Gold Mining: Competitive advantage, Mine Life and Market Potential

Setting The Scene: Competitive advantage, mine life and market potential

A gold mining company has the perfect moat and a closed market.

There is always a universal buyer.

No competitor can take away your competitive advantage (cost structure for example).

Any mine’s margins will fluctuate depending on global supply/demand and is affected the along with every other gold mining business.

Thus, competitive advantage remains even though margins will fluctuate along with everyone else’s.

The margins of a gold mine will dictate the discount on universal value.

If you owned a gold mine which produces 100,000 ounces per year with a 25% profit margin then you can buy everything and anything one can buy for 100,000 ounces 25% off.

That is a profit margin that could theoretically hold up as long as the life of mine.

In a “regular” business environment the company or sector with high margins is expected to attract competition which contracts that margin until everyone just breaks even, in theory.

What makes a good gold mining company?

In the mining business a company’s competitive advantage can come from things such as grade, geology and/or ease of processing. Kirkland Lake’s Fosterville Mine has a very good competitive advantage due to it being one of the highest grade mines in the world. No competitor can change that fact anytime soon given that fewer and fewer high quality mines are found each year and it takes longer and longer to put mines into production. In essence, the mine’s competitive advantage relative to the average mine is probably more likely to expand rather than contract. There is a twist however. The twist is that this advantage will only last as long as the high grade ore lasts.

A dream scenario for any owned of a gold mine would be to own a venture with both a competitive advantage and a long mine life.

One reason why mine life is important is because it puts a cap on P/E ratios. One would not want to pay a P/E ratio of 20 if the mine life was 10 years since one would only have gotten 50% of ones investment back before the income stream comes to an end. In other words it is a value destroying proposition which I think explains why the bull market in miners that peaked 2011 led to a 80%-90% decline during the bear market, when lofty P/R ratios at high gold prices adjusted to more rational P/E ratios along a much lower gold price.

The best example of a company that could have both a long lasting competitive advantage and a long mine life is Novo Resources through the combination of extreme leverage from ore sorting technology and the scale of prospective horizons.

If the characteristics of for example Egina leads to the company being able to make use of low cost ore sorting beyond any gold miner to date then that could become a long lived competitive advantage. No other gold miner can change the characteristics of their deposits so they can’t conjure up an at/near surface, loose gravel, gold deposit that shows up to 100% recoveries from ore sorting alone. No matter how much they would want it. Then add on the notion that this type of mineralization would cover hundreds to thousands of square kilometers. That could mean a mine life of decades depending on mining rate etc. Thus, whereas Fosterville might have finite zones that leads to extreme competitive advantages for a limited period of time, Egina could become a venture with both a competitive advantage in terms of costs on top of an unconventionally long mine life.

Mine life is capped by the “size of the market”. A gold miner can never grow more than the cumulative potential found within all its projects. If I own a gold mine and I own no more ground than what just covers said gold mine then there is no way for the company to grow bigger than that. If I own 100km2 of land and am looking for lode gold then there is potential that I will find multiple lodes of gold that are high quality enough that they could become mines sometime in the future.

