Novo Resources: Reading Between The Lines And Value Investing

Some recent material events/insights:

- The appointment of a senior Sumitomo member to the board

- $4M stake in a Victorian gold junior that might be on to a Fosterville-like deposit

- Options tied to production results issued

- Mill negotiations seemingly going well

- Ore sorting technology advancing that could affect all nuggety deposits and “shrink” Pilbara which potentially could lead to a super charged production profile down the line

… Why does the market refuse to discount most of these things?

Does the points above increase or decrease the implied odds of Pilbara being as good as we all hope?

Are the bulls missing something or is the market oblivious to things that actually does matter?

You probably know where I stand on these issues.

… Latest hint of how inefficient the market is was that Novo taking a 8% (max 16% with warrants) in a Victorian junior helped move Novo 12%. Meanwhile we are still trading lower than when the first of the information/hints described above were announced and all of them are positive.

Does that make sense from an “efficient market” point of view?

Did the NPV of Novo decrease in light of all those factors?

.. Of course not…

The share price is driven by emotion, not reason or logic and it oscillates irrationally on a day to day basis.

Reflections

Every Canadian market participant probably has heard about Kirkland Lake and its Fosterville deposit that helped take Kirkland Lake (then Newmarket Gold) from $6 to $60 in just a few years. Thus, a lot of investors have a reference point while reading such a news release and makes it easy to impulsively kick start some degree of “FOMO” (Don’t get me wrong, another Fosterville is of course an extremely exciting prospect and there is probably no one on earth that could judge the merits of Kalamazoo better than Quinton Hennigh, but in my opinion I actually see Fosterville as icing on the already unconventionally large Novo cake, and that’s saying something).

Meanwhile, advancements when it comes to the Pilbara gold fields which have more potential than even Fosterville, continues to be ignored by the marginal buyer/seller. Personally I think it points to the fact that investors who have done extensive DD in order to understand perhaps the most complex case in the sector, which is Novo, are already in it. These people realized the potential in Novo long ago and are thus already fully invested or close to it. Thus, it is mostly left for the traders and people “uninitiated” with Novo to move the needle at the moment. Traders doesn’t care about the actual information in the NRs and the uninitiated need events they can wrap their heads around in order to flip from neutral/bearish to bullish. Novo taking a stake in Kalamazoo was such an event, but we have yet to see follow through (breaking of $4), thus traders have yet to enter for real and help drive price higher (just an observation since I am quite agnostic in terms of share price and instead focus on the underlying value of the company).

The factors above would be problematic if Novo was far away from producing news that anyone that has never even put in one hour of DD into Novo could understand. However, as the list of NRs suggest, event that could indeed be easy to grasp seem to be drawing closer. If there is anything anyone could understand then it is production of gold and cash flow. If these things come to pass Novo will attract a lot more attention. With that said, I would be surprised if many would start to grasp just what the total size of the price is. In other words I doubt that the market would suddenly grasp the blue sky scenarios, in terms of semi-craton wide gold bearing systems and accompanying future production scenarios, that could be multiples of what Fosterville could ever produce (let alone the fact that mine life could also be decades or centuries). Then add on the fact that if ore sorting proves efficient at “shrinking” ore across the board, then the production profile could get super charged as was touched on earlier. If that wasn’t enough, the CAPEX requirements could be extremely low (and IRR extremely high), especially for the Egina type lag gravels. All these scenarios are looking more and more probably in light of the NRs, interviews and actions out of Novo during the last 6-9 months and yet the market has continued to turn a blind eye, even though these scenarios would dwarf even a Fosterville type mining operation.

If one expected Novo to be a pure exploration story over the coming 5 years then Novo could possibly continue to be chronically cheap relative to it’s potential. What makes 2020 a possible game changer is that it looks likely to be the year when some of that potential gets translated into something tangible, i.e. production of gold bars.

In case people are very nervous and believes that the market is efficient and rational even though miners are trading at historically low valuations then look no further than the involvement of Sumitomo Corporation. Sumitomo is a US$42 B behemoth that has done due diligence on Novo for the past two years and are frequently on site. Given the amount of time spent with Novo and it’s information advantage, is it rational to believe that this Japanese conglomerate is making a well founded rational bet on the future prospects of Novo and Pilbara or is it more likely that they are as foolish as some bashers would have you to believe?

