Will Novo Resources be a Cash Flow Monster?

I arrived back in Sweden two days ago and have slowly started to digest the trip to Novo’s Karratha gold project in Western Australia. I will most likely start working on a new article in a few days, but I have some family matters to attend to first. In the meantime I thought I would just do a quick post with some blue sky scenarios for the future start up operation at Comet Well.

Background

Snippet:

Snippet:

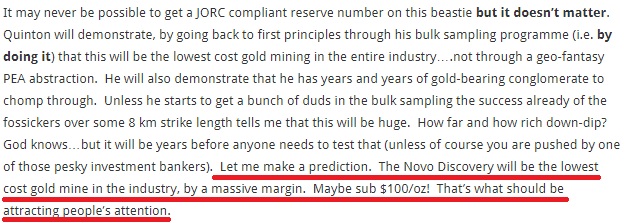

Now allow me to paint a picture why these gentlemen (and me too) are so focused on production and not that worried about if and when we could get a bankable resource…

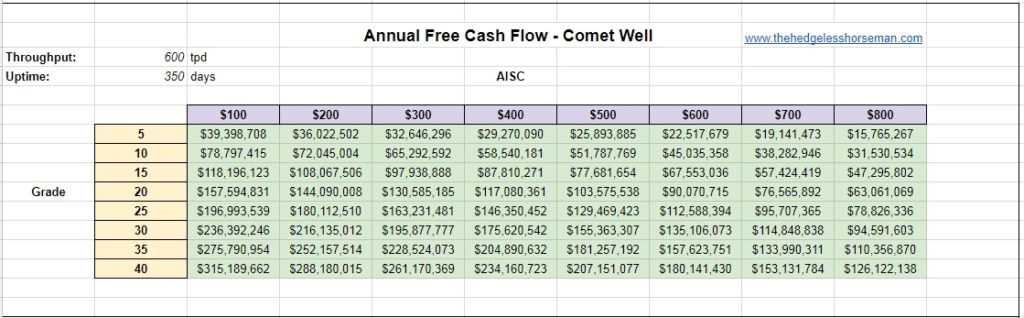

The plan is to start with a 600 tpd (tonnes per day) operation that can be up-scaled in the future. If we then assume say 350 days of up time then we can be looking at the following potential scenarios for the starter operations from Comet Well area (alone):

Discussion

Now, it will obviously take time to reach steady state production and costs etc, but it gives you an idea of just how insane this kind of near surface operation in Pilbara could potentially be. And remember, this is just step 1 and from a single prospect. Novo has multiple near surface prospects mapped already as can be seen in their latest presentation, as well as the pretty advanced Beaton’s Creek project. If Comet Well turns out to be the lowest cost operation in the world and we have 10,000 km2+ of prospective land, then just imagine what Novo might look like in a few years time.

All the above is a big reason why I am personally ridiculously bullish in terms of the Risk/Reward profile for Novo. An ounce at Comet Well might be worth multiple “conventional” ounces in terms of NPV, resource or not. A 100,000 ounces per year operation at Comet Well alone might have the same free cash flow potential as a “conventional” 400,000+ ounces per year operation, ie a mid tier size.

If we have costs anywhere close to what Dr. Keith Barron envisions, then Novo could turn out to be a real dividend champion in the future. If that happens, then the opportunity cost for conservative investors who wants/needs resources in black and white could get really high, and nothing is more real than dividends.

Best regards,

The Hedgeless Horseman

Follow me on twitter: https://twitter.com/Comm_Invest

Follow me on CEO.ca: https://ceo.ca/@hhorseman

Don’t forget to sign up for my Newsletter (top right on front page) in order to get notification when a new post is up!

If you want to learn more about Novo Resources and the Pilbara Gold Rush you can purchase all my premium content HERE.

If you find my work valuable and want to help me keep publishing most of my research for free then please consider making a donation.