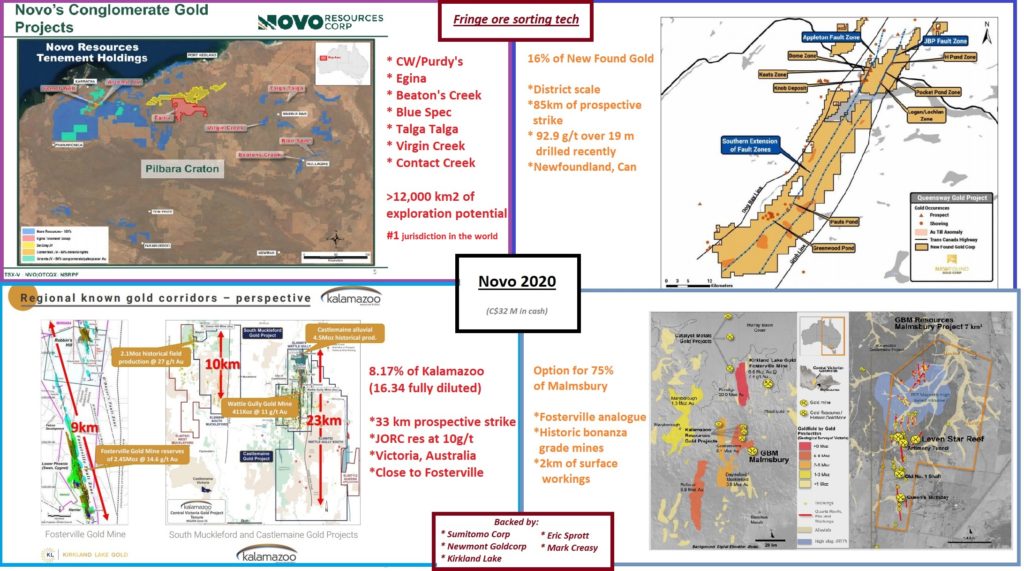

What I look for in juniors is the potential to grow both resources and ultimately production. Thus, I would want to see potential for a large “market”. This is a big part of why I have Novo as my favorite stock since I know no other gold company with even close to the market potential I see in the slide below:

One mine is very hard to find. Finding multiple mines is something few companies or teams ever do. What I find so attractive with Pilbara is that there is seemingly gold all over the place. So finding gold isn’t hard given that any and every junior that went out and tried to find gold bearing conglomerates have pretty much been successful in doing so. The all important thing however is not just finding gold but to find gold that can be economically recoverable. This is where ore sorting comes into the picture in a major way. Given the outstanding test results I see a chance for ore sorting technology to increase the odds of being able to economically recover all kinds of different conglomerates as well as the gold found in loose gravels near surface. This technology might help turn all those kilometers and square kilometers of gold bearing ground into cash flow one day.

Where most companies have trouble even finding gold in any meaningful scale, Novo already has passed that hurdle in my opinion. Thus, I am personally convinced that Novo’s market size potential is unparalleled and that processing techniques such as ore sorting is now the main value driver. If it can show that gold can be recovered at a profit within the Egina mining lease for example then I would expect Novo to be able to mine gold at a profit all over the 2,000-3,000km2 of prospective lag gravel areas. I think the same basically holds for any of the LATERALLY gold bearing conglomerate systems.

The lateral aspects of these systems is extremely important. A junior can own 10,000km2 of ground where they are chasing lode gold but the actual area that there is even potential for gold is a fraction of that. There might be one mine per every 100km2 in the major gold camps on average (just a guess). Compare that with owning “even” 1,000km2 of lateral systems like in the Witwatersrand. 1,000km2 of laterally extensive gold bearing conglomerates in the Witwatersrand might host hundreds of millions of ounces. At its peak, the Witwatersrand “market” was large enough to sustain thousands of companies. Thus, there is a very large difference between owning 1,000km2 of ground prospective for the rare lode gold deposit or two compared to ground where the targeted deposits extend laterally and Novo controls around 12,000km2 of land in Pilbara. This is beyond what any single mining company controlled in the Witwatersrand.

If ore sorters help show “proof of concept” in any system then any km2 where that system is proven to be gold bearing will jump in value. This is the reason why Novo has been forced to stake all the prospective ground first and show proof of concept later. We have all seen when an area becomes “hot”. All of a sudden there is a rush of juniors trying to stake every claim in sight. This of course means that the demand for ground in a “hot” camp goes up significantly. Just think about the revaluation of all the land in the US that covers the shale oil basins. There were a lot of people that suddenly got rich from just owning something that unexpectantly shot up in value because it might have precious oil at depth. Oil that until then could not be recovered and thus used to be valued at zero. When something that is laterally extensive goes from zero value to at least some value, then the real estate in that area goes up a lot. You can read about the skyrocketing price of land due to the shale boom here.

What the odds are that Egina will be economic to mine is something I do not know. All I know is that if proves to be economic to mine then I would argue that said “mine” could stretch over hundreds or thousands of square kilometers and be prove to be worth billions at the end of the day. Why? Because if the swales average 1g/m3, are 1m thick in average, covers say “even” 100km2, then that is around 4.8 Moz (per 100km2). Given that the first Egina swale averaged 1.7 g/m3, and it is expected to get better further north, I would not be surprised if 1g/m3 proves to be conservative. Furthermore, it seems that the current thesis is that it is far larger than 100km2. At least when it comes to total area that might be mineralized to some degree across the greater terrace (which is much much larger).

