THH – Novo: “I Didn’t Hear no Bell”

Given that success is the exception in the junior space I have seen countless juniors be unsuccessful with their flagship goal/project/target. Typically that results in a share price decline of -80% to -90%, and after that the company might be “dead money” for many years, if not forever. For better or for worse that is the nature of one of the highest risk/highest reward sectors around. Novo is a company which has probably gone through more than any other junior I can recall over the last >5 years. In this article I will discuss the junior sector overall, Novo’s journey so far, as well as my current of Novo right now. As always consider me biased since I own shares of the company and it is a banner sponsor. Do your own due diligence and form your own opinion!

Setting The Scene

Below is a chart of a grassroot explorer that I owned around 2019 which did a maiden drill campaign on their (only) flagship target which resulted in no discovery (the norm). This junior only had enough money for one drill campaign and when it missed the case was pretty much over for the foreseeable future:

It is not until today that this particular company has been able to find a new project that might have a shot of becoming something and it is trying to raise a bit of money. In other words it took this explorer several years to be able to potentially start from scratch again. The same goes for a lot of high risk/high reward stories that did not end up making a significant discovery.

Over the last 12-18 months we have also seen almost every junior gold developer who has been trying to get into production fail. With severe cost, labor and energy inflation in the wake of COVID it appears these past couple of years might have been one of the most unfortunate periods for any mining company to try on the big challenge of putting a mine into production Most of them are down >90% and a few of them even went bankrupt (-100%):

For the gold explorer there might be a couple years yet, if ever, that said story gets any meat on the bones. For the developer that story is over forever in this case.

Novo’s journey so far

- Exploration: Unconventional extremely nuggety conglomerate deposits

- We know they have a lot of gold but the technical challenges have proved unsurmountable so far

- Production: Unconventional nuggety deposit in Beaton’s Creek

- In a time when almost every conventional mine start up failed the challenge of an unconventional mine proved to be too much

- Exploration/Monetization: Conventional targets and monetization of different metals

- Primary focus: Gold

- Secondary focus: Monetizing different metals found in the ~10,000 km2 land package

So again, in most cases where the flagship exploration story of a junior fails (Always the norm) it will typically be many years, if ever, that a junior can regroup and have anything to be excited about again. When a developer fails to get a deposit into production (The norm last couple of years) it tends to lead to bankruptcy, or at least -90% returns, and then dead money for years to come.

There have been countless of juniors that have gone down >80% over the last seven years. I have owned countless myself at one point or another. The whole idea about a high risk/high reward sector is that few success stories are supposed to pay for the large amount of failures one will inevitably experience.

However I am personally not aware of a single junior that has had been able to suffer both scenarios and is still around to talk about it. Say what you will about Novo Resources but there are not many juniors out there that can even survive either of the two events described above. If they do it typically takes many years for them to have anything at all with some legit potential and for shareholders to be excited about.

Risk is the nature of this business and most juniors only get to scratch one “lottery ticket”. Well Novo has so far been able to scratch and lose twice while still being in the game and working on their third ticket which happens to include a lot of sub-tickets. It is like a hydra which has gotten two heads chopped off and instead of dying even more heads grow back. With that said we have to pay respect to Quinton’s early bet on New Found Gold which resulted in a ~$100 M windfall. If that bet was not made I think Novo might have gone under as per the vast majority of juniors would. It is bitter sweet to see New Found Gold make more and more discoveries, as Quinton thought they would, while not having Novo along for the ride anymore. BUT cutting off a leg to save the body of course made total sense at the time because otherwise I doubt Novo would still be a publicly traded stock.

Novo – Round Three

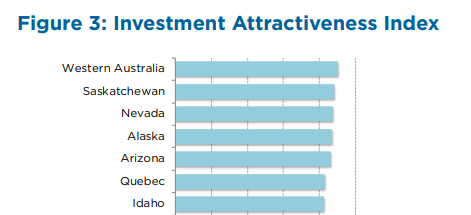

So Novo still controls one of the largest land packages of any junior and that is in Western Australia which has ranked top #3 in the world as a jurisdiction since as long as I can remember. As a matter of fact it was ranked #1 in the entire world on the “Investment Attractiveness Index” in the latest Fraser Institute report (Update: Now ranked #2 in the world as per the just released 2022 report):

Fraser Institute’s 2021 ranking

The funny part is that it has ranked so good for so long, which lead to a lot of mining activity in the region, that when COVID hit there was a huge issue of labor shortage. As a result salaries skyrocketed and Western Australian miners probably saw some of the highest inflationary pressures globally.

Anyway the point is that Western Australia is typically where any mining company would love to find a mineable deposit because odds are they get to keep it until the day the mine runs out. With that said there are obviously many more benefits from operating in a Western, English speaking country where the commodity business is enormous.

Today there just happens to be a looming shortage in most metals. COMEX is being drained of precious metals over the last couple of years and LME inventories recently hit “the lowest levels in at least 25 years”:

With the acceleration in EV’s and electrification there are a number of metals who are expected to see incredible demand growth over the next decade or two. There we have the problem of de-globalization and polarization of East vs West. Hence why the Western world, which typically imports a lot of its commodity needs, are scrambling to secure supply from friendly areas closer to home.

