Eloro Resources Announces Completion of Metallurgical Holes and Updates Progress on Definition Drill Program to Expand Higher Grade Mineral Resource for PEA at Iska Iska Project, Potosi Department, Southwestern Bolivia

- Three PQ sized metallurgical holes have been completed, two in the higher-grade Polymetallic (Ag-Zn-Pb) Domain Type and one in the higher-grade Tin (Sn-Ag-Pb) Domain Type with core shipped to Wardell Armstrong International (WAI) in Cornwall

- The Polymetallic Domain Type metallurgical testwork will focus on the predominant sulphide domain, while confirmatory testwork on the less predominant oxide domain is planned potentially using “sulphidizing” float conditions as required.

- The Tin Domain Type metallurgical testwork will focus on the predominant surface oxide domain only with a view to produce a lead-silver concentrate via the same flowsheet developed for the Polymetallic Domain Type mentioned above. Tin Recovery will not be part of the formal PEA deliverable, but its recovery will be tracked for future reference and use.

- Core will be crushed and sized into -60mm+25mm, -25mm+9.5mm and -9.5mm+0.85mm by WAI the +9.5mm products will be shipped to TOMRA in Germany for cascade “XRT ore-sorting” tests, whilst the -9.5mm+0.85mm will be tested using heavy liquids to further identify the amenability of the ore to Dense Media Separation (“DMS”) with further PEA metallurgical tests to be completed on the -0.85mm material and pre-concentrated products from the aforementioned test work.

- Definition drill program in progress will focus on expanding the higher-grade Polymetallic Domain mineral resource, which as previously reported contains an inferred mineral resource of 132 million tonnes at 24.3 g Ag/t, 1.11% Zn and 0.50% Pb at an NSR cutoff of $US25/t for a net NSR value of US$34.40 based on a cutoff grade of US$9.20/t.

- This higher-grade resource is included within the much larger inferred mineral resource in the Polymetallic Domain Type (Ag-Zn-Pb) of 541 million tonnes grading 13.6 g Ag/t, 0.69% Zn and0.28% Pb with an NSR value of US$20.32/t at an NSR cut-off of US$9.20/t. It is envisaged that this resource will be bulk mined in an open pit to minimise mining operating costs, with the run-of-mine feed then pre-concentrated to remove waste dilution.

- The Tin Polymetallic Domain Type (Sn-Pb-Ag) which has an inferred mineral resource of 110 million tonnes grading 0.12% Sn, 0.14% Pb and 14.2 g Ag/t with an NSR value of US$12.22/t at an NSR cut-off of US$6.00/t is very under drilled and is a major exploration target going forward.

TORONTO, Nov. 01, 2023 (GLOBE NEWSWIRE) — Eloro Resources Ltd. (TSX: ELO; OTCQX: ELRRF; FSE: P2QM) (“Eloro”, or the “Company”) is pleased to announce that it has completed a metallurgical drill program and commenced a definition drill program on the Iska Iska silver-tin polymetallic project in the Potosi Department of southwestern Bolivia.

Three metallurgical drill holes totalling 940m have been completed, two in the higher-grade Polymetallic (Ag-Zn-Pb) Domain Type and a third hole in the higher-grade Tin Polymetallic (Sn-Ag-Pb) Type. These metallurgical holes twinned previous holes drilled which contain representative values of the different domains as outlined in Table 1. Core size is PQ which has a diameter of 85mm (3.35 inches). The drill core selected for testing from these holes which totals 10,001 tonnes from 657.9m of core has been shipped to Wardell Armstrong International (WAI) in Cornwall for crushing sizing and then the +9.5mm crushed product will be sent to TOMRA GmbH based in Wedel, Germany for cascade “ore-sorting” tests.

The -9.5mm+0.85mm will have heavy liquid analysis performed on two separate size fractions (-9.5mm+5mm and -5mm+0.85mm) to identify the amenability of the finer size fractions to Dense Media Separation “DMS”. The -0.85mm un-preconcentrated material and the pre-concentrated products will provide charges for further preliminary economic assessment (“PEA”) level metallurgical testwork at WAI. This work will build on previous metallurgical test work completed as summarized in the Company’s NI 43-101 Technical Report filed on Sedar+ (see Eloro press release dated October 17, 2023). These metallurgical drill holes will also provide a bulk test of mineralization grade relative to the grade of the twinned holes.

