“The Curse of Karratha”: Also its Greatest Strength?

Karratha and its Mt Roe prospects are rather unique as we all know. In this post I will try to explain why the “Karratha Curse” might also be a blessing in disguise.

Setting The Scene

First of all. We all know that the Mt Roe conglomerates at Comet Well and Purdy’s Reward are very nuggety, especially the Upper Cannonball Conglomerate/Purdy’s Reward Conglomerate. This extreme nugget effect has been the main argument for the bears, and the bulls are well aware of the obstacles.

Now, I have been reading up a bit on ore sorting technology as well as watched a few presentations. I think I am starting to really understand why multiple royalty companies were interested in the Comet Well royalty, and why Novo (along with its insiders) decided to use their buy option to keep it in house. I am also starting to see where the 1Moz/year talk was coming from and particularly why Moriary and Barron have been tossing around “outrageous” cost estimates…

Bottlenecks and Blessings in Disguise

Typical underground mining operations have bottle necks in terms of limited infrastructure (limited faces, limited hauling capacity and limited room for trucks that are transporting ore etc). This means that many underground gold mining operations often have a bunch of bottlenecks outside mill capacity (There are a lot of examples of UG mines that are not able to “fill the mill”).

Typical open pit mining operations has limitations as well. They are bulk mining operations where the gold is usually microscopic and disseminated throughout large volumes of rock in very low grades and there is a lot of planning/capital involved to make it work.

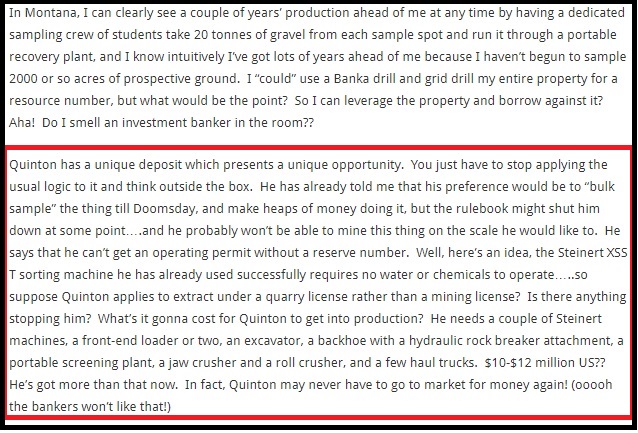

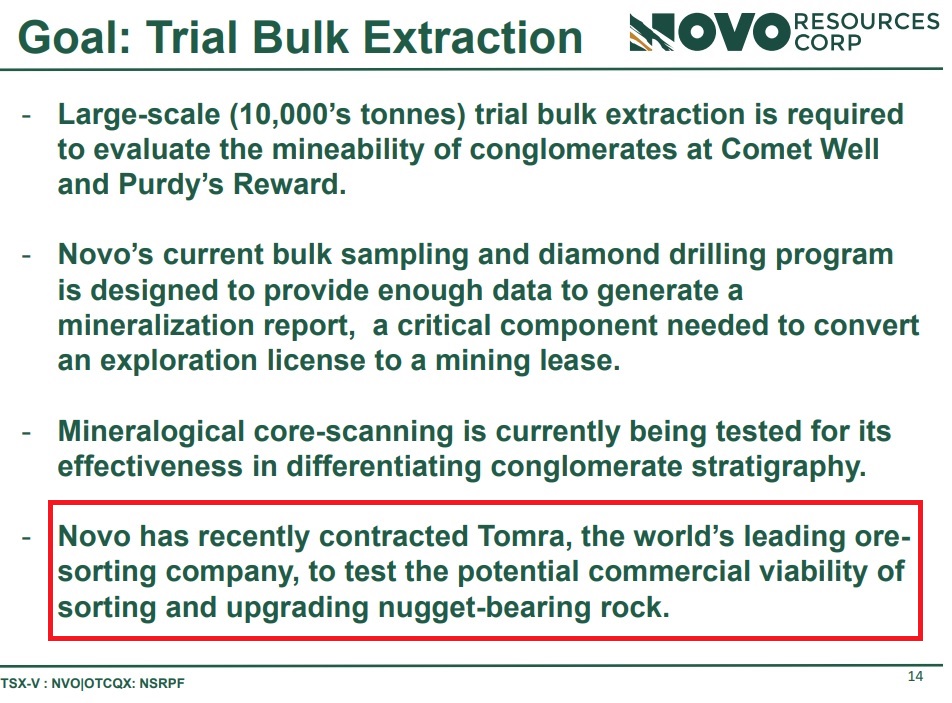

The Karratha Mt Roe conglomerates are made up of “beds”, almost like coal seams, starting at surface for over 8 km (at least). The beauty of this is that Novo should be able to strip any part of that 8km trend and start chopping up and transporting ore. Then the bottle neck is probably not infrastructure, but rather processing capacity. Well, one solution to that is to “high grade” and “shrink” the material what will go into a mill/plant, through the use of ore sorting machines. On that note, Novo recently announced that they have contracted Tomra to test the potential for using ore sorting technology to hopefully turn the “Curse of Karratha” into the “Blessing of Karratha”. We might not ever be able to drill the Mt Roe conglomerates and confirm gold due to the nuggety nature, but that nuggety nature might prove to be a very fortunate characteristic in the cash flow department instead…

The more the gold is disseminated throughout the rock (think very fine gold with high Au/cm3 foot print for example), the less the benefits of ore sorting one would expect. A heap leach operation would typically receive much less benefit simply because most of the material is actually very low grade ore, but ore none the less.

