THH – Thoughts on Hercules Silver

Oct 19, 2023

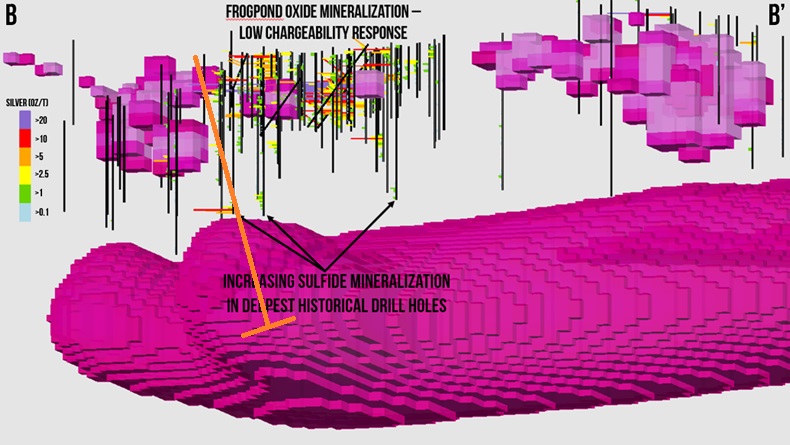

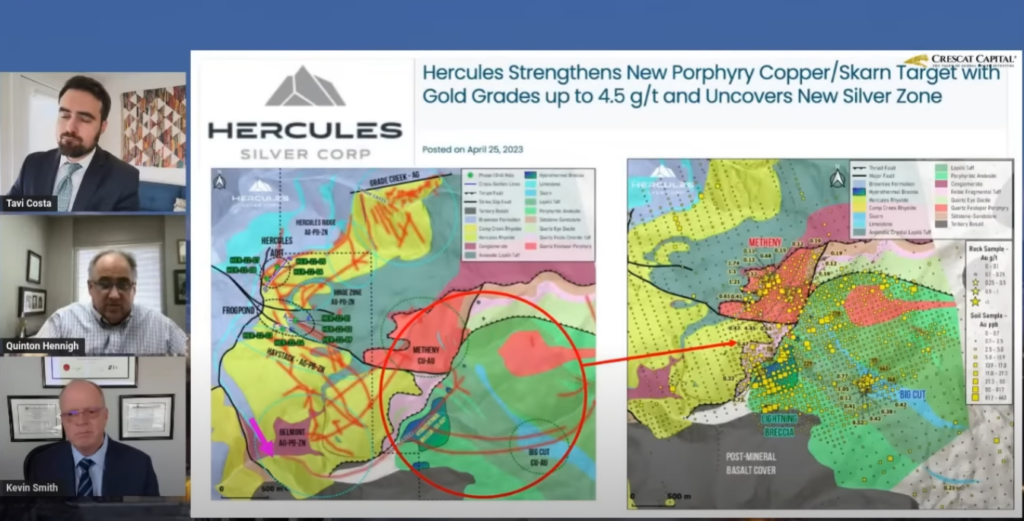

Hercules Silver is an interesting story. When I first bought into it a couple of years back the main attraction was the historic resource and the corresponding CRD system. Basically I saw it as a silver Beta with growth potential for more silver to boot (Alpha). Well today it looks like the company might have a very large Porphyry system (or two) with a corresponding district scale CRD as well as Skarn systems preserved…

“It is signaling to us that you have got the entire system, still preserved, at depth.” – link

Case in Short

~100-150 Moz of silver that acts as Margin of Safety. Regardless if there are no additional discoveries then there will still be a quite substantial silver resources in a first world country. In a better sentiment environment, like when silver does well, this alone could have the company do very well.

What tips the scale for me however is when you combine the above with the fact that it looks like Hercules could have an entire porphyry system (or two) with both Skarn and more CRD mineralization to boot.

Upside:

- 5.5 km of strike of CRD mineralization to test

- One potential porphyry to the west

- Very large copper/gold anomaly which suggest Skarn potential in the east

- One potential porphyry at depth under the massive gold/copper anomaly in the east

(After a recent interview with the CEO it is now known that the company believes there is one very large porphyry rather than two distinct ones).

… What makes it incredibly exciting is that the first hole drilled into a new target (IP anomaly), which was the first hole outside the historic resource area, hit a >200 grammeter AuEq interval which is extremely abnormal. So not only does this look to be a huge system, with multiple deposit types, but the first hole outside the known CRD area produced a barn burner hit.

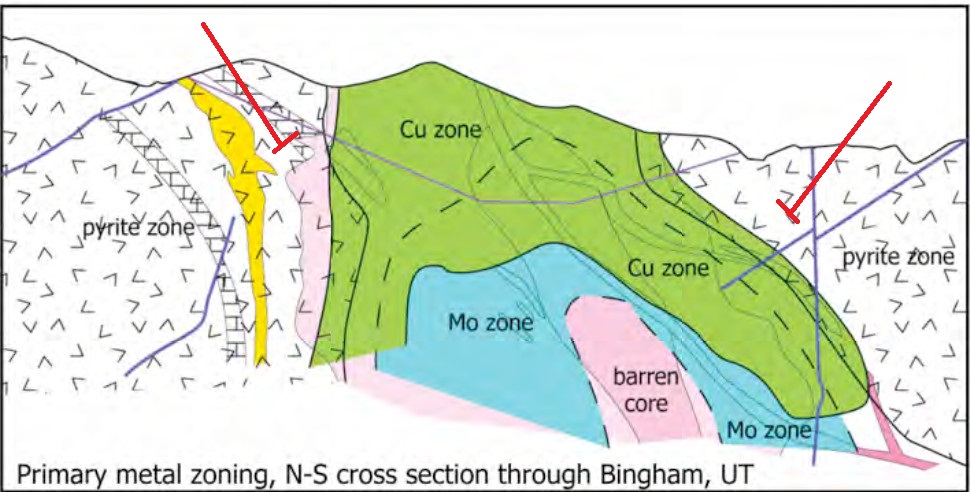

In short it looks like this might be a case where the company has company making potential from multiple deposit types like seen at Bingham Canyon for example;

- CRD

- Porphyry(s)

- Skarn

Competitive advantage – Permits

One other very significant advantage Hercules has vs peers as stated by Chris and found in Jeff Clark’s Gold Advisor: …. The historical resource and majority of historical drilling is on state land, for which T.BIG owns the surface mining and exploration rights. This is because the US company that T.BIG purchased, which owns the Hercules project, also owns certain surface rights to the land, with respect to mining. The state now owns the surface with respect to everything else. The situation is called a “split estate” and our US counsel completed an extensive title opinion that confirmed these rights prior to us executing the deal. So that means that we don’t need to permit to drill on that land and we can drill and build roads at our leisure. – Stateside

Infrastructure

There is a transmission lines, a highway and access roads running through the project.

