Headwater Gold (HWG.CN): ~US$7 M For 9 Projects in The US With 41% Insider Ownership

October 12, 2021

This article will explain why I have bought shares of Headwater Gold (HWG.CN) and why I was happy to have the company on as a banner sponsor.

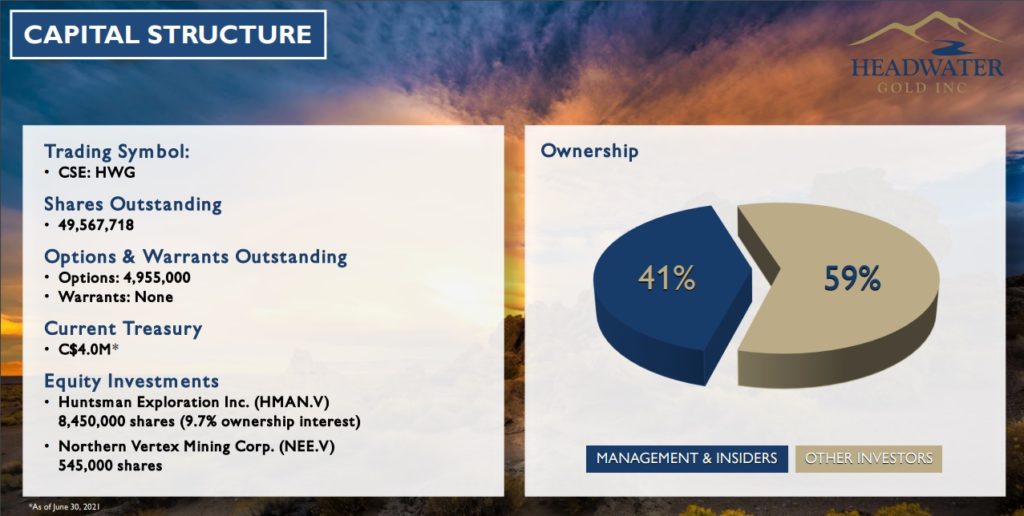

Headwater Gold is an early stage exploration company which means that on paper it is a high risk/high reward case. However, with >9 projects in the portfolio and a stellar management team behind it I dare say that it’s not even that high risk at these levels. The company is currently drill-testing two projects that are in Nevada and other projects will be drilled in the future. Management and Insiders own 41% of the company and the strategy is to drill and kill as many projects as they can. The thing to take note of is that the management team is very experienced and they have a lot of skin in the game. Guys like the CEO Caleb Stroup (former Senior Geologist for Kinross Gold) understand exploration and know that it’s a numbers game. Therefore Headwater has amassed a big portfolio of projects, and continuously look for new opportunities, while also planning to drill-test them all. Rinse and repeat.

Valuation at C$0.23/share:

- Market Cap: C$11.4 M (~US$9 M)

- Cash: C$2.9 M

- Equities: >C$500,000

- Enterprise Value: ~C$8 M (~US6.5 M)

For les than US$7 M I get:

- >9 Projects in USA

- A world class team (Ex Kinross, Barrick, Newmont etc)

- A company where Management and Insiders own 41%

- No warrants

- Very tight share structure

This is the stuff you are only going to see when SENTIMENT is extremely bad in the sector. If this was Q1 2016, when gold was much LOWER, Headwater would probably be trading some 200% higher than this. It’s like shooting fish in a barrel right now in the junior mining sector and it’s a great time to be an investor. It’s a joke to be able to buy such a high caliber team, 9 projects and 2 drill stage projects for less than US$6.5 M…

