Trigon Metals (TM.V): Probably The Cheapest Copper Junior Around

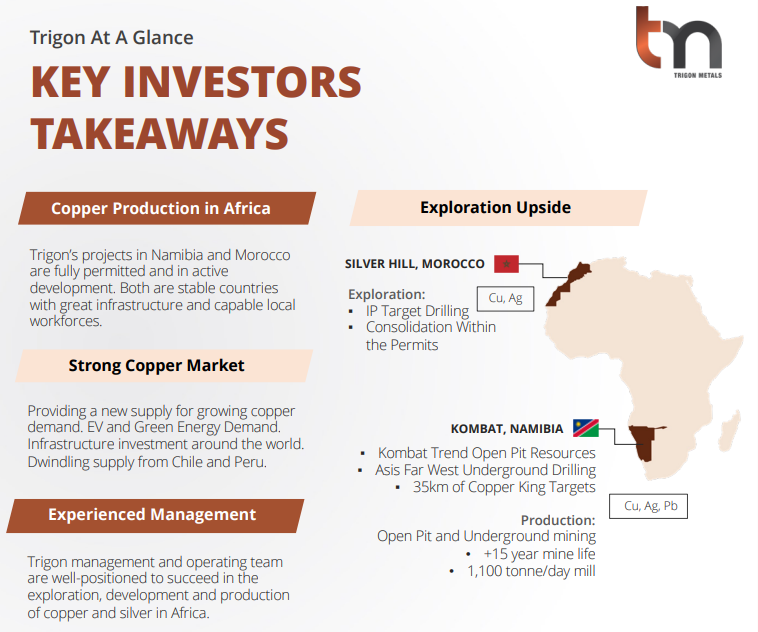

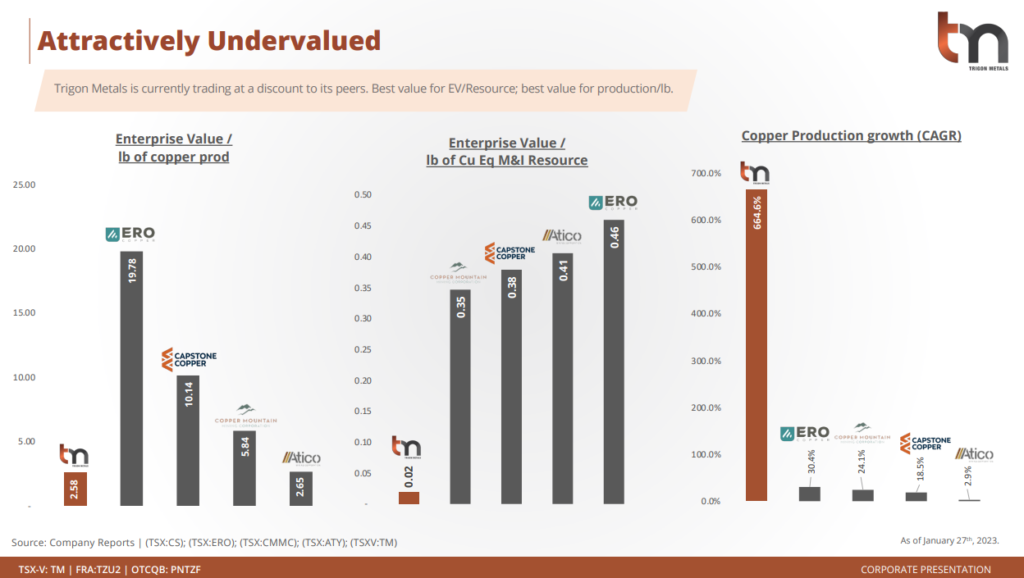

This article will be about Trigon Metals which is a copper focused junior that is planning to go into production at its “Kombat Mine” around May of this year and plans follow up drilling at their “Silver Hill” project which has considerable blue sky potential. The Kombat Mine is located in Namibia and the Silver Hill project is located in Morocco. Morocco is considered to be one of the best jurisdictions in the world (#1 in Africa) and Namibia is considered to be the second best jurisdiction, policy wise, in all of Africa. All in all this is one of the most absurdly undervalued juniors I know of given the current Enterprise Value of a mere C$7.4. And for $7.4 M you are buying a permitted mine with >12 year mine life, >$100 M in sunk costs, near term production potential and a bunch of exploration potential to boot.

I own shares of Trigon Metals and the company recently came on as a banner sponsor. Thus consider me biased and do your own due diligence!

Setting The Scene – Got Copper?