Well, given that it is my understanding that Sumitomo Corporation are “lifers” and Japanese companies overall are quite cautious and conservative, it leads me to believe that this is much more than just some risky punt. It rather tells me that this is far from it and that Sumitomo and Novo see a relatively high chance for success with the Pilbara goldfields and any other type of gold prospect, current and/or future. With that said, I see the board appointment as a sign of things that are yet to come and “reading between the lines” is a notion that I think is fitting at this point in time. Lastly, I think it’s worth bearing in mind that Sumitomo are “money people”. They take minority interests in operations and are after actual returns, as in seeing their investments generate profits. They don not have any shares to flip. The only way Sumitomo can make money is if said operations actually generate profits. This fact makes me even more happy since Sumitomo would only get involved if they see a good chance of Novo’s projects actually turning into Free Cash Flowing assets and if they are “lifers”, well then I guess they might expect to see Free Cash Flow over a long period of time.

How about the fact that Novo feels that they can spend AUD$4 M at this point in time. What does that infer…?

… It does jive with the board appointment and the characteristics of Sumitomo as a company, no? You know the fact that they are “lifers” that are only really interested in having a % of cash flowing ventures… Hint hint.

In essence:

We are getting a first hand view of just how inefficient the market can be when it comes to junior mining companies, and more so than ever when it comes to Novo. This is a long term value investors dream, make no mistake about it. When fundamentals change for the better, while the price for said fundamentals goes down, that is what value investors consider an opportunity.

It’s at times like this that extensive DD makes it possible to take advantage of the markets inefficiencies in order to produce better than average long term results. If you can understand how a tidbit of information affects the long term value of a business better than the market, then it allows a value investor to potentially seize an opportunity. If you see the market unable to discount events properly, then that is a good thing. If the market overestimates the value of a positive NR, that allows you to take over-sized profits. If it understates a positive NR, that allows you to buy something for a price that might be way too low.

Forget about what the market is telling you. If you have done your due diligence you should not get influenced by the noise and instead come to your own conclusion in terms of how any tidbit of information changes the long term value of a company, and act accordingly. If your DD leads you to adamantly believe that the price of a company is much lower than the risk adjusted long term value (Risk/Reward) then that hopefully also gives you enough conviction to act the correct way at any given point in time.

When I get nervous as a stock I own go down on any given day (for no apparent reason), that tells me that I either do not understand the case well enough (and thus have low conviction) and/or that my position size is too big. Both factors could lead to me making the wrong decision at the wrong time such as selling when I ought to be buying.

If one liked Novo one month ago at higher prices, one should probably like it even more in light of the information presented at the beginning of the article. With that said, if you still don’t understand Novo and thus have low conviction then don’t buy it, and if you own it, sell it. Research it until you potentially see an opportunity to buy a long term value proposition on the cheap and then buy (or rebuy). Do what makes sense to you. This article is not made to pump Novo, but to explain how I see things and hopefully drive home some points that I think are important for investors to keep in mind if they want to have success in the long run (regardless what type of company or sector you might be investing in) and Novo happens to be the best example of showing how Price can differ from Value at any point in time (at least in my opinion).

Lastly:

Just consider the small detail of Novo’s most recent presentation… What’s the first slide you see? A screenshot of the computer screen which shows nuggets that were detected by a Steinert Ore Sorter. That is the first time I have seen Novo “leading” a presentation with this technology and it’s obviously done for a reason. On that note: In my “Novo Resources: Sorting Out Pilbara” article I stated my personal view (and probably others as well) as follows:

“…and realize that currently, ore sorting probably is the main value driver by far as it relates to Novo…”

So, with Novo leading the presentation with this tech, this notion does not look that crazy. Meanwhile, the market does still not grasp the implications of a scenario where ore/mechanical sorting would unlock numerous deposits across Pilbara given the lack of discounting following progress in this area. This is fine of course because the proof will be in the pudding and if Novo shareholders are correct in assuming ore sorting will work then that will show up big time in the cash flow statement some day. Thus, it does not matter what the market grasps or does not grasp at this point in time because Novo will likely never need to go to the market for additional funding anyway. Furthermore, the implications of ore sorting being successful will benefit shareholders regardless of what the market thinks. This is a real blessing because if it would take 10+ years for theory to meet reality then the value of Novo would perhaps have to wait 10 years before the potential of the theory would start to get discounted…

In contrast, take a random exploration play for example. Or better yet a success story like Great Bear Resources. Despite their success, they are maybe 10 years away from seeing the potential in the ground turn into money in the bank, if there is not a take over before that happens. In other words, the stock will probably trade in a violent manner (albeit in an uptrend if they keep hitting) because there is nothing 100% tangible keeping the valuation “honest”, like say an income stream. On that note, lets say Great Bear released a NR that said they could apply ore sorting tech and that it should have very positive implications in terms of economics. In that case the market might care or it might not. There would be nothing “forcing” the price of the company to reflect this boosted potential, for the value of the project, if actual production would be 10 years off. In that case, the gold bull might even be over before theory actually meets reality. Note that this is not specific to Great Bear (Great Bear is already better than 98% of junior explorers) but all explorers who may or may not even have anything of value and it relates to developers as well. Nothing is forced to be reflected until it’s a reality. Hence Novo can continute to trade at (IMHO) low levels until theory meets reality, which might be sooner rather than later (and much sooner than your average developer).

