Novo Resources (NVO.TO): Ever Evolving

July 28, 2021

Investing is about the future.

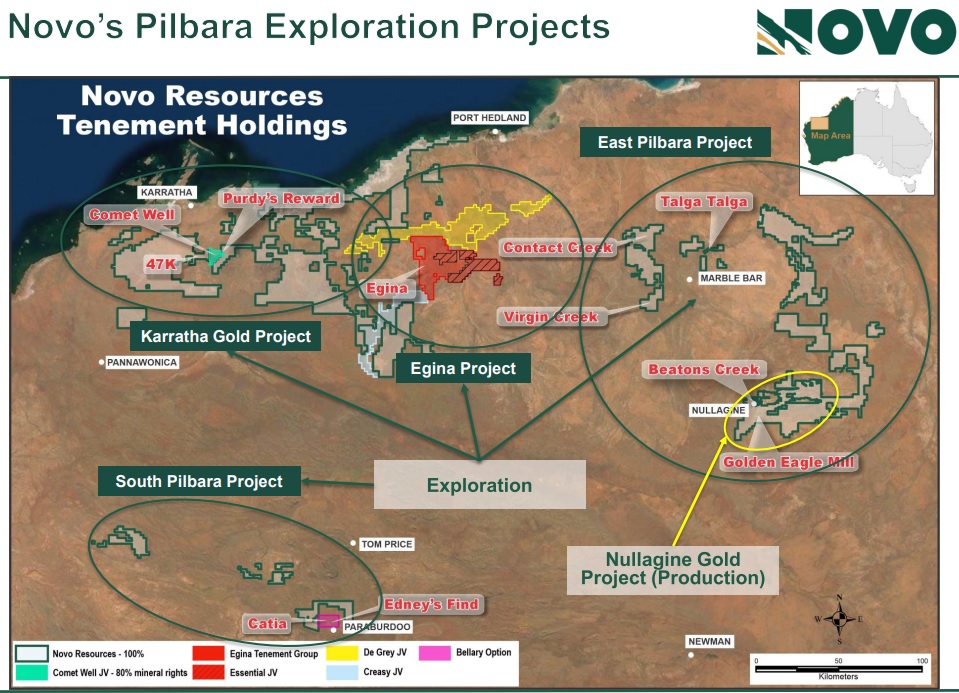

Novo Resources is easily the most dynamic story in the junior space. No junior has more projects, targets, prospects, type of targets, equity positions and probably few if any have a larger total land package. On that note I thought it was time to take a look at what Novo is today and what it might become in the future…

Beaton’s Creek: A Positive Trend

Investing is about buying something today that is worth more today and/or will be worth more in the future.

From Jay Taylor’s recent interview with Quinton Hennigh:

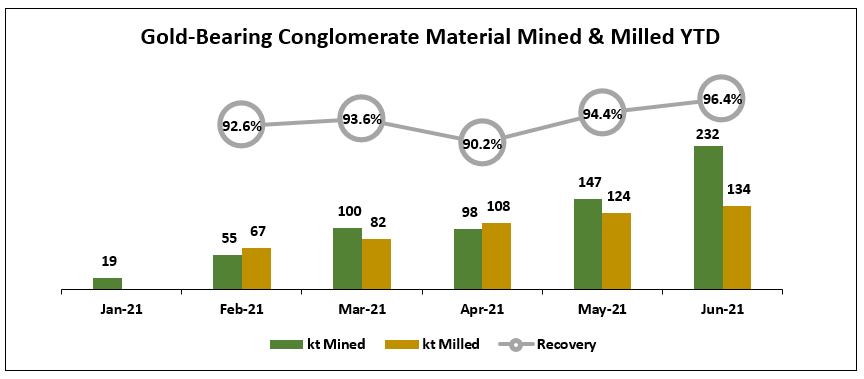

“The company has generated positive operating cash flows even with average mill head grades of 1.3 g/t gold. With the implementation of grade control measures, expectations are for average mill heads to closely match the 2.1 average grade of the deposit.”

