Novo: Winding Back the Clock

(August 1, 2018)

Lets take a trip down memory lane, and see if we can draw some parallels to today’s sentiment and action in Novo…

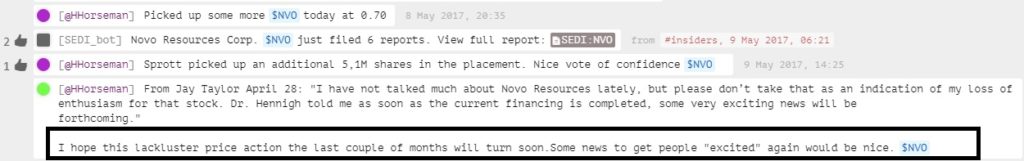

- Winding back the clock to May 8-9, 2017:

- What did the chart look like back then? (Spoiler: Worse than now!)

Only a complete fool would hold it, right? Eric Sprott has no clue what he is doing, right? Because the chart looked worse than death, RIGHT!?

Well… It turns out we did start getting news relatively soon after that, and Mr Sprott bought millions worth of shares that turned out to rise over %1,000 in value in a matter of months. This is what came to pass:

Similarities between THEN and NOW:

- Crap (overall) sentiment? CHECK

- Abyssmal market interest? CHECK

- Lousy price action for many months? CHECK

- Impatient and frustrated investors? CHECK

- Trading below 200 MA? CHECK

- Trading below 50 MA? CHECK

- Death Cross? CHECK

- Chart scaring people? CHECK

- RECENT HEAVY INSIDER BUYING? CHECK

- Chart NOW:

- Chart THEN:

… There are absolutely no guarantees that it will play out in any fashion resembling the immense 2017 run up, but I do see many similarities in the overall sentiment, expectations, price action (chart) and insider activity.

Now my hunch (as many of you probably know) has been that given the fact that we have TWO upcoming conferences where Novo will be presenting alongside a myriad of speakers all focused on the Pilbara conglomerate gold story and that Novo’s presentation hasn’t been updated since March, I have been expecting a treasure trove of new information, data and insights to be revealed in the coming 8 days.

Since I am sometimes an impatient man I asked Quinton if we might expect an updated presentation in the near future today and got the following response:

Quinton: “An update will be posted early next week for Diggers and Dealers.”

Thus my confidence level in terms of the next 8 days to contain a lot of news on all matter of things has gone up.

Lastly I would point out that I find the two most correlated Pilbara juniors to have some interesting charts, that in my eyes looks spring loaded for a move rather soon. Those stocks are of course Novo Resources and the aggressive Eric Sprott led newcomer Pacton Gold. Pacton Gold has been scooping up as much land in Pilbara as they can in short order, on the cheap. Although I think Novo is still the best Pilbarian by far, I was impressed that Pacton were able to pick up Marindi’s claims at Bellary Dome which I consider tier 1 ground.

Full disclosure: I have bought a small amount of Pacton Gold recently because I expect these coming days to hopefully change the sentiment at last, and I consider PAC to be somewhat of a beta play on Pilbara’s finest (Novo).

- This is what the Pacton Gold log chart looks like today:

… Again, to me this looks ready to blow, and I expect it to blow to the upside, which seems to be supported by TA-theory (approx. 75% chance to resolve to the upside).

Interestingly, Novo also looks to have been building a similar bullish pattern (if indeed it is a symmetrical triangle).

- This is what I posted on twitter yesterday:

- This is what the log chart looks after today:

- Bonus chart – Even Artemis looks spring loaded and ready to rumble:

… In my _amateur_ TA eyes, it really looks like we are close to some kind of “event” given how all of the stocks mentioned above (who are also fundamentally connected in many ways) are seemingly close to the end of multi month consolidation (continuation) patterns. Is this just a coincidence? Is it a coincidence that we have two Pilbara heavy conferences in the coming 8 days and that we are expecting a lot of news out of the juniors, and especially Novo (assays, 3D model, Beaton’s Creek update, presentation update, new prospects update)?

… I don’t know, but I personally don’t think so.

All I know is that I am extremely bullish on Novo (and also bullish on a select few juniors based on a lot of factors) and that I think the heavy insider action is telling us that the hunt for the “new Wits” is just starting. I expect and hope Sprott’s (and Kirkland’s) timing is as good as it was before the 1,000% rise last year.

With that said, this should not be considered trading or investment advice. This post contains my personal views, which I personally am basing my own decisions on. Everyone should have their own investment plan and act accordingly!!!

Best regards,

The Hedgeless Horseman

Follow me on twitter: https://twitter.com/Comm_Invest

Follow me on CEO.ca: https://ceo.ca/@hhorseman

Don’t forget to sign up for my Newsletter (top right on front page) in order to get notification when a new post is up!

If you want to learn more about Novo Resources and the Pilbara Gold Rush you can purchase all my premium content HERE.

If you find my work valuable and want to help me keep publishing most of my research for free then please consider making a donation.

Novo Resources in the context of Pilbara geology and paleobiology: scientific research vs. social validation

Thanks to Bob Moriarty’s early insight and steadfast support of Novo, starting in 2012 I built a core position of 80,000 NSRPF shares at an average price around 60¢. My last purchase was in May of 2017 at 51¢. We know the subsequent history through August through October of that year, during which rise I did not sell any Novo shares. Starting with the drop beginning in November, 2017, I began adding shares. The additional 20,000 shares that I purchased have an average cost around current market prices. I expect to add more NSRPF shares as possible while meeting other commitments, depending on price, and have little inclination to sell at all, at least until we are looking at many multiples of current prices.

I am respectful of the amount of research and thought that you have put into your research on Novo and its Pilbara geological setting. My own background in geology is self-taught, but I have sufficient background in paleobiology to understand in detail the causes and implications of the Oxygen Revolution, and have put in a lot of research time on that aspect of the problem, which still is not generally understood.

Dr. Quinton Hennigh is a class act as a person and a geologist. The Pilbara story is Quinton’s story, pure and simple. Although there are many other important players (Mark Creasy, Eric Sprott, Bob Moriarty, yourself, etc.), without doubt Quinton is at the center. Although there is a great deal of chatter about supposed delays and shortcomings of sampling and testing, as a scientist what I find impressive — and reassuring — is the sequential, methodical hypothesis testing on which Quinton has insisted.

Much of the criticism recognizable is from “professional investment advisors” who failed to recognize potential value early on, and thus must insist that it really is not there. Their “research” seems to comprise discussions with others who have little fundamental scientific knowledge; they may find reassurance at the $10/share level or higher, but real value investors reject such approaches.

The year past has been a lot of fun for us early Novo investors. My own perception is that the best is yet to come.

Bob Eckhardt

Oxford, UK

August 1, 2018