The definition diamond drill program consisting of 5,000m will focus on expanding the higher-grade Polymetallic Domain Type inferred mineral resource, which as previously reported contains an inferred mineral resource of 132 million tonnes at 1.11% Zn, 0.50% Pb and 24.3 g Ag/t at a NSR cutoff of $US25/t. The net NSR value of this higher-grade resource is US$34.40/t which is 3.75 times the estimated operating cost of US$9.20/t.

Tom Larsen CEO of Eloro commented: “This new drilling program will be an important part of our PEA which commenced with a site visit by the PEA team in late September. The cascade “ore-sorting” tests at TOMRA will be a more thorough investigation of the applicability of the Santa Barbara mineralization for “XRT ore sorting” and provide additional pre-concentrated products for further metallurgical tests to optimize recoveries. Definition drilling is in progress to expand the shallow higher-grade mineral resource which has the potential to provide an early payback in the PEA.”

Mr. Mike Hallewell, Senior Strategic Metallurgist and Manager of the Iska Iska PEA study, commented: “This larger bulk sample allows the Cascade XRT Ore sorting testwork to be conducted which provides “XRT Ore Sorter” data that is suitable for PEA level reporting whilst also providing more sample for the heavy liquid analysis and downstream lead-silver and zinc differential flotation. Work also will be completed on improving tin recovery for future use as the Tin Domain is a major, very underexplored, exploration target at Iska Iska.“

Metallurgical Drill Holes

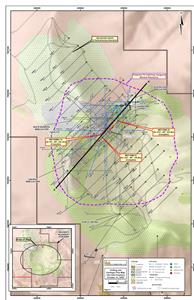

Locations of the three completed metallurgical test holes are shown in Figure 1, a plan map. and Table 1. Hole locations selected are based on recommendations by Micon International Limited (“Micon”). The average grade of the twinned holes is given in Table 1 and Table 2 lists the coordinates of these holes.

Table 1: Average Grades for Intersections in Holes Twinned for Metallurgical Holes and Estimated Sample Size of PQ Core Metallurgical Samples. Ag equivalent grades are calculated using 3-year average metal prices and metallurgical recoveries.

| CORE LENGTHS SELECTED – METALLURGICAL DRILL HOLES – SANTA BARBARA DEPOSIT, ISKA ISKA | |||||||||

| HG Polymetallic (Ag-Zn-Pb) Domain | Grade (based on twinned hole assays) | PQ Kg | |||||||

| Drill Hole | Twin Hole | From | To | Total (m) | Ag (g/t) | Zn(%) | Pb(%) | Ag-eq (g/t)1,2 | |

| MET-DSB-30 | DSB-30 | 47.60 | 336.80 | 289.2 | 8.61 | 1.60 | 0.86 | 83.85 | 4,396 |

| MET-DSBU-10 | DSBU-10 | 42.06 | 302.90 | 260.8 | 49.14 | 0.89 | 0.67 | 90.10 | 3,965 |

| Totals & Avg | 550.0 | 27.83 | 1.26 | 0.77 | 86.82 | 8,361 | |||

| HG Tin (Sn-Ag-Pb) Domain2 | Grade (based on twinned hole assays) | PQ Kg | |||||||

| Drill Hole | Twin Hole | From | To | Total (m) | Sn(%) | Ag (g/t) | Pb(%) | Ag-eq (g/t)3 | |

| MET-DSB-32 | DSB-32 | 0.00 | 107.88 | 107.9 | 0.30 | 45.76 | 0.52 | na | 1,640 |

| Total | 657.9 | Total | 10,001 | ||||||

| Notes: | |||||||||

| 1 | Recoveries for Ag-eq calculation are Ag=88%, Zn=87% and Pb=80% – see NI 43-101 Technical Report filed on SEDAR+ | ||||||||

| 2 | 3-year average metal prices in US$ of Ag=$22.52/oz, Zn=$1.33/lb and Pb=$0.95 used in Ag-eq calculation | ||||||||

| 3 | Sn is not being considered in the PEA which is focussed on the Polymetallic Domain hence no Ag-eq value is given here. | ||||||||