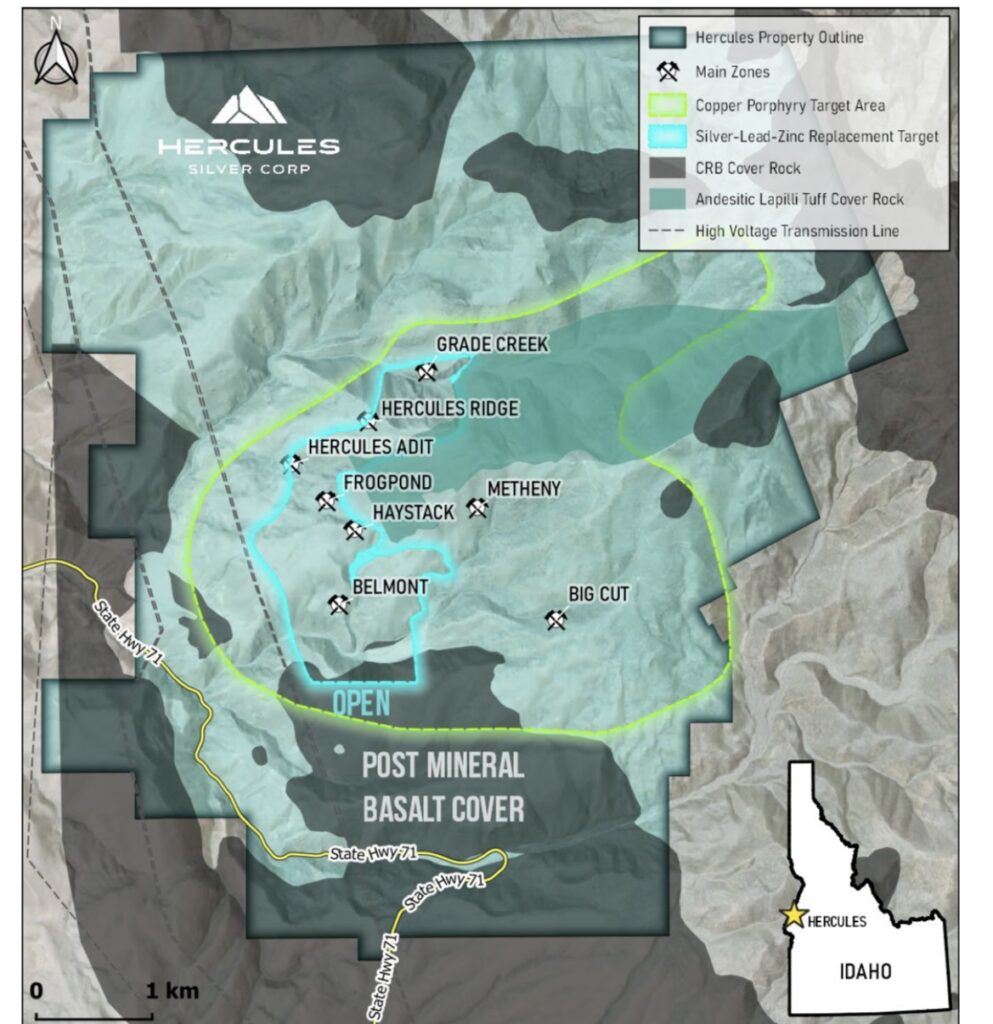

1. CRD mineralization – The silver/lead/zinc story

The silver/lead/zinc replacement style mineraliation would be the low hanging fruit and the potential footprint is absolutely massive:

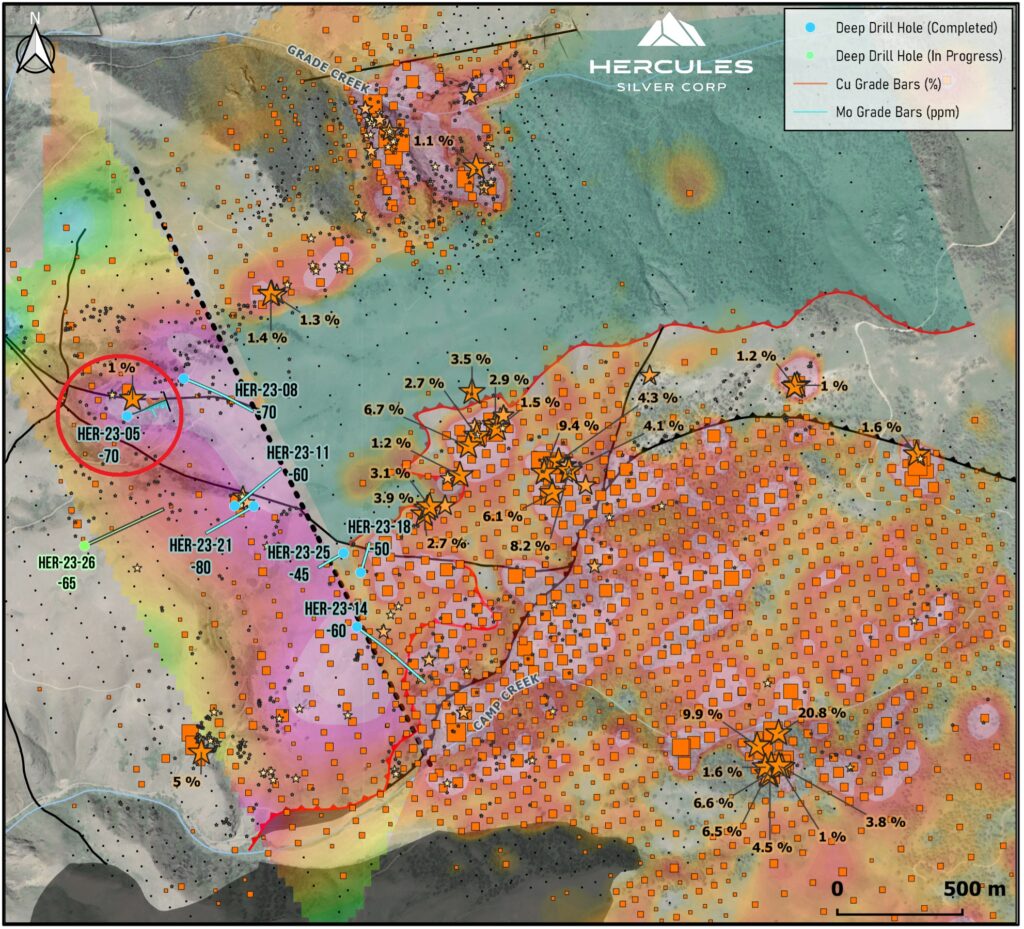

(Light blue)