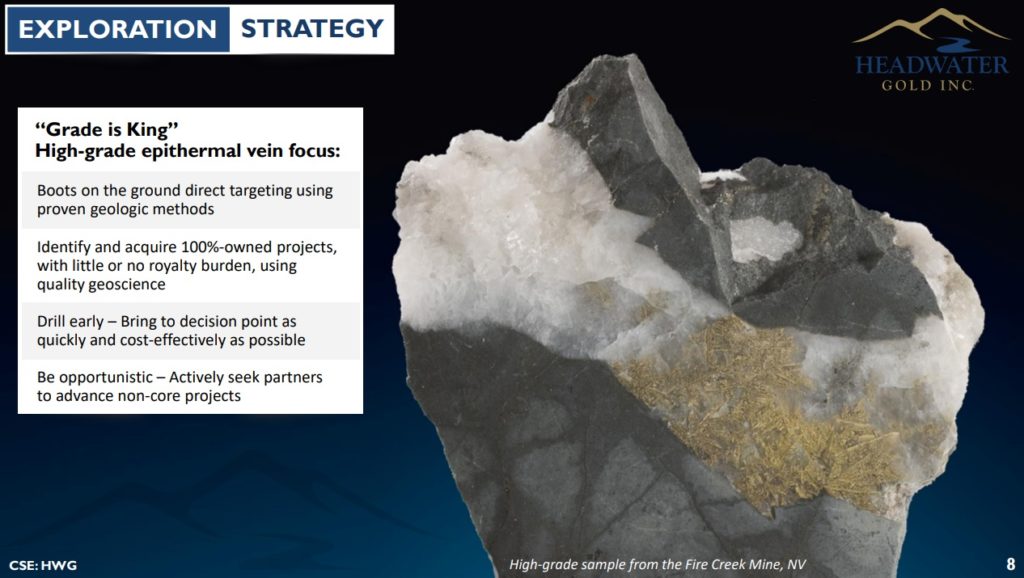

In other words I am paying US$7/9 = US$0.78 M per (hand picked) project at the current Enterprise Value. Sure, some are more de-risked than others, but in my opinion I think a few of them are probably worth more than US$7 M alone on a risk-adjusted basis. The thing with multi-asset juniors is that the projects outside of what the market would consider the “flagship project” tend to be heavily discounted (as is the case here as well in my opinion). These peripheral assets might never be reflected in the share price unless a company has some way of monetizing etc but what I really like about Headwater is that the company does not just acquire projects for the sake of acquiring projects like most juniors. In the case of Headwater Gold the goal is to actually drill-test these projects and then move on if they deem them to have low potential. Furthermore, since 41% of the company is owned by Management and Insiders one could be pretty sure that the company wouldn’t want to spend cash acquiring and testing projects that does not have real potential…

So in contrast to the average multi-asset junior Headwater Gold will a) Drill-test and actively try to monetize it’s large pipeline of projects and b) Be selecting legit projects that this experienced management team would actually want to spend money on, since Management and Insiders own 41% of the company, and therefore will be taking money out of their own pockets.

Upcoming Catalysts

- Assays from Spring Peak Project (Nevada) in the second half of October

- Drill start at Mahogony Project in mid-October and then move the rig to the Katey Project, Oregon

- Early stage exploration across multiple projects

Total Project Portfolio

(On October 4 the company announced the acquisition of the “Midas North Epithermal Gold-Silver Project” in Nevada which is not yet in the presentation)

As you can see Headwater has amassed a very large portfolio of projects that have been hand picked by a former Senior Geologist of Kinross Gold and his impressive team:

We got ex Kinross, Barrick, Patagonia Gold, Klonex, Newmont, Hecla, NovaGold and a bunch of other companies and institutions. I would think these guys know a thing or two about gold exploration.

Capital Structure

Tight share structure, no warrants, cashed up, equities in other companies and a whopping 41% of the stock is held by Management and Insiders. Given the share structure and the stock being tightly held it means that it could move a lot. Given the current valuation, which is close to a theoretical floor, the risks ought to be to the upside. The huge insider ownership also means that the ones who run the company eat their own cooking (they will profit when other shareholders profit). All in all, not really much more a junior mining investor could ask for honestly.

