Alpha Exploration Announces 18 m @ 15.33 g/t Gold & 49m @ 2.75 g/t Gold from Hill 52, Aburna

March 1, 2024 – TheNewswire – Alpha Exploration Ltd. (“Alpha” or the “Company”) (TSXV:ALEX) announces further drilling results from a 10,000m drill program underway on its Aburna Gold Prospect (“Aburna”) on the Company’s 100% owned, 771 km² Kerkasha Project located in Eritrea. Drilling consists of both reverse-circulation (“RC”) drilling and diamond core (“DC”) drilling.

HIGHLIGHTS:

- 18m @ 15.33 g/t Au from RC-DC hole ABD012 (Hill 52)

- 49m @ 2.75 g/t Au (including 7m @ 14.90g/t Au) from RC-DC hole ABD013 (Hill 52)

- Highest grade mineralization intersected to data across the Aburna project

- Drilling extends wide, high-grade zone to over 200 metres at Hill 52

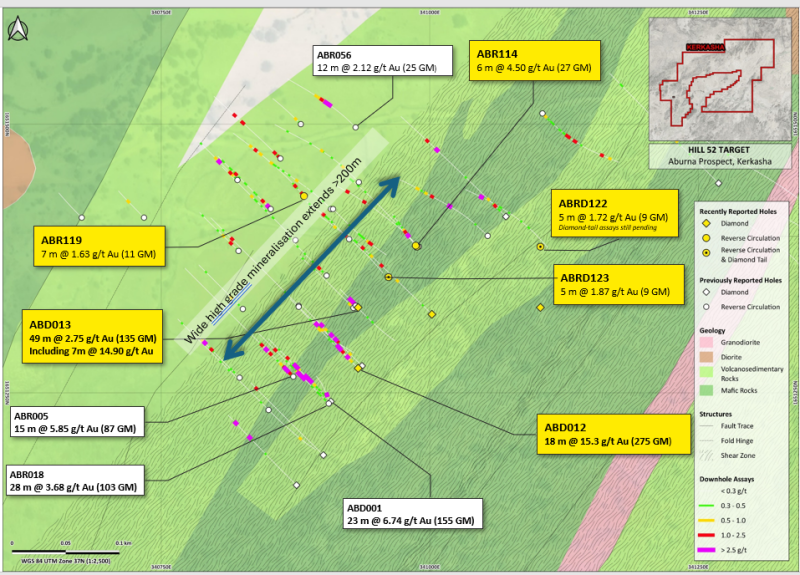

- Shallow plunging geometry of gold mineralization now confirmed at Central Area and Hill 52

Assays have been received from a further 16 holes completed over the Hill 52, Central and Northeast Area prospects on Aburna. Hole ABD012 intersected 15.33 g/t Au over 18m and was drilled as a step out along strike from existing high- grade mineralization that included holes ABD001 (20m@ 7.70 g/t Au). ABD013, a step out from ABD012, intersected 49m @ 2.75 g/t Au and included two separate higher-grade zones of 7m @ 14.90 g/t Au and 2m @ 6.19 g/t Au at shallow depths (<70m from surface).

In combination, holes ABD012 and ABD013 have significantly extended a wide, high-grade zone of mineralization that was originally defined in 2022 by the Company and reported in drill holes ABR005 (15m @ 5.85 g/t Au), ABR018 (8m @ 5.47 g/t Au) and ABD001 (20m @ 7.70 g/t Au) – see Figure 2, below.

Additional new results include hole ABR114 (6m @ 4.5 g/t Au and 2m @ 11.91 g/t Au), that has further defined a separate mineralized structure within Hill 52.

