Quick Thoughts on Recent News Releases: Eloro Resources, Eskay Mining & New Found Gold

Eloro Resources (NR) – “What is the market thinking?”

Firstly, we got the beyond insane channel sample that graded 442 gpt AgEQ over 166, including a bunch of long >1,000 gpt AgEQ intervals.

… With bonanza grades like that you don’t need a lot of tonnage to have a full blown deposit already.

Then we learned that it appears the mineralization at SBBP might be getting better to the east towards the center of the caldera (where the bonanza sample was taken):

“Recent drilling has doubled the extent of the breccia pipe from 400m to at least 800m in a northwest direction. The grade and intensity of mineralization appears to be increasing to the east, with the Santa Barbara adit returning the highest grades yet discovered at Iska Iska”

We also got snippets such as:

“We continue to encounter mineralization in every drill hole to date, showing potential for a world-class bulk mineable deposit, blending higher grade metal values within the lower grade wide-spread mineralization at Iska Iska. We are well financed to continue pursuing an aggressive exploration program.”

And:

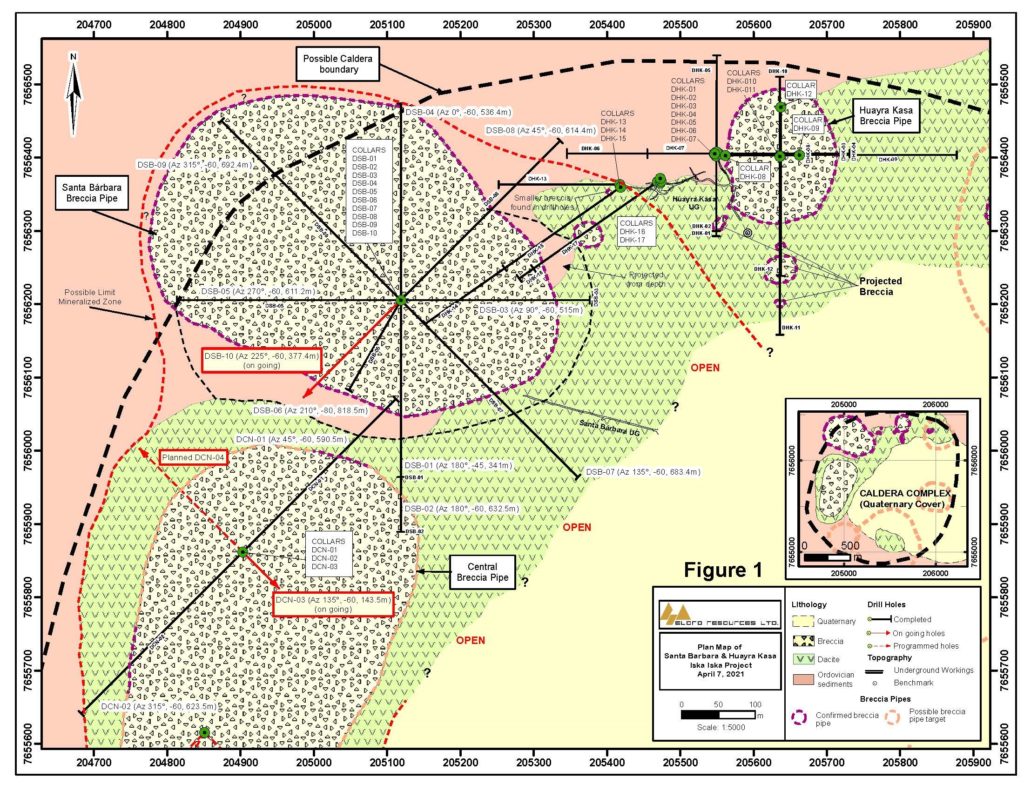

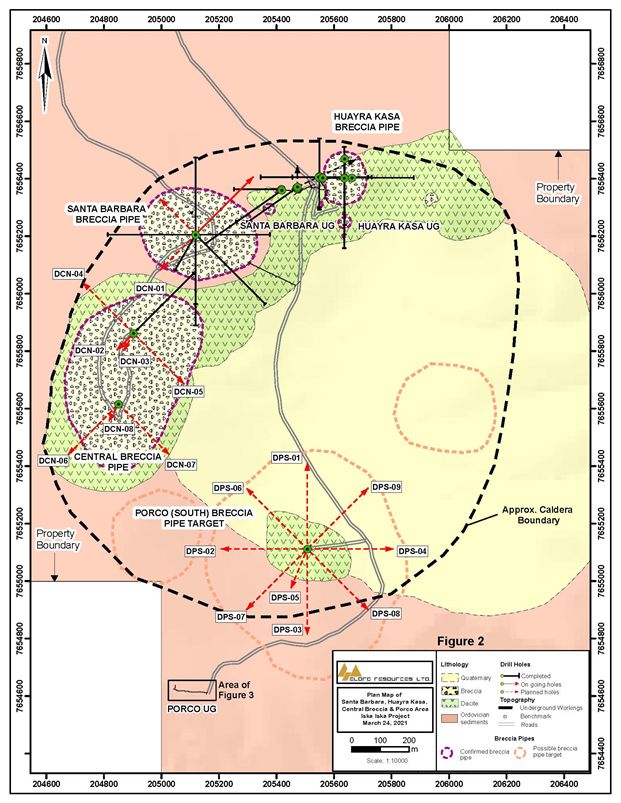

““We continue to intersect widespread silver-tin polymetallic mineralization in all our holes and have now doubled the extent of the SBBP. Our understanding of this remarkable mineralizing system continues to advance; however, we are still at a very early stage in the exploration. Following completion of our first pass drilling on SBBP, we will move the drill to test below the Santa Barbara adit and complete a section of holes to test east of the breccia pipe into the centre of the caldera complex. We will be working with Micon International to design further follow-up drilling on SBBP in order to define a National Instrument 43-101 mineral resource. Drilling will continue to test the CBP from both the north and south setups. As previously announced, we will be bringing in a third drill in early May to begin testing the very prospective Porco (South) target “