If a junior is years or decades away from production or a take-over (if ever) then the price of the company can go anywhere at any time since the market is emotionally driven. In other words there will probably be a lot of volatility and if you buy a “sleeper” stock, you are banking that the market will CARE some day for whatever reason, but you don’t know when or if the market ever will. And there are no guarantees that even an undervalued sleeper will get much attention and more positive emotions tied to it later on. Thus, one is at the mercy of what other investors/speculators feel and when said feelings start to materialize. Again, this is typical for most juniors but it doesn’t work the same when a junior actually can create bankable value (cash flow) in black and white itself. If Novo is self funded and headed for high-margin production then yield might be the real prize and in that case you don’t even want the market to ever really wake up since it would allow you to buy a potential high-yield security with operations in the #2 jurisdiction in the world with a project pipeline that is beyond any junior (or even major) in the whole space. Hence, why I am personally agnostic to the share price nowadays, as theory turning into possible reality draws ever closer. In that case it doesn’t matter what the bulls or bears think about Novo’s potential because it will be there for all to see. If there would be no bankable value creation coming then bulls and bears could have an endless Tug of War in infinity and the emotional price (price of the company) could go anywhere at any given point.

Share structure is something I underestimated the value of for a long time, and perhaps even today, because it fall outside the simple of “Price is what you pay, value is what you get”. Lately there has been a couple of juniors performing well, with a steady climb higher, and many of these have a low share count. This is another sign that companies with a low share count has a much easier time to move which is seen as a very positive attribute (albeit a double edged sword). Given that the vast majority of junior stocks are de facto “trading sardines”, to different degrees, this attribute is relevant to keep in mind pretty much all the time. However, if you are a “passive” investor with the goal to buy a stock as a long term INVESTMENT, then share structure really shouldn’t make a difference if the company achieves cash flowing status. In other words, a tight share structure will most likely be of help except in the rare case that you are really a HODL:er investing for long term dividends since share structure plays no part in that. Well, I guess one might even prefer a loose share structure if that might lead to a slight undervaluation, all else equal.

I will reiterate that I think DD is a lot about reading between the lines and noting details that the majority will deem insignificant (like what the first slide of a presentation changes to) and infer intentions/beliefs. Everything and anything that is said or put in print has a reason(s) behind it. In order to do all this, it is of course important to really do your due diligence, otherwise you will miss any small changes in wording or whatever that would not be picked up by most. I re-read every NR, presentation and interview multiple times for example. Know the case better than the marginal buyer/seller and you will have an edge! There are also things that have not been talked about lately, which is of course telling us something as well, but that is for people to figure out themselves (what it is and what it might mean).

Ps. Novo is on the way of doing something that the vast majority of people in the sector thought (and still think) was impossible. Many Pilbara sisters have come and went already. They gave up in short order. But not Quinton, Rob and the rest of the outstanding Novo team (some of which I am lucky to have personally met). They did not give up and they found solutions such as mechanical sorting which could overcome the lack of water as well as drop costs significantly. Not only that, but they have done so well that the $42B Sumitomo Corporation is teaming up with us, which is in itself a feat that no junior on earth has been able to do as far as I know. Make no mistake. taking on a single conventional gold prospect pales in comparison to what they are doing but the potential prize is equally impressive. If that wasn’t enough, Quinton has done more updates in terms of podcasts, interviews and public email responses (like covering all the challenges and laying out the then current base case) than any junior I personally know of, and now while I’m sitting comfortably in front of a computer, we have Novo personnel sweating their asses off in a 40-50 degree Pilbara. If we soon become a producer then that means that Quinton et. al. were successful in converting Novo’s unconventional targets into production without another financing since the last one three years ago… In short I don’t know what is more unique. The projects overall or the management team. I don’t think any other group of people would have been able to pull this off since it required both ingenuity, passion, patience, strategy, drive and extreme “out of the box” thinking. I think most people, even including myself, does not actually grasp just how many pieces would have to align for Novo to be where it is today and all they have asked shareholders for is “time and patience” which looks to soon pay off.