“At least 3.5 kilometers of silver-lead-zinc mineralization has been exposed at surface from the Belmont Zone in the south to the Grade Creek Zone in the north. The old mine workings in South Camp Creek, as well as two other erosional windows within the basalt, are evidence that silver mineralization continues for at least another 2 kilometers to the south, bringing the total strike length of the CRD system to at least 5.5 kilometers.” – link

The upside potential from the CRD system alone combined with the “margin of safety” could be enough to make Hercules a solid Beta/Alpha bet in my book:

“I looked into this and talked to QH a bit, but they already seem to have pretty economic open pit 100Moz Ag, could easily generate a US$300-400M NPV @$20 silver. Nice backstop for the copper” – CriticalInvestor

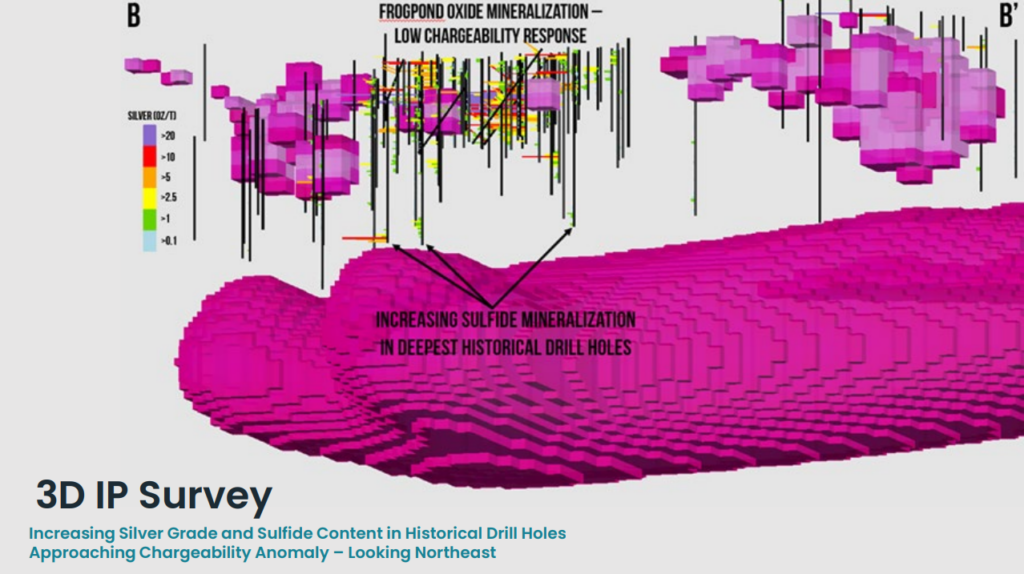

The nice part about the recent copper hit, which I will get into later, is that the drilled anomaly is located just under the near surface silver:

So if you would mine the silver, the material which might make the copper not amendable to open pit mining, might suddenly have a much lower strip ratio once the silver has been mined.

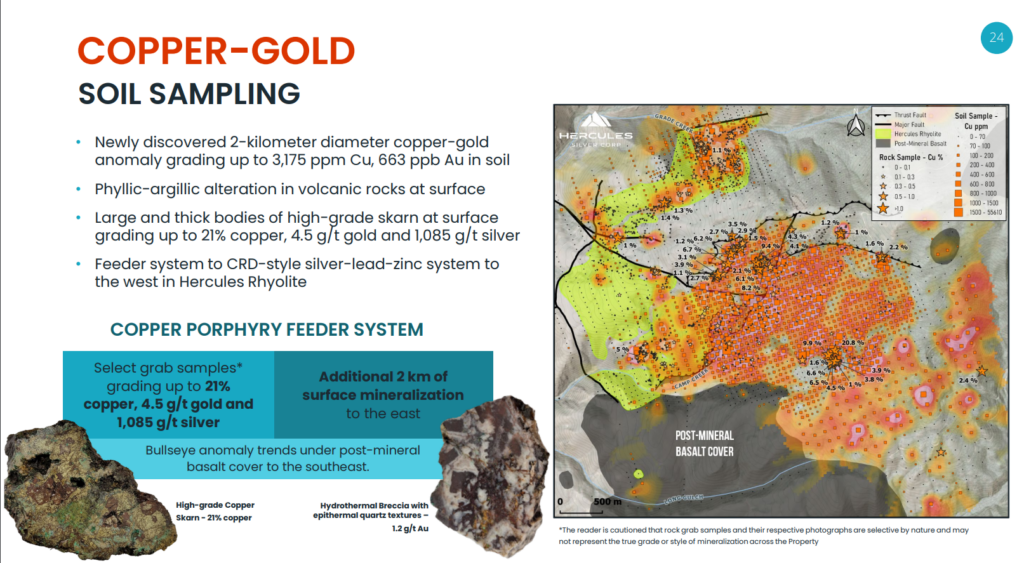

2. Skarn mineralization – The copper/gold story

“Two high-grade copper-silver targets, the Big Cut and Metheny Zones, occur within the Triassic Seven Devils Group on the east side of the Property. Both targets demonstrate skarn-style mineralization which occurs where limestone comes in contact with, or lies within close proximity to, a nearby porphyry intrusion. The Big Cut Zone is classified as a garnet-epidote skarn, whereas the Metheny is a specularite (iron) skarn. The differing alteration is likely a function of zonation around a potential porphyry intrusion or multiple intrusive centers at depth.” – Link

“High-grade skarns grading up to 21% copper, 4.5 g/t gold and 1,085 g/t silver (skarn occurs when limestone is altered and mineralized by a nearby porphyry copper intrusion)”

