Cabral Gold (CBR.V): Receives Excellent Column-Leach Test Results from MG Gold-in-Oxide Material, Cuiú Cuiú Gold District

Vancouver, British Columbia–(Newsfile Corp. – June 21, 2022) – Cabral Gold Inc. (TSXV: CBR) (OTC PINK: CBGZF) (“Cabral” or the “Company“) is pleased to provide results from column-leach test work on unconsolidated gold-bearing oxide material from the MG target within the Cuiú Cuiú gold district in northern Brazil.

Highlights are as follows:

- Column-leach test work indicates heap-leach processing is viable at Cuiú Cuiú, which should result in lower initial capital and operating costs

- Gold recoveries based on the calculated gold content of the bulk sample were 82% after 70 days. Recoveries after 15 days were 70% and recoveries after 30 days were 78%

- Leached gold recoveries were 0.974 g/t gold, significantly higher than the average assayed head grade of 0.896 g/t gold from head screen analysis of the composite bulk sample taken prior to the leach test

Alan Carter, Cabral’s President and CEO commented, “These column leach test results are very encouraging and indicate that the gold-in-oxide material at Cuiú Cuiú is amenable to heap-leach processing. The overall leach recovery of 82% is excellent and higher than most heap leach gold mines that are currently in operation. Furthermore, the results indicate that the composite sample used for the column leach tests may contain more gold and be higher grade than the assays from the composite sample indicate. The possible reason for this is that coarse gold particles may occur within the oxide material. On the basis of these results, Cabral plans to move forward with a Preliminary Economic Analysis of the gold-in-oxide blanket material at Cuiú Cuiú as soon as possible to demonstrate the economic viability of the gold-in-oxide blankets.”

Column Leach tests

Following the initial discovery of the MG gold-in-oxide blanket in early 2021 (see press release dated April 15, 2021), Cabral shipped approximately 400kg of mineralized oxide material from MG to the Kappes, Cassiday & Associates lab in Reno, Nevada to conduct heap-leach metallurgical testing.

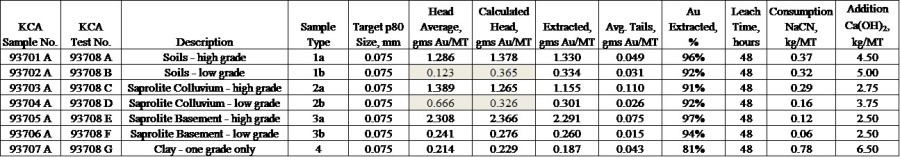

To create the bulk sample, seven sub-populations of various oxide materials and grades were sampled from five HQ diamond-drill holes. (see Table 1 and press release dated February 24, 2022). These subpopulations were designed to provide a representative bulk sample of the overall oxide mineralization, and test the specific attributes of the various components prior to creating a bulk sample.

Preliminary metallurgical results from bottle-roll tests of small samples from each of the seven subpopulations returned up to 97% gold recoveries over 48 hours (See press release dated February 24, 2022). Average assay grades from the individual samples ranged from 0.123 – 2.308 g/t gold (Table 1).

Table 1. Summary of cyanide bottle-roll leach tests for seven MG samples

Following bottle-roll and engineering test work, a 332kg bulk composite sample was created from the seven individual sub-samples.

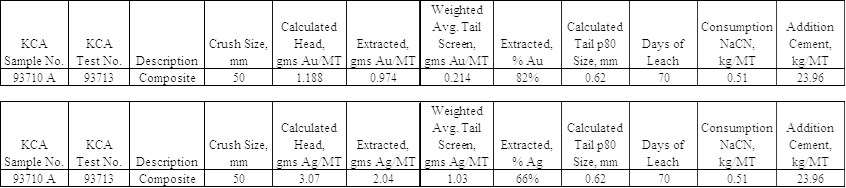

The composite sample was then subject to 70 days of leaching and gold recoveries after this period were 0.974 g/t gold (Table 2). This is significantly higher than the average assayed head grade of 0.896 g/t gold of the composite sample determined from head screen analysis measured in advance of the leach test.