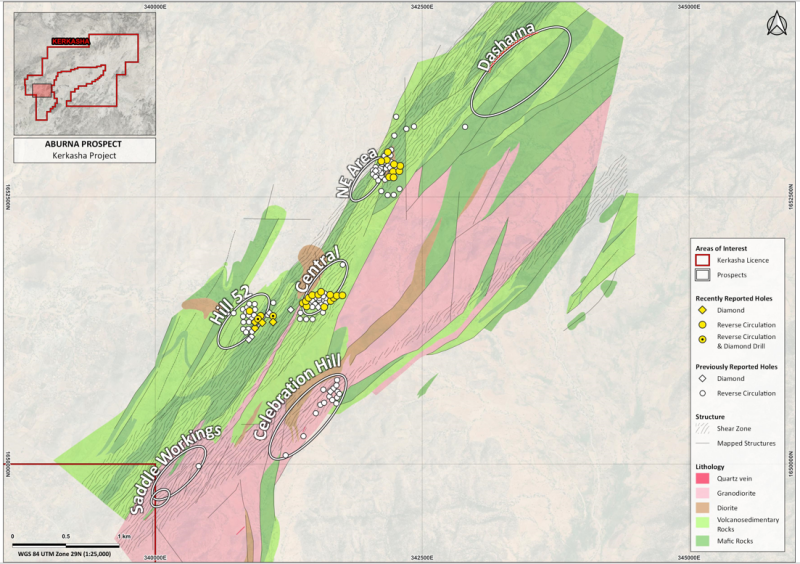

Aburna is a major, district scale orogenic gold prospect covering an area of at least 7km long and 2km wide and is one of the three significant discoveries made by Alpha on the Kerkasha licence in the last three years. Exploration to date by Alpha on the project has defined six primary areas of interest, and has established significant high-grade gold mineralized systems at Central Area, Hill 52 and Northeast Area (see Figure 1, below)

Michael Hopley, Alpha President & CEO said, “We are very pleased to report these spectacular results from the ongoing drill program at Aburna. In particular, holes ABD012 and ABD013 have exceeded all of our expectations by extending to over 200m a high-grade shoot originally identified in 2022. ABD012 (15.33 g/t Au over 18 metres) and translating to >275 gram metres is the highest grade result we have reported on the Aburna project.

The identification of shallow, plunging high-grade mineralization at Hill 52 following similar confirmation at Central Area last month, is testament to the strength of our technical team and the work completed to date. The team is already preparing additional drill targets to extend this zone further which remains open down dip and down plunge, with drilling expected to restart in the next few weeks.

We look forward to reporting further assay results on the project as data is released as well as the imminent start of the second phase of the 10,000 metre drill program at Aburna.”

Drill Program

A further 19 drillholes have been completed at Aburna and these have principally been completed at the Hill 52 prospect (11 holes), 3 drillholes at the Central Area with a further 5 drillholes at Northeast Area. Of the 11 holes completed at Hill 52, five (ABD116,-118,-120,-121 and -122) are partially reported and are awaiting assays from the diamond core ‘tail’ of drillholes which are expected shortly.

The Company commenced the current drill program in December 2023. To date, 33 drillholes for 6,033 metres have been drilled at Central Area (13 drillholes), Hill 52 (11 drillholes) and Northeast Area (9 drillholes). Further assay results have been received from 16 of these 33 drillholes. A full table of significant intercepts from assay results received to date is available in Table 1, below.

Shallow plunging gold mineralization confirmed at Hill 52 and Central Areas, Aburna

Drilling completed at Aburna last year, (https://alpha-exploration.com/alpha-reports-drill-results-from-aburna-gold-prospect-includes-9m-10-g-t-gold/) established the potential that shallow plunging mineralized “shoots” exist at several prospects within Aburna including Northeast, Central and Hill 52 areas. These mineralized “shoots “plunge at an azimuth of 065-070 degrees to the east-northeast.

Drilling in both Central and Hill 52 areas has now confirmed that mineralization at Aburna plunges as expected. At Central Area, consistent, wide, lower-grade gold mineralization extends over 300m in the down plunge orientation. At Hill 52 mineralization is less consistent but equally as wide containing multiple zones of high-grade mineralization extending over 200m in the down plunge orientation see (https://alpha exploration.com/wpcontent/uploads/2024/01/30JAN2024_PR_Alpha_Drilling-Results.pdf).