The best case scenario, which gives most bang for the buck and most benefit, would be a deposit that is as nuggety as it can get. This is because lets say you have one free and intact nugget that makes up 0.01% of the rock volume in a 5 tonne sample, and the ore sorter puts 99.99% of the rock in the “waste bin”, then that’s a mining operation in itself. That was of course just a theoretical best case example, but you get the idea. Furthermore, the coarser the material that is put into the ore sorters, the cheaper the process becomes (nuggets rule supreme again).

On that note, this is from Novo’s latest NR:

Again, Novo points out that the mineralization is indeed extremely nuggety. This of course has been known for quite a while since we were not able to readily confirm the presence of gold through standard diamond drilling. What it also means is that this is the PERFECT scenario from an ore sorting point of view. Pretty much ALL the gold is concentrated IN the NUGGETS themselves or as a fine grade halo that only stretches a few millimeters from the respective nugget. This in turn means that theoretically, the gold bearing “seams” at Karratha could reduce an obscene amount of dilution through ore sorting after only very crude crushing operations. Ore sorting is also cheaper the less “particles” it has to sort, so the sorting of the Karratha conglomerates might also be one of the most cost effective operations in the world, in terms of ore sorting operating costs.

With that said, read on and discover just how extremely good the first ore sorting results out of the most nuggety horizon was (Purdy’s Reward)…

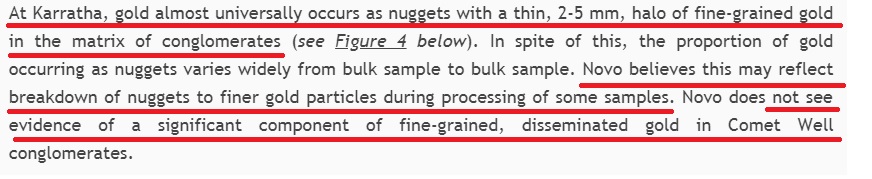

Lets take a real life example in the form of the first bulk sample(s) that Novo took from Purdy’s Reward:

Sub sample #1:

- Weight: 272.8 kg (0.2729 tonne)

- Sorted concentrate weight as % of total weight: 2.15% (5.865 kg = 0.00586 tonnes)

- % contribution of gold in the sorted concentrate to the calculated head grade of the sub sample: 83.12%

Lets first begin by calculating how much gold was in that sub sample:

With a total head grade of 87.76 g/t Au and a sub sample weight of 0.2729 tonnes, the total gold weight is 87.76 x 0.2729 g = 23.95 grams of gold. Now, 83.12% of the gold total is found in the Sorted Concentrate. In other words, 0.8312 x 23.95 g = 19.91 grams of gold. In turn, that means that the Sorted Concentrate has a head grade of 19.91 / 0.00586 g/t = 3,274 g/t.

Yes, in a matter of seconds the 272.8 kg total sub sample produced a high graded 5.865 kg Sorted Concentrate running 3,274 g/t that contains 83.12% of all the gold in the sub sample. Head Grade Improvement was thus ~3,630% ((3,274/87.76)-100%)

Picture of Sorted Concentrate:

novo-sorted-concentrate. Source

… Chuck stuff like that in a mill and let me know the margins!