First of all what I take away from this is that there is a lot of room for positive “surprises”. Furthermore, I think it is delusional to believe that a start up of an extremely unconventional deposit/mine would be fully optimized on day one. Like all human endeavors processes and techniques tend to get better with time as the people involved gain more knowledge and experiences. Therefore it is pretty unlikely that the Beaton’s Creek operation will get worse on paper unless the true grade of the deposit gets worse etc. In contrast I find it very likely that the Beaton’s Creek team will get better and better in pretty much all areas of mining this unique deposit. Thus I think there is an inherent positive trend that will hike up the long term value of Beaton’s Creek. Lastly the Beaton’s Creek operation has been improving month over month, which supports the previous statement, and I have no reason to believe that this positive trend will not continue for some time yet…

I re-iterate: Investing is about the future. Valuing Beaton’s Creek based on lets say the first month of production and then simply projecting that performance until the end of mine life is beyond stupid. And so far they have been proven wrong month after month. Beaton’s Creek 12 months from now will probably look very different to Beaton’s Creek today. Beaton’s Creek 36 months from now might look very different to Beaton’s Creek 12 months from now.

Novo took a big risk when it acquired Millennium Minerals assets and aggressively pushed Beaton’s Creek towards production without a Feasibility Study etc. Clueless people will believe that this was an unnecessary risk with little to no upside. Clearly said people have no idea what the vision is. The risk makes perfect sense from the stand point of wanting Novo to get Cash Flow in order to unlock Pilbara as fast as possible. If Novo would not have taken the “risk” then Novo might have been looking at many years of continuous dilution in order to de-risk the largest target portfolio of any junior in the sector. I personally loved the fact that the company took the risk because, as we are seeing right now, Beaton’s Creek started “slow” but is improving month after month.

Novo has always been a blue sky exploration story given the unparalleled land mass, number of projects, number of equity holdings and number of total targets. Beaton’s Creek is supposed to be the match that lights the fire even though many seem to view Novo almost entirely based on what Beaton’s Creek looks like TODAY…

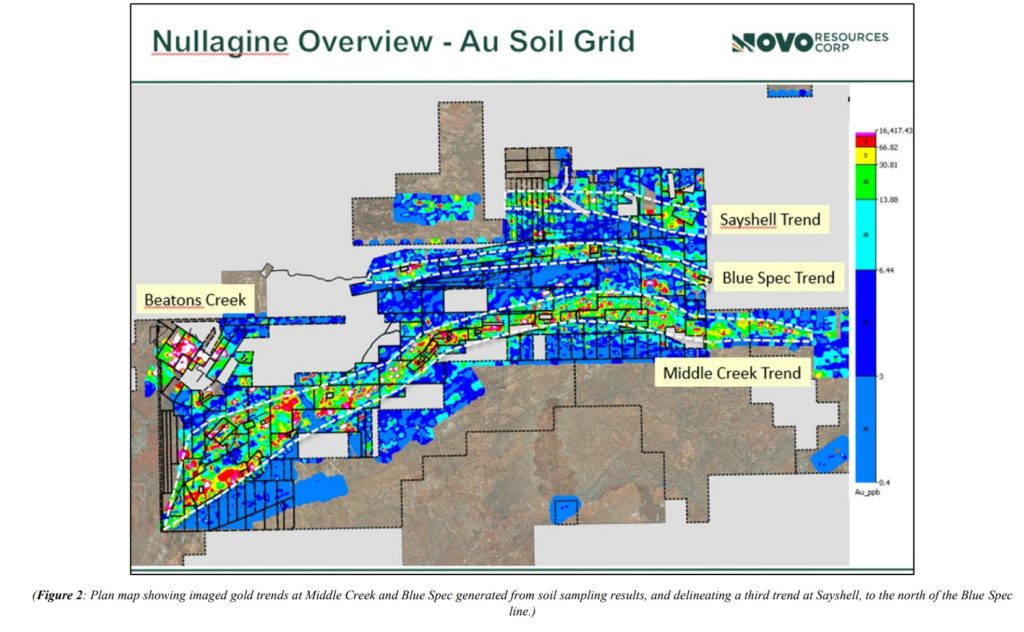

Furthermore I would say that very few realize the full potential of the new Beaton’s Creek/Millennium combination. First of all there is ample evidence that the Hardey Formation conglomerates which are being mined by Novo today extend for kilometers past the current deposit outline and that some recently discovered conglomerate horizons are different than the ones that are being mined. In other words there appears to be multiple gold bearing horizons within the Hardey Formation package around Nullagine. Secondly, Novo’s new “Nullagine Gold Project” covers several multi-kilometers trends of lode gold prospects:

Millennium Minerals which mined lode gold deposits and owned a lot of the land in the picture above did not run out of ore. The company went south due its inability to treat the sulfide (“fresh”) ore as far as I understand it. In other words there is a LOT of potential left, both for oxide- and fresh ore, for Novo. The slide below is an old long section made by Millennium Minerals and I think it speaks volumes. That’s ONE 10-kilometer trend with multiple gold zones that are open to depth intertwined with a lot of areas that are completely untested:

The Nullagine Gold Project, which includes the producing Beaton’s Creek mine in addition to all conglomerate and lode gold potential, is a grand prize by itself. The market is of course totally unaware and one is not paying anything for all this in my book.

… And everything is within range of a permitted and functioning >1.8 Mtpa mill in Western Australia which is a true tier #1 jurisdiction.

Things Change

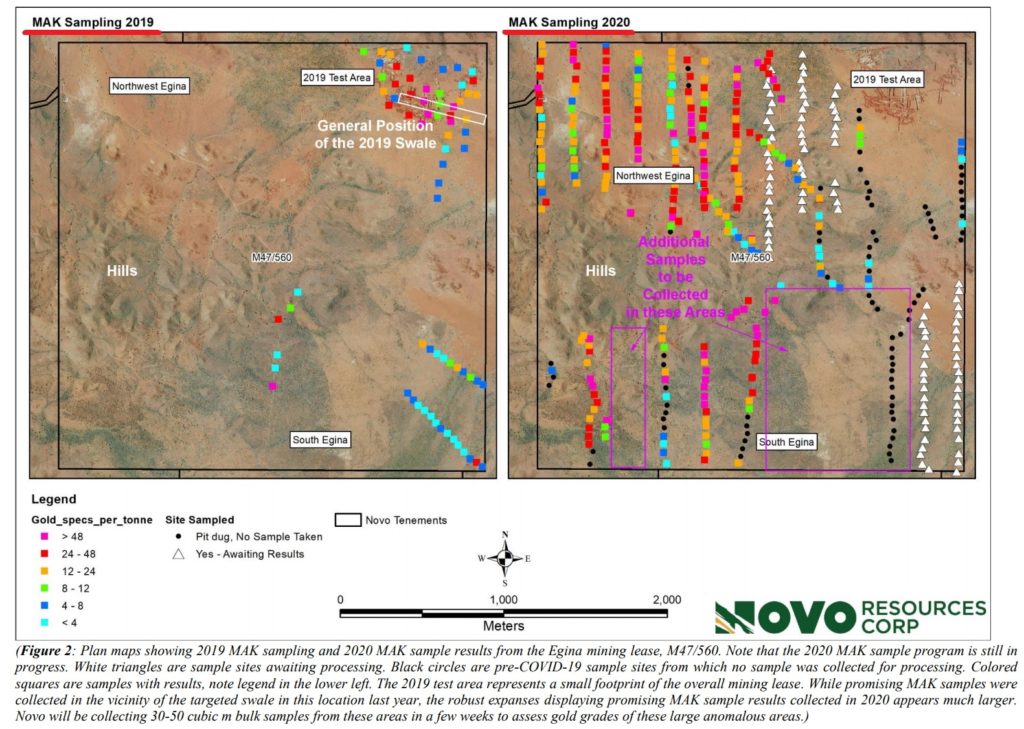

Many agree that Egina type lag gravels might be the current “crown jewel”, in terms of NPV potential, since it looks like it could have very low CAPEX and have huge lateral continuity. The unlocking of Egina will require Aboriginal cooperation as I understand it and COVID hasn’t helped matters. Thus, things have been a lot slower than I hoped. This is not something I blame anyone in Novo for but rather chalk it up to “typical hurdles in mining”. There is definitely gold at Egina and it is not going anywhere:

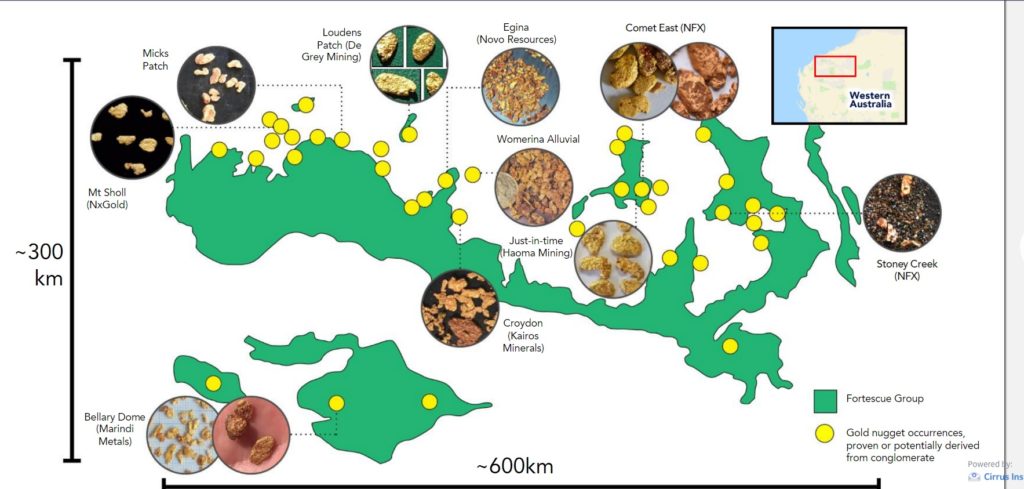

Anyway, yes Novo has continuously been changing every year. In 2017 it was all about Comet Well and Purdy’s Reward (Mt Roe Conglomerates). In 2018 we learned about this new Egina type lag gravel deposit and how these lag gravels had the potential to be present over large swathes of land. In other words the huge land package of Novo had the potential to host three different semi-craton wide deposit type (Mt Roe Conglomerates, Hardey Formation Conglomerates and Egina type lag gravels):

