Condor Resources: An easy to Test 10+ Moz Target And More

Condor Resources is a tiny junior explorer (C$32 M in Market Cap) that has an impressive portfolio of projects all around Peru. Like Eloro, I barely knew Condor existed before Quinton Hennigh got on board, and I didn’t know why he got on board before I watched his recent presentation and then did some calculations based on what was said.

Condor Resources (CN.V) in Short:

- Ticker: CN.V

- Website: LINK

- Presentation: “Coming Soon.”

- Market Cap: ~C$31 M (~US$24 M)

- Cash: ~C$1 M

- Possible Cash Infusion From Chakana: US$4.975 M over 18 months (C$6.74 M)

- Current Enterprise Value (EV): ~C$30 M (~US$23 M)

- Forward Looking EV With Cash Infusion: ~C$23 M (~US$18 M)

- Condor’s Projects (all in Peru):

- Pucayamo (Current flagship project)

- Cobreorco (Fast tracking towards drill readiness)

- Huinac Punta (Fast tracking towards drill readiness)

- Andrea (Fast tracking towards drill readiness)

- Soledad (Chakana Copper earning in and would have to pay US$4.975 M)

- Quriurqu

- Ocros

- Humaya

- San Martin

- Lucero

- Quilisane

- Management/Insider Ownership: NA

- Major Catalysts (Pucamayo):

- Land Access Permit

- … Then drilling!

Condor Resources does not have a corporate presentation up on their site yet, which I happen to personally like, since it means that fewer people will have been able to wrap their head around the story yet. I certainly know I had trouble wrapping my head around it until Quinton Hennigh presented his case for Condor during the recent “Crescat Gets Activist on Gold” video series:

If that is the only good presentation on Condor and their Pucamayo project in Peru then one can be assured that this story is still pretty much off everyone’s radar. This is of course a good thing because as an investor one wants to “steal” value and get in when something is unknown and undervalued, potentially significantly so, which I will try to explain in this article.

My Simple Case for Condor Resources

I went from having little idea of what the case for Condor was to being totally sold on the value proposition within the span of a week. Before I watched Quinton’s presentation the only thing I pretty much knew about Condor was that the company had a vast portfolio of projects in Peru. After I watched the presentation I started to get the idea of what the value proposition was but when I plugged in some numbers based on what Quinton was saying I almost fell out of my chair. The case for the Pucamayo target and Condor is rather straigthforward thankfully…

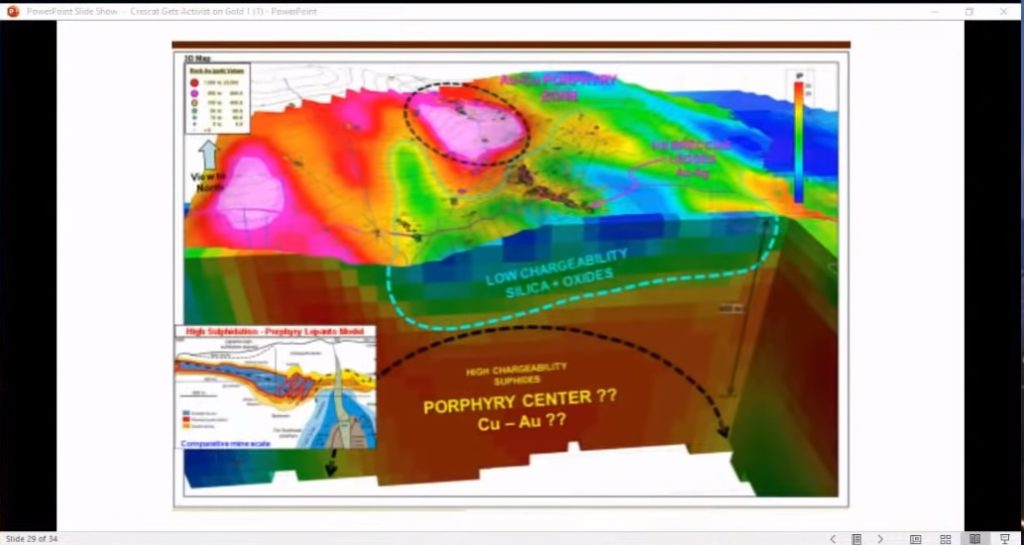

Pucamayo is a near surface high sulfidation epithermal system, that looks to be oxidized, and is potentially very large to say the least.