The Curse of Karratha (nuggety gold) might be a cash flow blessing in disguise…

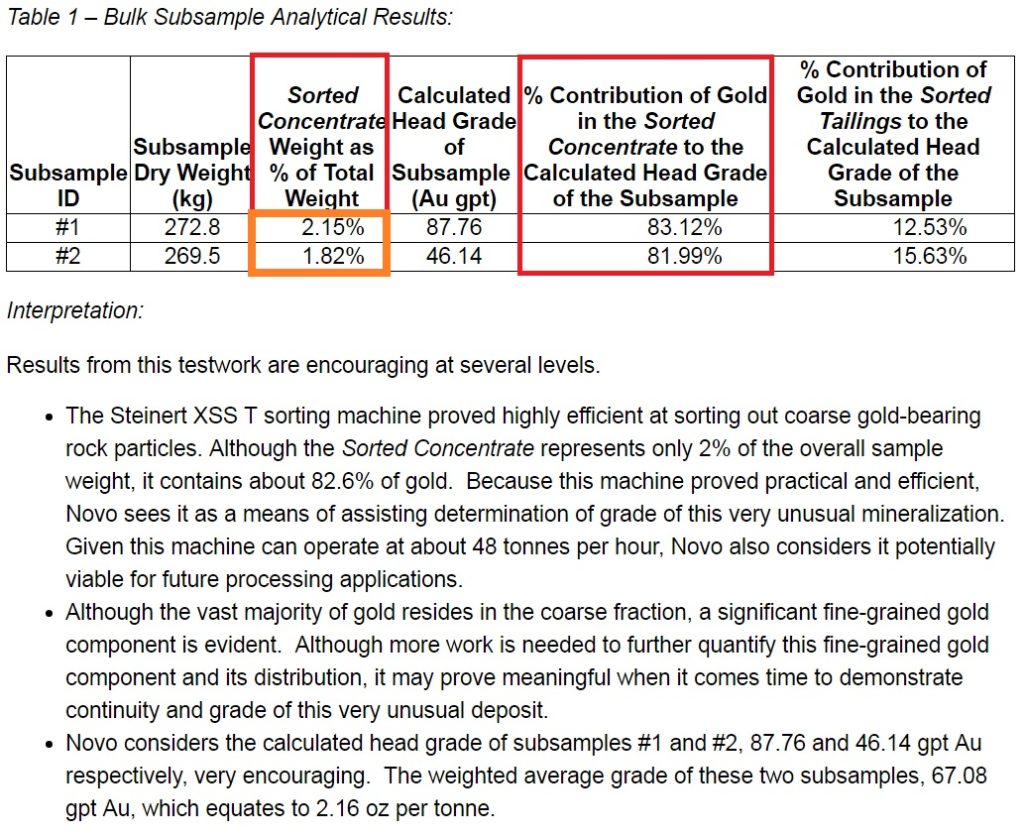

I am starting to really get why Novo tried to get the other Steinert to work for such a long time and why they have already contracted ore sorters from Tomra as per below:

Now let’s take some data from the latest batch of bulk samples and play around a bit…

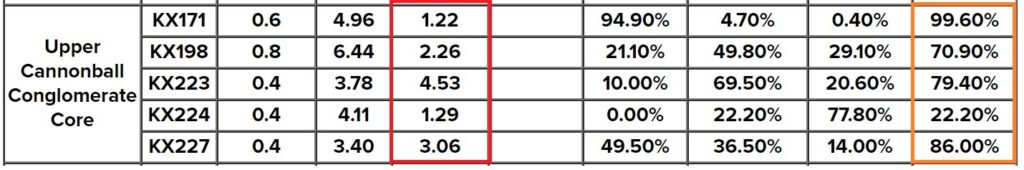

Upper Cannonball Conglomerate (Purdy’s eqv) Core Results:

- Grade in Red column.

- % Gold recovered by gravity in the Orange column.

- Sample weight is the column to the left of the Red column.

So, we have all heard people shouting these results are worthless. Well, given that the Upper Cannonball Conglomerate is the most nuggety of the two main gold bearing zones (and believed to be an extension of the Purdy’s Reward horizon, where the first bulk samples were taken from), it comes as no surprise that the percent of gold that was recoverable by gravity was very high for all but one sample. Quinton mentioned that some samples had almost all gold in visible nuggets, and in some samples the nuggety gold had most likely been remobilized.

So lets look at a few samples and assume we chuck it through an ore sorter after the rocks have been crushed to a maximum diameter of 6cm, that produces a Sorted Concentrate resulting in 75% of the gold being found in 15% of the material ( [“Base Case”] Sorted Concentrate ) instead of 83% of the gold ending up in around 2% of the total volume ( [“First Purdy’s sample input”] ), just to be on the conservative side. Lets also calculate what theoretical the Head Grade Improvement might be as result of first chucking all material through an ore sorter before it goes into any form of further crushing/processing plant.

Sample KX171 (“Base Case”)

- Weight: 4.96 tonnes

- Grade (total): 1.22 g/t

- Total gold: 6.05 grams (4.96 x 1.22)

- Gold in Sorted Concentrate: 4.54 grams (6.05 x 0.75)

- Sorted Concentrate Head Grade: 6.10 g/t (4.54 / (0.15 x 4.96))

- Head Grade Improvement: ~400%

Sample KX171 (“First Purdy’s sample input”)

- Weight: 4.96 tonnes

- Grade (total): 1.22 g/t

- Total gold: 6.05 grams (4.96 x 1.22)

- Gold in Sorted Concentrate: 5.03 grams (6.05 x 0.8312)

- Sorted Concentrate Head Grade: 47.27 g/t (5.03 / (0.0215 x 4.96))

- Head Grade Improvement: ~3,775%

Sample KX198 (“Base Case”)

- Weight: 6.44 tonnes

- Grade (total): 2.26 g/t

- Total gold: 14.55 grams (6.44 x 2.26)

- Gold in Sorted Concentrate: 10.91 grams (14.55 x 0.75)

- Sorted Concentrate Head Grade: 11.29 g/t (10.91 / (0.15 x 6.44))

- Head Grade Improvement: ~400%

Sample KX198 (“First Purdy’s sample input”)

- Weight: 6.44 tonnes

- Grade (total): 2.26 g/t

- Total gold: 14.55 grams (6.44 x 2.26)

- Gold in Sorted Concentrate: 12.09 grams (14.55 x 0.8312)

- Sorted Concentrate Head Grade: 87.32 g/t (12.09 / (0.0215 x 6.44))

- Head Grade Improvement: ~3,775%

In these scenarios, one could chuck a helluva lot of what might be pretty low grade material, that has only been crushed down to max 6 cm in diameter, into the ore sorters that would end up pretty high grade (even if you take the average of the [Base Case] and the [First Purdy’s Sample Input].

