New top 3 holding: Valore Metals (VO.V)

Valore Metals (VO.V): My Latest “Special Situation” Case

I have spent the last few weeks looking through countless of juniors for the best of the unloved, misunderstood and/or unknown stories that are undervalued. The by far most promising case I could find is Valore Metals. It’s basically a re-structured “hybrid” company with three flagship assets involving different commodities, now with a focus on PGM (Valore doesn’t even have a new presentation out yet!). It’s headed by Jim Paterson and is part of the serially successful Discovery Group of companies (Kaminak [Sold], Northern Empire [Sold] & Great Bear Resources etc). I personally had a great experience with Jim Paterson in Northern Empire which was a top pick of mine in 2017. It’s newest acquisition tipped the scale for myself which I will expand on later in the article.

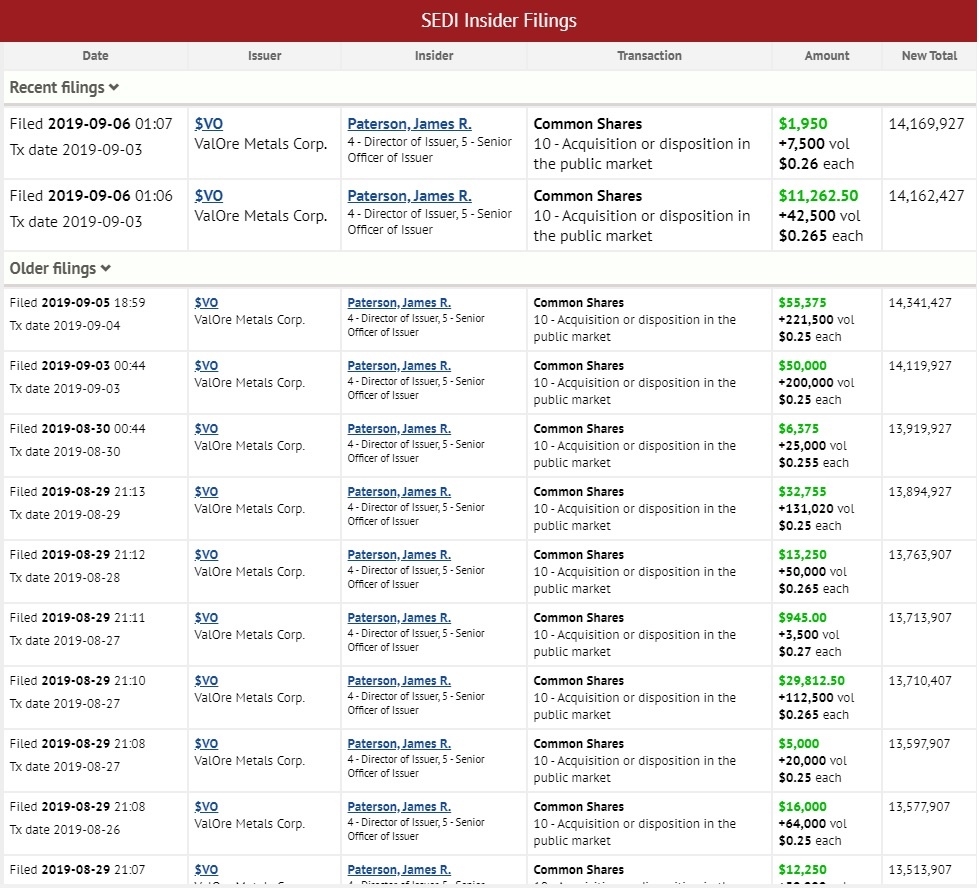

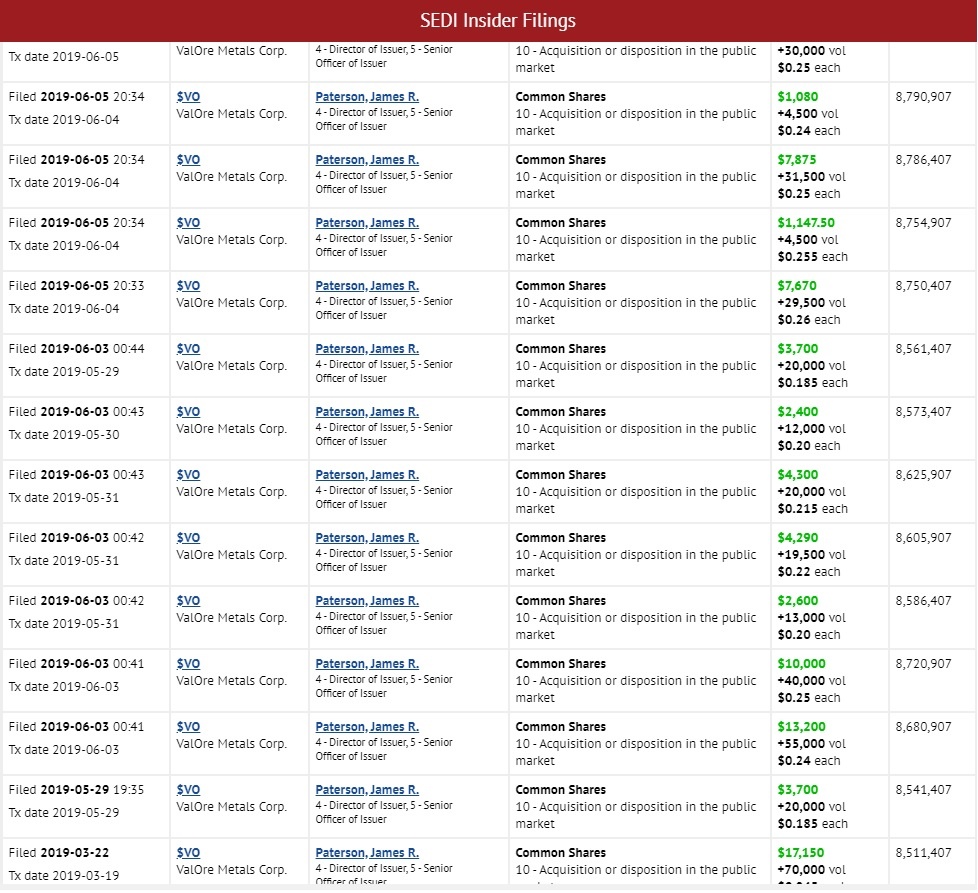

This pictures below is what compelled me to dig deeper into Valore Metals (Basically the same reason that made me take a closer look at Northern Empire back in the day):

… Ps. I could have included several more slides with insider buying but I think you get the idea.