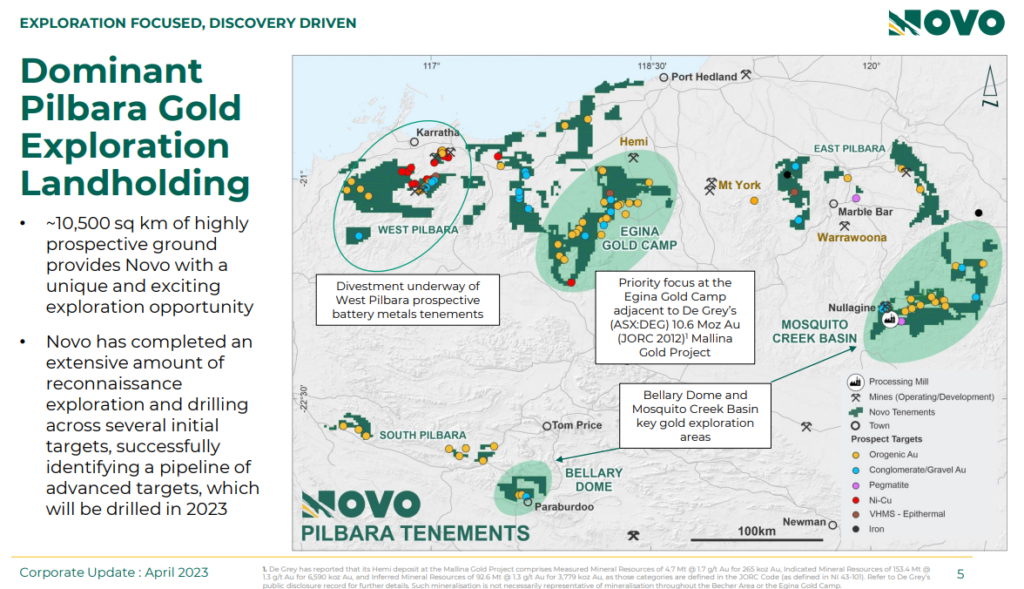

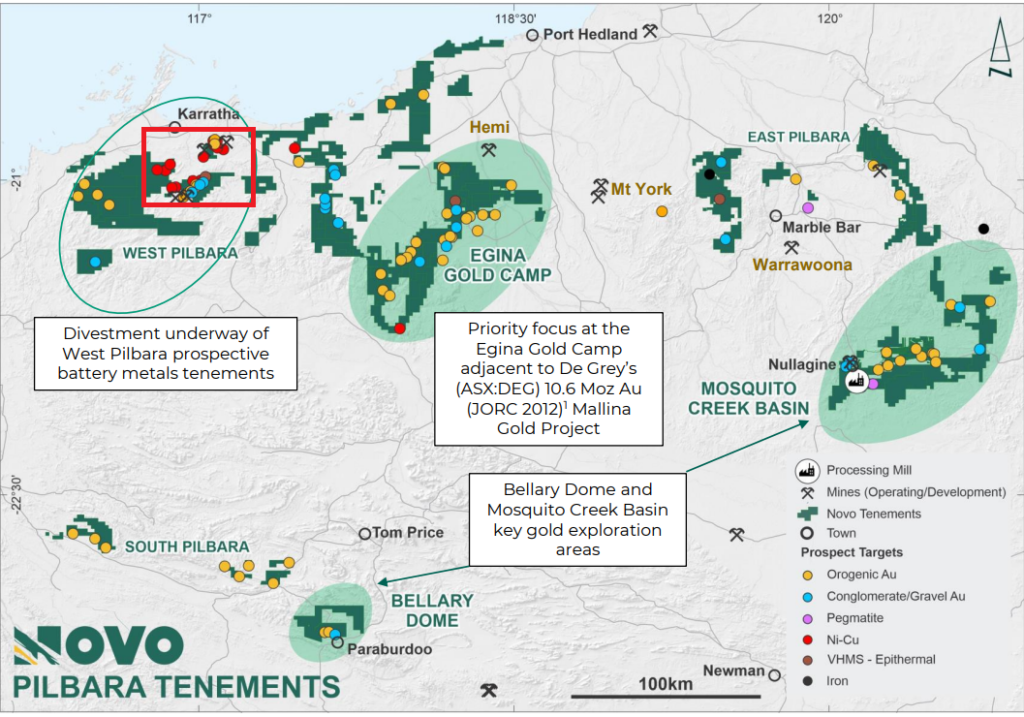

All of the above combined sure makes Novo’s ~10,000 km2 land package in the number #1 ranked jurisdiction in the world, which happens to be a Western Country, worth something for sure today:

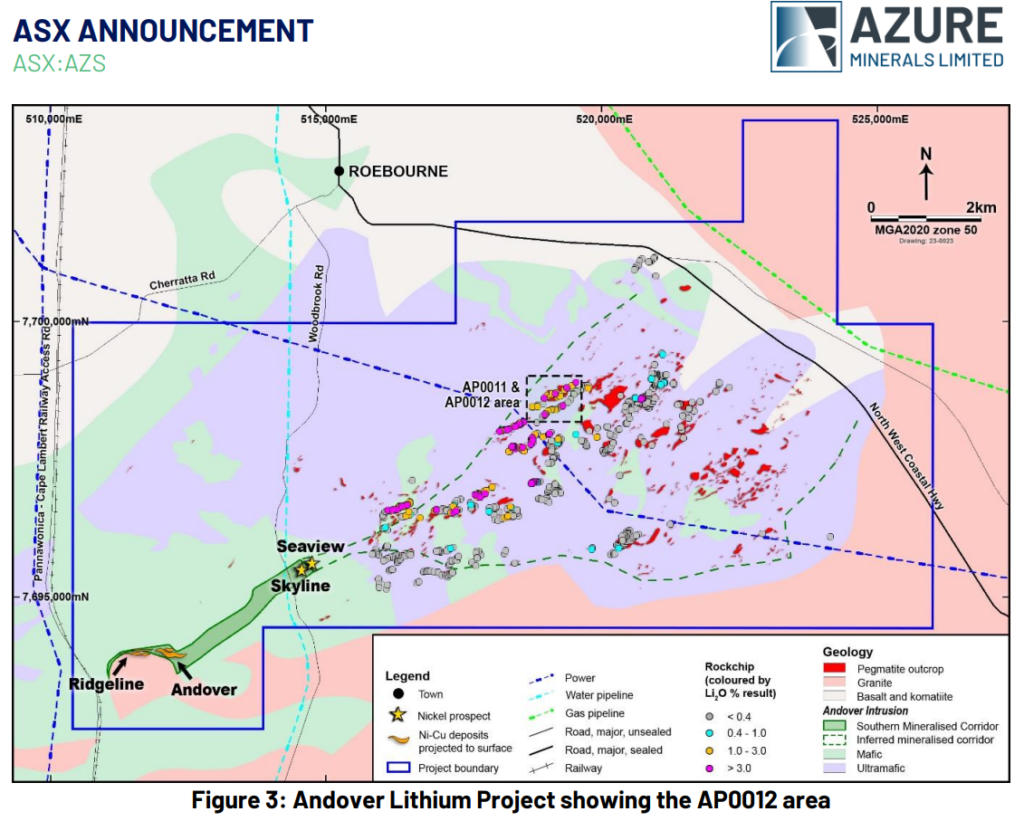

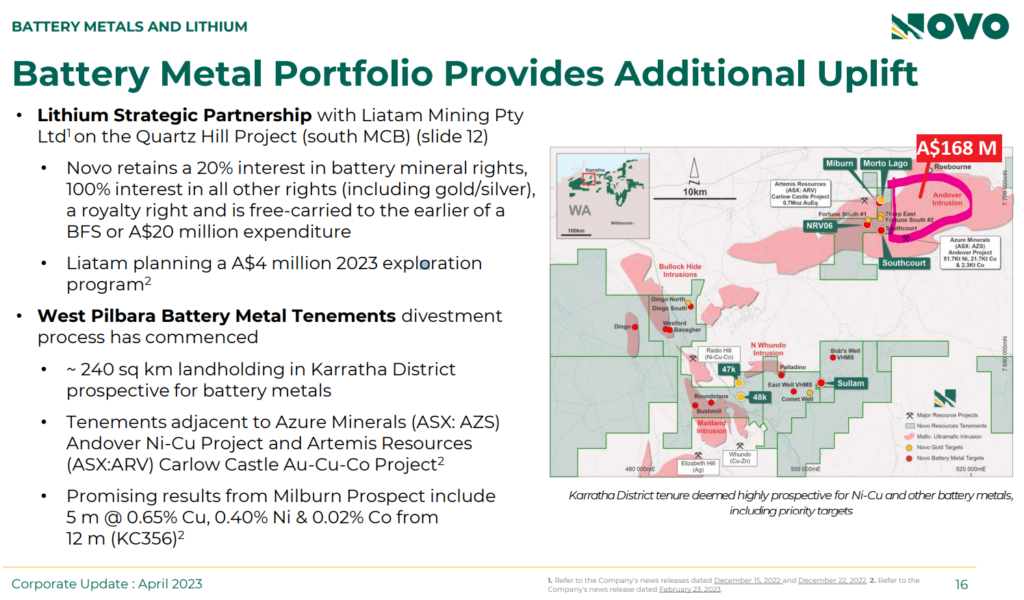

I see it as a large prospective mineral bank with options on many metals. Take Nickel, Copper, Cobalt & Lithium and other battery metals as an example. Azure Minerals (ASX:AZS) has run up to a market cap of A$168 M on the back of first discovery Nickel and very recently the company has been intersecting Spodumene rich Pegmatites (Lithium potential) at their flagship Andover project:

A$168 M from what is in that claim blook is not bad. Novo Resources has claims immediately to the west of what you see above as well as other claims with batter metal potential (including areas with mapped Mafic- Ultramafic intrusions):

(Azure Metal’s Andover project is approximately within the pink drawing that I added)

Note that what you see in the picture above (Shown in RED below) is only PART of Novo’s “West Pilbara” project hub:

… It kinda gives you a sense of scale and metal endowment potential within the entire Novo land package.

As can be read in a previous slide, from the April presentation, the company has commenced the process of divesting the “West Pilbara Battery Metal Tenements”. I do not know what any potential deals or sales will look like but I expect some value to be monetized here.

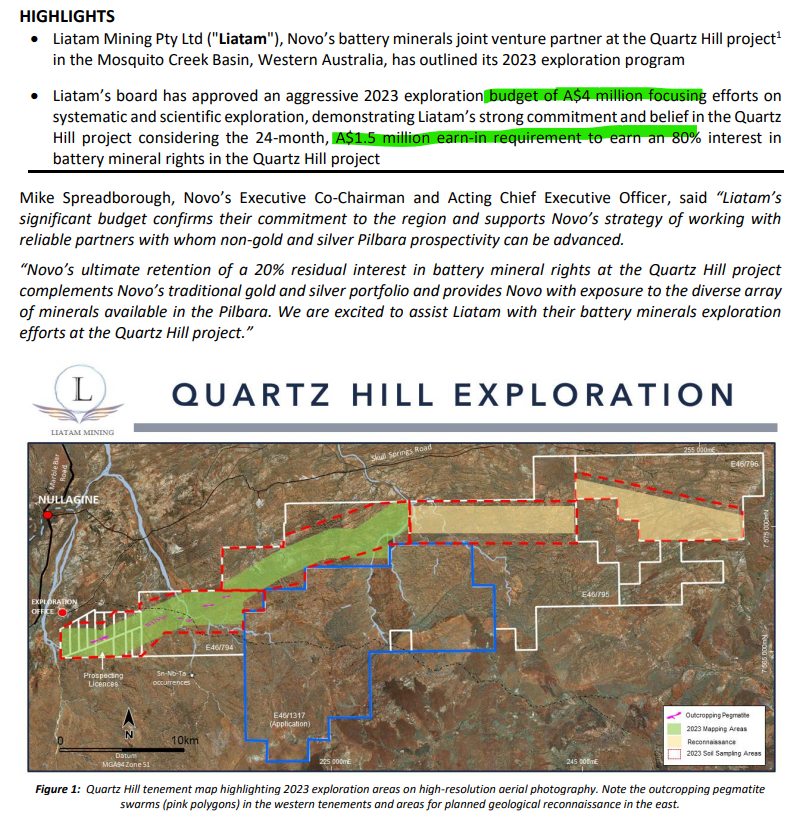

While on the topic of Battery Metals we recently learned that Liatam Mining PTY plans to spend $4 M on Lithium exploration within Novo’s Mosquito Creek Basin project hub:

What is noteworthy is of course the willingness to spend $4 for the rest of 2023 while the threshold for earning into 80% was “only” $1.5 M over 24 months. This is of course great signal value. On that note I think it is worth pointing out that Western Australia and the Pilbara Craton are the hot spots for the impressive Australian Lithium sector (aka this is not a “moose pasture” region but rather a highly prospective region with Archean aged rocks):

Now I do not know what value to put on the these two battery metal hubs for Novo but I like that Azure Minerals has been able to get a A$168 M Market Cap from their piece of ground and that Liatam is willingly overspending in the Mosquito Creek area.

