Eskay Mining (ESK.V): Eye on The Prize(s)

I get a lot of questions about Eskay Mining so I will outline my current thoughts in this article. Note that I own a lot of shares of Eskay Mining and the company is a passive banner sponsor. Therefore assume I am biased, do your own due diligence and always make up your own mind…

Setting The Scene

- Most recent news release

- Quinton Hennigh discussing the case and the latest news release:

Eskay Mining has been my largest position for over a year simply due to the fact that the case is playing out as I hoped and I have yet to sell a share of my original position. In other words my largest win yet in the juniors mining space was done by doing nothing while the company, with all the big brains involved, did all the work. My initial reasoning for taking a a large initial position was summarized in my original case which can be read HERE.

When I took my initial position this new version of the company had yet to drill a single drill hole. Today we know that TV has produced some of the most impressive drill results in the entire junior space. We also know that Jeff has high-grade precious metal horizons surrounded by a wide lower grade halo (A bit like Pretium’s Brucejack deposit according to John DeDecker).

First of all what do you get when you buy/own Eskay Mining?

- 52,000 Ha in the hottest tier #1 jurisdiction in the world right now and circa 85% of the entire Eskay Creek VMS district

- A de-risked TV and Jeff deposit which have 2 km of untested ground between them and more than 6 km of strike potential in total just on this particular trend

- Probably the best team in the world when it comes to finding Eskay Creek type VMS deposits

- More targets identified via historic drilling, prospecting and geophysics than I can remember at any given time

Competitive advantages

The premier jurisdiction means that any and all success will have have above average implied value. The interest from majors in the immediate area signals that large companies are more than willing to actually spend their bulging treasuries in this region. Recent examples are Franco Nevada investing in our immediate neighbor to the north-east (Skeena Resources) and Newcrest mining buying Pretium for $2.8 B. Eskay Mining’s massive land package is therefore “sandwiched between majors”:

With Seabridge and Eskay partnering up to boost the infrastructure in the center of that picture I think it both a) Shows the management team’s confidence that there will be mines and and b) Further hikes up the value of any success (and increasingly so the more success is had), and c) Makes Eskay Mining even more attractive in the eyes of majors.

With the above said I think the main value driver for Eskay Mining are the brains involved. My expectation was that it would take a year or two for Eskay to a) Really figure out the geology of the region and b) Have any meaningful drilling success. But to my pleasant surprise the company had outstanding success on its first (blind to semiblind) drill campaign and that drill campaign was then overshadowed by the 2021 year’s drill campaign. In other words the team was able to find immediate success and the trend has been up ever since. This trend includes everything from better drilling results to numerous geophysical targets identified as well as outcropping mineralization being discovered via prospecting.

What do we know today?

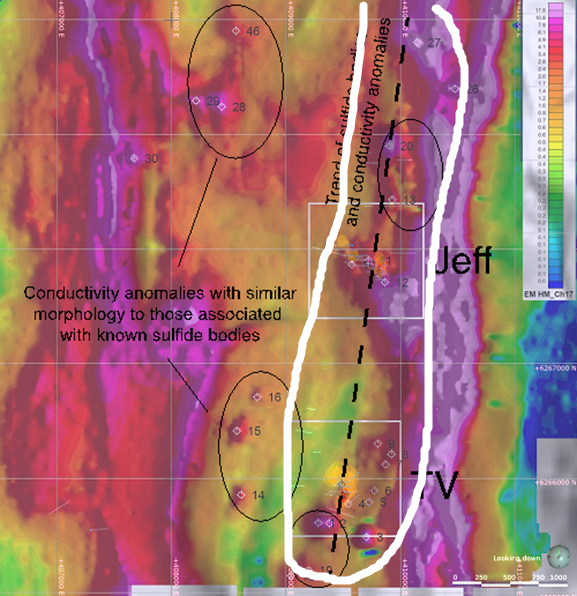

Geophysics (SkyTEM) seems to be very good at identifying sulfide bodies of interest. This is no small thing because the immediate success at TV and Jeff suggests that this is a very valid and efficient tool. Therefore it also hikes up the implied value of every geophysics target in the slide below:

Further evidence of how good the team is at finding VMS in this district today is the fact that the company hit mineralization at both the C-10 as well as Vermillion target. Now, they did not hit any economic mineralization at Vermillion (so far) but C-10 immediately delivered a high grade hit (31.16 gpt AuEQ over 1.95 m). Suffice it to say that I see there is a very probably runway for growth in Eskay and said runway is larger than almost any junior I am aware of. You see, just the eastern “string of pearls” in the picture above is some 6 km long:

… And that area in white is just covering a ~6 km strike, of the eastern limb, of the the central “Eskay Anticline”. Note that there are three Anticlines in total and all that potential just makes up this much ground of the overall district:

(Approximate area shown in the black box)

So while I am very happy with the profits on paper I have today it is obvious that the actual story/case is has barely begun.

To make my current case as simple as possible:

- Eskay Mining has abnormally large Blue Sky potential

- Eskay Mining has one of the most impressive teams around that have already shown they know how to prove up said Blue Sky potential

… And I simply think that if I do absolutely nothing other than let them do their job I think Eskay Mining will grow for years to come and that I have a shot at >10 bagger potential at these levels. If that sounds hyperbolic I would just like to point out that Skeena Resources has a project that is worth well over $1 B today and the company has around a billion dollar Market Cap. Of course Skeena is much more advanced with a banked resource and economic studies but compared to Eskay Mining controlling say 85% of the district it means that Eskay Mining has much higher blue sky potential and runway for growth.

It’s not just lateral potential, it’s vertical potential as well…

It’s easy to get excited about the sheer amount of targets and the immense land position. But there is a lot more to the story than that as we have found out over the last year. I am of course talking about the fact that for example TV and Jeff are “stacked” VMS systems that saw multiple episodes of VMS mineralization. While Skeena’s deposit is centered around the remnants of the legendary Eskay Creek deposit, which is located in the highest stratigraphic unit where VMS formed in this district, Eskay Mining is not even into said unit yet. When you include the fact that Skeena’s deposit is around 1-1.5 km long one could say that Skeena’s >$1 B deposit covers this theoretical part of the TV/Jeff system:

(Approximate strike and stratigraphic placement of Skeena’s >$1 B deposit in purple box)

To sum up what we know about TV:

- Two VMS zones at TV

- Three Feeder/Stockwork zones at TV

- TV is open up and down strata

To sum up what we know about Jeff:

- Two Stockwork/Feeder zones at Jeff

Note:

- a VMS feeder… feeds a VMS.

- The mineralization hit at TV and Jeff does mostly NOT correspond in terms of age/stratigraphy

… Therefore I think this following picture should be pretty accurate and should really hit home just how early days it is for Eskay Mining at TV, Jeff and the immediate >6 km trend (Let alone the entire district):

(Purple = VMS feeder zone, Green = VMS horizon)

Assuming the above is a correct interpretation then there is a LOT left to be discovered at TV, Jeff, the 2 km stretch between them and possibly over 6 km of strike along this trend. And again, this is just from a postage stamp of the entire district. Furthermore I would point out that it’s the actual VMS horizons that are considered to be the “main targets” and the company has not even gotten into any of the >2 VMS horizons at Jeff yet. With that said the feeder zone at TV is friggin nuts with holes showing up to 90 m true width with good grades. With all that said I just will re-iterate just how early stage TV/Jeff is and that I think the best is yet to come.

Oh and both TV and Jeff are wide open down dip and along strike:

To sum up

- Jeff and TV are wide open down dip

- Jeff and TV are wide open along strike in both directions

- Jeff and TV are 2 km apart

- Jeff and TV are situated along a >6 km trend of geophysical anomalies that could very well be sulfide bodies

- Jeff is wide open up strata and so far two feeder horizons have been found (which implies there should be at least two VMS horizons as well)

- TV is wide open both up and down strata

… All this makes this story almost uniquely fascinating in my opinion.

