Example of a HODL Portfolio: “Boring” is Good, “boring” is profitable

The following list makes up one of several junior focused portfolios I help manage for some family members. It’s a very diversified junior portfolio which is primarily focused on HODL aka “Fire and forget” kind of cases where there is preferably both Margin of Safety and Probable Growth. Not every portfolio looks the same because I want to diversify the holdings intra family wise. For example some other portfolio has Eskay Mining as the third largest holding at some 8% whereas this one has Eskay at sub 5%. Some portfolios will also have names that another does not have (At some point there are simply too many companies). The reason for the heavy diversification, other than decreasing risk, is that I think there are so many bargains out there that if there was ever a time one could afford to diversify it would be now. I also do not want any single case to be able to “break” the portfolio while many have the potential to materially impact the portfolio in a positive way over the next few years. Some portfolios also have names that

Personally I have a smaller active account, one decently large semi-active account, but most of my money is tied up in HODL cases (typically via PPs lately). Therefore my overall position sized becomes somewhat irrelevant due to volatility (Holdings can change wildly in terms of weighting and not necessarily reflect conviction level). As for the smaller more active accounts I think it could be the opposite problem since I can have extremely concentrated positions due to the fact that it’s just a subset to my total portfolio. Furthermore my position size will be influenced by the “deal” of a PP for example. If there are full 2-year warrants included in a deal I will be more likely to participate and/or take a larger position than I would if I could only buy in the open market (Due to warrants skewing the Risk/Reward favorably).

Therefore I think it is better to show an example of a less risky portfolio what is also suited for simply HODL:ing but with the capacity for adjustments. As always a) keep in mind that I cannot guarantee that any of these will succeed, b) I own most if not all of them and am therefore biased, and c) Many are banner sponsors which furthers hikes up the risk for bias.

Over 5%:

- Eloro Resources Ltd

- Goliath Resources Ltd

- Mantaro Precious Metals Corp

- I-80 Gold Corp

- Nevada King Gold Corp

- Novo Resources Corp

Under 5%:

- Magna Mining Inc

- Eskay Mining Corp

- Snowline Gold Corp

- New Found Gold Corp

- Cartier Iron Corp

- Headwater Gold Inc

- Timberline Resources Corp

- Pacific Ridge Exploration Ltd

- Lion One Metals Ltd

- Blue Lagoon Resources Inc

- Cabral Gold Inc

- Cassiar Gold Corp

- Western Alaska Minerals Corp

- ROKMASTER Resources Corp

- Dolly Varden Silver

- Core Assets Corp

- District Metals Corp

- Provenance Gold Corp

- Montage Gold Corp

- Irving Resources Inc

- Firefox Gold Corp

- Northern Superior Resources Inc

- E2Gold Inc

- Galantas Gold Corp

- Graphene Manufacturing Group Ltd

- Defiance Silver Corp

- Scottie Resources Corp

- Roogold Inc

- Blackwolf Copper and Gold Ltd

- Alpha Exploration Ltd

- Ophir Gold Corp

- Magna Gold Corp

- Inflection Resources Ltd

- Nulegacy Gold Corp

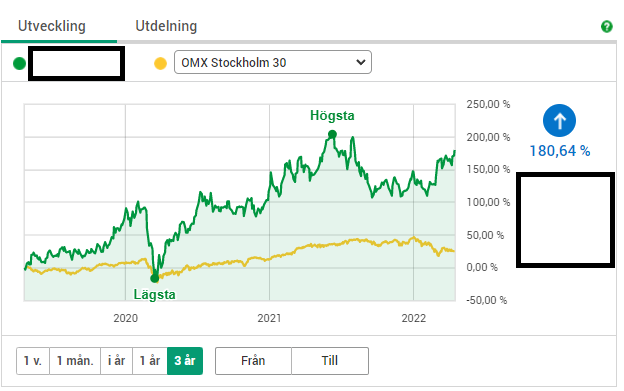

3 Year chart:

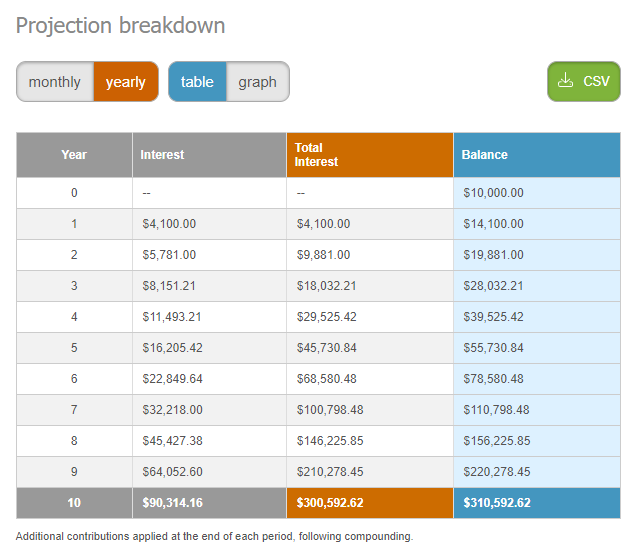

… Not a rocket but a steady climb higher with very little management. For reference it has outperformed GDXJ by about 3X even though juniors are currently lagging badly vs the larger miners on average. I guess my point is that one can do very well in juniors despite being quite diversified and have low activity (HODL:ing). The trick is of course, in my opinion, to pick above average growth stories with good to great Risk/Reward. Note that most people in this sector wants said 3-year return tomorrow at the latest while typically ending up even underperforming the GDXJ due to bad decisions and over-trading IMO. Meanwhile 180% over a 3-year period translates into a CAGR of 41%. If that sounds “boring” I would just like to point out the fact that $10,000 with a CAGR of 41% turns into $310,593 over a 10-year period:

“Boring” is good. Boring is a lot better than going all in a pre-discovery stock in order to get rich tomorrow. If one would just focus on stories with an Expected Return of say 30% over the next 12-months one would ultimately get very wealthy (assuming one is able to pick companies with said characteristics). Anyway, I am very happy with the results especially in light of the considerable diversification present. Oh and no leverage, no warrants and all positions have been bought in the open market.

Note: This is not investing advice. Assume I own shares of all companies mentioned. For simplicity also assume all are sponsors. Therefor consider me biased. Do your own due diligence. I share neither your profits or losses. Junior mining companies can be very volatile and risky.

Best regards,

The Hedgeless Horseman