THH – Scottie Resources (SCOT.V): Very High-Grade Gold Exploration in The Golden Triangle Close to Ascot and Newcrest

Scotties Resources is a company I was not aware of until just a couple of months ago. While digging into the story I got very intrigued and had a call with management to get some more meat on the bones. Since I got a positive impression I bought shares in the company and was able to get the company on as a banner sponsor to help spread awareness. In this article I will try to explain the case as I see it and why I purchased shares for myself as well as some family members (Long term, low maintenance HODL portfolios). I will try my best to be explain the case as I see it but bear in mind that I own shares and the company is a new banner sponsor as well. Thus treat me as biased, do your own due diligence and form your own opinion! If one does not see a case one has no conviction. If one has no conviction then that is an invitation to make wrong decisions in a volatile sector (like selling low and buying high).

Scottie Resources just closed a private placement to the tune of C$5 M at $0.30/share for flow-through$0.21/share for non-flow-through.

My Case for Scottie Resources in short:

Scottie Resources is a junior explorer which is active in the famous Golden Triangle of British Columbia, Canada. The company has put out some stellar high-grade hits from both the historic Scottie Gold Mine as well as the newly Blueberry Zone in the southern parts of the Golden Triangle. The company’s impressive 52,000 Ha land package is bordering both Newcrest (who bought out Pretium) and Ascot Resources (Which plans to be a producer within 12 months). Given the location, jurisdiction, infrastructure and proximity to larger mining companies I believe that success here will both be worth more than for your typical junior as well as having a lower threshold for success. These factors both lowers risk and hikes up the reward potential at the same time which I value very highly. “Even” 1 Moz of high-grade gold here could be more than enough to warrant development, thus have real economic potential, and perhaps be worth more than a multimillion ounce deposit in most places of the world. The high-grade nature of the mineralization also makes underground mining very possible which would leave a smaller footprint, lower CAPEX and be seen as more ESG friendly. Lastly, said high-grade potential could mean that the ounces would be profitable even in a relatively low gold price environment and act as margin of safety from a metals cycle perspective.

Competitive advantages

- Above average value of success

- Below average threshold for success

- Probable growth since is a post-discovery exploration story

- Wide open blue sky exploration potential until further notice

- Some impressive grades and widths shown so far (Potential for high-margin and thus high-value ounces)

- 7.44 g/t over 34.78 m

- 22.3 g/t over 6.1 m

- 16.5 g/t over 10.0 m

- 11.72 g/t over 10.95 m

- 28.8 g/t over 4.94 m

- etc.

- Underground (ESG friendly)

- Already disturbed ground (Historic Scottie Gold Mine)

- Vote of confidence (“who cares?”)

- Yamana Gold ($7.5 B Market Cap) – 9.9%

- Eric Sprott 13.5%

Price (Pre-financing) at $0.185/share: C$37.5 M

I believe that a good case should be very simple and clear in order to limit the amount of decisions needed and thus limit occasions where an investor could make mistakes…

My Simple Case in Practice:

Buy and hold until I cannot see the company have probable future growth on a rolling 12-24 month basis all else equal. Hopefully the company’s intrinsic value will thus end up being higher 12 months from now, and even more so 24 months from now, and so on. If the company’s exploration success continues it should one day either a) Get acquired or b) at least will have grown in both Value and Price enough for me to sell at a profit even if I have bad timing (sentiment cycle wise) in the future. Personally I think the company probably has close to, or perhaps more than, 1 Moz of high-grade gold inferred already. In that case an Enterprise Value of around C$37.5 M would be pretty cheap for what I think the company already has and I get all additional upside for “free”. This kind of inferred Margin of Safety along with open ended upside is exactly what makes a good Risk/Reward case in my opinion… If I am probably not overpaying for what a company probably already has, then the risks to the downside ought to be muted, and I would capture any upside surprises (further exploration success) without paying up for it in advance.