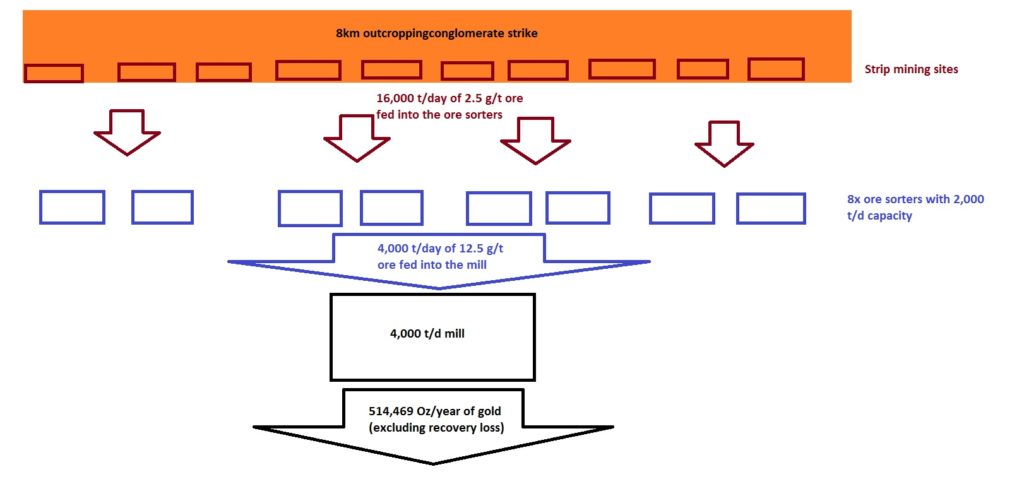

Now, lets go a step further and imagine what it would theoretically look like to fill a mill/gravity plant etc with a ~4,000 tonne/day capacity with Sorted Concentrate from X amount of the Steinert XSS. In the Novo News Release that covered the first Purdy’s Reward bulk samples using a Steinert machine, it said that the machine they used had a capacity of 48 tonnes/hour. Now, lets assume they are up and running 18 hours/day. This would mean that one Steinert XSS could sort 864 tonnes/day of rocks…

“Base Case”

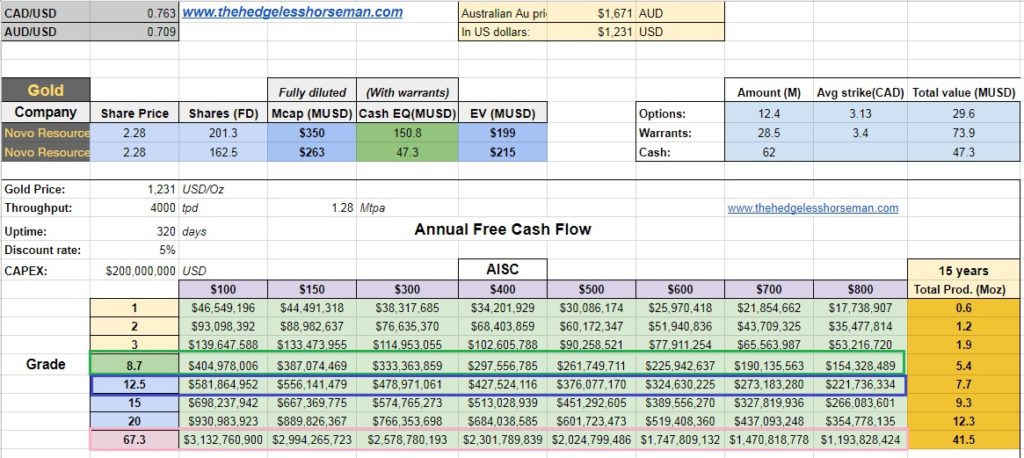

If we assume that the Steinerts will sort out 15% of the rocks into a “Sorted Concentrate”, that would mean that we need 31,86 Steinert XSS machines to fill the mill (lets round up to 32). If we take the average of grade of the two [“Base Case”] samples from the previous example, that would mean that we would need to crush and chuck 27,648 tonnes/day of rock into the Steinert machines, that would produce 4,147 tonnes of “Sorted Concentrate” with a head grade of 8.7 g/t Au ((6.10+11.29)/2), to be used for further processing. Karratha could endure a lot of mining dilution even in the base case scenario.

… In this scenario, the ~4,000 tonne/day plant would process 1.160 ounces of gold per day, which translates into 371,229 ounces per year (assuming 320 days/year of full time operations).

… Free Cash Flow calculations on that using an AISC of sub $100, $500 or even $800? Food for thought.

If we take an average “start out” grade of 2.5 g/t as estimated by QH in the recent Kereport interview one could picture something like this:

Note assumptions:

- 2.5 g/t conglomerate gold grade

- 400% head grade increase

- 25% mass pull (Sorted Concentrate)

- Ore sorting capacity: 2,000 t/d per machine

- Mill up time: 320 days/year

- Excluding recovery losses in the mill/plant

As you can see in the “Base Case” flow sheet scenario, we would only need a relatively small 4,000 t/day mill to produce about the same quantity of gold as a 16,000 equivalent operation that used no ore sorting. Ore sorting has very cheap operating costs as I understand it and thus being able to reduce the volume of rock that needs to be milled by 75% and at the same time hiking up the head grade to an astounding 12.5 g/t sounds pretty god damn sweet.

Depending on how much we can “shrink” the ore size going into the mill, our “problem” might be that we potentially will need large mining volumes, just to fill even a relatively small mill, with very high grade ore. Especially if it turns out we are closer to 2% mass pull as evidenced in the Purdy’s Reward sample than 25% that I used in the “Base Case”. Fortunately, it is indeed a positive “problem” to have, and what’s more is that this ore type looks to be basin wide(!). Talk about a match made in heaven.