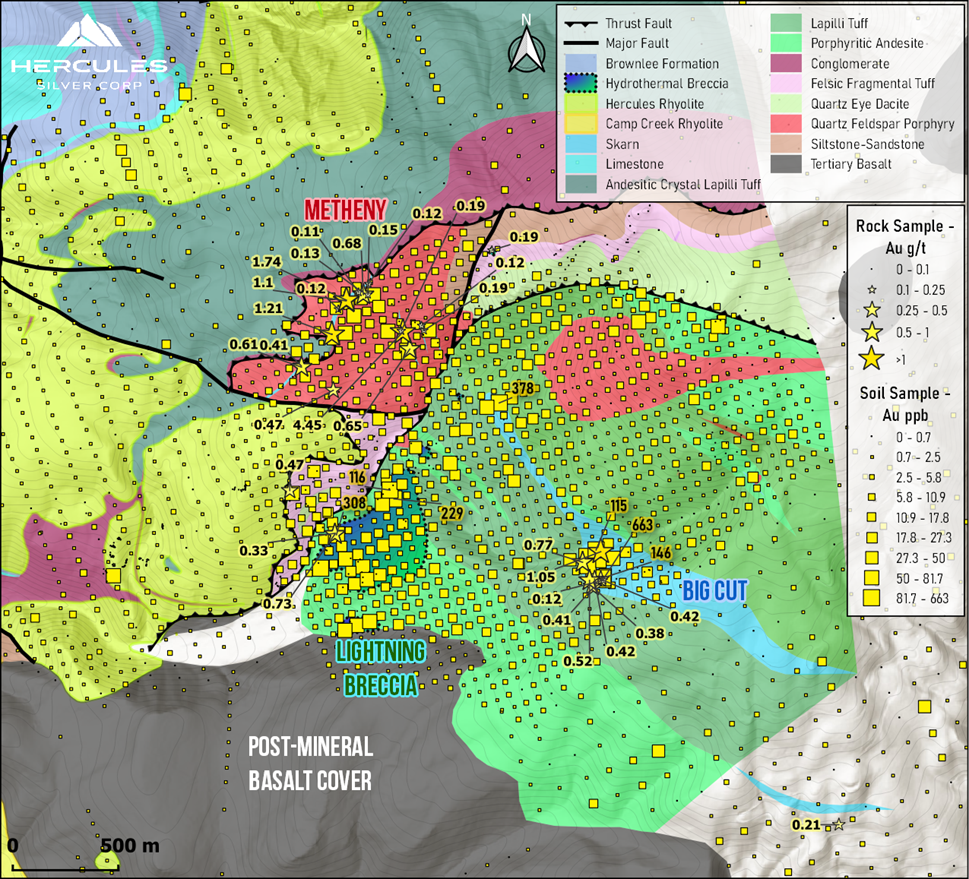

Gold

The Company subsequently fire assayed select rock samples within the porphyry copper target area, which revealed the presence of gold in bedrock. The gold is associated with mineralized skarns as well as a breccia pipe, both of which are interpreted to be the near-surface expression of a buried porphyry copper target. The new gold-in-rock values are shown along with associated gold-in-soil values in Figure 1. – link

