Portfolio: New additions

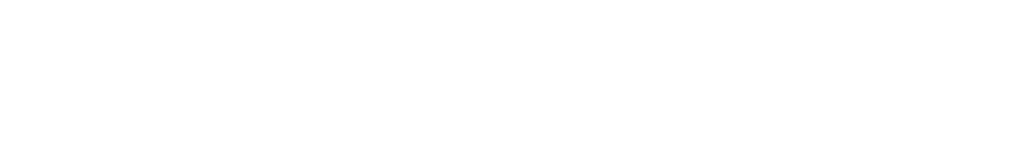

With my main thesis that we are in the beginning stages of a precious metal bull market, my portfolio has a slight overweight towards primary silver companies (although few actually have more than 50% of their revenue from silver at these prices). This focus on silver simply goes with the fact that silver usually out-performs gold on the way up, but of course also under-performs on the way down.

Anyway, I have recently added a few “lottery tickets” in the silver space. These companies are mainly still in the exploration stage and thus carry huge risk. The positive side of micro juniors like these are that 1) Not many buyers are required to make them head higher (or lower) and 2) In an up leg like the one we saw at the start of 2016, the tide usually lifts all boats (and will compound with point 1).

The newly added companies are:

- Arizona Silver Exploration

- Castle Silver Resources

- Bitterroot Resources

Each stake makes up less than 1% of my portfolio as they are fundamentally very risky compared to established companies.

Valuations spreadsheet