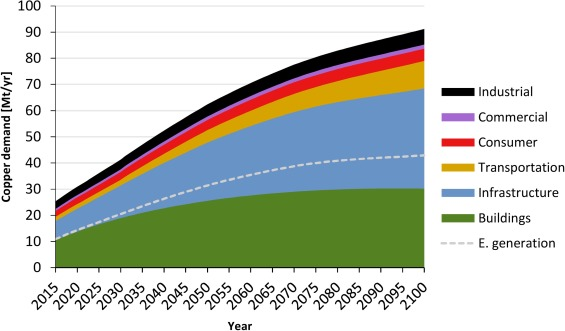

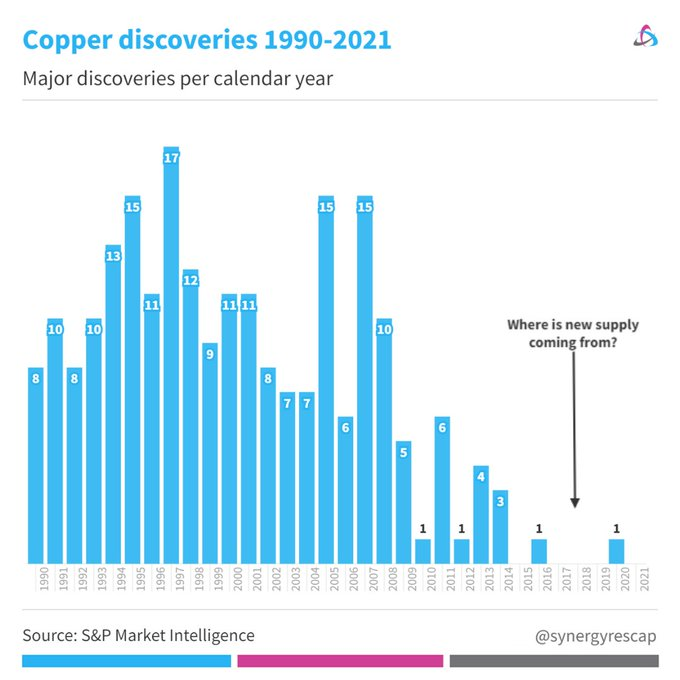

Most will know about the expected shortage of copper throughout this decade and that countries are now listing copper as a “critical mineral”. This is of course good news to anyone owning a copper mine with say >10 years left of production potential coupled with potential to find a lot more of said metal.

Anyway, copper inventory on the LME (London Metal Exchange) just hit a new 60-day low:

… Which happens to also be a new 5-year low:

Enter… Trigon Metals (TM.V)

- Website: LINK

- Video Presentation: LINK

- Market Cap (Basic): C$32.4 M @ $0.185/share

- Cash: ~C$25 M

- Enterprise Value (Basic): $C7.4 M

- Skin in the game: Management & Insiders own 6% of the company

- Notable shareholders: Sprott owns 20% of the company

Case in Short

Well to start off with it is cheap with a Market Cap of C$32.4 M, a cash balance of C$25 M and thus an Enterprise Value of a mere C$7.4 M…

What you get for C$7.4 M:

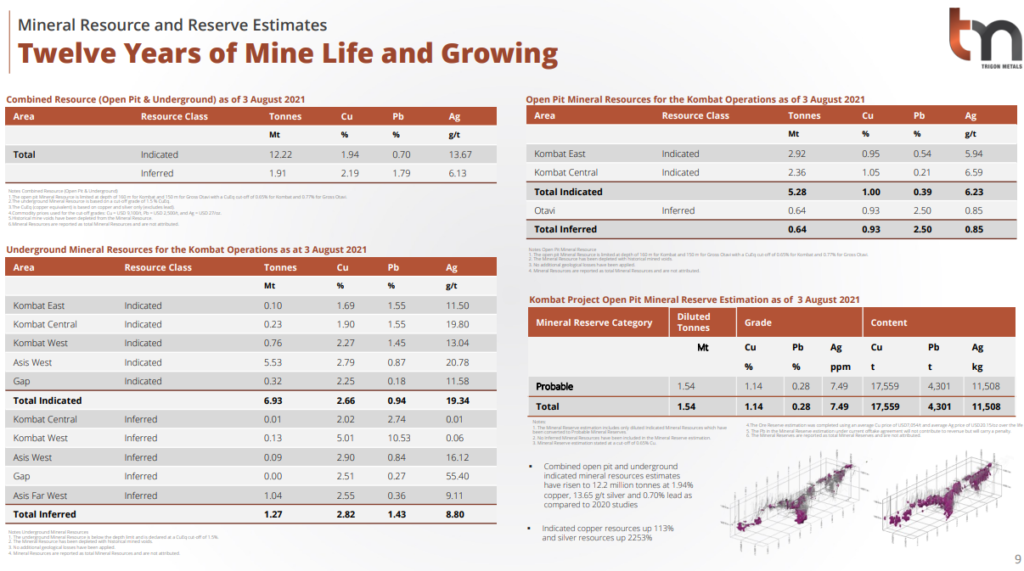

- A 14 Mt primary copper resource at the past producing Kombat mine in Namibia

- As a jurisdiction Namibia is ranked #2 in all of Africa on the “Policy Perception Index”