The Case in The Words of The Company:

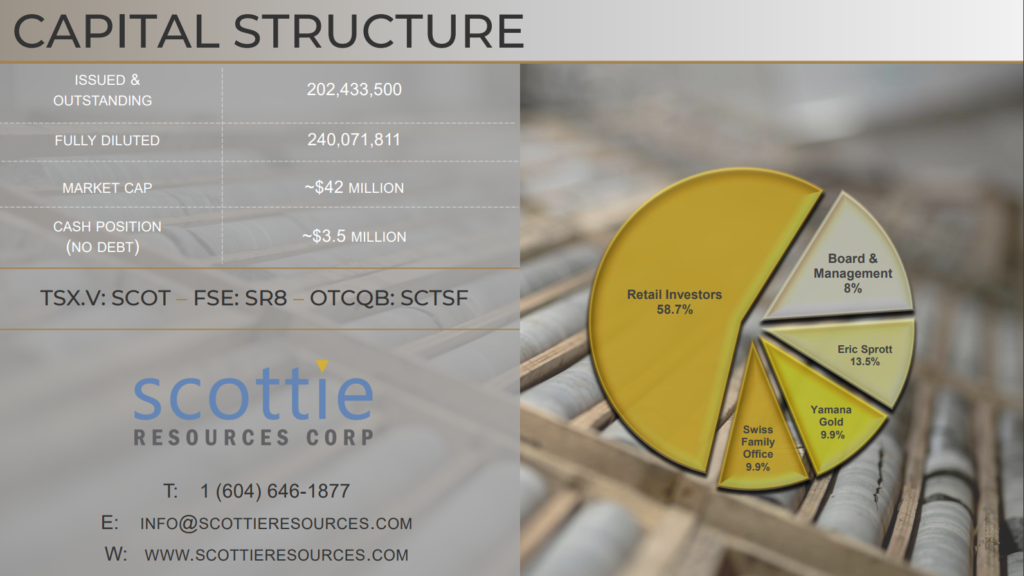

Shareholder base and capital structure (before current financing):

What stands out to me is obviously that a) Eric Sprott owns 13.5%, b) Board and Management owns 8%, and that a mid tier in the form of Yamana Gold owns a 9.9% of Scottie Resources. The insiders ownership is quite decent I think and having two major backers in the form of a billionaire and a large mining company is certainly not something every junior explorer can say. To me these are very much positives and I think speaks to the merits of Scottie Resource’s asset base (In other words the potential is legit). One negative would be the somewhat bloated share count. This of course does not change the company fundamentals at all, should provide added liquidity, but can sometimes weight a bit on a stock.