Valore Metals in short:

- Key People

- Jim Paterson, Chairman and CEO

- Kaminak (director), Northern Empire (founding director), Bluestone Resources (director) & Corsa Capital (founder)

- Strategic Advisor to Great Bear Resources, Genesis Metals, Dunnedin Ventures & Ethos Gold

- Discovery Group Principal

- John Robins, Special Advisor to Board of Directors

- Co-founder of Hunter Exploration, Kaminak, Stornoway Diamon, Northern Empire, Bluestone Resources & Fireweed Zinc

- Executive Chairman to Bluestone Resources, Fireweed Zinc & K2 Gold Corp

- Strategic advisor to Great Bear Resources, Genesis Metals, Dunnedin Ventures & Ethos Gold

- Co-founder and Principal of Discovery Group

- Jim Paterson, Chairman and CEO

- Flagship Projects

- Pedra Branca, Brazil

- 38,940 hectares

- Hosts five distinct PGM+Au (Ni+Cu+Co+Cr) deposit areas

- A maiden NI 43-101 inferred resource estimate of 1,067,000 ounces PGM+Au in 27.2mt grading 1.22 grams PGM+Au per tonne

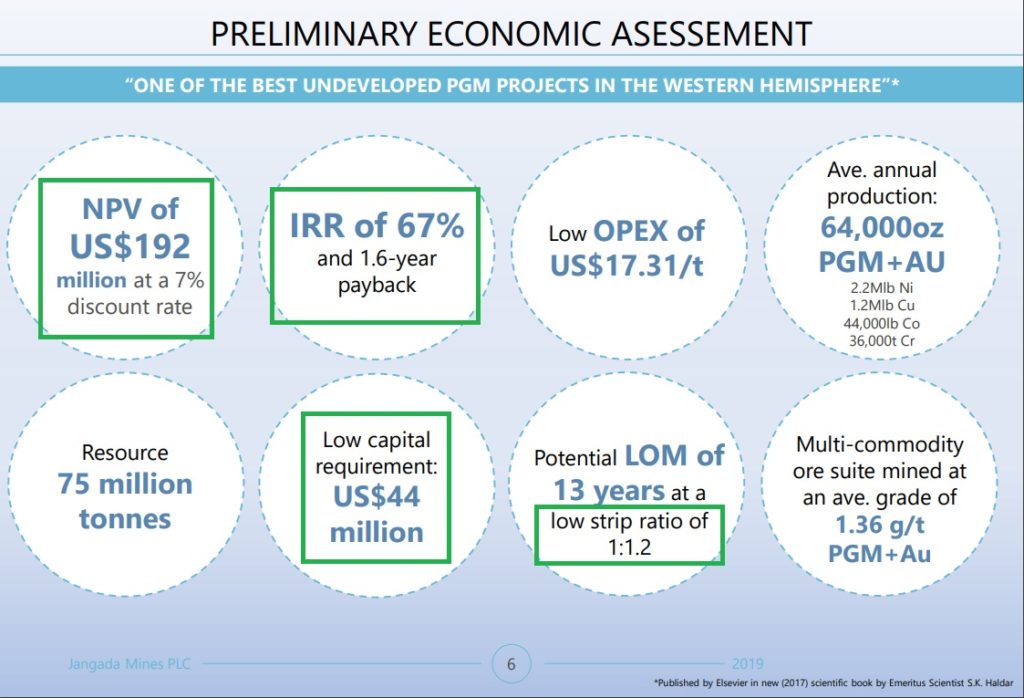

- PEA Study (Based on JORC so treated as “historic”):

- NPV (@7% discount) : US$192 M (Based on a Palladium price of US$1,080/oz)

- IRR: 67%

- Payback: 1.6 years

- CAPEX: US44 M

- Angilac, Canada

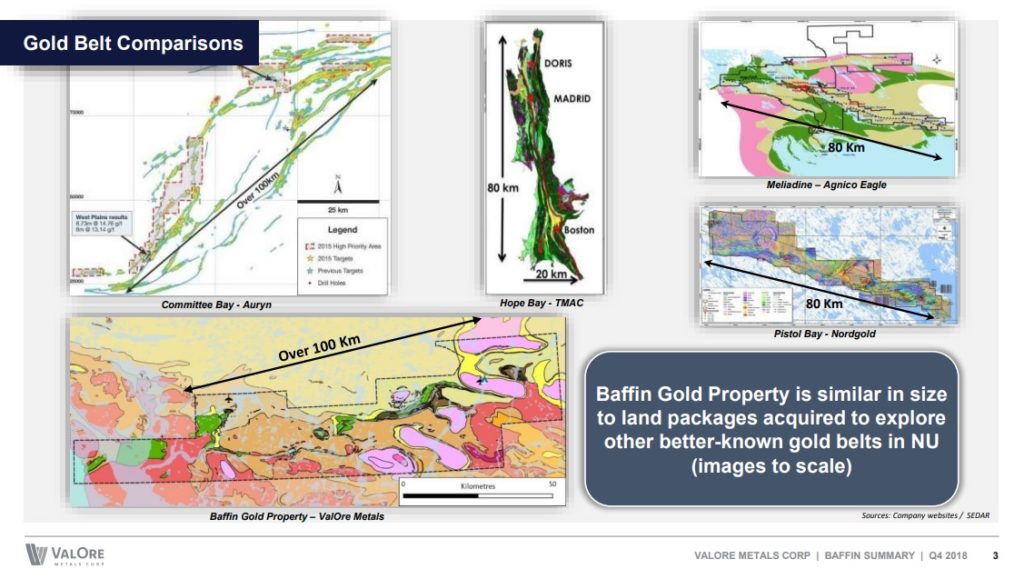

- Valued at around C$90 M at much higher uranium prices (but back then the resource was much smaller)

- Optionality play on uranium

- $C55 M invested in the project

- Baffin Gold District, Canada

- Enormous but early stage gold project

- C$25 M invested in the project

- Pedra Branca, Brazil

Setting The Scene

Valore Metals part 1

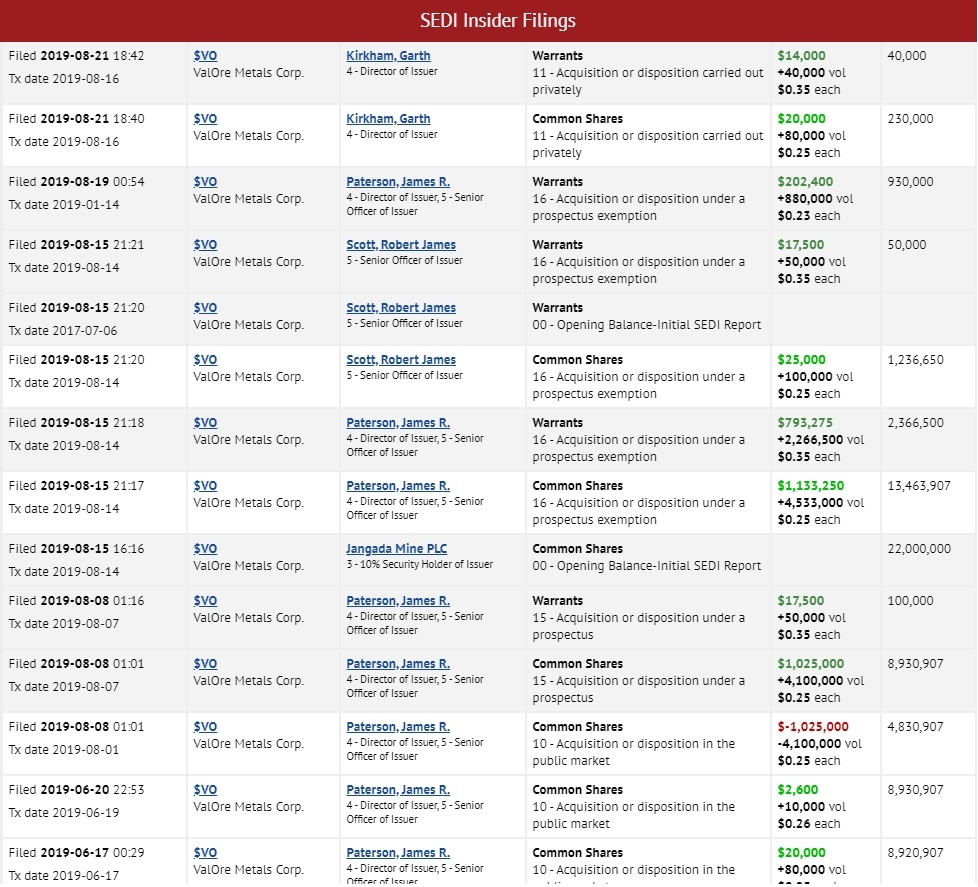

Valore Metals (“Valore”) started out as an uranium explorer called Kivalliq Energy in 2010 and primarily worked on their 105,280 hectare flagship property called “Angilak” which is located in Nunavut, Canada. The company plowed ahead with aggressive exploration programs with a lot of success and the value of the company climbed higher and higher right up to the Fukushima disaster which market the end of the uranium bull market:

As you can see in the slide above, the company was swimming upstream due to the deteriorating uranium price while spending tens of millions of dollars on proving up their Angilak project. In total, the company invested C$55 million in Angilak and within a few years the project had turned into Canada’s highest-grade uranium resource outside of Saskatchewan, and one of the highest grade uranium resources on a global basis.