- 35 km of strike along the Kombat mine trend which includes multiple copper showings

- An exploration project in Morocco with confirmed copper/silver and significant blue sky potential

- Morocco as a jurisdiction is ranked #1 overall in Africa and #2 in the world on the “Policy Perception Index“

- Pathway to near term production from the Kombat mine with considerable growth potential

- The mine is fully permitted and has all the infrastructure in place

- >US$100 M of sunk costs:

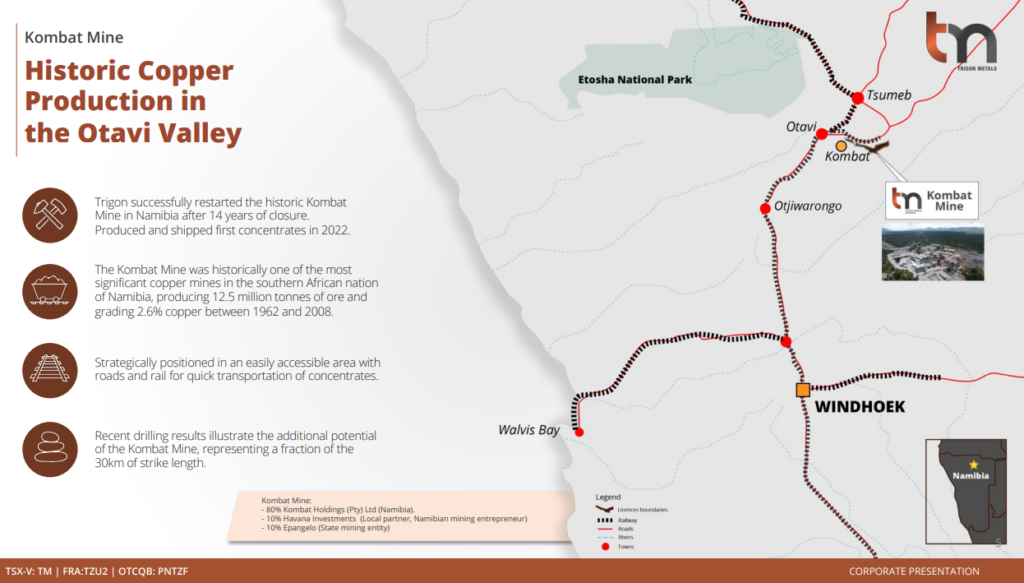

The mine has over USD $100 million worth of usable infrastructure in place. That includes a 1,100 tonne/day mill, an 800 m shaft with two other vertical shafts, extensive underground workings, tailings facility, ramp systems, mine buildings and concentrator. Its close proximity to the port of Walvis Bay and to one of only five commercial-grade smelters in Africa (located in the town of Tsumeb) is an additional benefit to the project.

All of the above is currently only C$10 M away from being given away for free. It would probably cost >>$200 M and take years of work to redo it all today if starting from scratch.

Two Shots at a multi bagger

As I see it Trigon is a very (extremely) cheap company which has two projects which either could deliver a multi-bagger if things go well. The company could succeed in bringing the “Kombat” copper mine back online and then rapidly ramp up production over the next couple of years. If successful then it could easily trade at multiples of what it is trading today. The company could also have success at the potentially very large copper/silver target called “Silver Hill” which is located in Morocco. Given the impressive early stage results coupled with the immense geophysical anomalies this could be a substantial price. If Silver Hill indeed delivers a major discovery, then who knows, maybe it could even manage to become a ten bagger.

If the company is both able to not only become a profitable copper producer (and ramp up production, as well as make a major discovery at Silver Hill then… Well you get the point.

For Trigon Metals to fail the company must be unsuccessful in ramping up the Kombat mine to positive and meaningful production and the Silver Hill project must fail to deliver anything substantial.

Scenarios

- #1 The Kombat copper mine successfully reaches production with a >10 year mine life

- Possibly up to $140 M of EBITDA per year by 2025 without the help of a rising copper price

- #2 The Silver Hill project becomes a major discovery

- Both #1 and #2 happens

- Neither #1 nor #2 happens (I lose money)

- … And as always the copper price might either help or hurt.

Risk/Reward

Lets say #1 would have a value of at least $500 M and #2 would also have a value of $500 M. The basic Market Cap is ~$32 M or C$16 M per project. One could then make a crude assumption that what is priced in, in terms of chance of success, is $16/$500 = 3.2% per project. Even if we cut both “blue sky” cases by 50%, to $250 M, we still only get a 6.4% chance of success priced in per project. If we go even more conservative one could say there is a $32/$250 = 12.8% chance priced in that at least one project delivers $250 M of value.