When it comes to the Mt Roe conglomerates we have heard guesstimates of either 375,000-750,000 ounces per km2. IF that proves to be true and at least some areas are economic to mine then that is basically a decent sized mine per every 2 km2. Is it any wonder why Novo has kept all the land near the outcropping areas and have even staked more land just a few weeks ago that covers outcrops of both Mt Roe and Hardey Formation? Is it any wonder why Novo who does not yet have any cash flow has been prepared to burn around $10M per year just to keep the ground (even though it will take years and years to explore)? Think about it.

We also have the Hardey Formation conglomerates such as what is found at Beaton’s Creek. The naysayers have said it will never be a mine. That it’s too complicated, patchy and too low grade. Well, Sumitomo who has been insiders for around two years certainly doesn’t think so and neither does Novo. When I visited Novo last year one of the biggest take aways was how confident Novo seems to be when it comes to nuggety gold today. There was a Dutch born Novo geo who explained in great detail how their understanding of the Beaton’s Creek geology and nuggety nature has evolved. Even though I couldn’t possibly grasp everything he said I think the proof is in the pudding. Novo has an “iron clad” resource today, and again, Sumitomo has given thumbs up on BC. If it’s good enough for a $40 B entity then it is good enough for me.

With all of the above said, what development should affect and revalue the implied value of any and of these nuggety systems…?

Ore sorting advancements.

Again, if ore sorting works at Egina I don’t see why it shouldn’t work in a similar manner for every “other Egina”. Just thinking that it only affects one area is totally missing the big picture.

Same goes for the Comet Well and Beaton’s Creek results.

The ore sorting trials so far is telling us that these state of the art ore sorters might help unlock any and all nuggety prospects across those thousands of square kilometers. Interestingly enough it was advancements in processing techniques for gold that actually revived and then made Witwatersrand flourish into becoming the most legendary gold field in history. In other words a brand new processing technique unlocked not just one mine but the whole gold field(!). Just like new technology unlocked entire shale oil basins in the US. I think that is something to consider when it comes to ore sorters and Pilbara.

So to sum up I think the characteristics of these lateral gold systems in Pilbara combined with ever more efficient ore sorters has the potential for Novo to:

- Have by far the largest market (and thus growth) potential of any gold company

- Potentially have a long lasting competitive advantage if ore sorting works close to what it shows during trial tests

- Have the potential to leverage any mill significantly through “shrinkage” of ore across Pilbara

Comments on some other holdings

What is my second favorite business model?

Irving Resources since it also has huge “market” potential and the flux credits might lead to a competitive advantage compared to most pure gold and silver producers.

My third favorite stock is Lion One Metals primarily because the company already has a permitted project and the company’s “market” potential is on par with Irving Resources. When it comes to competitive advantage I am not as certain but the grades are very high and if they find a feeder it might get even better.

TriStar Gold is quite advanced and their project shows both very solid economics as well as having a lot of exploration potential. I would be surprised if this one wasn’t bought out in the future.

Prime Mining has a business model that entail starting small with low CAPEX requirements and building from there. The district looks to have considerable exploration potential as well.

Note: I own shares in all companies mentioned which I have bought in the open market. Novo, Lion One, TriStar and Prime Mining are banner sponsors of this site. Always do your own due diligence and draw your own conclusion!

Dear THH,

I have been reading your writing for a while. I am very grateful for all your hard-work.

But please consider this point. We are in uncharted times. Any government citing any reason can nationalize the mining sector, especially PM mines. Please see what is happening in Venezuela.

IMHO, mining jurisdiction will play a major role in the coming years. It is just a matter of time before people will get turned away from most of South America/Mexico based miners.

Take care and stay safe.

With regards,

Govind

Hey Govindm

You are very welcome! Yes, we are in uncharted waters. My core are made up of miners in the better jurisdictions. Novo at the #1 spot with operations in the #1 jurisdiction is an example. However, I do think there are some juniors located in lower tier jurisdicitons that are priced low enough to warrant speculation. If nothing bad happens they should outperform the juniors with tier 1 premiums etc. Still I wouldn’t want to have a core built on the more speculative juniors. ALl the best