Portfolio: Why I bought more shares of Dolly Varden Silver

Company profile: Dolly Varden Silver Corp.

- Fully diluted market cap: 20 MUSD (April 10)

- Fully diluted share count: 43.3M

- Number of projects: 2

- Flagship project: “The Dolly Varden Project”

- Project size: 8,800 hectare (wholly owned, 2% NSR)

- Main product: Silver

- Grade: High (300gpt+)

- Bi-products: Lead & zinc

- Location: British Columbia, Canada.

- Fraser Investment Attractiveness Index score (2015): 75,41

- Noteable investors: Hecla 16%, US Global 15%

- Website: www.dollyvardensilver.com

- Interview with CEO Gary Cope: Click HERE.

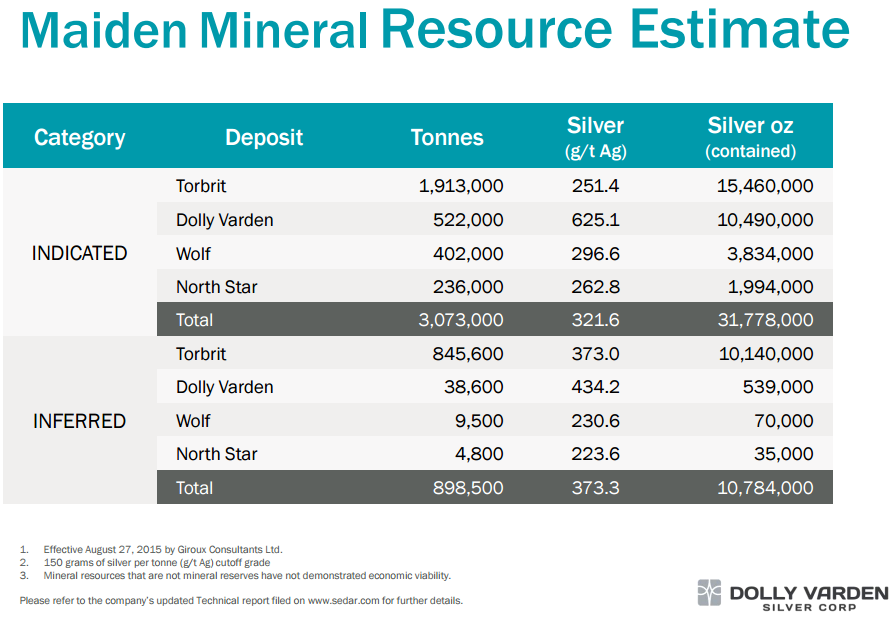

Resources:

Dolly Varden Silver is a very compelling course if you ask me. It is a company that is located in a top notch jurisdiction, with a high grade project as well as a tight share structure.

The management team is led by CEO Gary Cope, who was the former CEO of another silver explorer called Orko Silver. Orko Silver was acquired by Coeur d’Alene Mines Corp after topping a bid from rival company First Majestic, for the hefty sum of 350-384M CAD (exact number varies depending on source). Orko’s resource amounted to 100-150Moz of silver , with a silver grade of about 100gpt. Again the numbers vary a bit from source to source, but you get the picture. Having a CEO that has experience as a deal maker is a big plus in my book.

If we reckon that the resource amounted to about 100Moz at the time of the acquisition, we get a Price/Resources number of 3.8 based on a 380 MCAD take over price.

If we then take Dolly Varden’s current fully diluted market cap of 27MCAD (20MUSD) divided by it’s indicated resource estimate of 32Moz we get a Price/Resource number of 0,84.

Let’s imagine Dolly Varden would be given about the same Price/Resources multiple as Orko Silver in a take over deal. Implied market cap for Dolly Varden would then be about 121.6 MCAD or 91.2 MUSD. thats 4.56 times the current fully diluted market cap.

Some important factors to consider for this theoretical valuation:

- Price of silver was around $30/oz at the time of the take over!

- Dolly Varden is located in Canada while Orko Silver’s La Preciosa project was located in Mexico.

- Dolly Varden’s deposit has an average grade of 300gpt versus Orko Silver’s 100gpt.

Regardless it is my opinion that a high grade silver project the likes of Dolly Varden is a steal at 20MUSD when you consider how few (good) silver projects there are out there, especially with bankable resources and a major investor like Hecla. Considering the fact that Hecla tried to acquire Dolly Varden as recently as June last year, I would guess they would agree. That fact alone is enough to give Dolly Varden a serious look in my opinion.