Table 2: Drill Hole Coordinates for Metallurgical Holes, Iska Iska

| METALLURGICAL DRILL HOLE COORDINATES | ||||||

| Polymetallic (Zn-Pb-Ag) Domain | ||||||

| Hole No. | Collar Easting | Collar Northing | Elev. | Azimuth | Angle | Length (m) |

| MET-DSB-30 | 203499.6 | 7654100.5 | 4044.2 | 180° | -75° | 354.8 |

| MET-DSBU-10 | 203499.5 | 7654100.0 | 4044.3 | 40° | -65° | 434.3 |

| Tin (Sn-Ag-Pb) Domain | ||||||

| MET-DSB-32 | 205887.6 | 7654859.3 | 4089.9 | 180° | -75° | 150.8 |

| TOTAL | 939.9 | |||||

Figure 1: Location Map of Metallurgical Drill Holes

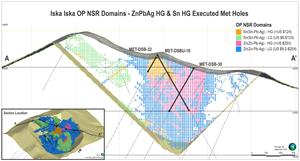

Figure 2: Cross Section A-A’ Showing the Metallurgical Holes Completed in the Polymetallic (Zn-Pb-Ag) and Tin (Sn-Ag-Pb) Domain Types (looking NW).

Note: For further information refer to the Eloro press release dated October 17, 2023.

DEFINITION DRILL PROGRAM

The definition drill program has been designed to fill-in major gaps in the block model as well as expand the higher-grade zone both along and across strike. As noted by Micon, authors of the NI 43-101 Technical Report detailing the initial mineral resource estimate (“MRE”)(see Eloro press release dated October 17, 2023), the highest grade areas are also the best drilled. As drill density in the deposit is improved, it is expected that grade will increase due to better sample density.

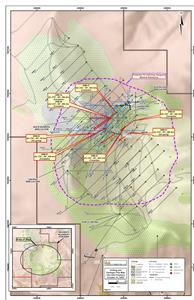

Table 3 lists the coordinates of the Definition Drill Holes completed, in progress and planned. Figure 3 shows the locations of the definition drill holes. Assay results for completed holes are pending. Results will be released as soon as they become available.

Table 3: Drill Hole Coordinates for Definition Drill Holes Higher-Grade Zone, Santa Barbara

| DEFINITION DRILLING HIGHER-GRADE ZONE SANTA BARBARA | |||||||

| Hole No. | Collar Easting | Collar Northing | Elev. | Azimuth | Dip | Length (m) | Status |

| DSB-57 | 205418.2 | 7656281.2 | 4208.8 | 235° | -50° | 500.3 | Complete |

| DSB-58 | 205618.0 | 7656188.0 | 4115.3 | 235° | -60° | 500.3 | Complete |

| DSB-59 | 205353.0 | 7656218.0 | 4239.8 | 270° | -60° | 500.4 | Complete |

| DSB-60 | 205356.5 | 7656220.6 | 4239.8 | 235° | -50° | 500.3 | Complete |

| DSB-61 | 205291.8 | 7656099.4 | 4269.2 | 270° | -90° | 509.4 | Complete |

| DSB-62 | 205448.0 | 7656073.1 | 4182.4 | 235° | -60° | 500.3 | Complete |

| DSB-63 | 205575.4 | 7656049.8 | 4111.7 | 235° | -65° | 386.3 | On going |

| DSB-64 | 205161.3 | 7656042.5 | 4301.7 | 270° | -90° | 29.5 | On going |

| TOTAL | 3,426.8 | ||||||

Figure 3: Location Map of Definition Drill Holes, Santa Barbara, Iska Iska

Qualified Person

The inaugural MRE for Iska Iska outlined in the NI 43-101 Technical Report (see Eloro press release dated October 17, 2023) has been prepared by Micon International Limited. Independent QPs for the Technical Report are Charley Murahwi, P.Geo., FAusIMM, Richard Gowans, P.Eng., Ing. Alan J. San Martin, MAusIMM (CP) and Abdul Aziz, Drame, P.Eng., all of whom are independent QP’s as defined by NI 43-101. Mr. Murahwi completed site visits in January 2020 and November 2022. An NI 43-101 technical report will be filed within 45 days of release of the MRE.

