Fathom Nickel (FNI.CN): A Nickel Exploration Story With Two District Scale Projects

This will be my first article on Fathom Nickel (FNI.CN) which is a junior explorer what is exploring two district scale projects in Saskatchewan, Canada.

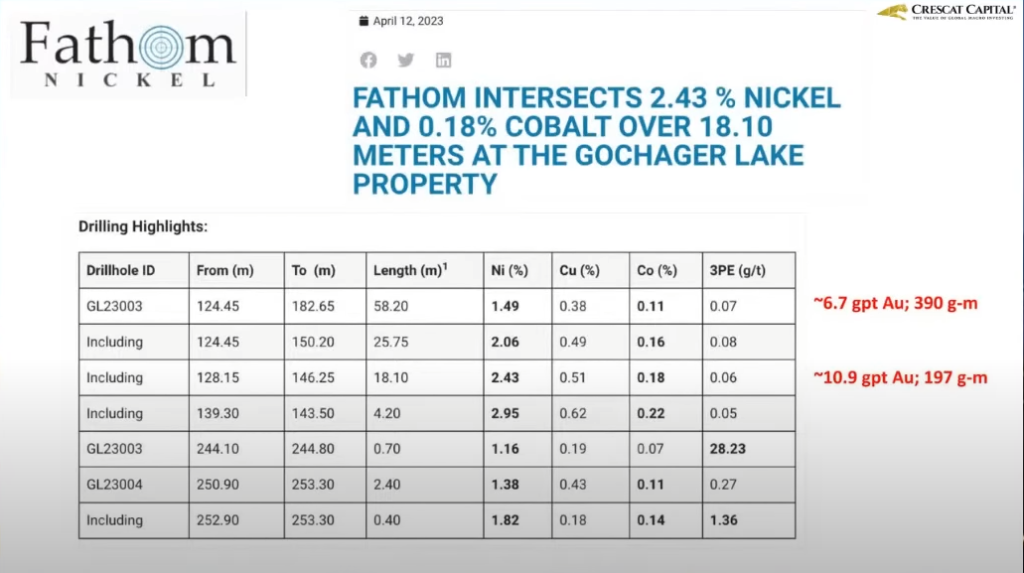

I own quite a bit of shares of Fathom Nickel and it is my second nickel play after Magna Mining. Unlike Magna this is a higher risk story that I have taken a pretty decent position in. Fathom has been on my radar ever since a presentation was done on the company by Quinton Hennigh of Crescat Capital. But it was not until we received assays from their first few holes into Gochager, which produced a hit of 2.43% nickel, 0.54% Cu & 0.11% Co over 18.1 metres, that I became really interested. After that the company started staking ground around it like crazy to boot. I participated in the PP It is large enough that it would hurt me much if the story fails completely, but large enough in light of the blue sky potential, that it could materially impact the portfolio in a positive way over time. It is one of the high risk/high reward cases featured in the “Gamblore portfolio” case study.

This article will contain forward looking statements, personal opinions, and I cannot guarantee the accuracy of the content, so think for yourself and do your own due diligence. Never buy a stock simply because someone else likes it. I share neither your potential profits or losses. And again, consider me biased as I own quite a few shares and the company is a (passive) banner sponsor!

Resources

- Fathom Nickel PRESENTATION

- Website: LINK

- Ticker: FNI.CN

Videos

- Wyloo CEO on the Nickel market and why the Andew Forrest backed entity has been acquiring Nickel sulphide projects in tier 1 jursdictions

- Wyloo on why they acquired Noront in Canada

- Mark Bennett of Sirius Resources on the Nova Nickel Deposit | Presentation

- Bill Amann: Nova: Geophysics for Geologists, from Exploration to Mining

Catalysts

- Near term: Drill start at Gochager Lake is expected shortly

- Q1, 2024: Drill start at Albert Lake

My Case in Short

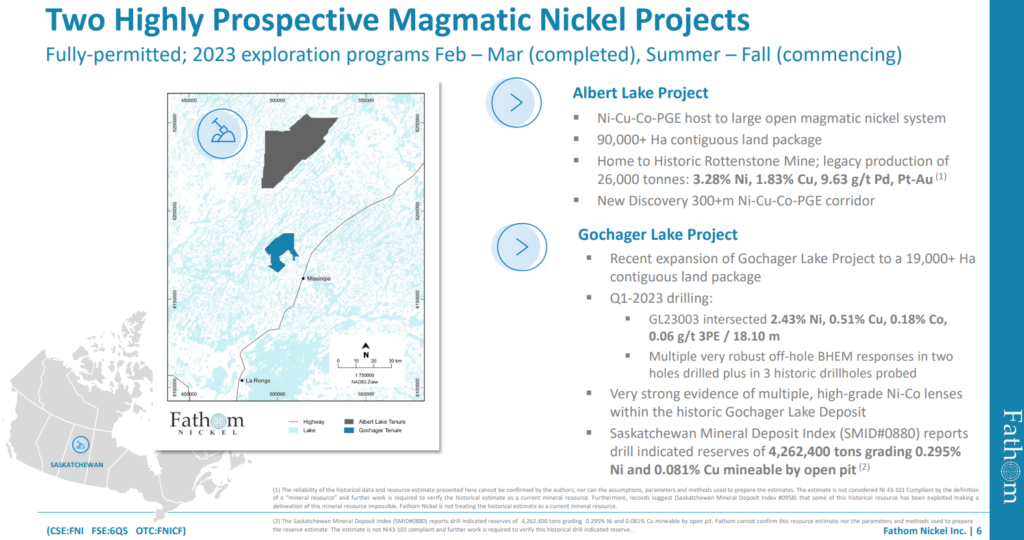

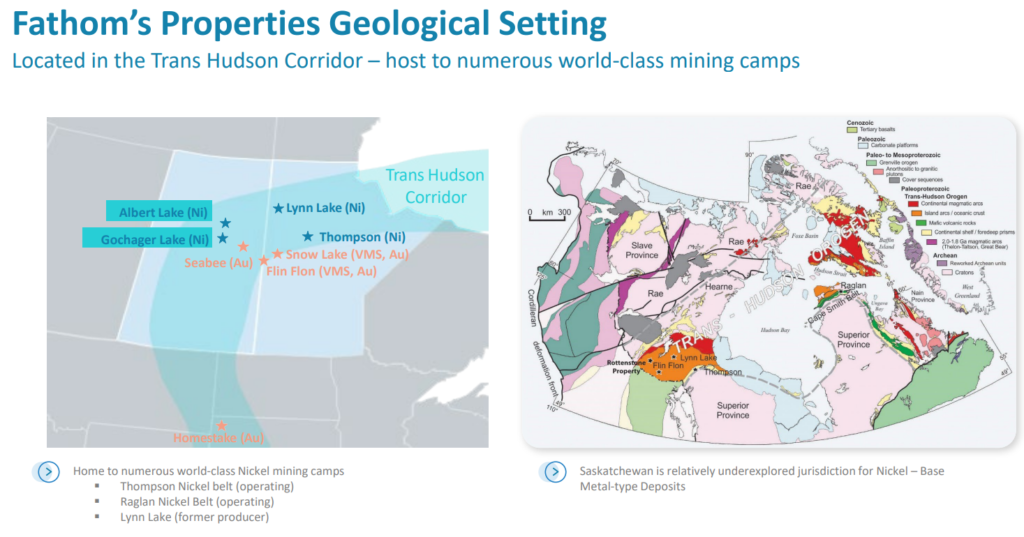

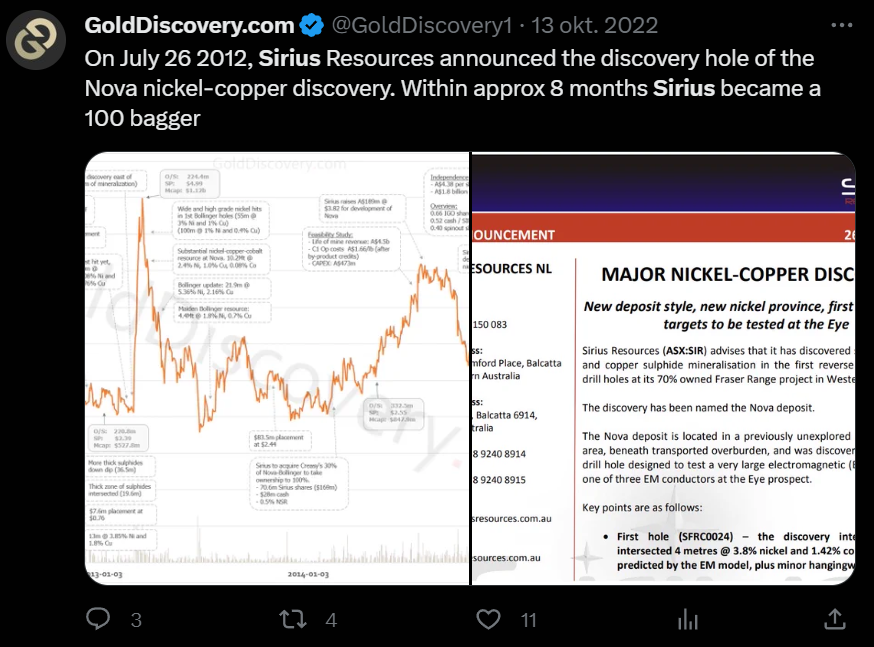

Fathom Nickel has two very large projects called “Gochager Lake“ and “Albert Lake” in Saskatchewan, Canada where they are exploring for highly coveted Nickel sulphide deposits. The thankful thing about nickel sulphide deposits is that they can a) Be worth billions of dollars and b) The beauty of Nickel sulphide discoveries is that they can revalue a lot in a very short time frame relative to most gold stories for example… On that note there are at least two quite recent success stories in the junior space where the discoverers went up 50X in less than two years (Chalice Mining) and 100X within 8 months (Sirius Resources).