Back to Novo’s Focus… Gold.

“Becher” Target Area

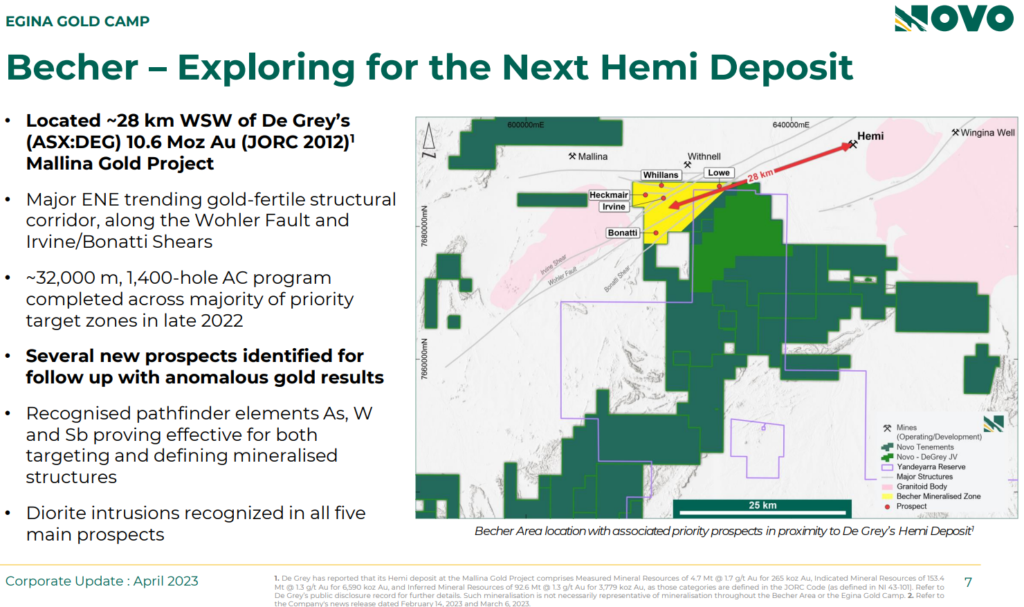

Novo still has a focus on gold. And there happens to be multiple high priority gold targets within the company’s enormous portfolio. What is perhaps the most exciting one right now is “Becher” which is part of the greater “Egina Gold Camp” project hub:

(“Becher” shown in Yellow)

What is exciting about Becher is of course the fact that it is located 28 km along strike from the massive ~10 Moz Hemi deposit(s) which was discovered by De Grey Mining a few years back…

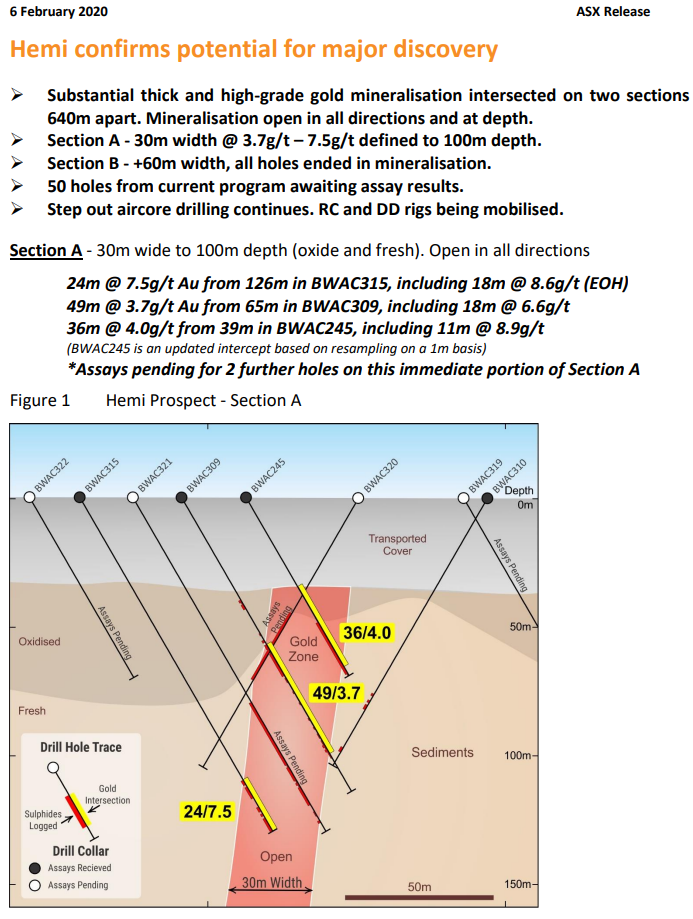

Much akin to Novo De Grey Mining had rocketed higher during the conglomerate gold rush. After sentiment peaked in late 2017 the share price of De Grey Mining proceeded to go down around -90% until it bottomed out it late 2019. However, everything changed just a couple of months later when the company announced a news release titled “Hemi confirms potential for major discovery”:

Those hits, as well as a few other ones, started one of the most relentless revaluations I have yet to see in the junior mining space. The share price of De Grey Mining proceeded to go up around 3,349% in just a little over 7 months:

Today, just about three years after the discovery the Market Cap of De Grey Mining sits at A$2.44 B and is now one of those rare legendary junior success stories. The fact that the stock first went down -90%, and all hope seemed lost, to then turn around and produce returns every junior investors dreams of makes it even more epic… “It ain’t over until the fat lady sings”. It is also worth noting that De Grey Mining had been exploring all over the Pilbara for years before it became one of the most prominent success stories of the last decade. In other words they took risks (drillng) over and over and over again until they were fortunate to have all that risk and capital spent pay off big time.

I know a few people who bought De Grey Mining near the bottom simply because they thought it was cheap. Well, the massive upside surprises tend to happen when you start off buying cheap.