The drill holes twinned for the metallurgical samples were selected by Micon in consultation with Mike Hallewell, B.Sc., F.S.A.I.M.M., F.I.M.M., C. Eng., Senior Strategic Metallurgist for Eloro, a Qualified Person as defined by NI 43-101. The core samples have been shipped to Wardell Armstrong International (WAI), an international accredited metallurgical laboratory for metallurgical testing and all work will be overseen by Mr. Hallewell who is a QP as defined by NI 43-101.

Dr. Bill Pearson, P.Geo., Vice President Exploration, Eloro and a QP as defined by NI 43-101 has reviewed and approved the technical content of this news release. Dr. Pearson who has more than 48 years of worldwide mining exploration, development and production experience, including extensive work in South America, manages the overall technical program, working closely with Dr. Osvaldo Arce, P.Geo. General Manager of Eloro’s Bolivian subsidiary, Minera Tupiza S.R.L., and a Qualified Person in the context of NI 43-101 who has supervised all field work carried out at Iska Iska.

Eloro utilized both ALS and AHK for drill core analyses, both of whom are major international accredited laboratories. Drill samples sent to ALS were prepared in both ALS Bolivia Ltda’s preparation facility in Oruro, Bolivia and the preparation facility operated by AHK in Tupiza with pulps sent to the main ALS Global laboratory in Lima for analysis. Eloro employs an industry standard QA/QC program with standards, blanks and duplicates inserted into each batch of samples analyzed with selected check samples sent to a separate accredited laboratory.

Drill core samples sent to AHK Laboratories were prepared in a preparation facility installed and managed by AHK in Tupiza with pulps sent to the AHK laboratory in Lima, Peru. Au and Sn analysis on these samples is done by ALS Bolivia Ltda in Lima. Check samples between ALS and AHK are regularly done as a QA/QC check. AHK is followed the same analytical protocols used as with ALS and with the same QA/QC protocols.

About Iska Iska

Iska Iska silver-tin polymetallic project is a road accessible, royalty-free property, wholly controlled by the Title Holder, Empresa Minera Villegas S.R.L. and is located 48 km north of Tupiza city, in the Sud Chichas Province of the Department of Potosi in southern Bolivia. Eloro has an option to earn a 100% interest in Iska Iska.

Iska Iska is a major silver-tin polymetallic porphyry-epithermal complex associated with a Miocene possibly collapsed/resurgent caldera, emplaced on Ordovician age rocks with major breccia pipes, dacitic domes and hydrothermal breccias. The caldera is 1.6km by 1.8km in dimension with a vertical extent of at least 1km. Mineralization age is similar to Cerro Rico de Potosí and other major deposits such as San Vicente, Chorolque, Tasna and Tatasi located in the same geological trend.

Eloro began underground diamond drilling from the Huayra Kasa underground workings at Iska Iska on September 13, 2020. On November 18, 2020, Eloro announced the discovery of a significant breccia pipe with extensive silver polymetallic mineralization just east of the Huayra Kasa underground workings and a high-grade gold-bismuth zone in the underground workings. On November 24, 2020, Eloro announced the discovery of the SBBP approximately 150m southwest of the Huayra Kasa underground workings.

Subsequently, on January 26, 2021, Eloro announced significant results from the first drilling at the SBBP including the discovery hole from 0.0m to 257.5m. Subsequent drilling has confirmed significant values of Ag-Sn polymetallic mineralization in the SBBP and the adjacent CBP. A substantive mineralized envelope which is open along strike and down-dip extends around both major breccia pipes. Continuous channel sampling of the Santa Barbara Adit located to the east of SBBP returned 164.96 g Ag/t, 0.46%Sn, 3.46% Pb and 0.14% Cu over 166m including 446 g Ag/t, 9.03% Pb and 1.16% Sn over 56.19m. The west end of the adit intersects the end of the SBBP.