Digging Into Pucamayo

Potential Competitive Advantages

- Easy to drill

- A blanket type target that is located relatively close to surface across the board

- Disseminated mineralization (not chasing elusive veins)

- Easy to prove up

- A blanket type target that is located relatively close to surface which means that proving up inferred ounces will be a lot quicker than lode gold deposits

- Since it is a blanket type target the drills will only need to move laterally and not need to drill deeper and deeper holes to increase the theoretical deposit

- Economics

- If the target has economic mineralization it could turn into a relatively simple, large and relatively shallow open pit mine

- The target seems to be oxidized

- Easy and quick proof of concept

- One drill campaign should be enough to a) show proof of concept, and b) show the quality of the system

- If they get good hits on the initial target scale from just the first drill campaign then they could go from no deposit to pretty much an inferred monster of a deposit from just the first drill campaign

- Extraordinary good bang for the speculative buck

Consider some of the aspects I just stated above…

A lode gold system can be tricky and expensive to drill. First you gotta find the veins, then you gotta potentially drill to considerable depths (costly) and it’s hard to know if you are on to say a 50 Koz or a multi Moz system. Condor is fortunate to have what looks to be a disseminated high sulfidation gold/silver-silver that shows up like a relatively well defined “blanket” through geophysics. This means that a) They already see the potential scope and orientation of the system and b) The gold and silver should be in a disseminated form which means that it should be easy to hit with the drill (if there is indeed a larger mineralized system below the surface). Just a few drill holes within a 800 x 500 m2 rectangle, drilled a few hundred meters down, could thus potentially come up good and pretty much infer a massive deposit right off the bat. This is not something I can say for most juniors. Examples that come to mind are Osisko Mining and Great Bear Resources who are forced to drill hundreds of thousands of meters (over a million in Osisko’s case) to get a good grip of how much gold they got. This of course takes time and a lot of money. Furthermore, both need to drill to ever increasing depths in order to explore and prove up more gold since their gold bearing targets are sub-vertical to vertical in nature (whereas Pucamayo is a relatively near surface blanket target).

An Example:

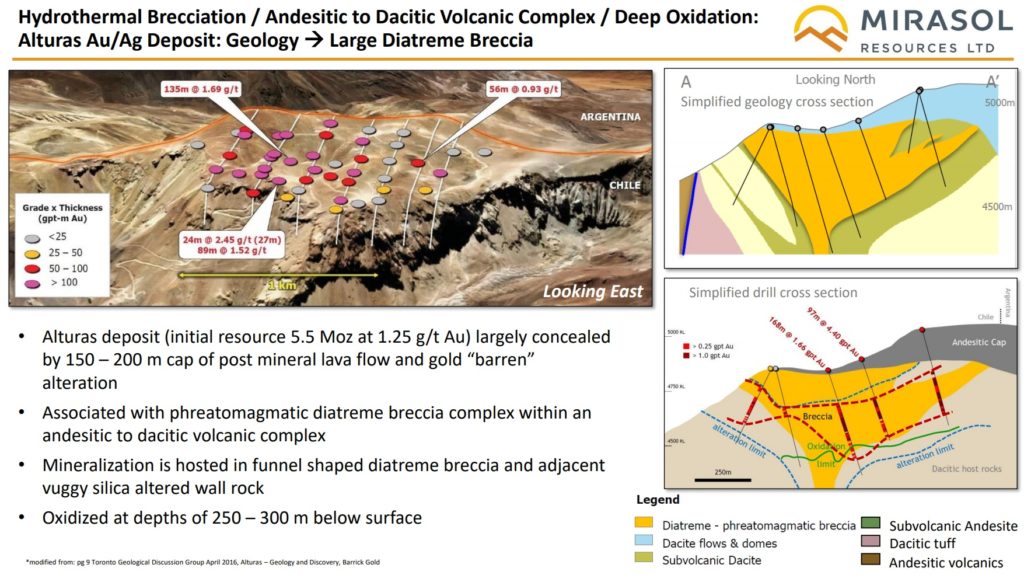

Compare how easy and cheap it is to prove up 5.5 Moz with this kind of deposit:

Compared to this kind of >5 Moz deposit:

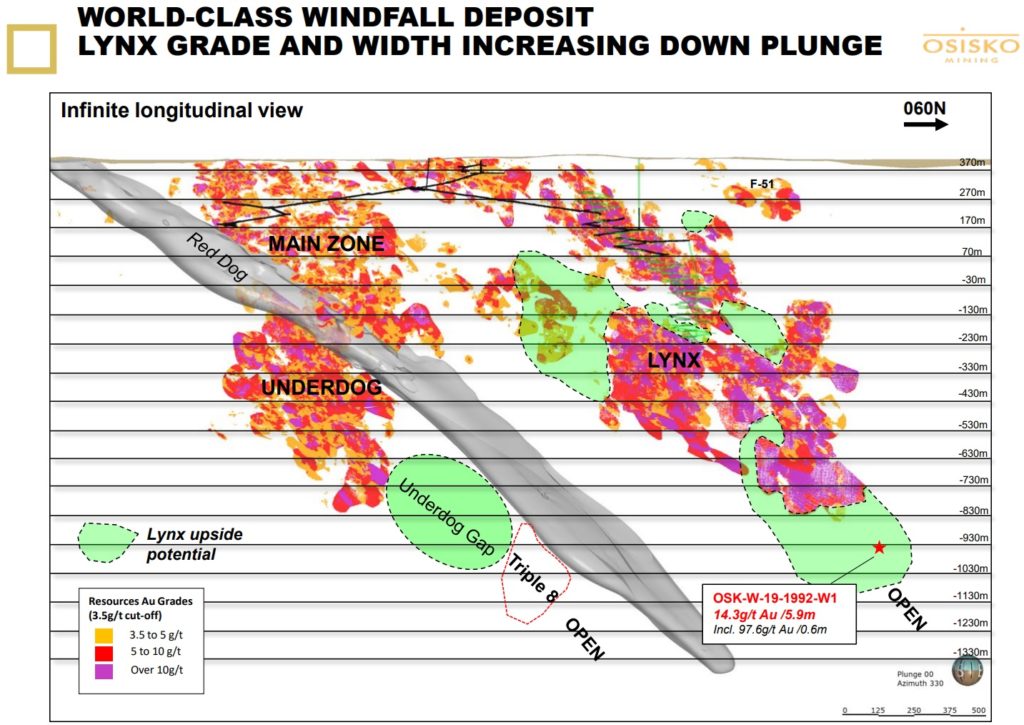

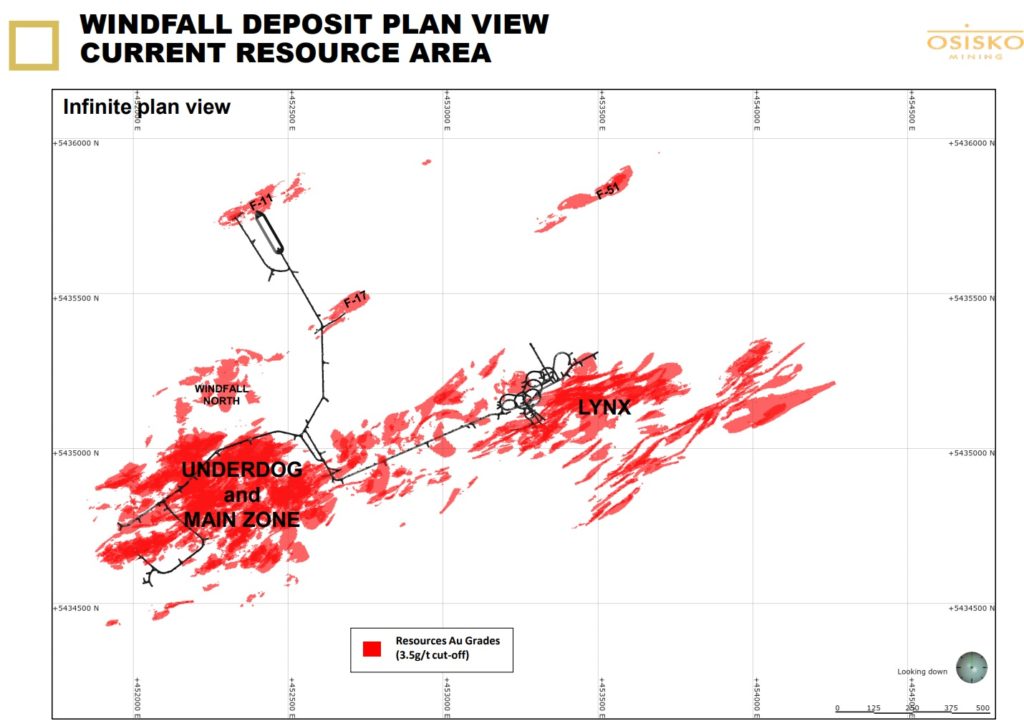

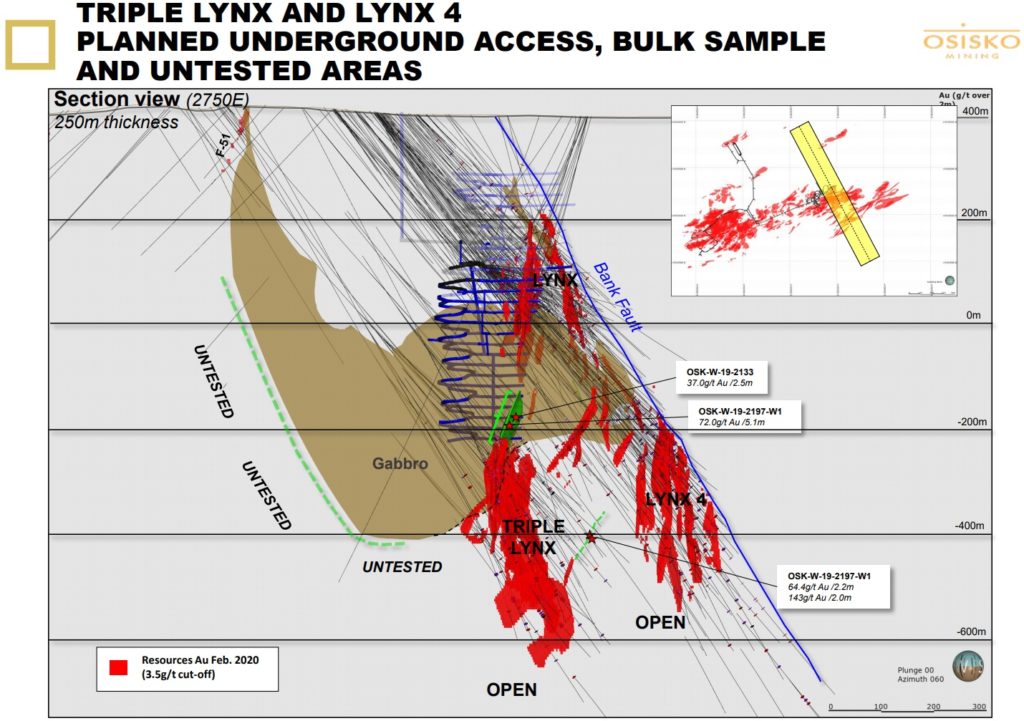

In the first example one could have a pretty good idea of there being over 5 Moz of gold from say 20 drill holes. The latter example took over 1,000,000 m of drilling and hundreds of millions of dollars to prove up:

… Those black lines are drill traces and they are drilling way deeper holes than that today in order to grow the deposit(s). They got a monster but it sure wasn’t cheap to prove and it was not done overnight.

This is why this kind of target that Condor has is a speculators dream. Mainly because it might just take 1 financing (which they just did) and cost peanuts for the company to, again, go from NO DEPOSIT to an inferred MONSTER DEPOSIT. In Osisko Mining’s case it took multiple financings for hundreds of millions of dollars before shareholders could be quite certain that they had an elephant by its tail. Given how expensive it is to drill out a lode gold monster like Osisko Mining’s Windfall Lake deposit, it can unfortunately lead to quite muted returns for shareholders, as evidenced by Osisko’s share price performance relative to its valuation.

Furthermore, if the initial target at Pucamayo proves to be the real deal then that will immediately revalue the potential of the very large area of alteration outside the initial target…

Which means that Condor will have EXTREME leverage on their maiden drill campaign.

Condor and its shareholders might know if they got nothing, something good or an elephant after said maiden drill campaign.