The highly mineralized shoot at Hill 52 as defined by AND001 and ANR008 (2022) and recent drillholes AND012 and AND013 (additional assays pending), is proving to be larger in size and higher in grade than expected. The shoot daylights at AND001 and 80m to the NE at AND013, mineralization is intersected 10m below the surface suggesting a very shallow plunge at an azimuth of 068°. The shoot is wholly contained within a highly foliated portion of a larger shear zone. The higher-grade portions of the shoot are developed within dilate areas created by internal structures within the shear zone. The high-grade zones are generally contained within an envelope of lower-grade material that is often 50m to 60m wide (i.e., ABD012 with 49m @ 2.75 g/t Au). The Hill 52 shoot is fairly well defined for 200m along strike and is open down dip and down plunge. Its size and grade are a key focus for Alpha as we look to extend the primary mineralized shoots at all three sub-areas on the Aburna prospect.

Figure 1: Map of Aburna with main prospects defined and drilling completed to date

Figure 2: Hill 52 – new drilling (yellow boxes, collars) and existing mineralization (white boxes, collars)

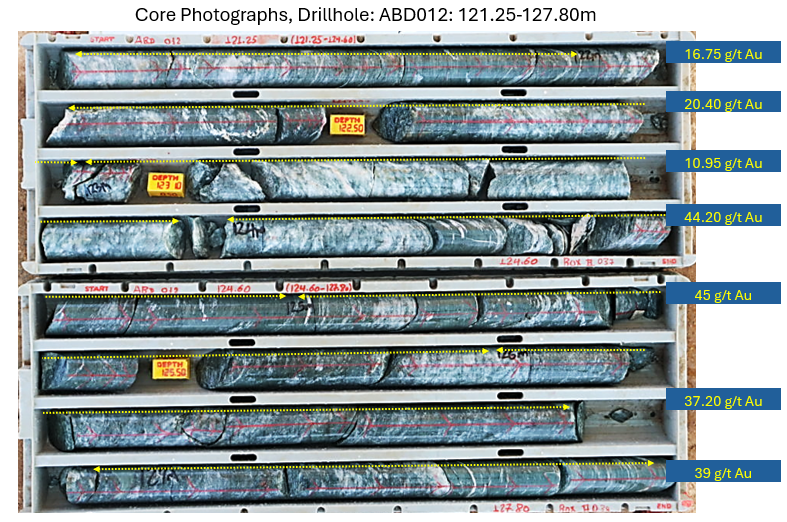

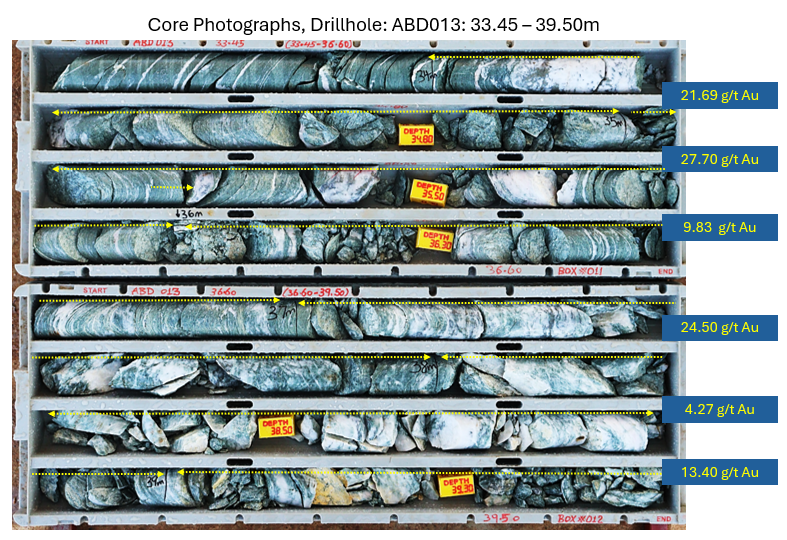

Figure 3 (a), (b): Drill core from holes ABD012 & ABD013 showing high grade mineralization