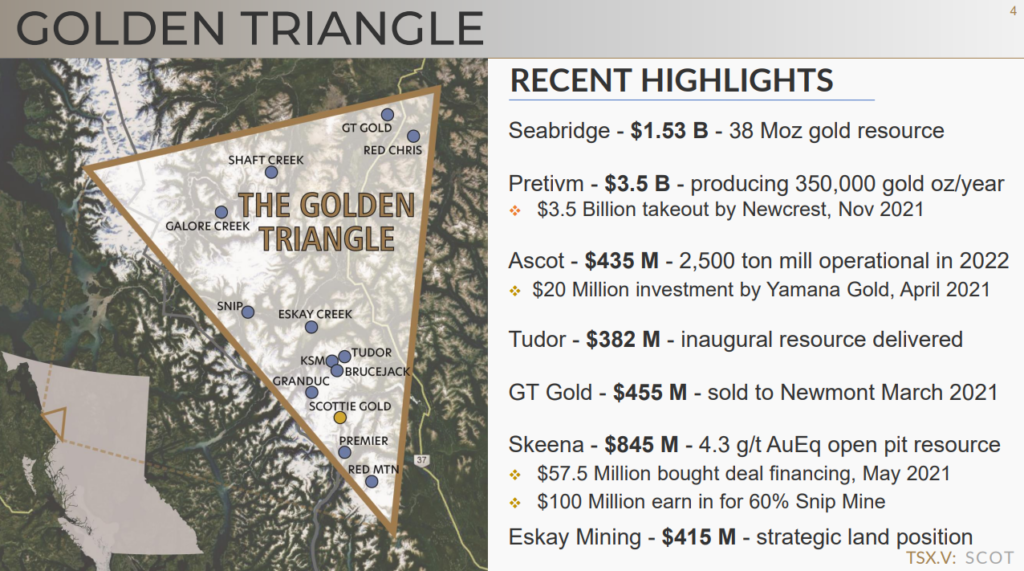

Location of the project and recent corporate highlights in the Golden Triangle:

There is no question that the Golden Triangle is remarkably well endowed with metals and is possibly THE go to place for major miners lately.

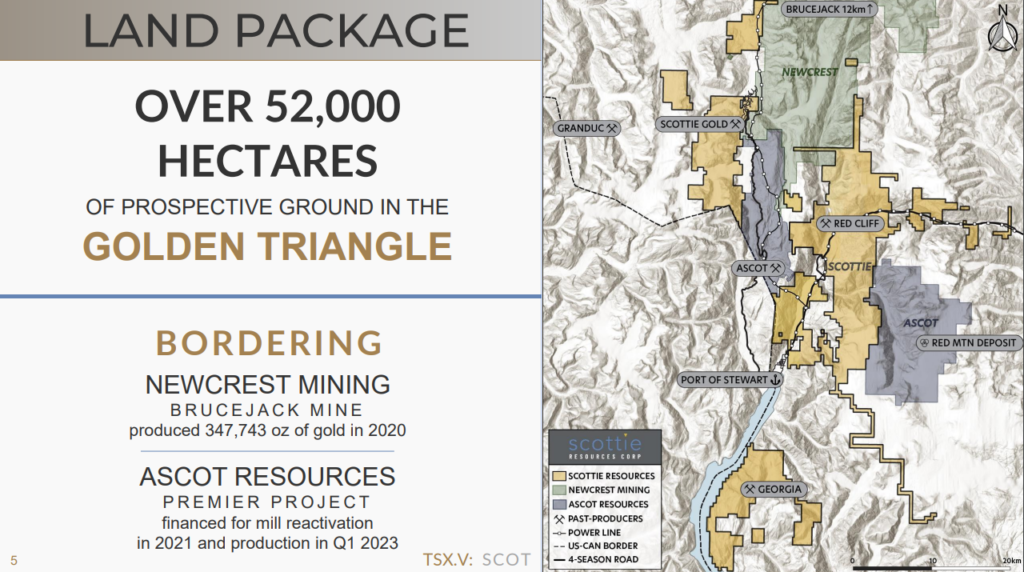

Overview of the 52,000 ha land package and neighbors:

As mentioned earlier Ascot Resources is set to put the Premier gold mine back into production in the not too distant future. This along with Newcrest’s Brucejack mine means that there are a lot of sunk costs already in place in the immediate area. In other words the ounces found by Scottie Resources ought to have a higher than average likelihood of being economic and recovered. This likelihood, and therefore implied value per ounce, is also upped by the excellent infrastructure in my opinion:

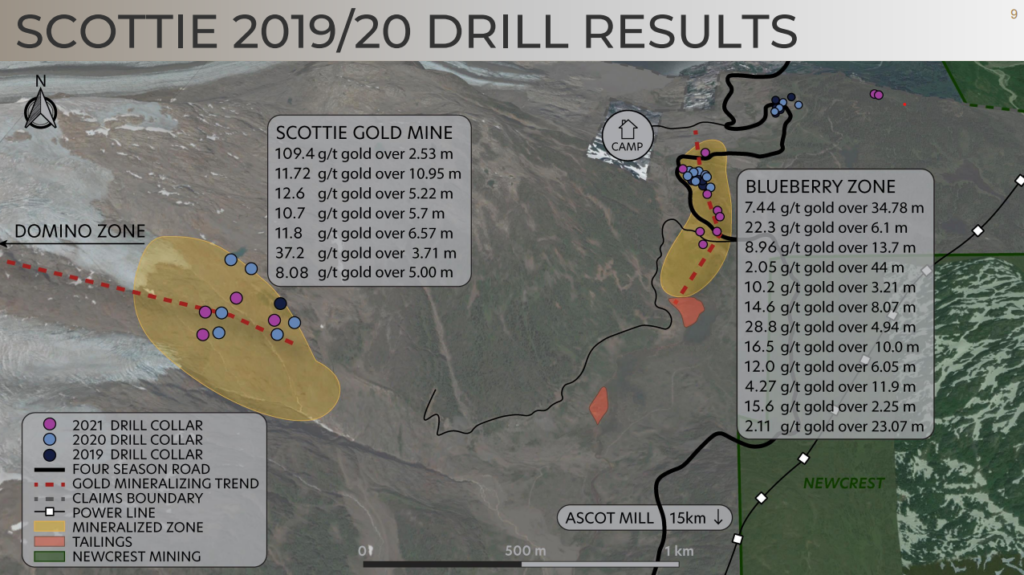

Scottie Resources basically has two primary, de-risked targets that the company is working on. The first one is the area around the historic Scottie Gold Mine and the second is the recently discovered Blueberry Zone:

… You can see that there have been some fantastic drill results from both areas and especially the Blueberry Zone. One does not need a lot of tonnage in order to possibly having something already material with those kinds of widths and grades obviously. Also note that the two outlined “Gold mineralizing trends” appear to be trending toward a possible inflection point. What this might mean I am not sure but I think the slide above would suggest that there could be some good strike potential in both areas (as well as both zones being open to depth). Furthermore it’s basically the historic tailings area that “masks” the ground where these mineralized trends might very well continue in the bedrock beneath:

#1 Scottie Gold Mine

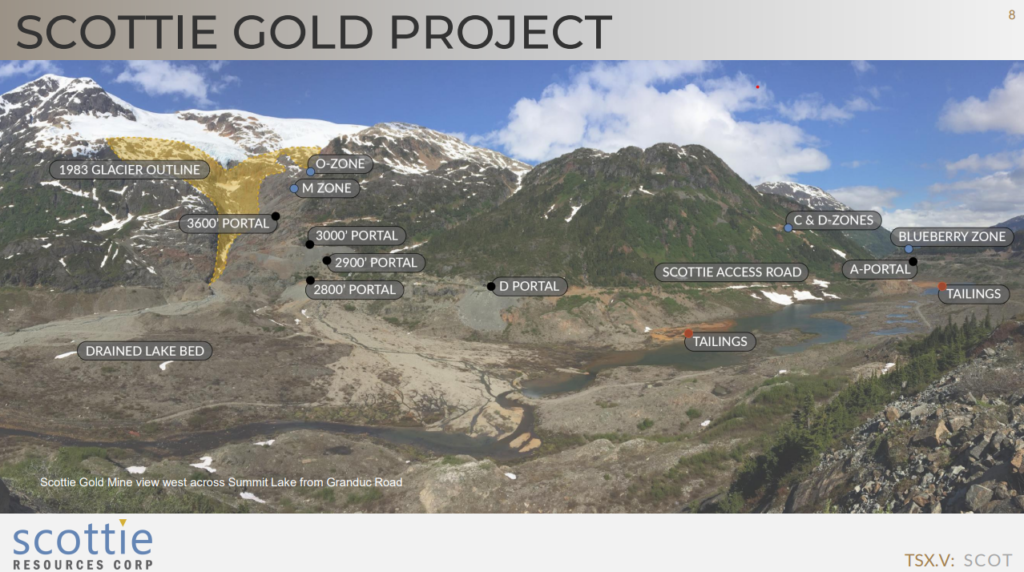

At the Scottie Gold Mine target there appears to be multiple zones of interesting:

The latest news release with results from the Scottie Gold Mine included the following comments, results and slides:

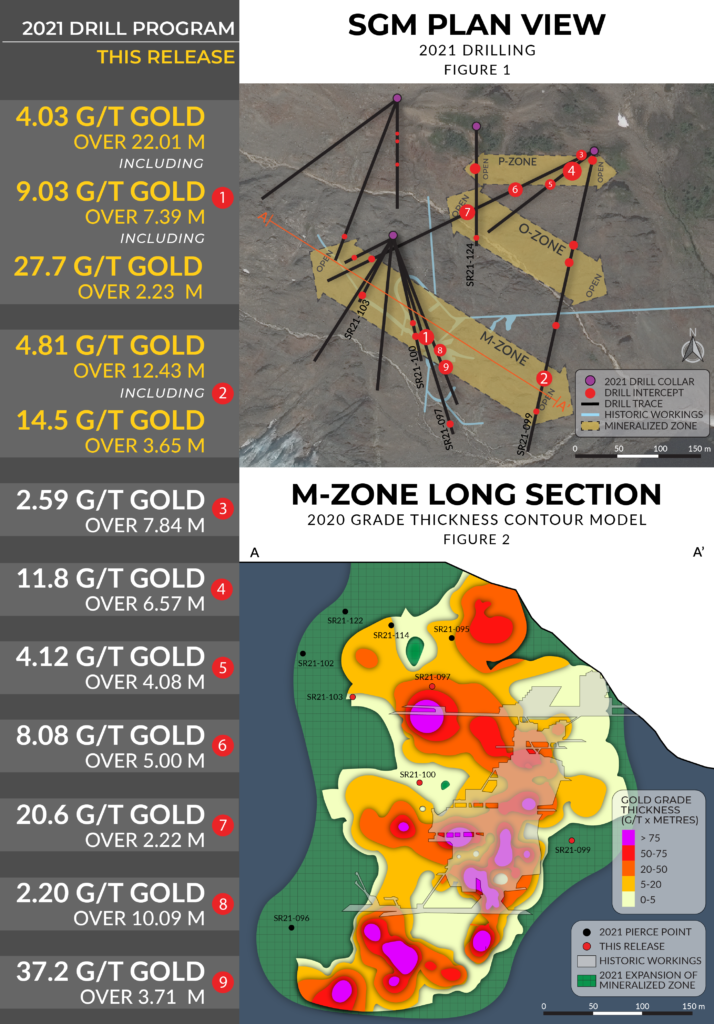

Vancouver, BC – February 22, 2022 – Scottie Resources Corp. (“Scottie” or the “Company”) (TSXV: SCOT), (OTCQB:SCTSF), (FSE:SR8), is pleased to report drill assays from its Scottie Gold Mine (SGM) target where multiple holes intersected high-grade gold mineralization on its targeting of additional ore shoots around the past-producing mine. Strong intercepts, including 9.0 g/t over 7.39 metres illustrate the expansion potential of near mine mineralization. The high-grade mine operated in the early 1980’s with a cut-off grade of 10 g/t gold, leaving substantial upside for additional expansion. The Scottie Gold Mine is located on the Granduc Road, 20 kilometres north of the Ascot Resources Premier Mill, and 35 kilometres north of the town of Stewart, BC.

“Strong intercepts continue to underpin our belief that the near mine exploration of the Scottie Gold Mine has the potential to develop a substantial high-grade resource adjacent to existing mine underground workings.“ comments President and CEO, Brad Rourke. “Drilling around this underexplored deposit and the ability to leverage the existing historic data, offers us tremendous value on our path towards defining a road accessible 1M+ ounce resource.”