- “Gochager Lake“

- >19,000 Ha

- Already has a “discovery” hole in line with the resource grade of Nova Bollinger (Sirius Resources)

- So far #15 targets have been identified within a portion of the large property.

- Q1-2023 drilling: 18.1 metres @ 2.43% Ni, 0.51% Cu, 0.18% Co, and 0.06 gpt 3PE

- An initial #15 targets identified

- “Albert Lake”

- >90,000 Ha

- as per the news release on August 15, shows a “very strong TDEM conductor” that is modelled to be 450 m x 150 m and to be situated 300 m below surface.

- Hosts a Ni-in-Soil anomaly that is larger than the one at Nova Bollinger

- Past production: 26,000 tonnes of 3.28% Ni, 1.83% Cu, and 9.63 gpt Pt-Au

Both projects are large enough to consider them “District plays” as the company has been relentlessly staking more ground this year. Both land packages now cover numerous nickel targets and thus the blue sky potential is very large.

To sum up

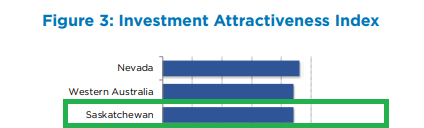

Fathom Nickel has two district scale projects in the 3rd best jurisdiction in the world according to the Fraser Institute. Nickel sulphide deposits can typically show up in clusters so where you find one pod there ought to be more. Both of Fathom’s projects have confirmed high grade, nickel sulphide mineralization and after a lot of staking both projects have district scale. If the company finds one economic nickel deposit(s), then the revaluation potential ought to be extremely high, from today’s MCAP of a mere $23 M. If they find more deposits, or prove up an entirely new nickel district or two, then I do not know where the value could end up at. If none of the former scenarios happen I could lose up to 100%.

In other words I see this as an extremely asymmetrical High Risk/High Reward bet, located in a very favorable jurisdiction, where success ought to trade at a premium:

Now lets dig in…

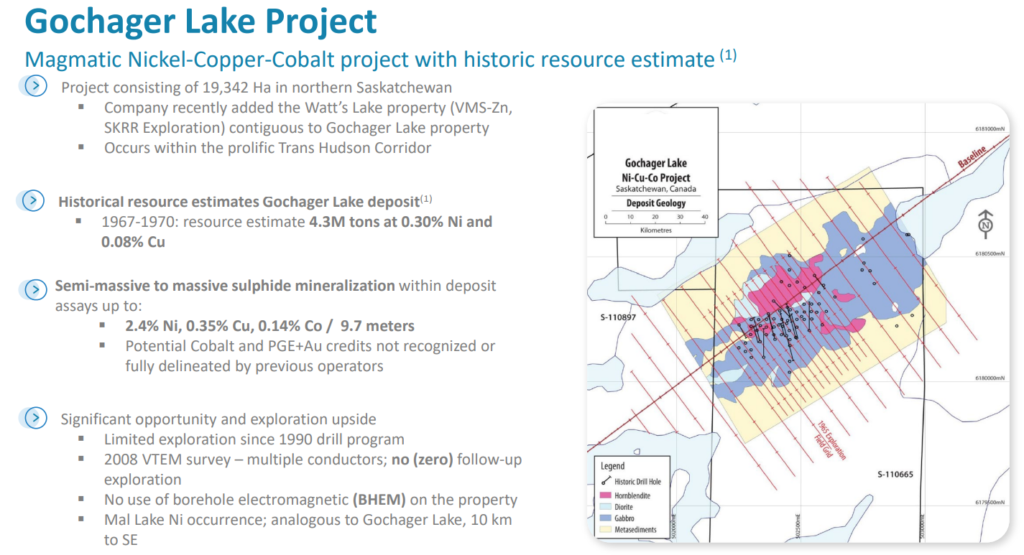

Part 1: “Gochager Lake”

This year some excitement has started to build on the back of some significant hits out of the Gochager Lake project…

First drill holes done by Fathom Nickel:

These hits out of the Gochager Project are not to be considered pure grassroot exploration hits. There is a known resource of 4.3 Mt grading 0.30% Ni and 0.08 Cu from the 90s, but there there has been zero follow up on a VTEM survey done in 2008, and there has been no use of borehole electromagnetics at all (which is the main tool used nowadays to identify semi massive to massive sulphide trends aka “The ore finder”):

What is new is that the Fathom team believes that the drilling done long ago was only scratching the surface of something that could be much bigger. Fathom’s thesis at Gochager is simply that geophysics suggest that there might be multiple high-grade nickel plates “hidden” within the historic Gochager deposit as well a more plates at depth, along strike, and in other parts of the very large land package.

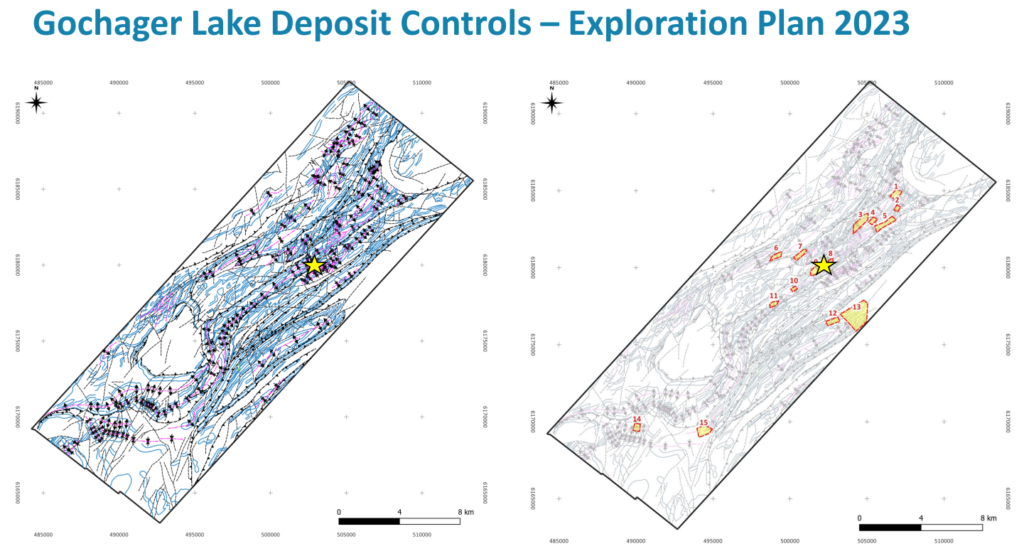

There are so far#15 targets identified at Gochager that could be tested in addition to following up on the Nova Bollinger quality “discovery” hole. As for the immense Albert Lake property we so far have the newly identified, and quite large, TDEM conductor that runs along a multi-kilometer nickel in soil trend.

Thus there are at least one discovery (with proximal conductors) at Gochager Lake, 15 or so additional targets at Gochager Lake, and so far one big TDEM conductor identified at Albert Lake. Furthermore only parts of both properties have been covered so far. In summary Fathom has a couple of obvious targets, and many more bullets in the chamber beyond that, within two large and underexplored properties.