Copper

CEO Chris Paul talks Skarn and Porphyry potential

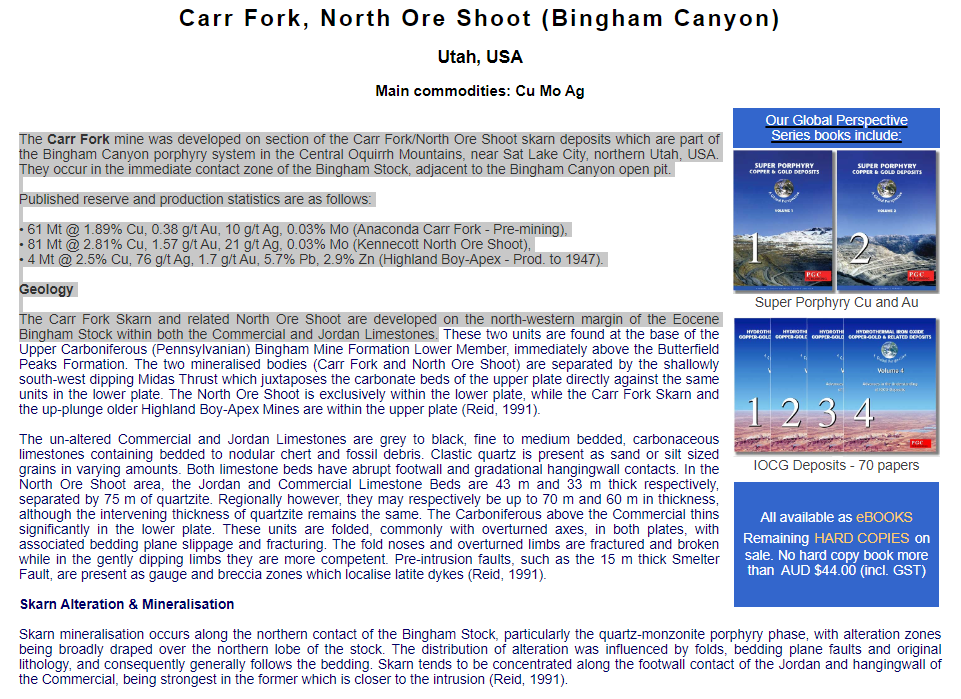

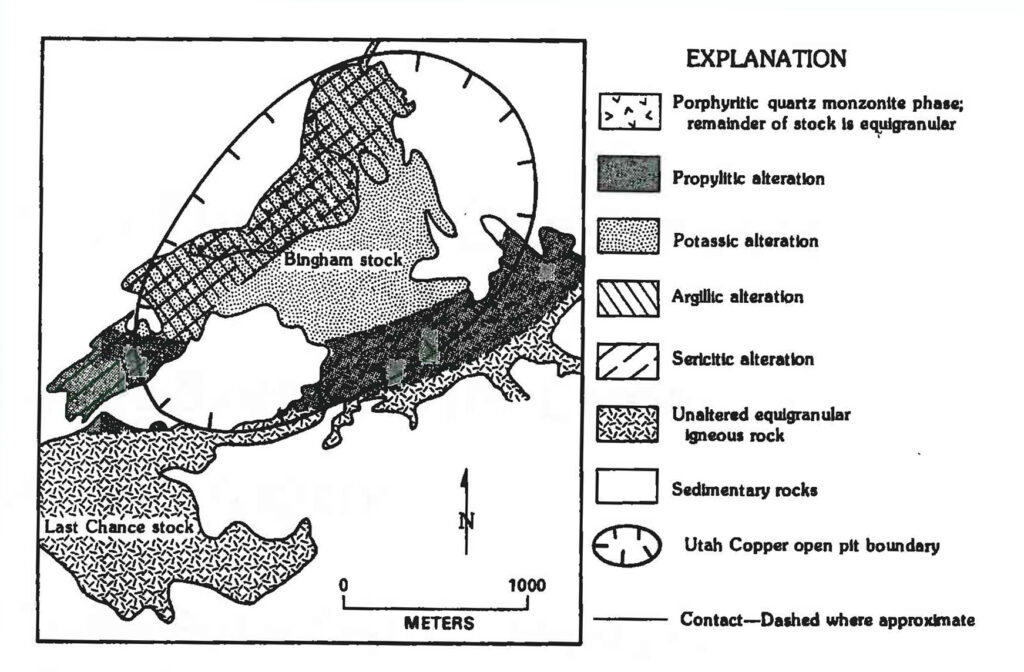

Bingham Canyon – Skarn deposits

“Copper-gold skarns peripheral to the porphyry copper deposit in the Bingham mining district, Utah, contain a geologic resource of over 7 million tons of copper and 9 million ounces of gold. The skarn deposits, hosted by Pennsylvanian limestone beds within the contact metamorphic aureole of the Tertiary Bingham stock, have been mined intermittently since 1896.” – link

Early Bingham operations showing Carr Fork and North – Link

Ex Anaconda employeed talk about the discovery of >100 Mt of Skarn mineralization at Bingham

3. Porphyry(s) – The copper/molybdenum story

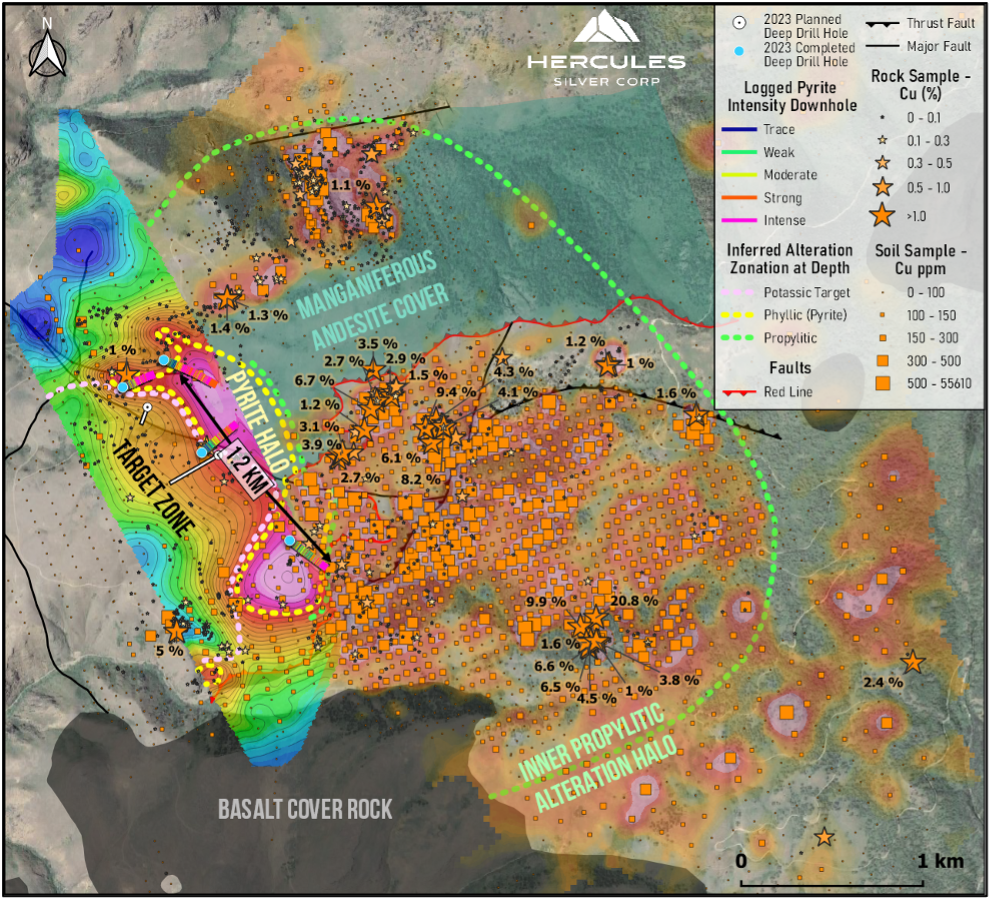

“Surface data suggests that the source intrusion responsible for the copper-gold mineralization at surface lies deeper in the system. The geology at surface is typical of the upper levels of a porphyry copper deposit, including phyllic and argillic alteration associated with the copper-gold anomaly, and widespread propylitic alteration outboard of that to the east. This is classic zonation around and above a porphyry copper system, where the higher-grade potassic alteration occurs at depth, below the phyllic and argillic cap.” link