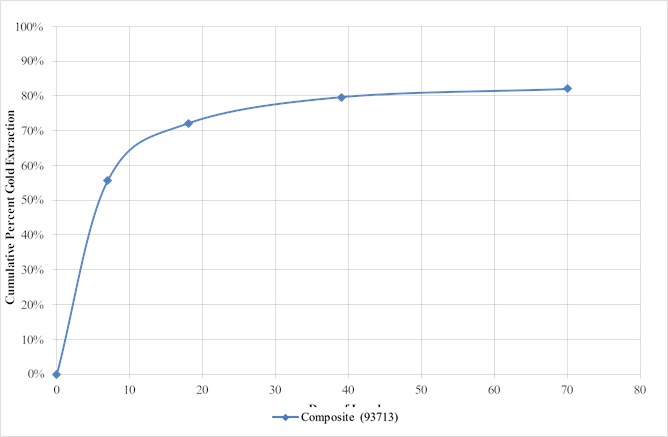

Gold recoveries reached 82% after 70 days. Recoveries after 15 days were 70%, and 78% after 30 days (Figure 1). Gold recoveries slowed significantly after 40 days, but still increased a further 2% during the final 30 days of the 70-day test.

Following the completion of the column test, the head-grade of the 332kg bulk sample was back-calculated to be 1.188 g/t gold, based on a reconciliation of the gold extracted and the residual gold values of the material in the columns (Table 2).

Figure 1. Cumulative % gold recovery of composite MG gold-in-oxide sample after 70 days

Silver recoveries after 70 days were 66%. The silver head-grade of the portion of the bulk sample under leach was back-calculated to be 3.07 g/t silver (Table 2).

Sodium cyanide consumption was low at 0.51 kg/t NaCN and would typically be reduced for feasibility study purposes to approximately 0.15 kg/t.

Cement used for the agglomerate product was 23.96 kg/t, based on an anticipated stacking height for a heap-leach pad of 20m.

Table 2. Summary of Column leach test logs with extractions based on solution assays for gold and silver recoveries after 70 days from the 332kg MG oxide composite sample

These column-leach recoveries compare very favorably with G Mining’s metallurgical recoveries of 71% from the saprolite oxide material at Tocantinzinho. These account for just 3% of the planned overall Tocantinzinho mill feed (G Mining’s press release dated February 9, 2022). The column-leach recoveries from Cuiú Cuiú.also compare very well with other heap-leach gold mines around the world.

The extensive gold-in-oxide blanket at MG was not recognized until early 2021, and was largely considered waste in earlier resource estimates. Recognition of the blanket should result in lower strip ratios than previously thought. The softer oxide mineralization is also anticipated to have lower mining costs than the underlying fresh basement.

While traditional processing will be required for the unweathered hard-rock basement mineralization, these MG results suggest heap-leach processing of soft, near-surface, oxidized mineralization is viable at Cuiú Cuiú.

Adopting heap-leach processing at Cuiu Cuiu could result in a significantly lower initial capital investment and processing costs. In addition, it should also result in lower cut-off grades for the oxide mineralization while increasing pit depths, thereby increasing contained ounces. In general, adoption of heap-leach processing has the potential to significantly improve the economics for any deposit that is ultimately developed at Cuiú Cuiú.

About Cabral Gold Inc.

The Company is a junior resource company engaged in the identification, exploration and development of mineral properties, with a primary focus on gold properties located in Brazil. The Company has a 100% interest in the Cuiú Cuiú gold district located in the Tapajós Region, within the state of Pará in northern Brazil. Two gold deposits have so far been defined at Cuiú Cuiú and contain 43-101 compliant Indicated resources of 5.9Mt @ 0.90 g/t (200,000 oz) and Inferred resources of 19.5Mt @ 1.24 g/t (800,000 oz).

The Tapajós Gold Province is the site of the largest gold rush in Brazil’s history producing an estimated 30 to 50 million ounces of placer gold between 1978 and 1995. Cuiú Cuiú was the largest area of placer workings in the Tapajós and produced an estimated 2Moz of placer gold historically.

FOR FURTHER INFORMATION PLEASE CONTACT:

“Alan Carter”

President and Chief Executive Officer

Cabral Gold Inc.

Tel: 604.676.5660

Guillermo Hughes, MAusIMM and FAIG., a consultant to the Company as well as a Qualified Person as defined by National Instrument 43-101, supervised the preparation of the technical information in this news release.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as such term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-looking Statements

This news release contains certain forward-looking information and forward-looking statements within the meaning of applicable securities legislation (collectively “forward-looking statements”). The use of the words “will”, “expected” and similar expressions are intended to identify forward-looking statements. These statements involve known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those anticipated in such forward-looking statements. Such forward-looking statements should not be unduly relied upon. This news release contains forward-looking statements and assumptions pertaining to the following: strategic plans and future operations, and results of exploration. Actual results achieved may vary from the information provided herein as a result of numerous known and unknown risks and uncertainties and other factors. The Company believes the expectations reflected in those forward-looking statements are reasonable, but no assurance can be given that these expectations will prove to be correct.