Angilak in short: A 105,280 hectare property which hosts a NI 43-101 Inferred Resource of 2,831,000 tonnes grading 0.69% U308, totaling 43.3 pounds of U308.

Now I won’t even pretend to know much about the uranium market or what the value of the project is worth today but I know the company valuation preached a peak around C$90 M, after the Fukushima disaster, and with a 37% smaller resource number than today. Uranium was however trading quite a bit higher. When uranium prices continued to fall and the company pulled in the reigns, the company’s valuation fell through the floor. With that said, I think it is noteworthy that a) C$55 M has been invested in the project , b) the company valuation hovered around C$15-C$20 M when the uranium sector was dead and buried, and c) The company was purely focused on uranium at the time with one flagship asset. Lastly, the company also has direct interest in two large claim blocks in Saskatchewan’s Athabasca Basin.

For simplicity’s sake, let’s be very conservative and assign a rock bottom value of US$10 M for Angilak and the rest of the uranium projects in the Athabasca Basin in light of the rock bottom price of uranium. These assets could basically be seen as an optionality play on uranium.

Valore Metals Part 2

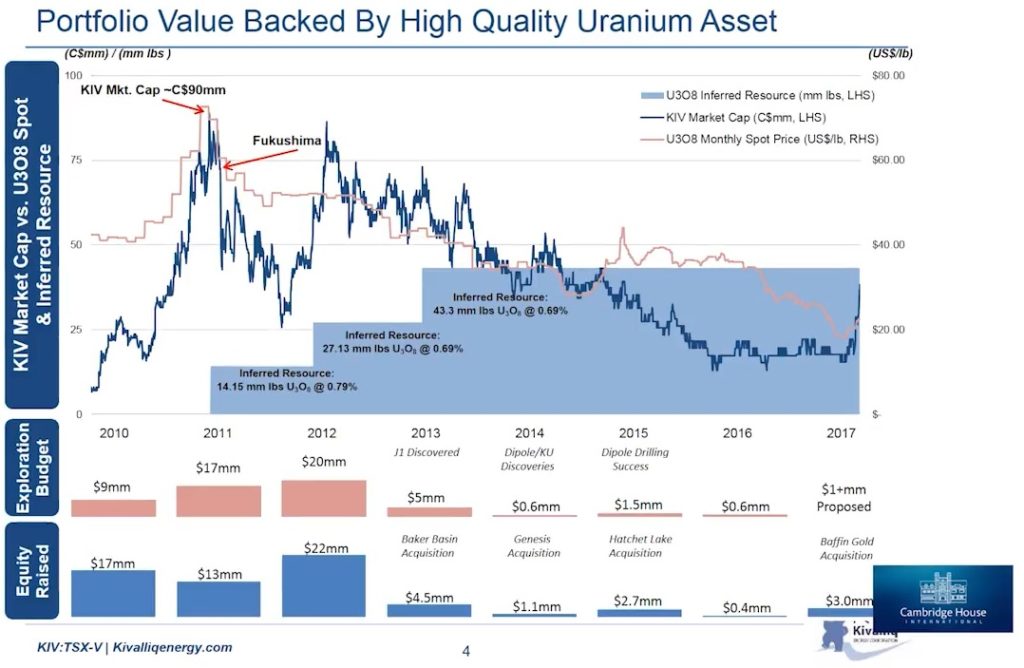

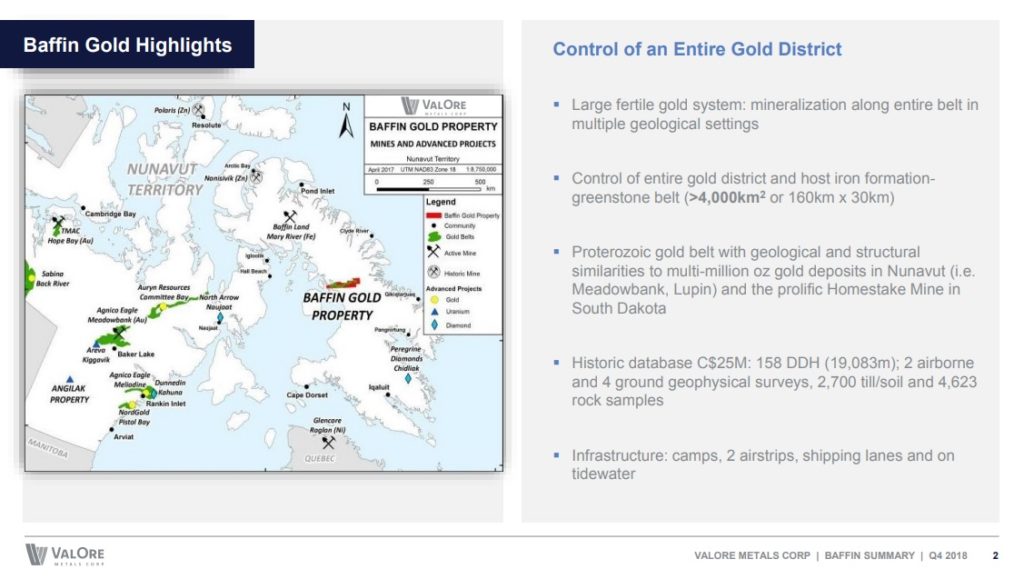

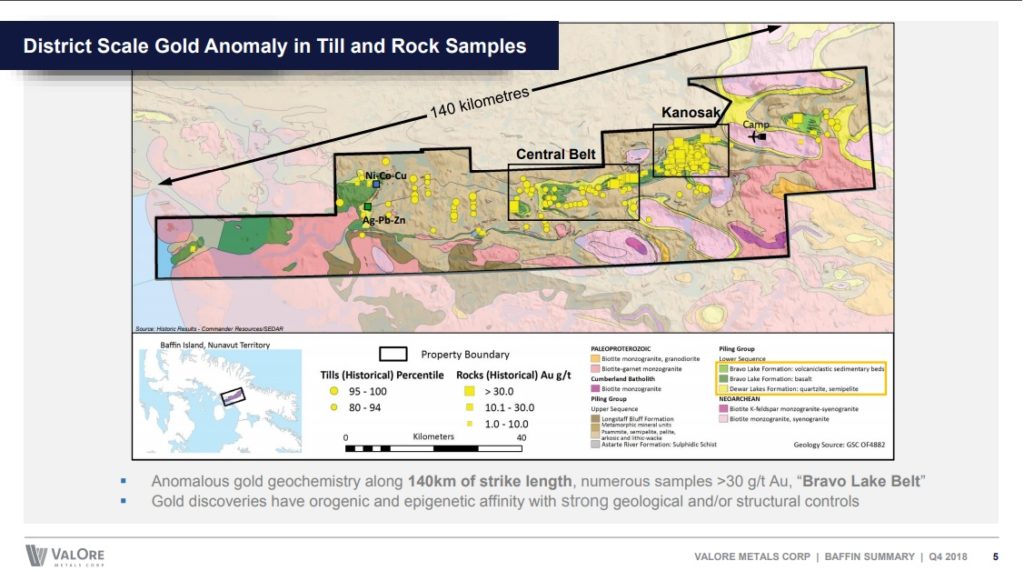

With an obliterated uranium market and a more favorable gold price, the company decided to pick up the Baffin Gold Project in 2017. It’s a giant 408,981.6 hectare property that covers an entire gold belt and is located in Nunavut (HH: synergies):