Strategy

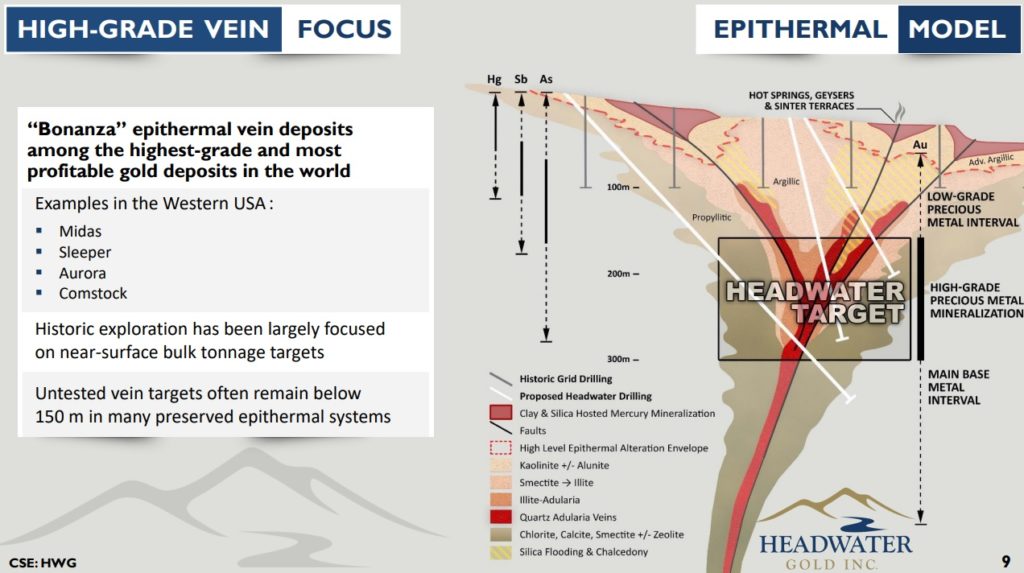

Headwater is almost a bit like a prospect generator in the sense that they are actively working on their already large project pipeline. However, unlike prospect generators, Headwater wants 100% ownership/exposure to their flagship projects. The company’s focus is on finding high-grade epithermal gold deposits. These deposits can be very valuable since they can potentially be very high margin mines. “Even” 1 Moz of high-margin gold in areas with good infrastructure could therefore be quite a pay-day (especially at this valuation).

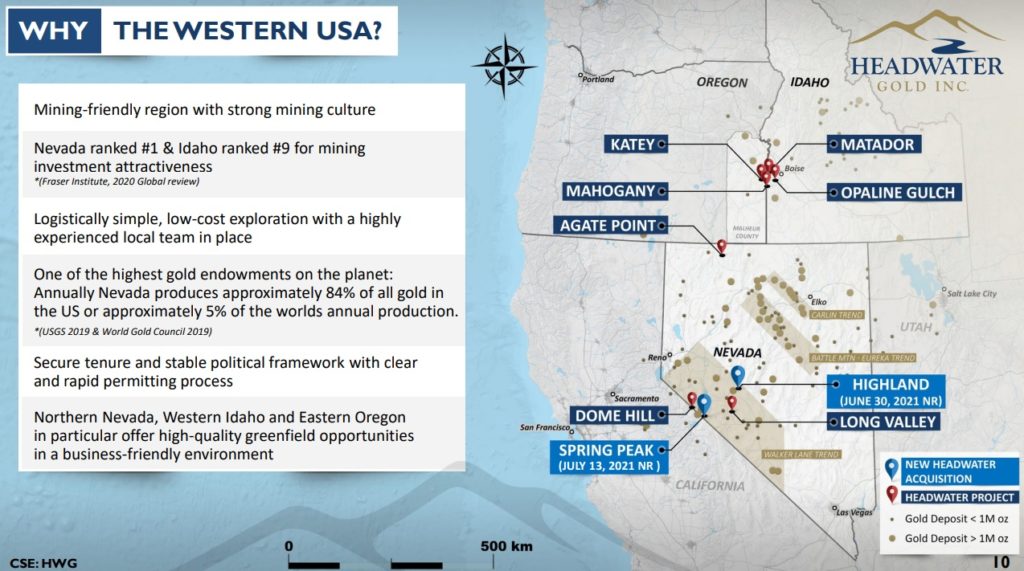

Western Nevada Projects

Headwater currently has four projects in Western Nevada and both the Highland Project as well as the Spring Peak Project are currently being drilled (well, they just finished up the Spring Peak drilling actually!)…

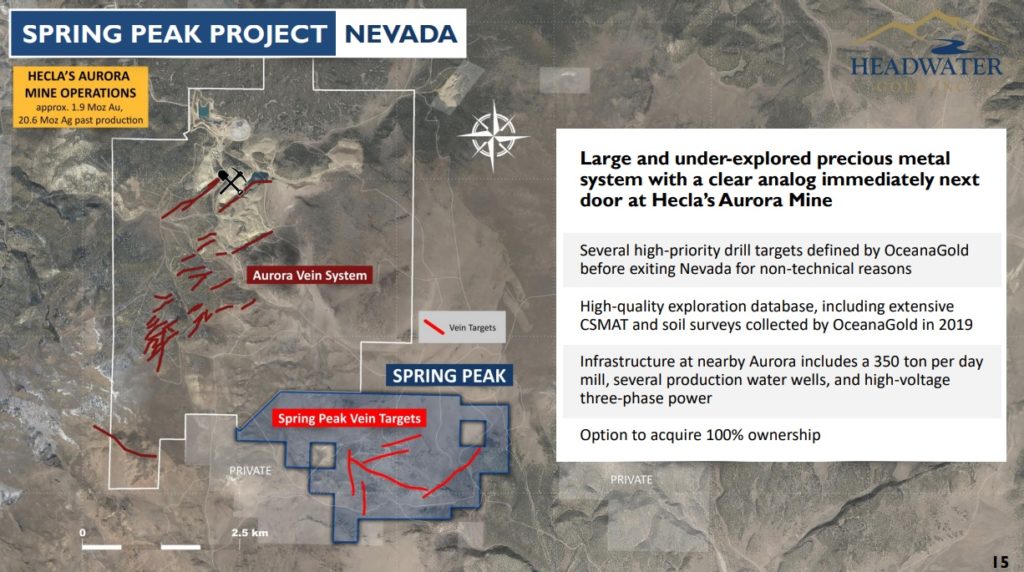

#1 Spring Peak Project, Nevada

The Spring Peak Project is right next to Hecla Mining’s Aurora Mine Operations which has produced approximately 1.9 Moz Au and 20.6 Moz Ag:

The jurisdiction, location, infrastructure and proximity to a Aurora and a mill would suggest that success here should be worth a lot (compared to majority of projects owned by a typical junior). Now lets zoom in on the Spring Peak Project:

This target might not look too impressive in terms of scale but keep in mind that there are several circa 1km long vein targets and that you don’t need a lot of tonnage if the grades are there. It was a small drill campaign consisting of five RC drill holes totaling 1,350m but was completed on schedule and under budget. The recent news release from September 15 states:

(underscore added by me)

The drill holes cut across the interpreted principal structural controls on the alteration cell at vertical depths between 100-200 metres below surface;

Epithermal quartz veins were intercepted in four of the five drill holes at a variety of elevations and within multiple structures. Individual vein zones range from 1.5 to 18.3 metres in drilled width; and

Assay results are expected in approximately six weeks.

Caleb Stroup, Headwater’s President and CEO, states: “We are very pleased with our rapid accomplishments at Spring Peak, having completed the first-pass drilling within two months of acquisition. Our drill program marks the first drilling on the Project since 1989, and the first ever drilling below approximately 100 metres vertical depth where we believe the potential exists for high-grade precious metals. The alteration and epithermal veins intercepted in the Headwater drilling largely confirm our general exploration thesis by proving the presence of quartz vein material in structures at depth below a high-level alteration zone. Assays are required to determine the economic significance of these new vein zones and are expected in late October.”

The fact that Headwater has completed first-pass drilling within two months of acquiring the projects speaks volumes about the team’s efficiency and motivation on my opinion. As it stands now we are awaiting assay results from Spring Peak which are expected to be released in the latter half of October.

#2 Highland Project, Nevada

I had done a section here on the Highland Project before the October 4 news release came out which contained the following update:

Highland Project

The Company has received assay results from the Highland drill program which was completed in early August (see news release dated August 10, 2021). No significant high-grade vein intercepts were encountered in the initial seven-hole program. The Company believes the high-priority targets in the district have been adequately tested and the underlying property owner has been notified of Headwater’s intention to terminate its option agreement. The decision to terminate the option is in-line with the Company’s disciplined exploration strategy of pursuing high-impact discoveries by testing high-quality targets as quickly and cost-effectively as possible.

I could have just cut out the Highland Project section entirely but I think it is important to point out that exploration is really a numbers game and this kind of “drill to kill” approach is what the company’s strategy is all about. Furthermore one can take a look at the share price performance and see that the valuation of the company stayed put pretty much which, in my opinion, highlights the fact that Headwater is so cheap that the other projects more than cover the valuation already. This is why I see Headwater, at this valuation, like an option on multiple projects. If one project fails the “damage” to shareholders is pretty much nil since the large pipeline of projects makes up for it and at the same time “only” one needs to succeed for potentially a material revaluation from these levels.

#3 Midas North gold-silver Project, Nevada

As mentioned earlier Headwater Gold recently added another exploration project in Nevada on October 4 and the Summary Highlights are as follows:

Company has acquired a 100% interest in a large, un-drilled epithermal alteration cell immediately north of and adjoining Hecla Mining Company’s (“Hecla”) (NYSE: HL) Midas mine;

Widespread sinter, water table silica, and clay alteration infers a fully preserved epithermal system is present;

Analogous geologic setting to Hecla’s Midas mine and the recent Green Racer Sinter vein discovery, where gold grades of 111.8 grams per tonne (“g/t”) and silver grades of 490 g/t Ag were intercepted over a drilled thickness of 1.4 metres (see Hecla news release dated February 18, 2021) (1);

Widespread areas of highly anomalous mercury geochemistry, which is one of the key pathfinder elements for epithermal vein exploration; and

The Project was acquired through the staking of 199 unpatented claims on open Bureau of Land Management (“BLM”) land and is 100% owned and royalty-free.

The project’s proximity to Hecla operations hikes up the implied value given that monetization via acquisition would have an above-average chance of happening in my opinion. Furthermore the critical threshold for success ought to be lower as well. What I mean by this is that “even” a discovery of say >500Koz of gold here could be worth quite a bit whereas if this was a remote location, far away from any operation belonging to a large miner, then a discovery might need to be on the order of >2-3 Moz for it to be deemed worthy of development. Another way to put it is that 1 Moz of gold here could be worth a lot more than 2 Moz in many other, more remote, places.