If we just assume a 20% chance of success for either of the projects to deliver $250 M in value the risk-adjusted value today comes out to $100 M. Compare that to the current Market Cap of $32.4 M and Enterprise Value of $7.4 M…

Signal Value

The reason why Trigon is so cashed up right now is because it forward sold stream on all the silver produced (4% of the mine’s revenue) from the Kombat mine to Sprott (50% can be rebought later). It is worth pointing out that Sprott is also a 20% shareholder. Anyway, streaming deals are made by bankers and bankers wouldn’t fork up tens of millions of dollars for metals that are still in the ground unless they believe there is a good chance that the metals will actually come out of the ground. So, either the bankers at Sprott are very wrong or the retail driven market is completely clueless right now. My bet is the latter and that is even before factoring in the value of the Silver Hill project in my opinion.

If the chance of success at the Kombat Mine alone is closer to 50% then I would say the company as a whole is extremely undervalued.

Bottom line

I think Mr Market is grossly mispricing Trigon Metals thanks to the current junior sentiment on top of the story being very much unknown still.

The highlights in the words of the company:

Now lets dig into the two flagship projects…

#1 “The Kombat Mine”

The Kombat Mine in Namibia has a long history of copper production that started in 1962 and lasted for 45 years. The mine was actually owned and operated by Goldfields once upon a time. Between 1962 and 2008 production totalled 12.5 million tonnes grading 2.6% copper. To know that this system has been successfully mined for many decades is very positive from a technical risk perspective. Unsurprisingly the mines has all the infrastructure in place already:

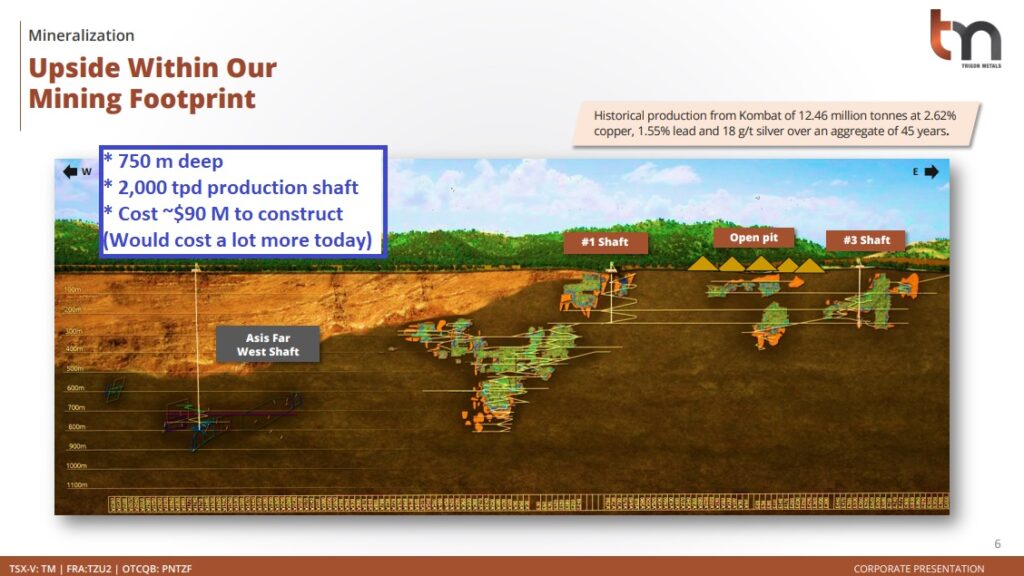

The current resource has mineralization both near surface, which will be mined by open pit, as well as deeper down for underground mining:

Interestingly the “Asis Far West Shaft” cost around $90 M to construct and would probably cost around 2.5X times more to construct today. On top of this you already have a 1,100 Tpd mill, more shafts and a lot of infrastructure simply because this was a past producing mine site. In essence Trigon is fortunate enough to have inherited sunk costs that would cost many times the current Market Cap to reconstruct today.

Nothing has been mined and a lot of known mineralization is yet to be defined at depth over at the Asis West Shaft area. This is also where the third phase of Trigon’s production growth at the Kombat mine is expected to come from.

The current total resource and reserve estimates shows #12 years of mine life and growing:

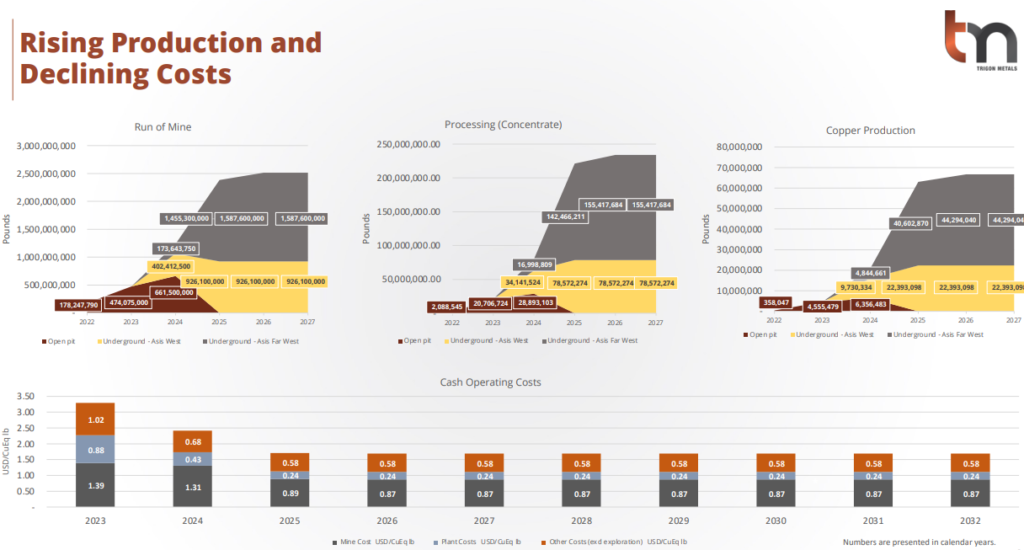

The plan is to grow production in three phases. For starters the plan is to open pit the resources located between shaft 1 and shaft 3. The next phase is to start mining underground as soon as next year and the final phase is underground mining at Asis Far West:

Importantly the company is expected to have all the cash it needs to reach “Underground Phase 1” already in hand.

Pathway to C$60 M of EBITDA per year and beyond

If things go according to plan then Trigon could be producing 30,000,000 pounds of copper as soon as next year. If/when Asis Far West is in full production by 2024/2025 the company could be producing close to 70,000,000 pounds of copper and the operating costs are expected to trend down as overall production scales up:

The CEO has stated that they expect to get $2 of EBITDA per pound of copper at around todays prices so there is certainly potential for very significant cash flow if theory translates to reality as $60 M of EBITDA (30 Mlbs X $2) could theoretically be hit next year and at 70 M pounds of production EBITDA could hit $140 M (70 Mlbs X $2). These are of course estimates but it shows just how cheap Trigon would be today if the base case plays out fairly well. Fluctuations in the price of copper could obviously increase or decrease these numbers as well.

Growth beyond the 12 year mine life

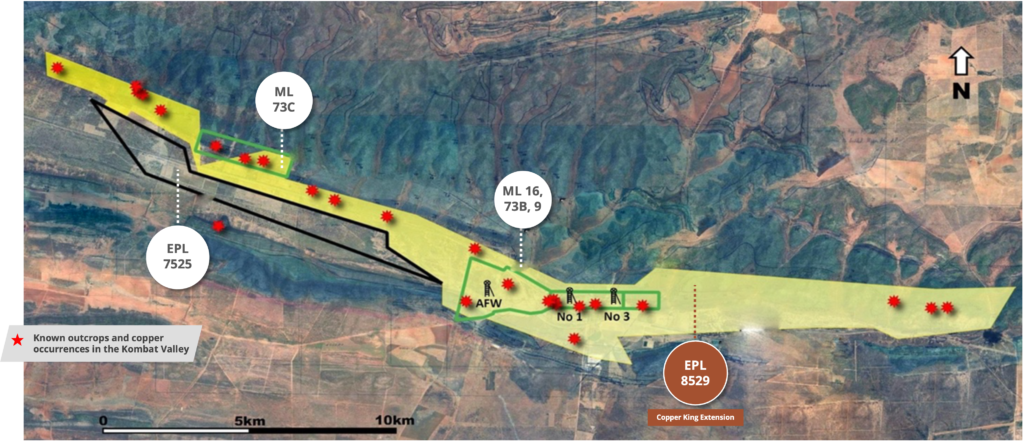

Trigon recently announced confirmation of the acquisition of the “Copper King Extension” which is the exclusive prospecting license “EPL 8529” in the slide below:

(Note the scale)

All in all the company now has 35 km of strike to work with alone the Kombat Mine trend and that includes two mining leases.

Some drilling highlights from the Kombat Mine project

- 4m @ 4.1% copper from 43m to 47m,

- And 4m @ 6.9% copper from 58m to 62m

- 17m @ 4.4% copper from 60m to 77m,

- And 3m @ 10.1% copper from 85m to 88m

- 4 m at 7.67 % copper and 10.73 g/t silver from 35.0 m

- 5 m at 3.98% copper and 8.7 g/t silver 44-49 m

- 17 m at 1.0% copper and 15.50 g/t silver 0-17 m

- 47 m at 1.20% copper and 5.35 g/t silver, from 28-75 m

Now lets move on to the second project which I think has the potential to, in time, be worth multiples of Trigon’s current Market Cap…