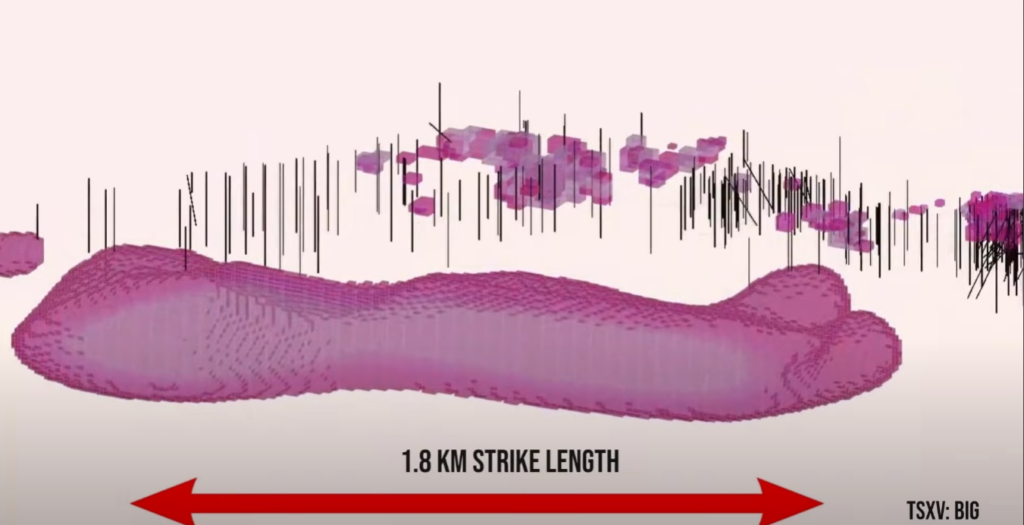

A chargeability anomaly with 1.8 km of strike…

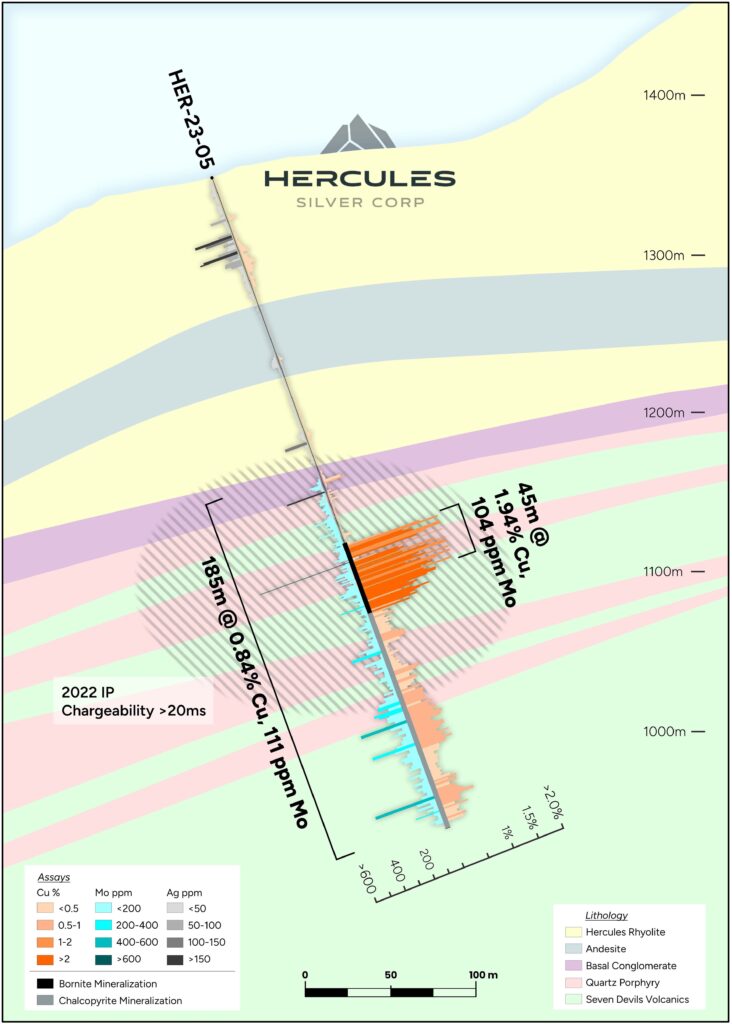

The recent news that stated “Hercules Silver Intersects 185 Meters of 0.84% Cu, 111 ppm Mo and 2.6 g/t Ag, including 45 Meters of 1.94% Cu in First Deep Hole Drilled at Hercules” was the first ever test of the 1.8 km long chargeabilityt anomaly shown below:

This hole, hole HER 23-05, was collated in the eastern part of the picture below (and quite far away from the massive gold/copper anomaly as you can see):

This is approximately where I think hole 05 hit the anomaly:

Keep in mind that the hole was cut short as per the latest news release:

“The hole ended prematurely due to drilling challenges encountered at a post-mineral dyke, however observations in subsequent holes indicate that the mineralization likely extends significantly below HER-23-05 at 435 meters.” – link

Cross section:

Addiotional holes have been drilled, as seen in the picture above, and the visuals are described as follows:

“Additional step-out holes drilled at various orientations to the southeast of HER-23-05, where chargeability data is currently available, have intersected similar alteration, veining and copper mineralization over variable lengths. Many directions remain to be tested, and the potassic center, which often carries the highest grades within porphyry systems, remains to be found.” – link

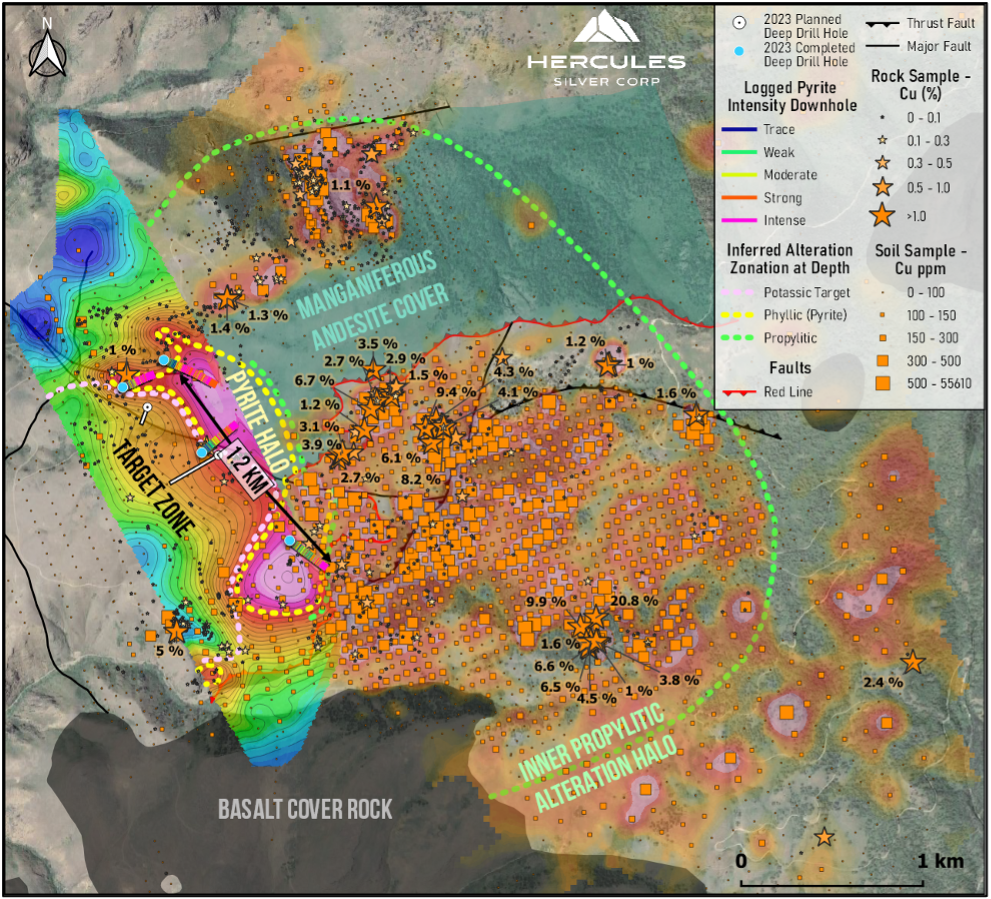

“Blind drilling across 1.2 kilometers of the chargeability anomaly has now returned strong alteration, veining, and mineralization, consistent with the margins of a porphyry copper system and early observations demonstrate it’s considerably larger and more intense than was first interpreted from surface exposures.” – link