Figure 4: Photos from drilling program

Table 1: Significant drilling intercepts from assays received

| Aburna Prospect | Drillhole ID | from (m) | to (m) | Significant Interval |

| Northeast | ABRD111 | 127 | 140 | 13m @ 0.37 g/t Au |

| DC-tail pending | ||||

| Northeast | ABR112 | 44 | 47 | 3m @ 0.72 g/t Au |

| and | 107 | 108 | 1m @ 1.10 g/t Au | |

| and | 114 | 118 | 4m @ 0.25 g/t Au | |

| Northeast | ABR113 | 75 | 79 | 4m @ 1.06 g/t Au |

| and | 98 | 101 | 3m @ 0.24 g/t Au | |

| Hill 52 | ABR114 | 60 | 66 | 6m @ 4.50 g/t Au |

| including | 62 | 64 | 2m @ 11.91 g/t Au | |

| and | 80 | 90 | 10m @ 1.04 g/t Au | |

| and | 101 | 102 | 1m @ 1.48 g/t Au | |

| and | 120 | 121 | 1m @ 1.36 g/t Au | |

| Hill 52 | ABR115 | 2 | 7 | 5m @ 0.20 g/t Au |

| and | 57 | 61 | 4m @ 0.50 g/t Au | |

| and | 135 | 141 | 6m @ 0.46 g/t Au | |

| and | 149 | 156 | 7m @ 0.50 g/t Au | |

| and | 161 | 166 | 5m @ 0.46 g/t Au | |

| Northeast | ABRD116 | 107 | 114 | 7m @ 0,21 g/t Au |

| and | 130 | 135 | 5m @ 0.43 g/t Au | |

| and | 138 | 150 | 12m @ 0.71 g/t Au | |

| DC-tail pending | ||||

| Northeast | ABR117 | 86 | 89 | 3m @ 0.74 g/t Au |

| Central | ABRD118 | 60 | 65 | 5m @ 0.20 g/t Au |

| and | 134 | 135 | 2m @ 4.44 g/t Au | |

| DC-tail pending | ||||

| Hill 52 | ABR119 | 4 | 11 | 7m @ 1.63 g/t Au |

| including | 4 | 6 | 2m @ 4.36 g/t Au | |

| and | 16 | 24 | 8m @ 0.94 g/t Au | |

| including | 22 | 23 | 1m @ 3.85 g/t Au | |

| and | 27 | 28 | 1m @ 1.07 g/t Au | |

| and | 43 | 52 | 9m @ 0.23 g/t Au | |

| and | 84 | 89 | 5m @ 0.23 g/t Au | |

| and | 100 | 102 | 2m @ 1.74 g/t Au | |

| and | 110 | 112 | 2m @ 1.94 g/t Au | |

| and | 119 | 122 | 3m @ 0.72 g/t Au | |

| Central | ABRD120 | 90 | 95 | 5m @ 1.36 g/t Au |

| and | 134 | 142 | 8m @ 1.02 g/t Au | |

| DC-tail pending | ||||

| Central | ABRD121 | 145 | 150 | 5m @ 3.38 g/t Au |

| and | 156 | 157 | 1m @ 1.44 g/t Au | |

| DC-tail pending | ||||

| Hill 52 | ABRD122 | 41 | 44 | 3m @ 0.47 g/t Au |

| and | 63 | 70 | 7m @ 0.22 g/t Au | |

| and | 79 | 80 | 1m @ 1.07 g/t Au | |

| and | 93 | 96 | 3m @ 0.53 g/t Au | |

| and | 122 | 127 | 5m @ 1.72 g/t Au | |

| including | 125 | 125 | 1m @ 6.3 g/t Au | |

| DC-tail pending | ||||

| Hill 52 | ABRD123 | 55 | 59 | 4m @ 0.21 g/t Au |

| and | 77 | 80 | 3m @ 0.40 g/t Au | |

| and | 92 | 97 | 5m @ 1.87 g/t Au | |

| including | 93 | 95 | 2m @ 4.30 g/t Au | |

| and | 107 | 111 | 4m @ 0.26 g/t Au | |

| and | 115 | 118 | 3m @ 1.11 g/t Au | |

| Hill 52 | ABD011 | 30 | 38 | 8m @ 0.54 g/t Au |

| and | 59 | 68 | 9m @ 0.80 g/t Au | |

| and | 75 | 83 | 8m @ 0.42 g/t Au | |

| and | 97 | 100 | 3m @ 0,23 g/t Au | |

| and | 109 | 116 | 7m @ 0.67 g/t Au | |

| and | 132 | 140 | 8m @ 0.46 g/t Au | |

| Hill 52 | ABRD012 | 39 | 52 | 13m @ 0.61 g/t Au |

| and | 70 | 76 | 6m @ 1.67 g/t Au | |

| including | 71 | 72 | 1m @ 8.89 g/t Au | |

| and | 98 | 106 | 8m @ 0.57 g/t Au | |

| and | 114 | 132 | 18m @ 15.33 g/t Au | |

| and | 149 | 153 | 4m @ 0.38 g/t Au | |

| and | 230 | 233 | 3m @ 0.21 g/t Au | |

| Hill 52 | ABD013 | 7 | 15 | 8m @ 1.03 g/t Au |

| and | 18 | 67 | 49m @ 2.75 g/t Au | |

| including | 34 | 41 | 7m @14.90 g/t Au | |

| including | 60 | 62 | 2m @ 6.19 g/t Au | |

| and | 70 | 73 | 3m @ 0.52 g/t Au | |

| and | 115 | 120 | 5m @ 0.28 g/t Au | |

A significant interval is defined by consecutive one-meter intervals starting and ending at 0.20 g/t Au or better. A significant interval must be at least 3m long. Internal dilution is limited to 2 consecutive intervals of <0.20 g/t Au. Multiple internal dilutions are allowed. Single one-meter intervals of 1.00 g/t Au or greater are also considered significant. At this early stage of exploration, the true widths of intersections is not known but is estimated to be at least 80% of the reported intervals.

