NEVADA KING EXPANDS OXIDE GOLD MINERALIZATION OVER 500M NORTH OF THE ATLANTA PIT IN THE “NORTH EXTENSION TARGET”

VANCOUVER, BC, Nov. 23, 2022 /CNW/ – Nevada King Gold Corp. (TSX-V: NKG), (OTCQX: NKGFF) (“Nevada King” or the “Company“) is pleased to announce assay results from four reverse circulation (“RC“) holes recently completed at its Atlanta Gold Mine Project located 264km northeast of Las Vegas, Nevada, in the prolific Battle Mountain Trend. This drilling was designed to better define the northern extension of the Atlanta Mine Fault Zone (“AMFZ“).

Drilling Highlights:

| Hole No. | From (m) | To (m) | Interval (m) | Au (g/t) |

| AT22NS-12 | 175.3 | 195.1 | 19.8 | 1.77 |

| AT22NS-13 | 135.7 | 160.1 | 24.4 | 1.67 |

| AT22NS-RC14 | 99.1 | 143.3 | 44.2 | 0.71 |

| AT22NS-16 | 91.5 | 106.7 | 15.2 | 0.54 |

| AT21-003* | 155.5 | 173.8 | 18.3 | 4.64 |

| Table 1: Full list of four RC holes released today. *Denotes NKG hole reported in 2021. |

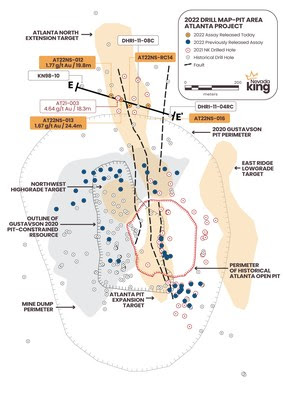

- The four holes released today cut across the northern projection of the AMFZ through high-grade discovery hole AT21-003, which was drilled in 2021, 560m north of the historic Atlanta Pit, intercepting 9.1m of 8.26 g/t Au, within a broader intercept of 18.3m of 4.64 g/t Au. This hole opens up a new target area well outside the current resource called the North Extension Target (“NET“), shown in Figure 1.

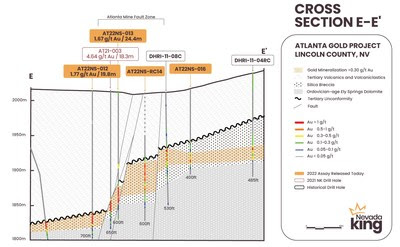

- As shown in Section E-E’ (Figure 2), today’s holes, along with AT21-003 and three historic holes summarized below in Table 2, drill-define a gold mineralized zone that is over 300m wide along the section line and remains open both to the west and east, indicating the presence of a strong gold system in the NET.

- Gold in this zone is hosted in silica breccia and is relatively sub-horizontal and down-faulted to the west along the AMFZ. Gold grade and mineralized thickness are greatest within the fault zone, as seen in AT21-003, AT22NS-12 and AT22NS-13, while grade tends to decrease laterally west and east from the AMFZ.

- Comparing gold grades in ATNS-016 and DHRI-11-04RC, gold mineralization appears to be strengthening east of Section E-E’ toward the East Ridge Target (“ERT“), which remains untested by drilling. Assays for holes completed south of Section E-E’ are still pending and these results will help to determine whether or not the NET gold mineralization can be tied to the main resource zone around the Atlanta pit.

- The NET target area measures roughly 600m north-south from the pit to Section E-E’. The mineralized zone on Section E-E’ averages 25m in thickness with average grades approaching 1.5 g/t Au across a minimum width of 300m east-west. If the NET mineralization can be tied to the main resource, it could significantly enlarge the footprint of the overall mineralized gold zone at Atlanta.

Cal Herron, Exploration Manager of Nevada King stated, “This first set of definition holes across the North Extension Target demonstrate good lateral continuity of gold mineralization between the holes and show the target zone to be open both west and east. The strong gold vector extending eastward from Section E-E’ points to a large area of strong surface mineralization that has not yet been drill-tested, placing additional emphasis on the need to access and drill the ERT.

“Receipt of more assays over the coming weeks will greatly clarify the potential for merging the relatively flat-lying and oxidized mineralization in the NET with the existing resource zone around the Atlanta Pit. Closely spaced drilling is needed along the 100m to 150m wide AMFZ in order to document down-faulted displacement of the mineralized horizon and define the higher grade areas within the fault zone. Drilling so far indicates the NET is large, but tapping into zones of higher-grade and thicker mineralization will be important for converting this blanket-like mineralization into a resource. With additional step-out and in-fill drilling north of the Atlanta pit, we expect to find other structures hosting higher grade mineralization within the silica breccia zone just as we encountered south of the Atlanta pit.”

| Hole No. | From (m) | To (m) | Interval (m) | Au (g/t) |

| KN98-10 | 198.2 | 211.9 | 13.7 | 1.19 |

| DHRI-11-4RC | 103.7 | 123.5 | 19.8 | 0.47 |

| DHRI-11-08C | 80.8 | 103.7 | 22.9 | 0.62 |

| Table 2: Historical holes used in Section E-E’. |

Qualified Person

The scientific and technical information in this news release has been reviewed and approved by Calvin R. Herron, P.Geo., who is a Qualified Person as defined by National Instrument 43-101 (“NI 43-101“).