Again, by now it should be abundantly clear that the company has barely started to scratch the surface at either target, the TV-Jeff trend and let alone the 52,000 Ha land package. Now, given that these are just the first tests of a relatively limited area of what could be a massive VMS system, one should probably not expect too much in terms of results. I mean most of the holes so far have “just” been into feeder zones and they have not even located any of the actual VMS horizons over at Jeff yet for example. Well, I must say that for such an early stage they sure have been hitting some immense intercepts already:

(Some drill highlights)

“TV” target:

- 4.01 gpt Au eq over 117.32m

- within 2.35 gpt Au eq over 238.87m

- 5.2 gpt Au eq over 47.77 m

- within 140.28m grading 2.6 gpt Au eq

- 4.7 gpt Au eq over 44.41 m

- within 92.3m grading 2.7 gpt Au eq

- 10.62 gpt Au eq over 14.58m

- within 2.96 gpt Au eq over 81.60m

- 4.7 gpt Au eq over 30.41m

- 3.4 gpt Au eq over 40.07m

- 2.5 gpt Au eq over 53.86m

- 3.5 gpt Au eq over 29.92 m

- 7.0 gpt Au eq over 12.09m

- 3.67 gpt Au eq over 27.49m

- 4.76 gpt Au eq over 15.60m

- 2.8 gpt Au eq over 34.03m

- 2.5 gpt Au eq over 35.50m

- 2.2 gpt Au eq over 40.80m

- 1.8 gpt Au eq over 40.74 m

- 2.5 gpt Au eq over 20.53 m

- 3.3 gpt Au eq over 17.46 m

“Jeff” target:

- 10.6 gpt Au eq over 35.5 m

- 33.4 gpt Au eq over 5.08 m

- 1.8 gpt Au eq over 50.36 m

- 61.3 gpt Au eq over 1.00m

- within 8.1 gpt Au eq over 8.53m

- 18.3 gpt Au eq over 1.08m

- within 7.1 gpt Au eq over 3.67m

- 5.08 m grading 33.4 gpt Au eq

- including 1.59 meters grading 83.8 gpt Au eq

- 4.9 gpt Au eq over 7.66 m

- 2.3 gpt Au eq over 32.83 m

(New) “C-10” target:

- 31.19 gpt Au EQ over 1.95 m

What is Eskay going to look like in 6, 12, 18 and >24 months? I don’t know. I just know that I think the results are going to be even better with each passing drill campaign as the company both has a better grip on the mineralization in the confirmed VMS systems as well as a high probability of finding more and more VMS systems in my opinion.

They have already stated that it appears that the so far known parts of the TV system gets better to the south and down dip… So to me that sounds like there might be a lot more “barn burner” holes coming from TV this time around. And when you combine that with what I believe is going to be 15,000 m ear-marked for TV then you can probably guess how impactful the coming news flow might be. Like Sprott likes to say: “See the future early”. I think I have a pretty solid “Base case future” for Eskay this year and my bet is simply that the company will be worth a lot more after this drill campaign. And then a lot more after 2023’s drill campaign and so on…

Think Big

- The original Eskay Creek VMS deposit had “only” around 1 km of strike and would probably be worth >$4 B today

- Skeena Resource’s deposit which is basically the “remnants” surrounding the original Eskay Creek deposit is worth well over $1 B on paper today

Until further notice I therefor put $1-$4 B in Blue Sky POTENTIAL per 1 km of strike to make it simpler to grasp just how large the Blue Sky Case is.

