A Bit More Color: Eskay Mining & NuLegacy Gold

Yesterday I discussed Eskay Mining and NuLegacy Gold with Cory Fleck on Kereport.com which can be accessed HERE. Anyway, I got a bit inspired to explain my case on both in a bit more detail and

Why I like Eskay Mining at C$151 M

- The Team

- The Team’s ability to figure out the geology and delineate multiple targets in a hurry

- Eskay Creek with 1 km of strike would probably be worth over $4 B today

- The (much) lower grade remnants at Eskay Creek is worth around $1 B today

- The sheer amount of targets

- If you have 10+ probable VMS systems you only need to get lucky once

Since I do like to use math and probabilities due to my poker background I usually do crude Expected Value calculations in order to identify if I think there is an opportunity or not based on math (probabilities). While a lot of people seem to focus on wanting the “sure thing” I am not afraid to take on a lot of UNCERTAINTY if the odds are good. Note that UNCERTAINTY and RISK are not the same things. RISK is pretty much paying for something that ends up not being true and UNCERTAINTY is just that… Uncertainty.

Expected Value

First of all lets assume that success at any of the VMS targets would be worth C$1 B. This is very low compared to the value of Eskay Creek (C$4 B + C$1 B) but lets be conservative since there will be dilution etc to prove up an Eskay Creek deposit and/or test all targets even though it might “only” need to be 1 km in strike length and have very concentrated value.

In other words: The Prize = C$1 B (Akin to the remnants of the Eskay Creek deposit as evidenced by Skeena Resources)

Then we need to consider the amount of chances to “win” said prize. We know JEFF/TV might be a single huge VMS system but lets assume that success at TV would be worth C$1 B and success at Jeff would be worth C$1 B. Then we have a total of 7 targets in the central part of Eskay Mining’s 56,000 ha land package. In the southern part of the land package we have prospects such as TET, Cumberland, Spearhead, Red Lighting and C10. These are all pretty much believed or confirmed to be VMS systems as well. Anyway, lets round it out and lets say that there are 10 VMS systems within the central and southern parts of Eskay’s land package.

In other words: “Amount of hands”: 10

Now lets just assume that 10 targets will be drill tested which means that it’s a long term case since Eskay Mining can’t test all 10 during the next field season. This is of course a bit optimistic since it might be hard to see the 10th target being tested if 9 would somehow end up as duds. But at the same time there is already mineralization, and quite good mineralization, already confirmed in some of these. Anyway, lets just assume that at least 10 “hands” will be “played”.

Scenario 1:

- Lets say there is only a 5% for each target to be a success worth C$1 B (again, very conservative in light of Eskay Creek).

- Lets say that one and ONLY one success could be discovered among the 10 targets (obviously conservative since all 10 could theoretically be successes)

What is the Expected Value of Eskay Creek if there is a 5% success rate and ONLY one success could possibly be discovered?

In that case the worst case scenario (finding NOTHING worth anything) across 10 targets would have a 60% chance of happening. Thus it means that there would be a 40% chance of AT LEAST one success being discovered worth C$1 B. By extension it would mean that…

Expected Value For Eskay Mining is then minimum: 0.40 * C$1 B = C$400 M

If one would just add the EV of each target then that would instead amount to: (1-0.95) * C$1 B * 10 = C$500 M

… Compare this to your average junior which might have lets say two targets, where the blue sky potential is lets say C$300, to keep it a bit conservative. If the chance of success is 5% in their case as well then the chance of total failure is 90% and the Expected Value would be C$30 M in total.

Scenario 2:

- Lets say there is a 5% for each target to be a success worth C$1 B (again, very conservative in light of Eskay Creek).