Table 1: Selected results from new drill assay (uncut) from the Scottie Gold Mine Project.

I believe there is significant exploration potential around this historic, (very) high-grade mine, as these zones are open in all directions (along strike and depth):

Again, you don’t need to much of that high-grade stuff in order to it to be a potentially economic gold deposit in this area (Especially when combined with the recently discovered Blueberry Zone)…

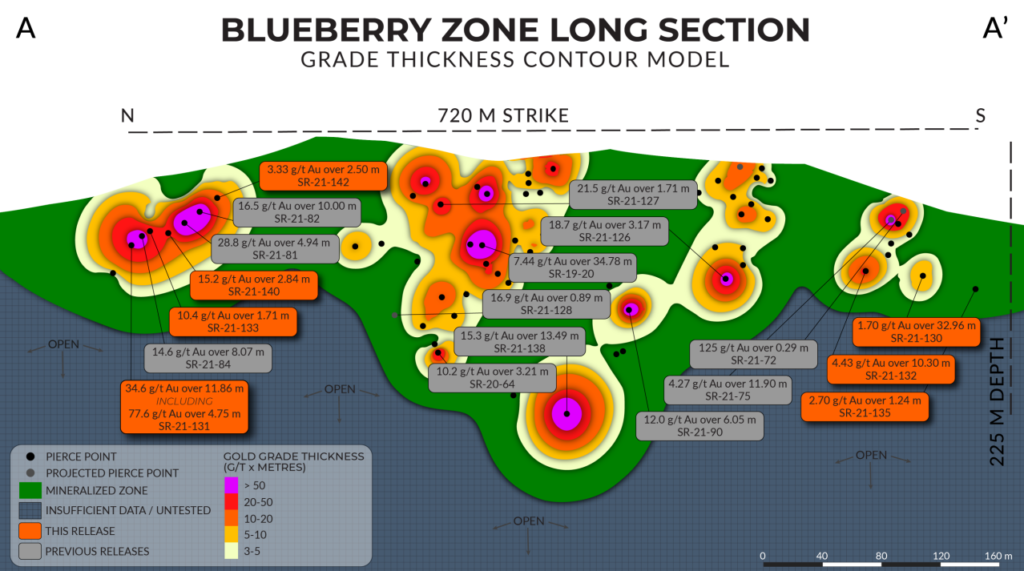

#2 Blueberry Zone

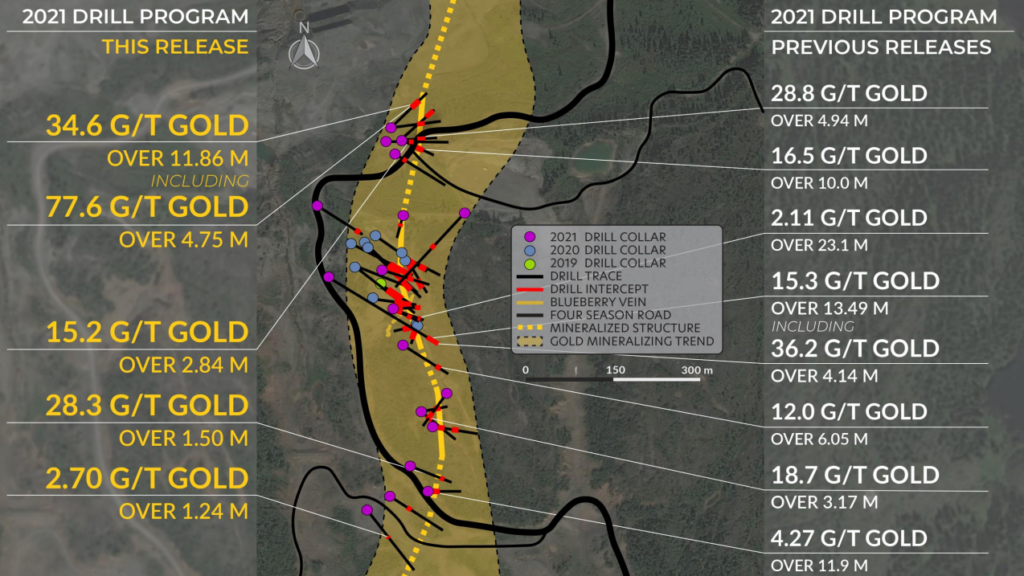

The Blueberry zone is in my opinion the most interesting of the two targets. Why? Because there have been some exceptional drill results right off the bat and it ought to have a lot of room left to grow:

Again, you don’t need too much of that high-grade stuff, combined with the Scottie Gold Mine, in order to possibly have a project worthy of development given the location and proximity to operating mines.

Something I have touched on before is the study done by Kenorland Minerals. The study basically tries to show the relationship between early stage exploration results and the final quality of a mineralized system (Basically the odds of finding a multi-million ounce gold system)…

These are some of the conclusions made by the authors:

(Note: “GT” = Gram*meters)

- If a company drills <4,000m and hit a 75 GT intersect, this could be very significant

- The majority of >2 Moz Au deposits have initial GT intersects >50 GT

- The majority of >5 Moz Au deposits have initial GT intersects >134 GT

- To capture majority of the >2 Moz deposits, discovery intersect should have >5m of mineralized rock

- To capture majority of the >5 Moz deposits, discovery intersect should have >10m of mineralized rock

So how does the Blueberry zone stack up?

Lets start with the results…