And make no mistake, Hecla Mining is very much active at Midas, and actually looks to be ramping up activity according to this news release on May 18:

“At the end of April, we received the amended plan of operation allowing further access to drill not only at this new high-grade discovery but also to drill test targets on previously unpermitted ground. While it is very early days in our exploration at Midas, these successful results warrant expanding the number of drill rigs from two to possibly four by the end of the year,” Baker concluded.

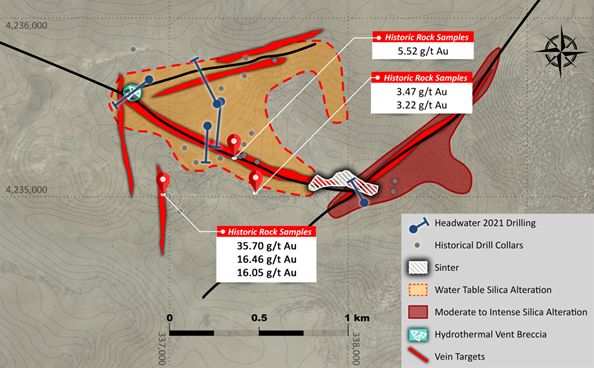

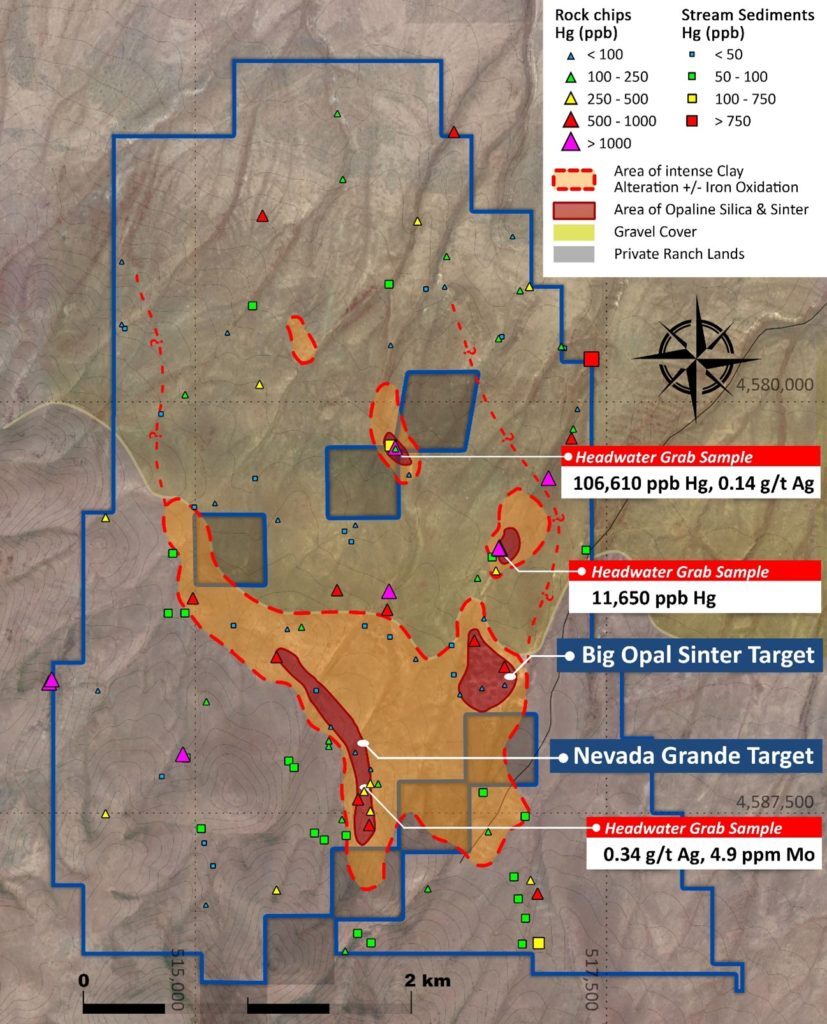

Further description of The Midas North Project:

Headwater’s Midas North project area covers a large hydrothermal alteration cell, extending at least 4 kilometres in strike and 1 kilometre in width, which is interpreted by Headwater geologists as representing the high-level manifestations of an epithermal precious metal system. This system occurs approximately 10 kilometres along strike north of the Midas mine. The Headwater Project consists of 199 unpatented mining claims on BLM land and covers approximately 1,530 hectares.

The current targets of interest are described as follows:

Two priority target areas have been identified by Headwater geologists in the field: the Nevada Grande target and Big Opal target areas (Figure 4), both of which exhibit widespread high-level chalcedonic to opaline silica flooding, clay alteration, and local sinter formation.