I could have called today’s reaction “Missing The Forest For The Trees version 2.0″…

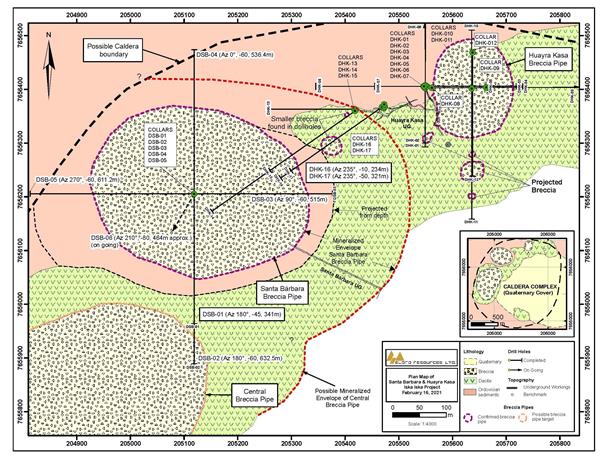

Compare this older slide:

(note the RED, dashed lines)

With today’s slide based on the new information:

(Again, note the RED, dashed line)

… You see where the dashed line is gone and there are multiple mentions of “open”? Yeah, I would say the potential is growing size wise. Oh and notice where the Adit is. There is just ONE hole that even came close to where the 166m of bonanza grade interval was sampled. If the mineralization gets a) better towards the east (center of the caldera) and b) SBBP is now wide open in that very direction then I would think this is pretty friggin good news.

The large, inferred Porco pipe is also left to be tested. All in all my amateur view is that the blue sky potential might not only be intact but it probably increased with the insane channel sample and realization that SBBP seems to be getting better and is open in the direction where the samples with the highest grades are located.

There is LOTS more to come from a fully cashed up Eloro I think:

Anyway, I added today. I might be wrong and it’s crazy but my gut feeling is that Eloro is going to get a lot bigger. With a resource coming up it should mean that a) There is already enough data that management believes a resource can be done, and b) A resource would mean that Eloro would be getting a “floor” to some degree by having confirmed ounces in black and white. This is very favorable from a risk/reward perspective (all else equal). I also doubt that the bonanza grade mineralization is only limited to the adit. And if that is true the endowment can build very quickly since the company will be drilling this area shortly. Based on my own crude calculations I think that the inferred mineralization could already be backing a big portion of the Enterprise Value. As such I think that almost all of the blue sky potential shown in the picture above comes for free. Note that I might be wrong but this is my personal belief and I have acted accordingly.