The two best holes so far from the Blueberry Zone ran 34.6 g/t gold over 11.86 m and 15.3 g/t gold over 13.49 m. The best hole equals a gram*meter (GT) intercept of 34.6 * 11.86 = 401 gram*meters. This is obviously well above the limits of point #1, #2 and #3. The lengths of both of these top intercepts are above both limits of points #4 and #5. With that said I assume the lengths used in the study are TRUE widths and as far as I can tell Scottie has not put out what the assumed TRUE widths are for these two holes. Thus I cannot conclusively say if they do actually check point #5 although point #4 should be in hand I think.

Anyway, it is safe to say that such outstanding early stage results from the Blueberry Zone is a sign that this could become a significant discovery in light of the conclusions made in Kenorland’s study. In fact, the company managed to hit a whopper of a discovery hole after just 630 meters of drilling that ran 7.44 g/t gold over 34.78 m in 2019:

Suffice it to say that drill results like this are extremely rare and to get such results this early on ought to be a very very good sign for the Blueberry Zone and thus the company. And as the slide suggests the company is more than aware of the merits of the Blueberry Zone given that the plan is to allocate 10,000 meters to this zone and push it towards a maiden resource.

In Summary

As always there are never any guarantees of success in exploration or the stock market. All there is is varying degrees of Risk/Reward. Personally I think that Scottie Resources will at least be relatively close to 1 Moz quite soon and given that all zones are open, including the impressive Blueberry Zone, I think there is room for a high-grade multimillion ounce deposit to be proven sometime in the future. One can debate what intrinsic value to put on an ounce here but lets just say that if I think Scottie will have 1 Moz with open ended upside then I don’t think an Enterprise Value of around C$45 M is that much of a stretch. Heck, these ounces could be quite valuable given the location etc and maybe they will find a lot more. In other words the company does not have “margin of safety” on paper, which I typically like to see, but I think there is simply a high probability that the company WILL at least end up with 1 Moz of high-grade gold on the books in the not too distant future. Anything beyond that would be somewhat free upside since I don’t think much of it is priced in at this point.