Gochager – Geophysics and Plans

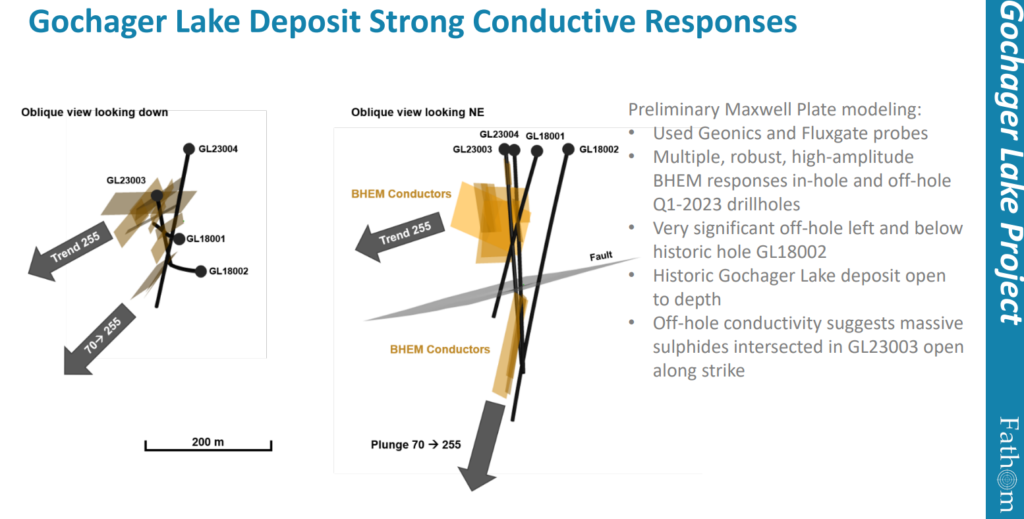

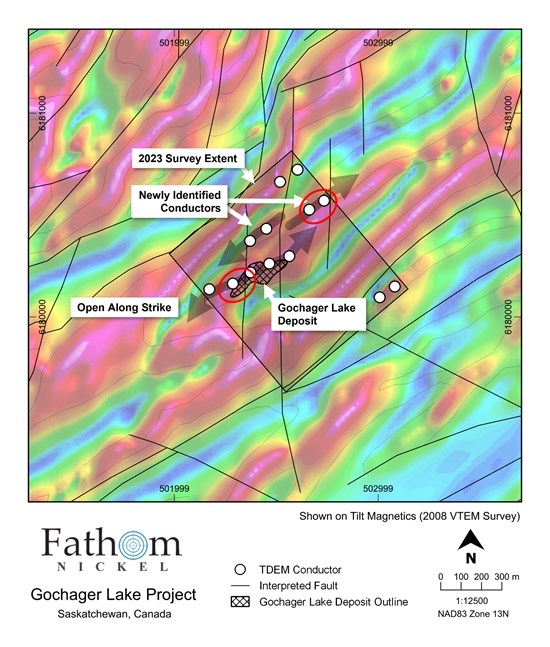

Fathom has done BHEM surveys (“the ore finder”) and several anomalies, that could theoretically be high grade nickel sulphide zones, have been delineated at Gochager:

(BHEM is basically running electricity through the ground and measuring the response. “Metallic rocks” like rocks, that could contain nickel sulphides, are better conductors than a plain rock)

As far as I understand, and which makes sense, the farther an anomaly stretches out from the hole the more promising the target (As it suggests more metallic content). As you can see in the slide above there are several “plates” stretching out from the surveyed holes closer to surface but there is also an anomaly at depth which appears to give a very strong signal given how far it stretches out from the nearest hole.

Gochager – Targets And Drilling

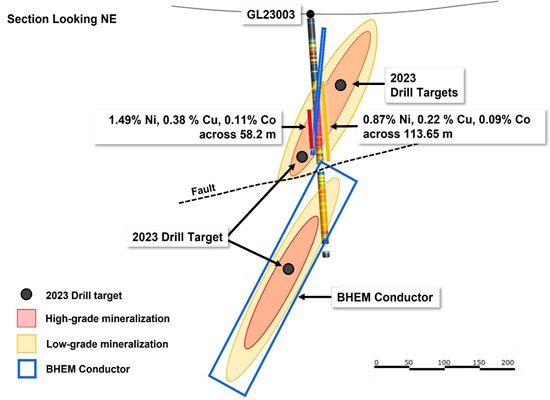

In light of the geophysics the company is soon expected to drill some of these plates (geophysical conductor anomalies) at Gochager:

The beauty of Nickel sulphide exploration with the help of geophysics is that it a) Generates obvious high priority targets and b) Suggests something about the potential footprint. In gold exploration it is very hard to get a clear picture in terms of target size if we are talking lode gold for example. Plus it can be very nuggety and tricky to hit. In nickel exploration a few holes that show “proof of concept” for a plate(s) will immediately de-risk the entire anomaly. This explains why nickel sulphide discovery stories can revalue so much and so quickly. With just a couple of (successful) holes the upper plate can be de-risked quite a bit and if even a single (successful) hole is confirmed in the deeper plate then that whole anomaly gets de-risked. I personally love this kind of “quantum leap” potential/torque that can come from spending relatively low amounts of money.

Below is an example of how a discovery can be made after confirming a geophysical conductor anomaly (“plate”) to indeed host nickel sulphides:

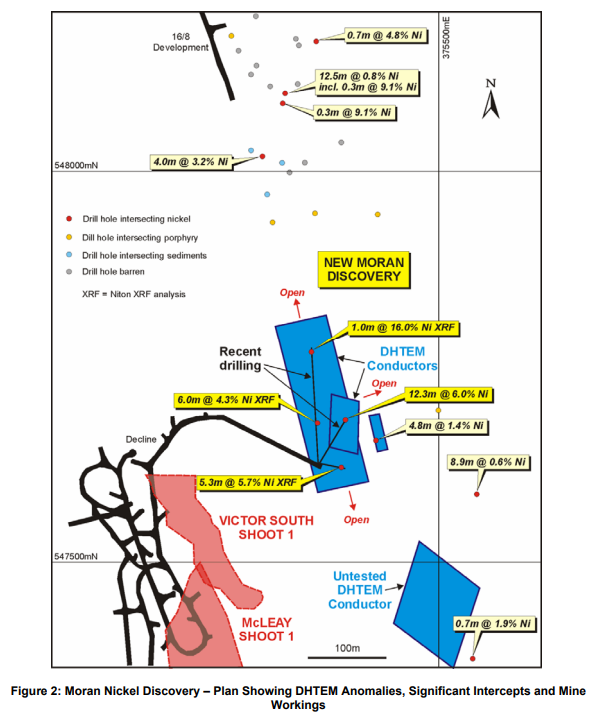

This “Moran” discovery was made by IGO in the world famous Kambalda nickel district. As you also can see this pod of nickel was found near known nickel pods/mines. That nickel deposits often form in clusters is something to keep in mind while evaluating Fathom Nickel and its several geophysical anomalies.

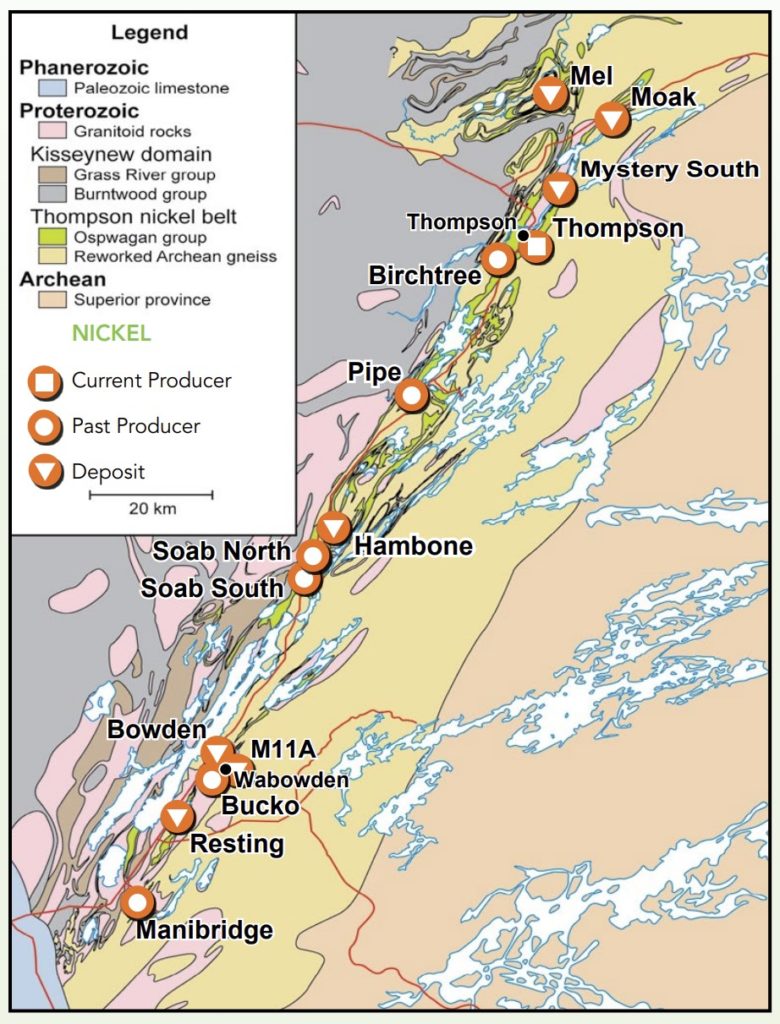

So not only can these nickel deposits show up in clusters on a “micro” scale but unsurprisingly they can also form across districts as evidenced by Kambalda and the incredible endowment seen in the Thompson nickel belt:

Here is a link to an interview with Mark Creasy where he discusses nickel exploration in the Fraser Range (Where Nova Bollinger was discovered), and him stating that he believes more discoveries will be made in the district, using the Thompson nickel belt as an analogue. In the case of Fathom their two district scale projects are located within the “Trans Hudson Corridor” which also hosts the world class Thompson and Raglan nickel belts:

Moral of the story – “If there is one, there ought to be more”

Where you find a nickel sulphide deposit there is a good chance that there are more in the area (A district play). Hence why Fathom Nickel started adding ground relentlessly around Gochager ,as soon as they confirmed the presence of high-grade nickel, which also correlated with the geophysics. This is also why the Albert Lake is a massive 90,000+ Ha in size. Fathom’s blue sky case is that both of these very large projects, with confirmed nickel, might end up being two brand new nickel districts. With such a small market cap there is almost zero chance of this priced in, and this is why I love the Risk/Reward, because one can only lose theoretically 100% in a stock but the upside risk is open ended. I do not like cases where the risk is -100% and the upside potential is +100%. I like cases where the downside risk is -100% and the upside risk is >>1,000% because that means I do not need to be right often.