Since the initial discovery hole DHK-15 which returned 29.53g Ag/t, 0.078g Au/t, 1.45%Zn, 0.59%Pb, 0.080%Cu and 0.056%Sn over 257.5m, Eloro has released a number of significant drill results in the SBBP and the surrounding mineralized envelope which along with geophysical data has defined an extensive target zone. On October 17, 2023, Eloro filed the NI 43-101 Technical Report outlining the initial inferred MRE for Iska Iska, prepared by Micon. The MRE was reported in two domains, the Polymetallic (Ag-Zn-Pb) Domain which is primarily in the east and south of the Santa Barbara deposit and the Tin (Sn-Ag-Pb) Domain which is primarily in the west and north. The Polymetallic Domain is estimated to contain 560Mt at 13.8 g Ag/t, 0.73% Zn & 0.28% Pb at an NSR cutoff of US$9.20 for potential open pit and an NSR cutoff of US$34.40 for potential underground. The majority of the mineral resource is contained in the constraining pit which has a stripping ratio of 1:1.

The Polymetallic Domain contains a higher-grade mineral resource at a NSR cutoff of $US25/t of 132 million tonnes at 1.11% Zn, 0.50% Pb and 24.3 g Ag/t which has a net NSR value of US$34.40/t which is 3.75 the estimated operating cost of US$9.20/t. The Tin Domain which is adjacent the Polymetallic Domain and does not overlap, is estimated to contain a mineral resource of 110Mt at 0.12% Zn, 14.2 g Ag/t and 0.14% Pb but is very under drilled.

The Company is currently carrying out a 5,000m definition drill program to expand the higher-grade mineral resource in the Polymetallic Domain and has commenced a preliminary economic evaluation PEA led by Lycopodium.

About Eloro Resources Ltd.

Eloro is an exploration and mine development company with a portfolio of gold and base-metal properties in Bolivia, Peru and Quebec. Eloro has an option to acquire a 100% interest in the highly prospective Iska Iska Property, which can be classified as a polymetallic epithermal-porphyry complex, a significant mineral deposit type in the Potosi Department, in southern Bolivia. A recent NI 43-101 Technical Report on Iska Iska, which was completed by Micon International Limited, is available on Eloro’s website and under its filings on SEDAR. Iska Iska is a road-accessible, royalty-free property. Eloro also owns an 82% interest in the La Victoria Gold/Silver Project, located in the North-Central Mineral Belt of Peru some 50 km south of the Lagunas Norte Gold Mine and Pan American Silver’s La Arena Gold Mine.

For further information please contact either Thomas G. Larsen, Chairman and CEO or Jorge Estepa, Vice-President at (416) 868-9168.

Information in this news release may contain forward-looking information. Statements containing forward-looking information express, as at the date of this news release, the Company’s plans, estimates, forecasts, projections, expectations, or beliefs as to future events or results and are believed to be reasonable based on information currently available to the Company. There can be no assurance that forward-looking statements will prove to be accurate. Actual results and future events could differ materially from those anticipated in such statements. Readers should not place undue reliance on forward-looking information. Neither the TSX nor its Regulation Services Provider (as that term is defined in the policies of the TSX) accepts responsibility for the adequacy or accuracy of this release.

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/a7a055e2-47ec-4153-9053-8ca8e4e0ac51

https://www.globenewswire.com/NewsRoom/AttachmentNg/4562eb8b-7750-4b55-a5bd-89eee94db815

https://www.globenewswire.com/NewsRoom/AttachmentNg/1ba70e24-505c-4776-9365-64b3f493670a

Such a rigged game…….No one cares about these juniors……it will keep sliding into oblivion…..

In a bull market everyone makes money. Just need to survive until that time when it is rigged in favor of holders

Yes, a bull market. We’ve had some short positive “blips” or “up trends” in the mining industry. since 2008…….but the overall trend has been NEGATIVE for this industry…..

I guess what upsets me the most is…..

why aren’t more of these mining companies taking proactive steps to not only make them more attractive to potential investors, but also to make them (and the whole industry) more profitable?

Look at companies like AGI…..I believe Alamos has taken steps to directly sell their mined product to the market. SVM (Silvercorp) has also apportioned money to buy back their shares….

Why don’t all mining companies dictate to their officers, that a percentage of your income HAS to go towards purchasing shares in their companies?

Why haven’t more junior (and bigger) producers gotten together to pool their strategies to sell directly to the market?

Where is the fight for their shareholders, or are officers content with just “getting theirs”?

To “survive” and be around for the next bull market in metals, should not be a stand alone strategy IMHO.

Bolivia just cut off diplomatic relations with Israel. Anyone owning a damn thing in this country is crazy.

Another new 52 week low today, $1.06!!!!