On that note…

Eskay Mining’s TV and Jeff targets are 2 km apart, might connect and just that trend alone has >6 km strike POTENTIAL right now. Then add Scarlet Ridge which seems to suggest a 1.5 km target at least. Then add Sib-Lulu. Then add C-10 which has confirmed high-grade VMS. Then add Cumberland, Spearhead, TET and the other known targets. Furthermore the geophysics slide from the TV/Jeff area show labeled geophysics targets that range up to #30 and I bet they will find even more targets with every passing field season for the foreseeable future. So again, Eskay might end up becoming something between “meh” (unlikely I think), to big, to one one of the most obscene discovery stories I might ever have the pleasure to be apart of. TV and Jeff is simply “ground zero”.

So what my plan is?

To keep sitting on my ass over the next months and years and let DeDecker, Monecke, Hennigh, Weiss and the other brainiacs keep increasing the value…

Some perspective

- The general stock market averages some +8% per year over the very long term

- 95% of people does not beat an index

- I would say that 95% of people are short term traders

Most people will focus on the short term and therefore focus on the next tree. We recently saw a sell off after the last drill results which I think was kind of expected. Why? Because now one can’t “get rich tomorrow” (Like that is ever a good strategy). As I see it these short term sell offs by hot money and impatient investors are gifts for long term investors who got a 20%-30% discount on ALL future NRs and value creation. That of course includes all the barn burner holes that I think will be coming out of at least TV just this coming field season.

“The stock market is a device for transferring money from the impatient to the patient.” – Warren Buffett

To give an example of this, lets pretend that I can see the future and will know that some 8 months from now Eskay will be trading at $6.7/share on the back of 5-10 net positive news releases. In that case just the last week gave huge swings in terms of opportunity due to short term gyrations. If I bought before the last drill results of the season were out I would get a 92% return. If I bought a couple of days after the last results were out when hot money exited the stock then I would have picked up a whopping 187% return by buying and waiting just 8 months (when the hot money has gotten back in again):

Assuming the growth trend for Eskay keeps up these extreme differences in future returns will increase even more as one draws out the investment horizon.

I am not in Eskay for a quick 10% here or there. I am after a 5-10 bagger or moreover the coming couple of years without doing anything than sitting tight (Like I have been doing). In terms of risks I am simply comfortable with the belief that regardless if this story might become big, or huge, I think it will at least fill its current shoes (which might be pricing in a 3 Moz AuEQ deposit or so from TV/Jeff alone aka half a Skeena Resources). Given the apparent potential both laterally and vertically I think the TV/Jeff trend has potential for >10 Moz AuEQ to boot. If we were to encounter a real Eskay Creek type VMS horizon then all bets are off given that such a deposit could be worth >$4 B from just 1 km of strike alone. I consider the Blue Sky Potential for Eskay Mining to be so large that I think that even 5%-10% of said blue sky would be very material for me as a shareholder from these levels.

Note: I own a lot of shares of Eskay Mining and the company is a passive banner sponsor. Assume I am biased, do your own due diligence, and always make up your own mind. There are no guarantees in the stock market just risk/reward. Juniors are risky and can be very volatile. Never invest money you cannot afford to lose or need in the short term.

Best regards,

The Hedgeless Horseman

I also own a lot of ESK at lower prices but am wondering why you like it more than NFG and LIO?

“After spending many years in Wall Street and after making and losing millions of dollars I want to tell you this: it never was my thinking that made the big money for me. It was always my sitting. Got that? My sitting tight!”

~Jesse Livermore

Eskay Mining is one to sit on IMO

I own all three as long-term holdings – I love the LIO story but I am somewhat concerned about the location – if I had to rank these three stocks LIO would be third based on geolocation – Fiji appears to be friendly towards the mining industry but Fiji isn’t B.C. (Eskay Mining) or Newfoundland (Newfound Gold)

to keep things in perspective, let’s remember that there are over 2000 mining stocks in the sector and most of them will NEVER produce a single ounce of Gold or Silver or any other metal – yet they will suck up every penny of investor money they can lay their hands-on and wish they had more

so LIO “only” ranks third but there are 1900+ mining stocks that rank lower