- Lets say that there is a 15% chance instead for Jeff and TV to be worth C$1 B respectively

Then the worst case scenario has a 48% chance of happening which means that there is a 52% chance of at LEAST one C$1 B deposit being found… By extension it would mean that…

Expected Value For Eskay Mining is then minimum: 0.52 * C$1 B = C$520 M

If one would just add the EV of each target then that would instead amount to: (0.15 * C$1 B * 2) + ((1-0.95) * C$1 B * 8) = C$700 M

If one instead assume that TV/Jeff has a 20% chance of being worth C$3 B together then the Expected Value jumps to: (0.20 * C$3 B) + ((1-0.95) * C$1 B * 8) = C$1 B

Consider This:

Eskay’s current Market Cap is C$150 M and that is supposed to crudely capture the Expected Value for all 10 targets. If the “success value” for one new Eskay Creek is C$4 B then Eskay Mining is crudely pricing in a 3.75% of such a deposit (Obs! On an undiluted basis!). But if we have ten targets then that percentage must be split 10 times which means that the current Market Cap could be said to be pricing in a chance of success per target of 0.375%.

… Do you think these guys would even get up in the morning if they believed the odds were that low?

Bottom Line

When it comes to Expected Value the AMOUNT of targets and potential PRIZE per target influences the mathematical value a lot. If this was a run of the mill VMS district then it would affect the value a lot. If Eskay Mining only had lets say two targets then that would greatly affect the value as well.

Thus it is this unique combination of;

- World Class Team (Increases the odds of success per target)

- Jurisdiction (Success here is worth a lot)

- Quantity: Amount of targets (only need to get “lucky” once and we might have 10+ shots)

- Quality: Theoretical prize (Having the best precious metal VMS system in the world should mean that there is potential for VMS systems with considerable value)

- Note: Being able to participate in a private placement with warrants further skews the prize on an individual level

… All factors affect the Expected Value since People/Team affects the chance of success, jurisdictions affects the value of success, quantity affects the number of hands/diversification and quality affects the value of success.

Closing Thoughts

While most of my fellow investors seem to be focused on certainty in an uncertain world, while confusing uncertainty and risk, I try to have a more mathematical approach to investing. Don’t get me wrong, margin of safety is a very important thing but when the market leaves too much money on the table because it has difficulty accounting for number of targets and Expected Value based on mathematics then I must pounce. In other words there simply are some stories that might not have margin of safety but so much “success diversification” that the result is rather similar. Years ago I was forced to make a living playing the odds and I’m not about to stop now. Especially since few seem to be aware of the concept of Expected Value and having a bit of a math based approach to this risky sector. I guess that is why my portfolio looks very different compared to most on MinTwit for example.

On a long term investment horizon I could argue that Eskay Mining is worth at least C$400 M. I say long term because in order for the target diversification to work (for the math to make sense) one can’t bet on a single drill campaign or target. This is an easy concept to grasp because if the chance of success for a given target is 5% (I think it’s much higher at TV/Jeff) then the chance of success is just that if the holding period is one one drill campaign/target. It’s the chance of no success after for example 10 targets being tested that is much less.

When we get the results of the first 23 holes at TV/Jeff then it will affect the chance of success and the theoretical prize for the TV/Jeff system(s). Personally I think there is a good chance that TV/Jeff will blow Skeena Resource’s “Eskay remnants” away and that would mean a forward looking NPV of way above C$1 B. And with Eskay Mining pricing in around a 15% chance of TV/Jeff being worth C$1 B, or 7.5% of TV/Jeff being worth C$2 B, with say 8 targets left to test then I think you understand my bullishness. Personally I think the chance is higher than 15% that TV/Jeff is a full blown success and in that case Eskay Mining is really cheap today from a long term HODL perspective which accounts for the other 8+ targets.

Why I Like NuLegacy Gold at C$92 M

The case for NuLegacy Gold is very different than the case for Eskay Mining for a couple of reasons:

- NuLegacy has pretty much one big prize or system

- NuLegacy’s prize is theoretically much larger than even a brand new Eskay Creek deposit

At face value NuLegacy will look expensive given that it has a Market Cap of C$90 M and especially so when compared to your run of the mill junior explorer. However, there are a couple of things to keep in mind with this case. Firstly, the prize is order of magnitudes larger than what your average C$20 Market Cap junior has:

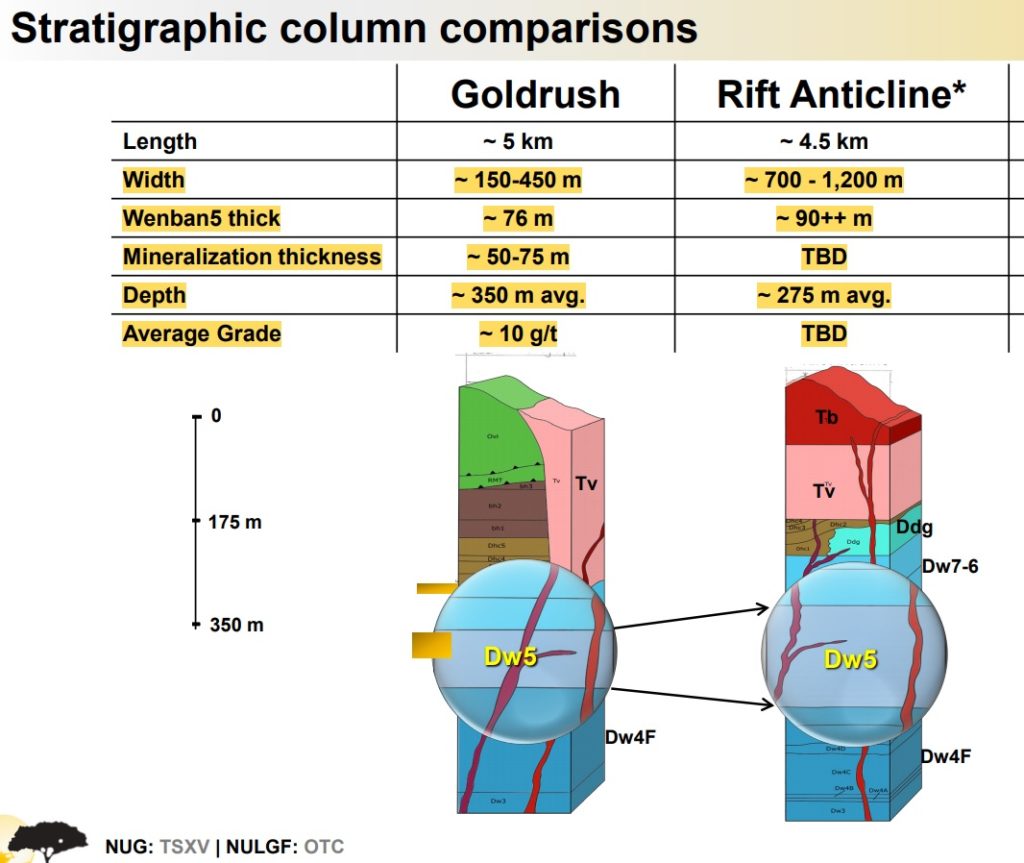

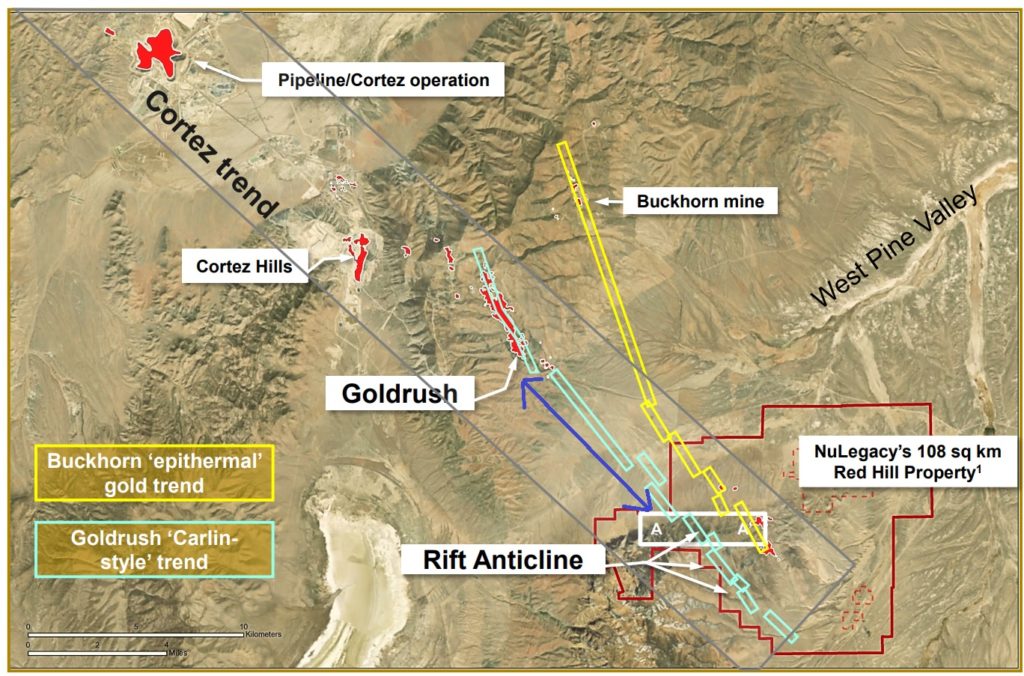

… According to the slide above the theoretical blue sky potential in terms of sheer volume is higher than the 10+ Moz Goldrush mine that is right next door. As a matter of fact Quinton has stated that NuLegacy’s “Rift Anticline” target;

“… Reminds me, or anyone who has worked in Nevada, of the cross-sectional view of what you see at Post-Betze”

