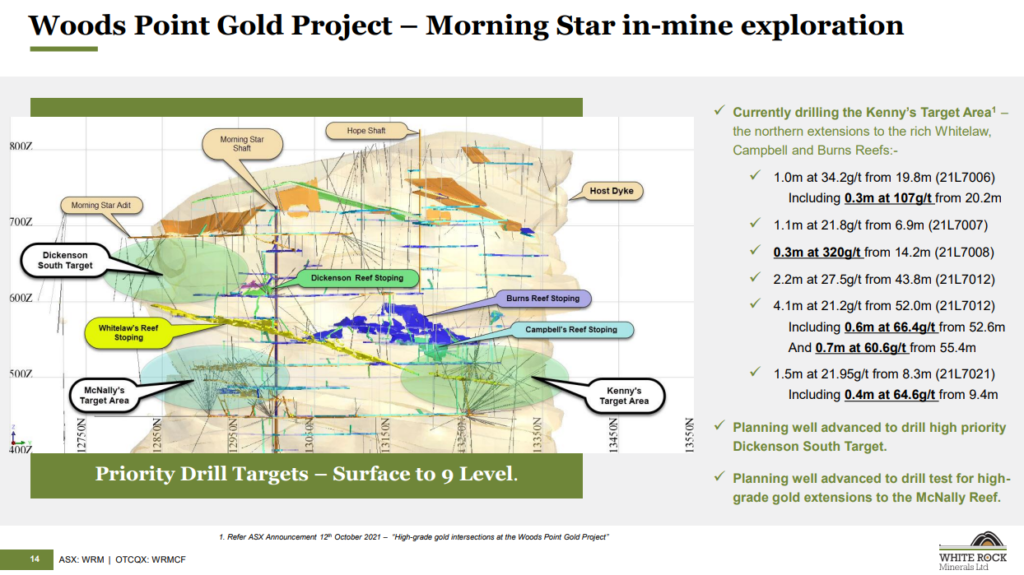

The company did some drilling late last year and there were some impressive intercepts:

There are some gap zones that have seen little to no exploration so there might be some juice left in this jewel yet. Furthermore this fully functioning mine comes with a very large land package surrounding it (collectively called the “Woods Point Gold Project”). I think there are currently two drill rigs working as we speak.

“White Rock has identified 36 targets with 8 nominated as high priority based upon available geochemical information, 2 of which are on existing granted Mining Leases. White Rock is defining a systematic plan to progress the most prospective targets to drill testing from 2022 onwards.” – White Rock Minerals website

White Rock Minerals have bigger plans here and decided to suspend the small scale production at Morning Star after merging with AuStar Gold:

“White Rock has taken the strategic decision to halt production and focus on exploration to define a resource sufficient to underpin a long-term mine-life. The company will then consider restarting production. This patient approach will provide confidence of continuity in profitable production.” – White Rock Minerals presentation

The Strategy Going Forward:

If I remember correctly the valuation for Austar Gold was around A$20 M at the lows, just prior to it being delisted, during a sentiment lull in the mining sector. Given that the company had little cash lets say the Enterprise Value was A$20 shortly before the merger. This would translate to US$14.3 M for Woods Point Gold Project alone. Also keep in mind that a company that is in need of funding when a sector is depressed can typically be priced “irrationally low” due to the circumstances and not necessarily reflect the fair value of the company’s assets.

Well if we stick with a conservative Value estimate for the Woods Point Gold Project at US$14.3 M and subtract that value from White Rock Mineral’s EV, which I think is around US$17 M right now, we get US$17-US$14.3 = US$2.7 M.

In that case ~US$2.7 M is what is left to reflect and incapsulate all the Intrinsic Value of;

- Red Mountain’s high grade resource (which should have grown as well)

- 9.1 Mt at 609 gpt AgEQ according to last resource estimate

- All potential within the Red Mountain VMS district

- This includes more targets than I can name here

- The Last Chance Gold target (Believed to be an Epizonal gold system)

- The new “Last Chance VMS” trend

- The Mount Carrington earn in JV option which would include cash payments of A$12.5 and a lot of free carried development

- 352,000 ounces of gold and 23.3 million ounces silver

- JORC Ore Reserve of 174,000 ounces gold

… If you had the option would you buy all of the above for US$2.7 M? Would you sell all the above for US$2.7 M which I argue Mr Market is doing right now?

