What Are You Afraid of?

OK, time for some reflections…

Everyone probably has a good example of giving out a tip or two to family members and/or friends…

Or possibly even managing some of said people’s portfolios…

And the tips and/or portfolio management for others will often result in strategies that are completely different to your own portfolio…

What would you do right now if you were managing say a family members portfolio who had an investment horizon of say 5+ years?

The reason I find this thought experiment interesting at this point in time is because we are in very chaotic times, with the miners selling off hard even though the commodity they sell (or hope to sell) is near all time highs.

Many are worried about stock PRICES heading lower. Some are worried about the end of the world…

Both are quite irrational thoughts in reality.

Think about it. Are miners cheap? Yes, cheap as dirt. Are commodities cheap? Yes, cheap as dirt…

In other words, mining investors aren’t afraid of buying something OVER PRICED, but rather afraid that the cheap stocks might get cheaper (at least for a while).

That is really a luxurious thing to be worried about…

If I owned the S&P500 or the Nasdaq I would be worried that I was holding very OVER PRICED stocks and that they would either drop in value or get FAIRLY VALUED. Airline and restaurants are taking a real beating for example and if this turns into a recession or a depression then a LOT of businesses will risk actually going under.

With many miners the dilemma is totally different…

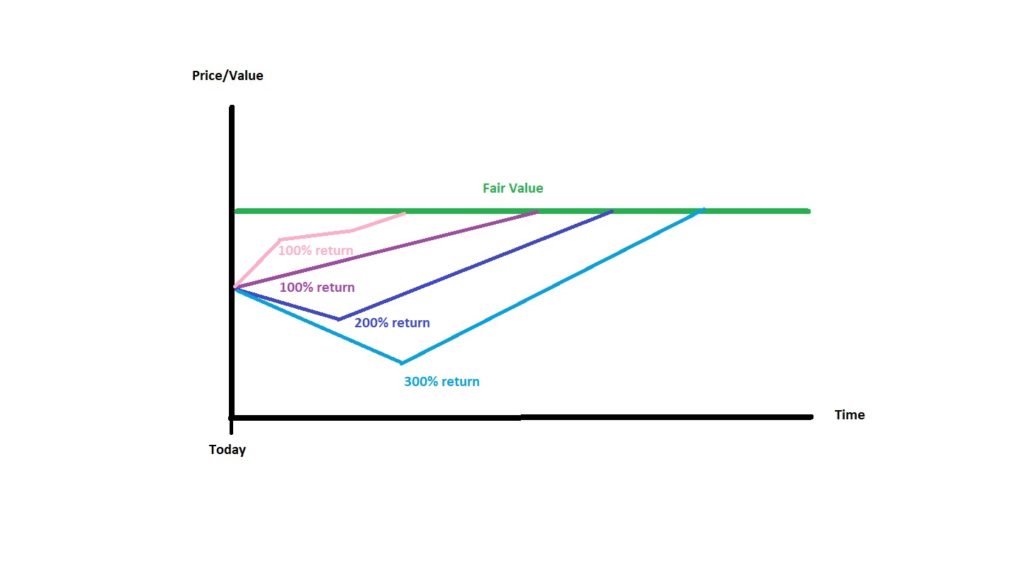

If one assumes that you own high quality juniors with good backing and access to capital then the risk of a permanent loss of capital should be relatively low in the short to medium term. Lets also assume that FAIR VALUE for juniors you own are 100%-200% higher than where they are currently priced…

What is your REAL RISK in the short term then?

It’s NOT that there won’t be any demand for your product since gold is a global market and prices are high. One could sell any amount of gold at the currently very high gold price.

It’s NOT that your company became worthless. Again, gold is at 5-year highs in US dollars (even ATH in some currencies) and lets assume that nothing could kill the company’s project in the short term.

You risk then boils down to opportunity cost…

The thing you own with a say 100% to 200% expected return could get cheaper for a while and present you with an opportunity for say 300%-400% returns.

… A salivating notion for sure, but the former scenario is already spectacular.

Now, what would you do with a family members portfolio after thinking about this?

Personally I am much more greedy when it comes to my portfolio than any family members portfolios.

Assuming no one absolutely NEEDS the money within say 1-2 years (then don’t) then the decisions become quite obvious…

I am not prepared to sell stocks that I think are worth (and should be priced) 100%-200% higher than they are currently priced…

100%-200% is a bloody good return over say 2 years even though it might look really bad until things calm down a bit.

If miner drop further I will simply advice them to put in more money and buy miners at their cheapest valuations in history.

What am I doing?

After reflecting on this thought experiment it becomes pretty obvious that something going from cheap to cheaper, while there has been no materially negative change in fundamentals, is a pretty weak problem to have.

Did Lion One Metals drop 50% in value over the last month for example? Hell no, it’s cheap as chips based on all current information.

Did Irving Resources suddenly become much less valuable compared to a few weeks ago when Newmont took a larger position? Hell no, the company has one of the best business models I know and could be worth billions in the end for whoever acquires Irving.

… So I guess the “problem” is that these stocks are currently cheap…

Not that they have gone down in terms of expected long term value AT ALL…

Both are cashed up and have projects located in good jurisdictions, so permanent loss of capital looks less likely than for 99% of juniors.

In other words, this ought to be a temporary paper loss unless the world ends or something fundamentally negative happens for these companies because they are certainly not over prices IMHO (Newmont agrees for IRV at least).

OK, so I am pretty sure that the current portfolio losses will be erased without me having to do nothing. That’s actually a great thing.

BUT, if there is at least a chance for even bigger bargains to be had then should I save up some dry powder just in case?

Hmm, well that might not be a bad idea. I mean I expect most if not all of my positions to be much higher in a year or two so that’s a good scenario already…

BUT, having say 10%-15% in dry powder in case we get the best bargains ever might not be a bad idea…

If some of these juniors drop 30%-50% in PRICE, then the return to mean valuations should produce some pretty easy 10-baggers, which could give a nice boost on top of 85%-90% of capital already employed which I expect to make at least 200% returns on within 2 years.

Closing Thoughts

I guess the main take away is that worrying about UNDER PRICED assets potentially getting MORE UNDER PRICED is a rather envious “problem” to have. If the “sell at any cost” panic selling continues then I hope I got some additional capital to deploy.

I don’t like the thought of shedding long term HODL positions for family members at these valuations since we could also be at or say 10%-20% away from the “final” bottom in miners. It would feel pretty crappy if I sold out and it turned tomorrow because it could mean that I essentially sold something that would return 200% within two years and bought it all back when the returns would potentially be down to 100% within two years… Just because of the “greedy fear” that something already incredibly cheap could become cheaper.

It’s of course a bigger dilemma for me since I am pretty much fully invested already… But I guess having say 10%-15% of dry powder might be a good idea just in case future 200% return stocks become 400% return stocks for example. With that said, I do really think I could do no changes in my portfolio, go on a 2 year vacation, and come back to a portfolio that is up at least 200% from here.

The ideas expressed in this article are not limited to Irving and Lion One. There are many stocks out there where the biggest short term “risk” seems to be that a good future return could potentially turn into a great future return.

As always: Never invest something you will need within the next say 12 months.

Note: This is not investment advice. I own shares of Irving Resources and Lion One Metals. Lion One metals is a banner sponsor.