#2 “Silver Hill” – The blue sky exploration target

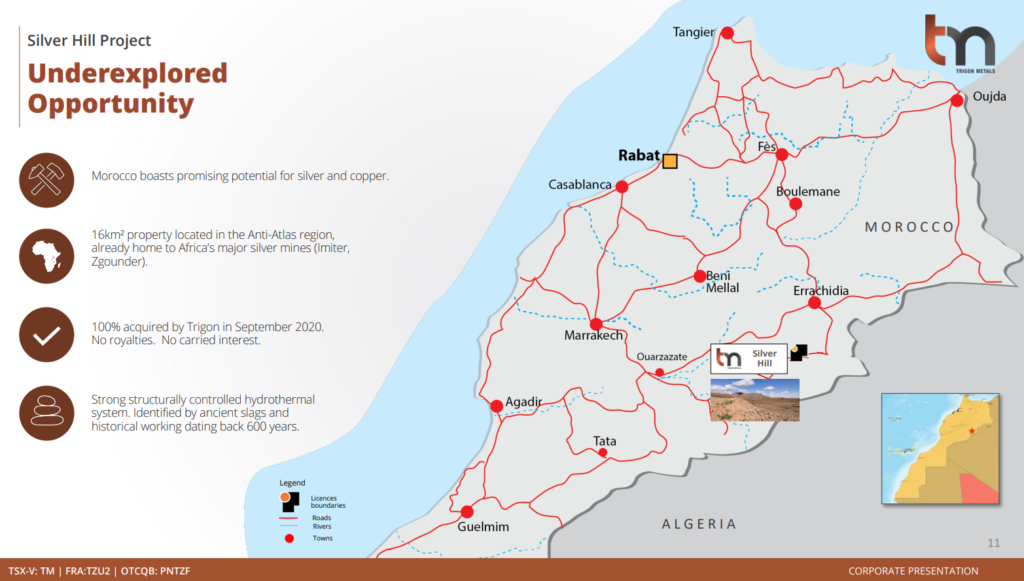

One could easily argue that Trigon is already very cheap in light of the possibility of becoming a copper producer in the next few months. What I think takes the Risk/Reward over the top however is the fact that the company has a potential Ace in the sleeve in the form of the “Silver Hill” project in Marocco. Even though Marocco might sound sketchy to some it is actually one of the better jurisdictions on earth. For example Aya Gold & Silver which is a Marocco focused junior producer recently closed an upsized $92 M financing and almost has a Market Cap of $1 B.

Location

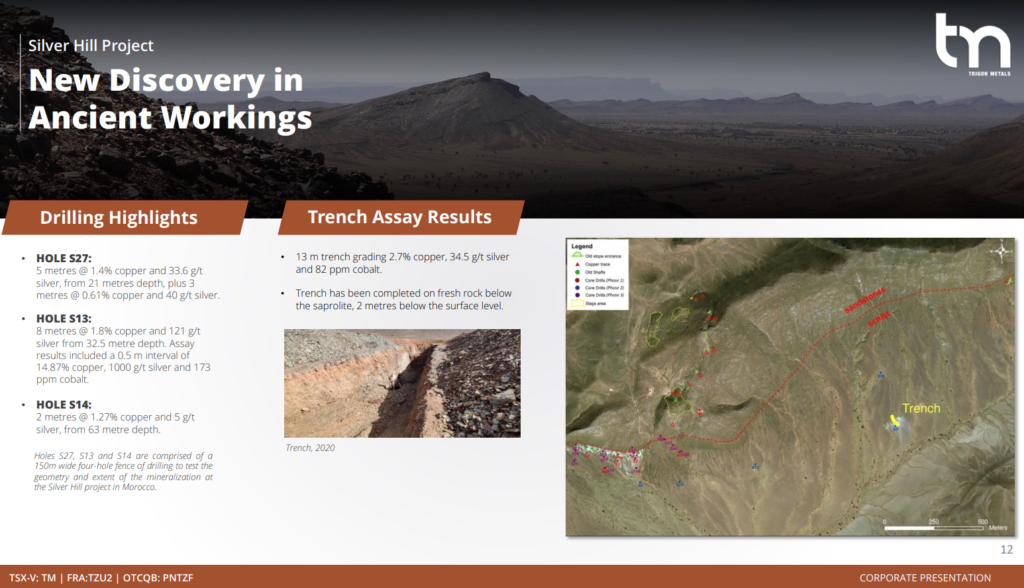

Interestingly Jed the CEO has stated that his impression is that shareholders are perhaps even more excited about this very large target in Marocco than they are about the advanced copper asset in Namibia. And why not? Some of the very limited, first pass results are as follows:

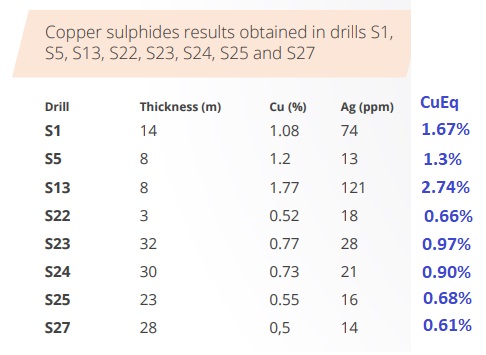

Other results include:

(CuEq added by me)

The important thing about these results are not the actual assays in a vacuum, but rather that the company was able to hit significant copper/silver mineralization, after just having drilled (blind) a bit over 2,000 m in total. As the Kenorland Discovery Study suggests even “decent” holes in early testing could be significant:

“If a company drill <4000m on an initial drill program and produces an intersect that is >50 GT, this could be very significant” – Source

Trigon hit a ~50 GT (AuEq) in Hole S23 after drilling way less than 4,000 m. Sure it’s not straight up gold but I think the point stands that these are very encouraging first pass results.