Sampling, Sub-sampling and Analysis

Alpha engaged an independent Consultancy, RSC Mining & Mineral Exploration (RSC) to develop a Standard Operating Procedure (“SOP”) for both RC and DD drill samples in June 2021 and all samples in this release use this RSC SOP. The RSC SOP utilizes blank standards and industry standards that are inserted at the beginning and end of every batch (and every 20 samples within the batch) for all batches submitted to ALS for assay. Additionally, field replicates are taken at a frequency of about 1 in 5 (20%) through mineralized areas.

One-meter samples from both RC and DD drilling were crushed (to >90% passing 2.0 mm) and pulverised (to >85% passing 75 μm). Two scoop samples were taken from the pulveriser bowl: approximately 130g for laboratory analysis and approximately 150g for portable X-ray fluorescence (pXRF) analysis. The coarse and pulp rejects were stored at Alpha’s warehouse in Asmara. The Company inserted certified reference material from OREAS (www.ore.com.au) into the sample stream, while Nabro sample preparation facility inserted barren granodiorite material into the sample stream as a blank. Samples were shipped to ALS Geochemistry (ALS), Loughrea, Ireland, for analysis. ALS analysed all drill samples for gold by method Au-AA26 (50 g charge fire assay, AAS finish). ALS is independent of the Company and its quality management systems framework is accredited to ISO/IEC 17025:2005 or certified to ISO 9001:2015 standards.

Alpha Extends Closing Date of Private Placement Financing

Further to the Company’s press releases dated November 15, 2023, December 8, 2023, January 2, 2024 and February 7, 2024, Alpha is pleased to announce that the TSX Venture Exchange (the “Exchange”) has agreed to extend the closing of the second tranche of its previously announced non-brokered private placement of units in the capital of the Corporation (“Units”) of up to $5,000,000.00 at a purchase price of $0.70 per Unit (the “Offering Price”), (the “Offering”) until March 31, 2024. The first tranche of the Offering closed after market close on December 7, 2023, for total aggregate gross proceeds of $4,180,001.00 as previously announced by the Corporation. The principal use of the proceeds of the Offering will be for funding ongoing exploration work on the Kerkasha Project in Eritrea, operating and administrative expenses, working capital and general corporate purposes.

Certain Insiders of the Corporation (as such term is defined under the policies of the TSXV) may participate in the Offering. The participation of Insiders in the Offering would constitute a “related party transaction” within the meaning of Multilateral Instrument 61-101 – Protection of Minority Security Holders in Special Transactions (“MI 61-101”). The Corporation intends on relying upon exemptions from the formal valuation and minority approval requirements of MI 61-101 based on a determination that the fair market value of the Offering, insofar as it involves the related parties, will not exceed $2,500,000.

Further details relating to the closing of the second tranche of the Offering will be provided in due course. For more information concerning the Corporation, please refer to the Corporation’s profile on the SEDAR website at www.sedar.com or at the Corporation’s website at https://alpha-exploration.com/.