One can’t pretty much not get better bang for the exploration buck. Lets imagine that Condor is lucky enough to hit mineralization, akin to what has been found outcropping at surface, over a 800 x 500 m area with decent thickness and then releases the results in one single NR. In that case Condor would have gone from no deposit (The day before the NR) to realistically be sitting on a 5-10+ Moz, relatively shallow, possibly oxide deposit one day later. Imagine what impact that would have for a ~C$30 M Market Cap junior (or even a $100 M junior). I have recently seen juniors go up tens to hundreds of millions in Market Cap from just a few good hits even if the target size is more or less unknown. Depending on the type of system it might then take a lot of successful drill NRs to start proving that said juniors actually have more than just a few good hits…

Thus it would be interesting to see what say a C$20 M junior could do if they are successful in delineating an inferred monster of a deposit in one fell swoop.

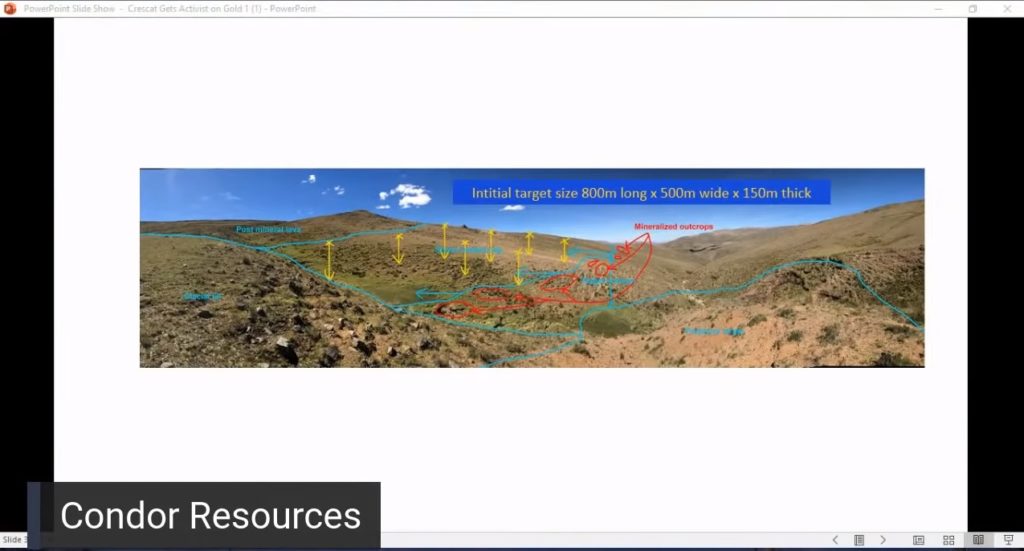

Initial target at Pucamayo with planned drill holes

I will admit that it required me to do some calculations before it dawned on me just how impressive this “initial target” is. The slide above doesn’t really scream “monster potential”. But if you take the time to actually punch the numbers of how much gold and silver could be hosted in that initial 800 x 500 x 150 m3 target (and using the grades seen in the outcrops) then you might get that “Aha moment” that I got…

Crunching The Numbers

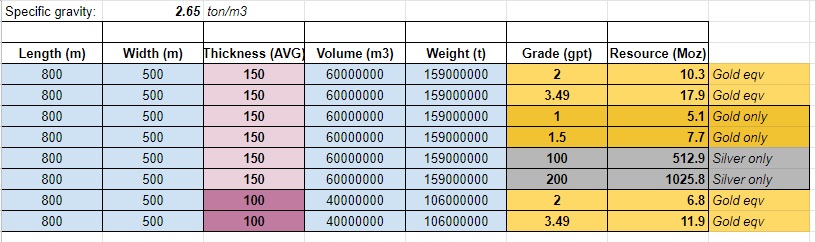

We know that the initial “blanket” target based on geophysics is approximately 800 m x 500 m x 150 m:

We know that the mineralized outcrops run about 1-1.5 gpt of gold and 100-200 gpt of silver. This gives an approximate gold equivalent grade range of 2 gpt (1 gpt of gold and 100 grams of silver) to 3.5 (1.5 gpt of gold and 200 gpt of silver).

In the table below you can see different resource potential numbers when using a specific gravity number of 2.65 ton/m3:

The table above shows that the Initial Target theoretically has the potential to host 10-18 Million gold equivalent ounces. The economics would likely be obscene if the gold equivalent grade comes in at 2-3.49 gpt given that it is probably also oxidized and open pittable. This is of course a world class target and even 3 Moz at lower grade could potentially lead to very good returns. I went from interested in Condor to extremely interested as soon as I did the calculations and appreciated just how big their initial target at Pucamayo was. Now I get Quinton’s excitement.