(Note: This is not a buy or sell recommendation. This is not investment advice and I am not a geologist. This article is highly speculative, forward looking and I can’t guarantee accuracy. Always do your own due diligence. I own a lot of shares of Novo Resources which I have bought in the open market and am thus biased. Novo is a passive banner sponsor on my site. )

Best regards,

The Hedgeless Horseman

Follow me on twitter: https://twitter.com/Comm_Invest

Follow me on CEO.ca: https://ceo.ca/@hhorseman

Horse, I think you meant to say “Why does the market discount most of these things?”, not “Why does the market *refuse to* discount most of these things?”

I know English is not your first language (and I should talk, I don’t even have a second one myself!) but you really could use a proofreader, not to mention an editor who could cut this down to about 1/4 of its length so more newbies had the patience to read it.

Those do seem to be the people you are most addressing, with all your advice about investing that arguably, has little to do with the subject at hand.

You are very welcome to have a different opinion. I could use a lot of things, but as long as the overall message is understood then the content is at least serving its purpose. I could probably make some posts shorter though… But if one does not have the patience to read 3 pages or whatever then I think hope is lost anyway. I’m currently reading another 200 page book in investing myself. I am addressing anyone who wants to read thoughts on investing, “newbies” or otherwise. What did not have much to do with the subject at hand?

Thank you for writing this informative article. What are your thoughts about Artemis has there been any developments with the mining site the stock has dropped considerably?

You’re welcome Pat. I have never really looked into ARV and never been much interested in the stock so I can’t help you there.

Best regards

KEEP UP YOUR EXCELLENT REPORTS ON NOVO. IF YOUR RECENT CRITIC IS MORE KNOWLEDGABLE

THAN YOU CONCERNING NOVO AND THE PILBARA, LET HIM PUT HIS “PEN TO PAPER” AND SHOW US WHY WE SHOULD LISTEN TOO SOMEONE WHO IS MORE INTERESTED IN PICKING APART THE STRUCTURE AND GRAMMATICAL CONSTRUCT OF A REPORT THAN THE CONTENT.

“METHINKS HE DOTH PROTEST TO MUCH”

Hehe thanks for the kind words Pete :).

I am getting kinda used to that sort of critique by now. I have asked many bears to put their bear case in paper and adress all the aspects that a bull like me touches on but that has yet to materialize… “Character assassination” is usually the preferred route instead 😛

Best regards

How many people is NOVO employing now? The last I heard about 2 years ago from Moriarty was 3 groups of 12-30 people.

The hidden thing I have seen in the the reports is the $2-3/ton land reclamation estimate. With that kind of money could they not build 1000 acres of greenhouses? Use piped in salt water, evaporate it and distill fresh for growing things. Give a number of the greenhouses back to aboriginals… etc etc

I’m not quite sure Lawrence. I heard it was around 40 people some months ago but dunno what it might be ATM.

Interesting thoughts but I know too little about those things to really comment.

Best regards

Thanks, HH. I agree with everything you say and don’t care if your grammar is perfect. I have believed in the Pilbara for several years and first bought [email protected] and kept buying more all the way down to .63 Almost doubled down @ 50 cents, but failed to pull the trigger. Anyway my average cost is a little over a dollar a share and I also own IRVRF@ 1.28 and [email protected]

Looking forward to an exciting year, especially if Miramont finds a 10 million oz gold deposit.

Good luck!

You’re very welcome Bonzo,

The “rantier” I get, the worse the grammar seems to be :). That is an impressive average sir. Fortunately I think the best is yet to come!

Best regards

The typical resource investor has the IQ of that tree-squirrel laying dead in the middle of the road and the comprehension skills of a moth doing a kamikaze into the nearest flame. Most aren’t going to “get it” until Novo is north of $100.

Haha, well I don’t know if it’s that bad Theo, but it does seem that we humans make a lot of (emotionak) mistakes regardless of IQ… Thus making it look like low IQ is involved.

However, I do agree that Novo seems to be almost impossible for people to “get”, for some mysterious reason. Well, I think it’s because it’s a multi asset, ultra-district and highly unconventional play. No one has a reference point and there hasn’t been one exactly like this, ever. The closes one is of course Witswatersrand, but that was “hot” 50-100 years ago and pretty much no one is familiar with how that played out today.