Lastly, the chart looks pretty good as well if you ask me. Reverse Head-And-Shoulded, trendline bounce and a saucer bottom… You name it:

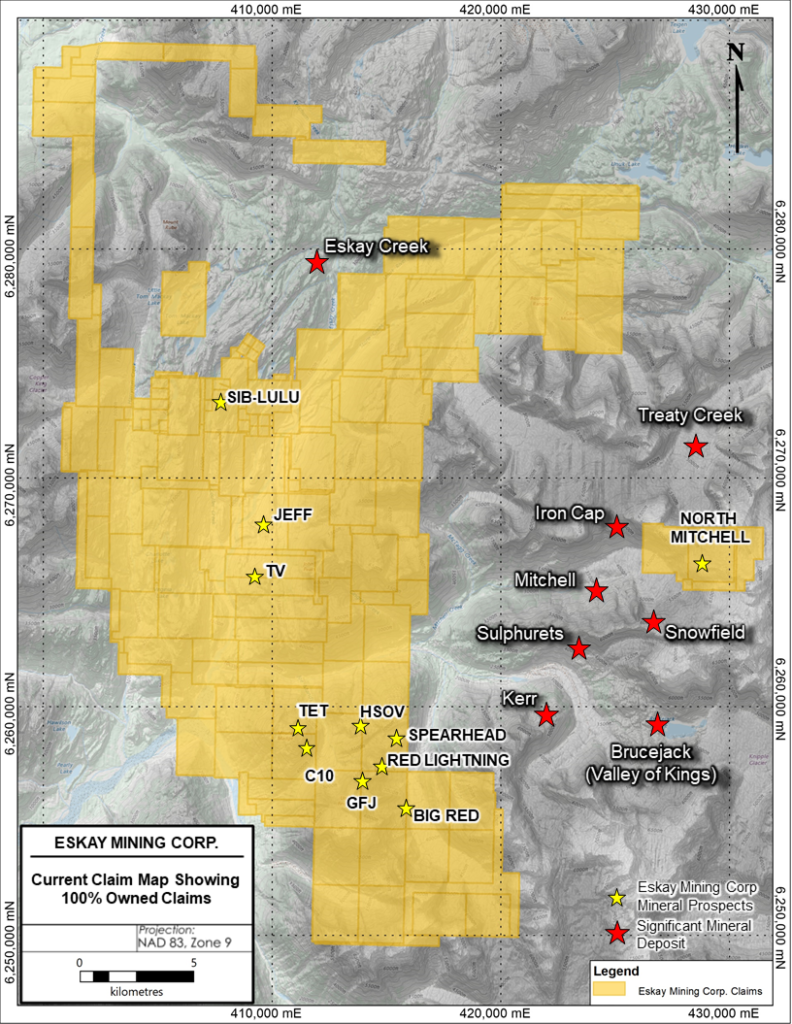

Eskay Mining (NR) – “The gift that keeps on giving”

Digest and try to appreciate these snippet from the NR:

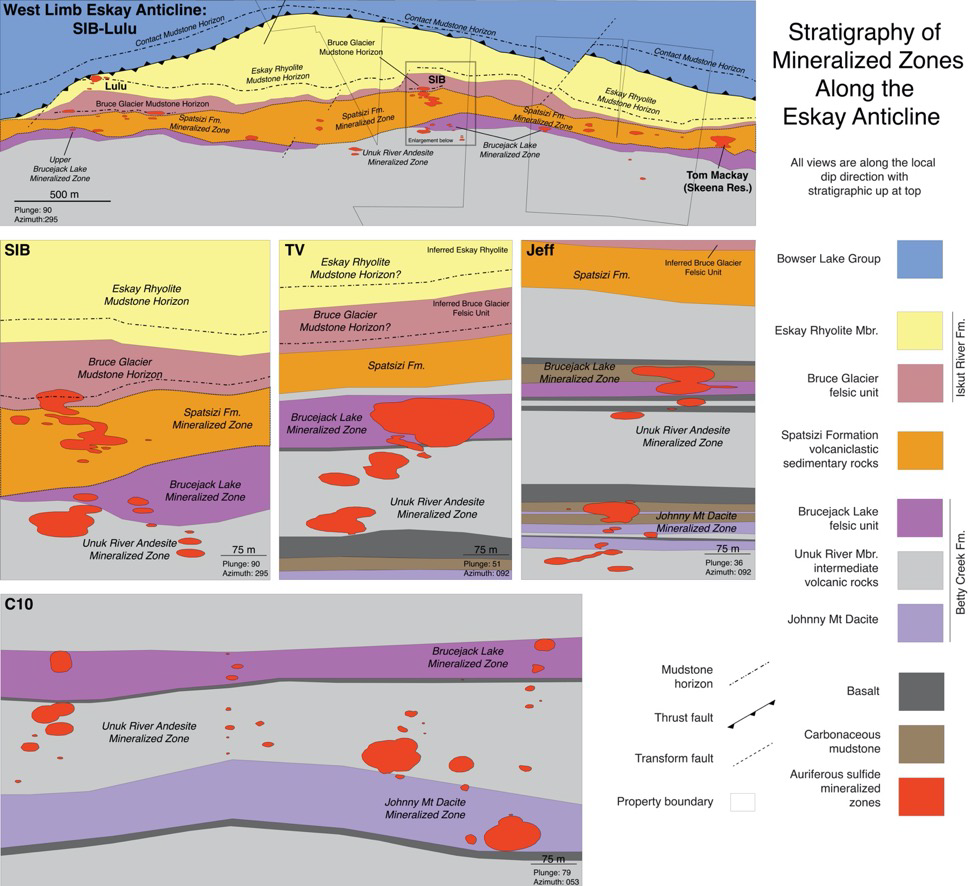

“This newly synthesized model of the sea floor mineralizing system demonstrates that at least six stratigraphic units are prospective for precious metal-rich VMS deposits across Eskay’s 526 sq km property. “

And this:

“On Eskay Mining’s land tenure, six mineralized horizons have now been confirmed within the entirety of the Hazelton Group stratigraphy, the volcanic and sedimentary sequence of host rocks that formed on the sea floor (Figure 1). These include from top to bottom: 1) the Contact Mudstone horizon, host to the high grade Eskay Creek deposit, 2) the Eskay Rhyolite Mudstone Horizon, 3) the Bruce Glacier Mudstone Horizon, 4) The Spatsizi Mineralized Zone, 5) the Brucejack Lake Mineralized Zone, and 6) the Johnny Mt Dacite Mineralized Zone. Horizons 1-3 have been identified at the adjacent Eskay Creek property and continue onto the Company’s property.Horizons 4-6 have been newly identified by Eskay and collectively represent a previously unrecognized VMS mineralizing event on the Company’s land holdings and within in the Golden Triangle as a whole.”

And the conclusion:

“mineralization within the older Betty Creek Formation indicates that back-arc rifting and VMS hydrothermal activity within the Eskay Rift began much earlier than previously thought. The implications of this discovery are profound, because it means the entire Hazelton Group stratigraphy is prospective for Eskay Creek-like VMS deposits.”

John Dedecker, Quinton Hennigh and Thomas Monecke et. al. are literally re-writing the geological blueprint for the whole Eskay Creek district.

It gets better:

“Detailed stratigraphic and geochemical investigations have allowed for correlation of stratigraphy including precious metal-bearing VMS deposits at the Company’s TV and Jeff deposits to the highly prospective C10 area a few km south. Although late metamorphism overprints rocks at C10, Eskay now can “see through” this overprint and thinks there is exceptional potential for discovery of precious metal-rich VMS deposits at C10 like those discovered by the Company at TV and Jeff last year. Stream sediment sampling (“BLEG”) at C10 in 2020 identified very high Au anomalism over a broad area approximately 7 km along strike. With the power of this enhanced model, Eskay anticipates developing drill targets at C10 for testing this year.”

Quinton Hennigh’s closing remarks:

“Eskay Mining’s exploration team applies thorough science to its exploration approach,” commented Dr. Quinton Hennigh, director and technical advisor to Eskay Mining. “We are delighted to see the synthesis of this new geologic model. Having a strong handle on the mineralizing processes and prospective host rocks puts us in an excellent position to have a highly successful 2021 exploration campaign. This campaign kicks off shortly with a SkyTEM survey covering all areas not covered by the 2020 survey. Our +30,000 m drill program is anticipated to commence in June. We think 2021 will be the most important year in the history of the Company.”