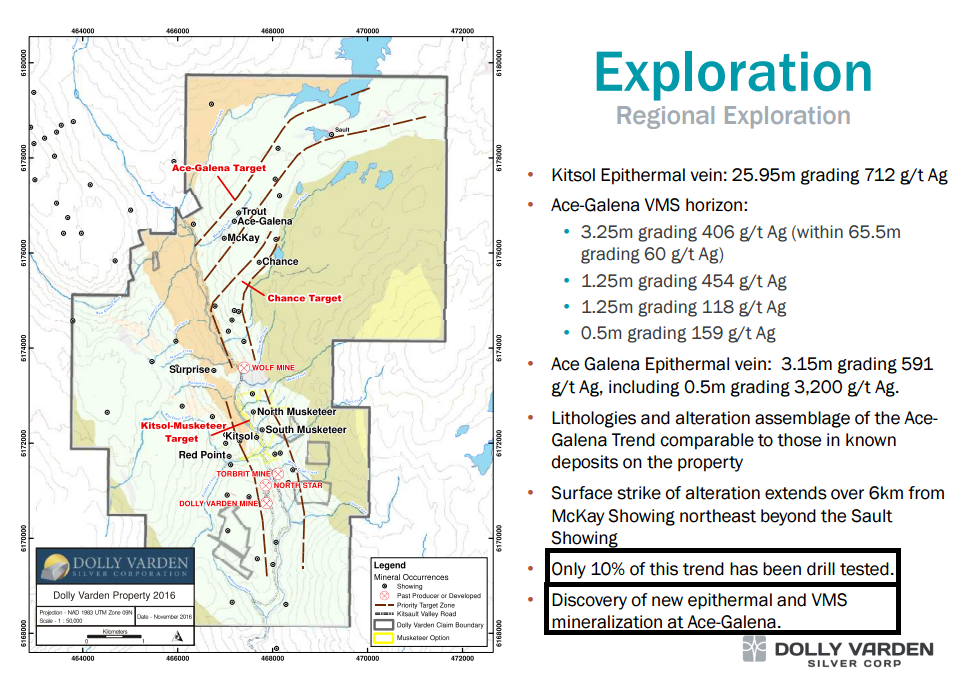

- Exploration upside is another compelling factor for a potential reevaluation of share price:

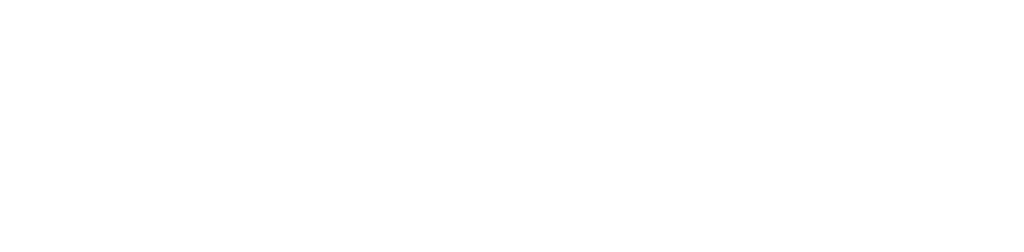

- Dolly Varden also provides it’s own “Market Comparables” valuation table:

One thing to consider about the table above is that while most of the “AgEq oz” numbers listed above include base metals (such as copper, lead and zinc), Dolly Vardens number is only made up of actual silver content. Thus I believe that Dolly Varden is cheap even compared to other silver juniors. Some with worse fundamentals to boot.

One last thought experience I like to run through when trying to decide if a company such as Dolly Varden is cheap or not is to try to imagine what the value might be to “become” the company in question…

What is it worth in time and money etc to outline a total resource estimate of 42 Moz high grade silver in a top jurisdiction?

For the sum of 20 MUSD you get 43 Moz of high grade silver that has taken years and millions of dollars to outline. Imagine how many obstacles one must overcome to be where Dolly Varden is today even if someone gave you 20 MUSD in cash with the set goal of recreating the story. It would take years of drilling even if you were lucky enough to acquire a land package as prospective as Dolly’s. It may also even cost you more than 20 MUSD since there are many costs associated with exploring for silver than the actual drilling over all those years (staff salary, office space, equipment, bonus compensations?, geological mapping/sampling , consultants?, land upkeep costs?, etc etc).

