Investing Matrix

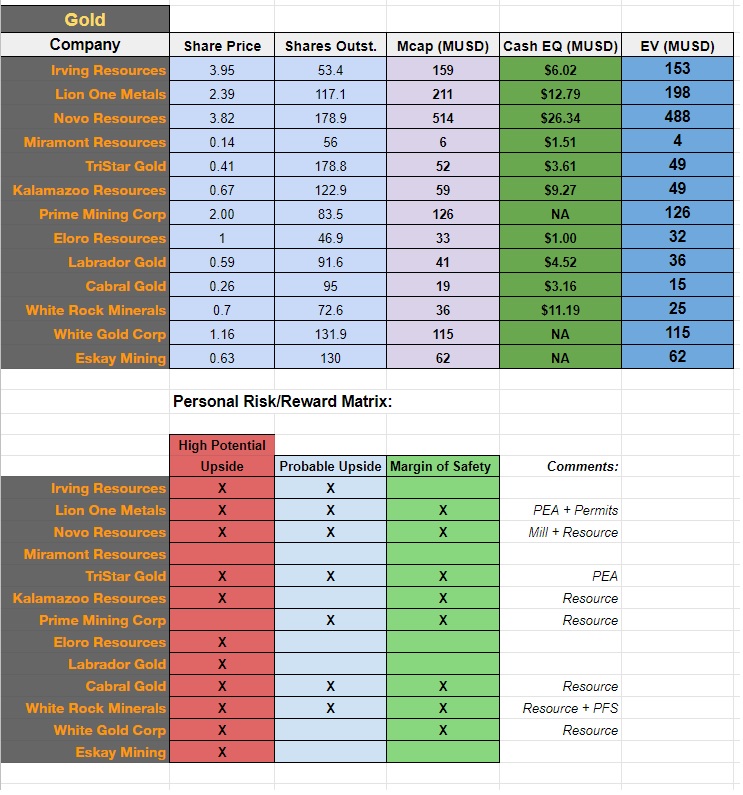

In this article I will only provide some valuations for some of the companies I really like and provide what I see in terms of Risk/Reward.

Important concepts for maximum long term compounding:

- Probable Upside > High Potential Upside

- Margin of safety should have a very heavy weight

Some of my favorite stocks:

Note: This is not investment advice!

Thanks, HH. I agree with you as I bought [email protected] yesterday and NSRPF 3 times since last Friday. Have you looked at Gold Terra TRXXF?

I added both as well recently. Not really. I think I looked at it a year ago or so but wasn’t that impressed with the pace. Maybe the case has changed so can’t say much…

/HH

Do you no longer like Condor?

I do. I did not include every company I own or follow. It was an example based on a spread sheet already made

Wish you would put a tick in the boxes rather than a X. Just seems more positive. Otherwise your work is brilliant.

Okay, might be able to do that in the future. Good tip, thanks!

What is the news on Miramount Resources? There is no trading… Some kind of trading halt since early June.

It’s going to become Kuya Silver in September through merger

What has happened to lion reporting of data 585m thru to 1000m?

Also disturbed to note the apparent mixing of that drill reporting interspersed with capital raising at very favourable prices. Very unsatisfactory.

Think the coy should provide existing shareholders not invited to caputal raising a scheme similar to that put in place by GBZ resources when novo took at shareholding placement. The same terms were offerwd to shareholders.

What are your views on the above please?

Many thanks

Per your August 2020 update on your top holdings list: Is White Rock Minerals ( first on list) your largest holding? Trying to ascertain where you are with Novo. Thanks

It’s not listed by size but currently Novo and WRM are tied for largest %

ValOre isn’t in your investing matrix, in 2019 you were invested in ValOre, has that changed?

Yes I was. Then the Palladium price looked to have peaked and things went a lot slower for the company that I had anticipated so I rotated quite a lot into gold juniors. I still have a few shares though but not a core holding anymore

Where are you at on Liberty Gold?

Thanks