… The Eskay Mining team has been obscenely successful in my opinion. The current version of Eskay Mining is still very much a baby and already the brainiacs have made “profound” geological discoveries. I mean think about it. When Eskay Creek was up and running not THAT long ago the accepted wisdom was that there was pretty much ONE target horizon called “The Contact Mudstone”. Now with this news release we learn that the Eskay Mining time has identified AT LEAST SIX different stratigraphic units that are prospective for precious metal-rich VMS deposits across the 526 km2 property.

To sum up the recent developments for Eskay Mining:

- Eskay Mining acuires 100% interest in all of its former JV property

- “Lateral” blue sky potential increases and the TV/Jeff discovery etc is now 100% owned

- Eskay Mining discovers that there is AT LEAST SIX different units that are prospective for gold and silver and that the entire Hazelton Group is “live”

- Lets call this “vertical” blue sky potential increasing

- Eskay Mining acquires a large stake in its neighbor, Garibaldi Resources, which controls some areas covering the three anticlines

… Which basically means a positive multiplier effect on the Expected Value of Eskay Mining since Eskay got 100% of more land and said land now holds more potential than previously thought.

New “Vertical Potential”:

… Times the new “Lateral Potential”:

… Equals a story with absolute blue sky potential that few can rival.

I already have an obscene position (way above what any rational person would have) so I can’t rally buy more but I am also getting less and less tempted to sell any for a long time. In just a couple of months this will become one of the hottest exploration stories in the junior mining space.

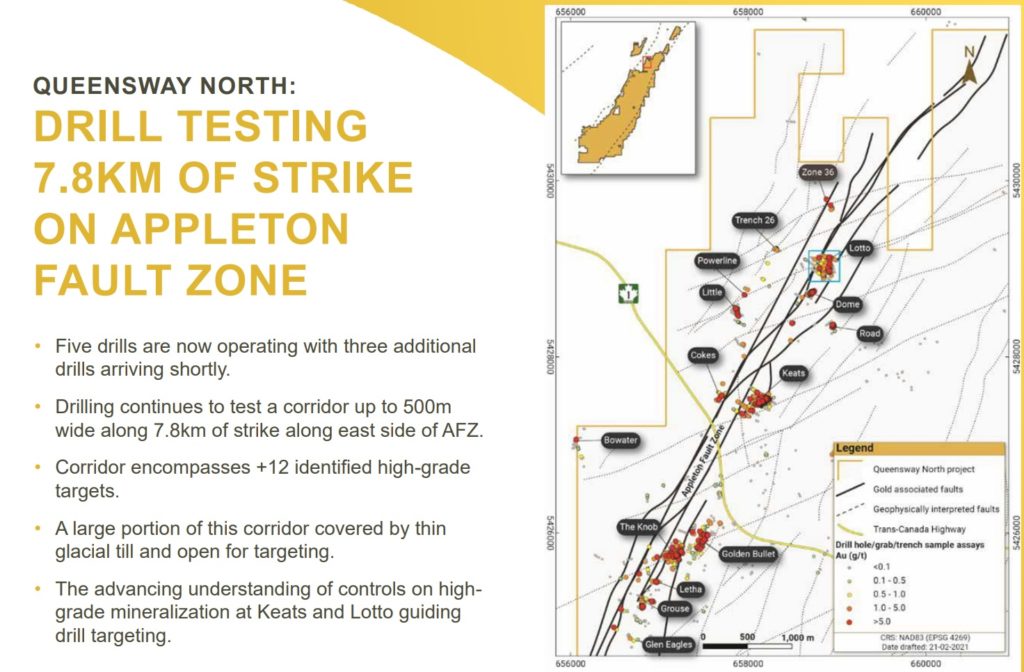

New Found Gold (Multiple NRs) – “Spoiled With Riches”