Nevada King is the third largest mineral claim holder in the State of Nevada, behind Nevada Gold Mines (Barrick/Newmont) and Kinross Gold. Starting in 2016 Company has staked large project areas hosting significant historical exploration work along the Battle Mountain trend located close to current or former producing gold mines. These project areas were initially targeted based on their potential for hosting multi-million-ounce gold deposits and were subsequently staked following a detailed geological evaluation. District-scale projects in Nevada King’s portfolio include (1) the 100% owned Atlanta Mine, located 100km southeast of Ely, (2) the Lewis and Horse Mountain-Mill Creek projects, both located between Nevada Gold Mines’ large Phoenix and Pipeline mines, and (3) the Iron Point project, located 35km east of Winnemucca, Nevada.

The Company is well funded with cash of approximately $14.5 million as of November 2022.

The Atlanta Mine is a historical gold-silver producer with a NI 43-101 compliant pit-constrained resource of 460,000 oz Au in the measured and indicated category (11.0M tonnes at 1.3 g/t) plus an inferred resource of 142,000 oz Au (5.3M tonnes at 0.83 g/t). See the NI 43-101 Technical Report on Resources titled “Atlanta Property, Lincoln County, NV” with an effective date of October 6, 2020, and a report date of December 22, 2020, as prepared by Gustavson Associates and filed under the Company’s profile on SEDAR (www.sedar.com).

| Resource Category | Tonnes (000’s) | Au Grade (ppm) | Contained Au Oz | Ag Grade (ppm) | Contained Ag Oz |

| Measured | 4,130 | 1.51 | 200,000 | 14.0 | 1,860,000 |

| Indicated | 6,910 | 1.17 | 260,000 | 10.6 | 2,360,000 |

| Measured + Indicated | 11,000 | 1.30 | 460,000 | 11.9 | 4,220,000 |

| Inferred | 5,310 | 0.83 | 142,000 | 7.3 | 1,240,000 |

Please see the Company’s website at www.nevadaking.ca.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This news release contains certain “forward-looking information” and “forward-looking statements” (collectively “forward-looking statements”) within the meaning of applicable securities legislation. All statements, other than statements of historical fact, included herein, without limitation, statements relating the future operations and activities of Nevada King, are forward-looking statements. Forward-looking statements are frequently, but not always, identified by words such as “expects”, “anticipates”, “believes”, “intends”, “estimates”, “potential”, “possible”, and similar expressions, or statements that events, conditions, or results “will”, “may”, “could”, or “should” occur or be achieved. Forward-looking statements in this news release relate to, among other things, the Company’s exploration plans and the Company’s ability to potentially expand mineral resources and the impact thereon. There can be no assurance that such statements will prove to be accurate, and actual results and future events could differ materially from those anticipated in such statements. Forward-looking statements reflect the beliefs, opinions and projections on the date the statements are made and are based upon a number of assumptions and estimates that, while considered reasonable by Nevada King, are inherently subject to significant business, economic, competitive, political and social uncertainties and contingencies. Many factors, both known and unknown, could cause actual results, performance or achievements to be materially different from the results, performance or achievements that are or may be expressed or implied by such forward-looking statements and the parties have made assumptions and estimates based on or related to many of these factors. Such factors include, without limitation, the ability to complete proposed exploration work given the global COVID-19 pandemic, the results of exploration, continued availability of capital, and changes in general economic, market and business conditions. Readers should not place undue reliance on the forward-looking statements and information contained in this news release concerning these items. Nevada King does not assume any obligation to update the forward-looking statements of beliefs, opinions, projections, or other factors, should they change, except as required by applicable securities laws.

SOURCE Nevada King Gold Corp.

![]() View original content to download multimedia: http://www.newswire.ca/en/

View original content to download multimedia: http://www.newswire.ca/en/

What is Good.?About Oxcide Mineralation ?

I’m pretty well invested in Navada King

I need somewhere to look ?

for these terms I don’t understand

Glade I got Out Apple Some time Ago is

Oxide gold is easier and cheaper to process than refractory. So if you have 1 gpt of oxide gold versus 1 gpt of refractory gold the oxide gold will have better margins and be worth more.

Best regards