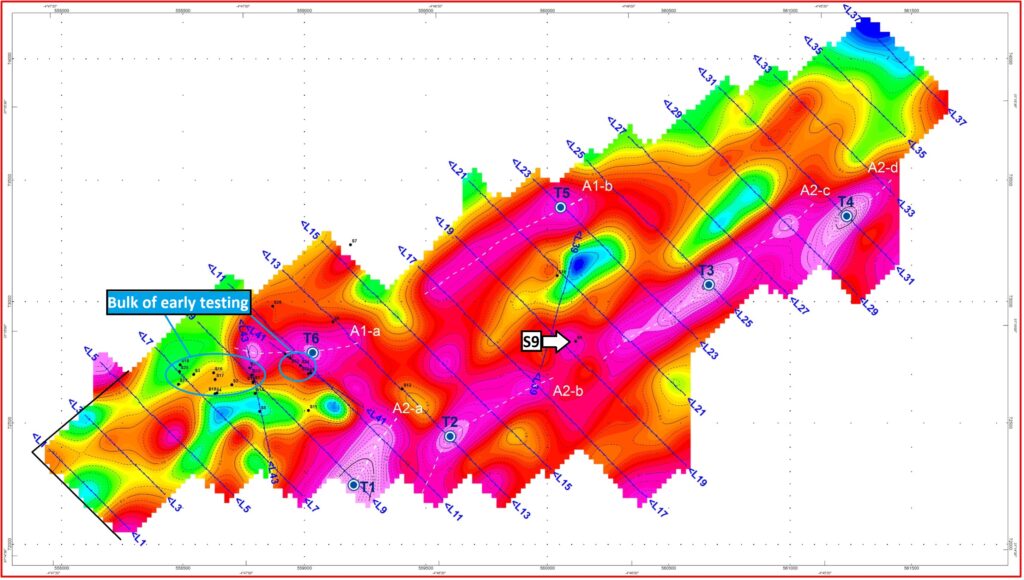

If that sounds encouraging then I think you might get really exciting when you take a look at the geophysics below and account for the fact that most of the drilling that has been done was done blind and before any geophysics were done…

Initial drilling targeted areas that showed evidence of historical mining, testing the strength of the mineralization in those areas. The program successfully identified copper and silver grades, with notable values for cobalt. The survey covers the areas of known mineralization providing signatures to compare to other areas of the property. Highly mineralized areas, defined by drilling or trenching, all had notable chargeability anomalies, and areas without mineralization coincided with areas of weak chargeability. However, the areas of drilled mineralization only accounted for two of the numerous chargeability anomalies and did not test any of the strongest anomalies, but comparatively weak anomalies near the surface. The survey identified two trends that run the full length of the property, increasing the scope of our target to two parallel trends with deep roots, beyond the two discrete zones that are visible at surface.

Jed Richardson, President and CEO, commented, “The survey shows that we have a very favorable position with two strong trends that run the full width of our 4 km claim area. That is even more exciting than the simple connection between the drilled discovery area and the mineralization highlighted by our first trench and hole S9 [THH: S9 (6.5m @ 1.29% and 3m @ 1.98% Cu or 21m @ 0.96% Cu) and from the trench (13m @ 2.7% Cu and 34ppm Ag)], we had hoped the survey would reveal. We now have a long list of promising targets to explore in the coming drill program and are looking forward to revealing the next generation potential of Trigon Metals.” – Source

The following slide shows he result of the geophysics survey which was done AFTER the drilling/trenching had been done already and I have highlighted Hole S9 as well as the two main areas that saw first pass testing via the drill bit:

“Silver Hill” project, Marocco

To sum up:

- Mineralized areas defined by either drilling or trenching correlated with chargeability anomoalies

- Areas without mineralization correlated with areas of low chargeability

- The strongest anomalies have not been tested and the anomalies that were tested were comparatively weak near surface

- The strong channel sample result as well as hole S9, which ran 0.96% Cu over 21 m, were located where the geophysiscs would suggest strong mineralization

Bottom line

This is a very big target with proven copper/silver and even cobalt mineralization.

To hit significant mineralization in first pass testing is encouraging. But it becomes even more encouraging when factoring the huge anomaly and the fact that A) Mineralization seems to line up with the geophysics and B) most holes were either drilled outside any strong anomalies or were too shallow for them to pierce the higher readings at depth.