Back to Becher

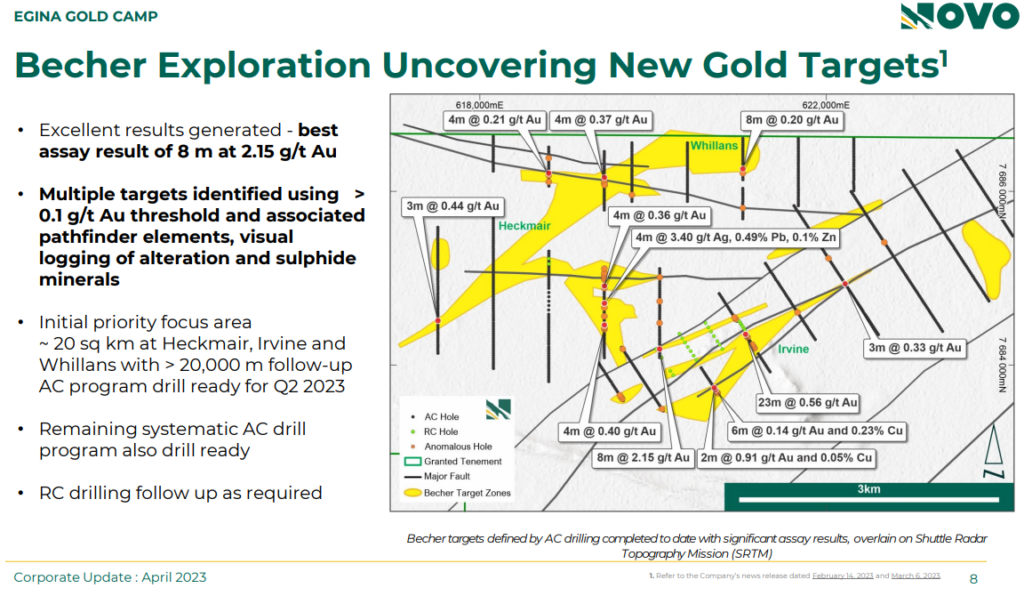

Novo is going the “air core” exploration route just like De Grey did. So far the air core drilling, which is like glorified soil sampling, has identified gold smoke at multiple areas:

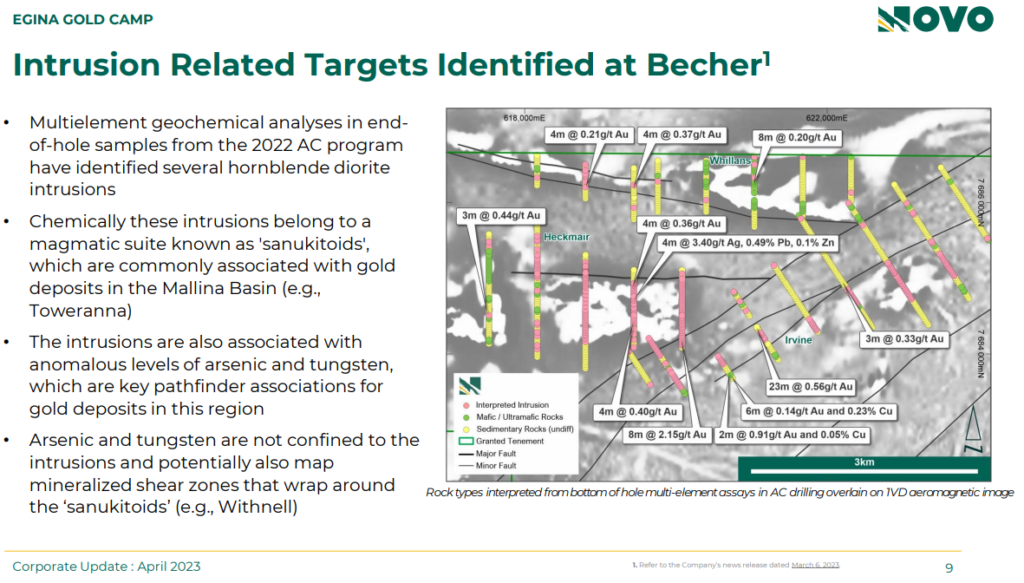

What is worth noting are the scales of the “Becher target zones”. The slide above might just be a small part of the greater “Egina” project hub but the theorized targets are typically kilometers long. The Hemi deposit(s) is related to “Sanukitoid” type intrusion as far as I understand and it appears that the Becher area is showing signs of these as well:

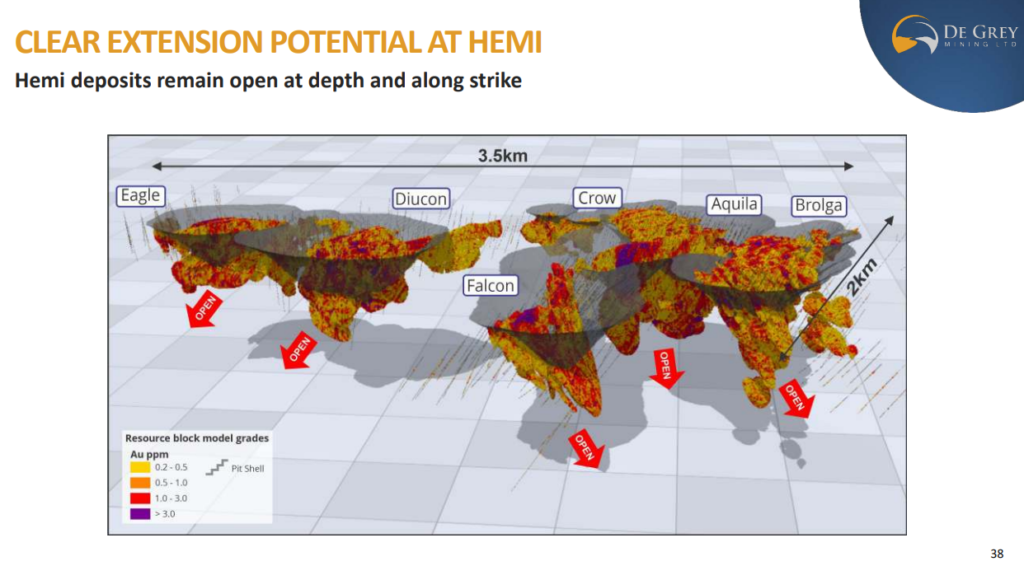

Suffice it to say that there could be a lot of drilling to do here, both more air core, as well as deeper (“real”) RC drilling. What the chance of success is to find another monster like Hemi I sure do not know. What we do know is that Novo is getting some pretty good results in the initial air core drilling campaign, the targets are large, and that there appears to be Sanukitoid intrusion in the area. One thing to note is that Hemi is made up of six actual deposits:

The Pre Feasibility Study suggests that the Hemi project has a NPV of $2.7 B and an impressive 41% IRR Post-Tax.