Anectodes: Australian billionaire Andrew Forrest and his Wyloo entity acquired Noront and as per the CEO they liked their massive land package because that is how you can make a big company (the district scale potential). Wyloo is also backing a junior exploring in the Raglan belt. IGO and others have tried to consolidate the entire Fraser Range in Australia. The Thompson belt is still being mined and explored today. Lastly there is of course other world class districts like Sudbury and Norlisk which hosts numerous deposits/mines.

Controlling a district scale land package in nickel country is thus a big value add simply because these deposits typically form in clusters and/or over districts… And Fathom is keenly aware of that.

Gochager – Other nearby targets

Fathom has also done (limited) TDEM surveys around the Gochager Lake nickel deposit that suggest there might be more targets nearby (including along strike from the known deposit):

What is important here is the fact that we know there are nickel sulphides here, and as evidenced by Fathom’s first hole, they can carry grade. Occam’s Razor would therefore suggest that the other conductors that show up via geophysics might very well be of the same ilk (Nickel sulphides). If these were just geophysical anomalies, and there was no evidence of nickel sulphides, then these anomalies would obviously have lower risk adjusted value. But again, we already know that the immediate conductors correlate with nickel mineralization so one would think these other ones might indeed turn out to be the same!

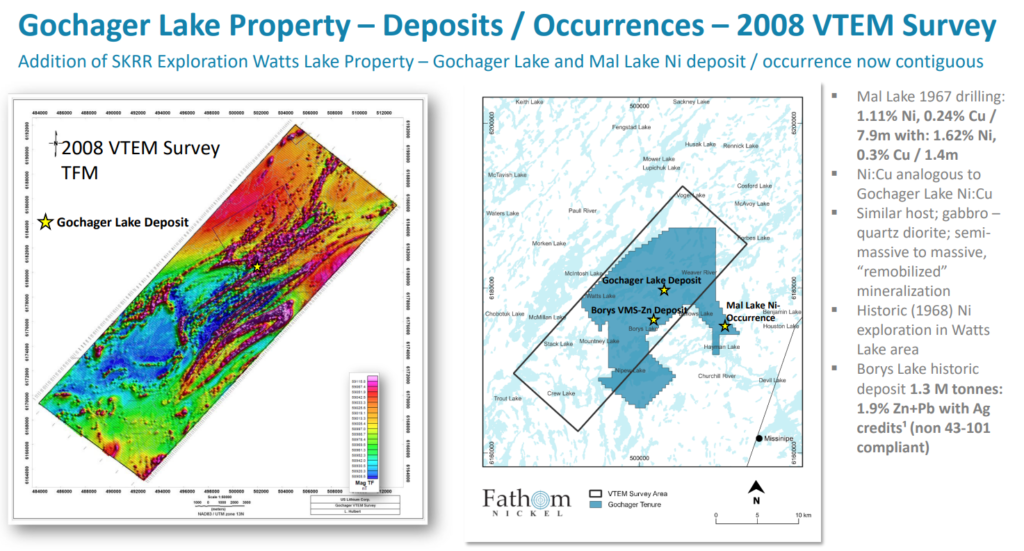

Gochager – District potential

As mentioned earlier, Fathom Nickel has been very busy staking more ground around the Gochager target, which includes the Mal Lake target. The Mal Lake target saw some drilling way back in 1967 which hit 1.11% nickel and 0.24% copper over 7.9m. This nickel hit is approximately 10 km away from Gochager which highlights the potential for an entire nickel district:

This entire area has basically never been explored with modern exploration tools as a guide. A VTEM survey was done over parts of Fathom’s current Gochager Project footprint by previous operators in 2008, but as mentioned earlier, there was literally ZERO follow up. Well Fathom has used this VTEM survey as well as other tools to come up with #15 targets and counting so far (This survey does not even cover the Mal Lake area):

How many of these targets actually hosts nickel sulphides? I don’t know. All we know that there are nickel sulphides present here, that these deposits tend to show up in clusters, and that there are at least 15 targets at Gochager so far.

Commentary

Here is Quinton Hennigh discussing Fathom after their high-grade hits some months ago:

Some notable tidbits:

“This is a story that I can tell you plain out… That people don’t get yet….”

“They have made a discovery here, there is no question…”

“…They have found a brand new district right here in Saskatchewan…”

“…in my view this is an amazing discovery… These guys might be on to something huge…”

“…Why is Fathom so exciting?… Well they did down hole EM… And they modeled those conductive zones…”

“…To give you a sense… These plates are basically… You know easily extending out 200 metres more or less around the hole…”

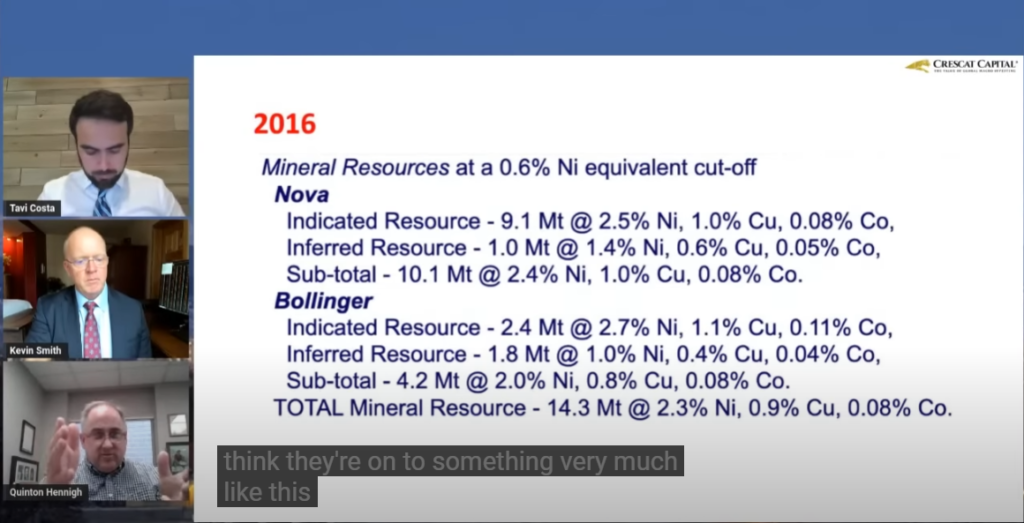

“… Well that’s the scale of Nova…”

“… Can I guarantee that they’re going to find you know 15… 20 million tonnes of high-grade nickel, copper… I can’t guarantee it but that looks like a pretty good possibility…”

So what’s the big deal with Nova Bollinger?

Well the discovery of the Nova Bollinger deposit was made by Sirius Resources and that lead to one of the most jaw dropping success stories that I have ever heard of…

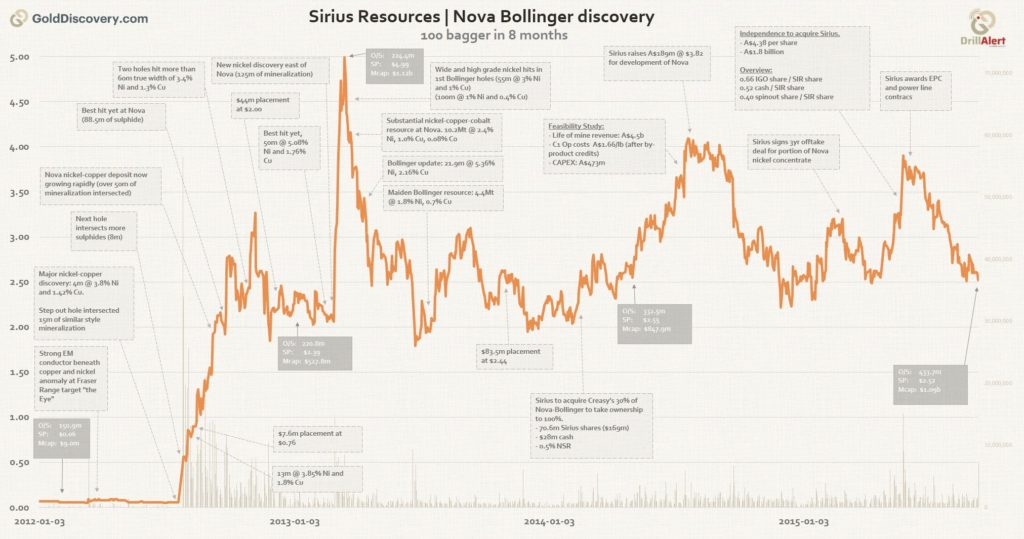

Sirius Resources (“Nova Bollinger”) – 100X in 8 months…

The share price went from a low of $0.06/share to a high of $5/share and the corresponding Market Caps went from $9 M to $1.12 B in only 8 months. In the end it was acquired for $1.8 B.