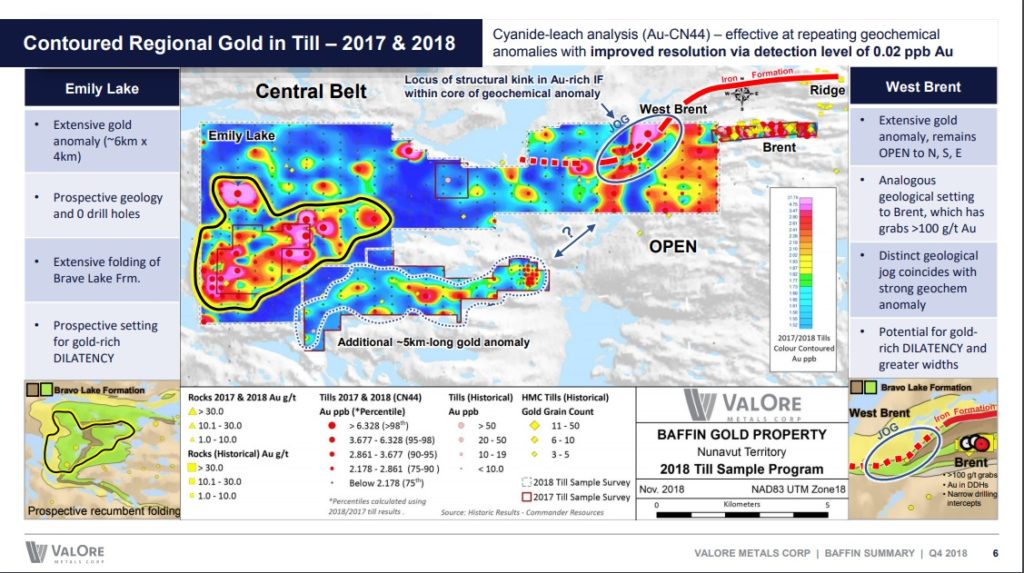

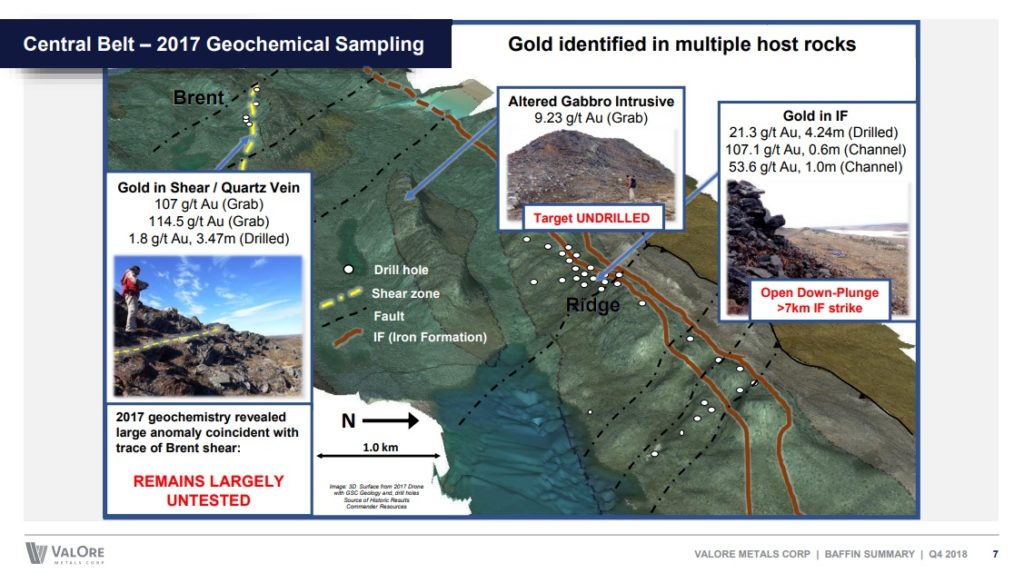

The Baffin Gold Project is very early stage but it came with a historic database worth around C$25M and there seems to be gold (and high-grade at that) all over the place:

There are more slides in the Baffin Gold Presentation document which can be found HERE.

For simplicty’s sake, let’s assign a value of US$5M for the Baffin Gold District.

Anyway, lets look at the most recent (and most important) development, that made Valore go from interesting to a possible no brainer in my view…

Valore Metals part 3: “The Steal”

On May 29 it was announced that Valore were to acquire the Pedra Branca PGM District in Brazil from Jangada Mines PLC. Jim Paterson who had already been steadily buying shares in the open market, continued to vacuum up shares as soon as that NR hit, and has been buying every since up until today basically:

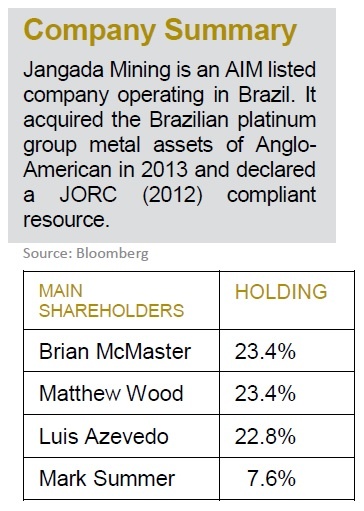

… Jim Paterson sure seems to think that the intrinsic value of Valore went up substantially with this (pending) deal. The acquisition which was finally closed as recently as August 15 involved cash payments of C3,000,000, 25M of Valore shares to be issued to Jangada (representing 26.1% interest in Valore) as well as the right to appoint two board members. This kind of deal suggests to me that Jangada is well aware of the value of Pedra Branca and wants to have keep a substantial stake in the project. In fact, the deal in itself was worth much more than the Market Cap of Jangada. All this is what made me take a closer look on this “Pedra Branca PGM District” project. Long story short, I think Valore was able to steal a real gem thanks to Jangada being listed on AIM…

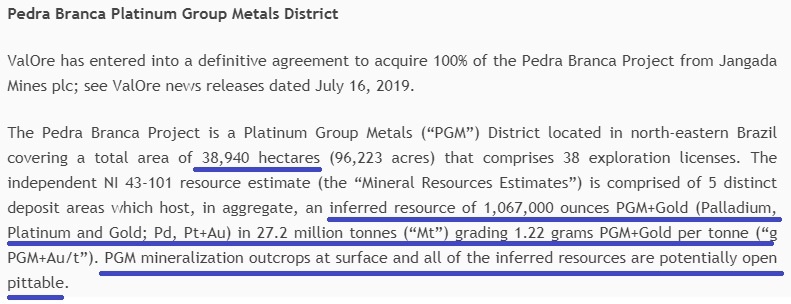

On July 24, Valore filed a 43-101 Technical Report for Pedra Branca PGM project. Main takeaway from the report:

1Moz of near surface 1.22 grans PGM+Gold per tonne is obviously fantastic, but the rabbit hole goes much deeper:

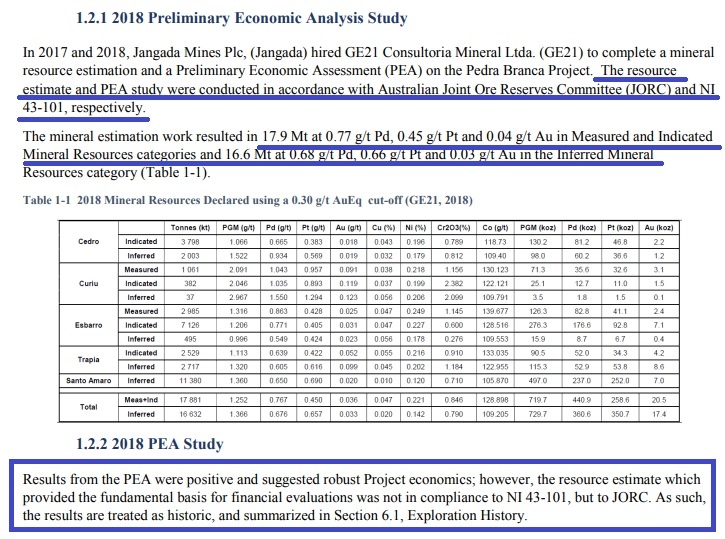

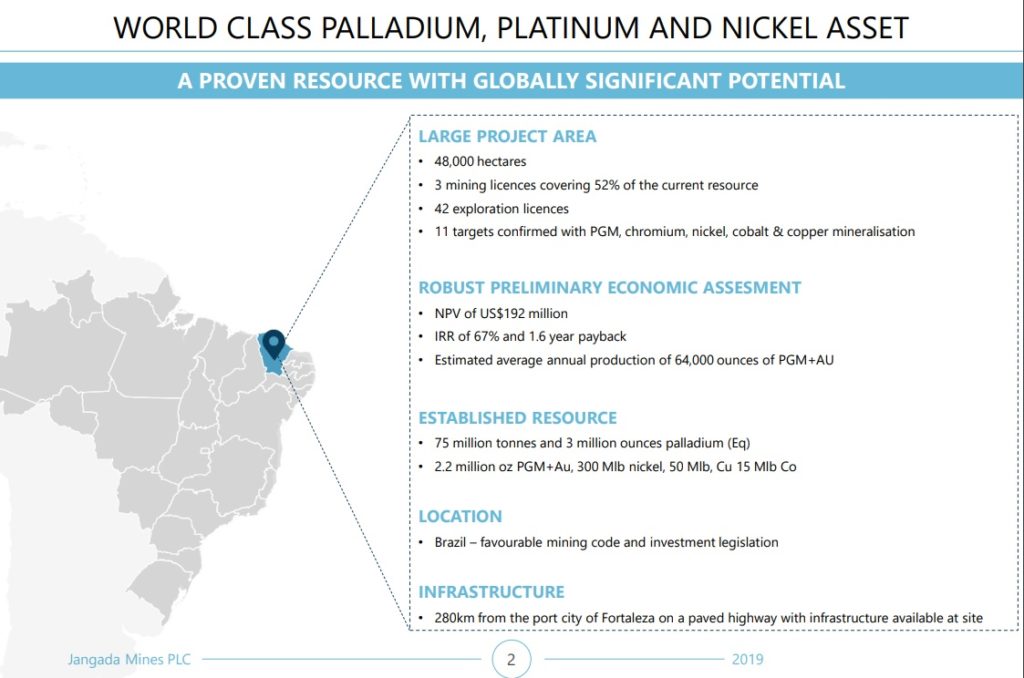

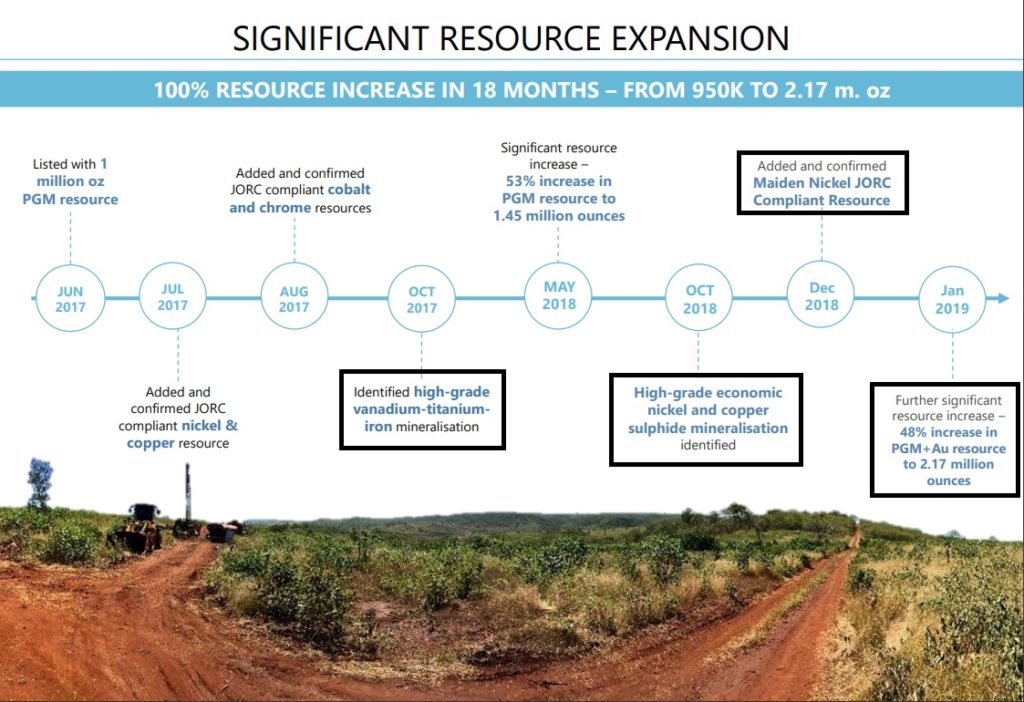

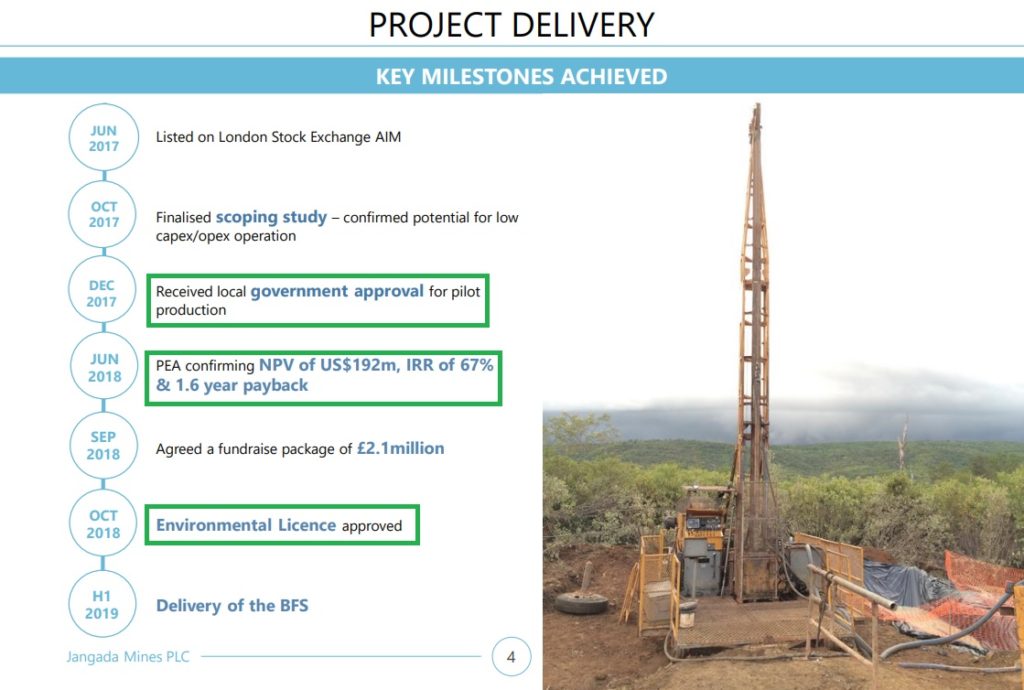

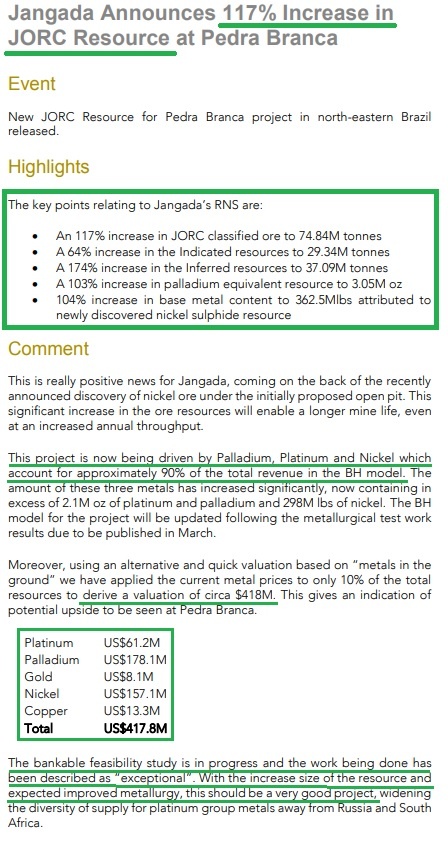

Jangada had a much larger polymetallic JORC-resource on paper as well as a PEA, but since it wasn’t all done with canadian reporting standards, Valore can’t really use it. But let’s take a look at the JORC numbers and some slides from Jangada’s presentation:

So the Pedra Branca Project is a) quite de-risked, b) high-grade, c) near sruface, d) polymetallic, and e) possibly much bigger than Valore was allowed to put on paper.

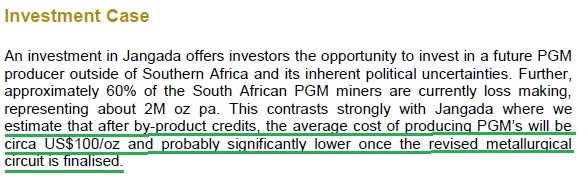

Let’s look at some of the things that Brandon Hill Capital (“BHC”) had to say about Pedra Branca in their initial coverage report.

First of all, Jangada’s insiders had a lot of skin in the game to say the least:

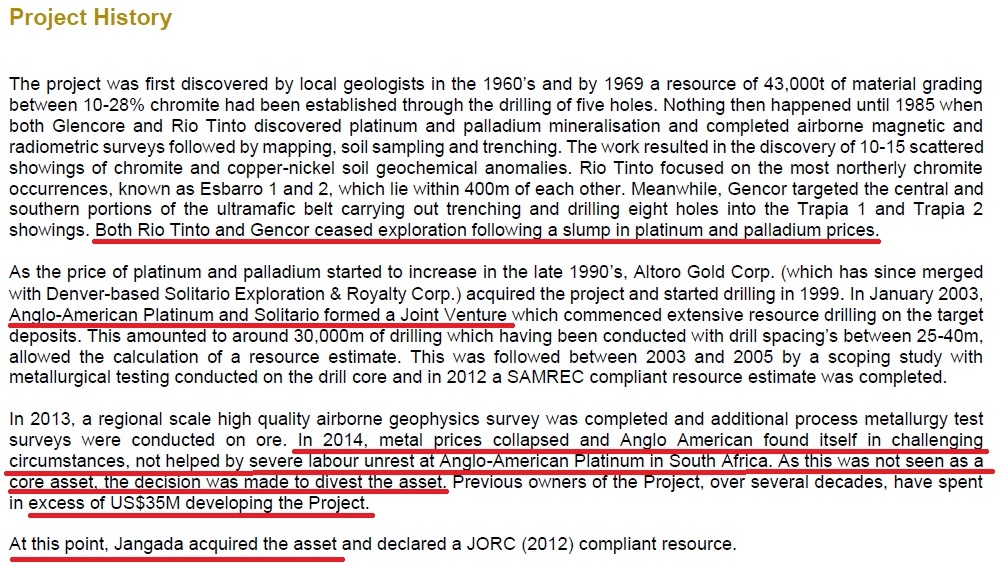

Glencore, Rio Tinto as well as Anglo-American Platinum have all worked on the project, but all stepped away when prices slumped:

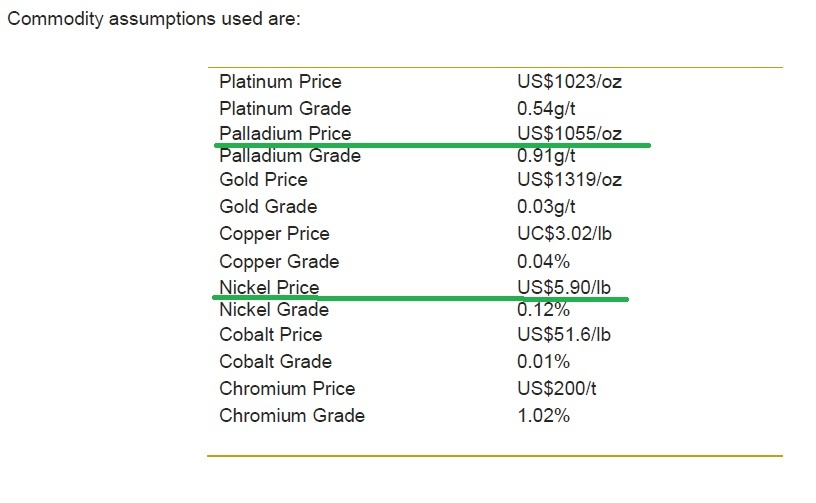

It’s worth noting that Palladium, which is the main commodity, traded at around US$750/oz at the time Anglo-American stepped away and Jangada purchased the asset. Since that time the resource has gotten a lot bigger and more metals have been included.

Lets start with the most recent PEA based on a JORC-resource (not usable by Valore):

Commodity assumptions used:

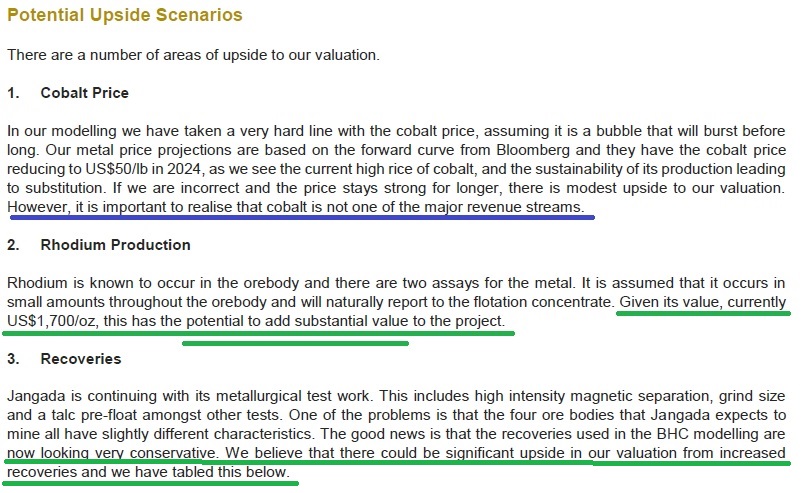

What stands out is that the Palladium price today is over 40% higher ( US$1,540/oz) and nickel is trading at around US$8/lb. This next slide is also quite interesting given the fact that Rhodium is currently trading at US$4,380/oz (!):

That obviously leaves even further upside potential to the already extremely good looking economic numbers. Cobalt has crashed as was expected in the report, but since cobalt is a tiny fraction of the production scenario, the impact is said to be modest.