Watch this clip for a few minutes and listen yourselves:

I

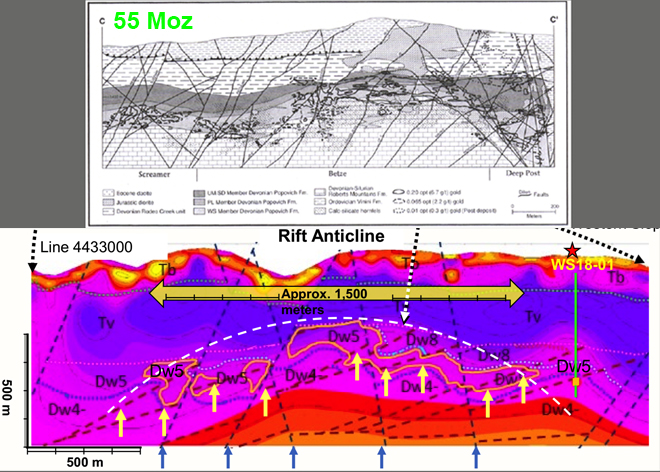

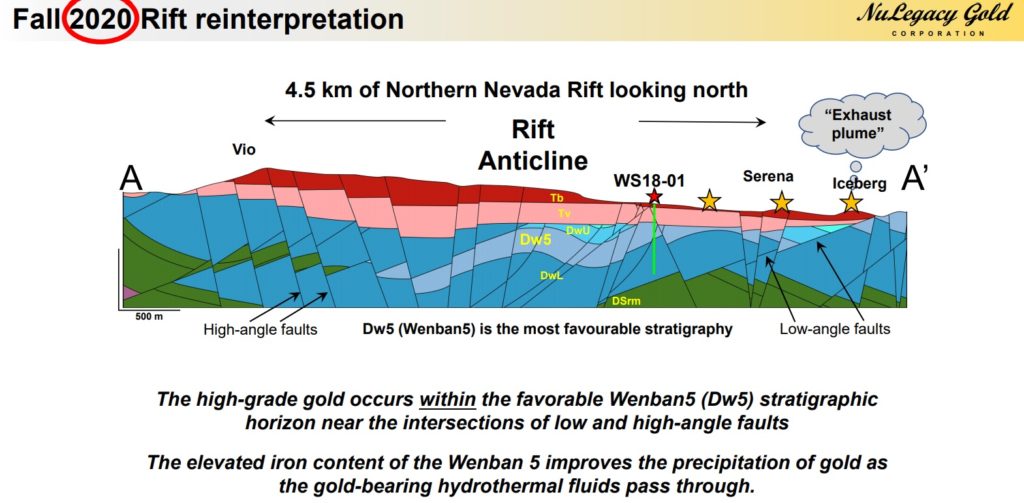

t’s this “up warp” feature he is describing which is also present at Post-Betze:

… And as you can see in the slide above I think Post-Betze was the biggest Nevada behemoth that has ever been found at a whopping 55 Moz…

Thus one must ask oneself what the prize of all prizes in the heart of Nevada would be worth?