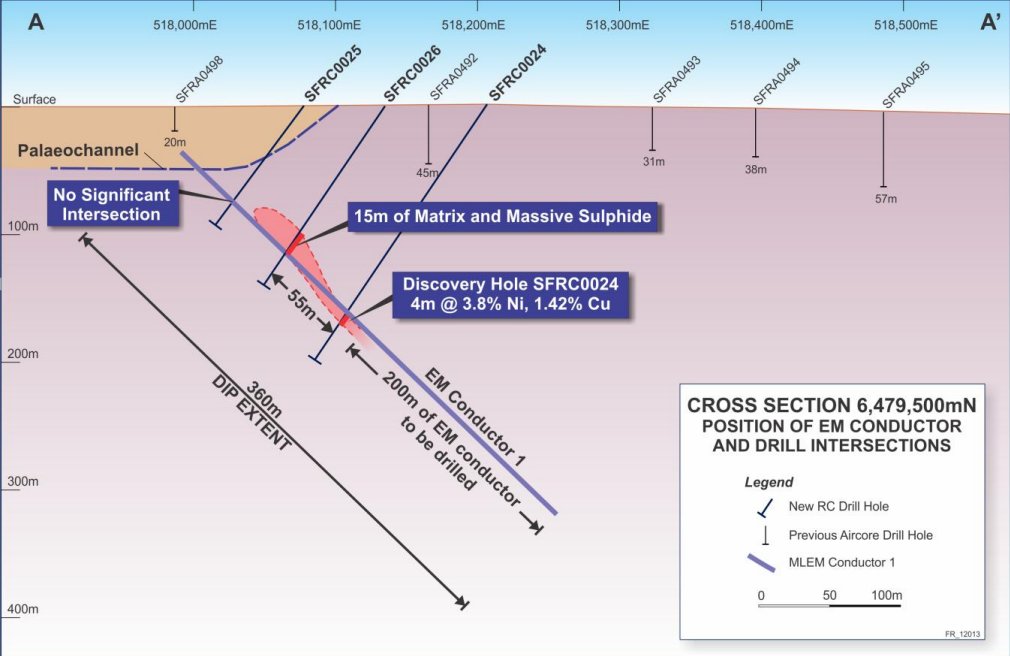

- Discovery hole: 4 meters @ 3.8% nickel and 1.42% copper

- Acquired for: A$1.8 B

(From GoldDiscovery1 on twitter)

Sirius early days:

Below is the resource estimate for Nova Bollinger and I think this resource contains more metals than when IGO (Mark Creasy) acquired Sirius Resources (who made the Nova Bollinger discovery):

- Nova Bollinger’s resource, as you can see above, totaled 14.3 Mt grading 2.3% Ni, 0.9% Cu, and 0.08% Co.

- Fathom’s hole GL23003 at Gochager lake hit 18.1 metres of 2.43% Ni, 0.51% Cu, and 0.18% Co.

Making another Nickel Sulphide discovery at Gochager on par with Nova Bollinger would obviously be a dream for obvious reasons. If that were to happen then Fathom could perhaps pay for >20 “failed” investments. Is there a guarentee that Gochager will be a company maker for Fathom? Absolutely not. Is it possible? I would think it is very much possible given:

- The quality of these early drill results

- The boor hole EM survey results

- The TDEM survey results

And as always the most important factor is what one pays for it and what chance of success is priced in. A superb and de-risked case, with a high chance of success, can be a sell if it is already fairly valued or even overvalued. On the flip side of the coin a case with a high degree of uncertainty/risk can be a good case if one believes that the market is too pessimistic and therefore the potential reward is higher than it maybe should be…

Running some numbers

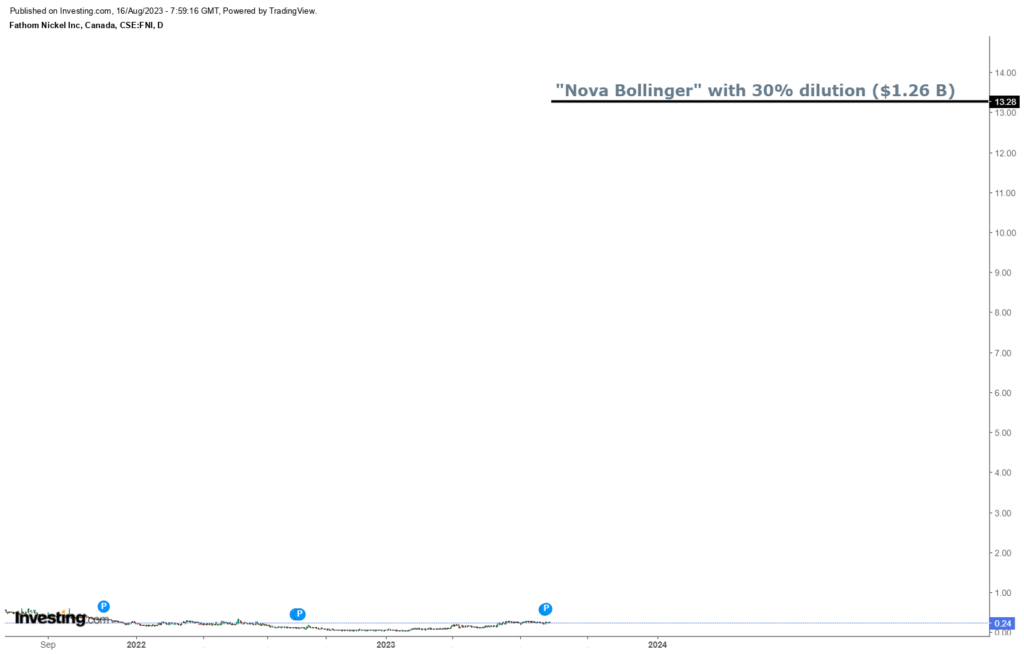

Fathom Nickel currently has a Market Cap of a mere C$23 M (at $0.245/share). That is 23/1,800 = 1.28% of what Nova Bollinger was acquired for in 2015. In other words one can say it is pricing in 1.28% of Nova Bollinger or a 1.28% chance of success that the Gochager Lake Project will end up being a Nova Bollinger type discovery. Now, given that Fathom has two projects one could say that only half of $23 M is attributed to Gochager Lake. In that case the chance of success priced in would be 0.64% at face value but this assumes no dilution. If we assume 30% dilution to prove it up it still would only reflect a 0.91% chance of success priced in of finding and proving up something comparable to Nova Bollinger (or 1.82% if we attribute the entire Market Cap to Gochager).

With that said what do you think the chance of success actually is?

Well no one can possibly know the actual chance of success. What is there is there and have been there for millions of years. But given that Quinton Hennigh is a geologist with a background in Newmont and Newcrest, I think we can safely assume that his geological intuition is some million times more accurate than my own, for example. So in light of Quinton’s comments do you think he personally believes the chance of success is close to 1.82%, let alone 0.91%? Would they have been able to raise any money if the investors believed that to be even close to the case? I don’t think so.

I simply participated in a PP, as well as bought shares in the market, for the simple reason that I think there is at least a 10% chance that Fathom might end up proving up a significant deposit(s) at Gochager (And there is potential for more than that). If I assume “only” a 10% chance then Fathom looks to provide me with a very attractive, and highly asymmetrical Risk/Reward opportunity. Enough so that if things go well then Fathom could pay for a large number of exploration stories that did not end up working out (and vice versa). With that said Fathom also has the Albert Lake project which is yet another very large nickel project (Some are even more excited about Albert Lake than Gochager).

If Fathom would be priced at say $100 M already the Risk/Reward would obviously be worse since it means less upside in a success scenario (while theoretical downside is always fixed at 100%).