Note that the Mount Carrington JV terms alone suggests that White Rock is crazy cheap. Also note that Sandfire used to have JV with White Rock minerals on Red Mountain and it is my impression that they walked away due to financial problems that sprung up from the bear market in base metals at the time.

White Rock Minerals is not cheap. It’s crazy cheap in my book. Like I have stated a lot recently I have never seen more blatant opportunities in the junior space since I 2015.

All in all what you get for ~US$17 M:

Lastly, remember how I thought White Rock Minerals was cheap when I first bought it in 202o?

Do you think I believe it is cheap now?…

I believe that depending how one looks at it one is either paying for The “Woods Point Gold Project” and get 1) “Red Mountain”, 2) “Last Chance” and 3) “Mount Carrington” for free OR one is paying for the latter three and get a mill, mine, infrastructure and 600 km2 of prime ground in NSW, Australia for free. An added benefit with the “new” White Rock is that the company can work at Woods Points in Australia when Red Mountain and Last Chance are on hold due to Alaskan winter conditions.

Oh and one should not forget the synergies…

Every junior explorer dilutes in order to grow. The goal is of course that the growth will more than off set the dilution to shareholders. What a blue sky case for White Rock would look like in my book is that the current raise is perhaps the last or second last raise before the company decides to start up the Morning Star operation again. If so, then Woods Point and the other two massive projects in Alaska could theoretically be grown via internal cash flow, thus creating value while not diluting said value. Are there any guarantees that this will happen? Of course not. More importantly White Rock is not pricing in any value at all outside Woods Point anyway in my book. Thus I am not paying up for what is already there let alone any potential of what else could be there. Like I have said many times before I consider risk to be overpaying for something that is or has yet to happen. Currently I find it impossible to be overpaying for 2/3rds of White Rock’s portfolio since only about 1/3rd is (almost) priced in. This kind of undervaluation of course leaves a lot of upside potential.

When the mining sector gets hot again I think White Rock could, if they wanted to, spin out some of the projects and see a combined Market Cap of multiples of what White Rock is currently valued at. And this is without creating any more value really. I mean the whole idea of investing is to buy assets and companies when they are undervalued and then wait to sell when they become overvalued. Well a swath of juniors are selling at fire sale prices and that includes White Rock Minerals obviously. Good things tend to happen, eventually, when one buys something for nothing.

Ways to win:

- Spin out assets in a hotter market environment

- Exploration success and value creation at one or more projects

- Re-starting the Morning Star operation and self fund a major pipeline of district scale projects that could last for years or decades

Ways to lose:

- Going bankrupt

- Never ending dilution

As Value and Price diverges one should be thinking more about the upside potential simply because the upside potential increases obviously. At around US$17 M in Enterprise almost nothing is priced in. I don’t know exactly what White Rock Minerals will look like in a year or two but to me it looks absolutely dirt cheap. Maybe even twice as cheap as when I originally thought it was cheap and bought my first shares given that Price is about the same while underlying asset value has gone up a lot. In light of that I was not surprised to see the January news release titled “Offer Closes Tomorrow, Crescat Confirms Full Participation”. With hopefully well over >A$10 M in cash shortly I do hope and think that it will lead to the unlocking of this vast portfolio and that one day the inherent Value of the underlying assets will be reflected in the Price of the company as well. I simply do not see how this portfolio of projects can get much cheaper than this without some serious missteps in the future since it’s probably a top #3 candidate in terms of being one of the cheapest companies I have ever seen. Thus, risks are very much to the upside in my opinion and that is all I can ask for.

Note: This is not investing or trading advice. I own shares of White Rock Minerals and the company is a banner sponsor. Therefore consider me biased. Juniors are volatile and risky. I cannot guarantee the accuracy of the content in this article. Never invest money you cannot afford to lose etc. This article includes forward looking statements.

Best regards,

The Hedgeless Horseman

Thx Erik for this extensive update. The company is clearly not betting on one horse and that’s very positive. To pay for all this meant share dillution (more than once) and that’s clearly not appreciated in a declining market sentiment. But things can change fast for the better in this business 🙂

Fortunately, I took advantage of a favourable price at the turn of the year to enter – I feel the outlook is very positive!