- C$10 B?

- >C$20 B?

- What would even 10% of that be worth etc?

Anyway, the key thing is that this might be the single largest blue sky gold target that will be drilled this year. NuLegacy is currently drilling five deep holes as a first test and I have no idea when we could expect “visual” assays and/or actual assays. There is certainly no guarantee that it will be the monster that we all hope or even 10% of that. Furthermore there is no guarantee that they will one or more barn burner holes on the first tries even if there actually is something big hiding in the area. With that said, lets look at some simple examples of what might be priced in:

With a Market Cap of C$92 M one could argue that there is a;

- 9.2% chance priced in of NuLegacy finding something worth C$1 B

- 4.6% chance priced in of NuLegacy finding something worth C$2 B

- 2.3% chance priced in of NuLegacy finding something worth C$4 B

- 1.15% chance priced in of NuLegacy finding something worth C$8 B

- 0.92% chance priced in of NuLegacy finding something worth C$10 B

- Etc.

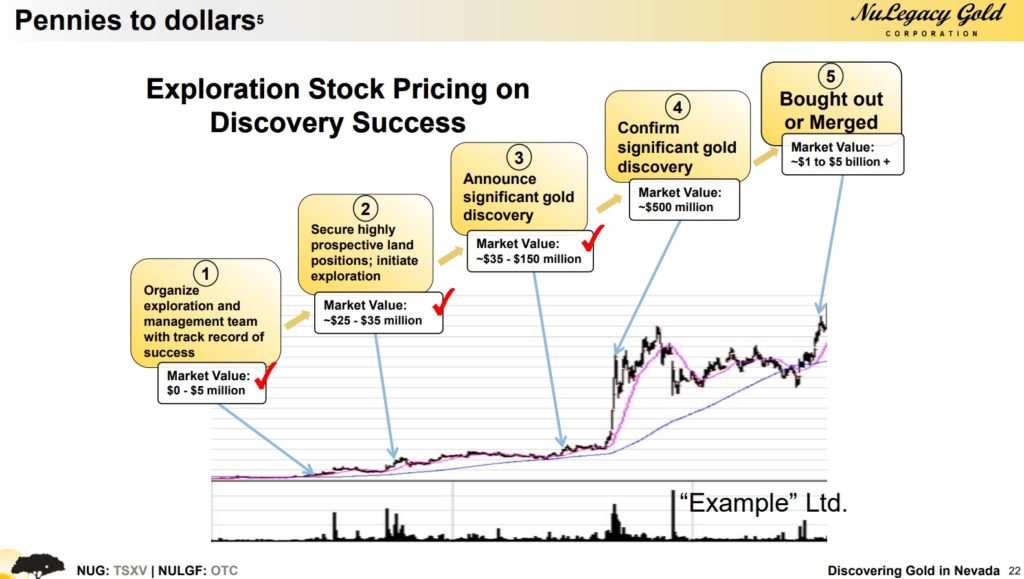

Note that there is no way of them proving up something worth “even” C$1 B in the first five holes and that there will be dilution needed in order to prove up a monster deposit. With that said the market will of course start pricing in some of the above scenarios even if they get “lucky” on these first five holes since that is usually how markets behave (pricing in the expected future). Lastly, I think NuLegacy would be taken over long before they even get close to proving up a monster in black and white (43-101).

A thankful feature of these (potential) Carlin style gold deposits is that the mineralization is “bedded” unlike lets say a vertical orogenic lode gold deposit. The former deposit could be drilled sorta like a grid and the mineralization might be at similar depths all around. In a typical lode gold deposit one needs to drill deeper and deeper holes. The best (worst?) example of this would be Osisko Mining’s Windfall deposit that has seen over 1,000,000 m of drilling and some of the holes are multiple kilometers in length and takes months to complete. If there really is something there at the “Rift Anticline” target then the mineralization might start at around 275 m (on average) in the whole system. This means less dilution and faster exploration compared to drilling up the Windfall deposit.