So my thinking is that around half a Hemi (lets say 3 smaller deposits) could be quite a significant find already, for a company like Novo with a Market Cap of ~$100 M, even if every other target in the portfolio lead to nothing. I also find it beneficial from a risk perspective that Hemi is not one large anomaly but rather a cluster of multiple deposits. I think this would increase the odds of Novo finding something in the area.

All in all I would say that the Becher area is probably the current flagship project given the proximity to a giant and the amount of, as well as scale of, the targets.

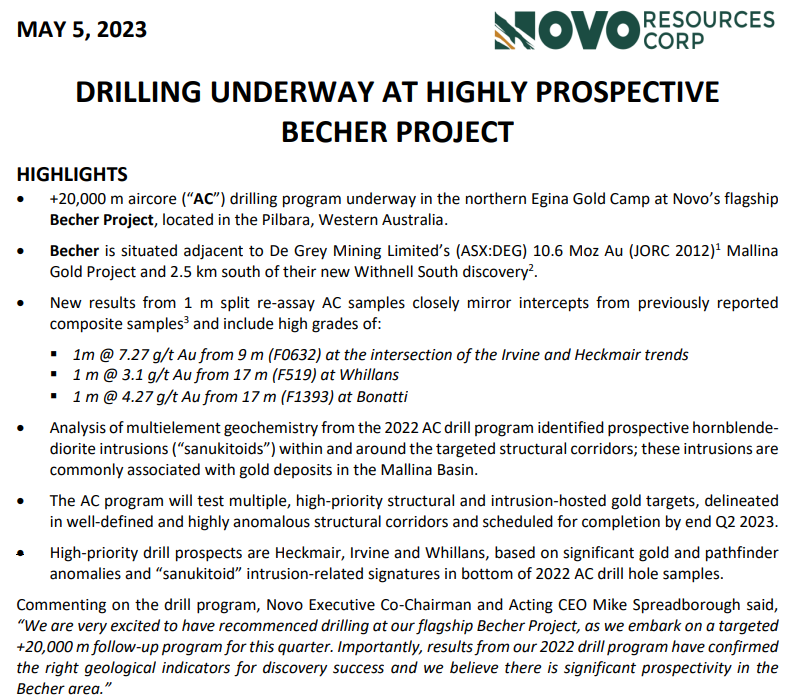

May 5 update: Drilling has just started again

Novo just announced (May 05) that drilling is now underway again at the Becher Project:

“Heckmair”, “Irvine” and “Whillans” are the high-priority targets and I look forward to see if the picture might have changed in a material way after the >20,000 m of air core drilling is completed.

A discovery akin to Hemi, or even half a Hemi, is far from a guarantee. All I know is that there is a lot of smoke and that the current Price is C$74 M (at $0.28/share) for all of Novo’s projects, assets, liabilities, cash and equity position.

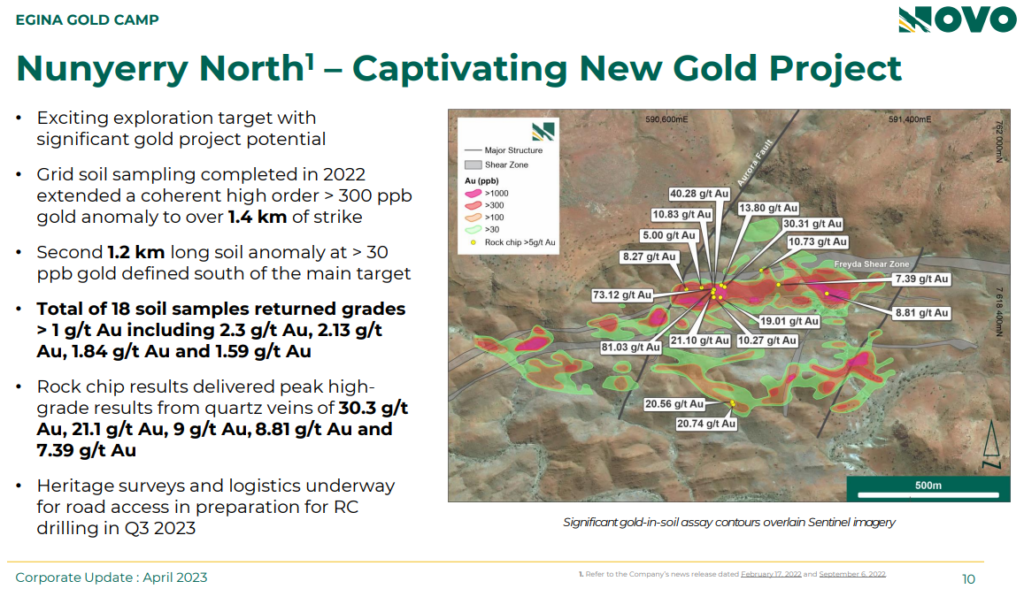

Nunyerry North

Next up we have a target called “Nunyerry North” which is also located within the greater “Egina” target hub:

The soil anomaly is quite robust and there is evidence of high-grade gold in quartz veins. Nunyerry North is scheduled to be drill in Q3 of this year. Could this turn into a significant discovery? No one knows but it is one of many bullets in the barrel.