Now one would expect that the core of the system, the potassic zone which is expected to be higher grade, would be located to the east as per the massive gold/copper anomaly:

(Red circle)

BUT, to my surprise the news release said the following:

“Figure 2: Potential alteration zonation, interpreted from observations in 4 deep drill holes across 1.2 kilometers, and IP chargeability at 200 meters below surface. Further IP surveying is planned to the east, where other centers may exist to alter this interpretation, as well as to the west where current drilling indicates increasing alteration/mineralization. Two planned holes are shown in white, to test increasing alteration to the west, and more moderate chargeability which may represent increasing chalcopyrite relative to pyrite.”

The latest news release also stated:

“Alteration observed in HER-23-05 and other deep holes consists of quartz-sericite-pyrite (phyllic alteration) with abundant porphyry-style A, B, and D-type veining. Phyllic alteration manifests as an outer shell of highly chargeable pyrite (+/- chalcopyrite) mineralization, that often surrounds an inner shell of chalcopyrite (+/- bornite) mineralization with lesser pyrite. “

If we look at a geological cross section of Bingham Canyon one could argue that the company believes the holes are in the “pyrite zone” that surrounds the core:

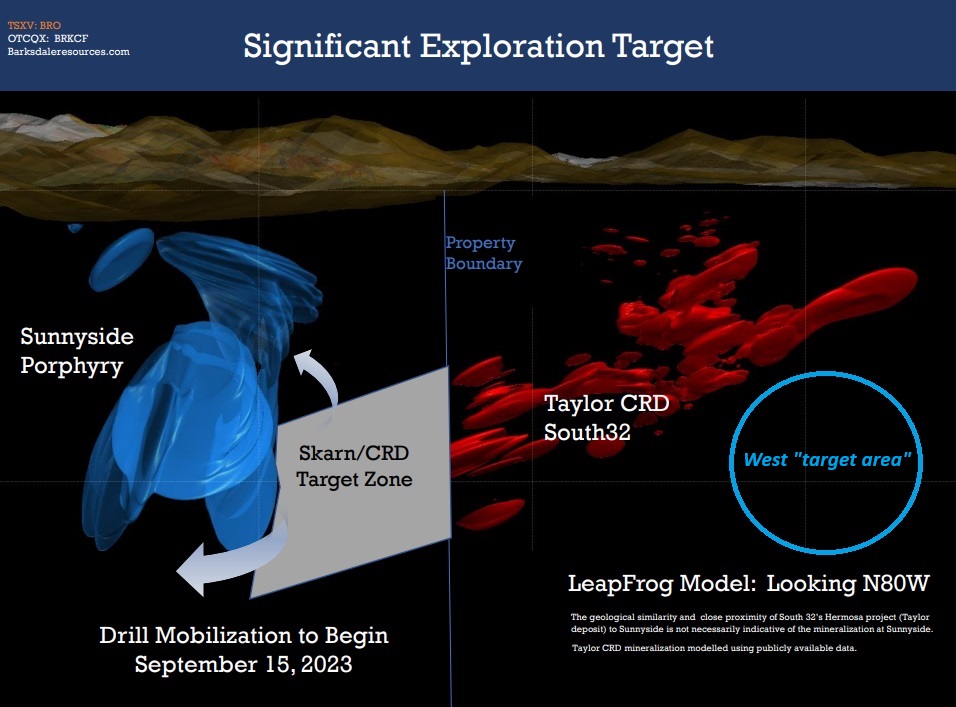

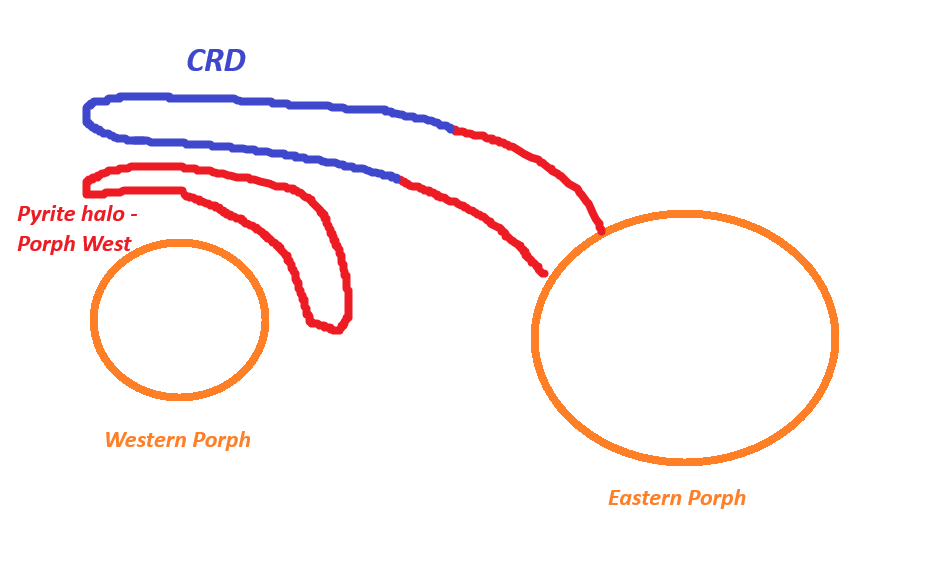

So to recap, the belief is that the holes drilled so far, are within the pyritic “halo”. And the belief is also that the drilling so far is suggesting that the porphyry source is actually to the west. Hence why the new “target zone” is to the west of the “pyrite halo”:

So what is going on here?