Best regards

Lets see what they *could* have. At 1gm per cubic meter, in reefs that avg. 1.5m thick, that is ~50K oz. per sq/km. If it is 1.5gm per cubic meter it would be ~75K oz. and at 2gm per cubic meter ~100K oz. If their 12,000 sq/km holdings are 1% mineralized at those rates they have 6-9-12M oz. of gold, if 5% mineralized then 30-45-60m oz. and if 10% mineralized they have 60-90-120m oz. of gold. The sorting technology is getting progressively higher yields and the geology appears to be consisent out there for tens and even hundreds of kilometers at a stretch. If they get it out for $3-400 oz. instead of industry avg. $800+ oz then that increases their margins, with very low capex to begin producing at scale. What would be estimated market cap of a producer with those reserves? At ~$3 share Novo is at ~$600M with 200M shares out. $5 per share = $1B market cap. $25 per share = $5B. Newmont has ~65M oz. and a market cap of $35B. That is at $1500 gold, but consider gold at $2K oz… or even $3K.

Am I missing something here? This does seem TGTBT. I hope these calculations are valid. Any math checks folks would like to do would be much appreciated. It could stop me before I mortgage the house. I’m kidding but I about the mortgage but I do own shares.

Hi Jim,

Thankfully the market prices it as “too good to be true” so if even a small part of the blue sky scenario ends up materializing, it should be quite rewarding for the early birds. I won’t comment on the math since the future scenario spectrum is so wide, but lets just say that if they crack either one or all systems, then I think the valuation could be something else.

Best regards

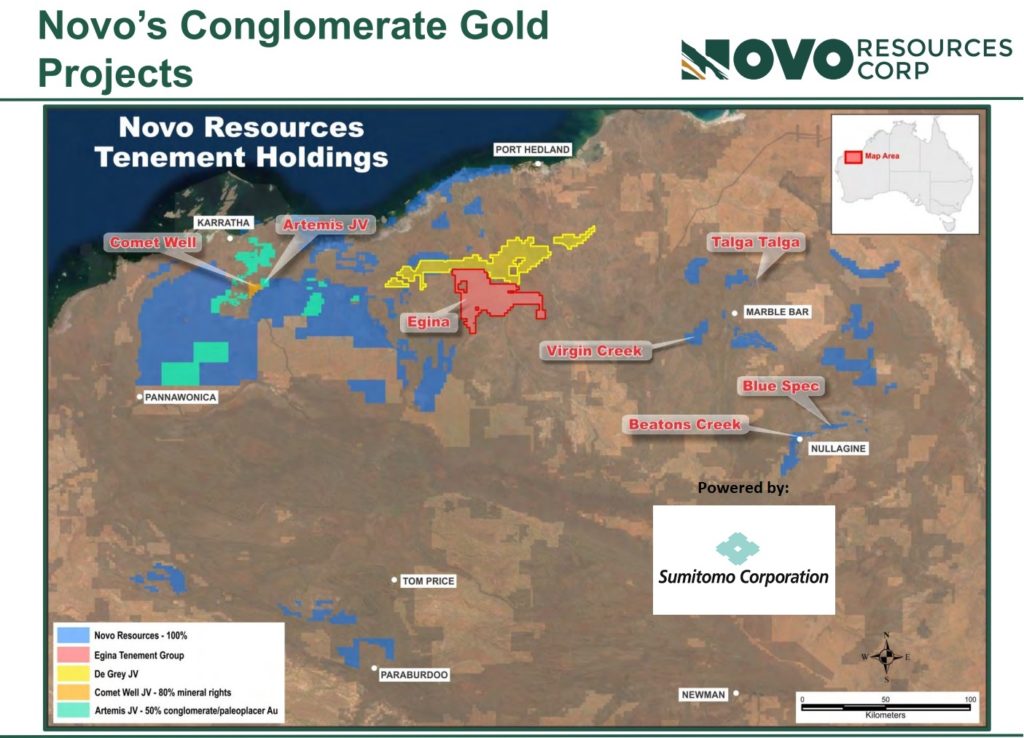

Hi. I was looking at the map above and wondering what the story is with the Karratha land holdings. I know there are already a lot of balls in the air but this seems to be the biggest portion of the land package and just wondering what the geological significance of this land is, as the recent investment was in Victoria etc.

Thanks you for all your insight

Hi Traveler,

Well, I think Novo will shed some of that land in the future given the fact that the prospective horizons might be very deep AND nuggety in a lot of areas… Furthermore I think they have already mapped like 1,000 km of “unconformities” which should be prospective for conglomerate gold and if we got 1,000km of near surface potential then that should keep us busy for several decades hehe.

I think the investment in Victoria is “greedy” in a good way. QH signals that he expects Novo to become cash flowing sooner than later and that he wants to build Novo into an empire IMHO.

Best regards