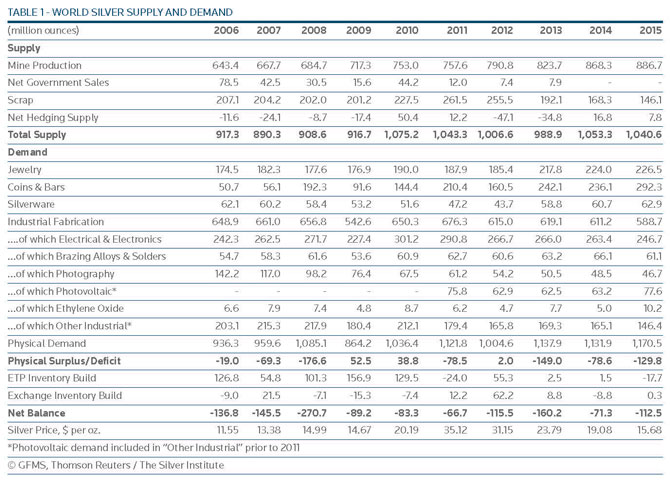

Can all this time, money and effort really be fairly valued at 20 MUSD in a time where silver has been in a deficit for multiple years in a row? A time when new supply of said metal has peaked? A time when demand has been steadily increasing on top of that as per silverinstitute.org?…

World silver supply and demand. Source: silverinstitute.org

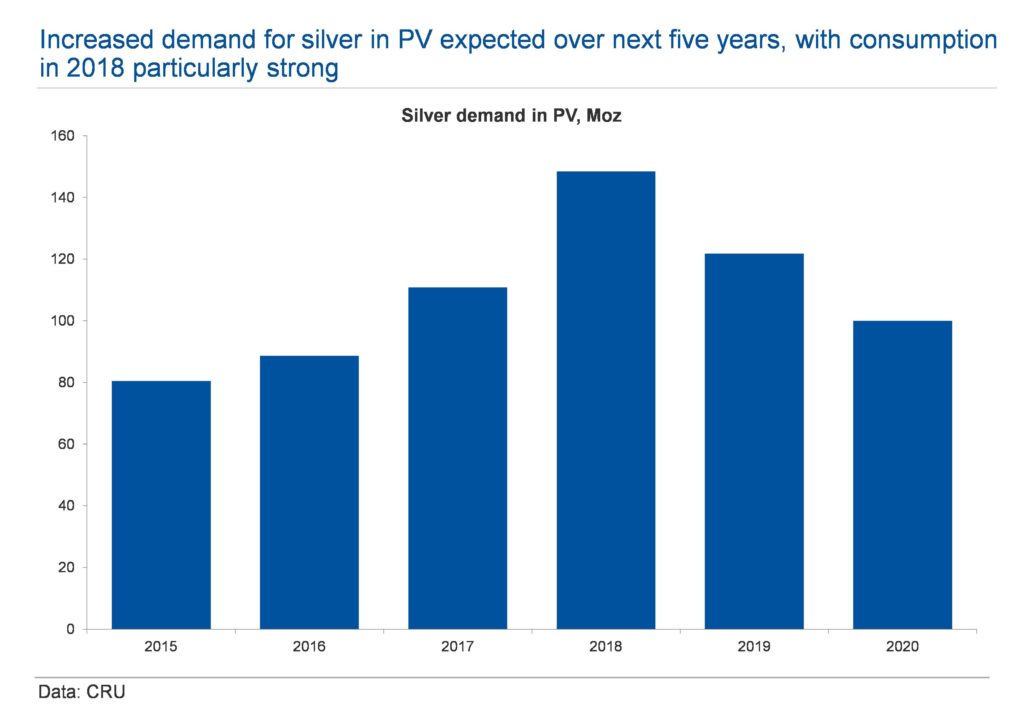

- In a time when silver demand from solar power (photovoltaics) alone is projected to substantially increase in the coming years?