Closing Thoughts

I’m just gonna say it: If one likes to speculate on drill results then Condor with its Pucamayo project might pretty much be as good as it gets because this type of target allows for almost instant success (or non success). If Condor only drills dusters then you still own a company with a vast portfolio of high quality projects in Peru. When you factor in the cash in hand coupled with the US$4.975 M which might be coming from Chakana Copper within 18 months, then the current valuation is truly ridiculous. In other words the implied Enterprise Value of Condor might be around ~US$18 M. Potentially US$18 M for a junior that is hopefully going to drill a world class target this year with multiple other projects in the pipeline? It’s like one is buying all the other projects in the portfolio on the cheap and get a free option on the most impressive Pucamayo target. All in all, this is some of the best risk/reward I have yet to see for an exploration play given that the high risk/high reward calculation for Condor might not have any “rational valuation risk” in it for Pucamayo. Sure, the share price would very likely get hit if they ended up drilling purely dusters even at this valuation, but I don’t see a rational argument for it to go down since no potential for Pucamayo is reflected to begin with, when you account for their other projects.

On the other hand if the drill campaign is a success, with hits along the lines of what has been found in outcrops over the lion’s share of the 800 x 500 m2 target, then you will own a junior that suddenly might be sitting on 5-10+ Moz of gold. With a Market Cap of C$32 M very little is priced in. If there is even a 10% chance of success then Condor is absurdly cheap. Now given that I don’t see a particular reason for why just the parts of the system that happens to be outcropping should be mineralized I think the chance of success is quite a bit higher than that. And if the initial target is a success it will of course open up the district potential which one certainly isn’t paying a dime for at the moment.

I should also point out (again) that if they hit similar grades like they have been finding in the outcrops (and its oxide ore as the geophysics suggests) then this might theoretically be a very economic deposit (potentially high grade, near surface & open pittable). If they hit what looks to be a 5-10 Moz target or more that could be worth a couple of billions in the end.

As people probably know I am very stingy when it comes to pure exploration plays and only really invest if I see extremely good risk/reward. Given the abysmal Market Cap of Condor coupled with the size of the target, ease of proving it up, cost of proving it up and the possibly instant proof (or no proof) of concept I see this as a no brainer speculation play at these levels. Possibly even the best I have seen in this space so far when it comes to exploration plays. As always a home run is the exception and not the norm but if none of the upside is priced in at these levels then how risky is it really? If it was valued at $50-$100 M then some chance of success would obviously be priced in. Anyway, if they do hit a home run then this it doesn’t take much to see this become a 10+ bagger. I mean think about it. A 10-bagger from here would “just” be around C$300 M and if they truly hit a 10+ Moz home run then then one could probably start thinking about a 100-bagger instead… That’s a big IF at this point though!

To Sum up:

- Blue sky potential for “just” the initial target at Pucamayo is huge at 10+ Moz Au Eq

- If the initial target is a success then it will revalue the blue sky district potential at Pucamayo

- With an EV of US$18-23 M, no real chance of success is priced in, which means I actually think Condor has 10-100 bagger potential (First time ever I have put such a claim in an article actually)

- I am crossing all fingers and toes for Condor getting land access sooner rather than later (they already got the drill permits in hand)

I also think that the fact that Condor has decided NOT to JV or farm out the Pucamayo project should be a sign of how much they like it. Furthermore Sandstorm Gold acquired royalties on the project a few years ago which is validation from one of the smartest royalty companies in the space. All in all, this is easily one of the best targets I know of in the hands of a junior and as far as I know the only thing that remains before we will know what Condor exactly has is land access rights from the locals because they got the drill permits already.

What You Also Get

If Pucamayo wasn’t interesting enough, Condor recently put out a news release where they state the planned path forward for #5 of their active projects. On that note Quinton did say he believes that Condor actually has 4-5 world class exploration projects. In other words one is getting exposure to any exploration success across at least 5 very promising projects for the tune of US$18 to US$23 M depending on Chakana Copper’s decisions. With that I will reiterate that I think Pucamayo alone should easily have an implied value of a lot more than that. On the flip side one could say that the four other projects are probably worth well more than that and any and all upside at their monster Pucamayo target comes for free. Either way it’s one or more of “free” options on any and all upside across a vast portfolio of apparently world class projects. Four of them in total are expected to head towards drill readiness as soon as possible.