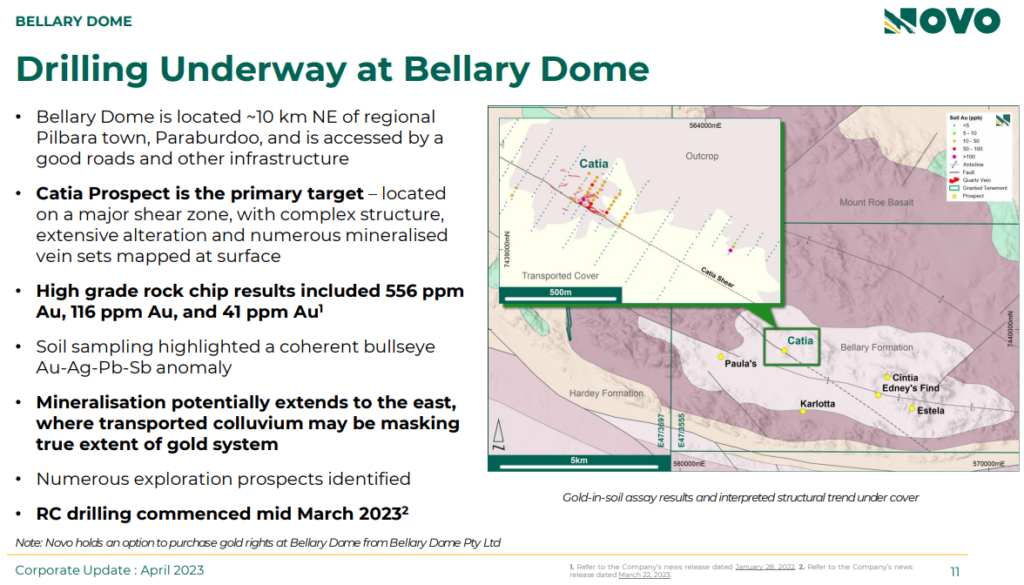

Bellary Dome

The Bellary Dome project is located in the south-western part of the Fortescue basin and contains several gold targets. The area has a lot of transported cover (overburden) but despite this the company has delineated an intriguing soil anomaly and assayed rock chip samples run up to 556 gpt Au:

Could this turn into a significant discovery? No one knows but it is yet another shot at it.

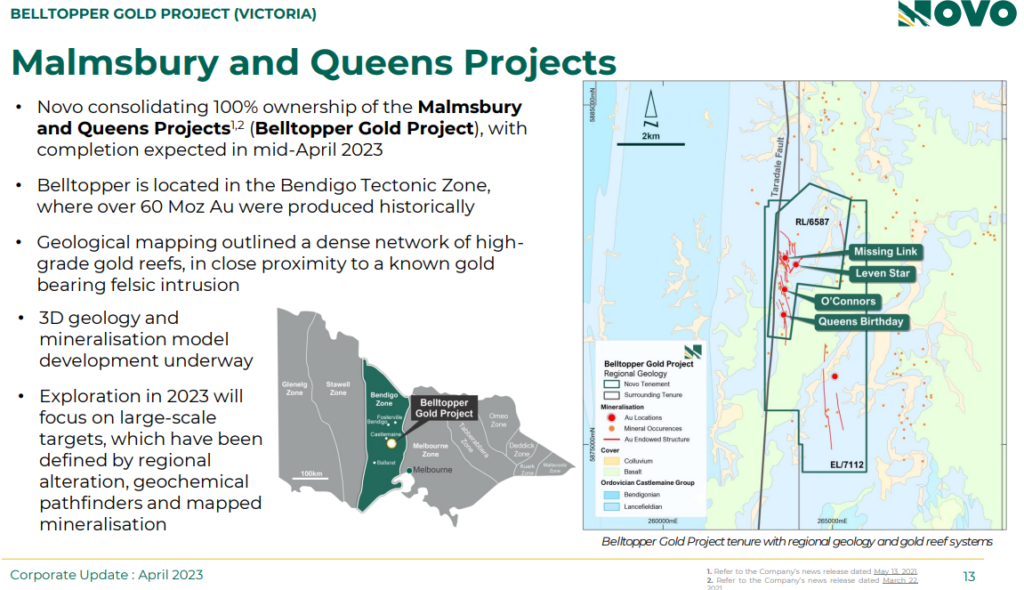

Malmsbury and Queens Projects (Belltopper)

As most will probably know Novo has consolidated the Malmsbury and Queens Project (aka the Belltopper gold project) which is located in the Bendigo Zone of Victoria, Australia. The very same belt where 60 Moz of gold has so far been produced which includes the Fosterville Gold Mine:

Similar to Fosterville this is an Epizonal Gold Target with confirmed high-grade gold. While tricky to find and delineate a potential bonanza zone the pay off can obviously be staggering. Will this be a company maker? Again, no one knows but it is yet another bullet.

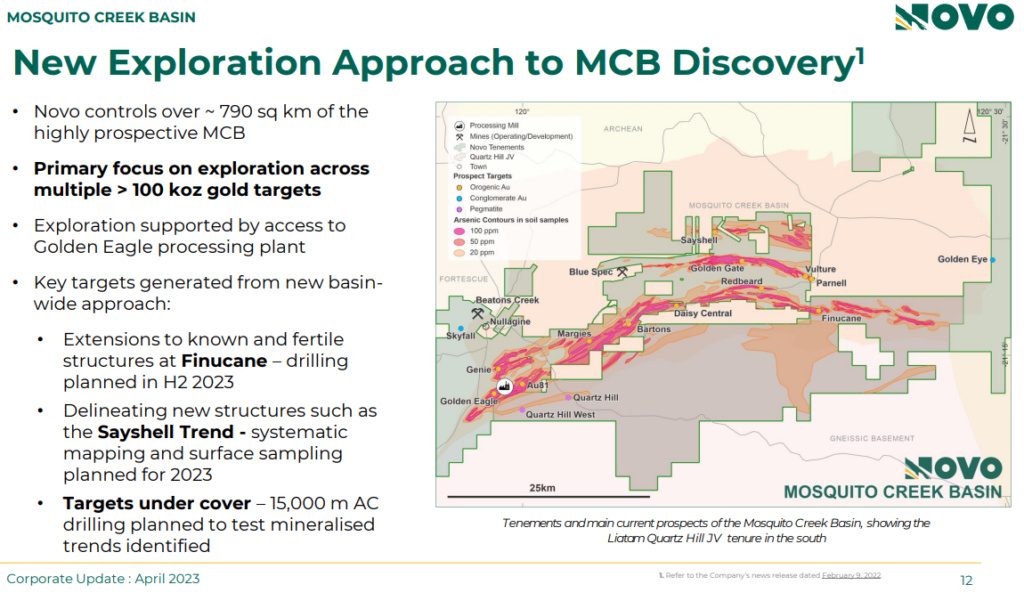

Mosquito Creek Basin

Novo controls over 790 km2 of the Mosquto Creek Basin which is where the Golden Eagle Plant is also located. There are several tens of kilometers of cumulative target trends in the area and of course having a functioning mill close by ought to lower the threshold for success:

What I think is the trick here is to find something of scale. Millennium which used to own the plant, as well as some of the land, mined from several smaller deposits. Now given the cost and labor inflation in Western Australia, I think one would need something quite “high margin” to even think about going back into production, at least at a time like this. But it wouldn’t hurt to find something for a time of lower costs and/or higher gold price of course. I therefore kind of see the MSB project and the mill as a potential high Beta bet on the price of gold.

In Summary Novo has:

- C$74 M in Market Capitalization

- ~C$30 M in cash as per last report

- But with a higher burn rate than most juniors

- ~C$20 M in equities

- A mill

- An absolutely immense land package with discovery potential for different commodities

- A JV with a Lithium company

- Countless exploration targets identified

Whereas most juniors would be dead and buried by now, Novo is not only alive, but have more irons in the fire than perhaps ever before (Several juniors worth of irons actually) along with quite a few assets (and liabilities).

I should note that I have had the pleasure of finally meeting Michael Spreadborough who is the Executive Co-Chairman of Novo today. As a Canada focused investor from the start I will admit that my knowledge of most Australian projects and industry people is lacking to say the least. However after hearing more about Michael’s background I was deeply impressed. If I recall correctly he had his first job as a mine manager at 26 years of age and became the mine manager of Olympic Dam (Legendary, giant mine still operating today under BHP) at around 33 years of age. I also ran across someone who used to work for none other that Robert Friedland who had positive things to say about Michael (who used to be Chief Operating Officer for Ivanhoe Australia). In short I consider the Executive Co-Chairman to be a highly (extremely) competent mining professional with a resume that few junior mining executives can match (Resume can be read HERE).

All in all I currently see Novo as a giant land bank, with varying degrees of exposure to multiple metals, in the #2 ranked jurisdiction in the world. But it is also an aggressive gold explorer with several identified targets within several (greater) project areas. I personally like the sound of controlling 10,000 km2 of ground going into a supply crunch in multiple metals and at a time where the West in particular is scrambling to secure supply from “friendly” countries.

The price for all of Novo is: ~$74 M at $0.28/share.

Closing Thoughts

First of all, regaining the market’s confidence at a time when sector sentiment overall is very poor (risk off), is not an easy task. Secondly I think the market is unsure of what Novo is. We know the story has gone from high risk/high reward, unconventional conglomerate exploration, to a development story (Beaton’s Creek), and now it is more like a regional scale, conventional exploration story. Each type of story attracts a certain type of investors.

I personally think Novo is very cheap right now (which I have also thought many times before) and that the market is pricing in no real chance of success in terms of finding anything of significance, at any target, across the entire project portfolio. We know what the Price is, where it has been, but not where it is going to be.

Novo will probably be very busy this year and if we are lucky we will see some significant exploration results that will make the current price look cheap in hind sight:

My hopes is that before 2023 is over there will be a clear clear flagship project that also has meat on the bones. Ideally it would be in the form of some kind of Hemi type discovery. I also hope that the some of the battery metals targets have been monetized and that the lithium JV is bearing fruit. Can I guarantee that any or all of that will happen? No. I can only pretty much guarantee that is is not priced in at the moment. Oh and fore better or for worse it is now around the same Market Cap as it was when I first bought shares of the company in 2017. That first netted me a paper return of >1,000% and after that >90% loss on paper from the highs. Here’s hoping to a new surprise to the upside in 2023!

Finally I would say that I consider Novo as a diversified, but still high risk/high reward, exploration story on balance.

Note: I am biased as I own shares of Novo Resources and it is a banner sponsor of my site. Juniors are high risk investments. Never invest money you cannot afford to lose. Do your own due diligence and form your own opinion. This is not investment advice.

Best regards,

The Hedgeless Horseman

Nice summary @HHorseman! So you get all of the above, plus, at no extra charge, the riddle of Comet Well and Purdy’s Reward, the mystery of the sorters and the vast, ultimate Witts 2.0 prize. This original lottery ticket has not been destroyed to my knowledge, but instead placed in storage. Last I looked, Bob has yet to change the title of his book!

Thanks CK! The only hurdle for a long dated call option on the conglomerate fields would be the holding costs for land. I do not doubt there are tens or hundreds of Moz of gold across the different conglomerate horizons but so far it has, as you know, proven too difficult to monetize. Will it some day? Maybe parts of it at least. However, until then I think Novo is taking the best course of action because we cant wait forever.

The title is: “What Became of the Crow? The Inside Story of the Greatest Gold Discovery in History” by Bob Moriarity

Well if I didn’t sell at $7, I sure ain’t selling at 30 cents. It would be sweet if Novo can come back like DeGrey. Every dog has his day…

With all that land maybe they could farm it out and take royalties on discoveries made by others. They will be totally out of cash at their burn rate in a few quarters and then what? Just an idea.

That’s the biggest risk – running out of cash and re-starting the engines of the dilution train again. They took too long to sell their NFG stake, but finally pulled the trigger, however that windfall is starting to dry up with no real land monetization on the horizon. So yes they have a lot of land/prospects, a mill, an apparently good CEO, and a little cash, but the sky is still dark because they placed their big bet on generating sustainable cash flow from Beaton’s to fund all this exploration which failed. It was a huge blow – and probably would have been fatal already if not for the NFG windfall which is buying them a little more time (for now). If they don’t announce a major find this year to lower their cost of capital, or get production going with the Beaton’s fresh material, then it most likely is game over.

These regions of the Pilbara will likely be mined over time, but whether Novo in its current form is the one that will do the mining is the question.