Novo: Egina Probabilities

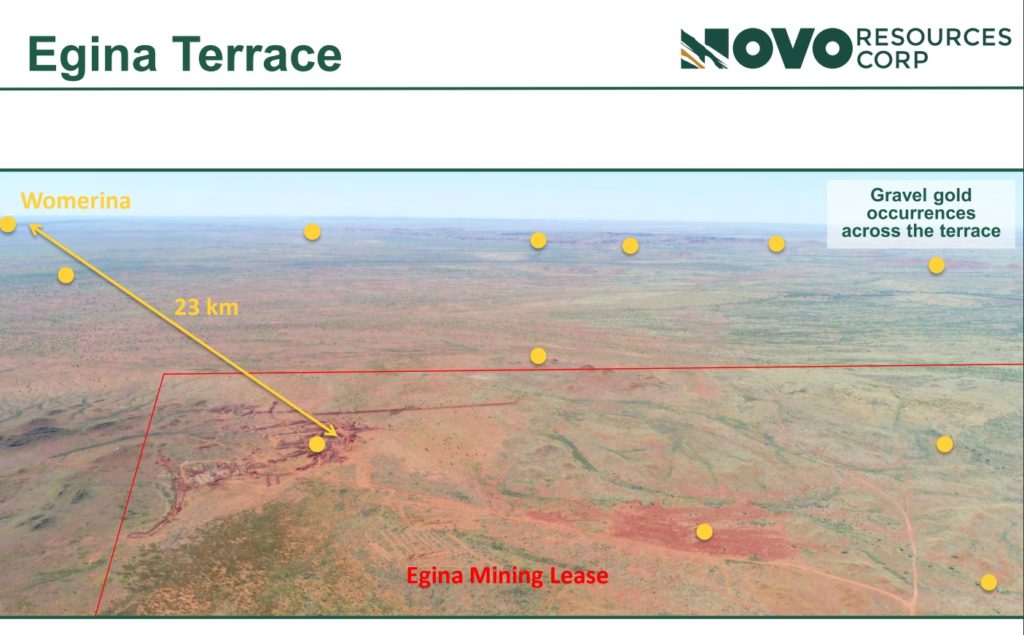

How much has the chance of success and value of success gone up for the Egina area of the Greater Terrace in light of these point(?):

- “The grades… They look robust right now… We don’t lose a lot of sleep there OK” – Quintin Hennigh, May 27

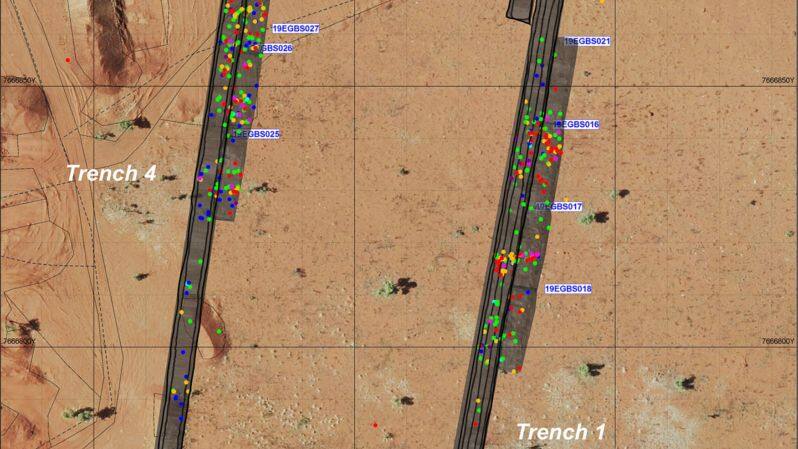

- “We are not really seeing any… quote on quote dead areas at this time… We get gold in virtually every single MAK sample we take… Alluvial deposits, yeah, they average about 0.2-0.3 grams… That’s our lowest grade..” Quinton Hennigh, May 27

- Hiring of Chris Mardon:

- “Chris Mardon has expertize in mining of this style” – Quinton Hennigh, May 27

- “He also has expertize in using mechanical sorters” – Quinton Hennigh, May 27

To sum up:

- Grades: Grades look robust

- Continuity: Not seeing any dead areas (yet at least)

- Technical: Hired a mining expert with experience from mining this type of style as well as use of mechanical sorters

The Egina thesis is quickly translating into reality, in a very good way, on all fronts. If the ore sorting results translates into the field then we can start checking the extreme MARGINS box as well. Personally I don’t see a reason why the ore sorters wouldn’t be able to perform well given that direct sorting of metals is not a new concept. It’s just new to the mining business since no one has a deposit that allows for it like Novo’s lose gravel deposits in Pilbara.

Note: This is not investment advice. Always do your own due diligence. I am not a geologist nor am I a mining engineer. This article is highly speculative and it’s just my opinions. Novo is my largest position and the company is a banner sponsor.

Best regards,

The Hedgeless Horseman

Follow me on twitter: https://twitter.com/Comm_Invest

Follow me on CEO.ca: https://ceo.ca/@hhorseman

Follow me on Youtube: My Channel

HH,

I’m fairly recent to the junior minor space, less than a year in. Regarding this space in general and Novo in particular, would it be reasonable to say?:

– investors are very happy to thrilled with a 10-bagger;

– investors are thrilled to ecstatic with a 100-bagger; and

– Novo, even with its current CAN $613M market cap, is a potential 1000-bagger.

Not that it’s guaranteed or anything of the sort, but the math seems to suggest that the upside potential with Novo is a gold MAJOR worth an order of magnitude more than Barrick, per https://www.statista.com/statistics/799761/gold-mining-companies-market-capitalization/

Almost beggars belief!