New Found Gold just keeps pumping out incredible drill results. First of all this is a story I would expect to simply keep on growing. It’s easy for people to call New Found “overvalued” but when one considers the grade, depth and jurisdiction I consider these “exploration ounces” to possibly be some of the most valuable ounces in the exploration space. Remember, an ounce in the ground is only as valuable as the economics of recovering and selling said ounces makes it. Ounces in the middle of nowhere which might have low margins and might not be recovered within 15 years will have very low NPV. Potentially very high grade ounces in one of the most mining friendly jurisdictions in a first world country should be exponentially more valuable. As a matter of fact, Newfoundland is considered to be perhaps THE best jurisdiction in Canada today, as per the provincial government:

Even though it is still very much an exploration story I think the company already has reached “critical mass” at Queensway and that there is a likelihood of these ounces being mined in the future. Therefore I consider New Found to have “margin of safety” even though there is no bankable resource yet. Combine that with the fact that the company has a huge land package with smoke all over the place makes me believe that there is a lot of growth yet.

With the above said is New Found “expensive” relative to what the company has done so far? Perhaps. However, I did not buy New Found Gold in light of the latest news release but what I believe news release number #1-#15 might potentially mean for the company. In other words I think the share price might fluctuate around Expected Value but that Expected Value will keep increasing. I actually think Kirkland Lake’s legendary share appreciation around 2019 is a good example of this. Sure the share price popped on a barn burner NR and the share price might have gotten ahead of itself from time to time but X amount of barn burner NRs later and one could look back and say “yeah it was actually pretty cheap back then”. It’s all about the probability of future positive NRs and the impact of said NRs. As it pertains to New Found Gold I currently see no reason why the company would start missing in every hole going forward.

I would also say the chart looks pretty juicy to me:

… That looks like a stock that is getting ready to move big time. New Found Gold remains a favorite of mine and it is a cornerstone stock in most of the portfolio I help manage.

Note: This is not investment and certainly not trading advice. I own shares of all companies mentioned and all three are banner sponsors of my site. Therefore you should assume I am biased and do your own due diligence. Junior mining stocks are risky and can be very volatile. I might buy or sell shares at any time.

Best regards

With an aggressive 200,000 meter drilling program this year, New Found Gold will likely have some great hits as well as misses. Depending on how the hits and misses are reported (i.e. together or separately), that could lead to a lot of volatility in their stock price. I also think the volatility will increase when New Found Gold gets its listing on the United States NYSE. As a U.S. based trader, that will save me from the “headaches” explained below.

Right now, in a Fidelity Investments account, I have to pay $50 per trade in New Found Gold. And when I tried to buy into the stock immediately after its IPO, I discovered that my Schwab account banned anyone from buying it for the first 45 days, saying it was their policy on thinly traded foreign IPOs. (Didn’t matter if you had a cash or margin account). When it was eventually allowed to be purchased thru Schwab, I could not initiate a trade by myself and had to pay a Schwab rep $25 to place each trade, with their excuse being that the stock is thinly traded. Yeah, right, I can buy thinly traded Irving Resources all day long for free but with New Found Gold I was blocked early on and later had to pay to play. And my trading accounts are cash type accounts with several million dollars available to trade and not one trading violation, ever.

I don’t mean to rant but rather inform you about how some stocks seem to be “persecuted” and others not by these U.S. trading houses and their choice of 3rd party order flow. When New Found Gold gets its NYSE listing, I would expect much more price volatility when the Robinhood type traders are unleashed.

Sach…

I use E*TRADE.

Any OTC trade only costs $4.95 a turn.

Regards

I love your writing and how you invest. Will you please write about Metals Creek. Thank You

According to their new presentation, NFG has 8 rigs drilling. QH in one if his updates said they were going to 12 rigs. 3 at Keats ( 1 doing step out, and 2 doing infill., 2 at Lotto and three drilling new targets. I suspect that the two additional rugs will be drilling the new targets if discovery holes are new deposits. For them to add two more rigs them must see VG in the new holes. I suspect they are going for a resource at Keats.

Great news for these companies.

But what about the Novo news?? They told investors they did not need more cash from private placements since the August financing to acquire the mill and get Beaton’s into production. They poured the first gold bar and are in production last I knew. So why do they now need another $22 million for exploration and production? Beaton’s was supposed to find the exploration right? Did Quinton and team lie to us or do they just not understand how to operate a budget? Or, worse, beatons creek is not seeing the gold production they expected for some reason. Im sure I’m not going to like any of the answers to these questions.