Right time, right place

Given the chaos out there in the world I have been thinking a lot about what jurisdictions and projects might have the most implied value. I really like Canada because it is a heavy weight in terms of resource extraction so I don’t see nationalization. I also like it because the country has a lot of domestic energy production (oil, gas & hydro) so the risks of mines not being able to operate are below average. I personally believe that Canadian juniors could get a hefty premium in the future and that high-grade ounces in Canada could fetch a very high value per ounce. Can I see Scottie having say an inferred >2 Moz within a year or two along with Canadian high-grade ounces being valued at $100-$200? Sure. Thus, I see multi-bagger potential for Scottie without the company needing to find a monster deposit.

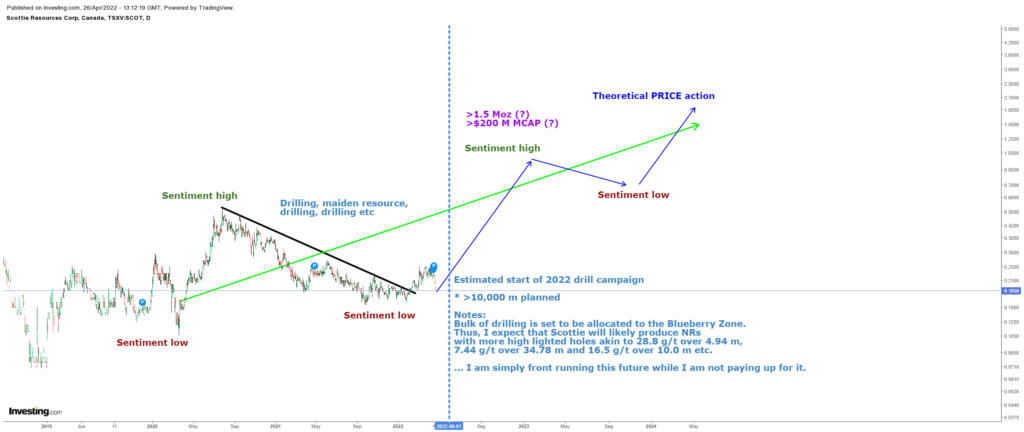

Expectations

I do expect Scottie Resources to grow, do a maiden resource, and then grow some more. If growth keeps up I expect to be able to sit on my hands for the next few years and just let the story play out. As any other stock it will swing from day to day, week to week, and month to month. I simply think and hope the company will be able to increase intrinsic value and that the share price will oscillate around a positive trend:

If I sit on my hands long enough I can see myself getting a multi bagger in Scottie in the next 1-3 years. If things go really well I can see it become a 10-bagger within say 4 years. Just HODLing growth stories is my bread and butter nowadays. Some will go down, some will go up 3X and some might go up 5-10X. I do not bet the farm on any single stock but I expect some of these growth stories to pay for 5-10 stories that did not pan out. All this is assuming I let the cases play out over a couple to several years. Keep in mind that it is very very hard to get a multi bagger without holding a stock for at least 2 years or more.

As always, I don’t think it’s wise to bet the farm on any single stock regardless of how great the Risk/Reward might look. Scottie is simply another solid growth story, with inferred Margin of Safety to boot, in my book. Therefore I have included in my some >40 company portfolio.

Note: This is not investing advice. I own shares of Scottie Resources and the company is a banner sponsor. Therefore consider me biased and always make up your own mind. Junior miners are risky and volatile. Never invest money you cannot afford to lose. I do not share in your profits or losses.

Best regards,

The Hedgeless Horseman

Good article Erik-

I’ve owned Scottie from the beginning and the story has slowly gotten better as each drill season results come out.

These are my reasons for holding until the payout:

-Massive land package in an incredible mining jurisdiction.

-Past mining of high grade gold

-Drill results have been outstanding and as they can raise funds to expand drilling this will speed up

-Two big fish investors

-I’m hoping that Crescat Capital will step up and invest, which would offer some support and free marketing

-The CEO is as humble, genuine and honest as you get. He hasn’t been a promoter. He’s been just telling his story and doing what they can with the drill as they get funding.

That’s my kind of story and position to be in.

Kevin