“The anomaly that we are dealing with is now four kilometers long… a kilometer and a half wide… And we will be pushing to get some exploration there… And we think we have a project there that could ultimately compare or even be larger than what we are dealing with in Namibia…” – Source

Knowing that the chargeability seems to indeed correlate with mineralization the picture below could make anyone quite excited given the sheer scale of the anomaly.

Closing Thoughts

It does not take a rocket scientist to conclude that Trigon Metals is extremely cheap and a high torque bet on copper prices. The risk comes in the form of operational risk at the Kombat Mine (Will they be able to successfully put it back into production and grow)? The risk also comes in simple exploration risk in regards to the Silver Hill project (Is there a significant mineralized system there?). The reward side of things becomes pretty interesting at this valuation if the company is successful at either, or both, of the projects.

If things go well then Trigon Metals could possibly be producing cash flow in two years which would be multiples of the current Market Cap and have a significant copper/silver discovery in Morocco to boot.

I happen to be bullish on copper over the next ten years and if the people at Sprott are not completely clueless then Trigon Metals must be undervalued currently pretty much by default. Why? Because such a low chance of success is priced in and I doubt bankers would forward ~C$40 M to a company they believed had a very low chance of success in terms of paying back.

Blue sky potential in 2-3 years

Blue sky success is absolutely not a guarantee but we want to know what the Reward could potentially be…

- I own a copper producer which is on the way to produce ~70,000,000 pounds of copper per year

- I own a copper producer which also made a substantial copper/silver discovery at its second flagship project

- I was able to buy the above for C$32.4 M in Market Cap and ~C$7.4 M in Enterprise Value in 2023

If there is a 15% chance of the above happening while the copper price has not cratered I think Trigon Metals is just way too cheap right now.

Copper: Supply And Demand

Expected demand:

Supply: Where is the new supply…?

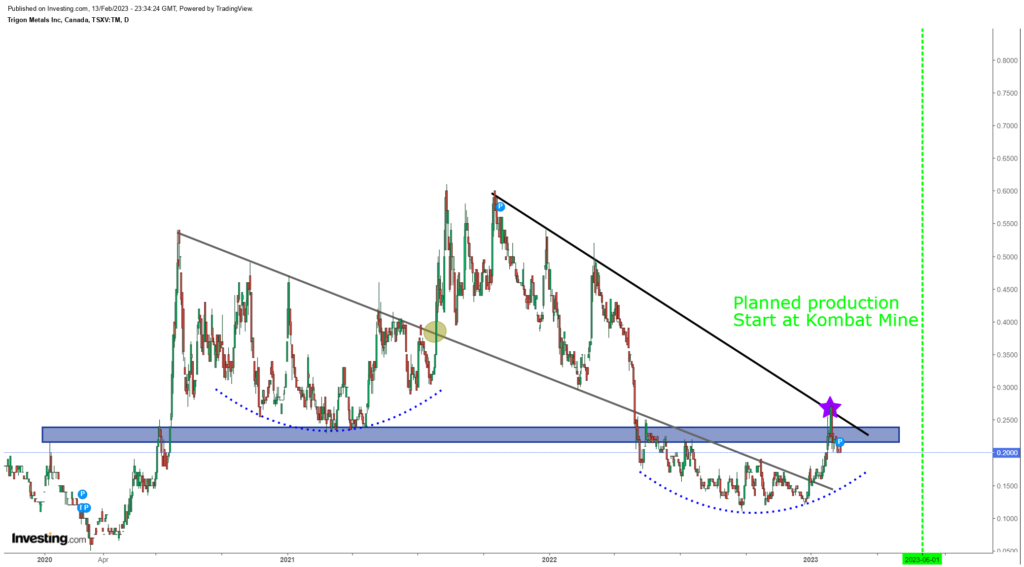

Amateur TA

As always junior stocks tend to be very volatile and almost everyone in this space is a trader of some sort. As a value investor in a poor sentiment environment I kind of like that fact. Why? Because I see traders as subsidizing value investors by respecting trend lines etc. You often see an undervalued junior start to revalue closer to fair value but then suddenly stop as some technical hurdle in a chart is reached. If there is not enough buying power the share price will make a short term top and head down to even cheaper levels. While this might be frustrating for many people it also means that a company can stay cheaper for longer. In other words value investors can get an even better opportunity than a totally rational market could provide.

Strict traders would of course no care about the Price to Value gap and would simply get in after lets say a break out has occurred. The value investor would instead be buying more the farther away a stock is from “breaking out” if no material fundamental change for the worse has taken place.

Note: This is not investment advice. I am not an investment advisor. I cannot guarantee the accuracy of the content in this article. Never invest money you cannot afford to lose. I own shares of Trigon Metals and the company is a banner sponsor. Thus assume I am biased and do your own due diligence. Juniors are risky. Assume I may buy or sell shares at any time without warning. I do not share your profits or your losses. You are responsible for your own decisions.

Best regards,

THH