About Alpha

Alpha (TSX-V:ALEX) is an exploration company that is rapidly advancing a number of important gold and base metal discoveries across its 100% owned, large (771 km2) Kerkasha Project in Eritrea.

The Aburna Gold Prospect is an exciting new gold discovery where recent drilling has established a high-grade discovery with grades including 16 m @ 14.07 g/t Au, 9 m @ 10 g/t Au and 23 m @ 6.74 g/t Au. The Anagulu Gold-Copper Prospect includes recent drilling intersections of 108 m @ 1.24 g/t Au and 0.60% Cu and 49 m @ 2.42 g/t Au and 1.10% Cu within a porphyry unit mapped over at a >2 km strike length. The Company has also advanced the Tolegimja volcanogenic massive sulphide copper-zinc-gold Prospect and over 17 other gold prospects since listing in 2021.

The Company is managed by a group of highly experienced and successful professionals with long track records of establishing, building and successfully exiting a number of world class gold and base metals discoveries in Eritrea and across the wider Arabian Nubian Shield.

For further information go to the Alpha webpage at www.alpha-exploration.com or contact:

Michael Hopley

President and Chief Executive Officer

Alpha Exploration Ltd.

Email: [email protected]

Tel: +44 207129 1148

Qualified Person

All scientific and technical information in this press release, including the results of the Aburna drill program and how these results relate to the ongoing exploration at the Kerkasha Project has been reviewed, verified, and approved by Michael Hopley, President, Chief Executive Officer of Alpha and a “qualified person” for the purposes of National Instrument 43-101 – Standards of Disclosure for Mineral Projects.

Cautionary Notes

This press release is intended for distribution in Canada only and is not intended for distribution to United States newswire services or dissemination in the United States.

Forward‐Looking Statements

Certain statements and information herein, including all statements that are not historical facts, contain forward-looking statements and forward-looking information within the meaning of applicable securities laws. Such forward-looking statements or information include but are not limited to statements or information with respect to future dataset interpretations, sampling, plans for its projects (including the Anagulu prospect), surveys related to Alpha’s assets, and the Company’s drilling program. Often, but not always, forward-looking statements or information can be identified by the use of words such as “estimate”, “project”, “belief”, “anticipate”, “intend”, “expect”, “plan”, “predict”, “may” or “should” and the negative of these words or such variations thereon or comparable terminology are intended to identify forward-looking statements and information. With respect to forward-looking statements and information contained herein, Alpha has made numerous assumptions including among other things, assumptions about general business and economic conditions and the price of gold and other minerals. The foregoing list of assumptions is not exhaustive.

Although management of Alpha believes that the assumptions made and the expectations represented by such statements or information are reasonable, there can be no assurance that forward-looking statements or information herein will prove to be accurate. Forward-looking statements and information by their nature are based on assumptions and involve known and unknown risks, uncertainties and other factors which may cause actual results, performance or achievements, or industry results, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements or information. These factors include, but are not limited to: risks relating to Alpha’s financing efforts; risks associated with the business of Alpha given its limited operating history; business and economic conditions in the mining industry generally; the supply and demand for labour and other project inputs; changes in commodity prices; changes in interest and currency exchange rates; risks relating to inaccurate geological and engineering assumptions (including with respect to the tonnage, grade and recoverability of reserves and resources); risks relating to unanticipated operational difficulties (including failure of equipment or processes to operate in accordance with specifications or expectations, cost escalation, unavailability of materials and equipment, government action or delays in the receipt of government approvals, industrial disturbances or other job action, and unanticipated events related to health, safety and environmental matters); risks relating to adverse weather conditions; political risk and social unrest; changes in general economic conditions or conditions in the financial markets; changes in laws (including regulations respecting mining concessions); risks related to the direct and indirect impact of COVID-19 including, but not limited to, its impact on general economic conditions, the ability to obtain financing as required, and causing potential delays to exploration activities; those factors discussed under the heading “Risk Factors” in the Final Prospectus; and other risk factors as detailed from time to time. Alpha does not undertake to update any forward-looking information, except in accordance with applicable securities laws.

Copyright (c) 2024 TheNewswire – All rights reserved.