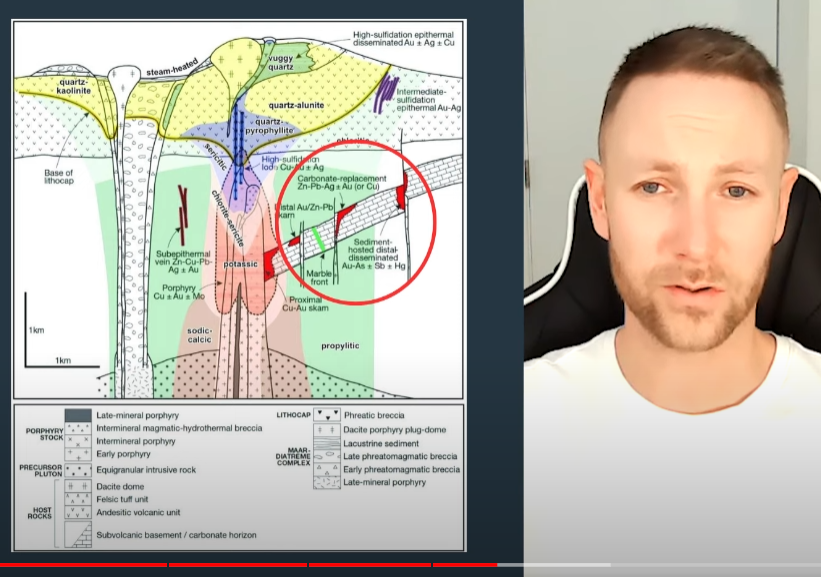

Well it is puzzling that the only hole drilled so far, which was very good despite being cut short, is believed to have its metals sourced from the west and not the east (under the gold/copper anomaly that sticks out like a sore thumb). Furthermore one would assume that the Skarn mineralization would be closer to the potassic core of the porphyry than the CRD mineralization as per this slide used by Chris:

(It goes “Proximal Skarn -> Distal Skarn -> CRD”)

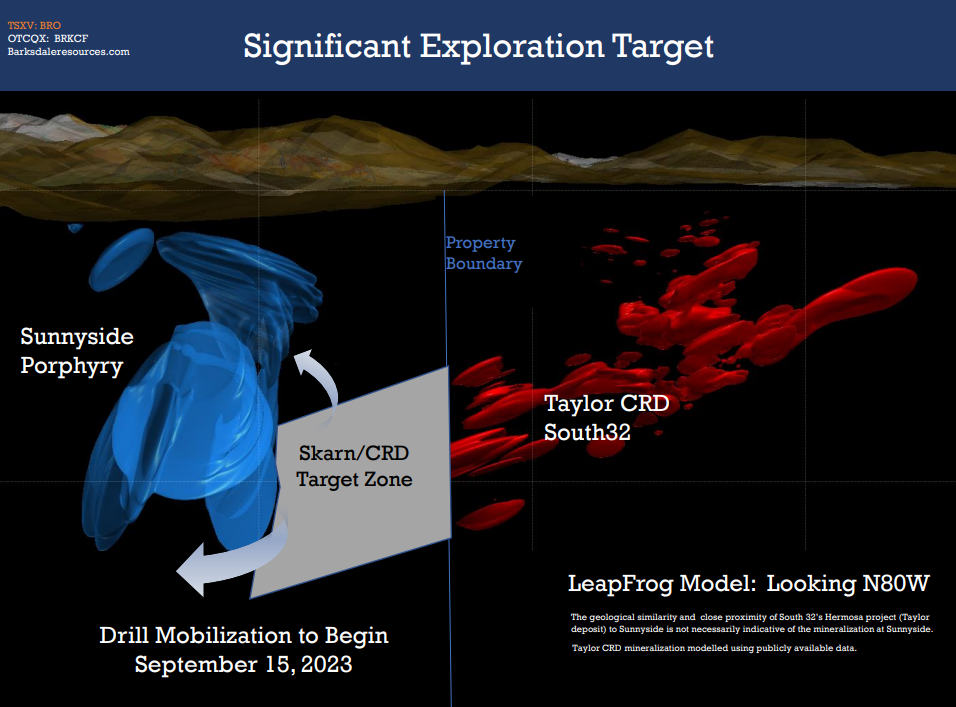

So the Skarn is expected to be closer to the Porphyry core as per this slide from Barksdale Resources:

(Porphyry in blue)

Yet we are seeing CRD to the west and Skarn to the east, even though the current belief is that the porphyry source of the currently drilled pyrite zone is to the west… In other words it is like we are looking for a porphyry to the right side in the schematic above given that Skarn is found kilometers to the east and the CRD mineralization is above the pyrite halo:

So do we have two porphyries and we are seeing overlapping halos…?

Is the CRD mineralization, which is located above the recent copper hits, originating from a potential porphyry to the east?

I sure don’t know and I am NOT a geologist. Still, I think it is a very good sign when things get “weird”.

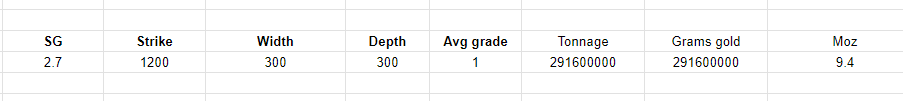

Playing with some numbers

We know that they have hit the anomaly over 1.2 km of strike. We know what the first hole, which was cut short for technical reasons, hit in terms of grade. Well just playing around with some numbers for the anomaly alone; assuming 1.2 km strike, 300 m with, 300 m depth, and ~1 gpt AuEq for grade, gets you:

(Note this is gross speculation as I don’t even know the specific gravity and we have no idea what the avg grade will be etc)

Closing Thoughts

I think Hercules Silver, with its abnormally good first drill hole into the pyrite halo, has become a very convincing Risk/Reward opportunity. I think the current, implies silver resource could at least be worth $50 M, even in a crappy market like this. In a better sentiment environment, rising silver prices, and more CRD exploration success, I don’t think it is out of the question to see a pretty good positive return from today’s level.

What makes Hercules stand out today is the fact that the upside could be significant beyond the CRD mineralization. If you get a hit like they just did on the first try into a porphyry halo then that could suggest that this is a very robust porphyry system (or even systemS). So the blue sky potential is to have another Bingham Canyon type situation where it is possible that Hercules ends up finding a massive CRD system, Skarn deposits as well as one or two porphyry deposits.

If the company did not already have a decent silver resource I think the Risk/Reward would be much different since everything would be relying on further exploration success. As I see it right now I may, or may not, even be overpaying for the silver potential whilst I may get all the potential upside in a potentially remarkable system for “free”. But the market is not rational in the short term so maybe I am still risking -50% in case the porphyry(s) story is a dud in exchange for a $1-$2 B prize, or more, in case it proves to be as robust as it looks.

Note: I am biased. This is not investment advice. I am not a geologist. I cannot guarantee the accuracy of the information in this article. I share neither your profits or your losses. Assume I may buy or sell shares at any time without warning.

Plain and simple; the financial

Action of the past few weeks ( since the Gold lows @$1810), clearly exhibit why it is absolutely fruitless to invest in pm stocks!!!!!