All in all, I am not just buying the huge potential in Pucamayo but also the potential of all Condor’s other projects of course. Who knows, maybe they will have been able to drill 2-3 projects in total over the coming 12 month period. If they also get the money from Chakana Copper than one might get more than one shot at a couple world class targets without any dilution.

Stated plans For Some of Condor’s Other Projects:

Andrea:

Like Pucamayo, Andrea is a large, largely untested high sulfidation gold project. Situated approximately 480 km south-east of Lima and just 15 km north of the Breapampa high sulfidation gold mine, the property hosts an extensive alteration system measuring approximately 3 km in diameter. Spot rock chip samples of hydrothermal and vuggy silica mineralization returned values up to 4.19 gpt Au. Like Cobreorco, Condor sees Andrea as a new, high-priority project and we plan to fast track it to drill readiness. This includes aggressive field work as well the DIA application process, initiating community consultation and other related activity necessary for Phase I drilling.

Huinac Punta:

Huinac Punta is located approximately 260 km north-east of Lima and host to a large, potentially high-grade sedimentary carbonate replacement style silver-rich mineralizing system with anomalous values of Cu, Zn, and Pb. Mineralization is both blanket-like and pipe-like in nature. Final documentation supporting a DIA application has been submitted to the Ministerio de Energia y Minas. In anticipation of receipt of its DIA approval, Condor is working on community consultation to secure access and water use permits that will allow it to diamond drill this important project. In the meantime, to better define drill targets, the Company will complete geophysical surveys, including an induced polarization and a ground based magnetic survey.

Cobreorco:

The company’s newest project, Cobreorco, is a porphyry-skarn system situated approximately 460 km south-east of Lima, and was acquired through staking by Condor’s exploration team. No prior drilling has been conducted on this intriguing new property although there are numerous small mine type workings in the skarn prospects. Recent exploration by the Company has included alteration mapping and sampling. This evaluation indicates the presence of a copper-gold porphyry system with roof-pendant style mineralized skarn, which itself is a potentially significant exploration target. Most encouraging surface rock sample results range between 0.57 and 4.4 g/t gold over 2 meter channels and between 0.12 and 1.8% copper over 2 meter channels collected from outcrops of leached porphyry-style mineralization. Given its strong potential, Condor plans to fast track Cobreorco to drill readiness. This includes aggressive field work as well as initiating the DIA application process and community consultation, and other related activity necessary for Phase I drilling.

If Chakana Copper continues to earn into Condor’s Soledad project then the company might have funding for a couple of drill campaigns without having to dilute any upside.

Lastly, even though this might be one of the best speculative plays around due to both a) Low valuation and b) The fact that blue sky success could be clear after just one drill campaign, I don’t think one should bet the farm. Even low exposure can make an impact given the nose bleed exploration leverage in this one. I see it as added spice and not something that should make up a large % of ones portfolio in my opinion.

I also note that this is one of the biggest break outs I have seen lately for any junior.

A break out from a 12-year long resistance line:

I think it’s a good idea to watch Quinton’s presentation again now that I have hopefully given a bit more context:

Note: This is not investment advice. I am not a geologist nor am I a mining engineer. This article is speculative and I can not guarantee 100% accuracy. Junior miners can be very volatile and risky. I have bought shares of Condor Resources in the open market and I might therefore be biased. I can buy or sell shares at any point in time. I was not paid by any entity to write this article. Always do your own due diligence and make up your own mind!

Best regards,

Erik Wetterling aka “The Hedgeless Horseman”

Follow me on twitter: https://twitter.com/Comm_Invest

Follow me on CEO.ca: https://ceo.ca/@hhorseman

Follow me on Youtube: My channel

Place me on mailing list. Thanks

Hi Erik, I came to the same conclusion as you and bought CNRIF @.12 last Thurs after buying Eloro the day before. Over the weekend I heard Quinton and Jay Taylor on NULGF and have been buying that 3 days this week. Eloro, CNRIF, and NULGF all look very interesting and have tremendous upside.

The horse race is on and White Gold and Lion One and Irving are good horses to ride too. Wonder which will do the best?