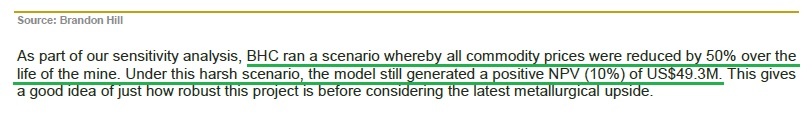

What’s also extremely encouraging is that according to BHC, the project economics are EXTREMELY robust (even with a 10% discount rate):

Since the release of the PEA numbers, a lot has happened as per an update from Brandon Hill Capital in January 2019:

I have actually been on the look out for some nickel plays but I guess I won’t need it since I might get it with Valore anyway.

These are some snippets found in news releases tied to the developments at Pedra Branca:

News Release: “117% inrease in JORC Resource at Pedra Branca Project”

“Clearly today’s announcement is a significant step forward for Jangada. We have been working with a highly skilled team on the BFS work, which has identified significant increases in grade and classification that will help form extremely exciting inputs to the BFS model. Investors can now see that labelling this a ‘PGM project’ doesn’t do it justice; it is clearly much more than that. The key economic drivers of the Project are palladium and nickel, two of the most in favour minerals of today and for the foreseeable future. Additionally, the increase in resource size will potentially drive a longer mine life and higher annual tonnage, all of which are positive developments. The work being done to finalise the BFS and prepare the Project for development is exceptional and the results are coming through better than expected.”

“Minxcon’s review included a complete rebuild of the resource geological, structural and estimation models. This updated resource estimate and resource classification are the inputs that will form the foundation for the BFS. Given the reclassification of much of the ore body to Measured and Indicated and the substantial increase in resources size, coupled with the expected significant decrease in capital expenditure requirements (as announced 12 November 2018), the Company anticipates that the economic viability of the Project will be further amplified beyond that disclosed in the Preliminary Economic Assessment (‘PEA’) announced 18 June 2018.“

News Release: “Preliminary Economic Assessment Confirms Economic Potential of The Pedra Branca PGM Project”

“Brian McMaster, Executive Chairman of Jangada said, “Pedra Branca is a truly exciting polymetallic project. With an estimated NPV of US$192 million, an IRR of 67% and a payback of just 1.6 years, the PEA underlines the significant upside and economic potential of the asset. The scope is for an average production of 64,000 ounces per annum of PGM+Au, with significant credits from technology metals including 2.2 Mlbs of nickel, 1.2Mlbs of copper, 44,000 lb of cobalt and 30,000 t of chrome. Having a project demonstrating such excellent potential for returns in an established mining jurisdiction that has strong legislative stability makes this an extremely compelling proposition.”

“Preliminary Economic Analysis

The Board elected to produce a PEA to update the market on the Project’s scope and economic potential given the improving Project metrics generated from recently completed and ongoing work. This work included adding 11Mt of mineable resource and 500,000 oz to the PGM+Au JORC resource and a successful metallurgical test programme, which demonstrated that the inclusion of magnetic separation would significantly increase recoveries of PGM and yield high gold and chrome grades in pre-concentrate. “

“The Board believes that a Pre-Feasibility Study (‘PFS’) would be premature without due consideration for these newly discovered aspects, which have not yet been incorporated into the current designs and would result in an underrepresentation of the Project’s potential. The PEA, therefore, outlines the main factors relating to the potential development of the Project and gives the Board comfort to proceed expeditiously with further work. “

News Release: “32% Reduction in Total Capital Expenditure and Updated Process Flowsheet”

“Brian McMaster, Chairman of Jangada, said: “Pedra Branca is the largest and most advanced PGM project in South America and the Jangada team has already demonstrated its potential to generate material returns to investors once in production. Today’s refinement and optimisation of the process flowsheet has delivered an impressive 32% and 38% reduction in plant capex and overall capex, respectively, further enhancing the Project’s potential to provide lucrative returns. As such, we are delighted with today’s result, which is primarily a result of Consulmet’s highly specialist experience in building PGM plants. The team from Consulmet have hit the ground running and their experience and understanding of projects such as Pedra Branca is coming to the fore.

“As we extrapolate the revised capex number into the already robust economic model, the financial merits of Pedra Branca will simply get stronger. Importantly, the revised process flow sheet has demonstrated a simpler and more efficient process route. We anticipate that this will reflect in reduced operating cost metrics that will feed into the ongoing BFS.“

On that note, this slide below is from the original BHC report:

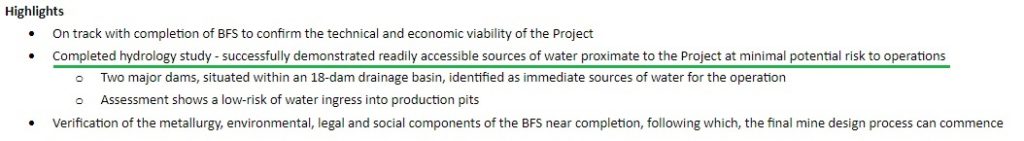

… And that was before nickel and rhodium began to skyrocket. Even more de-risking has been taking place such as the completion of an Hydrology Study in April of this year:

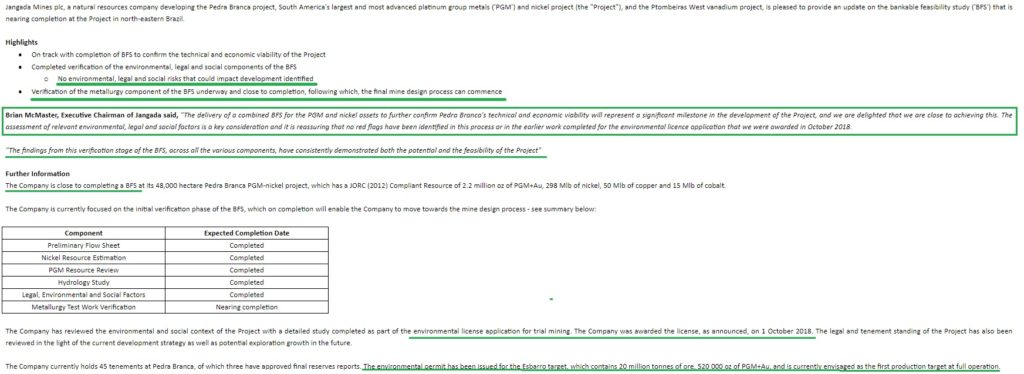

… And the completion of a Social, Legal and Environmental Review:

My guess is that Jim Paterson and the Discovery Group understood what was happening (A coming BFS that was expected to be even better than the already extremely robust PEA) and decided to “steal” this project before those developments were put in black and white. Given the Discovery Group’s connections and ability to raise capital I assume that the insiders (and main shareholders of Jangada) appreciated the potential of this project in the hands of such a team and on a much better exchange, and thus decided to sell the project but keep a major interest in it through shares of Valore as per this news release:

News Release from May 28: “Proposed Disposal of the Pedra Branca Project”

“Rationale for the Proposed Transaction and Future Focus on Ptombeiras

The Board of Directors of Jangada are aware that this announcement may come as a surprise to some shareholders and seem to be conflicting with the Company’s promoted views of the technical and economic prospects of Pedra Branca. This is not the case. The Board continues to believe very strongly in Pedra Branca and its prospects, which is evidenced by Jangada remaining a substantial shareholder of ValOre going forward, and the appointment of two Jangada nominees to ValOre’s board.