Photovoltaic silver demand. Source: silverinstitute.com

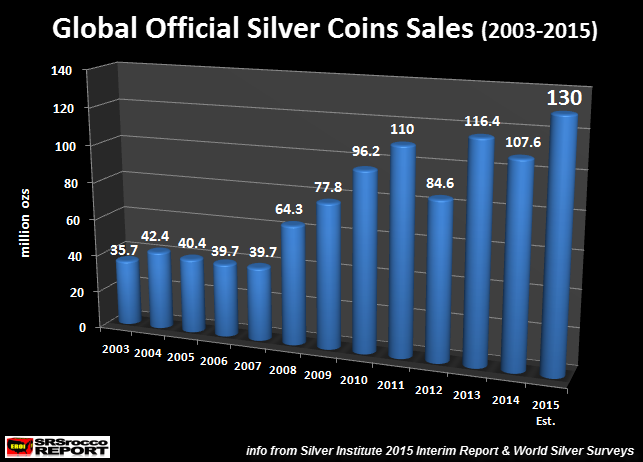

- In a time when global silver coin demand have tripled in ten years?

Add on top of that a gold/silver ratio of 70, which is a very high level historically and a picture emerges of a metal that seems to be one of the biggest, if not THE biggest contrarian trade in a long time. In my humble opinion of course.

In conclusion I would say that the valuation of Dolly Varden silver makes no sense unless one believes that silver will not trade above lets say $17/oz for an extended period of time during the coming decades. I would argue that to replicate this story starting today would cost a lot more in time and money than what the market ascribes Dolly Varden, which is a NPV of 20 MUSD. This is the gist of the thought experiment I use to help evaluate if I believe a company is undervalued. Of course there are many more factors to consider since a company can plow endless time and money into a project that is crap to begin with, but this one is far from crap. As I stated above, the markets valuation of Dolly Varden seems to suggest that it banks on either silver never going higher and/or the project never becoming economical. Both assumptions of which I disagree. Hence I consider Dolly Varden being a classic “contrarian trade”. Imagine what all that time, money and effort would be worth if silver doubled… Above “recreation” costs/NPV? I think so.

… Thus it is my belief that at the current share price, you get the typical potential of a contrarian stock on top of the potential of it’s underlying contrarian asset, namely silver.

- One last thought experiment regarding “recreation costs”/NPV:

Bitterroot Resources, Castle Silver Resources and Arizona Silver Exploration are more or less pure high grade silver (much like Dolly Varden) exploration plays. They have NO bankable silver resources as of yet. Since they are pretty similar to each other and are operating in North America like Dolly Varden I beg the question whether the added value of time, money spent as well as success in actually outlining 43 Moz of high grade silver (which the other juniors are wanting to recreate) is not worth more than a 13 MUSD market cap premium for Dolly Varden on average.

Bitterroot Resources haven’t even done the geological mapping yet. The silver miners are so depressed that it has given Dolly Varden a puny premium of 13 MUSD for 1) Having drilled thousands of meters over many years 2) Having an actual resource of 43 Moz and 3) Having actually succeeded in light of 1) and 2).

For Bitterroot to be on par with Dolly, it would probably take them 3+ years and a lot of equity raises (granted they actually have 43 Moz of high grade silver on their property). Still, the market is telling us that 3+ years of waiting + multiple equity raises + the inherent risk of not even finding anything to write home about is worth 14 MUSD?

Another favourite example is Sandspring Resources which is a true contrarian/optionality play. The market is not giving Sandspring much credit for having found gold, spent years of drilling as well as having spent more money than the company is valued at today. Imagine what one would value all that time, work and capital raises if gold rose to lets say $1700? What premium would a massive bankable economic gold project ready to go be worth compared to a gold junior that 1) Has no gold 2) Is years away from a resouce, and finally 3) Is not even guaranteed to find any?

The NPV of Sandspring in the eyes of the market would go from below recreation costs (not to talk about the value of success and years of development) to a NPV of who knows how high. This is the core of the gold and silver contrarian trade for me. Thus, I believe there are many precious metal focused companies with bankable success that are valued at levels beyond irrational. At the same time, one can see the opposite example in the overall stock market euphoria. Many companies are priced for permanently good economic times as well as guaranteed growth to boot. That is the true anti-contrarian trade.

Here is an interview with the CEO 8/22

http://www.kereport.com/2017/08/22/exclusive-introduction-dolly-varden-silver-corp/

Thanks Chris!

I was late to the DV party at .60 CAD, but the .21 run up since sure takes away the sting as silver comes to life!

Have been looking at silver stocks lately ( had AXR, just added BBB too) including your watch targets, was wanting your opinion on VML.V?

I don’t see it on your radar,recent news articles on stockboard etc suggest a potential 50m oz resource?

Is this fiction writing?

Brent.