Miners Won’t be This Cheap Forever

One can’t know when the bottom is in but one can now when something is so cheap that a revaluation higher is a matter of when and not if. Many juniors are already priced like gold is at least $200 lower. I love that kind of margin of safety.

The pendulum always swings and things can turn on a dime. Selling near a bottom is the most costly mistake one can make. Personally I am buying everything because I have never seen so many no brainers at the same time.

One does not simply sell 6 months INTO a correction!

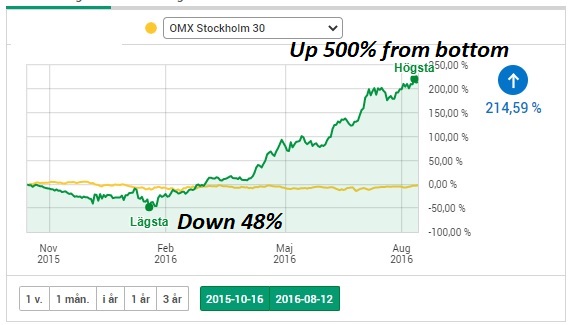

I will never forget 2015/2016:

In other news:

Another sign we’re nearing a bottom. Gold Miners Bullish Percent Index (BPGDM) fell to just 24.14% today, (down from 100% at Aug. top). Excluding very brief March 2020 mkt liquidity plunge, BPGDM lowest since May 2019. Following that low, gold up 22% GDX up 53% over next 3 months

— fred hickey (@htsfhickey) March 5, 2021

Any chance you can share with us your recent purchases? Recently bought Tristar and Wh Rock on your recommendations.

Your portfolio only has a few companies. Are you able to share all your picks?

I have bought more than I can count but last buys this week were Labrador Gold, District Metals, Altamira, Prosper Gold, Juggernaut Exploration, Kuya Silver, Idaho Champion and have bids in for stuff like FireFox Gold, Magna Gold, Defiance Silver and Dolly Varden (if I remember correctly).

I think all the companies I own are cheap and I own around 30 nowadays. It’s like shooting fish in a barrel IMO.

/Erik

Do you own Endro Metals?

I have TSX: AR

Agreed. Like shooting fish in a barrel. I bought DEF, KUYA, ALTA, DMX, and DV as well. But I was also loading BRC, SSVR, ORE.WT, ELO, ESK, ORX and MIS.

Why ORX and MIS? Location, location, location.

https://cdn-ceo-ca.s3.amazonaws.com/1g453c9-MIS-updated.jpg

ORX owns a big chunk of MIS.

I forgot to add Lion One! LIO. Stupid cheap.

20 BAGGER IN A COUPLE YEARS.

New found Gold symbol up north = NFG

So fabulous that only a few see and believe. IPO = &0 Mill with Sprott and friends in big.

My previous comment is erased?

Another review of NFG with some details.

http://www.321gold.com/editorials/moriarty/moriarty022421.html

All your followers need a tune up on the trading of the juniors in Canuck land.

Look at NFG on Stockwatch, and you see there are several, 5-8, alternate trading venues on any given day that are naked shorting the stock and doing it on numerous other stocks that look to be expensive, or whatever they use for a criteria to pound them down for nickels and dimes.

There are NO rules on naked shorting in Canada. Eric Sprott has complained about the practice on camera.

I have it on very reliable authority that the off market trading venues you see there are owned and run by the big banks. Learned from the big N.Y. banks with their SEC blessed dark pools, Maybe.

I have followed your work with great interest, and really wanted to make the Marfa Texas festival, as two of my long standing pals, the Ide brothers made it, but I could not.

Compared to big and small miners, the exploration stock NFG exhibits such low volume and liquidity, I would consider it a poor target for shorting. Yes, shorting a low volume stock will send its price down considerably but it also has to be repurchased, usually under the same low volume conditions. I think there are more liquid targets for the shorters, such as Calibre Mining and Pure Gold, which have been pounded down without mercy.