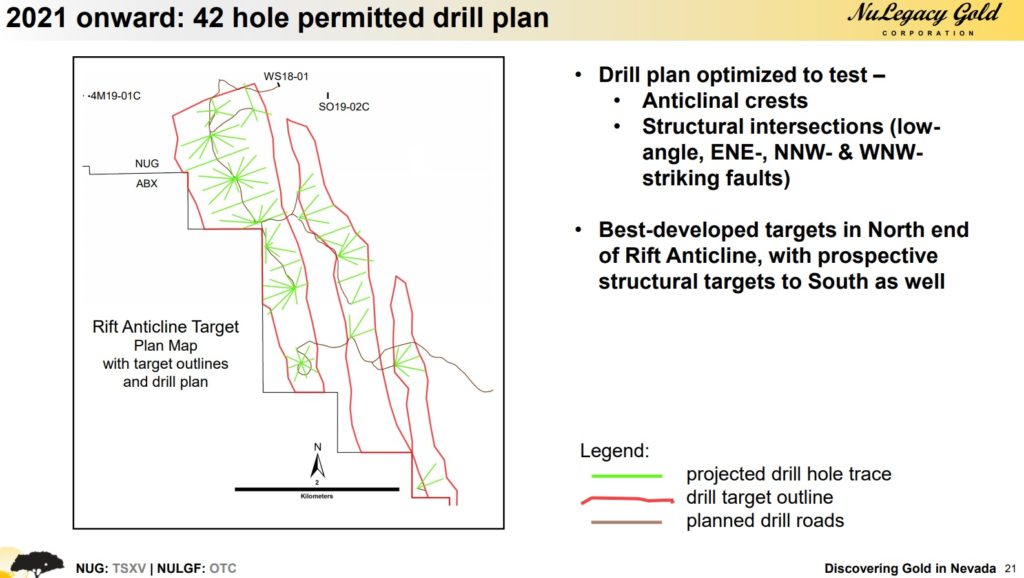

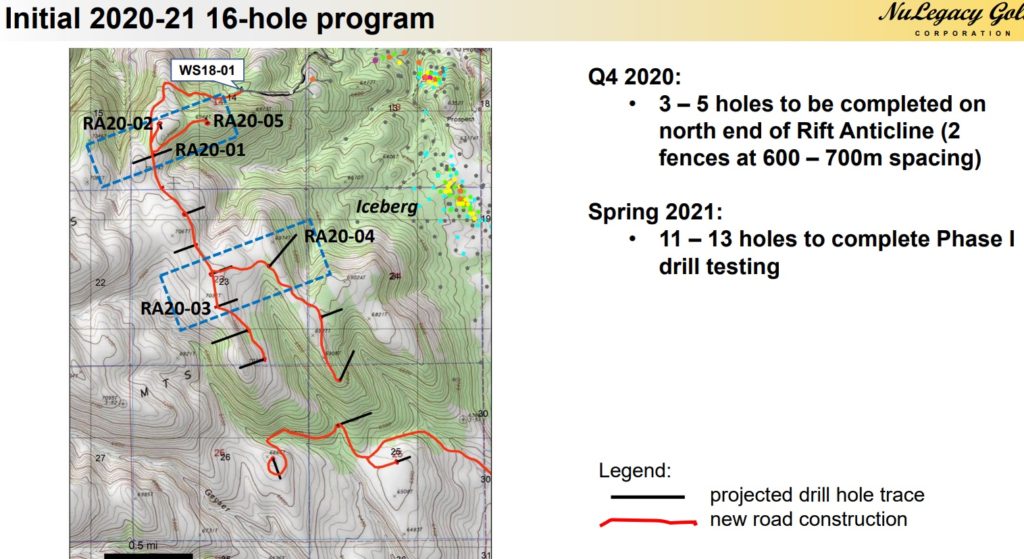

This is the drill plan for 2021 granted further drilling is warranted and money is available:

I’m not sure when this presentation was uploaded except that I know it’s the October Presentation. Anyway, I kinda want to believe that this slide is a bit telling in terms of the team’s confidence (cart before the horse). One thing to note is that this is note pure grassroot exploration given that there have been many drill holes that intercepted gold, some high-grade, at the Serena and Iceberg targets a few kilometers to the north-west of where they are currently drilling. A schematic in the presentation describes the Iceberg zone as an “Exhaust plume” and I know Quinton has alluded to this zone coming off something much bigger:

(Note “Exhaust plume” in the top-right corner)

Another slide clearly shows that the first five holes will be drilled parallel to where the highest grade hits were drilled around the Iceberg zone which is located to the north-east:

Furthermore the belief is that the Rift Anticline target used to basically be a continuation of the Goldrush system but was pulled apart during rifting some 30 million years ago:

(Blue arrow added by me)

And lastly, the journey we all hope is coming:

Bottom Line

NuLegacy shares most of the characteristics of Eskay Mining except the Quantity aspect:

- World Class Team (Increases the odds of success)

- Jurisdiction (Success here is worth a lot)

- Quality: Theoretical prize (One of the biggest I know of)

To Sum Up

Is NuLegacy drilling one of the most exciting targets around?

Yes.

Could this be worth several billions in the future?

Yes.

Are there any guarantees that they will find ANYTHING?

Certainly not.

Should one be “all in” or even close to it in hopes of getting “rich quick”?

Certainly not.

Is NuLegacy expensive?

I would say no since the theoretical blue sky prize is the largest that I know of. There are $25 M Market Cap companies out there that I believe are overvalued compared to NuLegacy simply due to the fact that their blu sky potential is maybe 5%-10% of NuLegacy’s. This is why it’s important not to compare apples to oranges. It’s the same for New Found Gold which might keep “surprising” people that tier 1 discoveries are on a completely different level than what 99% of juniors will ever find. If NuLegacy does indeed get a few good hits on these first few holes then I can easily see it becoming a multi bagger in short order. If they hit nothing but dusters in these first few holes then I can see a 50%+ haircut in short order. With that said I do hope to at least see some encouraging signs… That there is indeed something kicking around at depth. Keep in mind that there are three multi-kilometer trends of interest and that just because they don’t hit the jackpot right away does not mean that there isn’t an elephant in the area. Anyway, I expect the share price to be really swingy as the NRs comes out and one should not “gamble” with money one can’t afford to lose. Even a small position can do wonders for ones portfolio in case they hit it out of the park from the get go.

Closing Thoughts

If I would highlight some differences between the two cases it would be that NuLegacy has a shot of making the “great journey” quicker than Eskay Mining but that Eskay Mining is quite a bit less risky given the amount of targets (chances for success). Therefore Eskay Mining is a larger position for me personally because I don’t see Eskay not finding anything among 10 targets and I believe that Jeff/TV might already end up being a company maker.

OH, AND NEVER INVEST WHAT YOU CAN’T AFFORD TO LOSE.

Some TA

Eskay Mining looks to be basically coiling and volatility is very low. Thus I expect it to make a considerable move in the not too distant future. With assays on tap it would be a likely trigger:

NuLegacy seems to be coiling as well and might be forming a continuation pattern (symmetrical triangle) within a major resistance zone. It’s also squeezed near the trendline support in black. If it breaks the multi year resistance zone I would assume the following move to be a big one:

All in all both charts look loaded but I have no idea if we will get break outs, or fake break outs, not when. With that said I am not in invested in either based on TA but I don’t dislike what I see.

Note: This is not investment or trading advice. I am not a geologist nor am I a mining engineer. This article is speculative and I can not guarantee 100% accuracy. Junior miners can be very volatile and risky. I have bought shares of NuLegacy Gold and Eskay Mining in the open market. I also participated in private placements in both. I can buy or sell shares at any point in time. I was not paid by any entity to write this article but Eskay Mining is a passive banner sponsor of The Hedgeless Horseman. Therefore you should assume I am biased so always do your own due diligence and make up your own mind as always.

Best regards,

Erik Wetterling aka “The Hedgeless Horseman”

Follow me on twitter: https://twitter.com/Comm_Invest

Follow me on CEO.ca: https://ceo.ca/@hhorseman

Follow me on Youtube: My channel

I believe NULGF will find a deposit much bigger than Betze-Post, maybe 80 million oz and be bought by NEM and Barrick for 20 billion, or $40 a share. That is Bonzo’s dream, and you’ve got to have a dream or you’ll never have a dream come true.