This project will see some work in preparation for drill-testing which hopefully will take place next year:

The Project area has seen very limited historic exploration. Although the Project was reportedly staked by Newmont Corporation (NYSE: NEM) in the past, Headwater is not aware of any historic exploration drilling on the property. Headwater geologists are currently planning an expanded multi-disciplinary surface exploration program which will be carried out in late 2021 and into 2022 with a goal of identifying additional high-priority drill targets. This program is expected to include detailed geologic mapping, rock chip sampling, systematic soil sampling, airborne magnetics, airborne radiometrics, and ground based resistivity profiles.

The Idaho-Oregon Projects

You didn’t think the two Nevada Projects were it did you…?

As stated in the beginning Headwater has 9 projects and four of them are located near the Idaho-Oregon border:

These hand picked projects are also 100% owned and royalty-free which is really kind of rare in this day and age. Again I think it speaks to the intent and confidence of management/insiders. Anyway, first we will look at the Mahogany Project in Oregon…

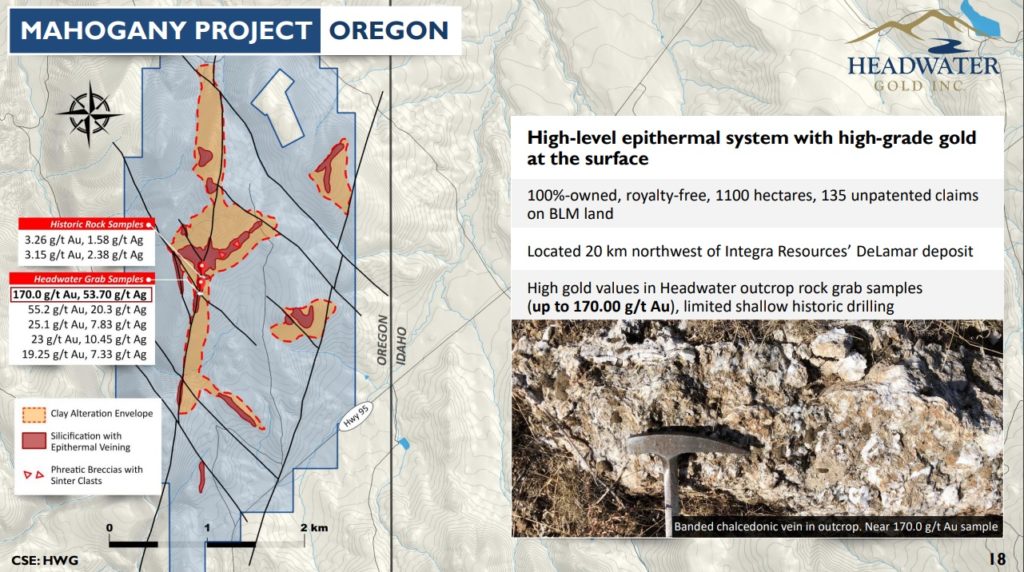

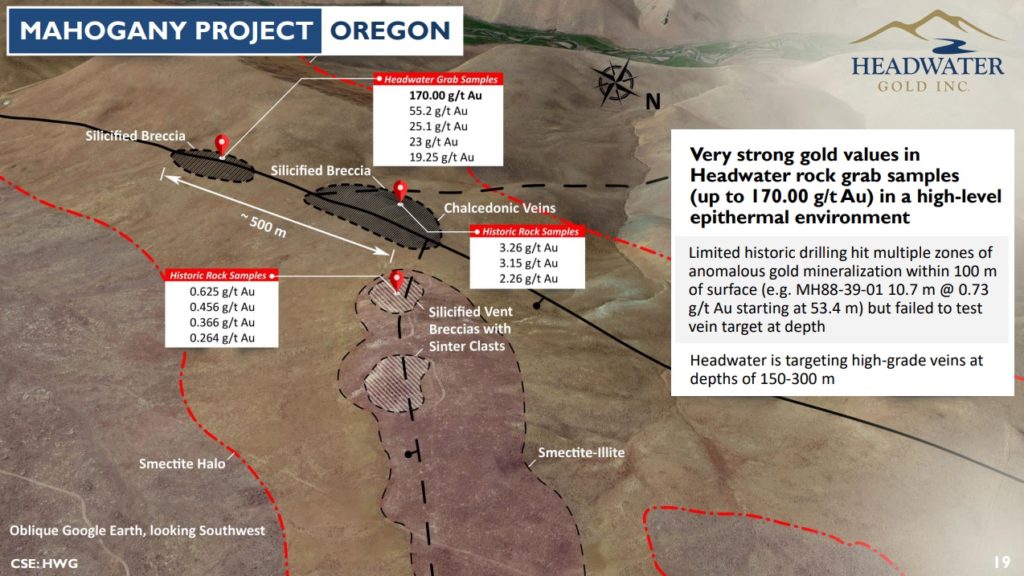

#3 Mahogany Project, Oregon

The Mahogany Project has produced some stellar grab and rock samples which tells us that this Epithermal System could really be something:

Also note the scale which suggests there is real size potential as well. There has been some limited historic drilling on the property but it was shallow (not deeper than 100m below surface):

As some might, or might not know already, “The Prize” in these Epithermal Systems is the “boiling zone” which tends to be located a few hundreds of meters below the paleo-surface:

In the shallower parts of the system the rock tends to be quite barren in terms of gold and silver content. The reason is because the metals have already precipitated out of the fluids at deeper levels. This “boiling zone” is labeled “High-Grade Precious Metal Mineralization” in the slide above and is the zone of focus for the company.

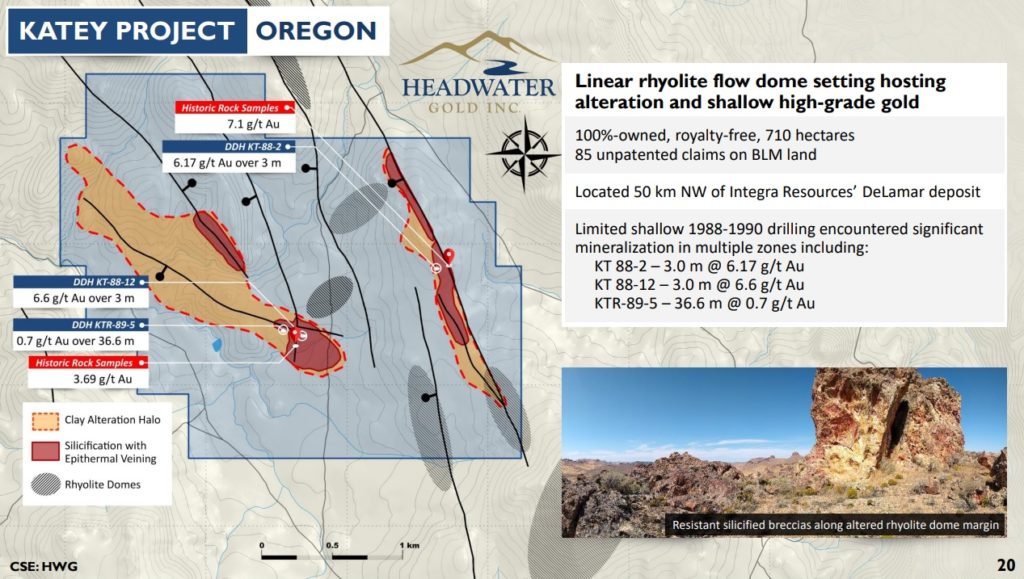

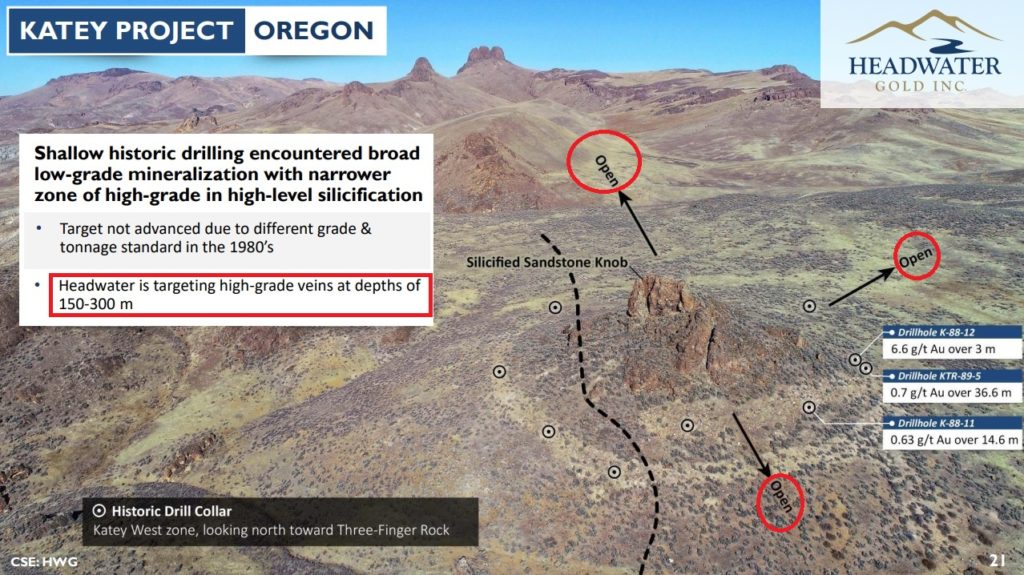

#4 Katey Project, Oregon

The second Oregon project is called the Katey Project. This is also a de-risked target given that limited historic drilling hit both narrower high-grade mineralization as well as broader lower-grade mineralization:

As with the Mahogany Project, and all the other Epithermal Systems, the target horizon is deeper down at depths of 150-300m:

(Red drawings added by me)

As you can see the system is open in multiple directions.