Also a very poor price on the capital rise. They had to sell at that big a discount to attract interest in this story. Not good. The timing given the gold market was also not ideal.

Hoping to hear some answers from the company on what’s going on over there as I’m left very disappointed this morning.

I’m also very, very disappointed with Novo’s new placement. Management’s stated plan was to fund further exploration and development with Beaton creek production. Instead, we get more dilution. What are they going to do…make the land package larger? How about starting to produce some gold?

Any quick thoughts on Novo? This better be the last capital raise for awhile. Honestly it doesn’t look good saying you’ve got a 50 year mine and then raising capital.

Novo has a market cap of about $450 U.S. And this cap increase was about $20 Million, that is only about 4.5% increase in stock,

This cash increase will speed up development of their two other plays and drilling of new areas,

With an increase of stock outstanding of only 4.5% and a stock price decline of over 30% it appears we are being given a big gift from the market.

I disagree with that. A share count increase is not the same as a market cap size increase. PRICE is what matters. Novo is raising money at a large discount to what other shareholders were recently buying the stock. They are selling shares/warrants to a special group of private placement investors at a steep discount to all other shareholders. (1) that’s not very equitable compared to a rights offering that is offered to all new and existing shareholders; (2) it suggests they think their stock price may been overvalued and are willing to add to the supply (more shares) versus finding alternative financing; (3) this raise goes against what Quinton and management have told investors over the last 8 months since the Millennium mill was acquired – Beaton’s creek production was to fund new exploration – not outside/dilutive financing.

So, no, this is not a “gift” from the market. The stock price decline reflects the company’ raising capital/valuing it’s stock at a lower price than yesterday (read the press release on the price of the raise) And the timing/size/reasoning is suspect and goes against what they’ve told investors.

I’m a large owner of Novo and will continue to be one, but not buying any more shares here until we, as shareholders, know more about what’s going on. From the outside, this raise is a bit of a red flag, suggesting a level of incompetence/dishonesty from management.

Well said, and that is why I have made the decision to remove Novo from my portfolios. I will get out whole but I will have to wait for the stock price to recover somewhat. Yeah, Kirkland Lake made the right decision to exit Novo’s stock. Dam shame! The only good news is that we are in a trading environment where cash can still be raised!

I understand that decision. If you lose faith in management to act in the best interest of shareholders, but then the team makes a rash decision to raise expensive capital at the expense of shareholders, how can you trust them in the future?

Management credibility is vital in my book to investing in junior mining stocks. This industry is littered with bad managers, greed, and incompetence. I had hoped that Novo would avoid making bad decisions, but this one today hurts and doesn’t make any sense to me.

Raising expensive capital in a weak gold environment when you really didn’t need to (and said you weren’t going to) is just plain bad strategy AND communication.

Novo needs a prudent financial mind on the board and at the company because while they may have superb geologists and operational folks, there is a lack of capital structure analysis being done. They are printing new shares and warrants like countries are printing new fiat currency…

For me it’s a nightmare all over again…

I recently got 3rd degree burns in Nautilus Minerals, which had all kinds of undersea technology, mining rights all over the Pacific, awesome samples, and a ship three quarters built to haul it all in… now it’s worthless due to diluting.

Lion One, Quinton Henningh on Jay Taylor media, six drill rigs, he suspects they are going to announce plans to start turning this into a development company as they continue to expand the resource (as in they are confident of the resource). https://www.youtube.com/watch?v=UO7BM1fMNio&t=387s

A part of the Eloro sell off might have been from less-than-hoped-for intercepts in the pipes. They were mineralized but it seems like the goodies are closer to the caldera. .43% tin is economic almost by itself, in a porphyry near surface, though.

Even more imporantly — which I missed on first reading — is that there is now the potential for the caldera rim to be mineralized. That could be much more tonnage than the breccias, and add decades of mining.

The whole thing seems much more geologically complex than I initially thought, but it might even be better than I thought.

DSB-07 is going to be a hole to pay close attention to… that is in the gernal vicinity of the adit, and heading off toward the caldera.

Eskay, once again, is outdoing itself. Tet and C10 look juicey, as well as around Red Lightning maybe. More enormous multi-billion buyout potential.

NFG: The whole trend seems riidiculous with its potential as well as neighbors SIC and LAB. Exciting days.