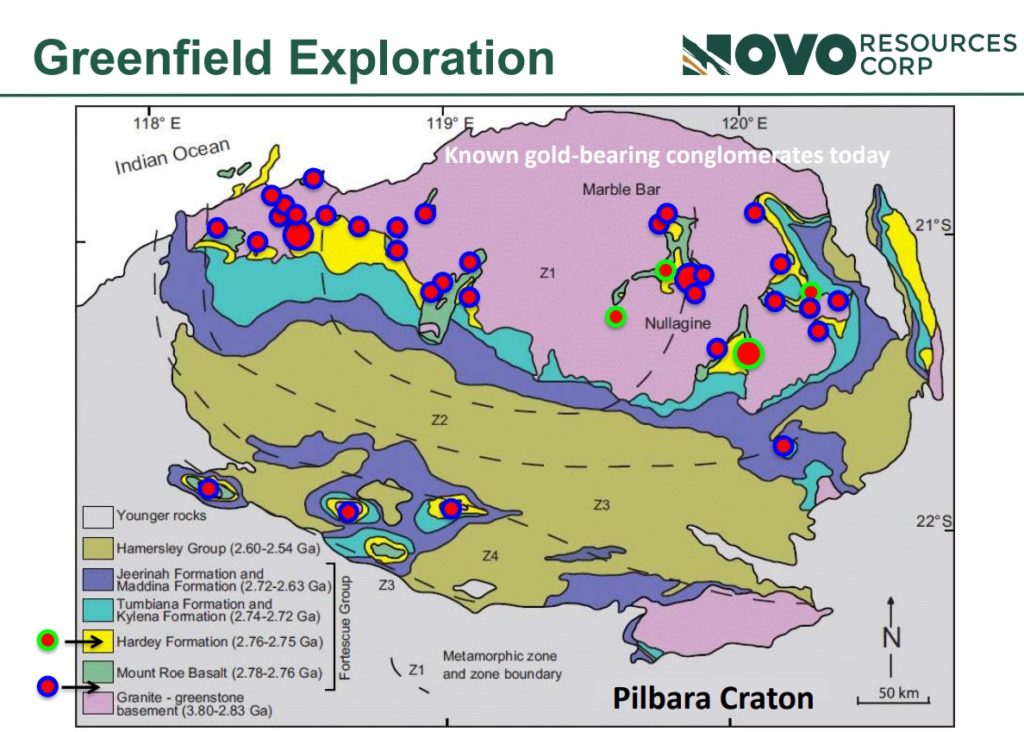

We already know there is conglomerate gold in every corner of the ancient basin:

Today

The slower pace at Karratha and Egina has been frustrating but Novo has been far from idle. While all the potential at Karratha and Egina is still intact we have been blessed by the multiple discoveries of high grade gold lodes up in Newfoundland by New Found Gold. Novo’s equity position in New Found Gold recently hit around C$200 M and that’s more tangible value creation than 98% of juniors will ever see IMO. And that story is certainly not over yet.

An additional avenue for growth comes in the form of the “Fosterville type” Malmsbury target in Victoria, Australia. I am very excited about this one and if the company is successful here we might be looking at a big prize at the end of the day.

Then we have the ever evolving ore sorting tech and Novo’s obvious confidence that the company is the world’s premiere experts on nuggety gold. I should also point out that it seems like the new Chrysos tech brings incredible value in terms of unlocking nuggety deposits and Novo is in the fore front here as well…

The Novo team has hinted a few times that it believes there will be opportunities to leverage its in-house “nuggety gold expertise” and could use it to unlock value in deposits all over the world where few if any other juniors could. The positive thing about such unique “know how” is of course that many projects could probably be worth a lot more to the buyer (Novo) than to the seller.

Finally Novo is also planning to be quite busy with a whole range of “new” targets:

- Hemi style intrusive targets

- New conglomerate targets

- Multiple lode gold targets

Conclusions

… Well it’s simple:

If one subtracts Novo’s (growing) equity portfolio and net cash the resulting Enterprise Value is laughable given that Novo is a gold producer with the highest absolute blue sky potential in the space across 14,000 km of land and then some:

- Beaton’s Creek (in production)

- Greater Beaton’s Creek

- Total Nullagine Gold Project

- New Found Gold

- Egina

- Talga Talga

- Greater Egina

- Karratha

- Greater Karratha

- Virgin Creek

- Contact Creek

- Malmsbury

- Elementum 3D

- Elsie

- Salvation Well

- … You get the idea

Owning Novo is like owning 20 juniors while note even paying full value for Novo’s Nullagine Gold Project.

… Oh and don’t expect the market to price all of this anytime soon. The market can usually only focus on one project at a time (you see it every day). Thus I see it as paying nothing for an endless amount of targets where I expect at least some might pay off big time. If/when that happens the market will eventually start caring and an investor who got in at this valuation took no target specific risk since it was free. In the meantime I expect Novo to fine tune Beaton’s Creek and that shareholders will be owning shares that generate profits while Novo gets increasingly aggressive all over Pilbara.

I don’t love Novo despite the valuation but because of it.

There are no guarantees, only degrees of Risk/Reward.

Novo’s latest AGM Presentation:

Note: This is not investment advice. I own shares of Novo resource and the company is a banner sponsor. Thus consider me biased and do your own due diligence. I cannot guarantee the accuracy of the content in this article. Junior mining stocks can be risky and very volatile. Never invest money you cannot afford to lose.

Well written positive article while negative articles about Novo also exists. Time will tell who’s right.

Do you know what Novo, Lion One, and Irving Resources all have in common?

I call them Bob’s “three amigos” of 2020. IMHO, they are slow to execute on known resources. All cashed up, yet slow moving. I dare to insult them by calling them “lifestyle” companies for the purpose of enriching management and leaving shareholders (who recently funded them) hanging in the breeze.

