THH – Taking Advantage of How Sentiment Works

In a hot market investors/speculators will have a high appetite for risk…

Investors will simply feel bold enough to pay up for potential. During the 2016/2017 peak in sentiment we saw a few potential discovery holes lead to a junior being able to fetch ~$100 M valuations.

For example GT Gold ran up to around $192 M in value on the back of some impressive holes from the Saddle South discovery. If the exact same news releases were to come out today, in a depressed sentiment environment, I doubt it would fetch a value higher than $50 M. Same news, same story, but different sentiment. What makes it even crazier is that Gold is currently trading at $1,860/oz while it was only trading at around $1,350/oz back then. Another example is Garibaldi Resources ran up to some $400-$500 M before the first assay was even out due to the hype surrounding Nickel Mountain.

The point is that during SENTIMENT HIGHS the miners will trade at a premium to what is KNOWN and POTENTIAL will fetch a high price.

In short Mr Market will (like in 2016/2017):

- Overpay for the bird in the hand (known value)

- Pay for the birds in the bush (Potential value)

Well what about SENTIMENT LOWS like right now?

Proven/banked/confirmed success will actually trade at a steep discount to fair value and POTENTIAL will often fetch ZERO value by the market.

Investors are currently so scared and demoralized that they are not willing to pay full price for a bird in the hand while two birds up to an infinite amount of birds in the bush will get a value of zero. This is why the Risk/Reward in juniors right now is so obscene. One can literally buy success, after the fact, for less than what it is worth… While getting any potential future value for free.

In short Mr Market will (like right now):

- Underpay for the bird in the hand (known value)

- Give away all the birds in the bush for free (Potential value)

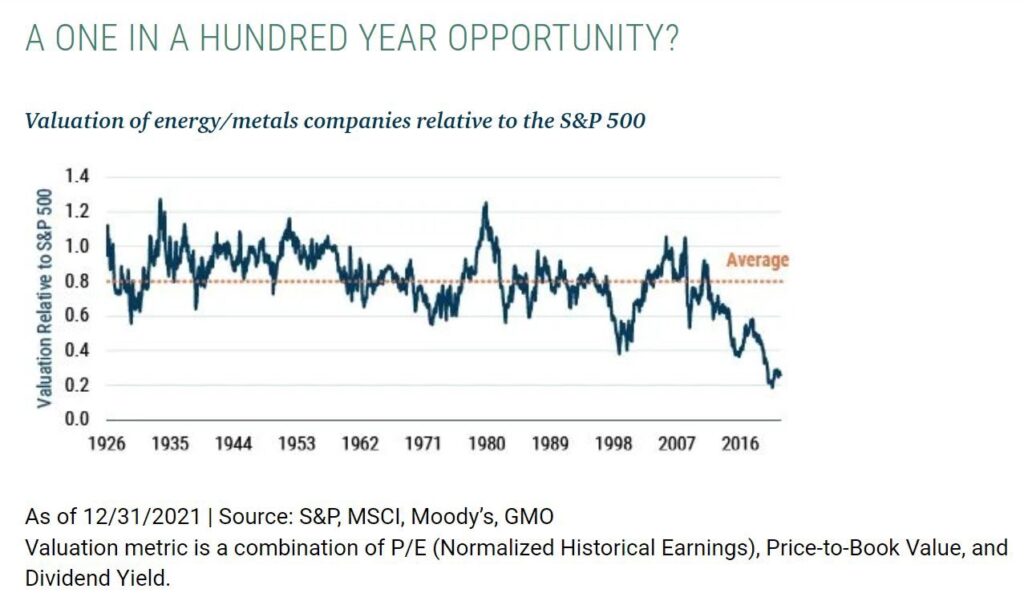

Oh and if you thought opportunities like this come around often…

And this comes at a time when one is reading about shortages in metals, oil and gas on a daily basis. In other words a time when future supply (in the ground) should fetch an increasing price. You couldn’t make up a better opportunity even if you tried.

The opportunity for any contrarian (value) investor is of course to front run the change in SENTIMENT

There will, as always, come a day when known success will actually trade at a premium and the market will be brave enough to reflect a good portion of potential future value (Just like in 2016/2017).

On that note there are plenty of juniors with very large land packages and multiple projects that one is able to buy for free right now. All of these will revalue higher as sentiment gets better WITHOUT the company having to lift a finger. This is pretty much a risk free option for investors.

This is why I keep talking about being an “asset hoarder” right now. I am trying to steal as much value as I possible can since I am getting most of it for free. This is daylight robbery and I almost have problem sleeping because I am so stressed about the amount of free stuff out there right now. In the last seven years I have never been this greedy or bullish on especially gold juniors. Since I have never seen gold juniors being this cheap I also expect the future returns to be better than I have ever seen…

So stop complaining about nothing being priced into your favorite junior. That’s the whole point of why one should be massively bullish. These gifts don’t come around that often…

Yet 95% of people will never see it. 95% of people will sell the free stuff and buy the expensive stuff. They don’t see the fact that in order to have great future returns one must start by buying as cheap as possible. One does not sow and harvest in the same season. Right now is the sowing period and in the next couple of years I think there will be a grand harvest to collect.

Let me use a poker analogy:

Do you know how many times I would play the worst hand possible, with the lowest chance of winning, if it cost me nothing? An infinite amount. Why? because if I am not paying anything for the hand it means that no matter how small the chance of winning is it will always be a bet with positive Expected Return. When you have a company with multiple assets where none of these additional assets are priced in, you are not taking on any direct risk, BUT you will still reap the reward when sentiment changes and parts of them get priced in again…

I wish I had such one sided hands aka asymmetrical bets to play in poker. In poker you had to be calm, smart and good with numbers. In investing it’s really enough to have common sense and patience… I do not miss poker.

You can be sure that I will keep hammering on these points until everyone of you are able to get greedy instead of fearful when Mr Market is literally selling stuff for free (aka a gift).

Literally all that is needed in this market is common sense and patience. The common sense to realize that buying stuff for free is an outrageous opportunity and have the patience to wait until the free stuff you just bought is not free anymore.

You see a juniors with a very large projects or pipeline of projects that Mr Market is giving zero value to but are scared to buy?

I see a bunch of juniors where I get a bunch of projects, targets and loads of potential for absolutely free.

…. Well what are you waiting for?

…. Still waiting for that stock that cannot go down in price and get even cheaper?

Well good luck in finding it.

Meanwhile I am happy buying something I know will go up >200% on average while not caring if it goes down 30% more before that happens. I do not expect to ever see a market as good as this for a mining investor in my life time.

A video from 2016 which I think is very fitting:

“Rick Rule: $2-$3B Gold Deposits That Can Now Be Bought For $15mm—Will Command A $2-$3B Price…”

Note: This is not investing advice.

Best regards,

The Hedgeless Horseman