Huge nugget effect –> Very low mass pull through ore sorting –> Very high grade ore going into the mill —> Need a lot of ore —>

… 8 km of outcropping strike to start with and multiple prospects across the basin = Some absurd mining scenarios!

“Purdy’s Reward First Sample Input” (Blue Sky scenario)

If we assume that the Steinerts (or Tomra machines) will sort out 2.15% of the rocks into a “Sorted Concentrate”, that would mean that we need 215.4 (4000/(864*0.0215) Steinert XSS machines to fill the mill (lets round down to 215). If we take the average of grade of the two [“Purdy’s Reward First Sample Input”] samples from the previous example, that would mean that we would need to crush and chuck 185,760 tonnes/day of rock into the Steinert machines, that would produce 3,994 tonnes of “Sorted Concentrate” with a head grade of 67.3 g/t Au, to be used for further processing. In that scenario, the ~4,000 tonne/day plant would process 8.642 ounces of gold per day, which translates into 2,765,748 (2,8 Moz) ounces per year (assuming 320 days/year of full time operations).

… This scenario is obviously a bit scary, and I don’t bank on the average metrics being in line with the first, simply extremely good Purdy’s Reward sorting results. This would be orders of magnitude beyond my blue sky scenario. Reality might be somewhere in between the “Base Case” and “Beyond Blue Sky Case”

Below is a spread sheet that shows different Free Cash Flow scenarios. The row in green is the calculated head grade from the Upper Comet Well (Cannonball) conglomerate using the “Base Case” increase in head grade, the blue row is “Base Case” coupled with Quinton’s 2.5 g/t estimation and the row in green is using the “Blue Sky” increase in head grade as evidenced by the first Purdy’s Reward ore sorting results. All grades are post-ore sorting grades:

When it really dawned on me what ore sorting technology could mean for these nuggety gold horizons beneath the Mt Roe basalts at Karratha (perhaps rest of Pilbara too?), I sent an email to Quinton Hennigh to check if my newfound enthusiasm for ore sorting coupled with Karratha style gold was warranted, and if he shared my enthusiasm…

I sent this:

“Hello Quinton!

I have been reading up a bit on ore sorting and am currently working on another Novo article. I went back to the first bulk sample and calculated that the 87 g/t sample from Purdy’s got high graded to about 3,700 g/t confined in the circa 5 kg “Sorted Concentrate”. It basically dawned on me that Karratha is perhaps the PERFECT deposit for said technology.I guess you don’t expect as spectacular results as was seen in the first Steinert XSS test run, in a commercial scale mining scenario, but the nuggety nature looks like a real blessing in disguise from a cash flow point of view.… Do you see ore sorting as a good bet for CW/Purdy’s only or might it be used at Egina and/or Beaton’s Creek as well?”

“I think ore sorting is of critical value to this project and believe Tomra is the best company to look at right now.

Tomra is willing to let us in the shop while they test our material and conduct our own evaluations of their system.

I see ore sorting as potentially highly effective at CW/PR and Egina. BC less so as the gold is a bit too fine.”