Additional Projects

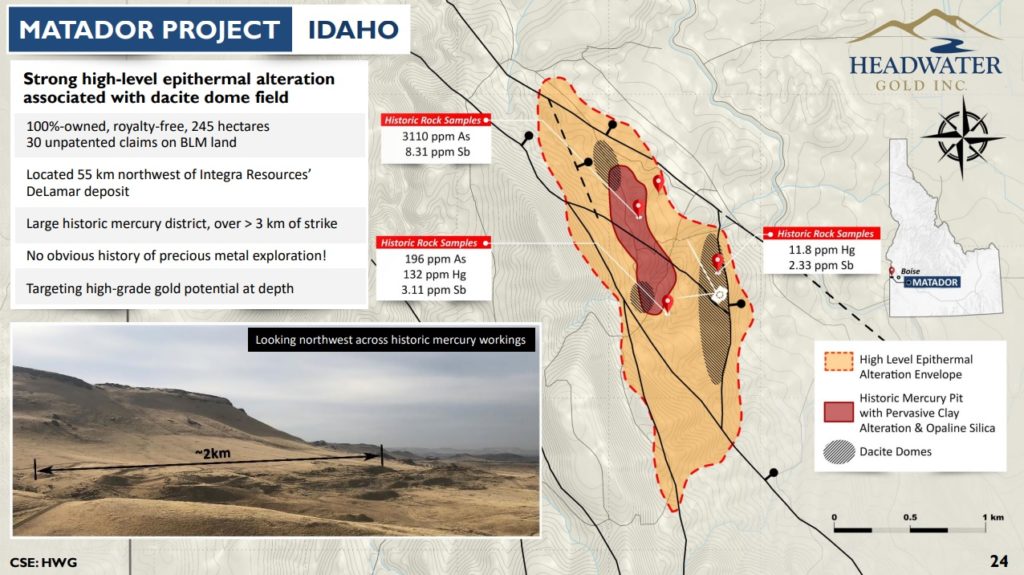

Headwater Gold has several projects in addition to the one that I have listed above. Given that I think the company is already disgustingly cheap relative to the four flagship projects I won’t go over all the rest. With that said they are a bit more early stage on average and an example would be the Matador Project in Idaho:

To sum up

The investment case in the words of the company:

I would only add the most important factor…

Price

At $0.23/share the Market Cap is C$11.4 M and the Enterprise Value is around US$6.5 M

One to one and a half million ounces of high-margin gold could be worth several hundred million dollars at today’s gold price…

For US$6.5 M I get exposure to the drilling at Spring Peak project which should have assays out in the latter part of October. I also get two additional projects that are de-risked via the drill bit. Then I get another six projects, and counting, for good measure. Even if the drilling at Spring Peak results in pure dusters it would still not make the current valuation expensive. Talk about obscene Risk/Reward even though it is still High Risk/High Reward.

I would point out that I think the risk/reward is great in Headwater Gold and it’s one of few early stage explorers that seem to really reflect the fact that exploration is a numbers game. Many juniors only have one advanced project and many are reluctant to kill said project. This is why one can see a lot of foot dragging and companies “working” on projects that the companies should have walked away from long ago. In the case of Headwater Gold the company has 41% insider ownership and said insiders will make a lot of money if/when shareholders make a lot money.

Lastly I would say that I love the Risk/Reward in Headwater Gold but there never ever any guarantees of a “ten bagger”. If the company makes a real discovery, or more, then I expect to have a serious multi bagger on my hand one day. And I also believe the company will keep churning projects in order to get said discovery but we don’t know if/and/or when this could happen. Therefore this is a longer term play for me and I am not investing money I can’t afford to lose or will need within the next >6 months lets say.

Note: This is not investment advice and I am not an investment advisor. I own shares of Headwater Gold and the company is a banner sponsor. Therefore assume I am biased and do your own due diligence and make up your own mind. Junior mining stocks can be very volatile and risky. Never invest money you cannot afford to lose. Assume I can buy or sell shares at any time.

Best regards,

The Hedgeless Horseman