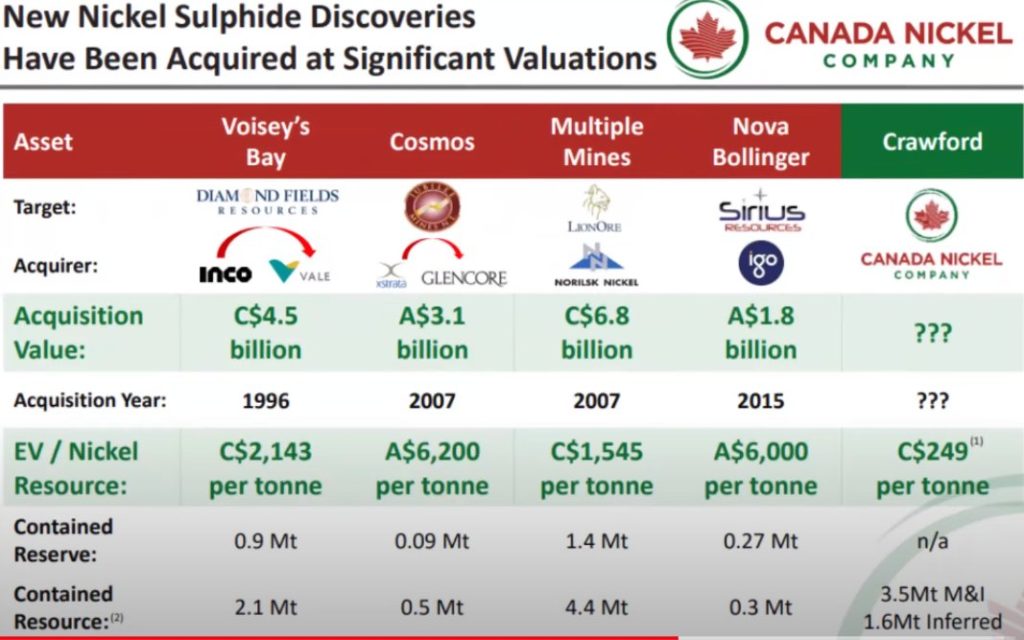

Before we continue lets get a sense of what Nickel discoveries can be worth in tier 1 jurisdictions we can look at some transactions and valuations:

- Sirius Resources (Nova Bollinger) was acquired for A$1.8 B in 2015

- Chalice Mining (Julimar) currently has a Market Cap of A$2 B and peaked around A$3.5 B in 2021

- Voisey’s bay was acquired for $4.3 B in 1994 (Around $8.4 B in today’s money)

- Noront Resources was acquired for C$617 M in 2022 after a take over battle between Wyloo Metals (Andrew Forrest) and BHP

To drive home the point just how crazy a nickel sulphide discovery story can be, lets look at another case, that failed…

In 2017 I guess Canadian investors still remembered how valuable a great nickel sulpide discovery can be, and as a result there was a micro cap explorer named Garibaldi Resources that ran all the way to (I think) >$500 M in Market Cap (>3,000% revaluation), before a single assay was out. The narrative at the time was that they were on to a new Voisey’s Bay type discovery. Later on, as the price just kept exploding higher, the narrative switched to it being a new Norilsk discovery (even bigger than Voisey’s Bay). Again, all of this before a single assay result was out. This was a target that had seen quite a bit of exploration already by Silver Standard if I remember correctly. Well they did hit nickel but the previous explorers proved to have been right about there not being any scale to it and the rest is history…

The chart above obviously looks crazy in hind sight but I think it highlights, at least at the time, that speculators had a grasp of how these nickel sulphide discovery stories can play out. If Garibaldi would have ended up making a major discovery then maybe even the ones that entered at the top would have made a lot of money. But sadly for shareholders this was not one of those success stories. But that was then and today the junior sector is as dead as it was around the 2015 bottom. Nobody cares. Almost nobody even seem to read news releases or care to even dig into stories anymore…

On that note there is almost no talk about Fathom Nickel. I can’t remember if I have seen anyone even mention it on twitter and on CEO there is only a handful of people who actually follow the story and are excited. And yet the stock has been creeping up even during this severe junior sector depression like we are experiencing right now and the Accumulation/Distribution indicator suggests “someone” is, and have been, (quietly) accumulating alongside the stream of encouraging news releases:

The chart above jives with Quinton’s comments from the Crescat Presentation discussed earlier where he ended by saying:

“… But there’s a lot of really smart guys out there in Toronto and stuff… These institutions are like ‘huh, we’ll just gobble up shares’ you know…” – April 14

Almost nobody is talking about the story, but someone appears to be paying attention and have been accumulating for months.

2 – “Albert Lake Project”

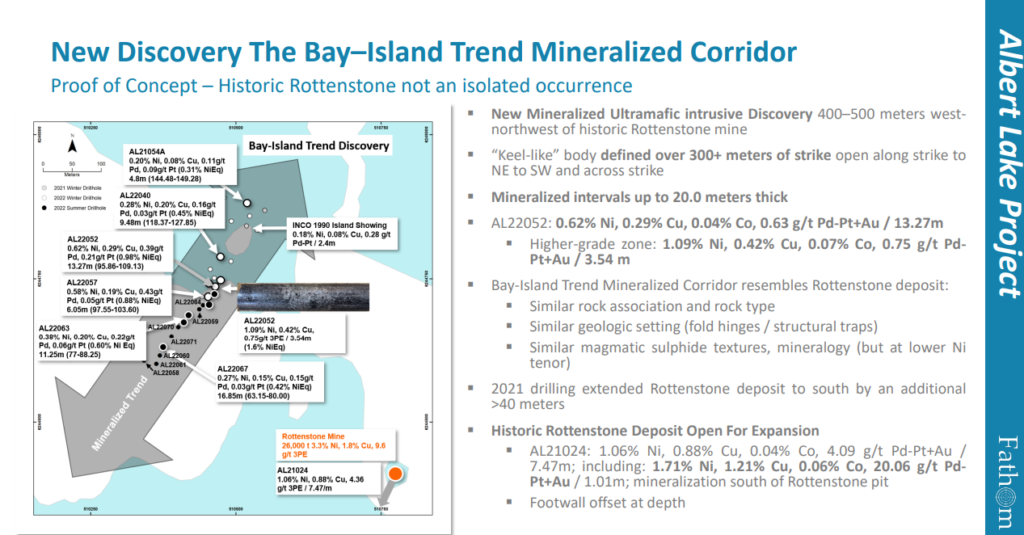

This article is already getting quite long so I will try to just briefly cover the 90,000+ ha Albart Lake Project and people can read up on it themselves. At Albert Lake there is a very small historic deposit/mine. Albeit small, the grades were simply incredible as the mine produced 20,000 tonnes grading 3.3% Ni, 1.8% Cu and 9.6 gpt 3PE:

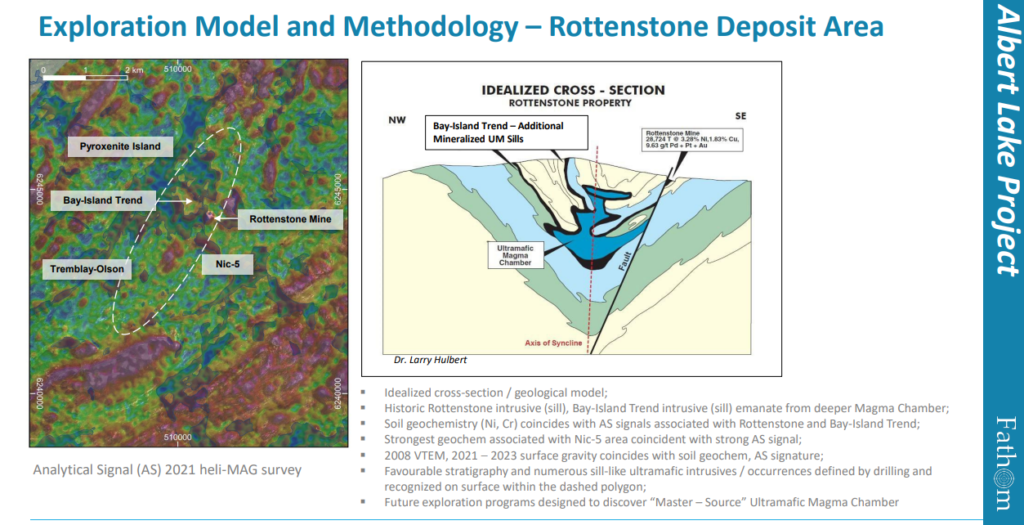

As you can see in the slide above there is confirmed nickel mineralization in other places proximal to the bonanza grade nickel mine. Fathom’s thesis is that it ought to be nearly “impossible” for such high grades to be present without there being a large system hidden at depth somewhere. The company basically believes that this bonanza mine is the tip of a potential ice berg:

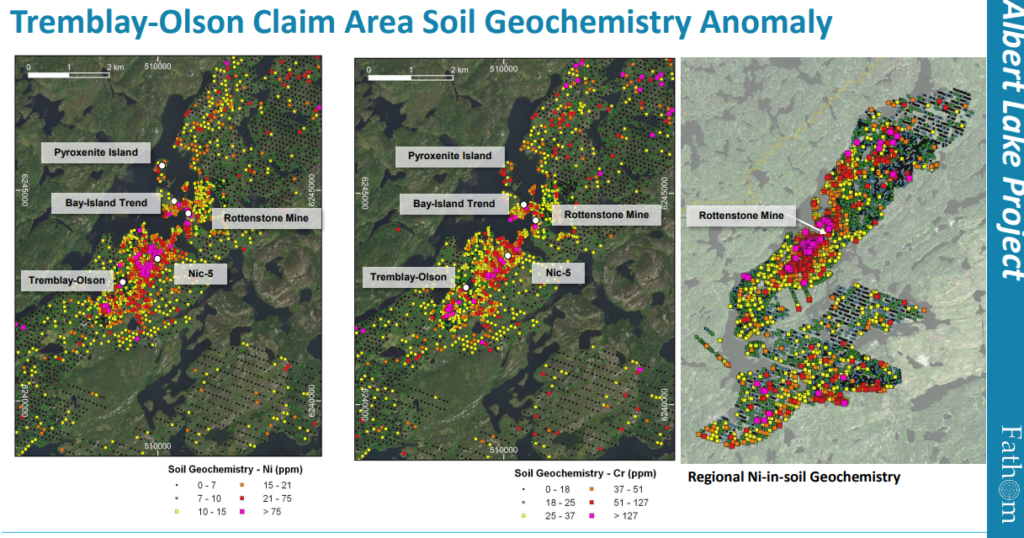

What would support this thesis is the presence of very large and robust Nickel-in-Soil anomalies that are impossible to be explained by just the historic Rottenstone mine:

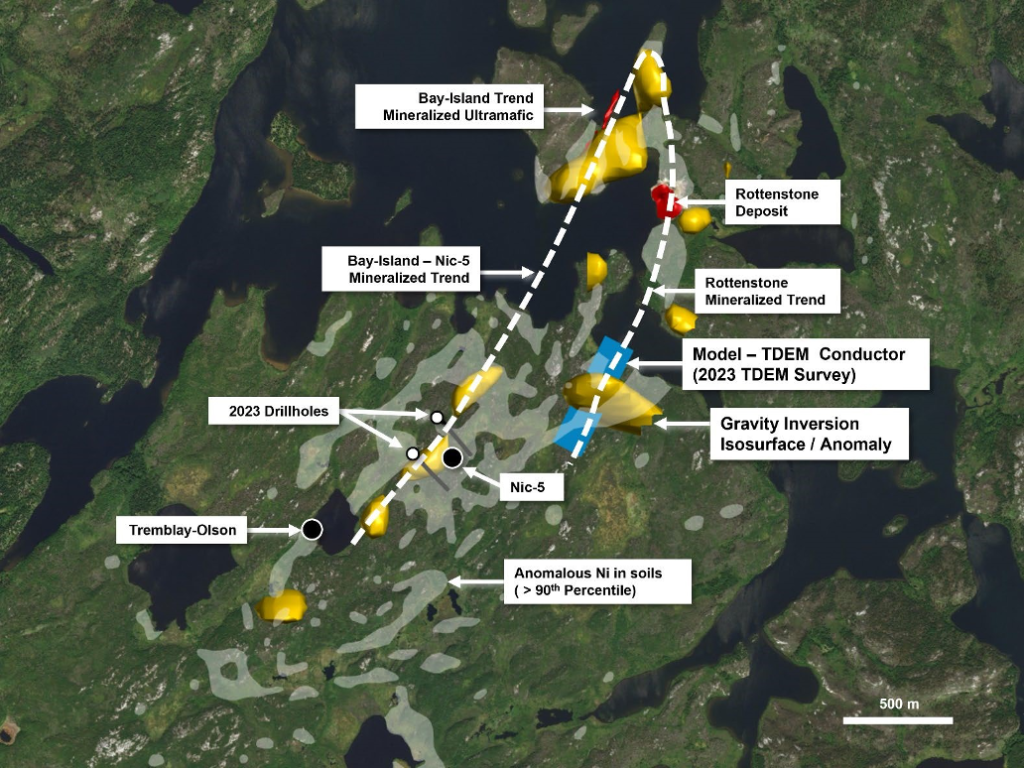

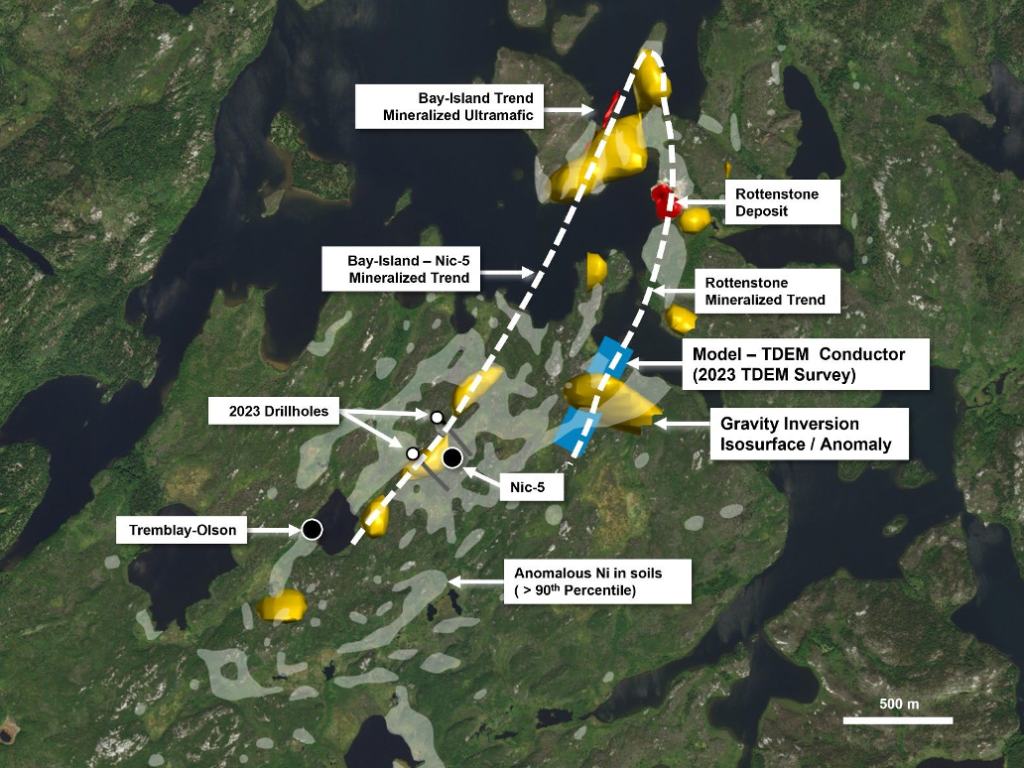

Fathom has done quite a bit of work at Albert Lake in order to generate targets, and the (still evolving) picture currently looks like this, as per the Aug 14 NR:

Note the grey areas (Ni-in-Soil anomalies), the blue TDEM conductor targets and the yellow gravity inversion anomalies.

More from the NR…

TDEM highlights include:

- A very strong TDEM conductor occurs approximately 1,000 meters south-southwest of the historic Rottenstone Mine/deposit (see Figure 1).

- Modelling of this conductor suggests a very conductive, flat lying body with an area that is approximately 450m x 150m and is situated approximately 300 meters below surface.

Notes to Exploration Update Map:

- The >90th percentile (>15.7ppm Ni) Nickel in soils has defined an area of above background Ni-insoil that measures in excess of 3.7 kilometers in strike x 1.0 kilometers wide. Coincidentally the Rottenstone deposit*, The Bay-Island-Trend**, the Tremblay-Olson***, and Nic-5**** occurrences all occur within this trend. Note: >97th percentile Ni-in-soil is >28.96ppm Ni.

- Within the Ni-in-soil anomaly area and proximal to the modelled TDEM conductor, individual soil samples returned up to 743ppm Ni, 547ppm Cu, 946ppb Pd, 575ppb Pt and 175ppb Au.