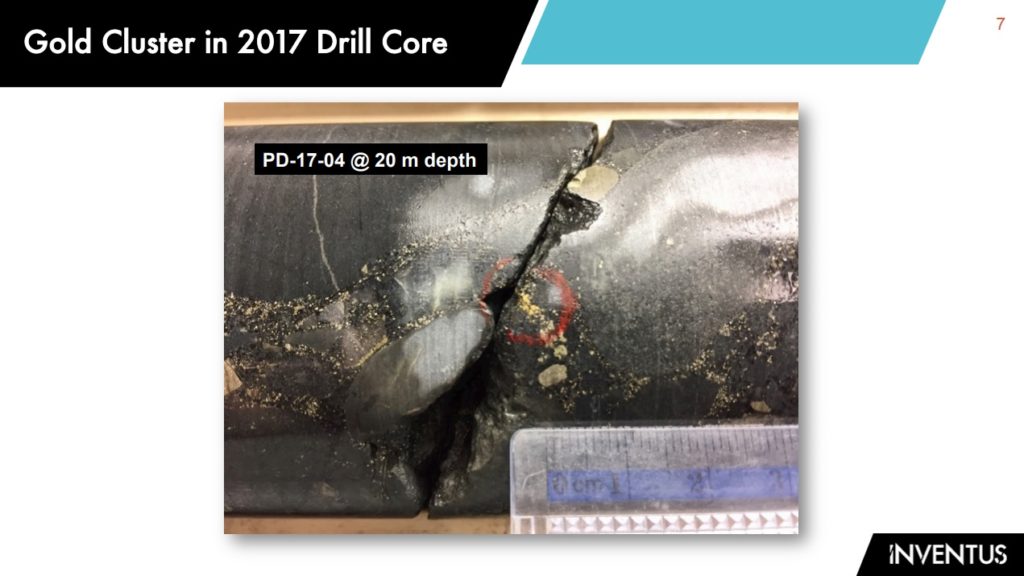

Inventus Mining’s “Wits Like” Paleoplacer Project

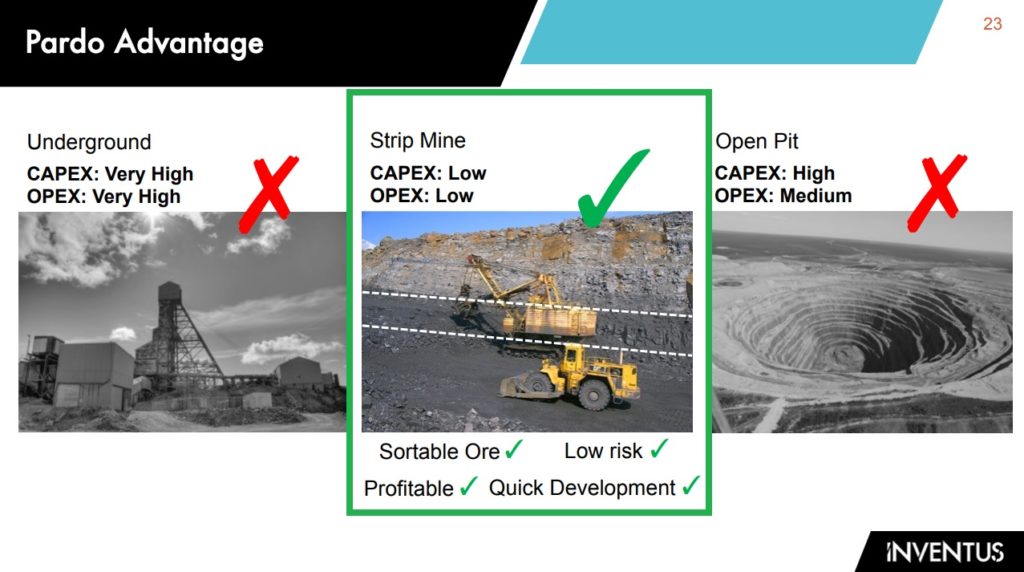

When I was just about to wrap up the article I remembered that Inventus Mining’s Pardo Project had done some tests with sorting technology and their project is also a “Wits cousin” so to speak.

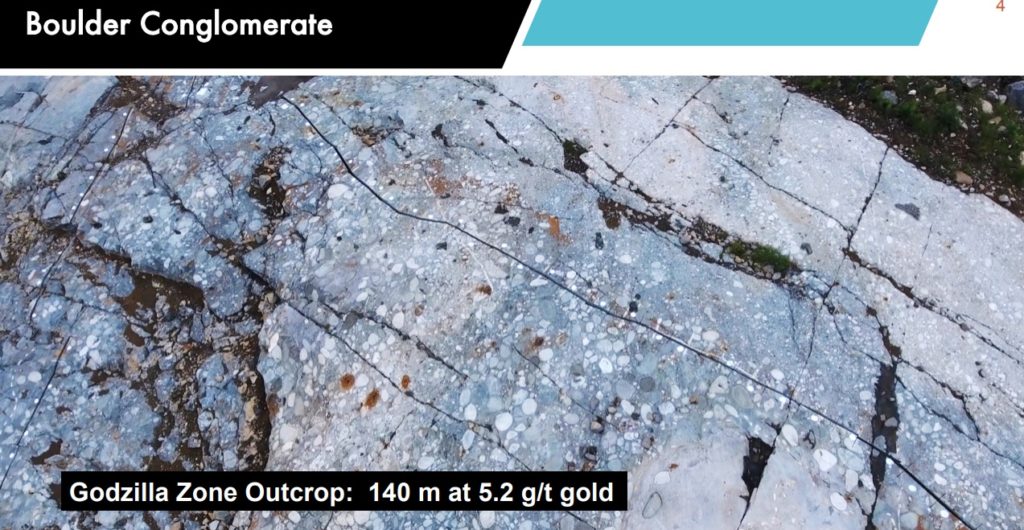

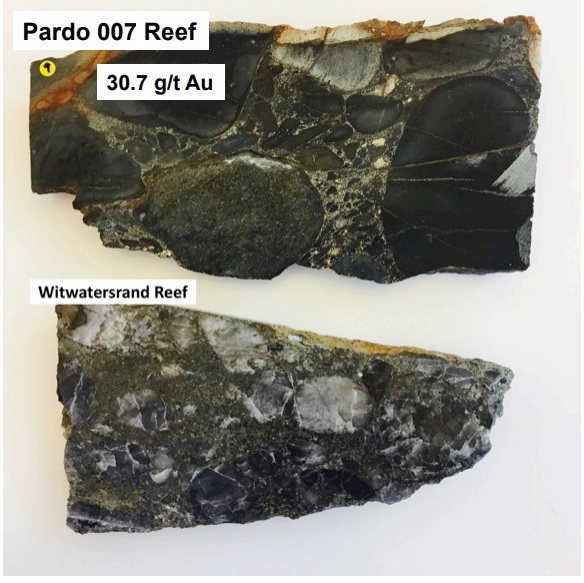

Pardo Project mineralization:

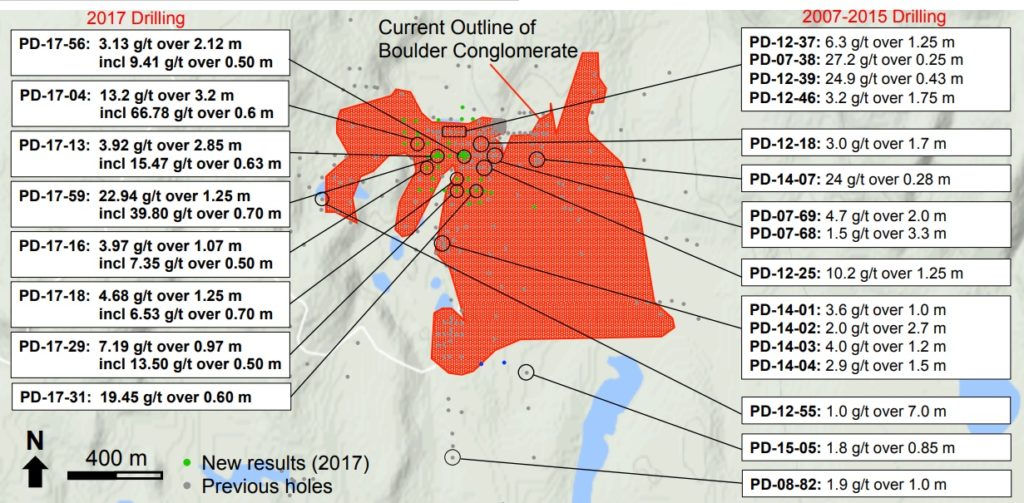

Ok, so we see that the clasts are coarser than Witwatersrand, but it is probably much less coarse than Karratha (at least the gold mineralization), due to the fact that they are actually able to hit gold with the drill bit:

Note that the widths and grades are often pretty close to the early reports out of Comet Well interestingly enough. Now, let’s take a look at the results from their ore sorting tests…

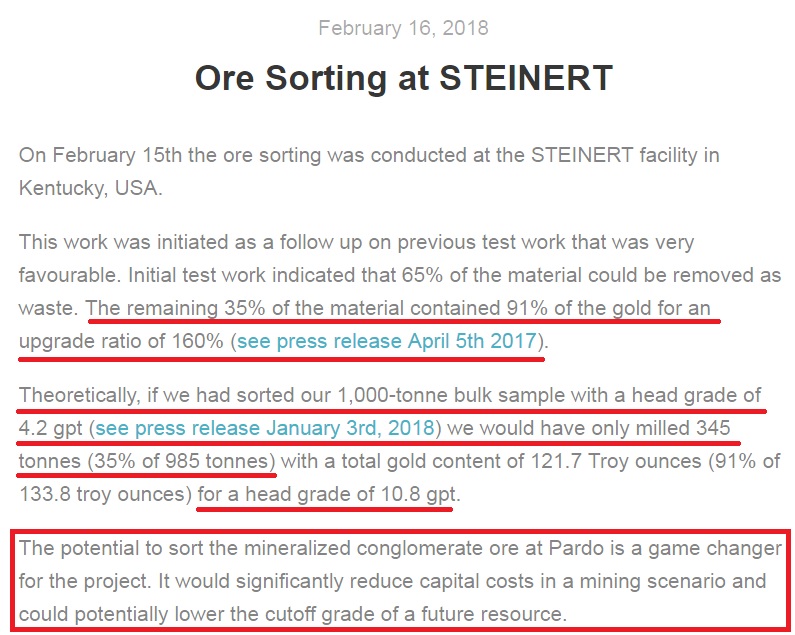

The following slides are from a page on their website that summarizes the ore sorting results:

… That slide explains the potential benefits perfectly!

If those results were to hold up in a full scale mining operations, they could up their head grade that goes to the mill by an astounding 160%, while at the same time shrinking the volume of rock that goes into the mill by 65%, and still recover 91% of the gold!

(HH: Again, one of Novo’s first Purdy’s Reward Samples saw a ~3,630% hike in head grade, and shrunk the ore by ~98% and retained ~83% of the gold!!!)

Inventus thus states:

“The potential to sort the mineralized conglomerate ore at Pardo is a game changer for the project. It would significantly reduce capital costs in a mining scenario and could potentially lower the cutoff grade of a future resource.”

… A whammy all around in that it it might not only reduce capital costs significantly, but also lower the cutoff grade, which means more gold AND lower costs. This next slide is from their latest presentation:

… Starting to get the picture? Strip mining is probably doable at Karratha as well since it’s outcropping for 8 km of strike, at the least.

If it looks to be a game changer for the Pardo Project with a preliminary 160% hike in head grade, what would it mean for Novo’s Karratha Project even if one would cut some metrics from the first ore sorting results out of Purdy’s by 90% (aka 10 times worse)?

… Instead of the sorted concentrate containing 2% of the mass, it would contain 20% of the mass and instead of a 3,630% hike in head grade going into the mill, it would be a 363% hike in grade. It would still blow the Pardo Project out of the water. Thus, the obscene/unconventional nuggety nature of Novo’s Karratha Project might in reality lead to obscene/unconventional cash flow in a mining scenario.

A schematic of how the ore sorter works:

Discussion

First of all, I know that the 32 and especially 215 Steinert machines numbers used in two of the scenario sounds like a lot, but there are sorters with much greater capacity than the one used for Novo’s first bulk sample, so don’t get hung up on the specifics. There are operations that plan to chuck 200,000 tonnes per day through 32 ore sorting machines! The main take away is that if the Tomra ore sorting machines are even somewhat successful, the “Karratha Curse” could end up being the best thing ever from a cash flow perspective. The ore sorters don’t need any water or chemicals, they just need a lot of rocks! I am really starting to see why Moriarty and Barron believe this might be the lowest cost operation in the world. Furthermore, this is NOT some “voodoo magic” we are talking about. It is a PROVEN inclusion in over 100 mining operations around the world (for every metal and every deposit type), and my bet is that none of those had preliminary results even close to the ones Novo got out of Purdy’s Reward. As a matter of fact, I doubt many (or any of them) even have numbers that can stand up to the “Base Case” scenario I used. Time will tell if I should have been more conservative, but again, the “Base Case” wasn’t even close to the first results out of Purdy’s.