Now compare the three amigos to New Found Gold whose management is super aggressive around a known resource. It’s a day and night comparison. If, for example, Collin Kettell of New Found Gold had been running Lion One, we would all be rich by now 🙂 Instead, because the three amigos are essentially non-performing or low performing companies (by my criteria), I have to put them in the pile to get out of at break-even, DESPITE them having extraordinary gold resource targets.

My time and money is better spent in fast-moving explorers in NewFoundland and in Nevada (e.g. Collin’s Nevada King Gold) then enduring the three amigos who can’t drill themselves out of a corner.

Like you, I greatly respect Collin. With NFG he has benefitted from outstanding grades and widths so he can be aggressive with additional drills. But with Nevada King, Collin is more like Q: A very large portfolio of projects, of which only some can get immediate attention, and others are in the planning stage for the future. Novo was successfully aggressive (no PFS) getting into production. Like you, I have made much more money on NFG and LAB, but only because exceptional drill results launched the price sky high in the short term. With Nevada King, price is languishing as with Novo because it is a longer term play. I believe that Novo will be slow and steady and a long term winner. Neither Colin’s companies nor Novo appear to be lifestyle companies.

Novo, for the most part, is making the right moves operationally and exploration-wise. Acquiring the mill, getting Beaton’s into production, and exploring tangential opportunities are all good things for management to invest in and focus on.

I see one big reason why Novo’s value has not done well. And it relates directly to the stupid capital raise decision a few months ago that was conducted in haste and in a weak gold market. Novo sold the entire company’s undervalued assets at a stupidly low valuation, giving away the company to new investors dirt cheap. That decision, which was unnecessary at the time, particular given that Beaton’s Creek is now free cash flow positive and the company had other assets it could sell, will continue to haunt the company and be an impediment to value creation in the short-medium term. Novo tapped the most expensive capital source it could, at one of the worst times for the company – right when it was starting to show production gains at Beaton’s and demonstrate it could be a producer. Talk about shooting yourself in the foot!

Great exploration and production gains can be more than offset by an extraordinarily poor capital allocation decision in the flip of a switch. And the more mistakes that are made in that department, the worse it will get for Novo with respect to value creation, as defined as free cash flow per share, the ultimate determinant to building stockholder value over time.

Some people Just cant see the forest through the trees!!!

Yes these companies have sold off sharply in the last year and they have their reasons for poor performance, but its allowing the Wise to pick up shares cheap. Just keep accumulating, all these will be winners. Take some of those nice profits from NFG and buy buy buy.

#notworried

-sasha san diego

The three amigos 😁

I think you are right, indeed look at NFG and De Grey how they made advantage of momentum. Compare that with Novo and Sokoman. It’ all about management and keeping the retail investors informed and happy. Investors in Novo are far from happy. Stock may be cheap or not but investing in goldminers should be exiting, not depressing.

Thanks Horseman, for your usual excellent big picture analysis of Novo.

One question, the ore sorting equipment isn’t that expensive, I believe under US$1M. Why not leave the currently owned ore sorter at the mill and get another mobile ore sorter ordered for Karratha so they can execute on the original ore sorting plan at Karratha and eliminate shipping unprocessed ore to the mill which was the original reason to acquire the ore sorter. Now Quinton is saying they plan to ship unprocessed ore from Karratha to the mill. This doesn’t make sense to me, Novo now has the money to buy another mobile ore sorter without killing the bottom line. Why not buy a second mobile ore sorter that can be used for testing at Karratha and moved when necessary?

Your thoughts.

Good points, Jackson. I’d like to see Q’s and HH’s response.

I understand from watching interviews with Quinton, is that they need aboriginal approvals for ore sorting at Karratha and perhaps Egina…

Excellent update and summary, Erik. Novo does NOT seem to me to be a lifestyle company, especially given all the ongoing activity you have outlined.

This message thread is turning into a great discussion. I wish we get more contributors.

Any word on when Novo might list on the NYSE?