Since the Company’s IPO in June 2017, the Jangada Board has found there to be limited support in the UK financial markets for financing a PGM project. The support that Jangada has experienced is diametrically opposite to both the independent experts’ value of the underlying assets and the level of support given to projects with similar asset suites on other bourses. Notwithstanding Jangada’s success at developing its two projects, the UK financial markets have not responded as expected. The Jangada Board believes that Pedra Branca will continue to develop strongly as a project, but, in order to continue that development, the project requires stronger financial market support, which the Jangada Board believes ValOre will experience in Canada. It is for this reason that Jangada has made the decision to proceed with the Proposed Transaction which will see ValOre raising finance to continue the development of Pedra Branca and allow the Company to maintain an interest in a project that will be funded through to its next stage of development.

Recognising the difficulties of financing PGM projects in the UK markets, since October 2017, the Board has increasingly focused its efforts on proving up the vanadium potential of Ptombeiras, and on 5 February 2019, reported the results of its vanadium drilling campaign, which confirmed the presence of a high-grade deposit with the potential for significant resource delineation.

The Board believes there is a strong appetite amongst UK and international investors for vanadium as an asset class, primarily driven by its importance as an input to battery metals, and assuming completion of the Proposed Transaction, the Board considers that it’s in the best interests of shareholders to focus the Company’s resources on pursuing the development of Ptombeiras. In the near term, this would involve further drilling and metallurgical work, the results of which would then dictate the path forward for development. A NI 43-101 compliant CPR is already underway, which is expected to be completed by the Company during Q3 2019. The Proposed Transaction includes a cash consideration component allowing Jangada to substantially progress the development of Ptombeiras.”

It must be pretty bitter sweet for the Jangada insiders who were able to “steal” this project and advance it significantly in multiple ways, and then be “forced” to hand over control due to a clueless AIM market. I love “new” stories, where the market has yet to catch up and has yet to appreciate the value of an acquired asset (just like Northern Empire). Valore just added around US$192M+ of value and it’s still trading around the same valuation levels as it did when it had one flagship project, and was tied to a single, poor performing commodity.

There is literally pure grass root exploration companies out there that are trading at higher valuation levels than Valore.

Summing Up

Valore just bought a very advanced high-grade, near surface polymetallic 48,000 hectare project that was about to deliver a BFS study for peanuts. On a JORC-basis, Valore acquired a project worth US$192 M (which was based on a palladium price of US$1,050/oz), with preliminary indications that it could produce PGM metals at $100/oz (before metallurgical improvements and the rise in nickel and Rhodium etc) and which did not account for a preliminary 38% reduction in CAPEX to the low level of US$44 M. Keep in mind that the original NPV was based on a 7% discount rate as well (unlike most who use 5%).

So what might the intrinsic value of Pedra Branca be if a) that 117% increase in JORC-resources would end up in a production scenario, b) accounting for the rise in nickel (which looks to be a big value driver) and rhodium etc?, and c) accounting for the 38% decrease in overall CAPEX when the base case is already at US$192 M?

I mean just think about it: A 1.26 PGM+gold grams per tonne deposit that starts at surface with possible SIGNIFICANT base metals credits.

Now, given that Jangada used JORC for their resource modelling, Valore can’t use their full resource numbers or the “historic” PEA without more work. With that said, the current inferred JORC resource sits at 3.05 Moz of PdEq with a lot of base metals and the PEA was based on 27 million tonnes of run-of-mine ore (same tonnage as the new 43-101 resource)

The heart of the matter is that Pedra Branca has been worked on by three majors and is now a very advanced and much bigger project. The main insider is loading up like crazy up to the 0.265 level and the accumulation/distribution line is steadily climbing. My guess is that Jim Paterson is trying to accumulate more but also hoping not to have the SP breaking out of a possible cup-and-handle pattern and/or the 0.30 level since that is the last line in the sand. Well, he might be running out of luck:

Based on the sum of its parts, I would say Valore is the best “new” case since I found Gatling Exploration. It’s perhaps even better than the case was for Northern Empire, and both of those performed very well.

Assets

- Angilak + Genesis + hatchet lake = US$10 M?

- Baffin Gold District = US$5 M ?

- Pedra Branca = US$192++ M ??

Current Valuation for Valore (basic) = C$23.8 M = US$18 M

… So the current valuation only reflects say US$3 M of Valore’s new flagship asset which I obviously think is bonkers.

… What’s the downside?

… What’s the upside?

I have no idea, but I reckon that Valore is extremely undervalued given that it’s trading around the same levels as it did when it ONLY had the uranium assets. Who knows, maybe the PEA will prove to quite correct and that the multiple developments since then will prove to be somewhat correct. Are we then talking about a PGM producer with cash costs at sub $100/oz with a value of around US$400 M or whatever? I dunno, I just know that if the preliminary (JORC) work done by Jandaga is even in the ball park of being accurate then this advanced asset would be worth multiples of Valore’s current Market Cap and I guess insiders from both Valore and Jangada agree given their actions. I couldn’t find any red flags at least and insiders seem to have a very high conviction so that’s good enough for me. Especially since the company is priced like they didn’t have such a good looking deposit.

These special situations (under the radar corporate transformations) does not come around often, but it happened with Northern Empire and it happened with Gatling Exploration which were two brand new and un-followed companies flying under the radar. Northern Empire was a totally different company after it acquired the Sterling property and Gatling Exploration was a completely new company as it was spun out of Bonterra. I would argue that Valore is a completely new company with the acquisition of Pedra Branca and the market has yet to pick up on that fact. It is also the most advanced and possibly the most valuable of the three.

If the preliminary economics from Jangada are correct, the metal prices could pretty much go to shit, and the project would still work. If the metal prices does not go to shit, it might be one of the lowest cost miners in the world. This is all assuming that the preliminary work proves to be fairly accurate and that Valore is able to put it into a production scenario of course!

Given the legacy projects owned by Valore I would argue that the margin of safety and thus Risk/Reward is incredible. If uranium prices kicks off, then Angilak might be worth a lot more than the current Market Cap for example. All in all, not much upside in either project is reflected in Valore’s valuation and I reckon I almost get most if not all of the upside from Pedra Branca for free at these levels. I am personally very long (and so are some family members) and I am therefore biased and I don’t plan on taking some money off the table until it’s trading at least 50% higher or so, but it looks like a “no brainer” to me at THESE LEVELS. Do your own due diligence!

THERE ARE NO GUARANTEES ONLY RISK/REWARD!

(Note: This is not investment advice and I am not a geologist. This article is highly speculative and I can’t guarantee accuracy. Always do your own due diligence. I own a lot of shares of Valore Metals which I have bought in the open market and am thus biased. I have not received any compensation from any entity to write this article.)

Best regards,

The Hedgeless Horseman

Follow me on twitter: https://twitter.com/Comm_Invest

Follow me on CEO.ca: https://ceo.ca/@hhorseman

THH, an excellent synopsis and I am pleased to note that I am not the only one that has recognised the potential with ValOre and Jangada, I sense a few more will as the phase 1 works at PB gather some momentum and Jangada’s CPR for their Vanadium asset is finalised in the next few weeks,

Cheers,

Mark.

I guess I’m the only one still interested in Valore.