We certainly don’t need the efficiency shown by the Steinert XSS machine that processed the first bulk Purdy’s Reward bulk sample to imagine why ore sorters coupled with our VERY nuggety gold might be the perfect match. Even if the ore sorters ONLY concentrate the majority of the gold in lets say 20-40% of the material, then we can handle much more dilution before we suffer from materially lower grades. What it means in practice is that, if Novo have anything near the success shown in the first results from the original Steinert XSS (which were extremely good), then they could have a highly levered production profile. Imagine a 4,000 tonnes per day mill/plant processing about the same gold (equivalent content) as if the operation would have been 12,000 tonnes per day, due to the inclusion of ore sorters in the flow cheat.

Again, we have all heard “the usual suspects” shouting about how poor the grades are, but none of them have accounted for the ore sorters. If Tomra’s ore sorters are anywhere near as efficient as the first Steinert XSS was, then the majority of investors will be taken completely off guard, because with enough relatively cheap tools as ore sorters, we can plow through an immense amount of waste rock and still have world class head grades for further processing… The 3,274 g/t “Sorted Concentrate” from Purdy’s is just obscene, and it only took a few seconds to high grade a 0.27 tonne sample into only 0,006 tonnes with such a ridiculous grade. Again, one could chuck an enormous amounts of rock into such efficient ore sorters and end up with bonanza grade “Sorted Concentrates”, even if 98% of the rock is waste… And still have a very economic deposit. We wouldn’t need to spend big bucks on a very big plant, we would simply spend it on ore sorters and increased crushing capacity, that would shrink/high grade the tonnage so we could make big bucks from a small mill/plant.

Ore sorting is apparently widely used in Russia, but Canada has seemingly been very very slow to adopt the technology. That might explain some of the skepticism. I mean, if it’s not on anyones’s radar up there, how could they factor it in when looking at Karratha?

Ore sorting can be used on a broad spectrum, even for some open pit heap leach projects, where there are spots of high grade ore. BUT the best thing about it is that extremely nuggety deposits is actually where it shines the most.

Final Notes

The Mt Roe conglomerates at Karratha are the probably the type of targets where ore sorting produces the absolutely most amount of benefits, and thus has the greatest impact (bang for the buck), compared to all other types of gold deposits. In the presentation below, Brent Hilscher of Sacre-Davey Engineering stated that they aim for a 100% hike in head grade, and that anything above 25% is considered a success. Inventus Mining’s ore sorting tests from their somewhat nuggety Pardo Project came in much better than the “success” threshhold, with a 160% jump in head grade. Novo’s extremely nuggety Comet Well (Mt Roe) project might be in a league of its own though, considering one of their sorted samples came saw a 3,630% hike in head grade and retained 83% of the gold! I can’t stress this point enough. The first ore sorting results out of Purdy’s (Upper Comet Well) were orders upon order of magnitude better than Pardo’s results as well as the 25 “success threshhold” used by Sacre-Davey Engineering (Oh and btw, Sacre-Davery Engineering was the firm that performed the ore sorting trials for Inventus). There might not be a mining operation on the face of the earth that would benefit as much from ore sorting as Karratha. One can only imagine the ROI numbers.

Now I understand why the royalty was bought. Now I understand why a bunch of royalty companies were in discussions with JC. Now I understand (more) why Kirkland doubled down at $5. Now I understand where the 1Moz/year comment came from. Now I understand why Novo tried to replicate the success with the second Steinert Machine for so long. Now I understand why they have already contracted ore sorting solutions by Tomra.

Suffice it to say, I have found a whole new level of appreciation for Karratha and all other Mt Roe prospects in Pilbara.

I am still sticking to my guns that the Blue Sky scenario for Novo and the Pilbarians is not the sheer size of the targets, but rather the LT cash flow potential (future dividends). If we got tens or hundreds of kilometers of near surface material with grades somewhere along the lines that we have recently seen, and the ore sorters work even decently, then Karratha will be producing gold for decades to come… And that’s not even including all the stuff that would need underground mining (if it’s even possible).

I will probably write more posts in the future about all this and include some more detailed production costs scenarios.

Lastly, I highly recommend anyone to watch this presentation called “Sensor based ore sorting” from “McEwen Mining innovation series”:

Note! This is NOT investment advice. Junior mining stocks are risky and can be very volatile. Novo Resources has been my largest holding since 2016 and might buy and sell stock at any time. I can’t guarantee 100% accuracy in terms of what is contained in this post and thus would encourage everyone to do their own Due Diligence. This post is contains my personal view on Novo. I have not received any compensation for writing this article.

Best regards,

The Hedgeless Horseman

Follow me on twitter: https://twitter.com/Comm_Invest

Follow me on CEO.ca: https://ceo.ca/@hhorseman

Don’t forget to sign up for my Newsletter (top right on front page) in order to get notification when a new post is up!

If you want to learn more about Novo Resources and the Pilbara Gold Rush you can purchase all my premium content HERE.

If you find my work valuable and want to help me keep publishing most of my research for free then please consider making a donation.