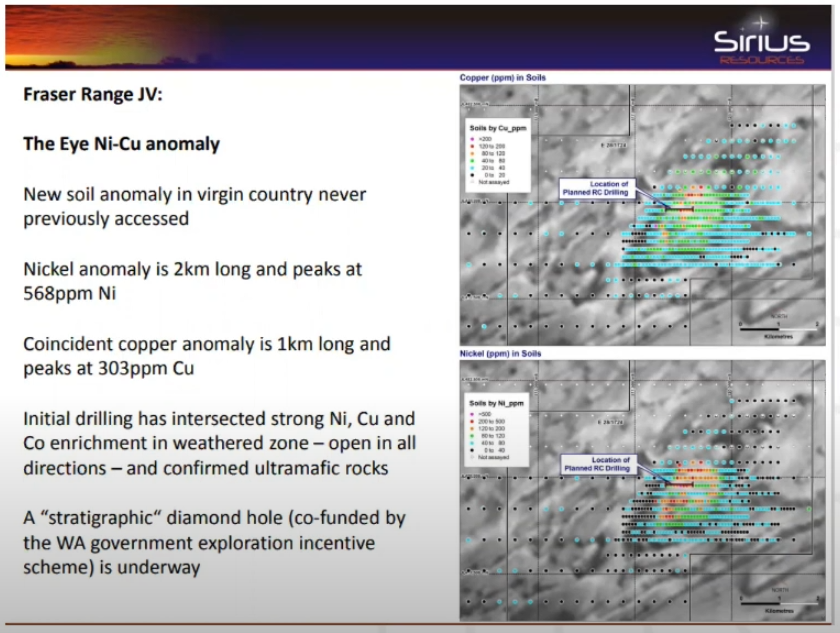

Note the scale and peak grade of this northern soil anomaly and compare it to the soil anomaly a Nova Bollinger:

Nova Bollinger anomaly

- 2km long

- Peak grade of 568 ppm Ni

Fathom’s northern >90th percentile Ni-in-soil anomaly that runs through the historic Rottenstone mine:

- 3.7 m long (and 1 km wide)

- Peak grade of 743 ppm Ni

… In other words much larger and peak grade is quite a bit higher than Nova Bollinger as well.

On the new BHEM survey results from Albert Lake

There is a poster called megacopper who has been seen commenting on Fathom on the Stockhouse forums. Recently, after being asked, he has also joined the CEO forum and has been posting a lot of interesting stuff. Now I do not know this person and I am not a geologist so I cannot say he sounds wrong or right but to me he has made a lot of sense at least. Anyway, below are some comments made by said poster (Make of them as you wish):

megacopper wrote: As good as the Gochager property looks there is new scientific data indicating that the target at Albert Lake could even be better. That target is indeed a monster with dimensions of 450 meters by 150 meters. To put that in terms people can understand that is almost as large as the Ovoid at Voisey’s Bay that was 32 million tonnes of nickel copper and cobalt that sold for 4.3 billion dollars back in the mid 90’s when metal prices were 1/3 what they are today. Amazing.

So the Ovoid deposit at Voisey’s Bay (see below) that contained 32 million tonnes of high grade Nickel was contained in an area only 450 meters by 250 meters by 110 meters thick. Compare that with the recent news of the new target at Albert Lake that is 450 meters by 150 meters by unknown meters thick. Do you guys see what I’m getting at. The physical size of that target at Albert Lake is very impressive. It could be well over 20 million tonnes if it’s 100 meters thick. And this target is only 1km away from one of the highest grade historical nickel mines that averaged 3% Ni 2% Cu and 9 g/t PGE’s. Hello!!! That sure gets my attention. I don’t think investors have a clue what Fathom Nickel has on these properties. Not the slightest clue. Just sayin

the gravity survey at Albert Lake is indicating a very dense body of rocks to go along with the geophysics at that target and the huge soil anomaly very high in metals. There is an extremely high probability that the target at Albert Lake is a nickel sulphide deposit. To get something that big and that dense show up on geophysics and on a gravity survey at a depth of 300 meters. My mind is made up as to what it is.

And for anybody not familiar with Fathom Nickel story, the old Rottenstone Mine back in the 60’s at Albert Lake was only about one km away and it had an average grade near 3% nickel, 2% Copper and 10 g/t platinum group elements. It was one of the highest grade base metals mine on the planet. Yes the pieces of the puzzle are coming together. FNI shareholders could very well end up with two or more world class high grade nickel deposits.

(Refresher slide)

Closing Thoughts

I have no idea what Fathom will end up finding at Gochager Lake or Albert Lake. What I know is that there is confirmed Nickel there and geological as well as geophysical evidence suggest there might be two large Nickel systems present there and that the company has numerous high priority targets including directly following up on the high-grade hit at Gochager as well as the anomalies at depth and along strike. And those are just the immediate targets near the Gochager deposit. Beyond that there are some #14 targets and counting at Gochager. And there is a whopper of a soil anomaly, with a very large TDEM anomaly, which coincides with a gravity anomaly at Albert Lake.

Fathom Nickel could end up anywhere from not finding anything of worth to finding one or two entire Nickel districts.

For $23 M I am more than happy to take a position.

Some prominent Nickel discoveries in tier 1 jurisdictions

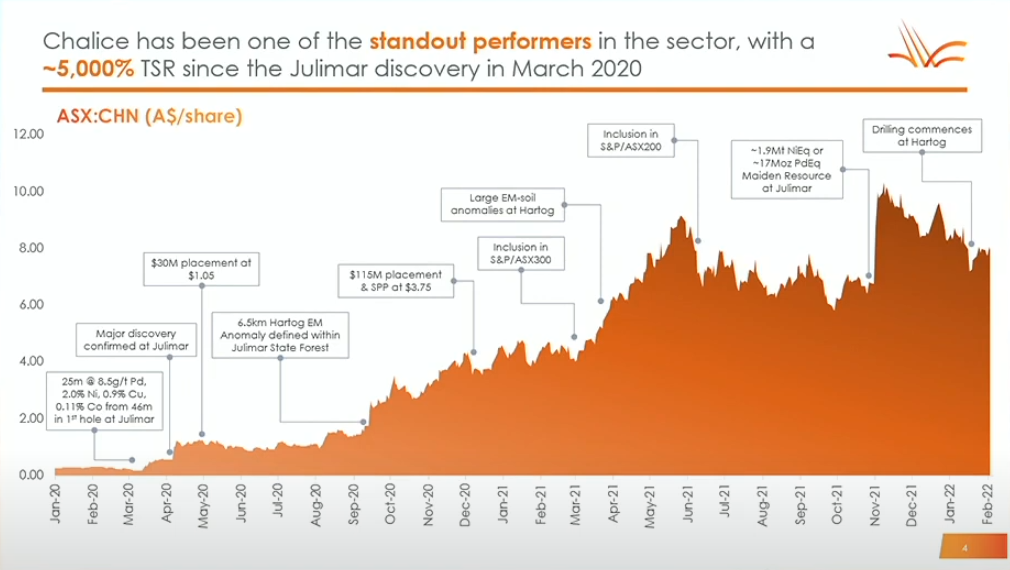

Chalice Mining (“Julimar”) – 50X in less than 2 years after the discovery hole

- Discovery hole: 19 metres @ 2.61% Ni, 1.0% Cu, and 9.5 gpt PGE

- Valuation: Currently $2 B, but reached $2.9 B in April of this year, and peaked around $3.5 B in 2021

(Source: 2022 Chalice presentation)

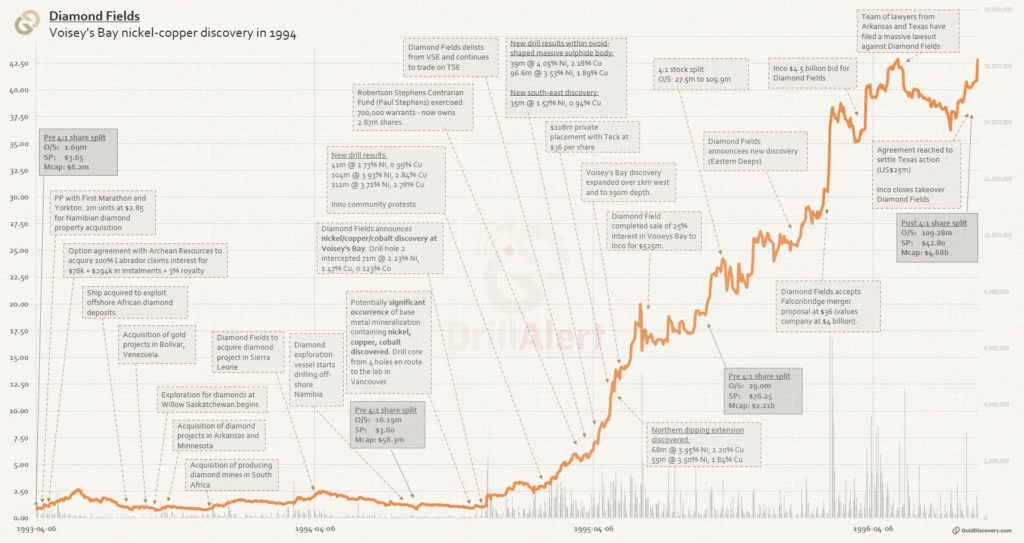

Voisey’s Bay – 47X within 2 years from discovery

- Discovery Hole: 71 meters @ 2.23% Ni, 1.47% Cu, and 0.123% Co

- Acquired for: $4.3 B in 1996 (Around $8.4 B in todays dollar)

(Source: GoldDiscovery1 on twitter)

Note: I am biased. This is not investing advice and I am not an investment advisor. Do your own due diligence. I did not get paid to write this article BUT the company is a banner sponsor and I own shares of the company. Therefore I am biased. I do not share your profits or your losses. For your sake assume I may buy or sell share at any time to boot!!!

Best regards,

THH